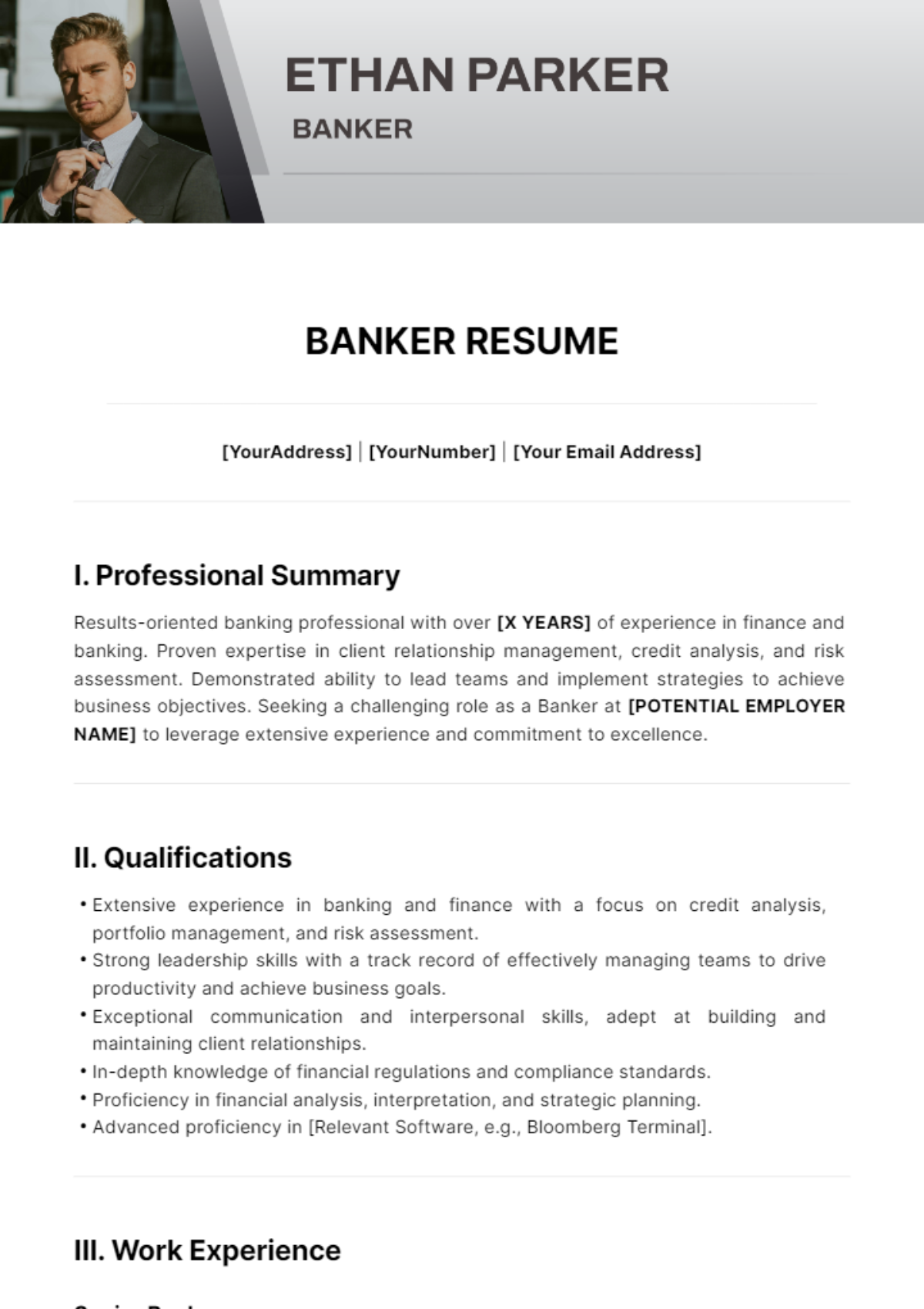

Free Banker Resume

_____________________________________________________________________________________

[YourAddress] | [YourNumber] | [Your Email Address]

I. Professional Summary

Results-oriented banking professional with over [X YEARS] of experience in finance and banking. Proven expertise in client relationship management, credit analysis, and risk assessment. Demonstrated ability to lead teams and implement strategies to achieve business objectives. Seeking a challenging role as a Banker at [POTENTIAL EMPLOYER NAME] to leverage extensive experience and commitment to excellence.

II. Qualifications

Extensive experience in banking and finance with a focus on credit analysis, portfolio management, and risk assessment.

Strong leadership skills with a track record of effectively managing teams to drive productivity and achieve business goals.

Exceptional communication and interpersonal skills, adept at building and maintaining client relationships.

In-depth knowledge of financial regulations and compliance standards.

Proficiency in financial analysis, interpretation, and strategic planning.

Advanced proficiency in [Relevant Software, e.g., Bloomberg Terminal].

III. Work Experience

Senior Banker

[Your Company Name] – [Your Company Location]

[Month, Year] - [Month, Year]

Manage a portfolio valued at approximately [X AMOUNT], ensuring optimal performance and profitability.

Drive client acquisition and retention strategies, resulting in a [X%] growth in the customer base.

Conduct thorough risk assessments on loan applications, leading to a [X%] decrease in the default rate.

Provide training and mentorship to [X NUMBER] junior bankers, enhancing team productivity.

Associate Banker

[Previous Company Name] – [Previous Company Location]

[Month, Year]–[Month, Year]

Analyzed and approved over [X] loans monthly while adhering strictly to bank policies and regulatory requirements.

Contributed to a project that streamlined credit assessment processes, reducing processing time by [X%].

Engaged in continuous learning to stay informed of banking regulations and financial trends.

IV. Education

[Degree]

[Your University Name], [Location]

[Year Graduated]

Major: [Your Major]

Minor: [Your Minor] (Optional)

Relevant coursework: Advanced Financial Analysis, Investment Banking, Risk Management, Client Relationship Management.

V. Skills and Competencies

Financial Analysis and Interpretation

Risk and Compliance Management

Client Relationship Management

Team Leadership and Training

Project Management

Strategic Planning and Execution

Advanced proficiency in [Relevant Software, e.g., Bloomberg Terminal]

VI. Certifications and Professional Development

Certified Financial Analyst (CFA) – CFA Institute | 2050

Participate regularly in workshops and seminars to enhance professional skills and stay up-to-date with banking trends and technologies.

VII. References

References are available upon request.

- 100% Customizable, free editor

- Access 1 Million+ Templates, photo’s & graphics

- Download or share as a template

- Click and replace photos, graphics, text, backgrounds

- Resize, crop, AI write & more

- Access advanced editor

Discover the pinnacle of professional presentation with Template.net's Banker Resume Template. Crafted to perfection, this editable and customizable template ensures your resume stands out. Tailor your credentials effortlessly with our AI tool, guaranteeing a polished, personalized document that captivates recruiters and secures your dream banking role.

You may also like

- Simple Resume

- High School Resume

- Actor Resume

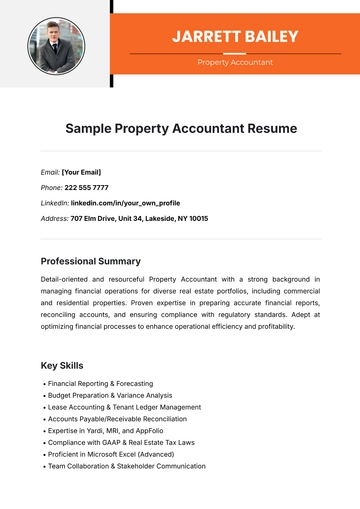

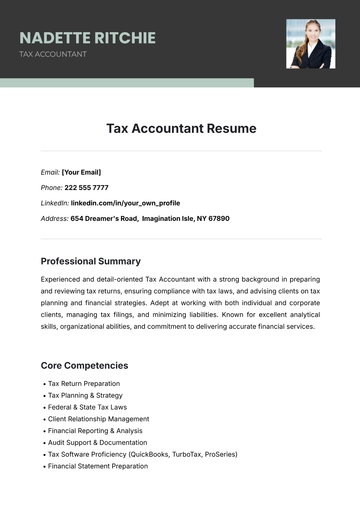

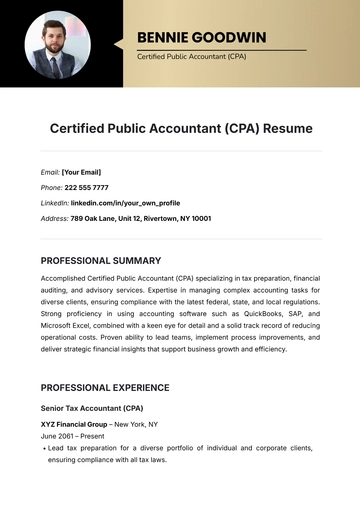

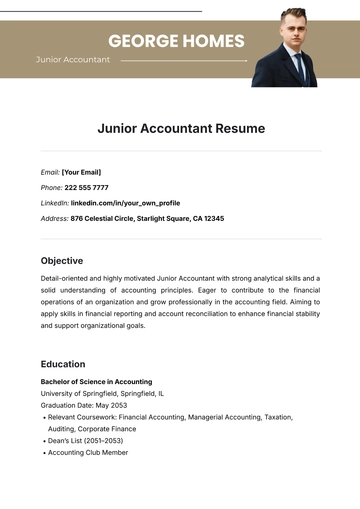

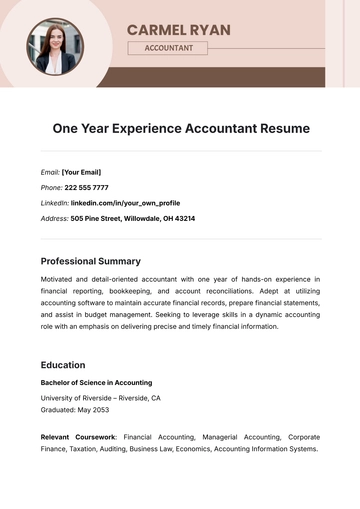

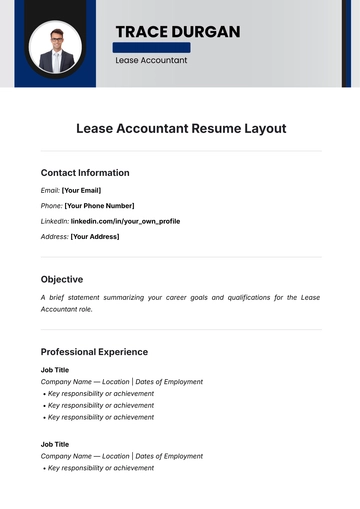

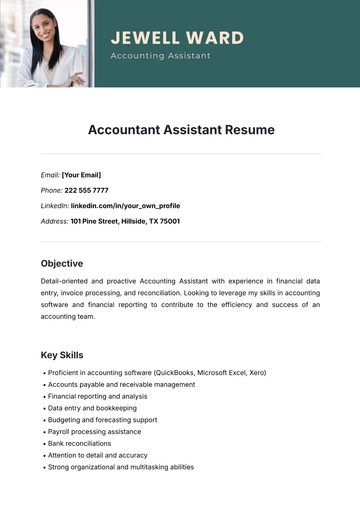

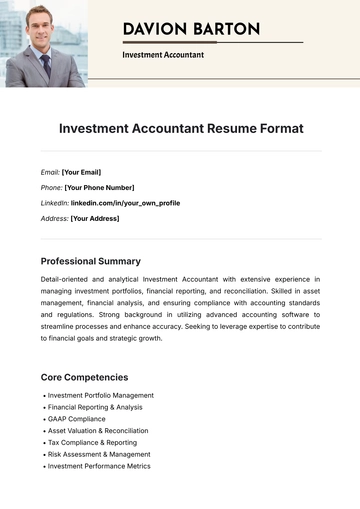

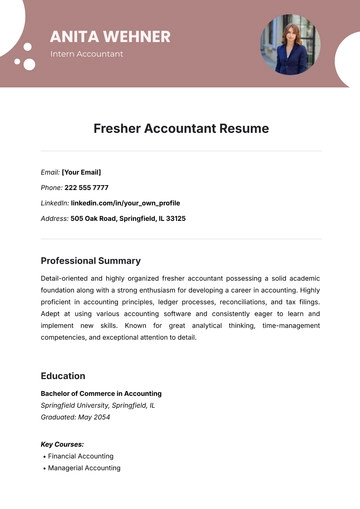

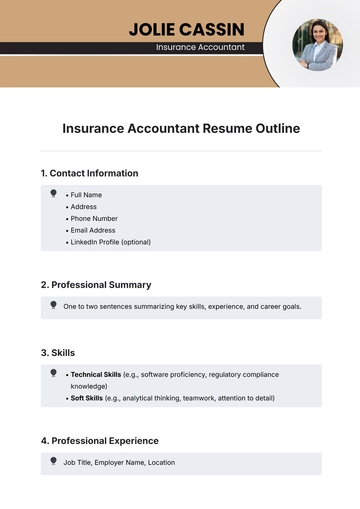

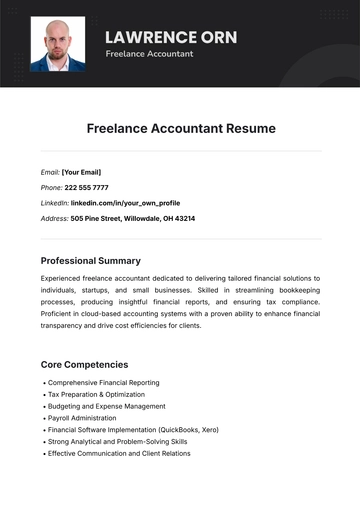

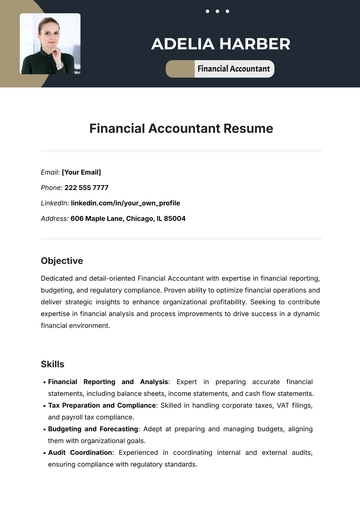

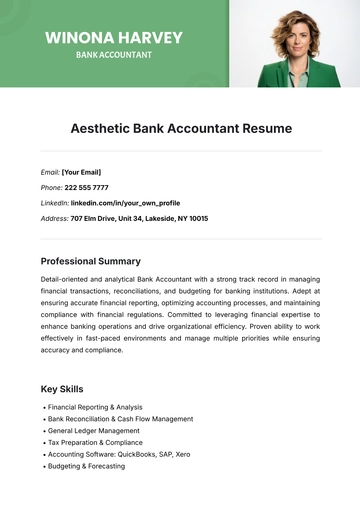

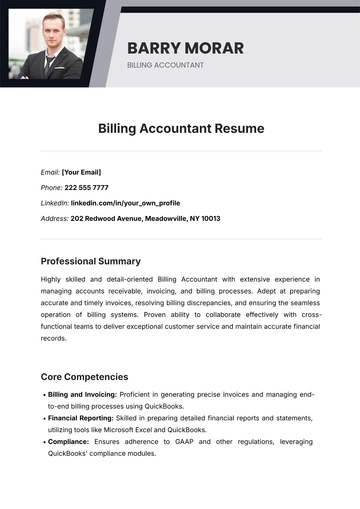

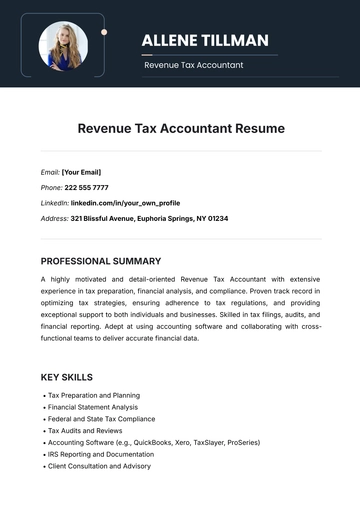

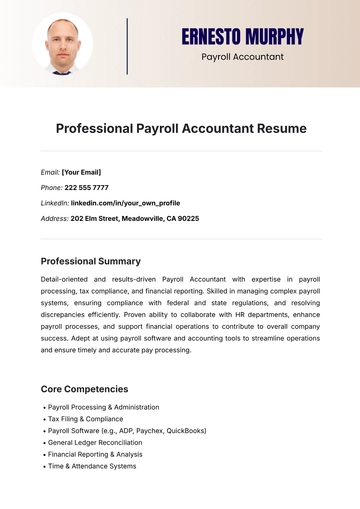

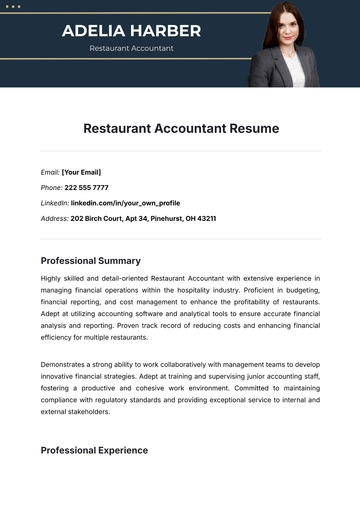

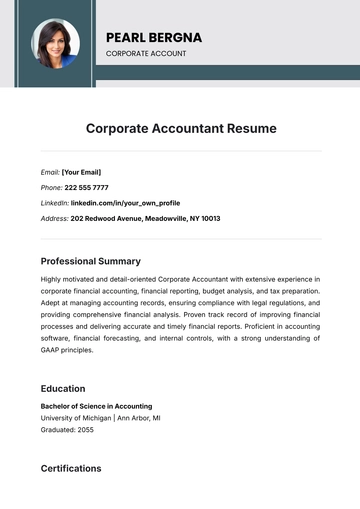

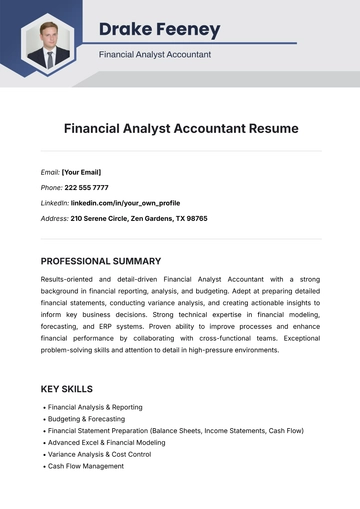

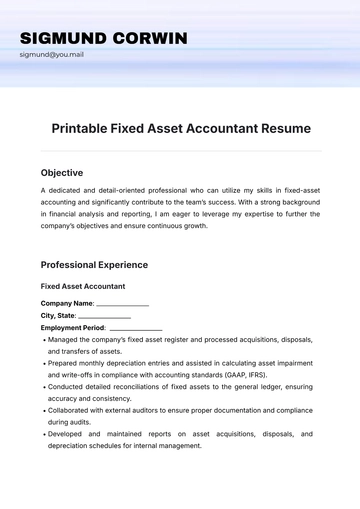

- Accountant Resume

- Academic Resume

- Corporate Resume

- Infographic Resume

- Sale Resume

- Business Analyst Resume

- Skills Based Resume

- Professional Resume

- ATS Resume

- Summary Resume

- Customer Service Resume

- Software Engineer Resume

- Data Analyst Resume

- Functional Resume

- Project Manager Resume

- Nurse Resume

- Federal Resume

- Server Resume

- Administrative Assistant Resume

- Sales Associate Resume

- CNA Resume

- Bartender Resume

- Graduate Resume

- Engineer Resume

- Data Science Resume

- Warehouse Resume

- Volunteer Resume

- No Experience Resume

- Chronological Resume

- Marketing Resume

- Executive Resume

- Truck Driver Resume

- Cashier Resume

- Resume Format

- Two Page Resume

- Basic Resume

- Manager Resume

- Supervisor Resume

- Director Resume

- Blank Resume

- One Page Resume

- Developer Resume

- Caregiver Resume

- Personal Resume

- Consultant Resume

- Administrator Resume

- Officer Resume

- Medical Resume

- Job Resume

- Technician Resume

- Clerk Resume

- Driver Resume

- Data Entry Resume

- Freelancer Resume

- Operator Resume

- Printable Resume

- Worker Resume

- Student Resume

- Doctor Resume

- Merchandiser Resume

- Architecture Resume

- Photographer Resume

- Chef Resume

- Lawyer Resume

- Secretary Resume

- Customer Support Resume

- Computer Operator Resume

- Programmer Resume

- Pharmacist Resume

- Electrician Resume

- Librarian Resume

- Computer Resume

- IT Resume

- Experience Resume

- Instructor Resume

- Fashion Designer Resume

- Mechanic Resume

- Attendant Resume

- Principal Resume

- Professor Resume

- Safety Resume

- Waitress Resume

- MBA Resume

- Security Guard Resume

- Editor Resume

- Tester Resume

- Auditor Resume

- Writer Resume

- Trainer Resume

- Advertising Resume

- Harvard Resume

- Receptionist Resume

- Buyer Resume

- Physician Resume

- Scientist Resume

- 2 Page Resume

- Therapist Resume

- CEO resume

- General Manager Resume

- Attorney Resume

- Project Coordinator Resume

- Bus Driver Resume

- Cook Resume

- Artist Resume

- Pastor Resume

- Recruiter Resume

- Team Leader Resume

- Apprentice Resume

- Police Resume

- Military Resume

- Personal Trainer Resume

- Contractor Resume

- Dietician Resume

- First Job Resume

- HVAC Resume

- Psychologist Resume

- Public Relations Resume

- Support Specialist Resume

- Computer Technician Resume

- Drafter Resume

- Foreman Resume

- Underwriter Resume

- Photo Resume

- Teacher Resume

- Modern Resume

- Fresher Resume

- Creative Resume

- Internship Resume

- Graphic Designer Resume

- College Resume