Free Sales Year-end Presentation and Collateral Report

The objective of this report is to provide a comprehensive review of [Your Company Name]'s sales performance for the current fiscal year while highlighting the vital role of marketing collateral in business development. This report provides an analysis of the sales output, trends, and any insightful data linked directly to our robust sales strategy.

This integrated approach will create a compelling narrative that enhances and embodies the brand's unique identity, thus elucidating how it directly correlates with our sales performance.

1. Introduction

The primary objective of this report is to present a comprehensive analysis of the organization's performance in sales and the effectiveness of marketing collateral for the fiscal year ending [Month Day, Year]. This report has been meticulously prepared to provide stakeholders, including management, employees, and investors, with valuable insights into the financial and operational aspects of the company's sales department.

2. Executive Summary

The fiscal year [Year] has been a pivotal period for [Your Company Name], marking notable successes and identifying areas for growth and optimization. This enhanced executive summary offers a more detailed view of our year's performance, incorporating both financial and qualitative measures.

Financially, we have achieved a total revenue of [$], representing an [%] year-over-year growth. The revenue streams were mainly derived from three key products, with different contributions to the overall revenue. Geographically, the United States remains our strongest market, contributing [%] to the total revenue.

3. Sales Performance Overview

This section serves as a pivotal section of this report, providing an in-depth analysis of the financial and operational dimensions of [Your Company Name]'s activities for the fiscal year ending on [Month Day, Year]. This overview encapsulates three principal aspects: revenue trends, product-wise breakdown, and market-wise analysis, each vital for understanding the company's standing and prospects.

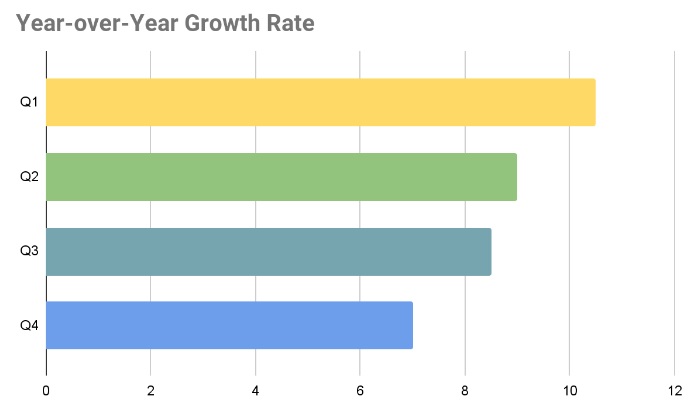

Revenue Trends:

Quarter | Revenue |

Q1 | $2,500,000 |

Q2 | |

Q3 | |

Q4 | |

TOTAL: |

The fiscal year [Year] has been an exemplary period in terms of revenue generation. A total revenue of [$] was generated, translating to an [%] year-over-year growth. Although the rate of growth decelerated slightly in Q4, the overall performance remained strong, underlining the effectiveness of our sales strategies.

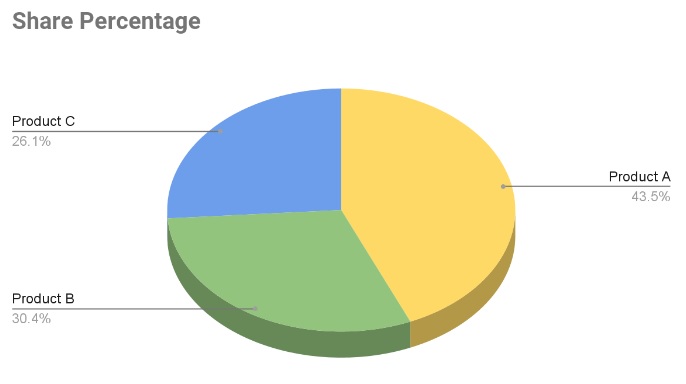

Product-wise Breakdown:

Product | Revenue |

Product A | $5,000,000 |

Product B | |

Product C | |

TOTAL: |

Product | Units Sold |

Product A | 50,000 |

Product B | |

Product C | |

TOTAL: |

In terms of product contribution, the revenue was mainly driven by three core products: Product A, Product B, and Product C. While Product A remained the frontrunner, accounting for [%] of the total revenue, it is imperative to focus on enhancing the market position of Products B and C in the subsequent fiscal year.

Market-wise Analysis:

Market | Revenue |

United States | $7,000,000 |

Europe | |

Asia | |

TOTAL: |

Market | Customer Base |

United States | 70,000 |

Europe | |

Asia | |

TOTAL: |

Geographically, the United States continues to be our largest market, contributing [%] of the total revenue. However, a closer inspection reveals promising growth in the European and Asian markets. Detailed market penetration strategies are needed for these regions to capitalize on untapped opportunities.

4. Collateral Utilization

This section provides an enriched analysis of the various marketing assets deployed during the fiscal year ending [Month Day, Year]. This segment aims to shed light on the ROI generated from digital and print media assets, thereby offering a comprehensive perspective on the efficiency and effectiveness of our marketing collateral. Two main categories—Digital Assets and Print Media—are addressed in detail below.

Digital Assets:

Digital Asset | Investment | Revenue Generated | ROI |

Social Media | $200,000 | $300,000 | 50% |

Email Marketing | |||

Web Banners | |||

Video Marketing | |||

PPC Campaigns | |||

TOTAL: |

The implementation of digital assets remains crucial in today's rapidly evolving digital landscape. For the fiscal year [Year], the Return on Investment for digital assets such as social media, email marketing, video marketing, PPC campaigns, and web banners has been exceedingly favorable, standing at [%]. This reflects not only the asset's capacity to reach a wide audience but also its ability to engage and convert potential customers.

Print Media:

Print Media Asset | Investment | Revenue Generated | ROI |

Brochures | $80,000 | $88,000 | 10% |

Flyers | |||

Print Ads | |||

Billboards | |||

Direct Mail | |||

TOTAL: |

Although the adoption of digital assets continues to surge, traditional print media still plays a vital role in our collateral strategy. For the fiscal year 2050, print media, including brochures, flyers, billboards, direct mail, and print advertisements, generated an ROI of approximately [10%]. While this figure is less than that of digital assets, it should not be discounted, given that it effectively targets a different demographic and contributes to a well-rounded marketing approach.

5. Recommendations

This section is designed to provide a detailed roadmap for [Your Company Name]'s sales and marketing endeavors for the forthcoming fiscal year [Year]. These suggestions are formulated based on the insights gleaned from the comprehensive analysis of both sales performance and collateral utilization for the fiscal year [Year]. The recommendations are categorized into Sales Strategy and Marketing Collateral Strategy.

Strengthen Product C's Market Position

Product C has emerged as a significant revenue generator for [Your Company Name]. To capitalize on this, it is advisable to design and execute targeted marketing campaigns that focus on this specific product's unique selling points.

European and Asian Market Expansion

Given the robust growth observed in Europe and Asia, a strategic push in these regions is recommended. This could involve forming alliances with local distributors to extend the reach and crafting culturally nuanced advertising campaigns to resonate with the regional audience.

Optimize Pricing Strategy

A comprehensive reassessment of the existing pricing model for all product lines is essential. Such a review should explore various alternatives, such as bundled offers and tiered pricing structures, to incentivize bulk purchases and expand market share.

Invest More in Digital Assets:

Given the notable [%] ROI from digital assets, increased investment in this area appears highly justified. Potential avenues include expanding the email marketing list through optimized lead capture strategies and the initiation of new, high-impact social media campaigns. The integration of advanced analytics tools could serve to refine campaign effectiveness in real-time.

Reassess Print Media Investments

While print media has proven its worth with a respectable ROI, a critical evaluation of its ongoing effectiveness is warranted. The potential integration of QR codes within print ads could bridge the gap between digital and physical customer interactions, thus enabling more detailed tracking and potentially enhancing ROI further.

User Experience Optimization

Given the growing importance of digital assets, a focused initiative to enhance the user experience across the website and mobile application is crucial. Usability tests, A/B testing, and customer feedback loops should be employed to identify areas for improvement. Optimizing the user journey could result in higher customer engagement and conversion rates.

Content Personalization

With the aid of advanced data analytics, there is an opportunity to offer highly personalized content to our consumer base. This personalization could range from targeted product recommendations to individually tailored content feeds. Implementing these strategies has the potential not only to elevate the user experience but also to significantly boost customer retention rates.

Implement Augmented Reality

To capitalize on the cutting-edge technology that is Augmented Reality (AR), it is advisable to integrate AR features into the company's digital assets. This could range from virtual product demonstrations to interactive 3D advertisements. The integration of AR not only serves to enrich customer interaction but also offers a differentiated user experience that could be a strong USP (Unique Selling Proposition) for the company.

Sustainability

In alignment with the growing global emphasis on eco-friendly practices and corporate responsibility, it is strongly recommended to initiate a dedicated sustainability marketing campaign. This could involve showcasing the company’s commitment to sustainable practices in both operations and product development.

Localization Strategies

As the company endeavors to enter new geographic markets, particularly those with distinct linguistic and cultural characteristics, it becomes imperative to adopt localization strategies. By offering tailored collateral, the company can better resonate with local consumers, thereby optimizing market penetration and increasing the likelihood of successful market entry.

6. Conclusion

The fiscal year [Year] has been successful for [Your Company Name] in terms of sales and collateral performance. Strategies are already in place to leverage this momentum into [Next Year] and beyond. The information and insights in this report will guide our path to continuous growth and profitability.

This report was put together by [Your Name], drawing directly from the experiences, insights, and practices that have defined [Your Company Name]'s journey thus far. We look forward to further assessments and implementations in the coming year.

- 100% Customizable, free editor

- Access 1 Million+ Templates, photo’s & graphics

- Download or share as a template

- Click and replace photos, graphics, text, backgrounds

- Resize, crop, AI write & more

- Access advanced editor

Streamline your year-end reporting with Template.net's Sales Year-end Presentation and Collateral Report Template. Fully customizable and editable using our AI Editor Tool, this comprehensive solution makes data consolidation effortless. Transform your company’s annual achievements into compelling narratives and stunning visuals. Elevate your business performance review and make a lasting impression with this essential tool from Template.net.

You may also like

- Aesthetic Presentation

- Presentation Background

- Slide Show Presentation

- Cute Presentation

- Education Presentation

- Border Frames Presentation

- Teacher Presentation

- Professional Presentation

- Timeline Presentation

- Brand Presentation

- Promotion Presentation

- Business Presentation

- Event Presentation

- Company Presentation

- Startup Presentation

- University Presentation

- Food Presentation

- Music Presentation

- School Presentation

- Art Presentation

- Marketing Presentation

- Business Plan Presentation

- Mobile Presentations

- Freelancer Presentation

- Project Presentation

- Agency Presentation

- Sales Presentation

- HR Presentation

- Product Presentation

- Roadmap Presentation

- Slideshow

- Technology Presentation

- Real Estate Presentation

- Medical Presentation

- Speaker Presentation

- Construction Presentation

- Conference Presentation

- Restaurant Presentation

- IT and Software Presentation

- Portfolio Presentation

- Campaign Presentation

- Game Presentation

- History Presentation

- Math Presentation

- Lesson Presentation

- Health Presentation

- Graduation Presentation

- New Year's Day Presentation

- Social Studies Presentation

- Photography Presentation

- Social Media Presentation

- Valentine's Day Presentation

- Services Presentation

- Workshop Presentation

- Organization Presentation