Free Financial Disclosure Act Fact Sheet

Prepared by: [YOUR NAME]

Company: [YOUR COMPANY NAME]

Department: [YOUR DEPARTMENT]

Date: [DATE]

1. Purpose

The Financial Disclosure Act, also known as the FDA, has a specific design that is aimed at promoting transparency within the workings of the government. It also functions to prevent any possible conflicts of interest. The ultimate goal of the FDA is to maintain, or even boost, the public trust in the government machinery. It seeks to achieve this by enforcing that certain public officials as well as select employees must disclose their financial interests to the relevant authorities.

2. Who Must Disclose?

The act known as the Financial Disclosure Act applies to:

Elected officials (e.g., mayors, council members, state legislators)

Appointed officials (e.g., agency heads, commissioners)

Government employees in designated positions (e.g., procurement officers, regulatory board members)

3. Disclosure Requirements

Public officials who are subject to the rules and regulations of the Food and Drug Administration are obligated to disclose the following financial interests:

Sources and amounts of income (e.g., salary, bonuses, dividends)

Investments (e.g., stocks, mutual funds, real estate)

Business interests (e.g., ownership in companies, partnerships)

Liabilities (e.g., loans, mortgages)

Gifts or benefits received related to official duties

4. Filing Deadlines

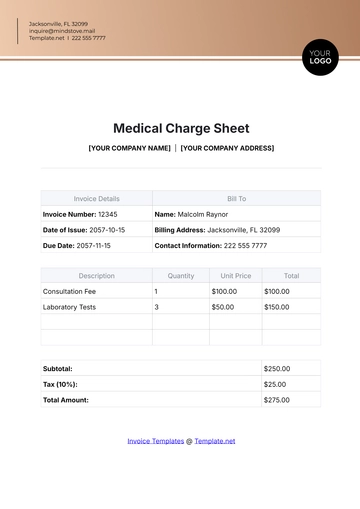

Disclosure Type | Deadline |

|---|---|

Initial Disclosure | Within 30 days of assuming office or appointment |

Annual Disclosure | Due by April 15th of each year thereafter |

Additional Disclosures | Within 30 days of acquiring new financial interests or significant changes to existing interests |

5. Confidentiality and Access

The disclosed information is generally accessible to the public to ensure transparency and accountability in government operations. However, certain personal details or specific categories of assets may be exempted from public disclosure for privacy reasons.

6. Penalties for Non-Compliance

If an individual or entity does not comply with the requirements as they are laid out by the Financial Disclosure Act, there could potentially be negative consequences or penalties resulting from this non-compliance.

Civil penalties range from fines to suspension or removal from office.

Legal consequences for intentional or repeated violations of disclosure obligations.

The risk of reputational damage and loss of public trust.

7. Enforcement and Oversight

The [YOUR COMPANY NAME], appointed under the Financial Disclosure Act, oversees enforcement and administration, including:

Auditing and reviewing financial disclosures.

Providing guidance and assistance to filers on completing forms.

Investigating alleged violations and imposing penalties as necessary.

8. Instructions for Filing

Obtain the official Financial Disclosure Act disclosure form from [YOUR COMPANY WEBSITE] or [YOUR COMPANY NAME].

Complete all sections of the form accurately and thoroughly.

Attach supporting documentation as required (e.g., bank statements, investment portfolios).

Submit the completed form by the specified deadline to [Submission Address or Online Portal].

Retain copies of your disclosure for your records.

9. Conclusion

In conclusion, adherence to the Financial Disclosure Act (FDA) is vital for promoting transparency and integrity in government. By disclosing financial interests within the specified deadlines, public officials contribute to maintaining public trust and accountability. It is essential to comply with the FDA's requirements to avoid penalties and ensure ethical conduct in public service.

- 100% Customizable, free editor

- Access 1 Million+ Templates, photo’s & graphics

- Download or share as a template

- Click and replace photos, graphics, text, backgrounds

- Resize, crop, AI write & more

- Access advanced editor

Explore the Financial Disclosure Act Fact Sheet Template on Template.net, a valuable tool for compliance and transparency. This editable and customizable template simplifies the creation of detailed disclosures. Compatible with our Ai Editor Tool, personalize the content to meet specific requirements. Streamline your reporting process with this user-friendly template, ensuring accurate and compliant financial disclosures with ease.

You may also like

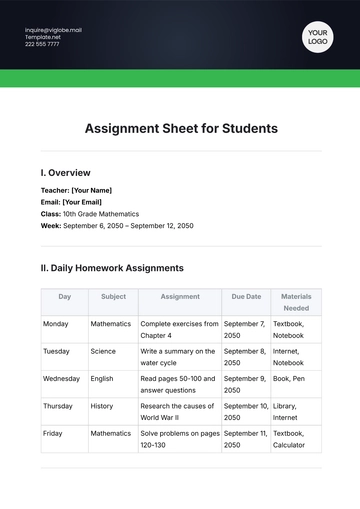

- Attendance Sheet

- Work Sheet

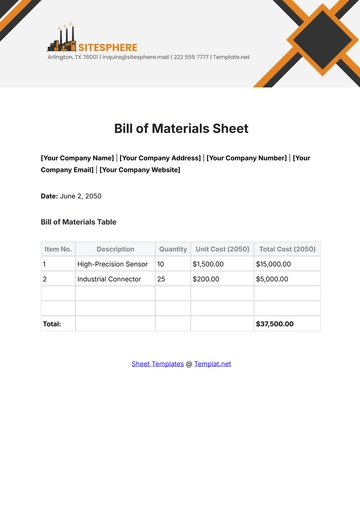

- Sheet Cost

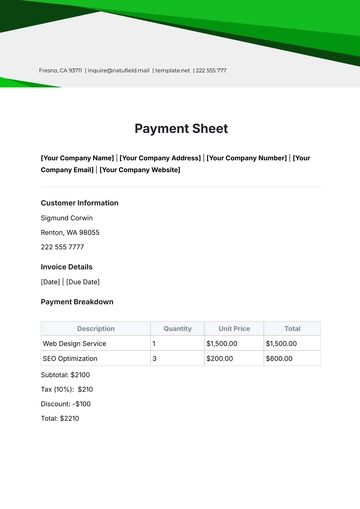

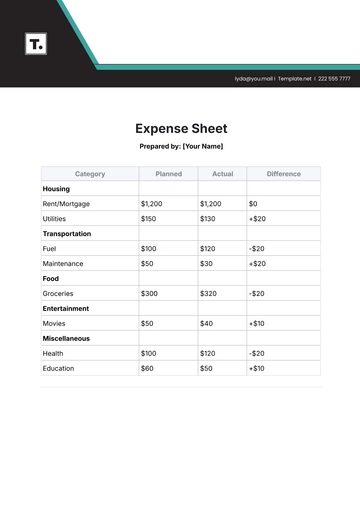

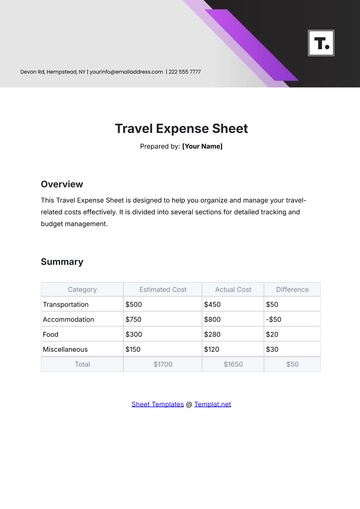

- Expense Sheet

- Tracker Sheet

- Student Sheet

- Tracking Sheet

- Blank Sheet

- Information Sheet

- Sales Sheet

- Record Sheet

- Price Sheet

- Plan Sheet

- Score Sheet

- Estimate Sheet

- Evaluation Sheet

- Checklist Sheet

- Bid Sheet

- Call Log Sheet

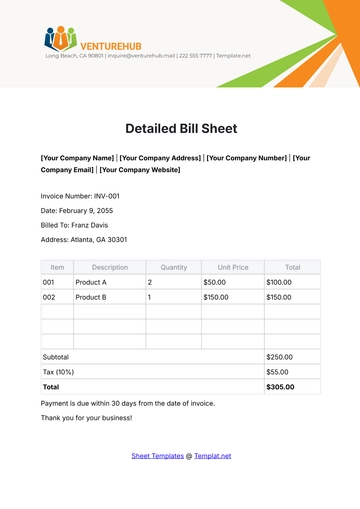

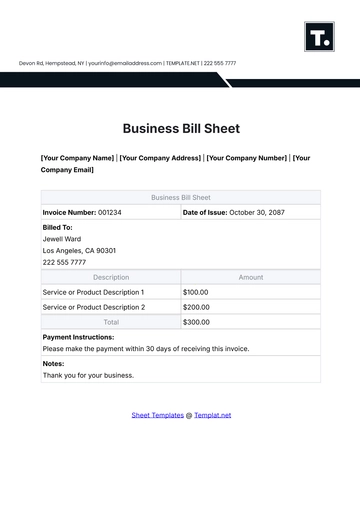

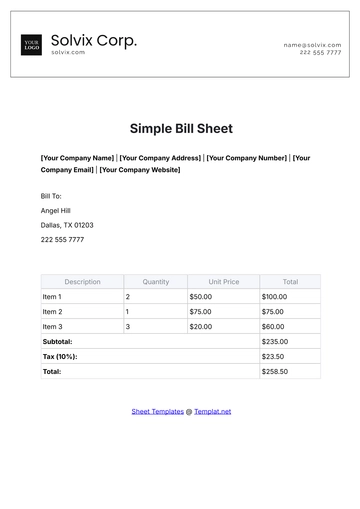

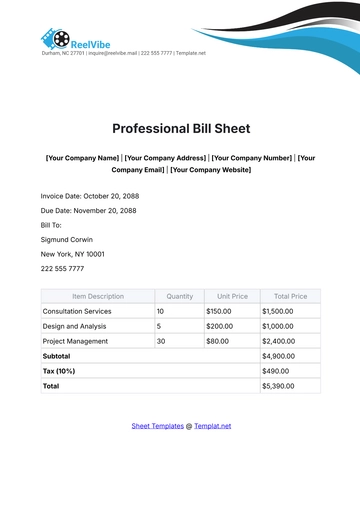

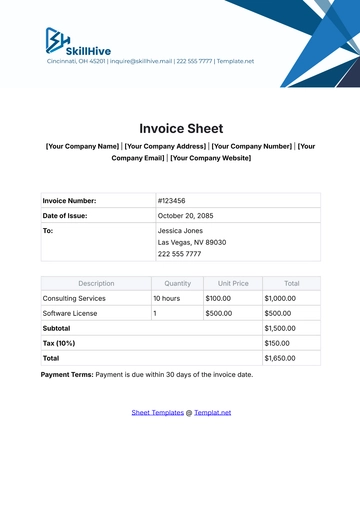

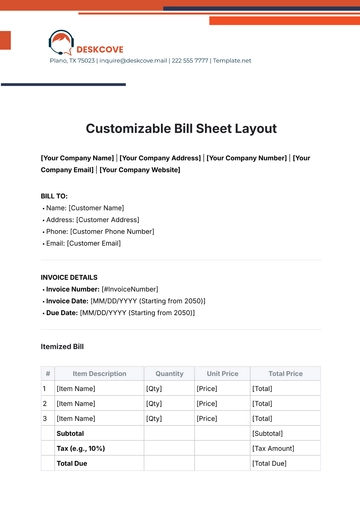

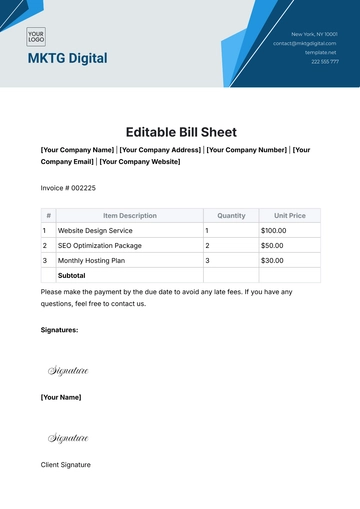

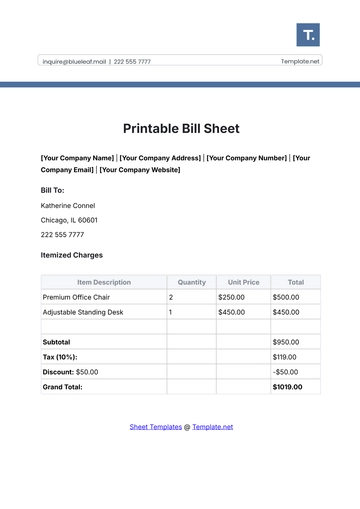

- Bill Sheet

- Assessment Sheet

- Task Sheet

- School Sheet

- Work From Home Sheet

- Summary Sheet

- Construction Sheet

- Cover Sheet

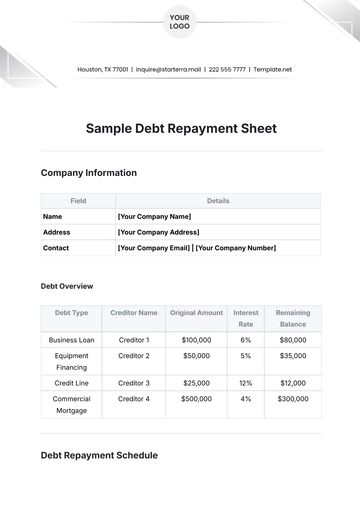

- Debt Spreadsheet

- Debt Sheet

- Client Information Sheet

- University Sheet

- Freelancer Sheet

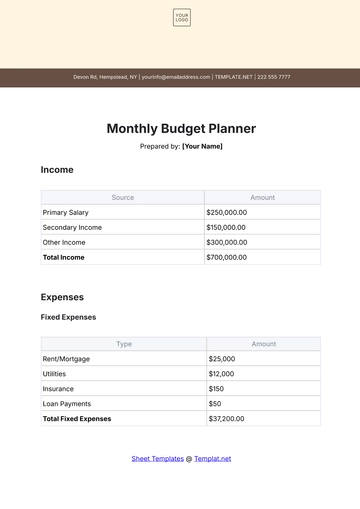

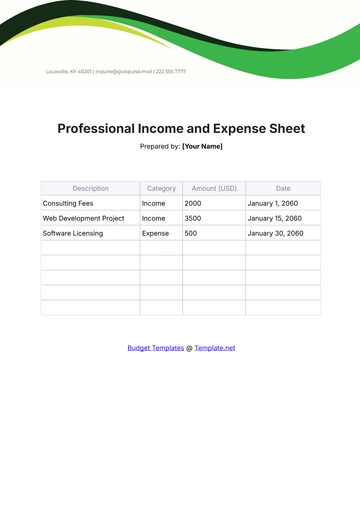

- Bookkeeping Sheet

- Itinerary Spreadsheet

- Scorecard Sheet

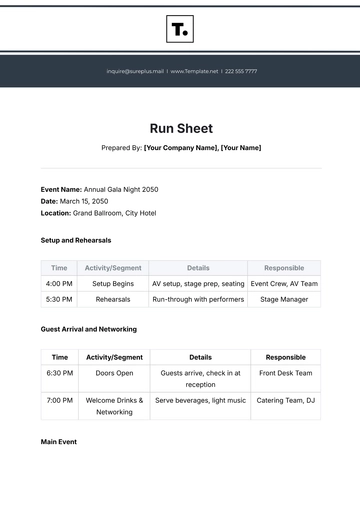

- Run Sheet

- Monthly Timesheet

- Event Sheet

- Advertising Agency Sheet

- Missing Numbers Worksheet

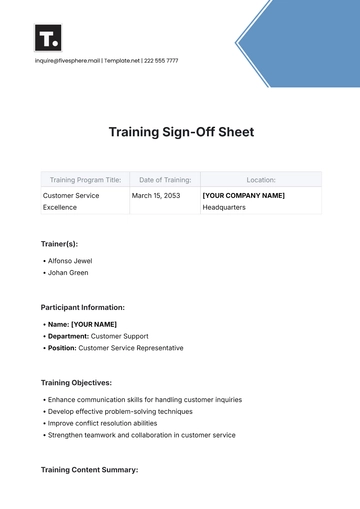

- Training Sheet

- Production Sheet

- Mortgage Sheet

- Answer Sheet

- Excel Sheet