Table of Contents

3+ Investment Budget Templates in XLS

Investment Budget is also known as capital budgeting. It refers to the method of allocating resources for spending on some big capital or investment. One of the capital budgeting investment’s primary objectives is to increase the firm’s value to shareholders. The cumulative cash flows from each possible investment or initiative are used by these processes.

3+ Investment Budget Templates in XLS

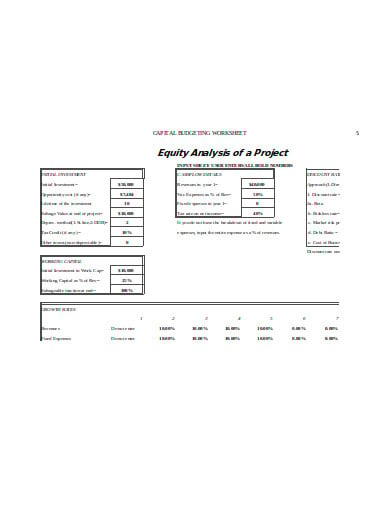

1. Investment Capital Budgeting Template

people.stern.nyu.edu

people.stern.nyu.edu2. Return on Investment Budget Template

marketingmo.com

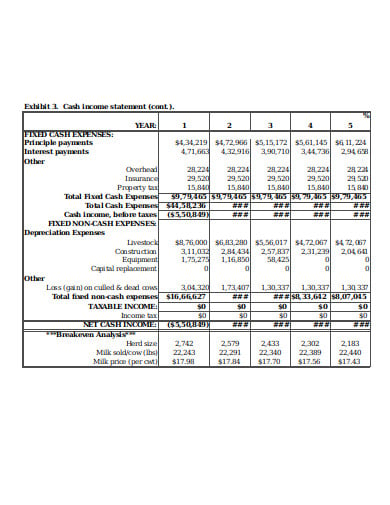

marketingmo.com3. Investment Budget Template in XLS

dairy.ifas.ufl.edu

dairy.ifas.ufl.eduWhat is Investment Budgeting and What is Its Net Value?

Capital or investment budgeting is the planning process used to assess whether long-term investments of an entity such as new machinery, machinery expansion, new plants, new products, and technology development projects are worth the cash funding through the company’s capitalization structure such as debt, equity, or retained earnings.

To provide the company with the additional net present value (NPV), cash flows are adjusted to the cost of capital. If the capital is limited or there are dependencies between projects, the firm will consider all projects with positive NPV to maximize the value-added to the business. This type accounts for the funding’s time value. Mutually exclusive projects refer to a group of projects from which at least one will be approved, for instance, a set of projects performing the same function. Therefore, when selecting between mutually exclusive projects, more than one of the projects can meet the criterion of capital budgeting, but only one project is generally appropriate.

Equivalent Annuity Method

The equivalent annuity formula describes the net present value as an annualized cash flow by dividing it by the annuity factor’s present value. It is generally used only when calculating the costs of different ventures with the same cash inflows. It is known as the equivalent annual cost (EAC) measure in this form and refers to the cost per year of maintaining and running an asset throughout its lifespan. It is often used when evaluating disproportionate lifespan investment projects. Using the EAC approach ensures that the task will be substituted by a similar task.

Importance of Investment Budgeting

- One of the most important tools in financial management is capital or investment budgeting.

- Budgeting offers a wide range of opportunities for financial managers to assess different projects in terms of their investment viability.

- It aims to show the risk and uncertainty of different projects.

- It works to maintain a balance on or under investments.

- Proper monitoring of the costs of capital projects is given to the management.

- The fate of an organization is determined by how the available resources are optimally used.

Besides these, there are three very important why investment budgeting is required;

- Long-term Investments: Long-term investments include several risks. These investments with more financial risks are capital expenditures. This is why careful planning is required with the help of investment budgeting.

- Large Investments: Considering that the investments are large however the funds are small, a pre-requisite is proper planning for capital expenditure. Capital investment decisions are also irreversible. This means that once a permanent asset is acquired, its destruction would result in losses.

- In the Long Run: Investment budgeting decreases costs and allows improvements in the company’s competitiveness. It helps to avoid investments over or under these. Proper project planning and analysis also help in the long-term.

Techniques Used in Investment Budgeting

Investment budgeting is a series of strategies used to decide which projects to invest in. There is a range of techniques available for capital budgeting including the following:

Payback period method

This approach, as the term suggests, refers to the time during which the plan should generate cash to recover the initial investment. This solely stresses cash inflows, the project’s economic life and the investment made in the project, with no understanding of the money’s time value. The identification of a plan through this process is based on the project’s earning capacity. The selection or rejection of the project can be achieved with simple calculations, with results that will help to measure the risks involved.

Accounting Rate of Return Method (ARR):

This approach helps in resolving the limitations of the payback-period process. The rate of return is expressed as a percentage of the investment earnings in a given project. This method operates on the basis that any project with ARR greater than the minimum rate set by the administration will be taken into account and those below the agreed rate will be refused. The approach takes into consideration the whole economic life of a program and provides a better means of evaluation. It also implies that the idea of net earnings compensates for the anticipated productivity of projects. This method, however, often ignores the time value of money and does not recognize the life span of the projects. It is also incompatible with the company’s goal to optimize share market value.

Discounted Cash Flow Method:

This technique of discounted cash flow methodology computes the cash inflow and outflow by an asset’s lifespan. These are then offset by a discounting element. The discounted cash inflows are then correlated with outflows. This strategy takes the interest factor into account along with the return after the payback period.

Net Present Value (NPV) Method:

The net present value is one of the most commonly used approaches for evaluating plans for capital investments. In this approach, the cash inflow is discounted at a specific rate, which is predicted at different times. The actual cash inflow amounts are contrasted with the original investment. It will be accepted only if the difference between them is positive; if the difference is negative, it is rejected. This method looks at the time value of money and is consistent to increase the owners’ profits. The drawback here is that knowing the idea of the capital cost is not an easy task.

Internal Rate of Return (IRR):

The internal rate of return is defined as the rate at which the investment’s net present value is zero. The reduced cash inflow is equivalent to the reduced cash outflow. This approach also considers the time value of the money. This method aims to attempt to arrive at an interest rate at which funds invested in the venture can be repaid from cash inflows. The drawback of this method is that the computation of IRR is a complicated and demanding task. It is known as internal cost as it depends almost entirely on the outlay and the project-related proceeds and not any factor calculated outside of the investment.

Profitability Index (PI):

The profitability index is the measure of the current value of potential cash benefits, at the necessary rate of return on the investment’s initial cash outflow. It could be gross or net; the net is just gross minus one.