Effortlessly Create Meaningful Moments with Free Pre-Designed Gift Letter Templates in Microsoft Word by Template.net

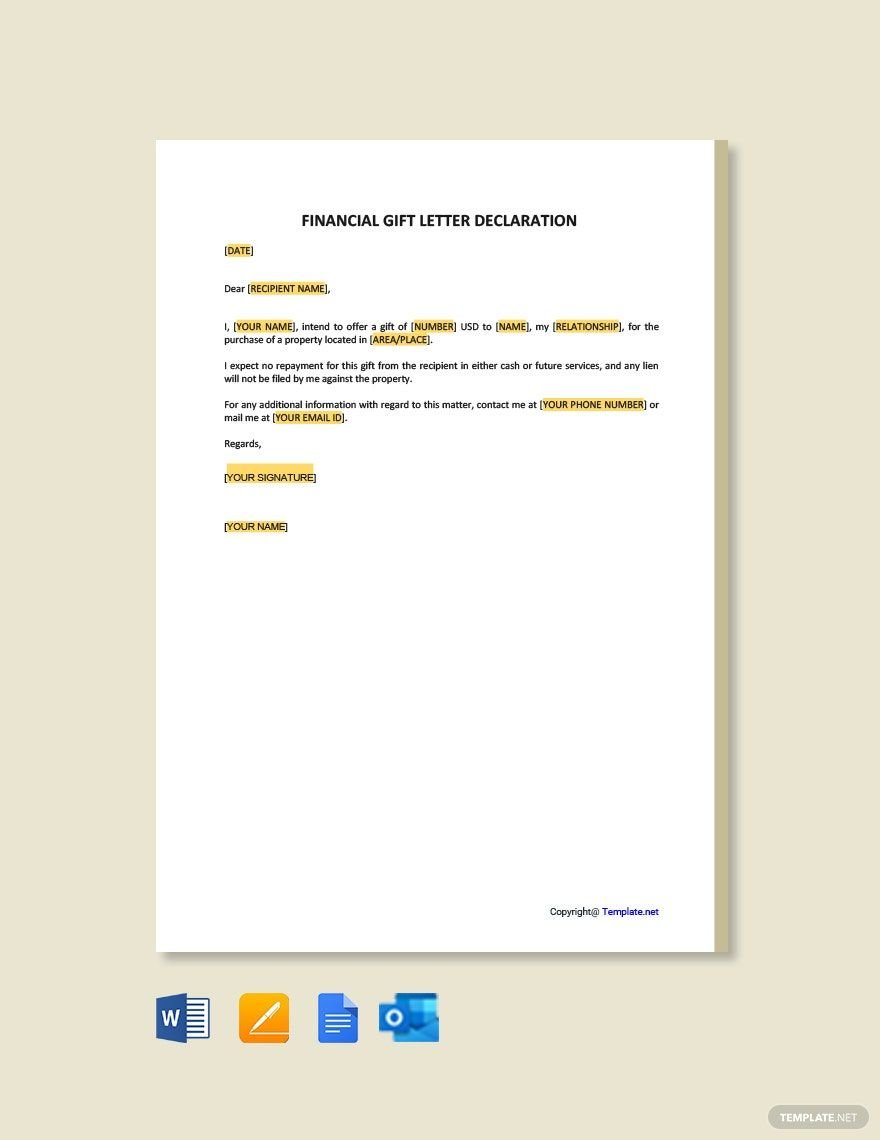

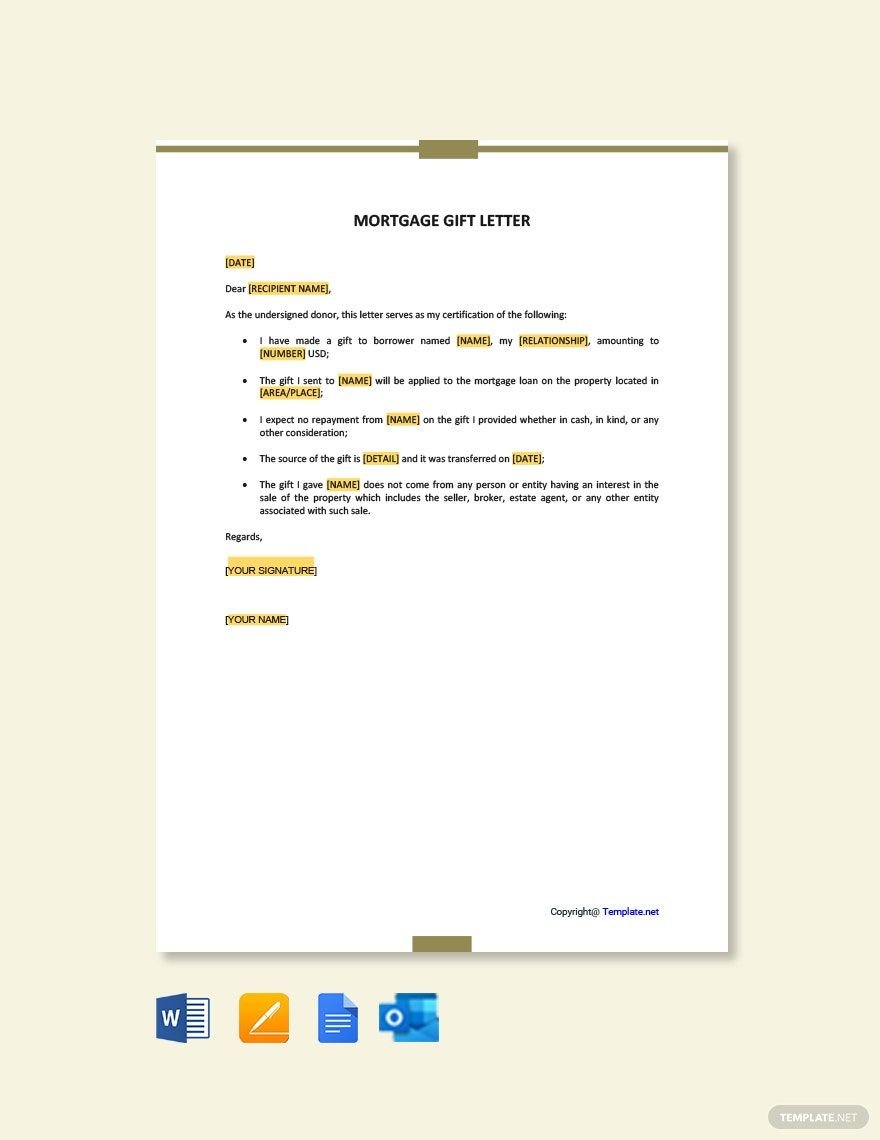

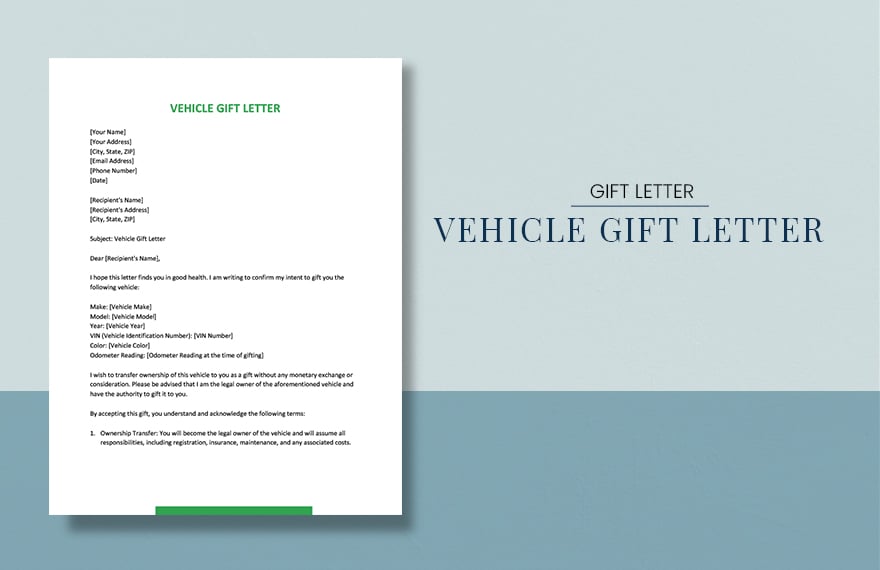

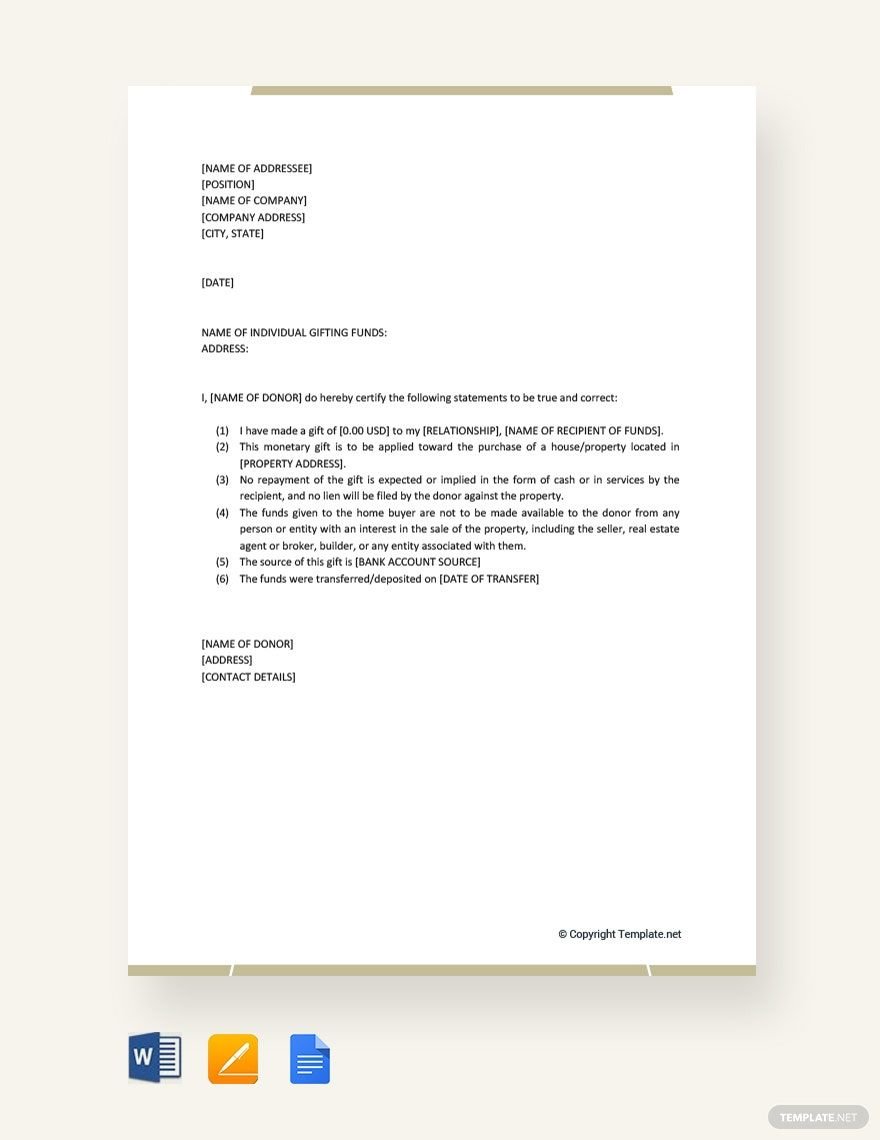

Make your gestures truly memorable with Gift Letter Templates in Microsoft Word by Template.net. Whether you're expressing gratitude or marking a special occasion, you can create beautifully crafted letters effortlessly and without any prior design experience. Imagine being able to craft a heartfelt letter to accompany a cherished gift or formalize a corporate gift-giving initiative with precision. With free pre-designed templates readily available, you'll have downloadable and printable options to suit any purpose. Our templates ensure that you spend more time focusing on what truly matters—the personal message within—without stressing over design, thanks to our beautiful pre-designed templates.

Explore a wide variety of visually stunning Gift Letter Templates that cater to every need, from individual surprises to corporate gift-giving. Stay on top of the latest trends with our regularly updated library of templates, designed to inspire and simplify your creative process. Share your elegantly crafted letters effortlessly by downloading them or sharing through various platforms like email and print, maximizing your reach. Take advantage of the flexibility offered by our combination of free and premium templates, allowing you to customize each letter to fit personal tastes and occasions seamlessly. Dabble in both options to discover the ease and satisfaction of creating the perfect gift accompaniments.