Free Month End Closing Checklist

Prepared By: | Company Name: |

|---|---|

[Your Name] | [Your Company Name] |

The checklist is meticulously crafted to streamline your financial procedures and ensure accuracy and efficiency at the end of each month. This checklist serves as a comprehensive guide, outlining essential tasks to be completed before finalizing financial statements. Simply follow the step-by-step instructions to facilitate a smooth and organized month-end closing process.

I. Account Reconciliation

This section includes tasks in verifying account balance accuracy at the end of the month.

Tasks | |

Implement a reconciliation software to automate the reconciliation process, reducing human error and saving time. | |

Conduct intercompany reconciliations to ensure transactions between subsidiaries are accurately recorded and eliminated in consolidation. | |

Review aged receivables and payables to identify and address long-standing issues affecting financial accuracy. |

II. Journal Entries and Accruals/Deferrals

This segment of the checklist addresses the necessary bookkeeping items for accurate financial statements.

Tasks | |

Assess prepaid expenses and adjust amortization schedules as necessary to ensure accurate monthly expense recognition. | |

Ensure expenses are recognized in the period in which the related revenue is earned, enhancing the accuracy of financial reporting. | |

Ensure that all capital expenditures are accurately recorded and classified and that depreciation schedules are updated. |

III. Financial Reporting

This section ensures the production of accurate financial reports.

Tasks | |

Compare actual results to budgeted/forecasted figures and analyze any significant variances to understand the underlying causes. | |

Refresh financial dashboards and key performance indicators (KPIs) to provide a quick snapshot of financial health to management. | |

Assess the company's compliance with any loan covenants or financial ratios required by creditors or investors. |

IV. Audit Preparation

In this category, the tasks revolve around preparing for any potential audits, internally or externally

Tasks | |

Conduct an internal review of high-risk areas to identify and address any potential issues before the external audit. | |

Review and document any changes to internal controls over financial reporting to ensure they are current and effective. | |

Confirm that accounting policies and procedures are up-to-date and in compliance with applicable standards and regulations. |

V. Closing Procedures

This section covers tasks required to close the financial period officially.

Tasks | |

Finalize all financial statements, ensuring they accurately reflect the company’s financial activities and position. | |

Lock the period in the accounting system to prevent any changes, ensuring the integrity of financial data. | |

Conduct a final review for financial accuracy and completeness, addressing any remaining discrepancies. | |

Document any significant financial issues or discrepancies identified during the closing process for future reference and action. | |

Officially declare the books as closed for the period, communicating the closure to all relevant departments and stakeholders. |

- 100% Customizable, free editor

- Access 1 Million+ Templates, photo’s & graphics

- Download or share as a template

- Click and replace photos, graphics, text, backgrounds

- Resize, crop, AI write & more

- Access advanced editor

Enhance your month-end closing process with the Month End Closing Checklist Template from Template.net. This customizable, downloadable, and printable template offers a comprehensive guide to ensure all tasks are completed. Editable in our AI Editor Tool, you can tailor the checklist to suit your needs. Simplify your month-end procedures with this essential tool.

You may also like

- Cleaning Checklist

- Daily Checklist

- Travel Checklist

- Self Care Checklist

- Risk Assessment Checklist

- Onboarding Checklist

- Quality Checklist

- Compliance Checklist

- Audit Checklist

- Registry Checklist

- HR Checklist

- Restaurant Checklist

- Checklist Layout

- Creative Checklist

- Sales Checklist

- Construction Checklist

- Task Checklist

- Professional Checklist

- Hotel Checklist

- Employee Checklist

- Moving Checklist

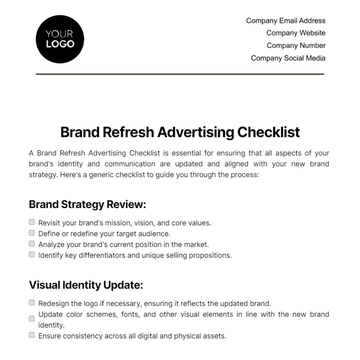

- Marketing Checklist

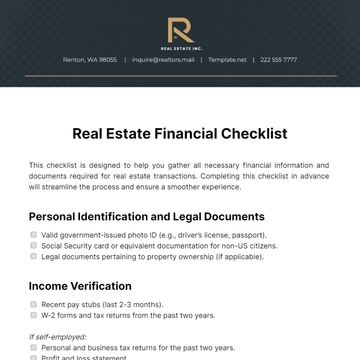

- Accounting Checklist

- Camping Checklist

- Packing Checklist

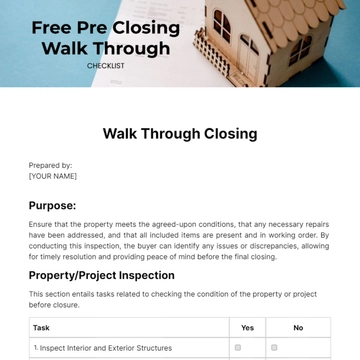

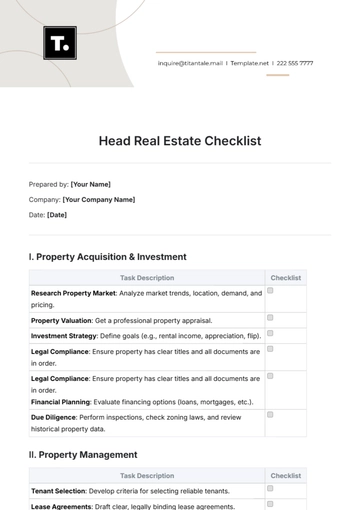

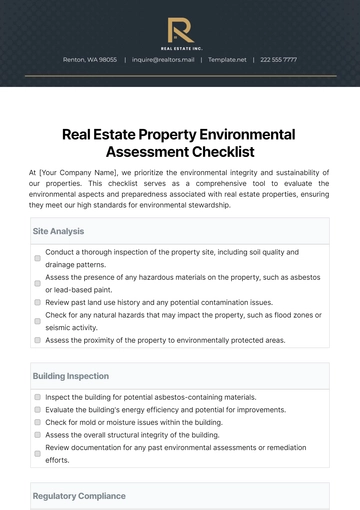

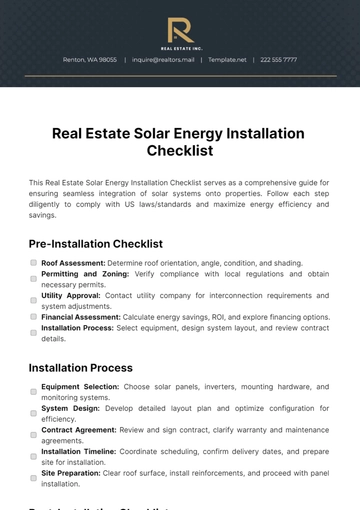

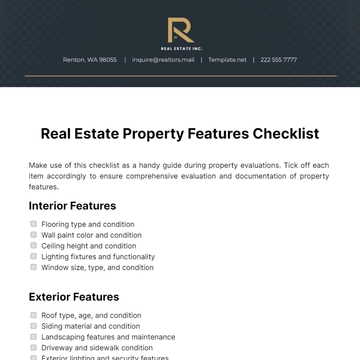

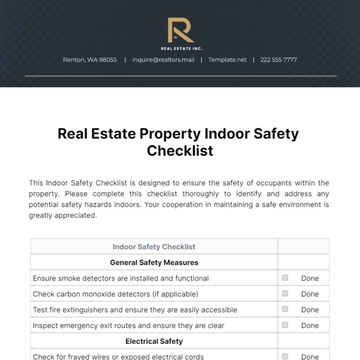

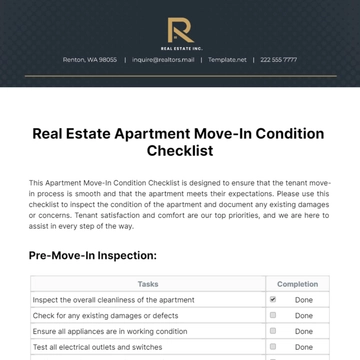

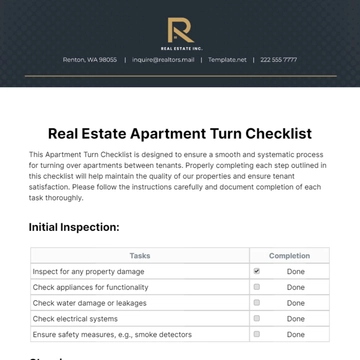

- Real Estate Checklist

- Cleaning Checklist Service

- New Employee Checklist

- Food Checklist

- Home Inspection Checklist

- Advertising Checklist

- Event Checklist

- SEO Checklist

- Assessment Checklist

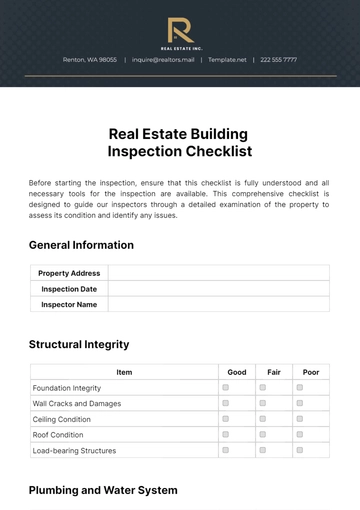

- Inspection Checklist

- Baby Registry Checklist

- Induction Checklist

- Employee Training Checklist

- Medical Checklist

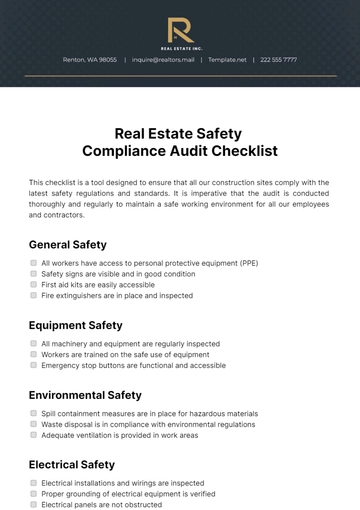

- Safety Checklist

- Site Checklist

- Job Checklist

- Service Checklist

- Nanny Checklist

- Building Checklist

- Work Checklist

- Office Checklist

- Training Checklist

- Website Checklist

- IT and Software Checklist

- Performance Checklist

- Project Checklist

- Startup Checklist

- Education Checklist

- Home Checklist

- School Checklist

- Maintenance Checklist

- Planning Checklist

- Manager Checklist

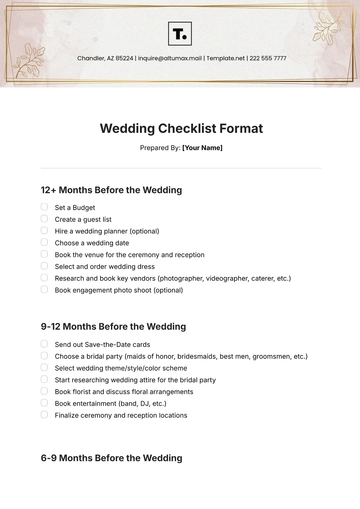

- Wedding Checklist

- Vehicle Checklist

- Travel Agency Checklist

- Vehicle Inspection Checklist

- Interior Design Checklist

- Backpacking Checklist

- Business Checklist

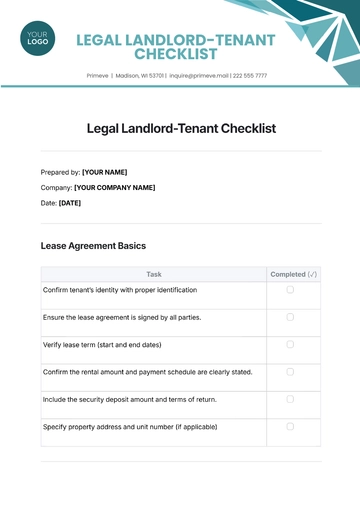

- Legal Checklist

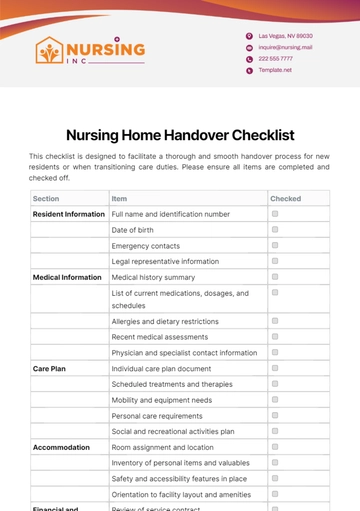

- Nursing Home Checklist

- Weekly Checklist

- Recruitment Checklist

- Salon Checklist

- Baby Checklist

- Equipment Checklist

- Trade Show Checklist

- Party Checklist

- Hospital Bag Checklist

- Evaluation Checklist

- Agency Checklist

- First Apartment Checklist

- Hiring Checklist

- Opening Checklist

- Small Business Checklist

- Rental Checklist

- College Dorm Checklist

- New Puppy Checklist

- University Checklist

- Building Maintenance Checklist

- Work From Home Checklist

- Student Checklist

- Application Checklist