Table of Contents

- 6+ Income Investing Templates in PDF | DOC

- 1. Equity Income Investing

- 2. Low Income Investing

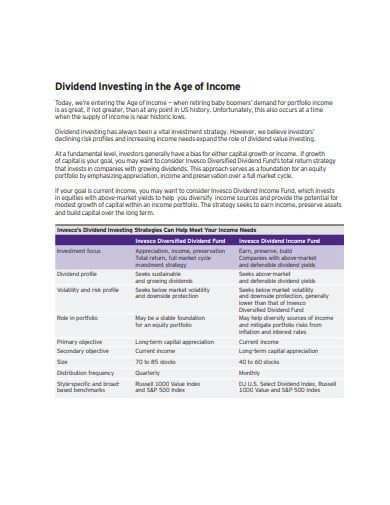

- 3. Dividend Income Investing

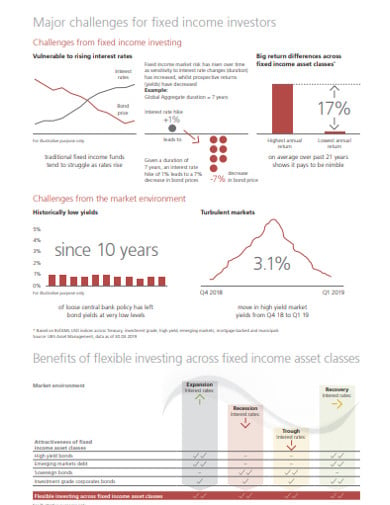

- 4. Flexible Fixed Income Investing

- 5. Aggressive Income Investing

- 6. Fixed Income Investing

- 7. Income Investing Example

- What is the Income Investing?

- What are the accounts that generate Investment Income?

- What are the few things that income investors must know?

6+ Income Investing Templates in PDF | DOC

The ability to do good income investing is putting altogether the collection of assets like stocks, bonds, mutual funds, real estate that will enhance the possible yearly income at the minimum level of the risks. And most out of the income is given to the investors so that they can use it in their everyday life to fulfill their basic amenities like buying clothes, paying the mortgages, traveling, covering living expenses, doing charity or things that they wish to do.

6+ Income Investing Templates in PDF | DOC

1. Equity Income Investing

brooksmacdonald.com

brooksmacdonald.com2. Low Income Investing

bayareainvest.org

bayareainvest.org3. Dividend Income Investing

invesco.com

invesco.com4. Flexible Fixed Income Investing

fk-g.com

fk-g.com5. Aggressive Income Investing

edwardjones.com

edwardjones.com6. Fixed Income Investing

wilmingtontrust.com

wilmingtontrust.com7. Income Investing Example

quakerwm.com

quakerwm.comHow Income Investing Plan Works?

What is the Income Investing?

The investment income is the sum of the money that anyone earns from the intensifying in the value of the investments. And it involves dividends paid on stocks, capital profits derived from the sale of the property and the interest on the saved money or market account. Either you’re self-employed or working under a company, people earn money for doing any work or providing services.

And many people make use of the different investment mediums to save money for retirement like the 401(k) account, stocks, etc. As the investments enhance in value, it produces interest income which would accumulate in the time-period to produce the investment income. Income investing is the plan and wealth-generating strategy that includes the portfolio of the assets that provide the payouts.

What are the accounts that generate Investment Income?

Among the different types of investments, you’ll find the various income-generating portfolios like bonds, dividends, stocks, real estate, etc. Each of the income-generating investment vehicles is described to make your concept more clear about it.

Bonds: The bond is the loan provided to the government entity or organizations and it pays off the fixed amount of income in the form of the interest on the fixed time schedule. When the amount of paying off the loan ends, then the bondholder gets the total amount of the loan back. And the interest rates differ according to the time period, the creditworthiness of the borrower and the conditions of the market.

Dividend Stocks: The dividend stocks are the shares of the company that chose to pay in cash to the stakeholders. And they are generally the way for the organizations to give their profit shares of their earning to the investors out of the free cash flow that their trades generate.

Real Estate: Most of the investors move to the business of real estate to generate income from it. And the right real estate investment can give more income opportunities from the rental payments more than that you have paid in property-related finance and costing. Any type of left income is yours to keep.

What are the few things that income investors must know?

There are several keywords that income investors should know before investing and getting effective results. The Payout Ratios would tell you that if the dividend stock is going to survive its current payouts or not and the payment growth measures how an income investment increases the income payment over the period of time. The dividend yield measures the amount of income dividend stocks pay.

The payout ratios calculated by dividing the yearly earning or FCF by the total dollar amount of the dividends that the organization distributes or will disseminate in that particular year.

The payout growth calculated by taking dividends during the ending point of the particular time period, deducting the value of the dividend at the starting time of the comparison, later dividing the end value from the dividend at the starting point. Mostly, the faster the growth rate of payout, the better the stock business is doing. The long-term record is important in evaluating, how the dividend is likely to rise.

And the percent that an organization’s yearly annual dividend payout represents the percentage of the company’s stock price. And the dividend yield calculated by dividing the organization’s annualize dividend by the stock price.