Table of Contents

- Contract Template Bundle

- Construction Contract Template Bundle

- 11+ Investment Management Contract Templates in PDF | DOC

- 1. Investment Management Contract Report

- 2. Geography of Investment Management Contract

- 3. Asset Investment Management Contract

- 4. Service Contract for Investment Management

- 5. Investment Company Management Contract

- 6. Electricity Investment Management Contract

- 7. Investment Management Multi-Year Contract

- 8. Investment Firm Management Contract

- 9. Investment Management Current Contract

- 10. Investment Advisory Management Contract

- 11. Investment Capital Management Contract

- 12. Investment Management Proposal Contract

- How do you create Investment Management Contract?

- What do you mean by Investment Management Contract?

- What is the key task of an Investment Management Contract?

11+ Investment Management Contract Templates in PDF | DOC

Investment Management firms invest their client’s money. And they choose right selection of investment from fast-growing, risky stocks to safe but slow-growing bonds. The aim is to achieve return client needs at a level of risk that they are comfortable with. The Investment Management firm takes on every effort of creating an investment portfolio. Investment Management is to maintain the objectives and goals of investment companies and organizations.

Contract Template Bundle

Construction Contract Template Bundle

11+ Investment Management Contract Templates in PDF | DOC

1. Investment Management Contract Report

worldbank.org

worldbank.org2. Geography of Investment Management Contract

ac.uk

ac.uk3. Asset Investment Management Contract

morganstanley.com

morganstanley.com4. Service Contract for Investment Management

stanford.edu

stanford.edu5. Investment Company Management Contract

klgates.com

klgates.com6. Electricity Investment Management Contract

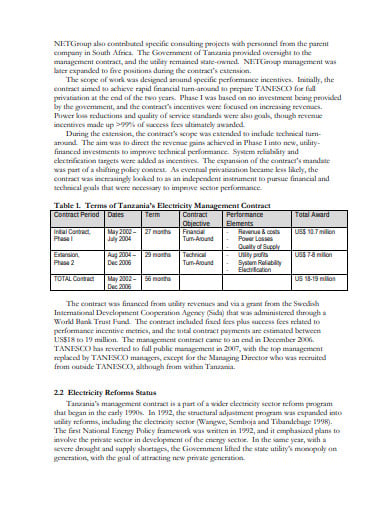

ac.za

ac.za7. Investment Management Multi-Year Contract

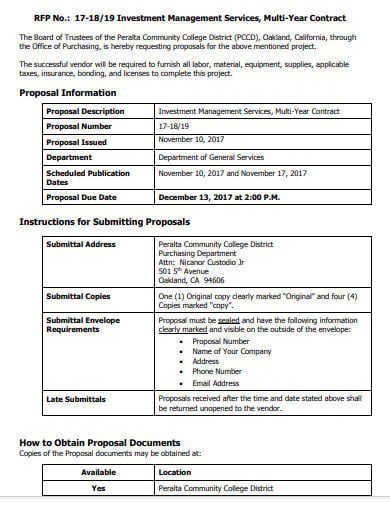

peralta.edu

peralta.edu8. Investment Firm Management Contract

associates.com

associates.com9. Investment Management Current Contract

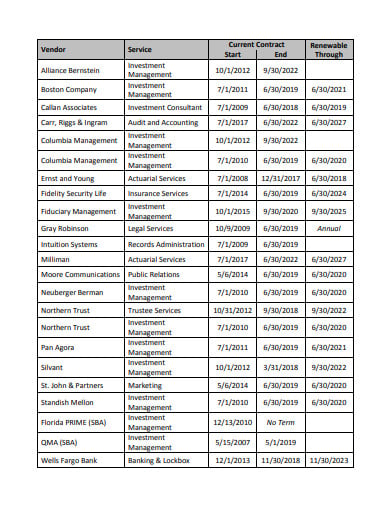

sbafla.com

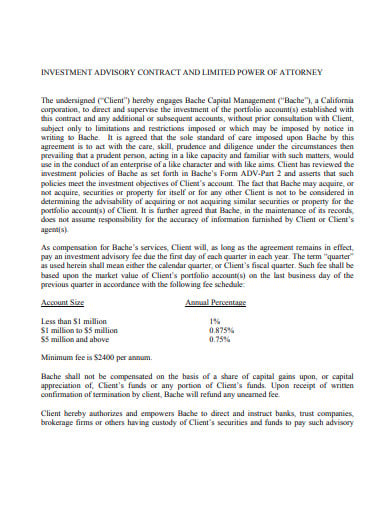

sbafla.com10. Investment Advisory Management Contract

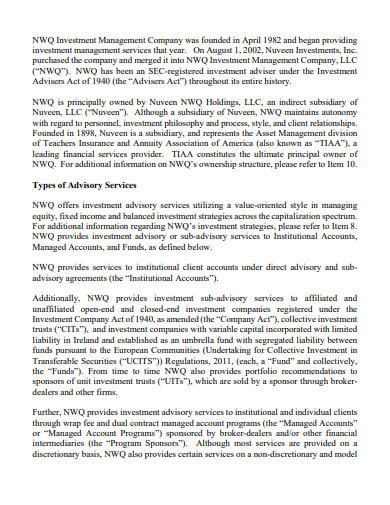

citibank.com

citibank.com11. Investment Capital Management Contract

bachecapital.com

bachecapital.com12. Investment Management Proposal Contract

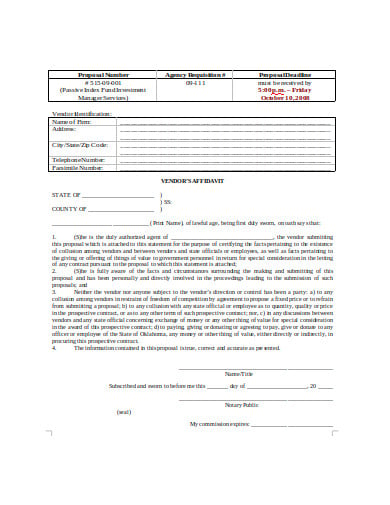

ok.gov

ok.govHow do you create Investment Management Contract?

Step 1: Establishing Goals

The contracts are legally binding that should not be approached lightly. It is essential to be organized and prepared with proper resources. And carefully identifying needs, reasons, and ultimate goals that need a contract make a decision much easier. Contracts should seek to define and mitigate risk in a relationship.

Step 2: Author contract

Consulting with people such as investment managers and experts is a wise thing to do. Ensuring all information and data is up to date and required clauses and terms are included in it. When you author terms and conditions in the contract and it is important to pay attention to wordings and language in it.

Step 3: Negotiate Contract

It does not matter how much you research, plan and prepare. It goes into the first draft of the contract and its negotiation always follows. Any kind of discussion and negotiation starts with transparency and trust. To know more about other parties’ needs and grants, it is necessary to negotiate and discuss with rest.

Step 4: Get Approval before Finalizing Contract

When both parties agree with each other, then it is time to approve the contract. In huge companies, you need the approval of the senior managers or persons represented with responsibility. If any company has procured rules and policies to followed, then it should be met before gaining approval for the contract.

Step 5: Execute Contract

It is seen as signing is the simplest part of a contract where both parties agree and sign documents. Here, wordings are exact and the next part is making it official. Every time the businesses make deals across the world but it is not that simple to crack it like that in person. And for this, electronic signatures are done on documents on tight deadlines or incompatible time-zones.

What do you mean by Investment Management Contract?

Investment Management firms work for different types of clients. Some of these work for wealthy or private investors. And some others work for companies, charities, trusts, or major corporations. It plays a vivid role in investment firms and businesses. It is, therefore, a voluntary agreement that is enforceable by law as a binding legal agreement. And it is a written document which outlines a full-understanding of the business relationships.

It is legal evidence between both investment managers and their clients. It protects rights and policies of both parties i.e of client and investment company. It is through the contract that it assess clients financial goal and attitudes to risks by gathering information like how much money to invest to minimize risks factors in it and when can they access their money and how much they are willing to lose.

The contracts witness investment that is more potential and efficient in nature which will give unpredictable results in the near future. An investment management firm must be aware of possibilities by calculating investment risks and returns of each. It is the sole responsibility of an investment company to work on contracts and agreements between client and company.

Keeping in mind the goals and objectives of the investment management company must prepare itself to develop and come up with agreements that are legally and officially maintained. There are no strategies or plans mentioned in agreement or contract but it caters to different things and policies within it. And it is through contracts that investors are bound to rely on these investment management company.

What is the key task of an Investment Management Contract?

The Investment Management Contract is an entity between two parties such as investment company and client. With contracts, you establish a legal and official bind among both parties. Investment management is to know about investors and their percentage of investment in different forms like charities, trusts, mutual funds, etc. It is a contract that is engaging investment advisers and investors. It is built on behalf of a client or investor. The investment company asks for a commission from returns received by investors from different sources.

The investment management contract manages investors’ accounts and funds invested in different profit-oriented areas like an insurance company, mutual fund, etc. The contract is a shield that protects from every type of damage and insecurities.