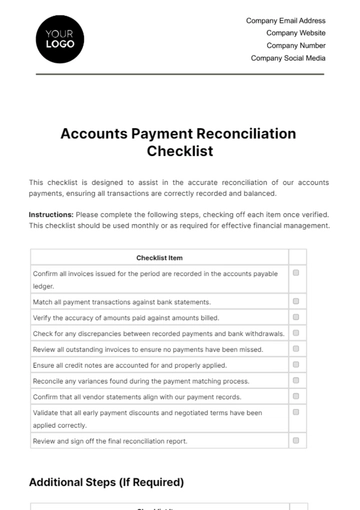

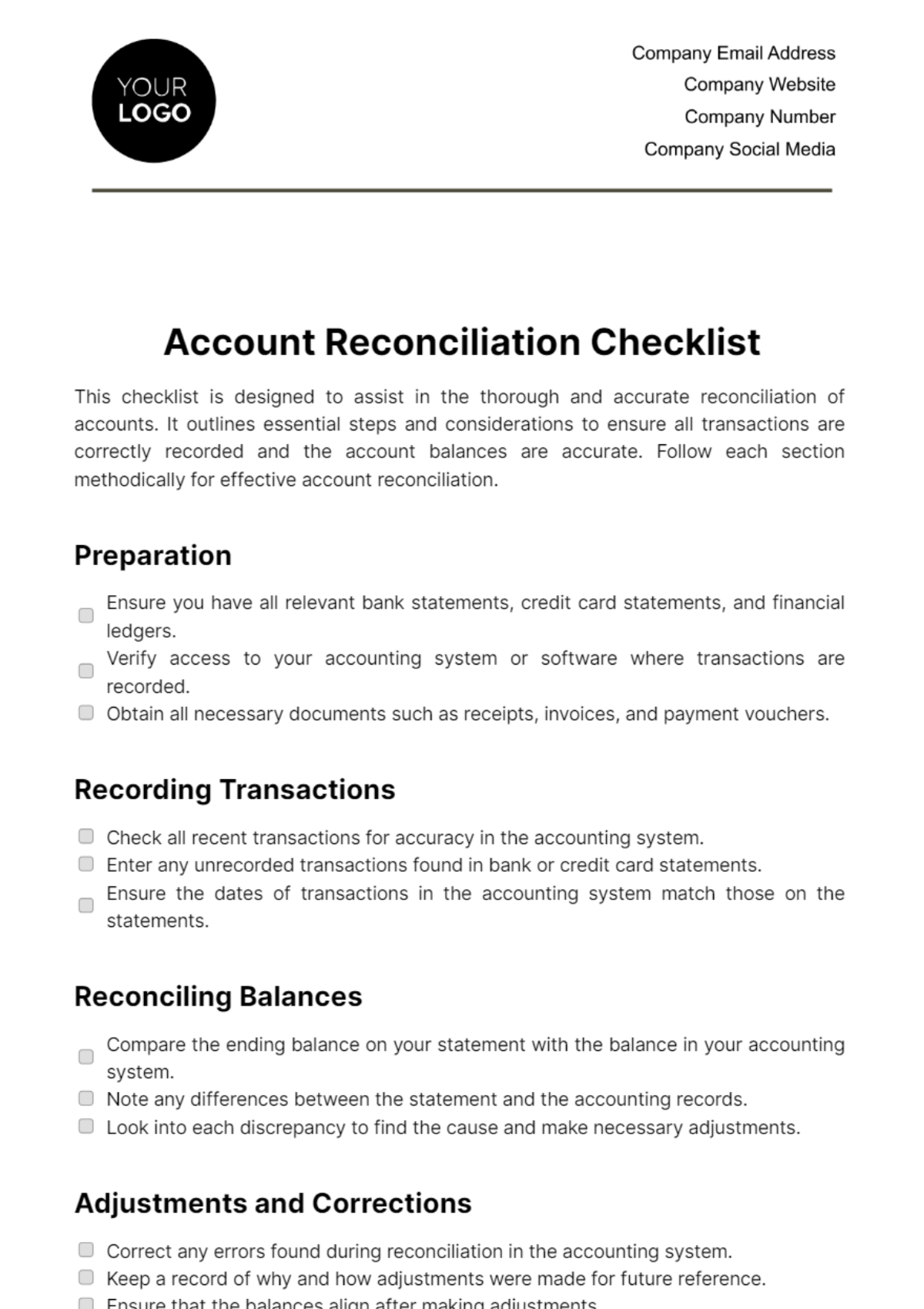

Free Account Reconciliation Checklist

This checklist is designed to assist in the thorough and accurate reconciliation of accounts. It outlines essential steps and considerations to ensure all transactions are correctly recorded and the account balances are accurate. Follow each section methodically for effective account reconciliation.

Preparation

Ensure you have all relevant bank statements, credit card statements, and financial ledgers.

Verify access to your accounting system or software where transactions are recorded.

Obtain all necessary documents such as receipts, invoices, and payment vouchers.

Recording Transactions

Check all recent transactions for accuracy in the accounting system.

Enter any unrecorded transactions found in bank or credit card statements.

Ensure the dates of transactions in the accounting system match those on the statements.

Reconciling Balances

Compare the ending balance on your statement with the balance in your accounting system.

Note any differences between the statement and the accounting records.

Look into each discrepancy to find the cause and make necessary adjustments.

Adjustments and Corrections

Correct any errors found during reconciliation in the accounting system.

Keep a record of why and how adjustments were made for future reference.

Ensure that the balances align after making adjustments.

Final Review and Approval

Double-check all reconciled accounts for completeness and accuracy.

Have a supervisor or a senior accountant review and approve the reconciled accounts.

Securely file all relevant documents and reconciliation reports for auditing purposes.

Additional Notes

The accurate completion of this Account Reconciliation Checklist should provide confidence in the accuracy of your company's financial records. User discretion is advised in case other steps or measures are deemed necessary.

Prepared by: [Your Name]

- 100% Customizable, free editor

- Access 1 Million+ Templates, photo’s & graphics

- Download or share as a template

- Click and replace photos, graphics, text, backgrounds

- Resize, crop, AI write & more

- Access advanced editor

Elevate accounting efficiency with Template.net’s Account Reconciliation Checklist. An exemplary and customizable tool, precisely crafted to streamline your financial analysis. Editable in our Ai Editor Tool, this indispensable resource ensures comprehensive results. Boost your productivity further with this editable, polished, and professional template. The power of convenience lies in your hands.

You may also like

- Cleaning Checklist

- Daily Checklist

- Travel Checklist

- Self Care Checklist

- Risk Assessment Checklist

- Onboarding Checklist

- Quality Checklist

- Compliance Checklist

- Audit Checklist

- Registry Checklist

- HR Checklist

- Restaurant Checklist

- Checklist Layout

- Creative Checklist

- Sales Checklist

- Construction Checklist

- Task Checklist

- Professional Checklist

- Hotel Checklist

- Employee Checklist

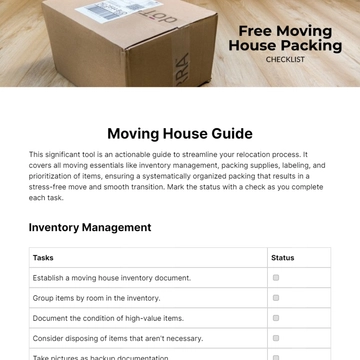

- Moving Checklist

- Marketing Checklist

- Accounting Checklist

- Camping Checklist

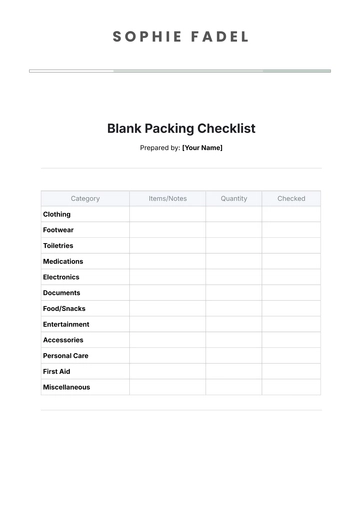

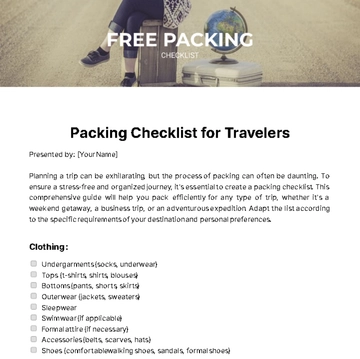

- Packing Checklist

- Real Estate Checklist

- Cleaning Checklist Service

- New Employee Checklist

- Food Checklist

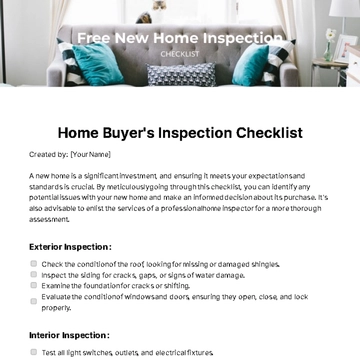

- Home Inspection Checklist

- Advertising Checklist

- Event Checklist

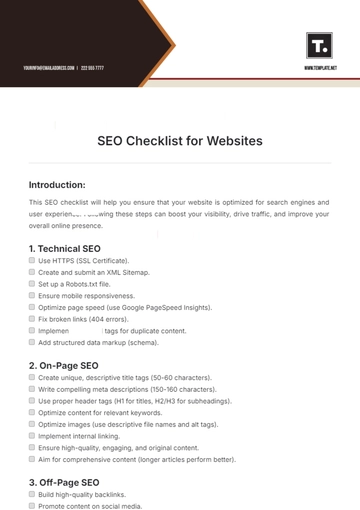

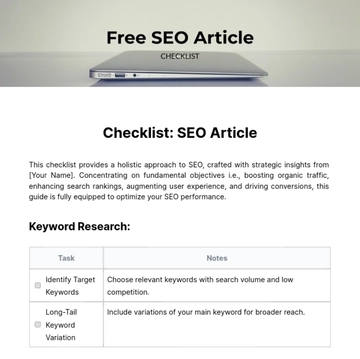

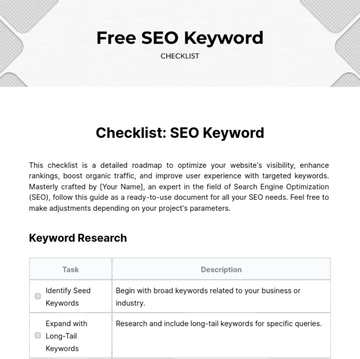

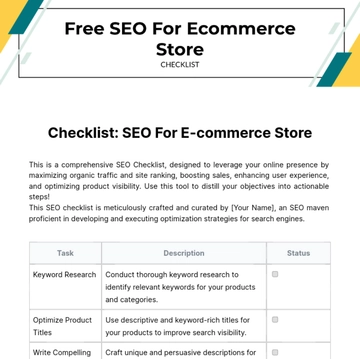

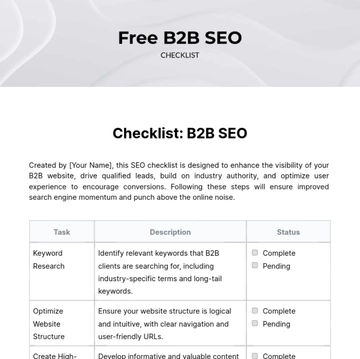

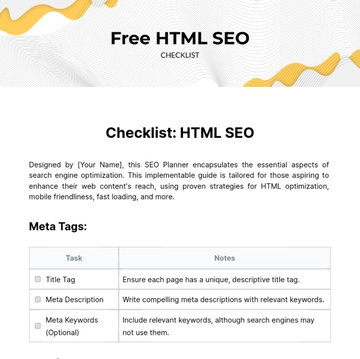

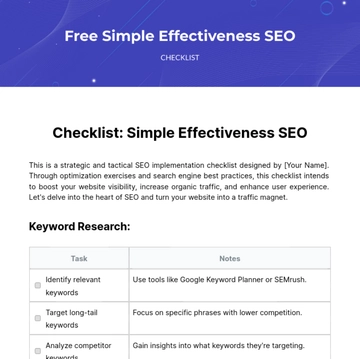

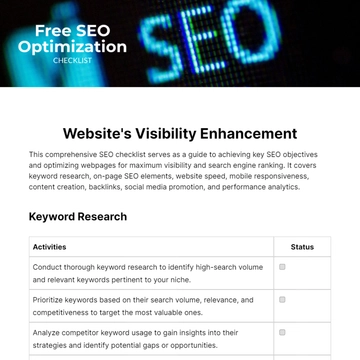

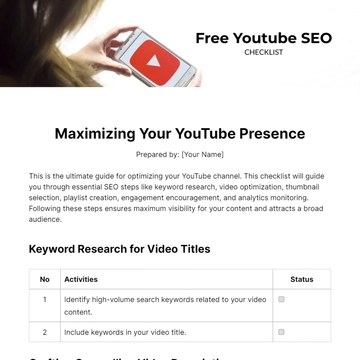

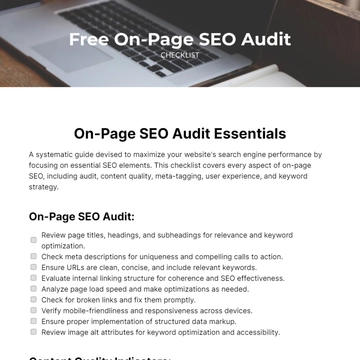

- SEO Checklist

- Assessment Checklist

- Inspection Checklist

- Baby Registry Checklist

- Induction Checklist

- Employee Training Checklist

- Medical Checklist

- Safety Checklist

- Site Checklist

- Job Checklist

- Service Checklist

- Nanny Checklist

- Building Checklist

- Work Checklist

- Office Checklist

- Training Checklist

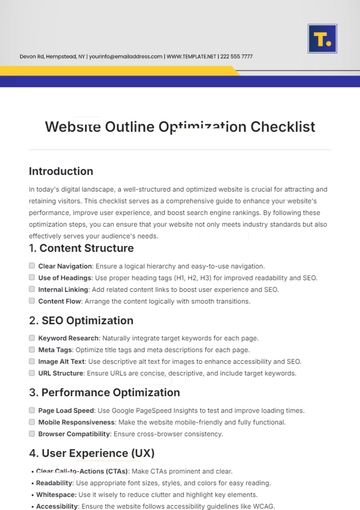

- Website Checklist

- IT and Software Checklist

- Performance Checklist

- Project Checklist

- Startup Checklist

- Education Checklist

- Home Checklist

- School Checklist

- Maintenance Checklist

- Planning Checklist

- Manager Checklist

- Wedding Checklist

- Vehicle Checklist

- Travel Agency Checklist

- Vehicle Inspection Checklist

- Interior Design Checklist

- Backpacking Checklist

- Business Checklist

- Legal Checklist

- Nursing Home Checklist

- Weekly Checklist

- Recruitment Checklist

- Salon Checklist

- Baby Checklist

- Equipment Checklist

- Trade Show Checklist

- Party Checklist

- Hospital Bag Checklist

- Evaluation Checklist

- Agency Checklist

- First Apartment Checklist

- Hiring Checklist

- Opening Checklist

- Small Business Checklist

- Rental Checklist

- College Dorm Checklist

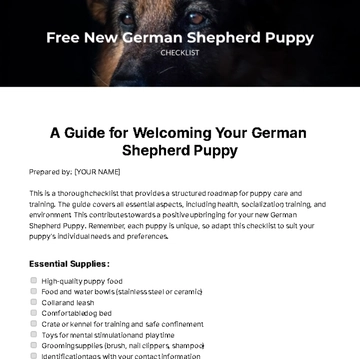

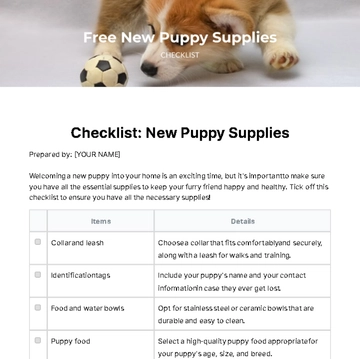

- New Puppy Checklist

- University Checklist

- Building Maintenance Checklist

- Work From Home Checklist

- Student Checklist

- Application Checklist