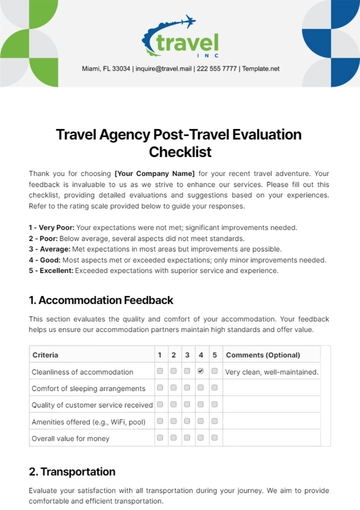

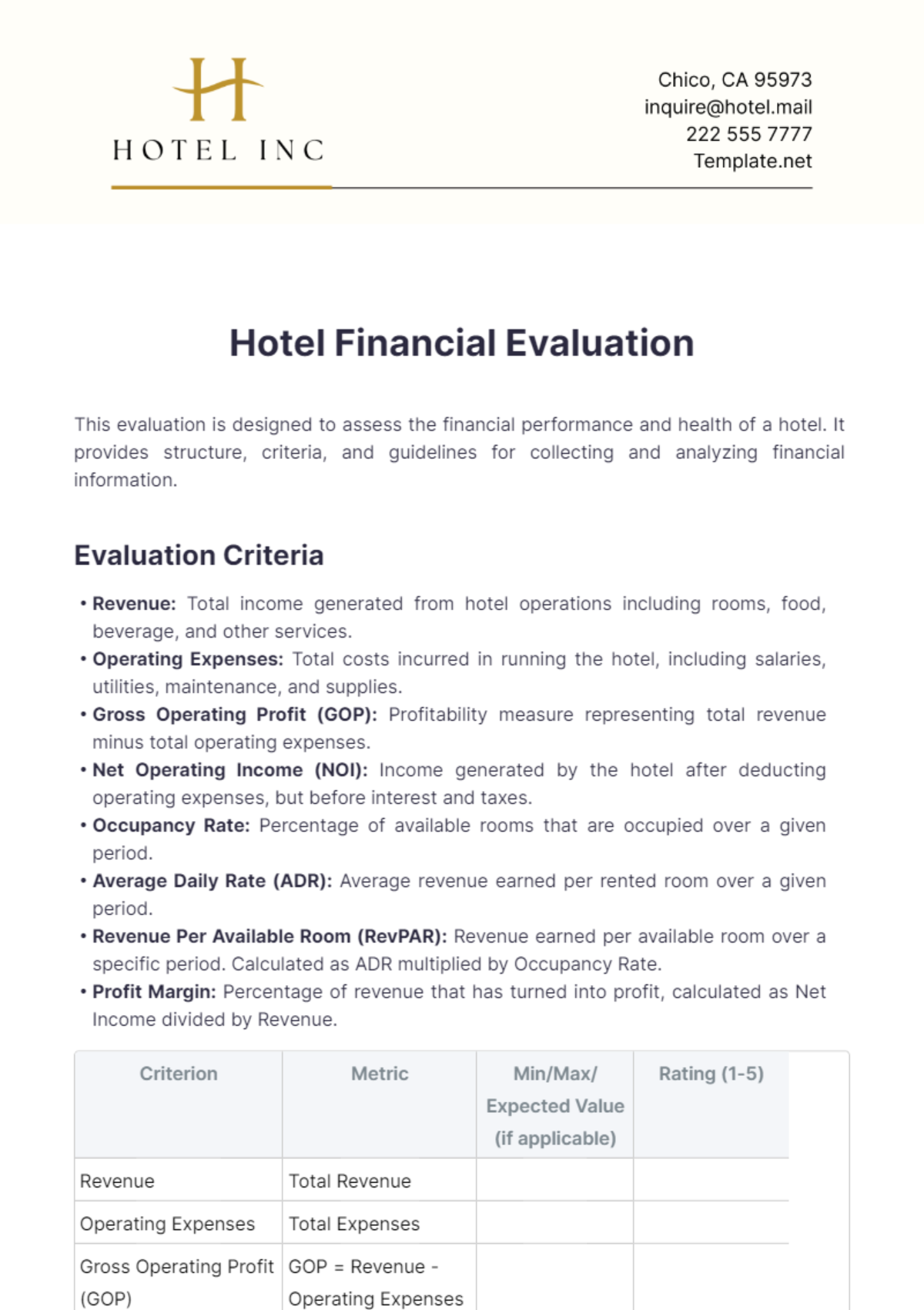

Free Hotel Financial Evaluation

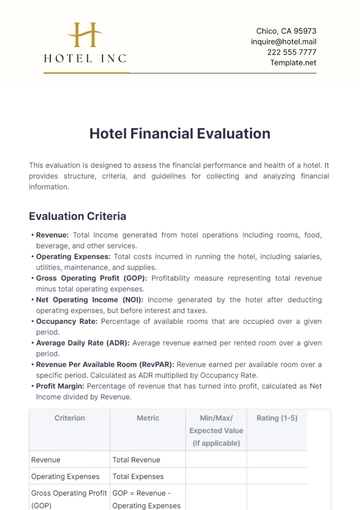

This evaluation is designed to assess the financial performance and health of a hotel. It provides structure, criteria, and guidelines for collecting and analyzing financial information.

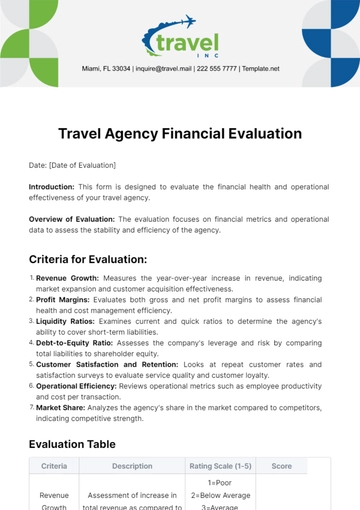

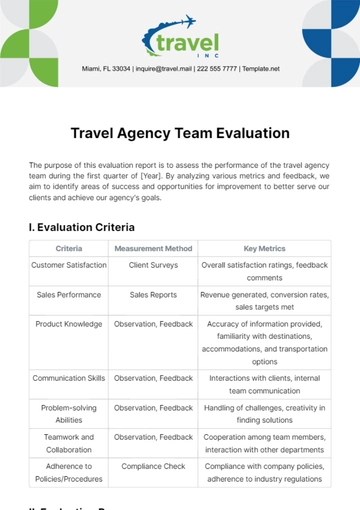

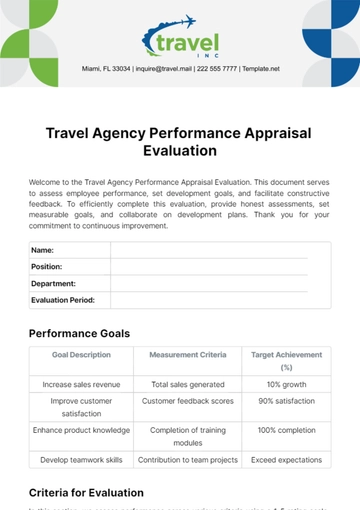

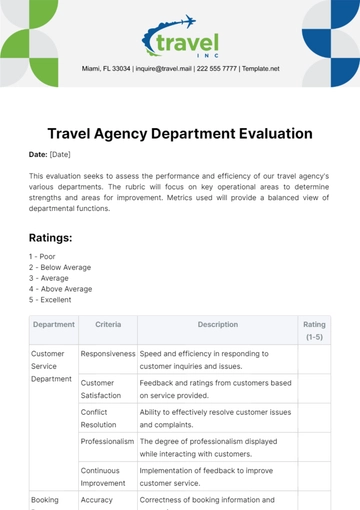

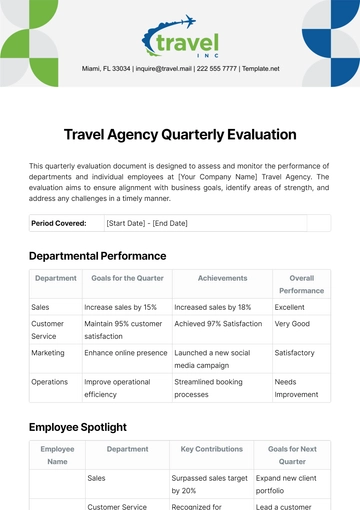

Evaluation Criteria

Revenue: Total income generated from hotel operations including rooms, food, beverage, and other services.

Operating Expenses: Total costs incurred in running the hotel, including salaries, utilities, maintenance, and supplies.

Gross Operating Profit (GOP): Profitability measure representing total revenue minus total operating expenses.

Net Operating Income (NOI): Income generated by the hotel after deducting operating expenses, but before interest and taxes.

Occupancy Rate: Percentage of available rooms that are occupied over a given period.

Average Daily Rate (ADR): Average revenue earned per rented room over a given period.

Revenue Per Available Room (RevPAR): Revenue earned per available room over a specific period. Calculated as ADR multiplied by Occupancy Rate.

Profit Margin: Percentage of revenue that has turned into profit, calculated as Net Income divided by Revenue.

Criterion | Metric | Min/Max/ Expected Value (if applicable) | Rating (1-5) |

|---|---|---|---|

Revenue | Total Revenue | ||

Operating Expenses | Total Expenses | ||

Gross Operating Profit (GOP) | GOP = Revenue - Operating Expenses | ||

Net Operating Income (NOI) | NOI = Gross Operating Profit - (Interest + Taxes) | ||

Occupancy Rate | Occupancy Rate = (Occupied Rooms / Available Rooms) * 100% | ||

Average Daily Rate (ADR) | ADR = Total Room Revenue / Occupied Rooms | ||

Revenue Per Available Room (RevPAR) | RevPAR = ADR * Occupancy Rate | ||

Profit Margin | Profit Margin = (Net Income / Revenue) * 100% |

Additional Comments and Notes

- 100% Customizable, free editor

- Access 1 Million+ Templates, photo’s & graphics

- Download or share as a template

- Click and replace photos, graphics, text, backgrounds

- Resize, crop, AI write & more

- Access advanced editor

Assess financial health and performance with the Hotel Financial Evaluation Template from Template.net. This customizable and editable document allows you to analyze key financial metrics, trends, and ratios for your hotel. Seamlessly tailored in our AI Editor Tool, conduct thorough evaluations to identify areas for improvement and strategic planning.