Table of Contents

- Plan Template Bundle

- 11+ Investment Plan Templates in PDF | DOC | Pages

- 1. Business Investment Plan

- 2. Property Investment Business Plan

- 3. Property Investment Sales Plan

- 4. Investment Company Business Plan

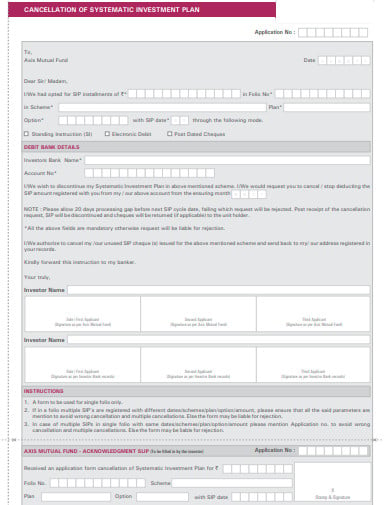

- 5. Cancellation of Systematic Investment Plan

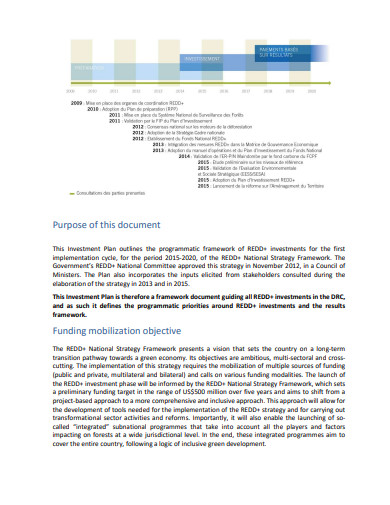

- 6. Democratic Investment Plan

- 7. Mutual Fund Investment Plan

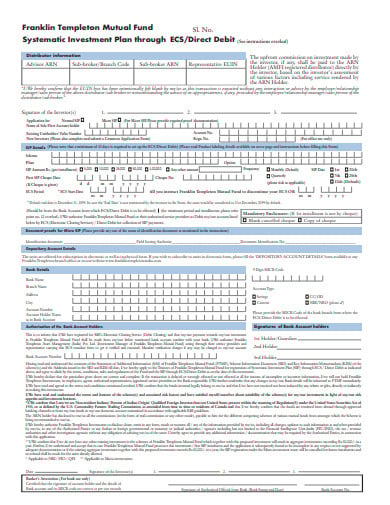

- 8. Micro Investment Plan

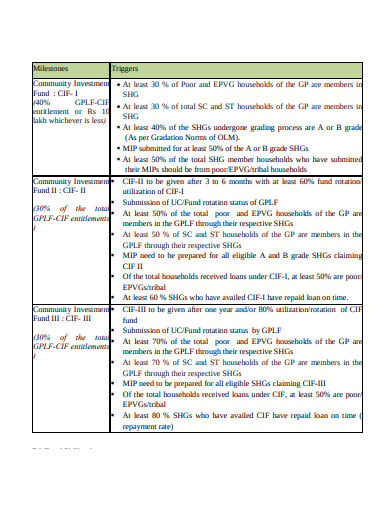

- 9. Investment Plan Mandate

- 10. Investor Education Investment Plan

- 11. Regional investment plan

- 12.Agriculture Investment Plan

- How to Make an Investment Plan?

- What is the Purpose of Your Investment?

- Tips for Beginners in Making Investments

11+ Investment Plan Templates in PDF | DOC | Pages

An investment plan refers to a process of matching your financial goals and objectives with your financial resources. It is considered to be a central component of financial planning and it is impossible to have one without the other. This process starts when you are clear about your financial goals and objectives. There are various types of different investments and the most commonly used are cash, equities, bonds as well as property. A good investment plan will generally contain all the different characteristics of any kind of investment.

Plan Template Bundle

11+ Investment Plan Templates in PDF | DOC | Pages

1. Business Investment Plan

2. Property Investment Business Plan

3. Property Investment Sales Plan

4. Investment Company Business Plan

5. Cancellation of Systematic Investment Plan

axismf.com

axismf.com6. Democratic Investment Plan

unfccc.int

unfccc.int7. Mutual Fund Investment Plan

utiitsl.com

utiitsl.com8. Micro Investment Plan

nic.in

nic.in9. Investment Plan Mandate

sharekhan.com

sharekhan.com10. Investor Education Investment Plan

licmf.com

licmf.com11. Regional investment plan

ceer.eu

ceer.eu12.Agriculture Investment Plan

reseaux.org

reseaux.orgHow to Make an Investment Plan?

Creating an investment plan includes more than simply selecting a few stocks in which to put money. You need to think about your current financial situation and your objectives. It is also important to define your timeline and how much risk you’re prepared to take on to evaluate your optimum asset allocation. For a wider selection of investment brochure templates, check out more options here. The following steps can serve as a guide on how to make an investment plan:

Step 1: Evaluate Your Current Situation

Defining your present financial situation is the first step in making an investment plan for the future. You have to figure out how much money you’ll need to invest. You can do this by creating a budget to assess your disposable monthly income after expenditures and emergency savings. This will allow you to evaluate how much you can afford to invest reasonably. It is important to contemplate on how accessible you want your investments to be. Find more investment fund templates by visiting this link. If you might need to cash in on your investment quickly, you’d rather invest in more liquid assets, such as stocks, than in something like real estate.

Step 2: Determine Your Goals

The next step toward making an investment plan is to determine your objectives. Why do you need to invest? From buying a car in a few years to retiring comfortably for many years down the road this can be anything. You also need to identify a timeline for your target, or time horizon. How quickly do you want to make money out of your investments? Want to see rapid growth, or are you interested in seeing growth in investment over time? You can summarize all of your objectives in three main categories: security, growth, and income. View a wider selection of investment memo templates right here.

Step 3: Identify Your Risk Tolerance

The third step includes deciding how much risk you are preparing to take. The younger you are, the more chance you can take because the portfolio has time to recover from any losses. If you’re older, you’d need to look for less risky investments and instead invest more money upfront to stimulate growth. Besides, riskier investments have the possibility for significant returns along with major losses as well. Taking an opportunity on an undervalued stock or piece of land may prove fruitful, or you might lose your investment. Explore a variety of investment proposal templates here. If you are looking over the years to build wealth, you might want to choose a safer route to invest.

Step 4: Make Your Decisions

The final step is to make decisions about where to invest. There are many different accounts you can take advantage of for your investment. Your budget, priorities, and appetite for risks will help guide you towards the right types of investment. Wherever you wish to invest, make sure your portfolio is diversified. To optimize your growth and stability, it’s best to assign your assets to a few different types of investments that match your priorities and risk tolerance. Once you have reached this step in the process, finding a financial advisor might be necessary. Check out more investment agreement templates available here. A consultant can help you identify the best ways to invest your money based on your current financial situation and objectives.

What is the Purpose of Your Investment?

Investments ought to be chosen with the main objective in mind: health, income or development. The first thing you need to know is which of these three most important characteristics. Do you require the current income to live on during your retirement years or do you need growth so the investments can provide the income later? Or is it safety that you need for preserving your principal value?

You must make a specific type of financial plan which is called a retirement income plan in case you are 55 years or older before creating an investment plan. This type of plan calculates the future sources of your income and expenses and then estimates your financial account values that include any deposits and withdrawals. This also helps you in identifying the point in time where you will need to use your money.

Tips for Beginners in Making Investments

- Start earlier than later. Start investing once you have an emergency fund in place and your debts on file. The sooner you start, the more risk you can take and the greater the growth of investment you can experience over time. Explore additional investment plan templates on our website, template.net, to find a variety of options that suit your needs.

- Differentiate. As described above, not placing all of your eggs in one basket is a key to successful investing. One easy way to diversify young investors is by investing in exchange-traded or funds mutual funds.

- Do your homework and do not hesitate to ask a professional. If you’re not sure where to start, or just don’t think you have the time to monitor and handle your investments, employ a financial advisor to help.