Table of Contents

- 9+ Investor Qualification Form Templates in DOC | PDF

- 1. Investor Qualification Form Template

- 2. Form of Letter of Intent Template

- 3. Qualified Investor Form Template

- 4. Investor Information and Qualification Form

- 5. Accredited Investor Qualification Form

- 6. Sample Investor Qualification Form

- 7. Application Form for Institutional Investors

- 8. Investor Identification Form Template

- 9. Accredited Investor Assessment Form

- 10. Accredited Investor Suitability Form

- What are the Various Prerequisites of Becoming a Qualified Investor?

- What are the Factors that Influence on Becoming a Qualified Investor?

- Qualified versus Non-Qualified Investor

- The Difference between a Qualified Investor and a Qualified Institutional Buyer

9+ Investor Qualification Form Templates in DOC | PDF

A Qualified Investor also is known as a certified financial specialist additionally alluded to as a licensed speculator, is an individual or substance that can buy protections that aren’t enlisted fundamentally because of the speculator’s salary and total assets. Explicit principles apply to meet such prerequisites, which are characterized in the Securities and Exchange Commission (SEC) Regulation D-Rule 501.

9+ Investor Qualification Form Templates in DOC | PDF

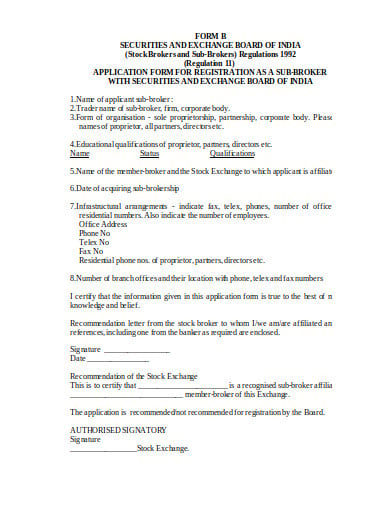

1. Investor Qualification Form Template

nseindia.com

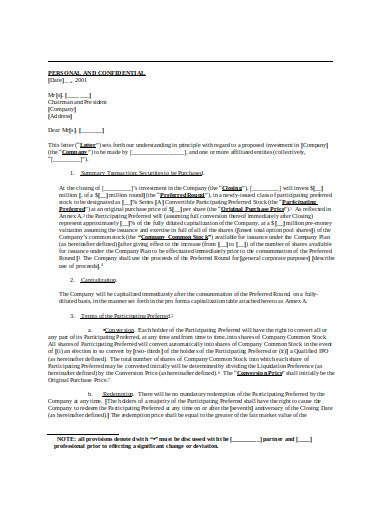

nseindia.com2. Form of Letter of Intent Template

law.columbia.edu

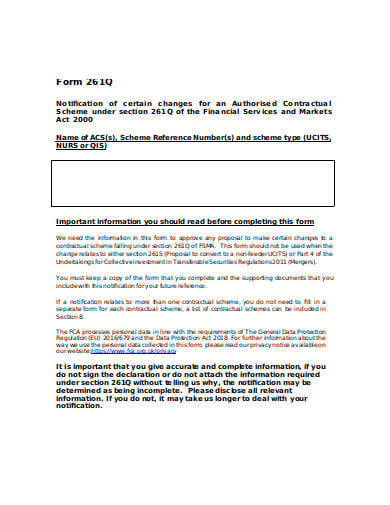

law.columbia.edu3. Qualified Investor Form Template

fca.org.uk

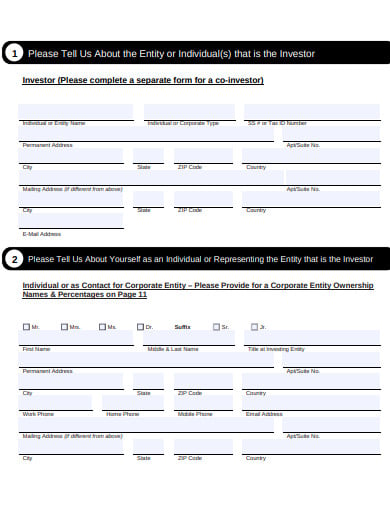

fca.org.uk4. Investor Information and Qualification Form

veber.com

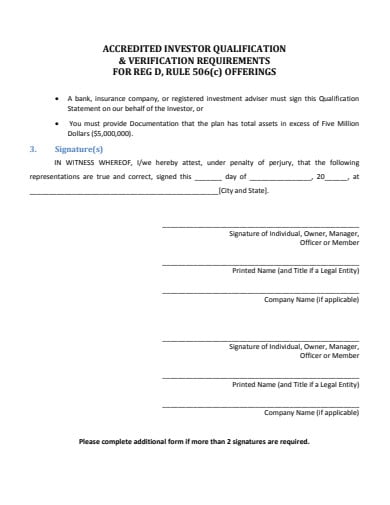

veber.com5. Accredited Investor Qualification Form

gripsecret.com

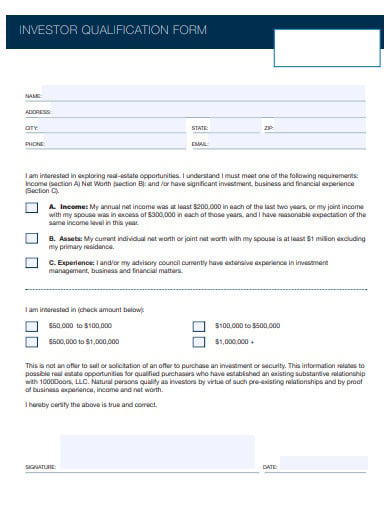

gripsecret.com6. Sample Investor Qualification Form

reverieinv.com

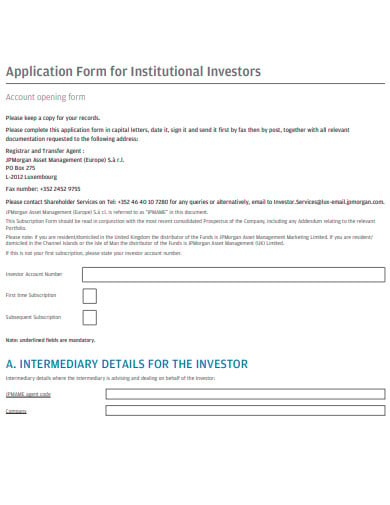

reverieinv.com7. Application Form for Institutional Investors

jpmorganassetmanagement.lu

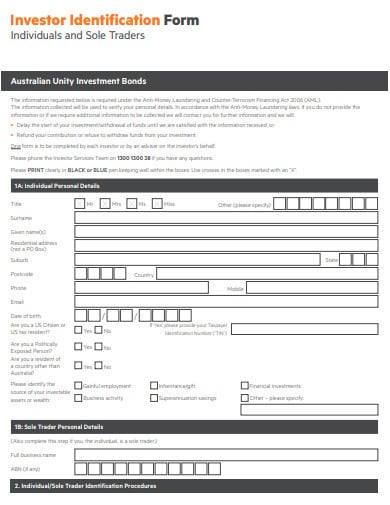

jpmorganassetmanagement.lu8. Investor Identification Form Template

australianunity.com.au

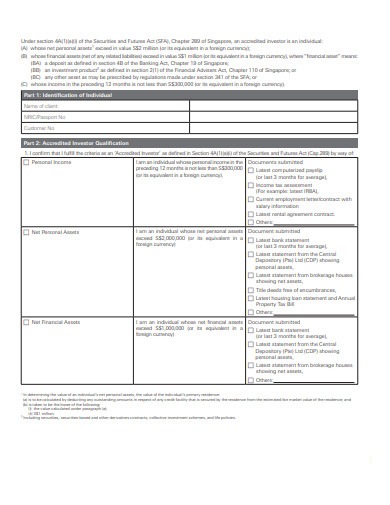

australianunity.com.au9. Accredited Investor Assessment Form

hsbc.com

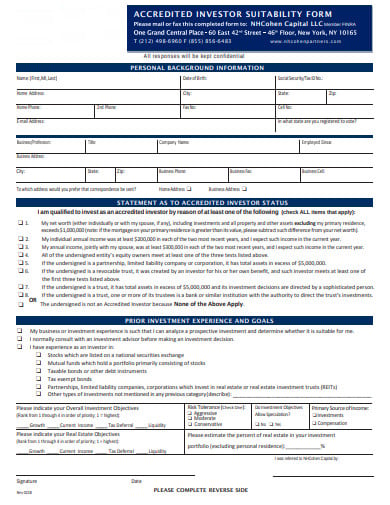

hsbc.com10. Accredited Investor Suitability Form

nhcohenpartners.com

nhcohenpartners.comWhat are the Various Prerequisites of Becoming a Qualified Investor?

Numerous organizations offer protections to just qualified financial specialists since this absolves them from enlisting such protections. Notwithstanding, if the protections are offered to both qualified and non-qualified financial specialists, the protections must be enlisted with the SEC. Qualified speculators can incorporate individuals, organizations, budgetary foundations, companies, trusts, and even not-for-profit associations.

What are the Factors that Influence on Becoming a Qualified Investor?

One is demonstrated to be qualified or licensed in the accompanying manners:

Information

Administrative offices, including the SEC, must confirm that an individual or business has both the benefits just as the information to take on such speculation hazards in unregistered protections before sorting the individual or element as being qualified.

Salary test

The imminent financial specialist must have a yearly pay of $200,000 or $300,00 for joint pay throughout the previous two years with the affirmation that the salary will continue as before or increment after some time. Two special cases apply to the salary test:

- When somebody is hitched inside the timeframe in which the pay test is led and;

- When the individual has total assets of over $1 million, either exclusively or together with a life partner, at that point the pay test isn’t essential.

Remember that the SEC might be changing the system sooner or later to make the prerequisites stricter as far as getting qualified. Some extra prerequisites may incorporate one’s instructive foundation just as the number of long stretches of expert experience.

Jumpstart Our Business Startup (JOBS) Act has consistently assumed a job in changing the general scene for private ventures and giving that non-qualified financial specialists approach certain private contributions. As of now under audit is another proposed decision that would permit non-certify financial specialists, which means anybody, to put resources into crowdfunded contributions, which is commonly just open to qualified speculators.

Qualified versus Non-Qualified Investor

While a certified financial specialist must meet the previously mentioned criteria, a non-qualified speculator is one who doesn’t meet such criteria. For instance, a non-qualified speculator will have total assets of under $1 million (independently or potentially together) and doesn’t meet the salary prerequisites of $200,000 separately or $300,000 mutually.

The Difference between a Qualified Investor and a Qualified Institutional Buyer

A certified institutional purchaser (QIB) is an enterprise that is regarded as a certified financial specialist. Such partnerships put at least $100 million in protections on an unlimited premise, the limit for putting resources into an intermediary vendor being $10 million. Remembering for the meaning of an enterprise under the QIB rule are money related organizations, insurance agencies, and worker advantage plans. In any case, the QIB must be an element, regardless of whether the household or outside and can’t be a person.