Free Accounting Depreciation Method Memo

Method Memo

To: All Department Heads

From: [Your Name], Chief Financial Officer

Date: [Month Day, Year]

Subject: Update on Accounting Depreciation Method Change

Dear Team Leaders,

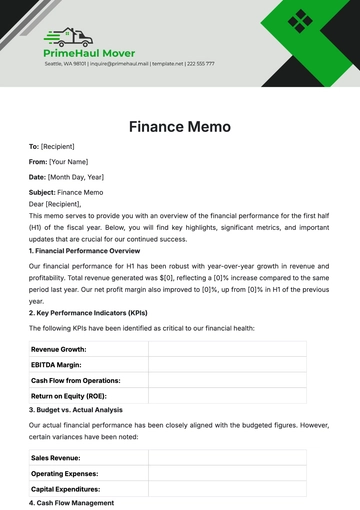

As part of our commitment to aligning our financial reporting practices with the best accounting standards, we are updating our approach to asset depreciation. After a thorough review of our current asset base and depreciation methods, we have decided to transition from the Straight-Line Depreciation method to the Declining Balance Depreciation method for certain asset categories, effective from the fiscal year beginning January 1, 2084.

Rationale for Change

This decision stems from our analysis, indicating that the Declining Balance method more accurately reflects the usage and wear of our assets over time, particularly for our technology and manufacturing equipment. This method accelerates depreciation expense in the earlier years of an asset's life, aligning with the higher utility and faster obsolescence of these assets.

Impact Analysis

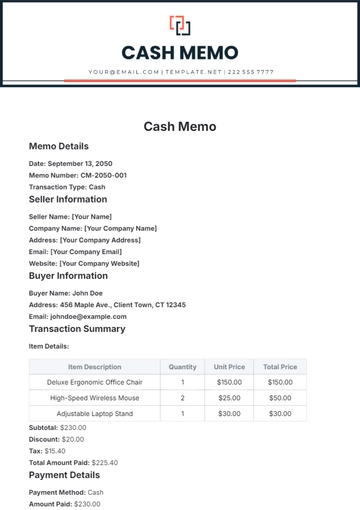

Consider a piece of manufacturing equipment purchased on January 1, 2084, with an initial cost of $100,000, a salvage value of $10,000, and a useful life of 10 years.

Under the Straight-Line method, annual depreciation would be $9,000 ($100,000 - $10,000) / 10.

Switching to the Declining Balance method at a rate of 20%, the first year's depreciation would be $20,000 ($100,000 * 20%), significantly higher than under the Straight-Line method.

This change will result in a more substantial depreciation expense in the initial years, reducing taxable income and thereby deferring tax liabilities. It will also provide a more accurate reflection of the asset's value on our balance sheet.

Implementation Details

This change will be applied to all new acquisitions from January 1, 2084, onwards. Existing assets will continue to be depreciated using the method initially applied. Our accounting team will work closely with department heads to ensure a smooth transition, including adjustments in budgeting and forecasting processes.

Expected Benefits

Tax Efficiency: By accelerating depreciation, we can leverage tax benefits sooner, improving cash flow.

Accurate Asset Valuation: This method offers a truer representation of an asset's economic value over its life.

Budgetary Adjustments: Reflects a more realistic expense pattern, aiding in better financial planning and analysis.

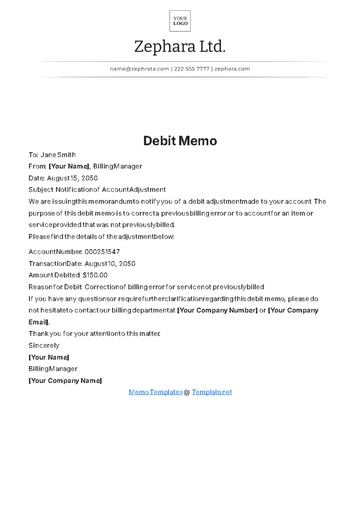

We understand that this is a significant change and are committed to supporting all departments through this transition. Training sessions and detailed guidelines will be provided to ensure everyone is familiar with the new process.

Should you have any questions or need further clarification, please do not hesitate to reach out to the Accounting Department.

Thank you for your attention to this important update and your cooperation in implementing these changes.

Best regards,

[Your Name]

Chief Financial Officer

[Contact Information]

- 100% Customizable, free editor

- Access 1 Million+ Templates, photo’s & graphics

- Download or share as a template

- Click and replace photos, graphics, text, backgrounds

- Resize, crop, AI write & more

- Access advanced editor

Streamline your financial communications with the Accounting Depreciation Method Memo Template from Template.net. This template is profoundly editable and customizable, allowing you to convey the specifics of depreciation methods with precision. Editable in our AI Editor tool, it offers the flexibility to perfectly align with your accounting policies. It's an essential tool for clear, effective communication regarding depreciation strategies within your organization.