Table of Contents

- 11+ Capital Investment Plan Templates in PDF | DOC

- 1. Capital Investment Plan

- 2. Natural Capital Investment Plan

- 3. 10-Year Capital Highway Investment Plan

- 4. Strategic Capital Investment Planning

- 5. Sample Natural Capital Investment Plan

- 6. Capital Investment Plan Overview and Financial Forecast

- 7. Printable Capital Investment Plan

- 8. Capital Investment Plan Public Review

- 9. Infrastructure and Capital Investment Plan

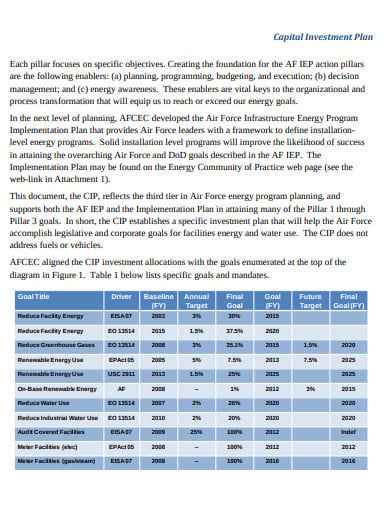

- 10. Air Force Capital Investment Plan

- 11. Water Works Capital Investment Plan

- 12. Capital Investment Plan in DOC

- How can you make the capital investment plan?

- What do you mean by the capital investment plan?

- Why do you need the capital investment plan?

- What are the things that you require in making a capital investment plan?

11+ Capital Investment Plan Templates in PDF | DOC

The capital investment is the total amount of the money invested in the organization or business associations. It is referred to the company’s long term assets like the real estate, manufacturing plants, and machinery. Generally, capital investment is the broad and huge term. The decision made by the company to make the capital investment is for the long term growth and development. The capital investment plan should be for long term purposes and it is through the plan and the strategy that you come to know which areas to invest.

11+ Capital Investment Plan Templates in PDF | DOC

1. Capital Investment Plan

prudential.com.hk

prudential.com.hk2. Natural Capital Investment Plan

files.wordpress.com

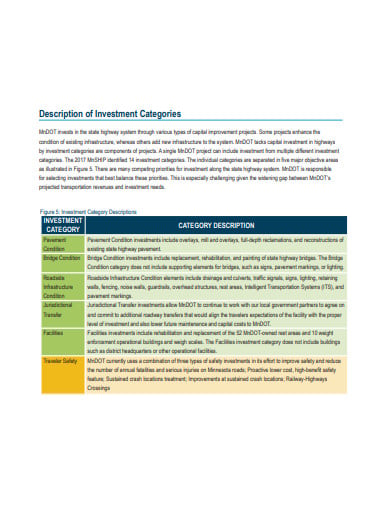

files.wordpress.com3. 10-Year Capital Highway Investment Plan

state.mn.us

state.mn.us4. Strategic Capital Investment Planning

va.gov

va.gov5. Sample Natural Capital Investment Plan

eftec.co.uk

eftec.co.uk6. Capital Investment Plan Overview and Financial Forecast

bellevuewa.gov

bellevuewa.gov7. Printable Capital Investment Plan

escribemeetings.com

escribemeetings.com8. Capital Investment Plan Public Review

pvpc.org

pvpc.org9. Infrastructure and Capital Investment Plan

cilt.ie

cilt.ie10. Air Force Capital Investment Plan

afcec.af.mil

afcec.af.mil11. Water Works Capital Investment Plan

mcleansask.com

mcleansask.com12. Capital Investment Plan in DOC

mycouncil.oxfordshire.gov.uk

mycouncil.oxfordshire.gov.ukHow can you make the capital investment plan?

The capital investment planning is made to invest in the firms and the enterprises in order to increase the business goal and objectives. The strategist invests their time and money making plans for the long term capital growth. The plan or the strategies are for fulfilling the future goal and objectives of the organization or business institution. The business leaders plan to invest their funds in the capital or fixed assets. The capital investment takes place on the various types of asset depending on the need and want of that organization.

Step 1: Identifying and evaluating opportunities

The capital investment planner must identify and then evaluate the opportunities before the execution of the planning. The identification of the sources of the investment should be in the plan of capital investment. The successful business or trade depends a lot on the identification and evaluation of the opportunities and threats in the plan. Because of it, the backup plan or the option is kept by the organization to avoid a crisis situation.

Step 2: Estimate operation and execution expense

The capital investment plan is the estimation and creating the idea for the funds to be invested in the organization for future objectives. The estimation of the operations and its execution can cost you a fortune if you are not planning.

Step 3: Estimate the cash flow

When the capital investment plan starts to form, it is necessary to keep a budget ready and with it, you require the cash flow. The planning and strategizing should include the prior successful past project to make an idea of the funds needed for future projects. And, these also help in sorting out the sources of the cash flow.

Step 4: Assessing the risk

The assessing and evaluating the risk factors during the making of the plan or the strategies for capital investment. Before making the plan, it is the core duty of the planners to navigate through the risk and plans to asses it with the help of a backup option.

Step 5: Implementation of the plan

The capital investment plan is for the investors or the stakeholders to make the move by investing in fixed or long-term assets. Implementing the plan in the business is an important step before reaching the conclusion. The investment planning is for the futuristic growth and development of the business and trade.

What do you mean by the capital investment plan?

The capital investment plan or the strategies is the fund invested in the firm or enterprises with the aim to achieve future objectives. The aim and objectives of capital investment are to attain long-term growth. And, so the company plans and implements the capital investment in order to ensure its growth and future. With the capital, investment planning comes the capital budgeting that investing in the new products and research development is worth pursuing or not.

And it is the budget for major capital or investment expenditures. The capital budgeting has different methods within it to achieve the desired result and the consequence of a successful business strategy. The capital investment plans and strategy is to make an increase in an operational capacity, a larger share in the market and earn more revenues.

Why do you need the capital investment plan?

The capital investment plan is to benefit the company in the long run but it can have short term downsides. The constant and regular capital investment can also lead to downsizing or degradation. The stock owners and the market analyst can figure out the amount of money and funds are debt on the company. With the effective and proper capital investment plan, the business organization can avoid such a situation. The company investment plan is a well-strategize entity that works that the business organization follows for the future prospect.

What are the things that you require in making a capital investment plan?

The business organization wishes to secure its future objectives and plan of investing the capital in the profit bearing areas. The setting up of the achievable and realistic goals and objectives. Creating the objectives that are hard to get is not really a wise thing to do while making the capital investment plans. Carefully select and pick up the investment plan those are easily achievable and assist in growing the future perspective of the organization.

Firstly the capital investment plan is for investing in fixed assets. And secondly, the funds are invested for the day to day operation coverage. Therefore, the investment plans are important to make to acquire future growth and objective in the organization.