Free Health Savings Account (HSA) Guide HR

INTRODUCTION

Welcome to [Your Company Name]

At [Your Company Name], your health and financial well-being are of paramount importance to us. We understand that managing healthcare costs can be challenging, and that's why we offer Health Savings Accounts (HSAs) as part of our employee benefits program.

Purpose of the HSA Guide

The purpose of this comprehensive HSA Guide is to provide you with a clear understanding of HSAs, how they work, and how you can leverage them to your advantage. We believe that informed decisions lead to better financial and health outcomes, and this guide is your gateway to that knowledge.

HSAs are not just savings accounts; they are financial tools designed to help you navigate the complexities of healthcare expenses more efficiently. Whether you're a seasoned HSA user or considering one for the first time, this guide will serve as a valuable resource.

In the following sections, we will delve into the intricacies of HSAs, including eligibility requirements, contribution limits, how to use your HSA for qualified expenses, and the tax advantages associated with these accounts. We'll also address some common questions and offer tips on maximizing the benefits of your HSA.

WHAT IS AN HSA?

Understanding Health Savings Accounts

A Health Savings Account, or HSA, is a tax-advantaged financial account that allows you to set aside pre-tax dollars to pay for qualified medical expenses. These accounts are designed to help individuals and families cover healthcare costs while providing significant tax benefits.

Here's how it works: You contribute a portion of your pre-tax income to your HSA, which can then be used to pay for a wide range of medical expenses, including doctor visits, prescription medications, dental care, vision care, and more. The money you contribute to your HSA is not subject to federal income tax, which means you reduce your taxable income and, consequently, your tax liability.

Benefits of an HSA

HSAs offer several key advantages:

Tax Savings: Contributions to your HSA are tax-deductible, reducing your taxable income and, by extension, your tax bill.

Triple Tax Advantage: HSA funds grow tax-free, and withdrawals for qualified medical expenses are also tax-free, creating a triple tax advantage.

Financial Flexibility: Your HSA is your money, and it's portable. You can take it with you if you change jobs or retire.

Savings for the Future: HSAs aren't just for immediate medical expenses. You can invest your HSA funds and let them grow over time, building a financial cushion for future healthcare needs.

Control: With an HSA, you have more control over your healthcare decisions and expenses. You decide how and when to use your HSA funds.

ELIGIBILITY AND ENROLLMENT

Who is Eligible for an HSA?

Not everyone is eligible for an HSA, as they are associated with High Deductible Health Plans (HDHPs). To be eligible for an HSA, you must meet certain criteria:

HDHP Enrollment: You must be enrolled in a qualified High Deductible Health Plan (HDHP) to open and contribute to an HSA. HDHPs typically have higher deductibles and lower premiums than traditional health plans.

No Other Health Coverage: You cannot have any other health coverage that is not an HDHP. However, some exceptions, such as dental and vision coverage, do not disqualify you from HSA eligibility.

Not Enrolled in Medicare: If you are enrolled in Medicare, you are generally not eligible for an HSA. There are specific rules around HSA eligibility and Medicare, so it's essential to understand these nuances.

How to Enroll in an HSA

Enrolling in an HSA is a straightforward process, and we're here to guide you every step of the way. Here's how you can get started:

Check Your Eligibility: Ensure that you meet the eligibility criteria.

Select Your HSA Provider: We have partnered with [HSA Provider Name] to offer you a convenient and user-friendly HSA platform. Visit [HSA Provider Website] to begin the enrollment process.

Complete the Enrollment Form: Follow the online enrollment process, providing the necessary information and agreeing to the terms and conditions.

Set Up Contributions: Determine how much you want to contribute to your HSA. Your contributions will be deducted from your paycheck before taxes, reducing your taxable income.

Start Using Your HSA: Once your HSA is established, you can start using it to pay for qualified medical expenses. Your HSA provider will issue you an HSA debit card and provide instructions on how to access your account online.

CONTRIBUTIONS AND LIMITS

HSA Contribution Limits

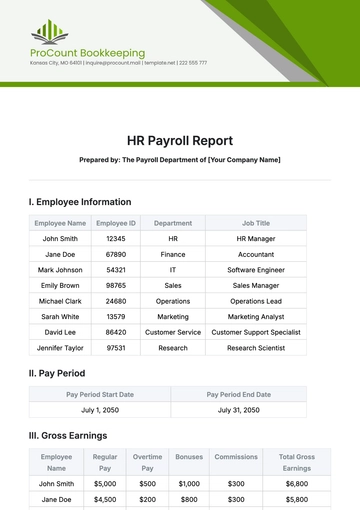

As an HSA account holder, it's crucial to understand the annual contribution limits set by the IRS. These limits may change each year, so it's essential to stay informed about the most up-to-date figures. As of 2050, the annual contribution limits for HSAs are as follows:

For individuals with self-only coverage: $150,000

For individuals with family coverage: $300,000

Contributions made to your HSA are typically tax-deductible, meaning you can reduce your taxable income by the amount you contribute. However, it's essential to stay within the annual limits to maintain your HSA's tax-advantaged status.

Employer Contributions

Many employers offer contributions to their employees' HSAs as part of their benefits packages. These contributions are a valuable addition to your HSA savings, helping you cover healthcare expenses more effectively. The employer's contribution policies can vary, but common approaches include:

A fixed dollar amount contributed annually.

A matching contribution based on your own contributions.

A percentage of your annual deductible or out-of-pocket maximum.

Employer contributions are typically considered part of the annual contribution limit, so it's essential to be aware of your employer's contribution policy to maximize your HSA's benefits.

Tax Advantages

One of the primary advantages of an HSA is its favorable tax treatment. Here's how it works:

Pre-Tax Contributions: The money you contribute to your HSA is deducted from your taxable income for the year in which you make the contribution. This reduces your overall tax liability.

Tax-Free Growth: Any interest, dividends, or capital gains earned within your HSA account are not subject to taxation. Your savings can grow tax-free.

Tax-Free Withdrawals: When you use the funds in your HSA for qualified medical expenses, those withdrawals are also tax-free. This includes payments for yourself, your spouse, and any dependents.

This triple-tax advantage makes HSAs a powerful tool for managing healthcare costs while minimizing your tax burden. It's important to keep accurate records of your contributions and expenses to ensure you fully enjoy these tax benefits.

USING YOUR HSA

Qualified Medical Expenses

HSAs are designed to help you cover a wide range of qualified medical expenses. These expenses include but are not limited to:

Doctor's visits and medical consultations.

Prescription medications.

Dental and vision care.

Hospital stays and surgeries.

Medical equipment and supplies.

Preventive care services.

You can find a comprehensive list of qualified medical expenses in IRS Publication 502. It's crucial to ensure that any expense you plan to pay with your HSA meets these criteria to avoid potential tax penalties.

INVESTING HSA FUNDS

HSA Investment Options

Besides serving as a savings account, HSAs often offer investment options to help your funds grow over time. These options may include mutual funds, stocks, bonds, and other investment vehicles. Investing your HSA funds can be a strategic financial move, especially if you have long-term healthcare expenses to consider.

Before investing, consider these key points:

Risk Tolerance: Assess your risk tolerance and choose investments that align with your financial goals and timeline.

Diversification: Diversify your investments to spread risk and potentially increase returns.

Review Periodically: Regularly review your investment portfolio to ensure it aligns with your financial objectives.

Consult with a financial advisor or your HSA provider's investment resources to make informed investment decisions.

Growing Your HSA

Over time, diligent contributions and smart investment choices can help your HSA grow significantly. As your HSA balance increases, it becomes a valuable financial resource for addressing current and future healthcare needs, including retirement healthcare expenses.

To maximize the growth of your HSA:

Contribute regularly, taking full advantage of the annual contribution limits.

Invest wisely based on your financial goals and risk tolerance.

Consider using your HSA as a long-term savings tool for retirement healthcare expenses.

RECORD KEEPING AND DOCUMENTATION

Keeping HSA Records

Maintaining accurate and organized records of your HSA transactions and expenses is essential for several reasons:

Tax Compliance: Proper record-keeping ensures that you can easily provide documentation in case of an IRS audit. The IRS may request records to verify that your HSA funds were used for qualified medical expenses.

Reimbursement Requests: When you need to request reimbursement from your HSA for qualified medical expenses, having organized records simplifies the process. You'll have all the necessary information readily available, making reimbursement faster and more efficient.

Future Planning: Keeping track of your HSA expenses allows you to monitor your healthcare spending over time. This information can be valuable for budgeting and future healthcare planning.

To maintain accurate records, consider the following tips:

Save Receipts: Keep copies of all receipts for qualified medical expenses, including bills from healthcare providers, pharmacy receipts, and receipts for over-the-counter medications.

Use Online Tools: Many HSA providers offer online portals or mobile apps that allow you to track and categorize your expenses. Take advantage of these tools to simplify record-keeping.

Store Documents Safely: Store your physical receipts in a secure location, such as a folder or file cabinet, and use digital storage solutions for electronic receipts.

Tax Reporting

Properly reporting your HSA contributions and withdrawals on your tax return is crucial to ensure compliance with IRS regulations:

Contributions: Report your HSA contributions accurately on IRS Form 8889 when you file your taxes. Your contributions are tax-deductible and reduce your taxable income.

Withdrawals: When you use HSA funds for qualified medical expenses, these withdrawals are tax-free. Ensure you retain documentation of these expenses in case of an IRS inquiry.

Tax Forms: Your HSA provider will typically provide you with an annual tax form (IRS Form 1099-SA) that summarizes your HSA distributions. Ensure that the information on this form matches your records.

CHANGING OR CLOSING YOUR HSA

Changing Contributions

Life circumstances may change, and you might need to adjust your HSA contributions. Here's what you should consider when making changes:

Life Events: Major life events, such as marriage, divorce, the birth or adoption of a child, or a change in employment, can impact your healthcare needs and your ability to contribute to your HSA. Evaluate your contributions in light of these events.

Annual Review: Even without major life changes, it's wise to review your HSA contributions annually. Consider your expected healthcare expenses for the upcoming year and adjust your contributions accordingly.

Contribution Limits: Be mindful of the annual HSA contribution limits set by the IRS. Exceeding these limits can result in penalties and tax implications.

To change your HSA contributions, contact your HR department or HSA administrator. They can guide you through the process and ensure that your adjustments are made accurately.

Closing Your HSA

Closing your HSA is a decision that should be made carefully. Here are some important considerations:

Tax Implications: Closing your HSA may have tax implications. Any funds used for non-qualified expenses may be subject to income tax and penalties. Consult with a tax professional before closing your HSA to understand the tax consequences.

Healthcare Planning: Consider your current and future healthcare needs. If you anticipate future medical expenses, it may be beneficial to keep your HSA open to continue growing your savings tax-free.

Employer Contributions: If your employer contributes to your HSA, closing it may result in the loss of these contributions. Review your employer's HSA policy to understand the implications.

Administrative Fees: Some HSAs charge administrative fees. Check with your HSA provider to understand any fees associated with closing your account.

CONCLUSION

Making the Most of Your HSA

In conclusion, your Health Savings Account (HSA) is a valuable financial tool that offers tax benefits and flexibility in managing healthcare expenses. By following the guidelines outlined in this guide, you can make the most of your HSA:

Stay Informed: Continue to educate yourself about HSA rules and benefits. The more you know, the better you can leverage your HSA to save on healthcare costs.

Plan Ahead: Use your HSA as part of your long-term financial planning. Consider contributing the maximum allowed by the IRS to maximize tax benefits and savings.

Record and Report: Maintain accurate records of your HSA transactions and report contributions and withdrawals correctly on your tax return. This ensures IRS compliance and maximizes your tax advantages.

Seek Guidance: If you have questions or need assistance with your HSA, don't hesitate to reach out to your HR department or HSA provider. They can provide guidance and support.

Your HSA is a valuable resource for managing healthcare expenses and planning for the future. By managing it wisely, you can enjoy the financial benefits it offers and achieve greater peace of mind regarding your healthcare costs.

- 100% Customizable, free editor

- Access 1 Million+ Templates, photo’s & graphics

- Download or share as a template

- Click and replace photos, graphics, text, backgrounds

- Resize, crop, AI write & more

- Access advanced editor

Introducing the Health Savings Account (HSA) Guide HR Template from Template.net. This editable and customizable resource empowers HR professionals to navigate the intricacies of HSA management effortlessly. Editable in our Ai Editor Tool, it streamlines processes, enhances employee benefits, and ensures compliance. Simplify HSA administration for a healthier, happier workforce.