Table of Contents

- 10+ Government Bond Fund Templates in PDF | DOC

- 1. Government All Maturities Bond Fund

- 2. Government Income Bond Fund

- 3. Global Government Bond Fund

- 4. Government Securities Bond Fund

- 5. Currency Government Bond Fund

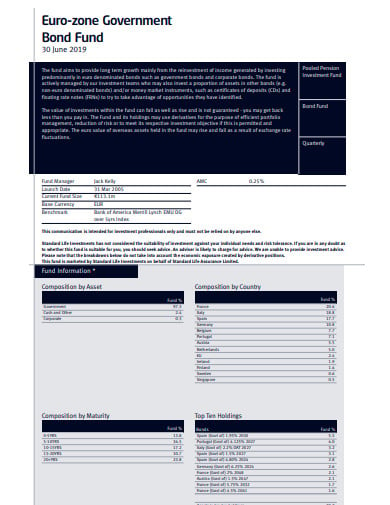

- 6. Euro-zone Government Bond Fund

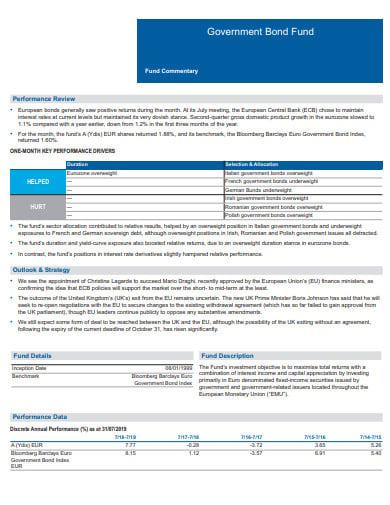

- 7. Investment Government Bond Fund

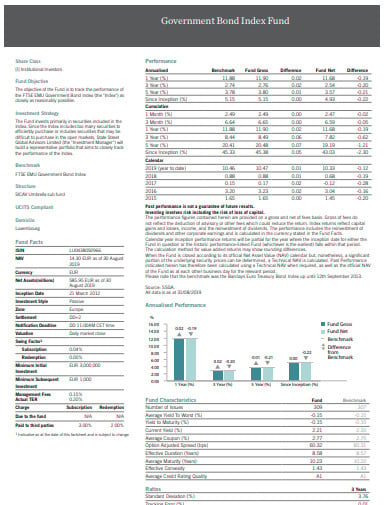

- 8. Government Bond Index Fund

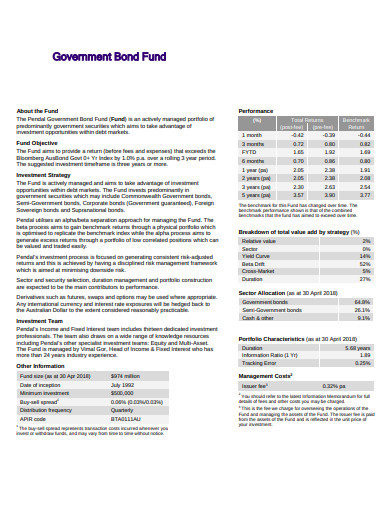

- 9. Government Bond Fund Fact Sheet

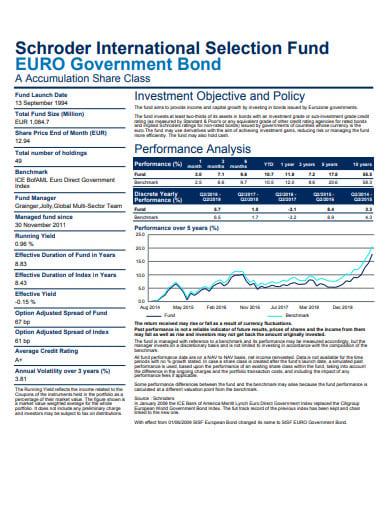

- 10. International Selection Fund Government Bond

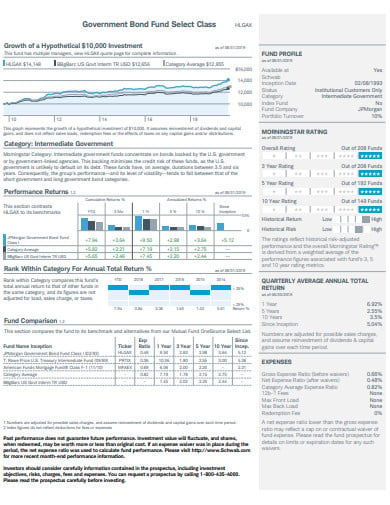

- 11. Government Bond Fund Select Class

- Who Uses the Government Bond Fund?

- What are the Features of a Government Bond Fund?

- What is the Usage of Government Bonds?

- Advantages and Disadvantages of Government Bonds

- What are the Pros in a Government Bond Fund?

- What are the Cons of a Government Bond Fund?

- What are the Types of Government Bonds?

10+ Government Bond Fund Templates in PDF | DOC

A Government Bond Fund is an obligation gave by a legislature to help government expenses. Government bonds can pay intermittent intrigue installments called easy payment installments. Government bonds are viewed as considerations since the government itself backs them.

10+ Government Bond Fund Templates in PDF | DOC

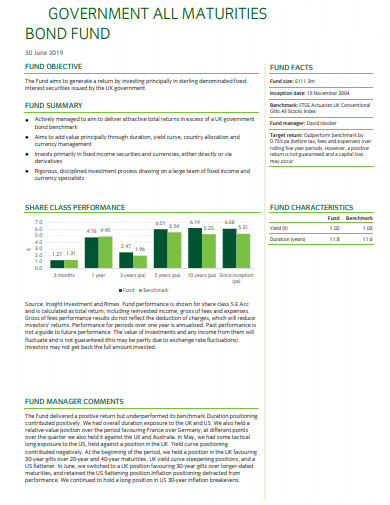

1. Government All Maturities Bond Fund

insightinvestment.com

insightinvestment.com2. Government Income Bond Fund

trustamerica.com

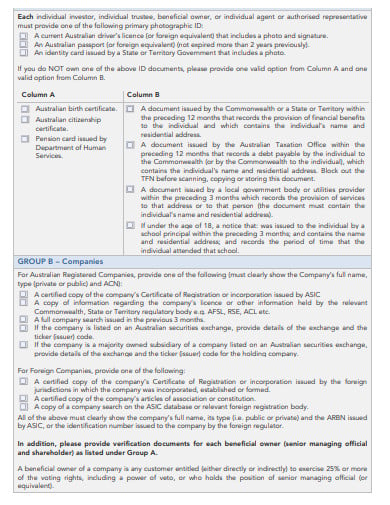

trustamerica.com3. Global Government Bond Fund

com.au

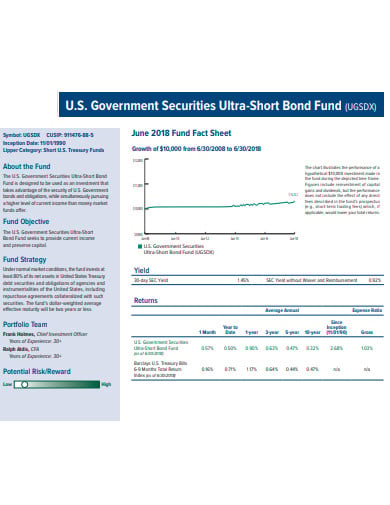

com.au4. Government Securities Bond Fund

usfunds.com

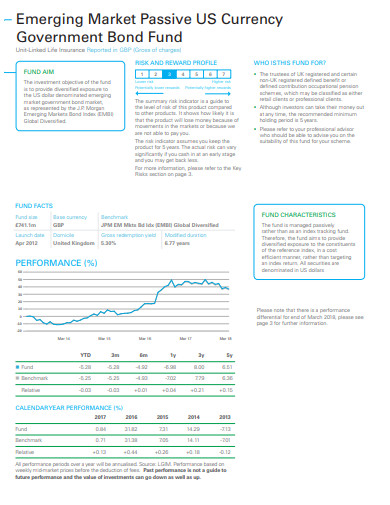

usfunds.com5. Currency Government Bond Fund

lgim.com

lgim.com6. Euro-zone Government Bond Fund

standardlifeinvestments.com

standardlifeinvestments.com7. Investment Government Bond Fund

templetonoffshore.com

templetonoffshore.com8. Government Bond Index Fund

ssga.com

ssga.com9. Government Bond Fund Fact Sheet

pendalgroup.com

pendalgroup.com10. International Selection Fund Government Bond

schroders.com

schroders.com11. Government Bond Fund Select Class

wallst.com

wallst.com

Who Uses the Government Bond Fund?

Government bond funds are given by the government itself to fund-raise in several activities or everyday tasks. The U.S. Treasury Department sells the bonds during barters consistently. Some Treasury securities exchange the auxiliary market. Singular speculators, working with a money related foundation or dealer who can purchase and sell recently gave securities through this commercial center. Treasuries are broadly accessible to buy through the U.S. Treasury, representatives just as trade exchanged assets, which contain a bushel of protections.

Fixed-rate government securities can have loan cost chance, which happens when financing costs are rising, and speculators are holding lower-paying fixed-rate securities when contrasted with the market. Likewise, just select bonds stay aware of expansion, which is a proportion of cost increments all through the economy. If fixed-rate government security pays 2% every year, for instance, and costs in the economy ascend by 1.5%, the speculator is just gaining .5% in genuine terms.

What are the Features of a Government Bond Fund?

- A Government Bond Fund is obligation security gave by a legislature to help government spending.

- Government bonds can pay intermittent intrigue installments called coupon installments.

- Government bonds are viewed as generally safe speculations since the administration backs them.

- There are different sorts of bonds that are offered by the U.S. Treasury that have different developments, some compensation premium, while some don’t.

Nonetheless, government-sponsored securities, especially those in developing markets, can convey dangers that incorporate nation hazard, political hazard, and national bank chance, including whether the financial framework is dissolvable.

What is the Usage of Government Bonds?

- Government securities help with subsidizing deficiencies in the bureaucratic spending plan and are utilized to raise capital for different activities, for example, foundation spending. Be that as it may, government securities are likewise utilized by the Federal Reserve Bank to control the country’s cash supply.

- At the point when the Federal Reserve repurchases U.S. government securities, the cash supply increments all through the economy as dealers get assets to spend or put resources into the market. Any assets saved into banks are, thus, utilized by those budgetary establishments to credit to organizations and people, further boosting financial movement.

Advantages and Disadvantages of Government Bonds

- Likewise, with all investment ventures, government bonds give the two advantages and detriments to the bondholder. On the upside, these obligation protections will in general return a constant flow of intrigue salary. In any case, this arrival is normally lower than the different items available because of the diminished degree of hazard associated with their ventures.

- The market for U.S. government securities is fluid, enabling the holder to exchange them on the optional security showcase effectively. There are even ETFs and common supports that attention their speculation on Treasury bonds.

- Fixed-rate securities may fall behind during times of expanding swelling or increasing business sector loan costs. Likewise, remote securities are presented to sovereign or legislative losses, changes in cash rates, and have a higher danger of default.

- Some U.S. Treasury bonds are liberated from state and government charges. In any case, the financial specialist of remote bonds may confront assesses on salary from these outside speculations.

What are the Pros in a Government Bond Fund?

- Pay a relentless intrigue salary return;

- Generally safe of default for U.S. bonds;

- Excluded from state and neighborhood charges;

- A fluid market for exchanging;

- Assessable through shared assets and ETFs.

What are the Cons of a Government Bond Fund?

- Offer low paces of return;

- Fixed pay falls behind with rising expansion

- Convey hazard when market loan costs increment

- Default and different dangers on outside bonds

- Genuine Examples of U.S. Government Bonds

There are different kinds of bonds offered by the U.S. Treasury that has different developments. Likewise, some arrival standard intrigue installments, while some don’t.

What are the Types of Government Bonds?

Reserve funds Bonds

The U.S. Treasury offers method EE securities, arrangements and investment funds securities. Securities sell at face esteem and have a fixed place of intrigue. Bonds held for a long time will arrive at their assumed worth and successfully twofold. Investment securities get a semi-yearly determined auxiliary rate attached to a swelling rate.

Treasury Notes

Treasury notes (T-notes) are middle of the road term bonds developing in two, three, five, or 10 years that give fixed coupon returns.

Treasury Bonds

Treasury bonds (T-Bonds) are long haul bonds having a development between 10 to 30 years. The bonds help to counterbalance deficiencies in the government spending plan. Likewise, they help to control the country’s cash supply and execute U.S. money related arrangements.