Table of Contents

- 10+ Certificates of Deposit Templates in PDF | DOC

- 1. Certificates of Deposit Template

- 2. Institutional Certificates of Deposit

- 3. Certificates of Deposit Disclosure Statement

- 4. Sample Certificates of Deposit

- 5. Basic Certificates of Deposit

- 6. Methodology Certificates of Deposit

- 7. Certificates of Deposit Account

- 8. Negotiable Certificates of Deposit

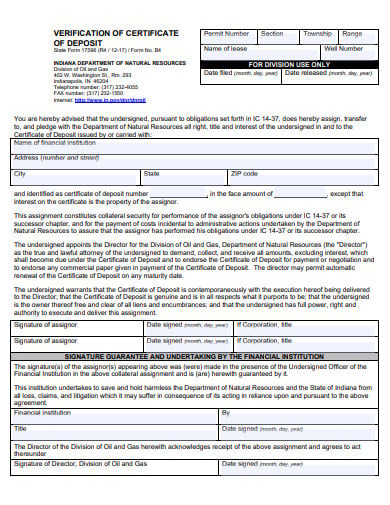

- 9. Assignment of Certificates of Deposit

- 10. Verification of Certificates of Deposit

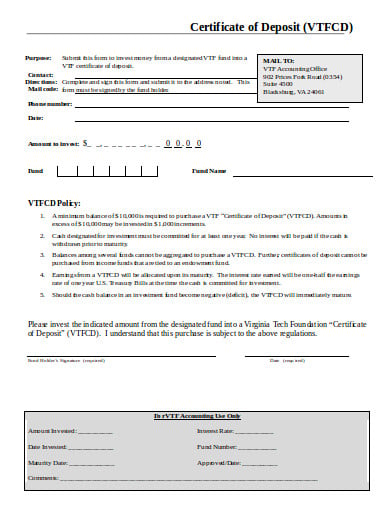

- 11. Certificates of Deposit Example

- Features of A Certificate of Deposit

- Terms and Conditions of a Certificate of Deposit

- Advantages and Disadvantages of a Certificate of Deposit

10+ Certificates of Deposit Templates in PDF | DOC

A certificate of deposit is a certificate issued by a bank to the individual depositing money at a defined rate of interest for a specified period of time. It is a time deposit or a financial product that is typically sold by banks, credit unions and thrift institutions. Such certificates are similar to savings accounts in that they are “bank money” insured and therefore practically risk-free, up to the local insured deposit cap.

10+ Certificates of Deposit Templates in PDF | DOC

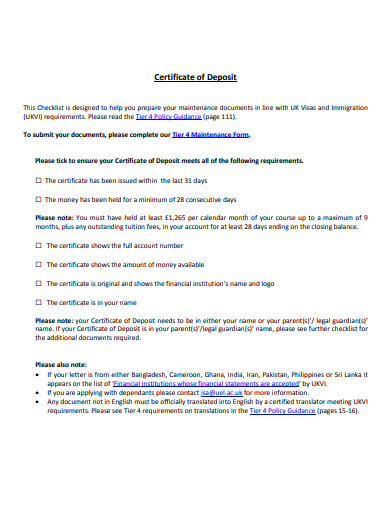

1. Certificates of Deposit Template

uel.ac.uk

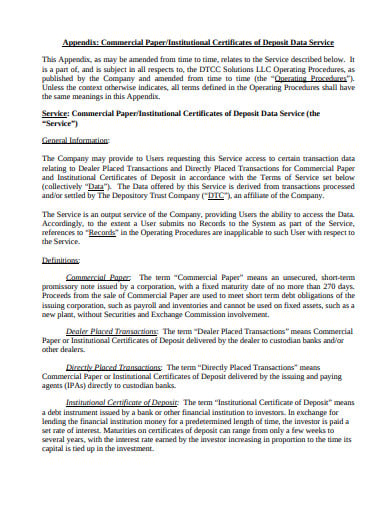

uel.ac.uk2. Institutional Certificates of Deposit

dtcc.com

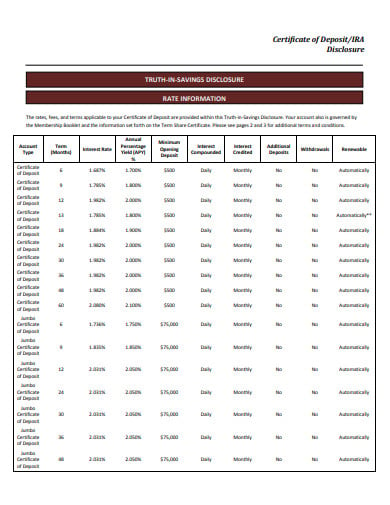

dtcc.com3. Certificates of Deposit Disclosure Statement

alightfinancialsolutions.com

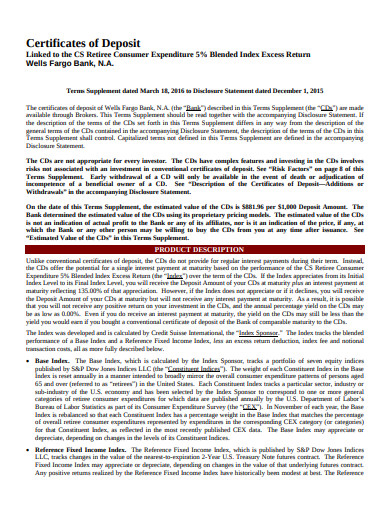

alightfinancialsolutions.com4. Sample Certificates of Deposit

trumarkonline.org

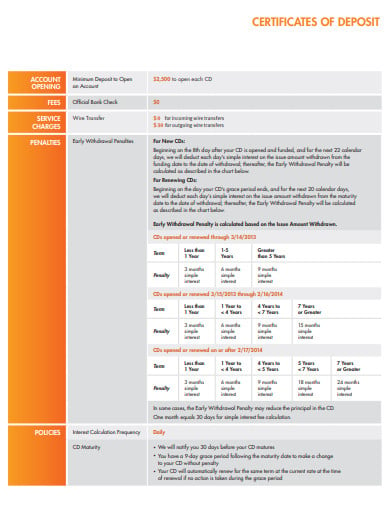

trumarkonline.org5. Basic Certificates of Deposit

raymondjames.com

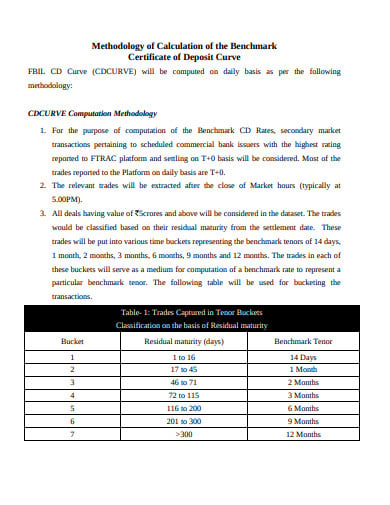

raymondjames.com6. Methodology Certificates of Deposit

ccilindia.com

ccilindia.com7. Certificates of Deposit Account

discover.com

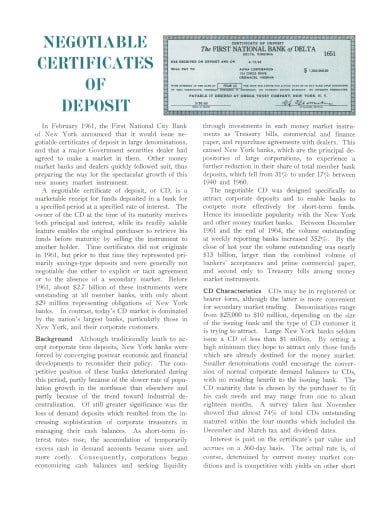

discover.com8. Negotiable Certificates of Deposit

fraser.stlouisfed.org

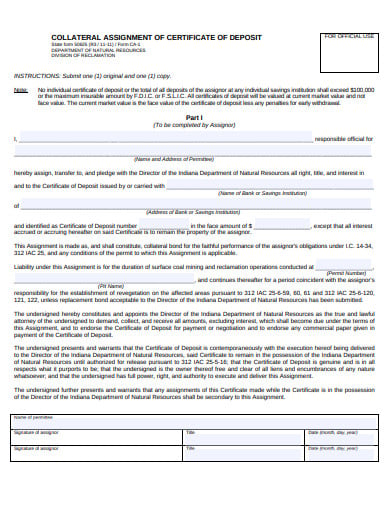

fraser.stlouisfed.org9. Assignment of Certificates of Deposit

forms.in.gov

forms.in.gov10. Verification of Certificates of Deposit

forms.in.gov

forms.in.gov11. Certificates of Deposit Example

vtf.org

vtf.orgFeatures of A Certificate of Deposit

- A higher interest rate could be provided to a larger principal.

- In general, a longer-term receives a higher interest rate, except for an inverted yield curve such as when accompanying a recession.

- Smaller organizations prefer to deliver higher rates of interest than bigger ones.

- Private certificates of deposit accounts typically get higher interest rates than commercial CD accounts.

- Banks and credit unions that don’t have FDIC or NCUA insurance generally offer higher interest rates.

Such certificates usually require a minimum deposit, and higher rates may be available for larger deposits. The highest rates are usually provided on “Jumbo CDs,” with a minimum of $100,000 deposits. Jumbo certificate of deposits is typically bought by large institutional investors who are interested in low-risk and stable investment options, such as banks and pension funds.

Terms and Conditions of a Certificate of Deposit

The terms and conditions for certificates of deposits vary widely. If the initial issuing entity has combined with another organization, or if the purchaser exits the CD early, or there is some other problem, the purchaser will have to refer to the terms and conditions agreed upon to ensure that the withdrawal is handled according to the original contract terms.

- The circumstances and terminology may be complex. These may include language such as “We can add, delete or make any other changes” (Changes) “that we wish to make to these Terms at whatever time we please.”

- The CD is theoretically callable. The terms can state that the CD can be closed by the bank or credit union before the period ends

- Interest payments are included. Interest can be charged as accrued or cumulative on the CD.

- Regarding the calculation of the interest, the CD may start earning interest from the deposit date, or the beginning of the next month or quarter.

- People have the right to delay withdrawals. Institutions typically have the right to delay withdrawals to prevent a bank run for a specified period.

- Regarding the revocation of the principal, it may be done at the financial institution’s discretion. The removal of principal below a certain minimum — or any withdrawal of principal at all — may cause the complete CD to be closed.

- Discontinued interest may be limited to the latest interest payment or permit removal of accrued total interest since the CD was delivered. Interest can be measured as of the date of withdrawal or until the end of the last month or fifth.

- A fine for early withdrawal may be expressed in months of interest, maybe estimated as being equal to the existing cost of replacing the money by the company, or may use another calculation.

- In the case of fees, a fee may be charged for withdrawal or termination or qualified inspection. In the case of fees, a fee may be charged for withdrawal or termination or qualified inspection.

- Concerning automatic reconstruction, the organization may or may not attempt to give a note upon CD maturity before automatic rollover. The institution can designate a grace period at maturity before automatically rolling over the CD to a new CD. Many banks were known to renew at rates below those of the original CD.

Advantages and Disadvantages of a Certificate of Deposit

Advantages:

The first advantage of a CD is safety. In other words, you can be assured of the safety of your funds. The Federal Deposit Insurance Corporation insures up to $250,000 worth of CDs. The government ensures that you will never lose your principal. This is why they are less risky than shares, commodities or other more risky assets, for that reason.

Secondly, they deliver rates of interest than account deposits and interest-bearing banking.

Thirdly, you have the option of buying the best rate. Small banks are offering better rates, as they need the funds. Online-only banks will be offering higher rates than brick and mortar banks because they have lower costs.

Disadvantages:

The main downside is that the duration of the certificate is tied to your income. If you need to withdraw your money before the term is up you pay a penalty.

The second downside is that while your money is tied up you will miss out on investment opportunities that arise.

The third issue is that the CDs are not charged enough to keep up with the inflation rate. When you just invest in CDs, over time you will lose your living standards. Investing in stocks is the best way to keep ahead of inflation but that is risky. You could lose your investment entirely.