Make Your Billing Process Seamless with Restaurant Invoice Templates from Template.net

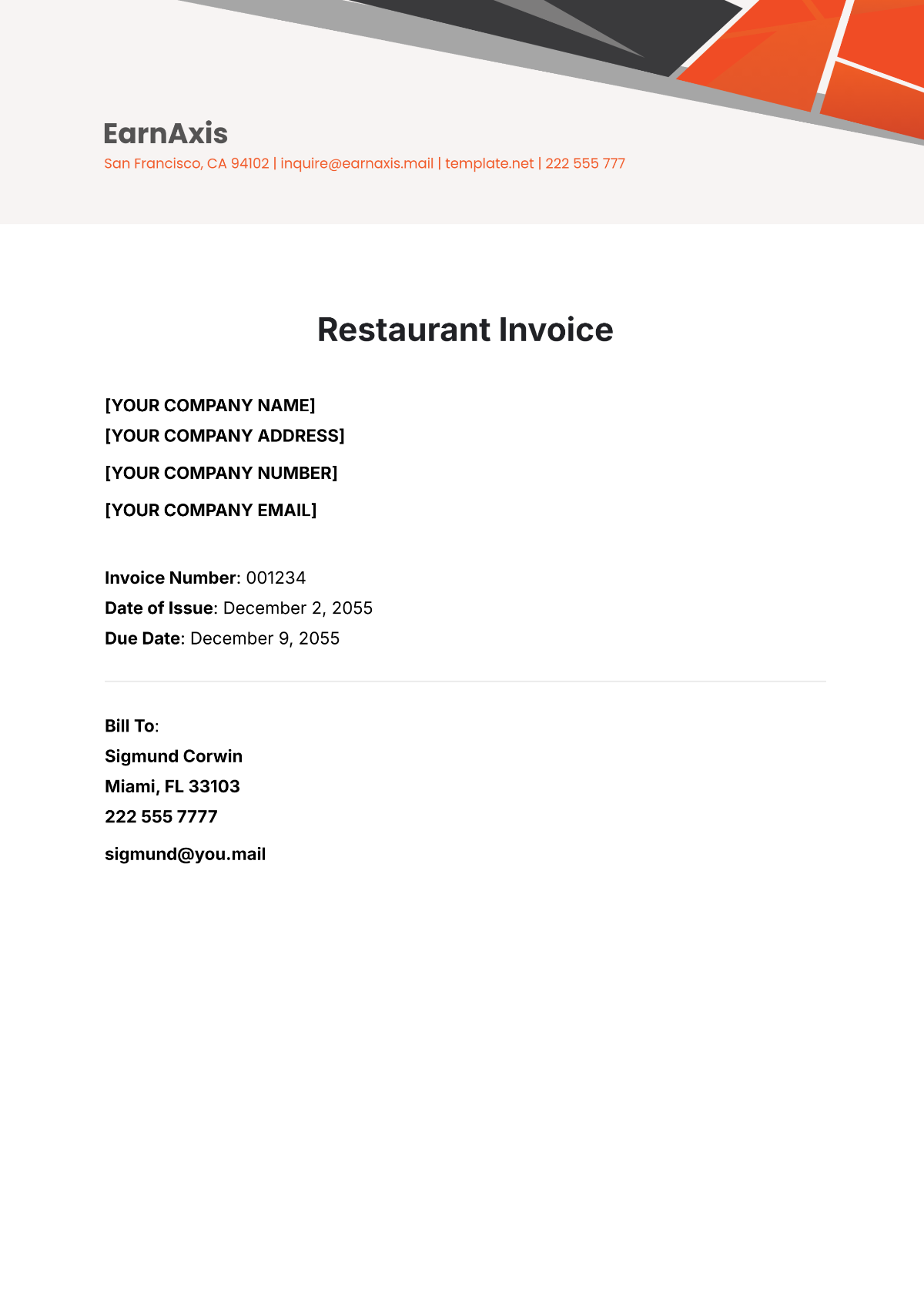

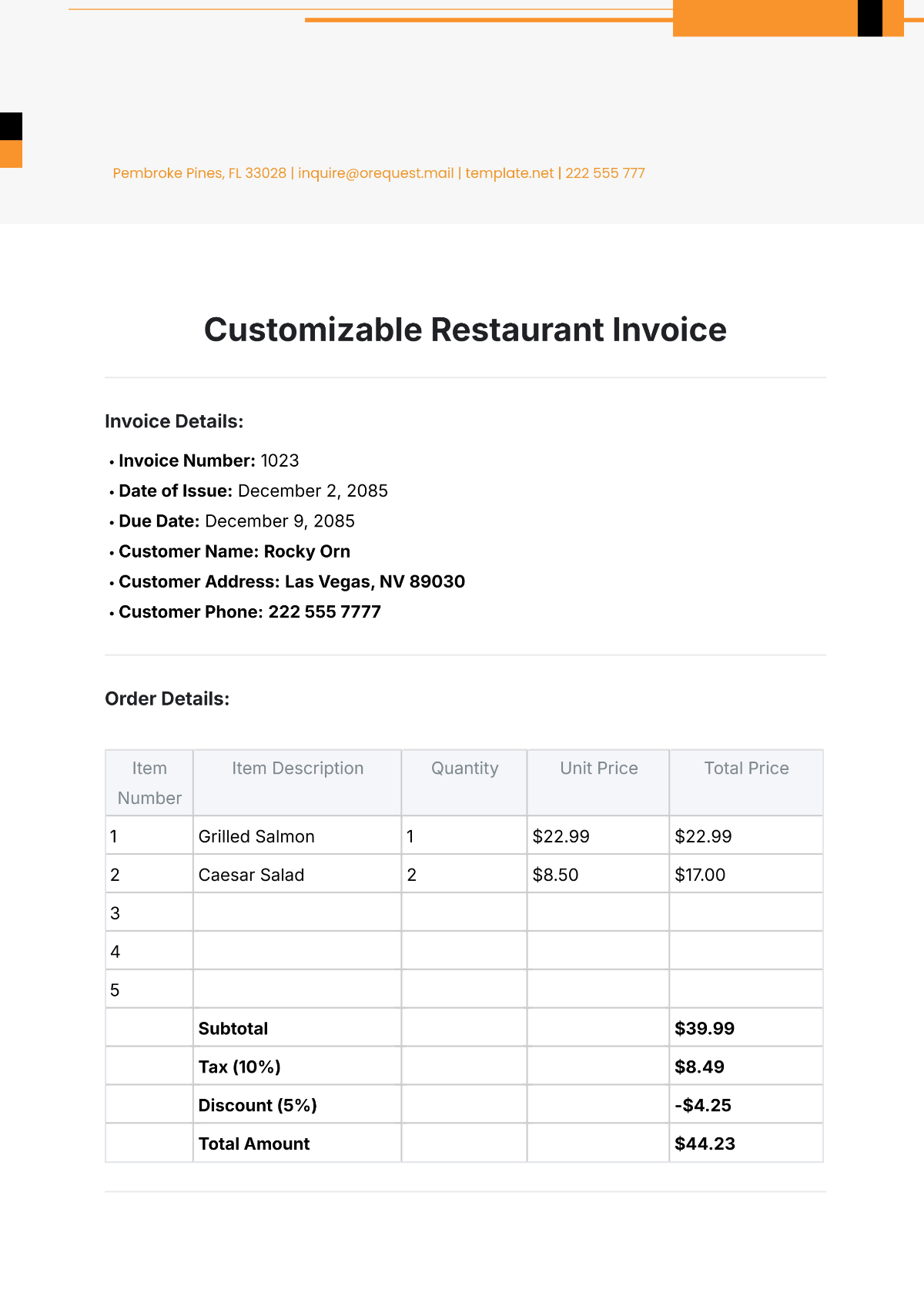

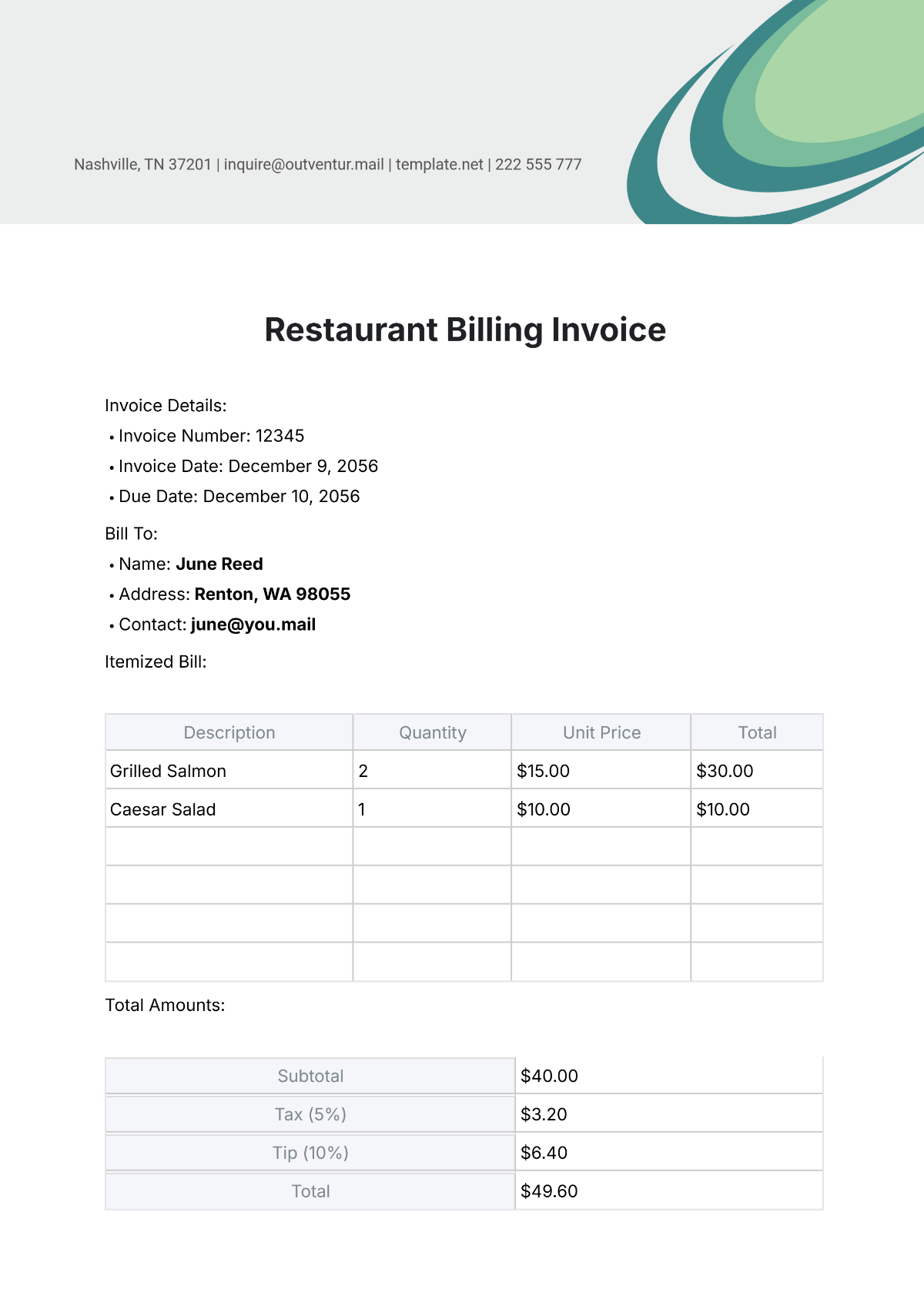

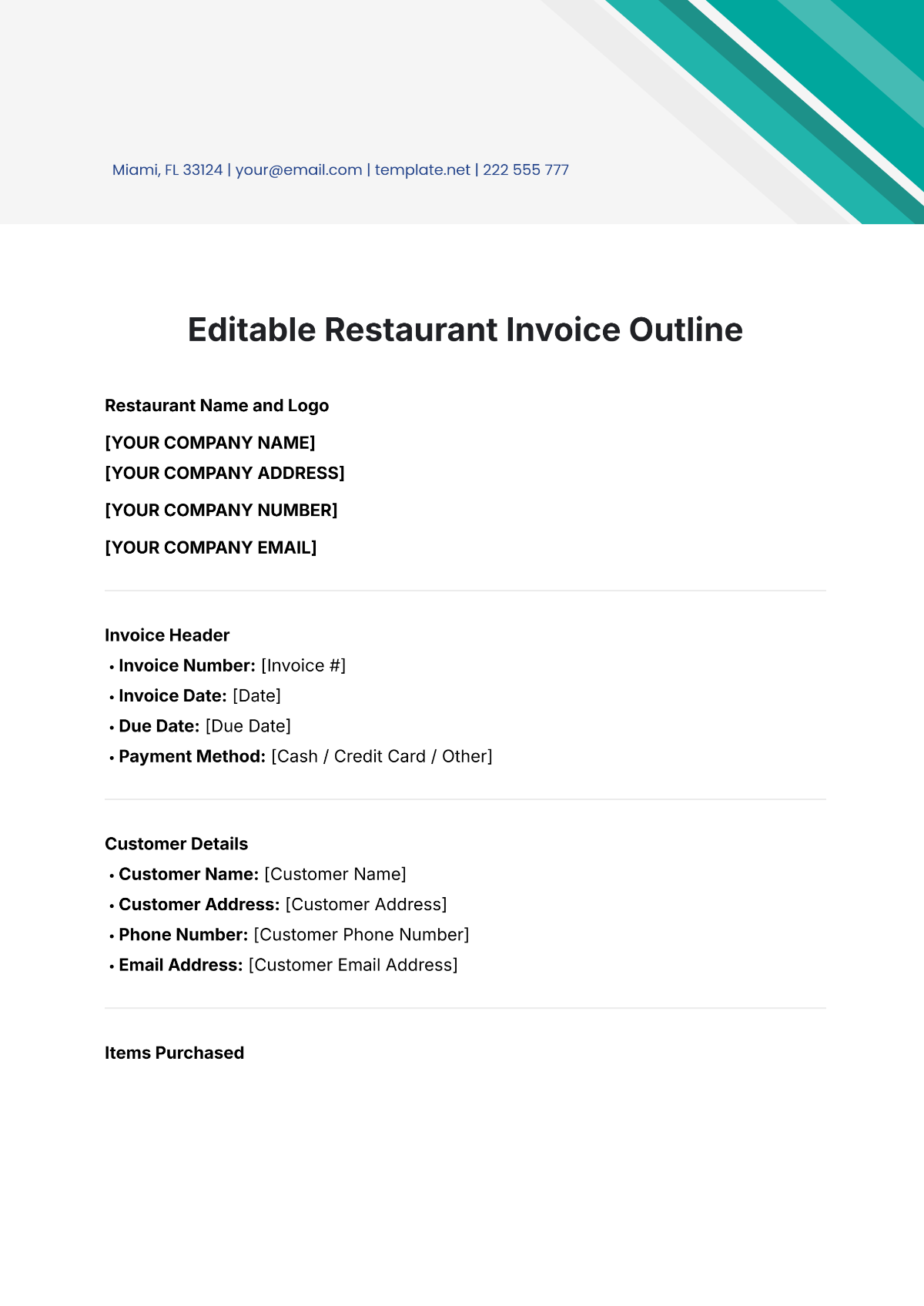

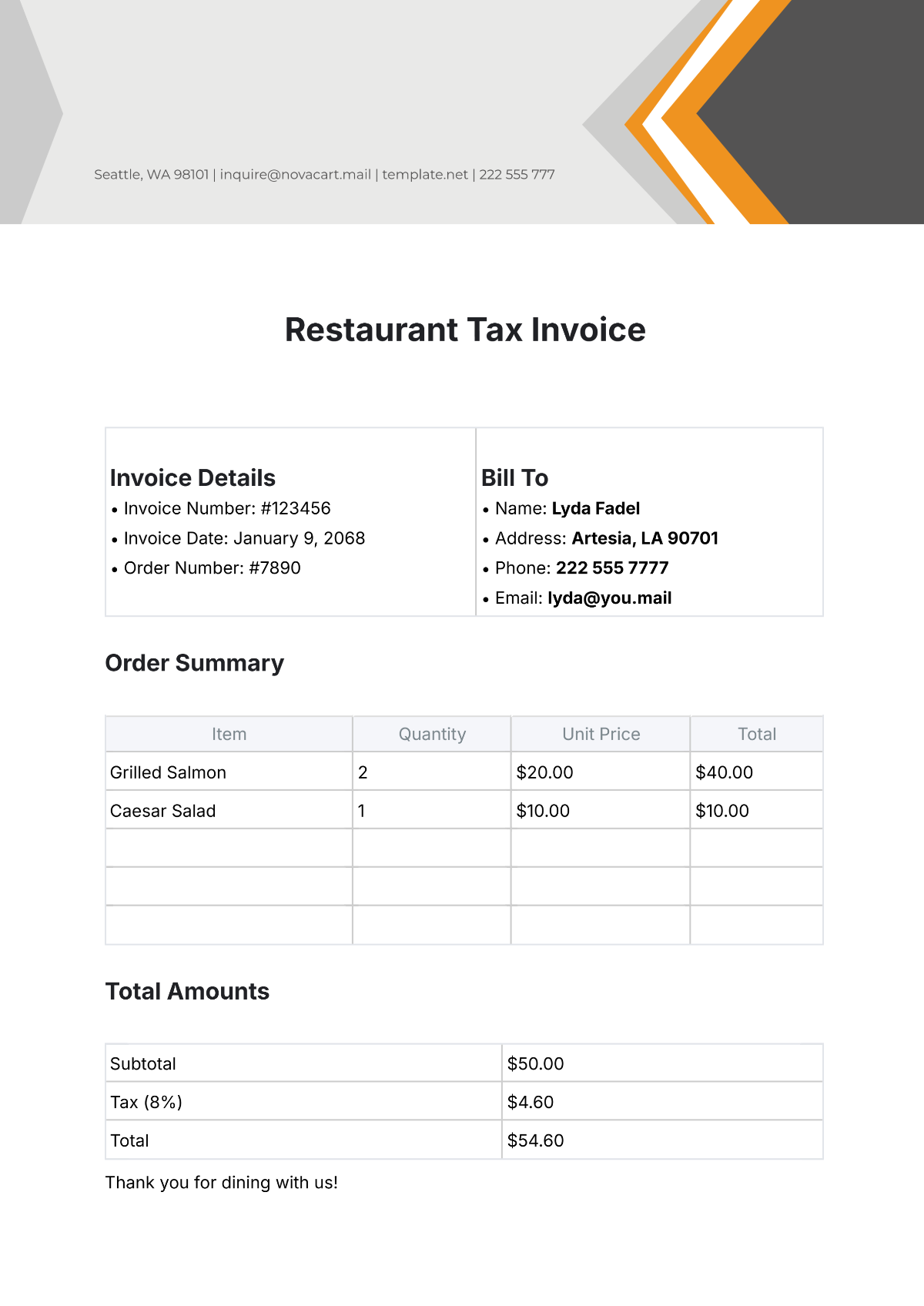

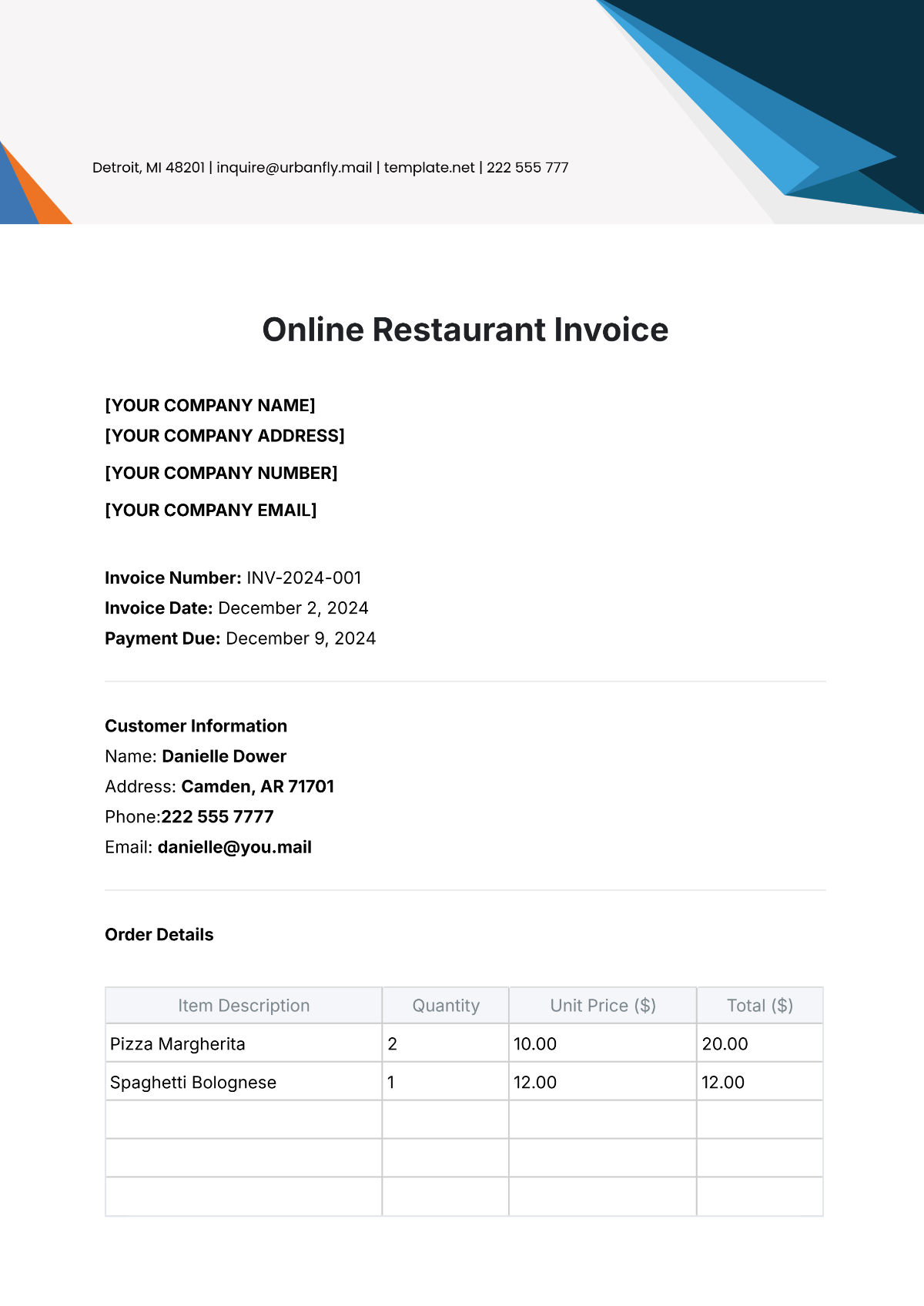

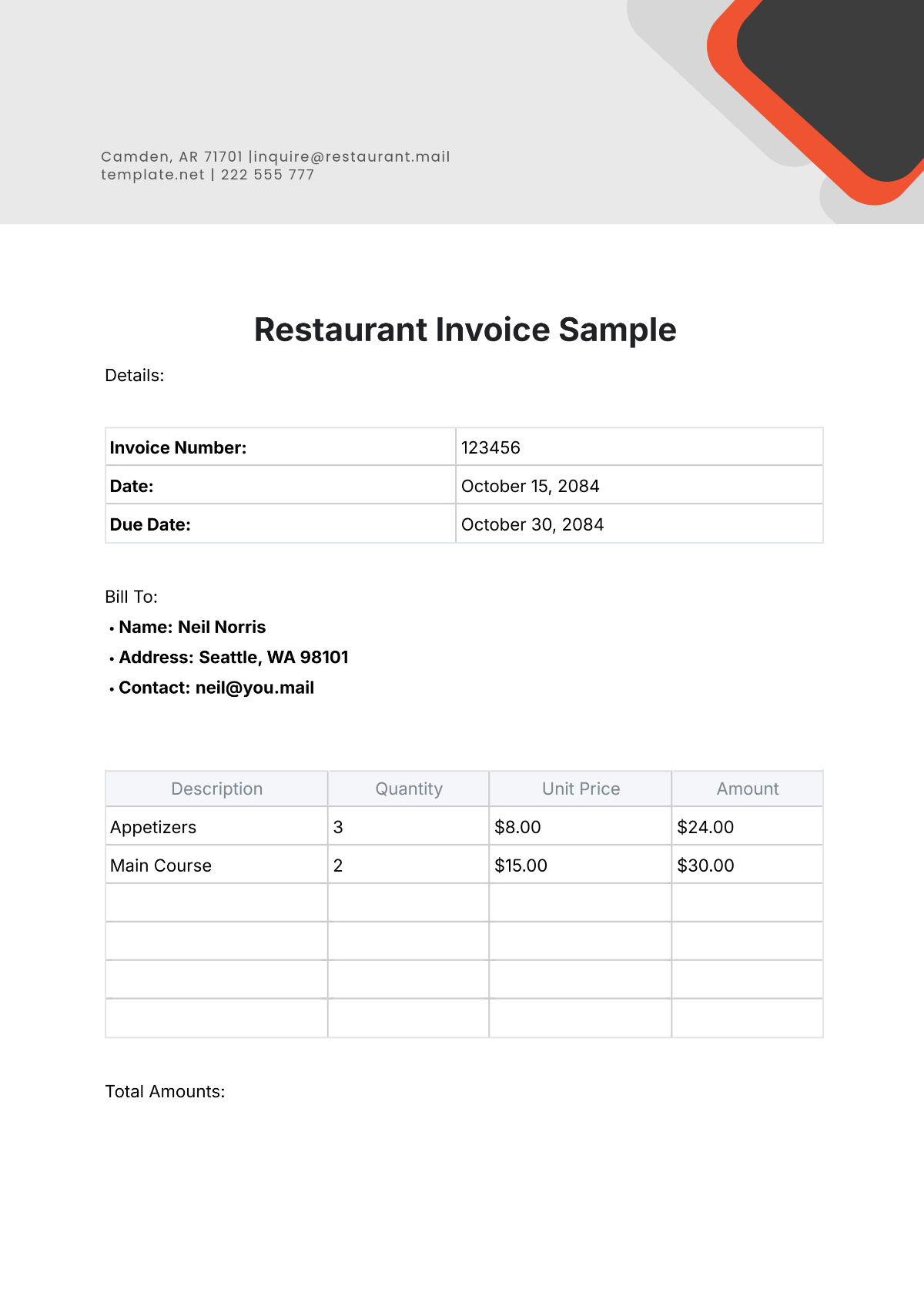

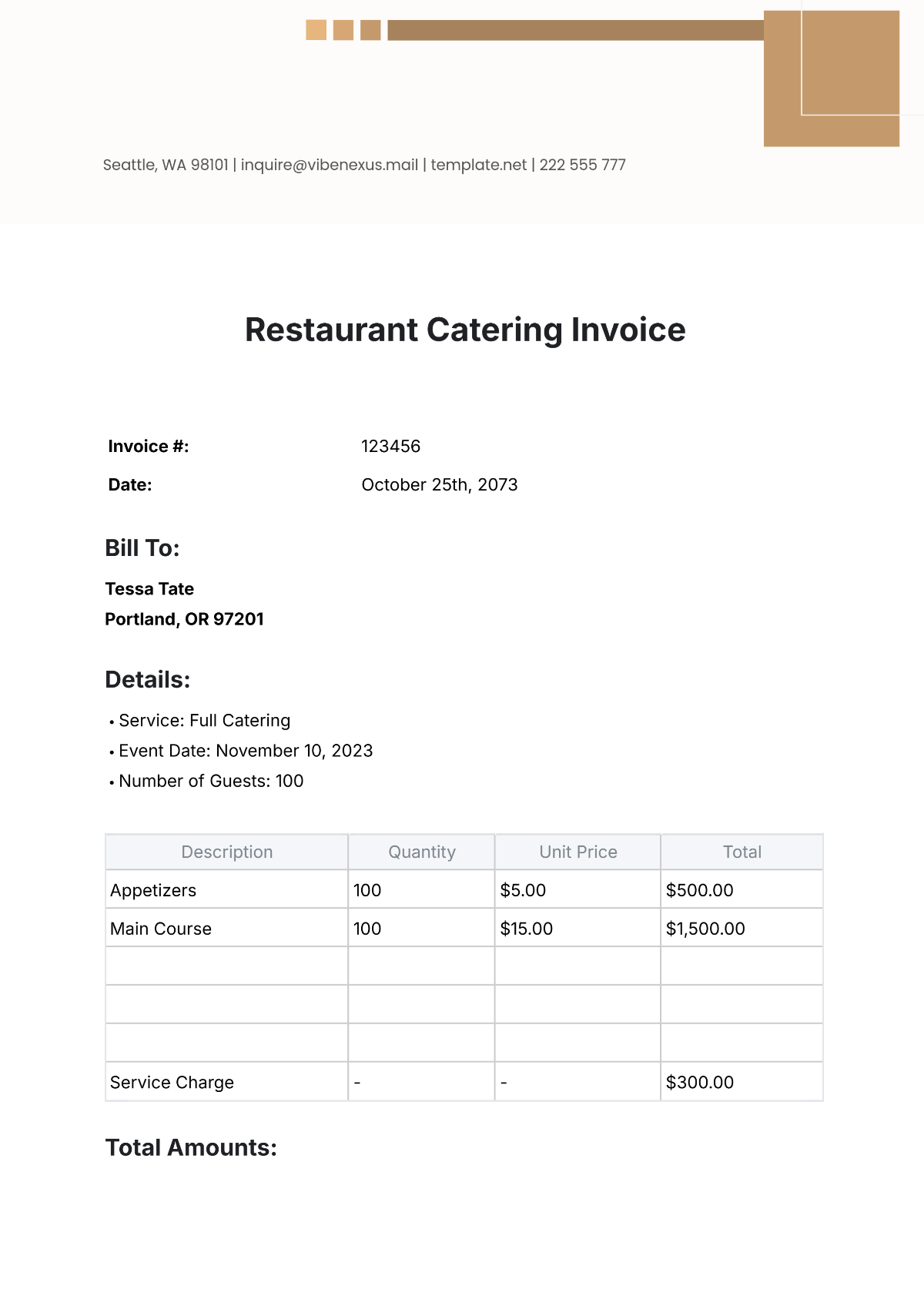

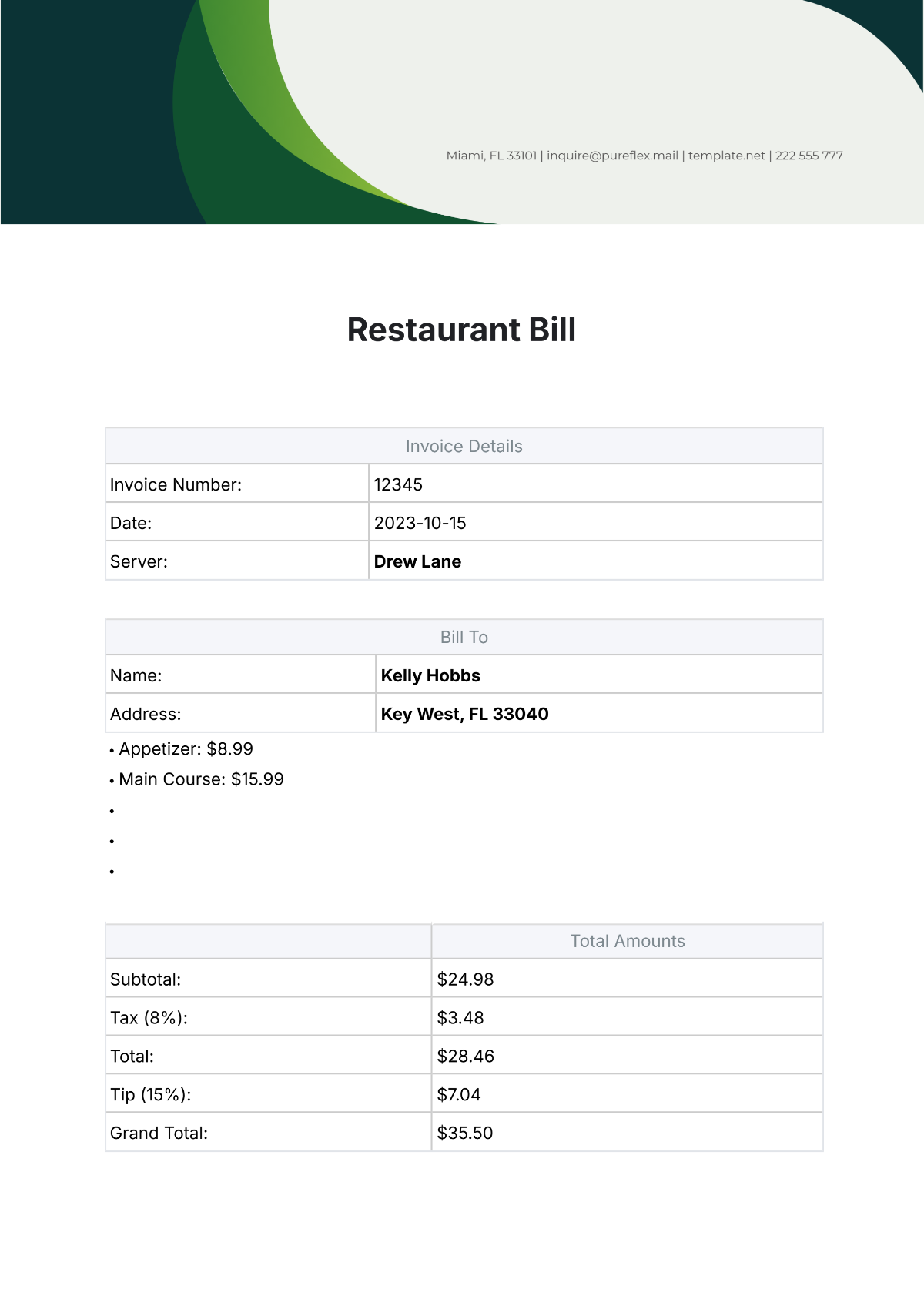

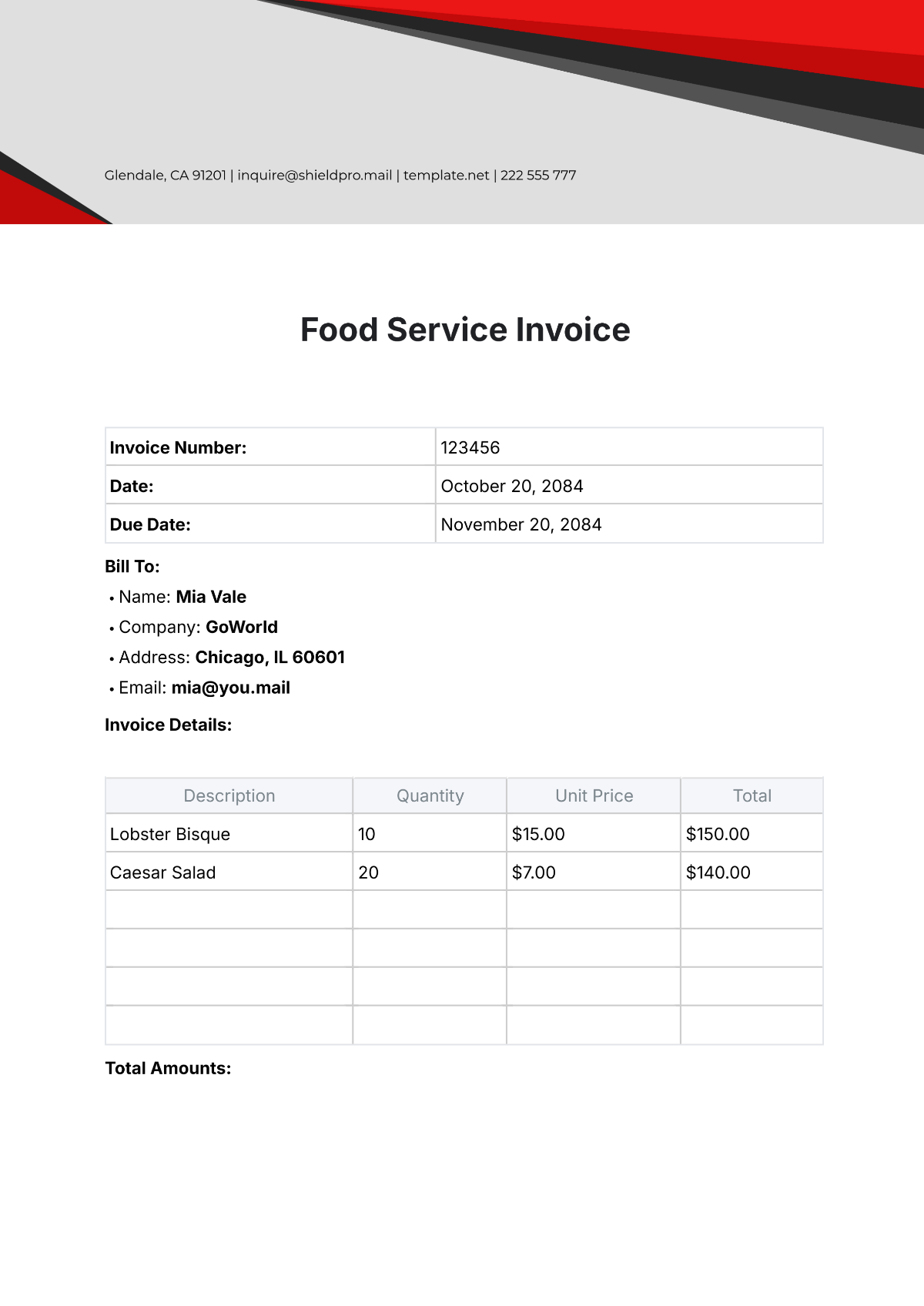

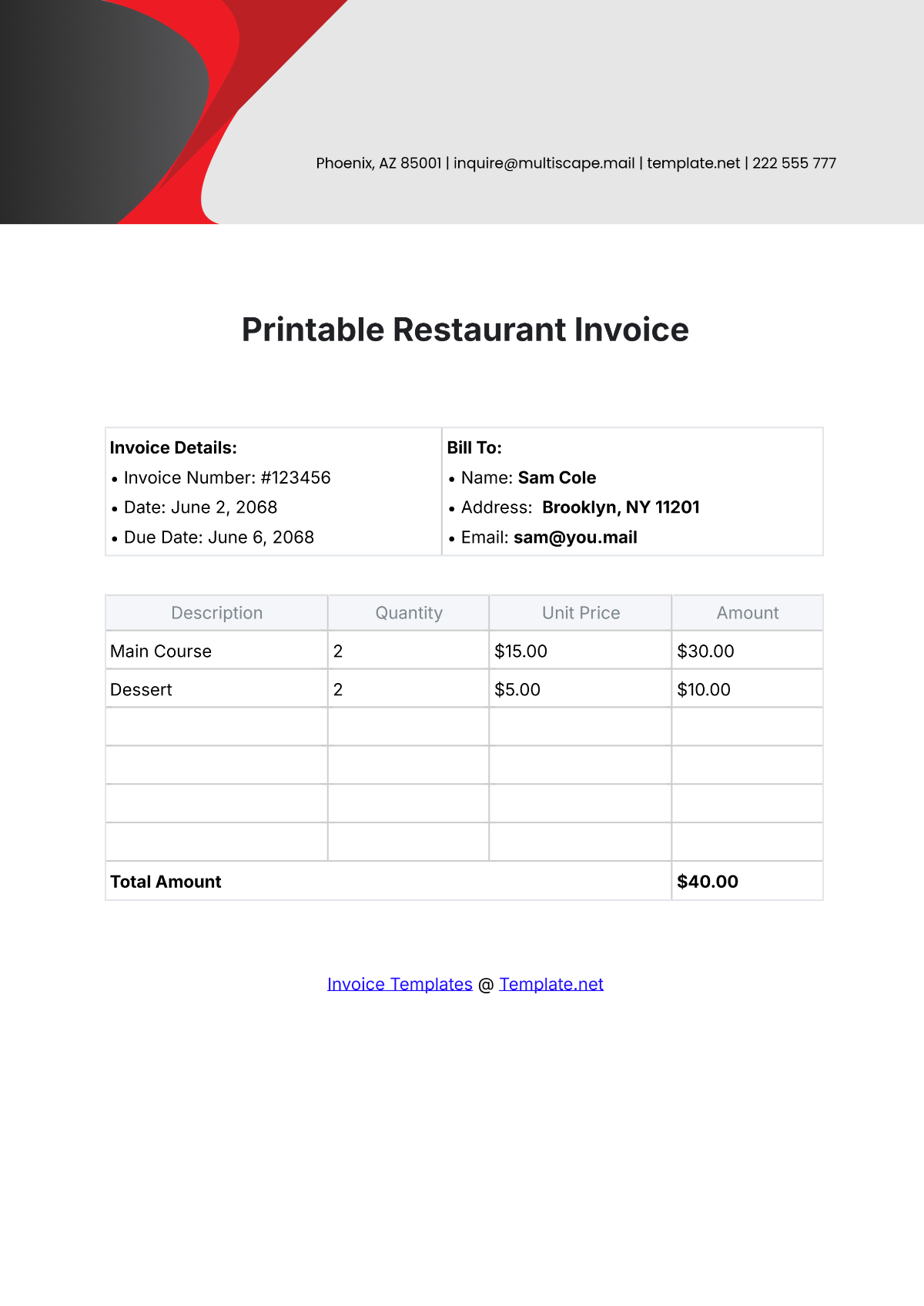

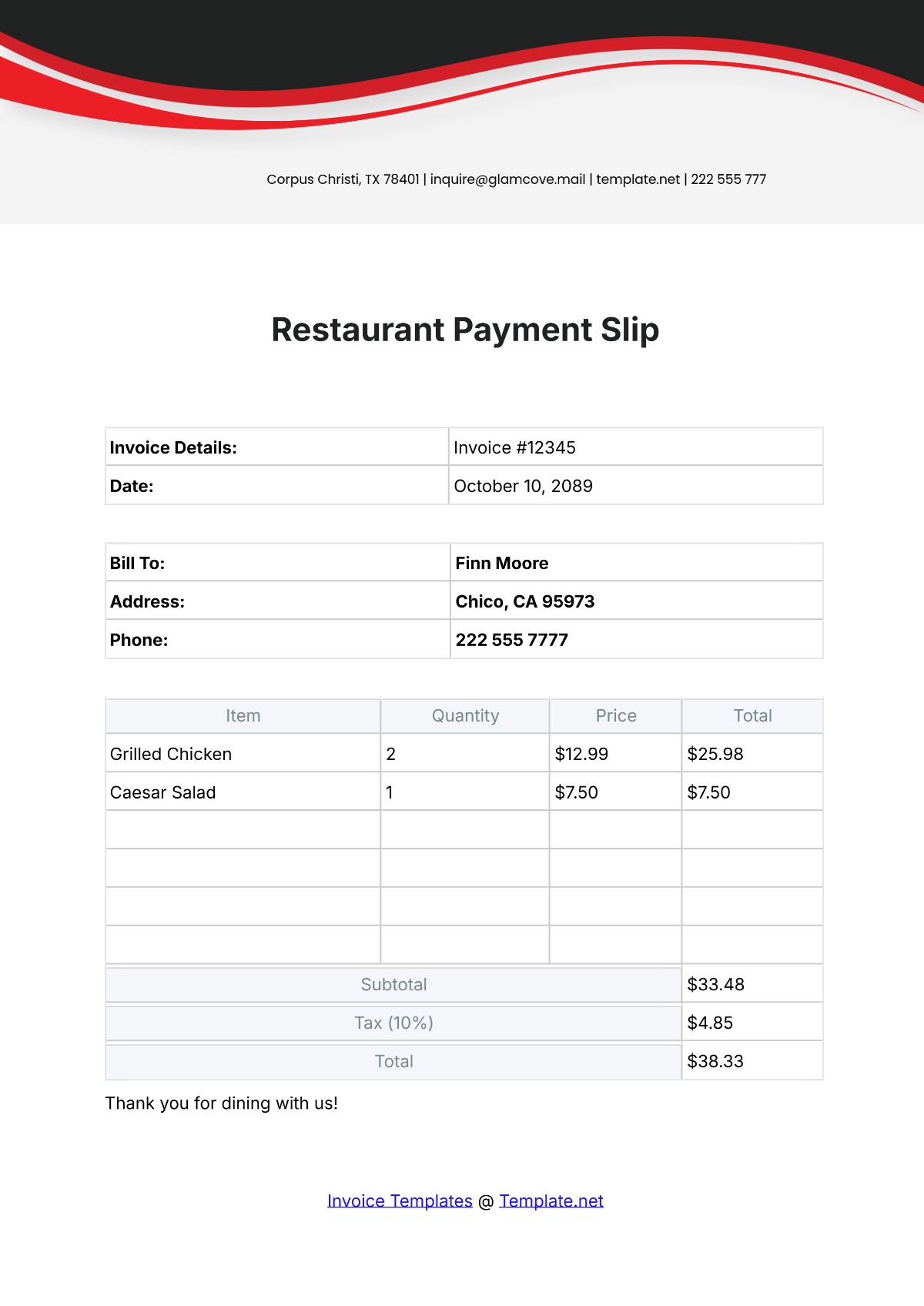

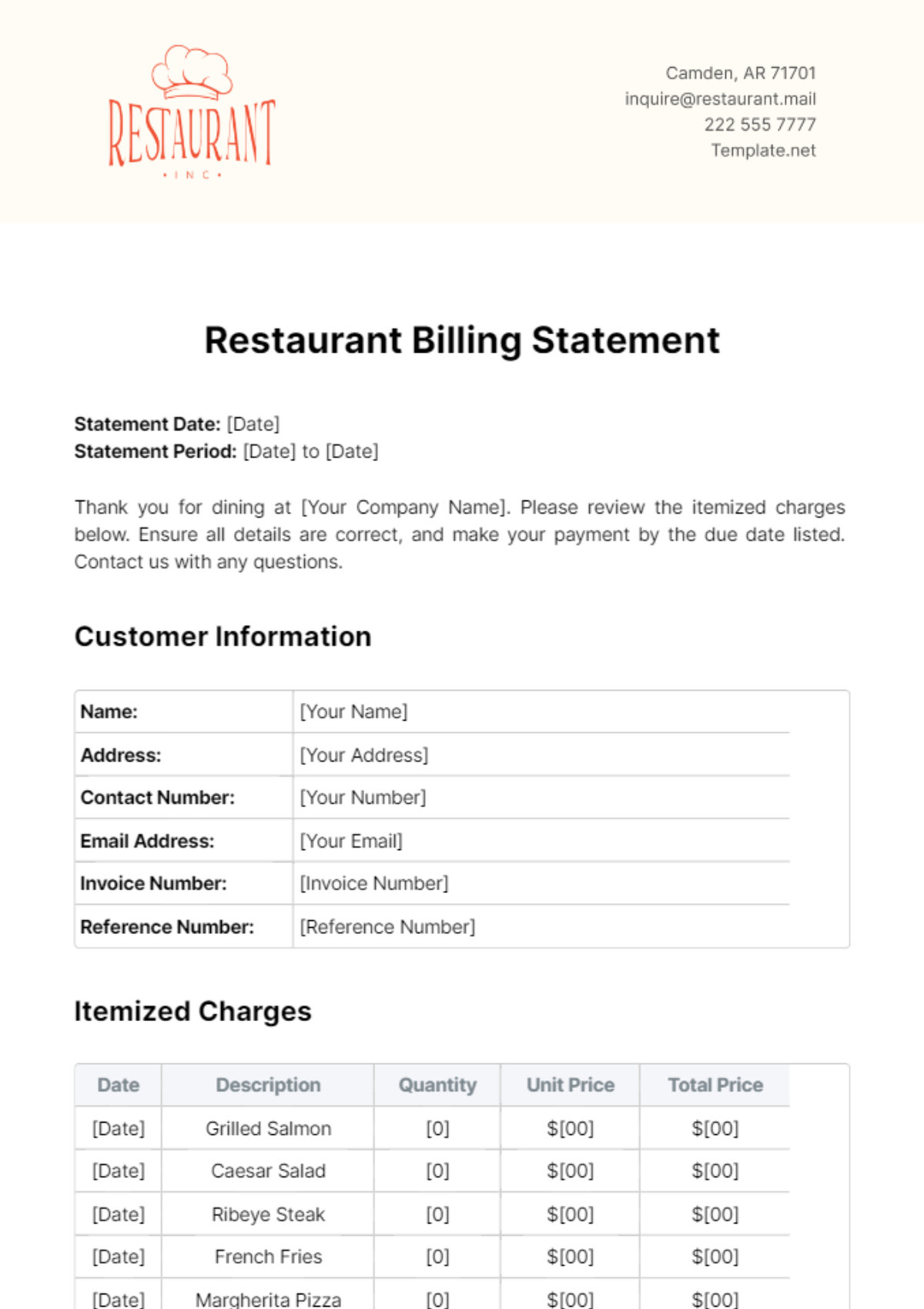

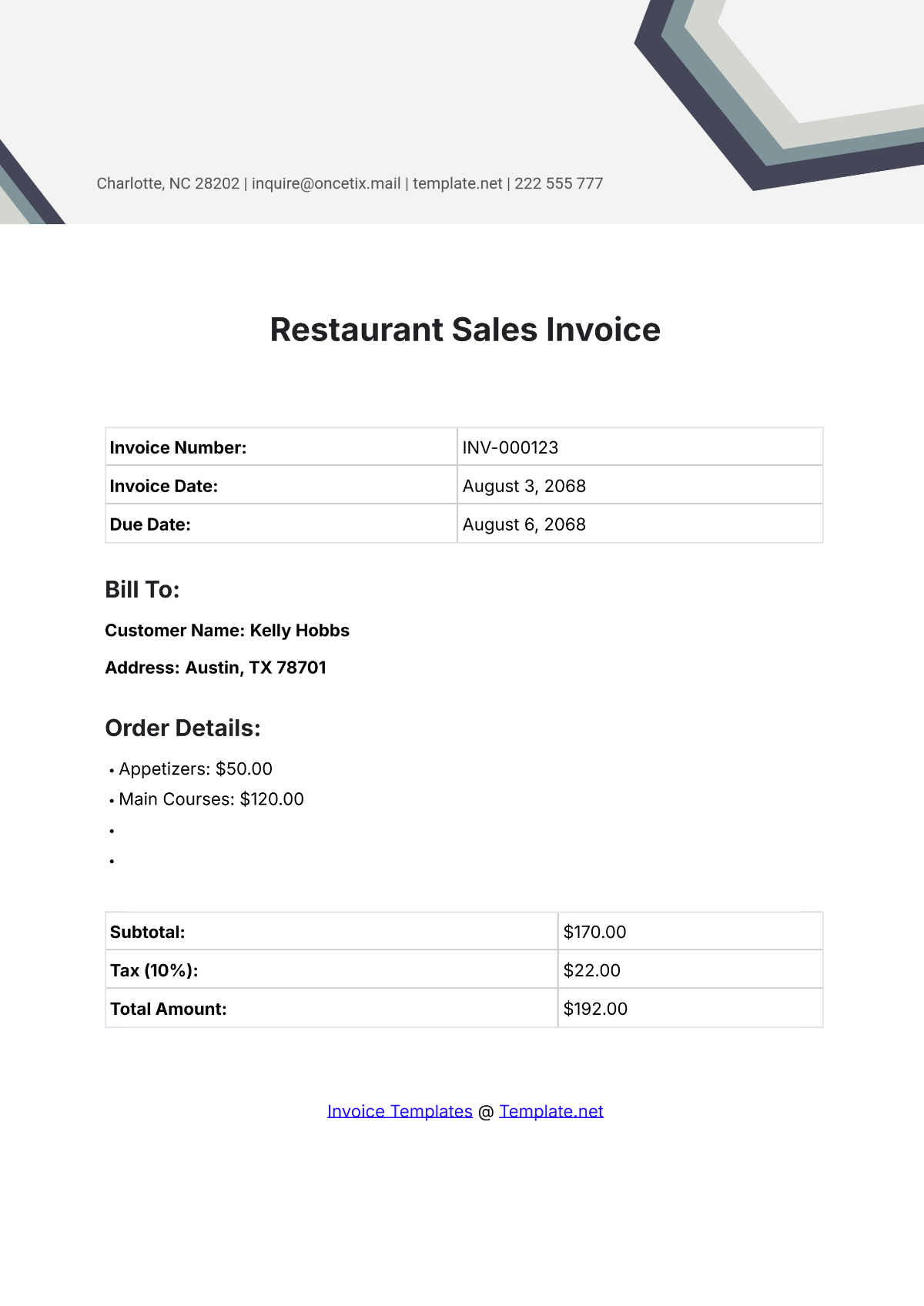

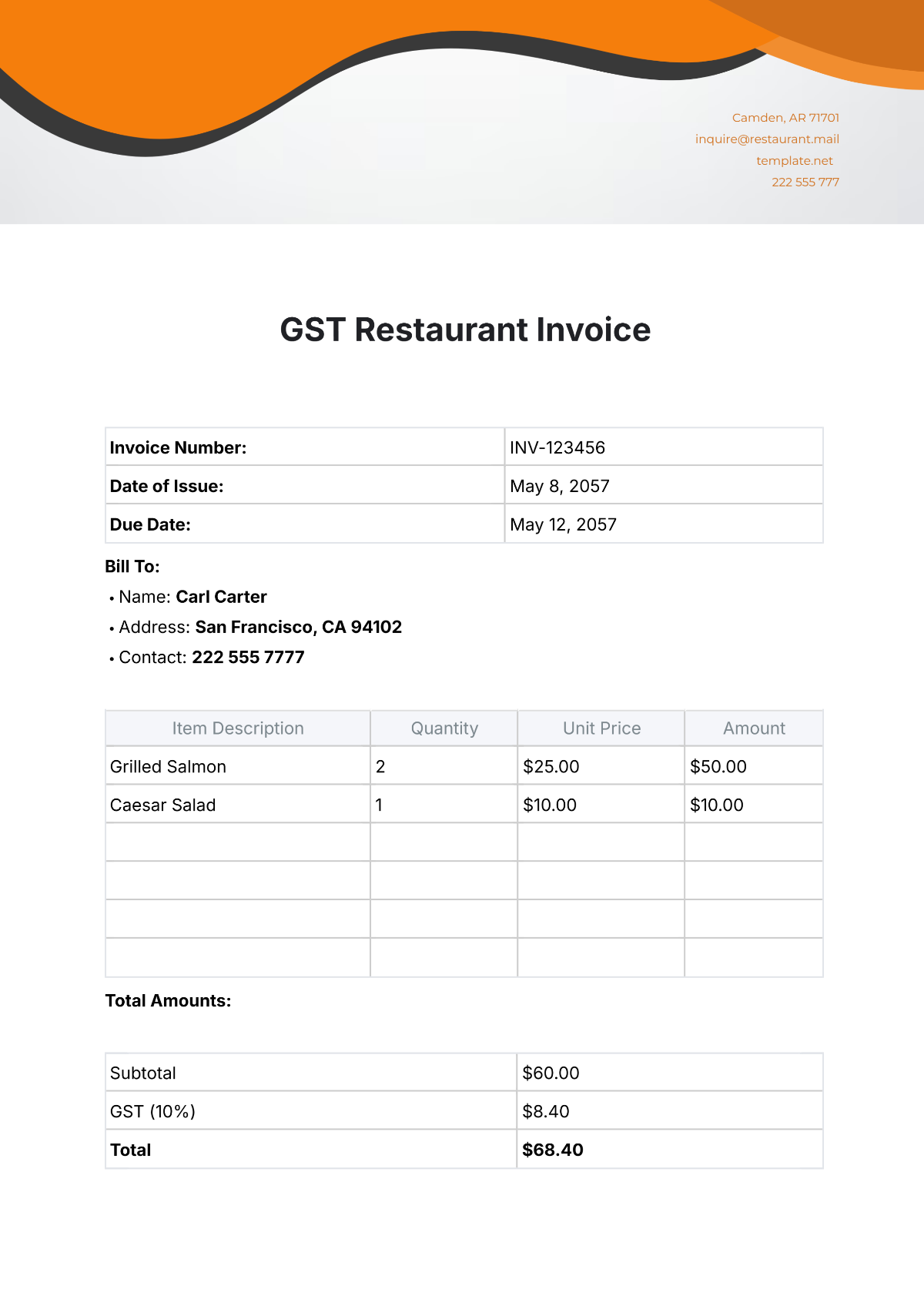

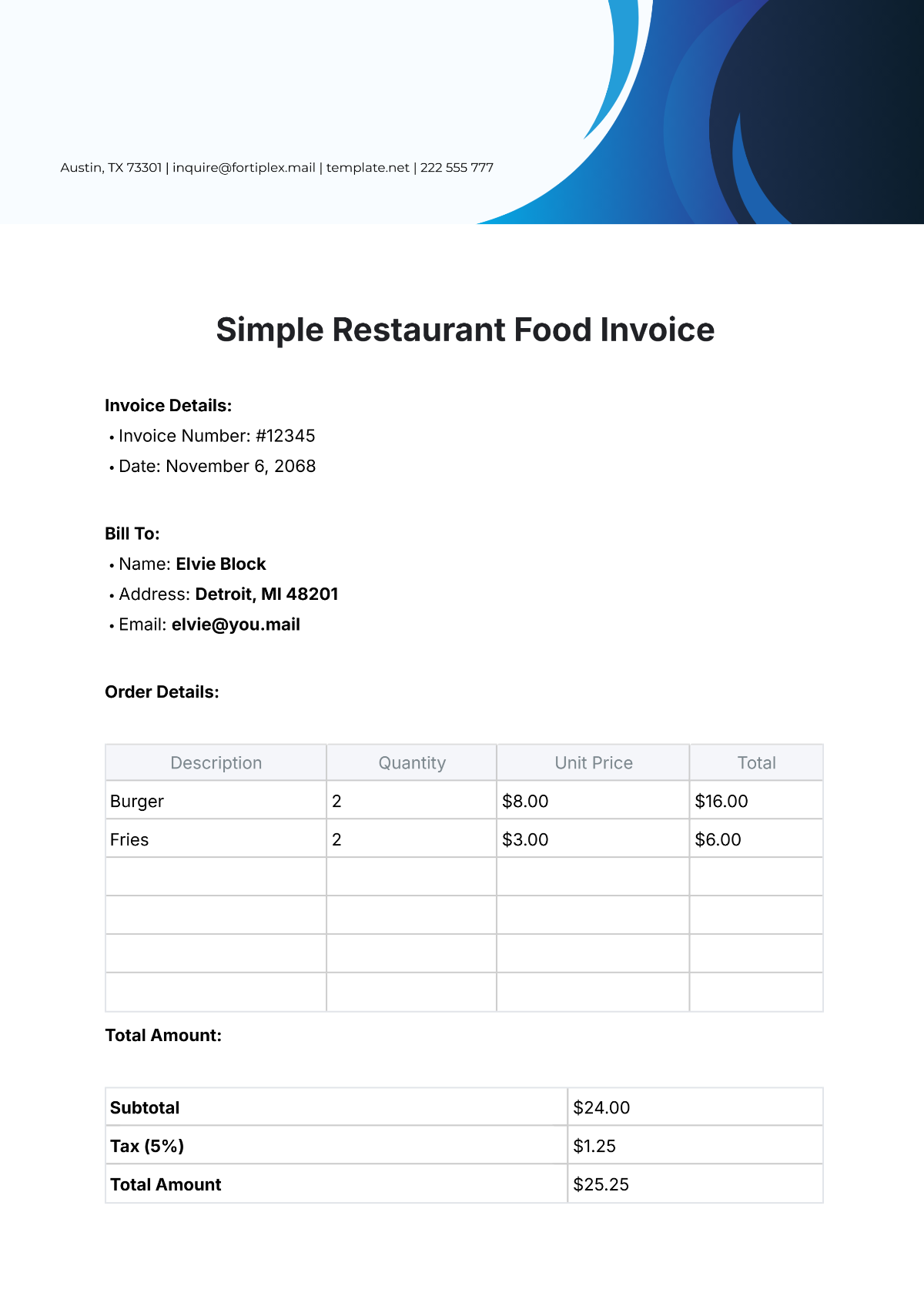

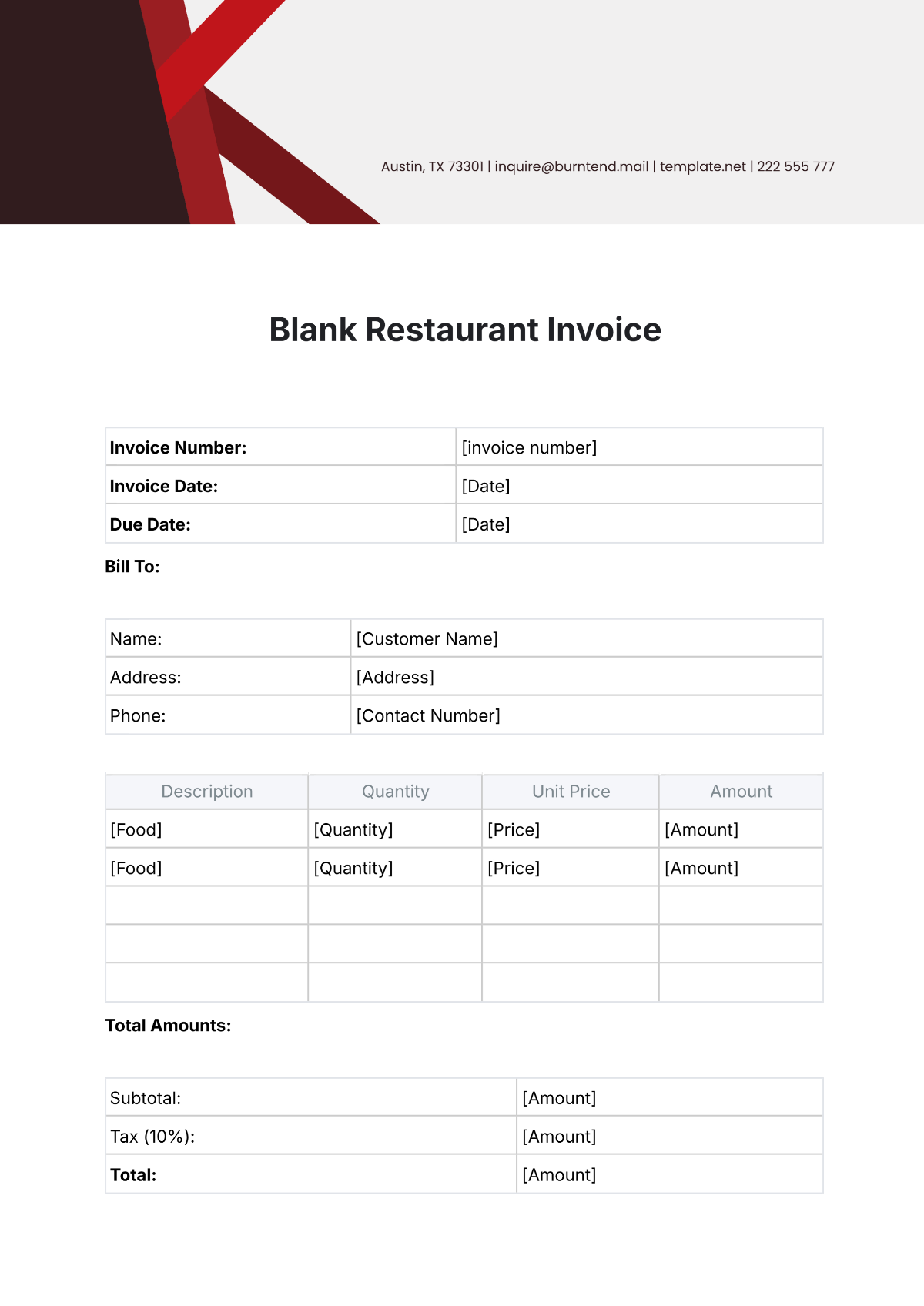

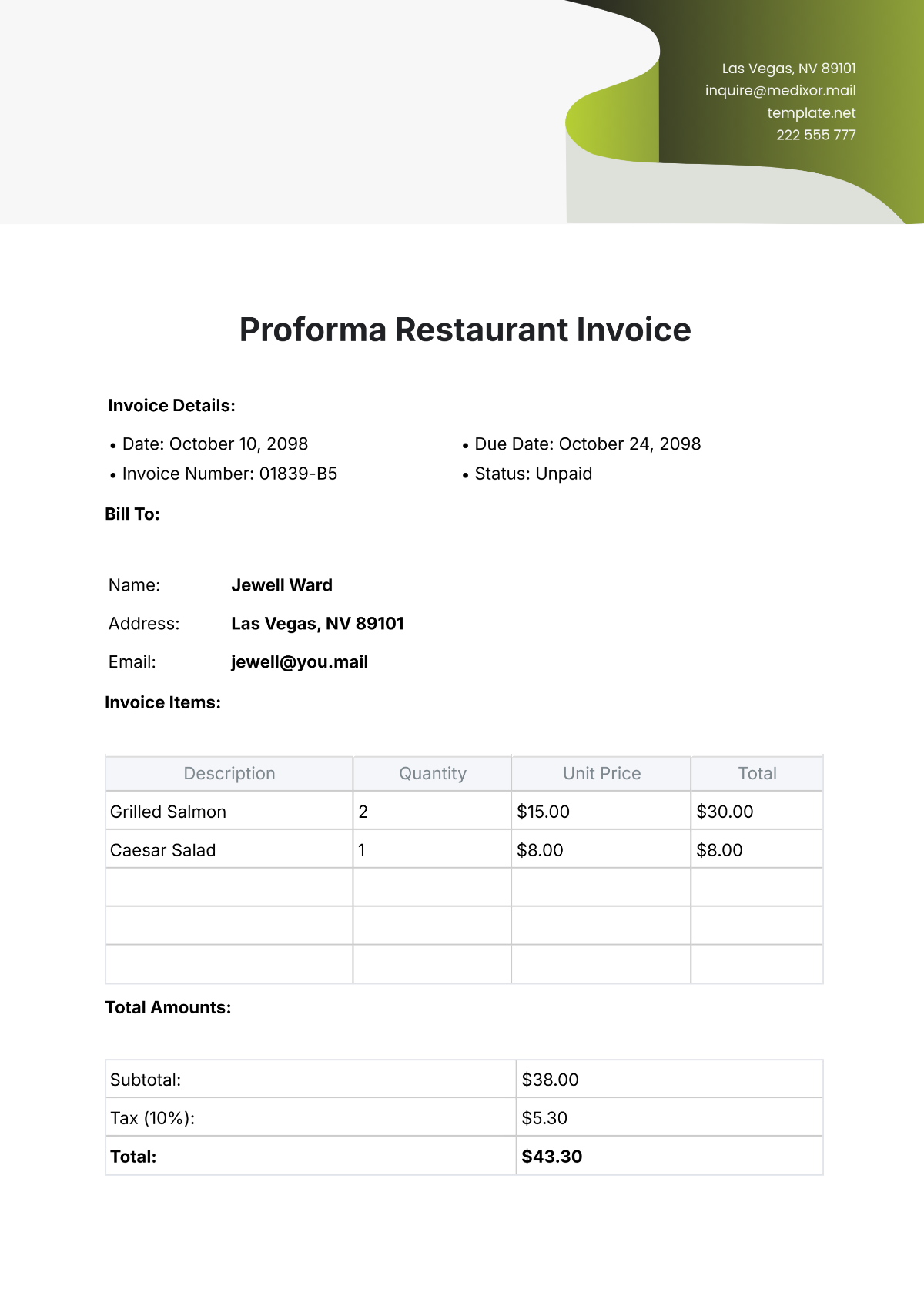

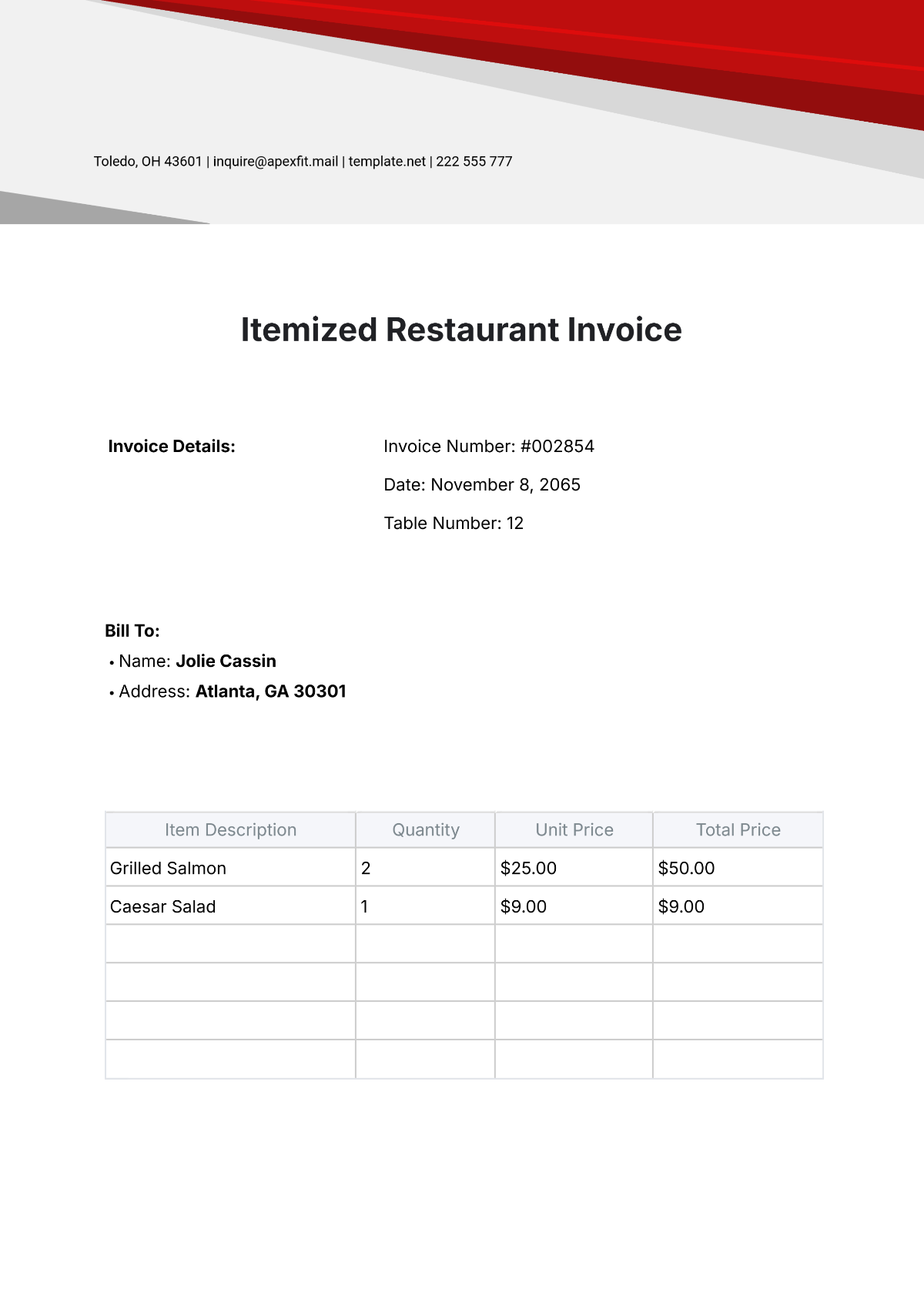

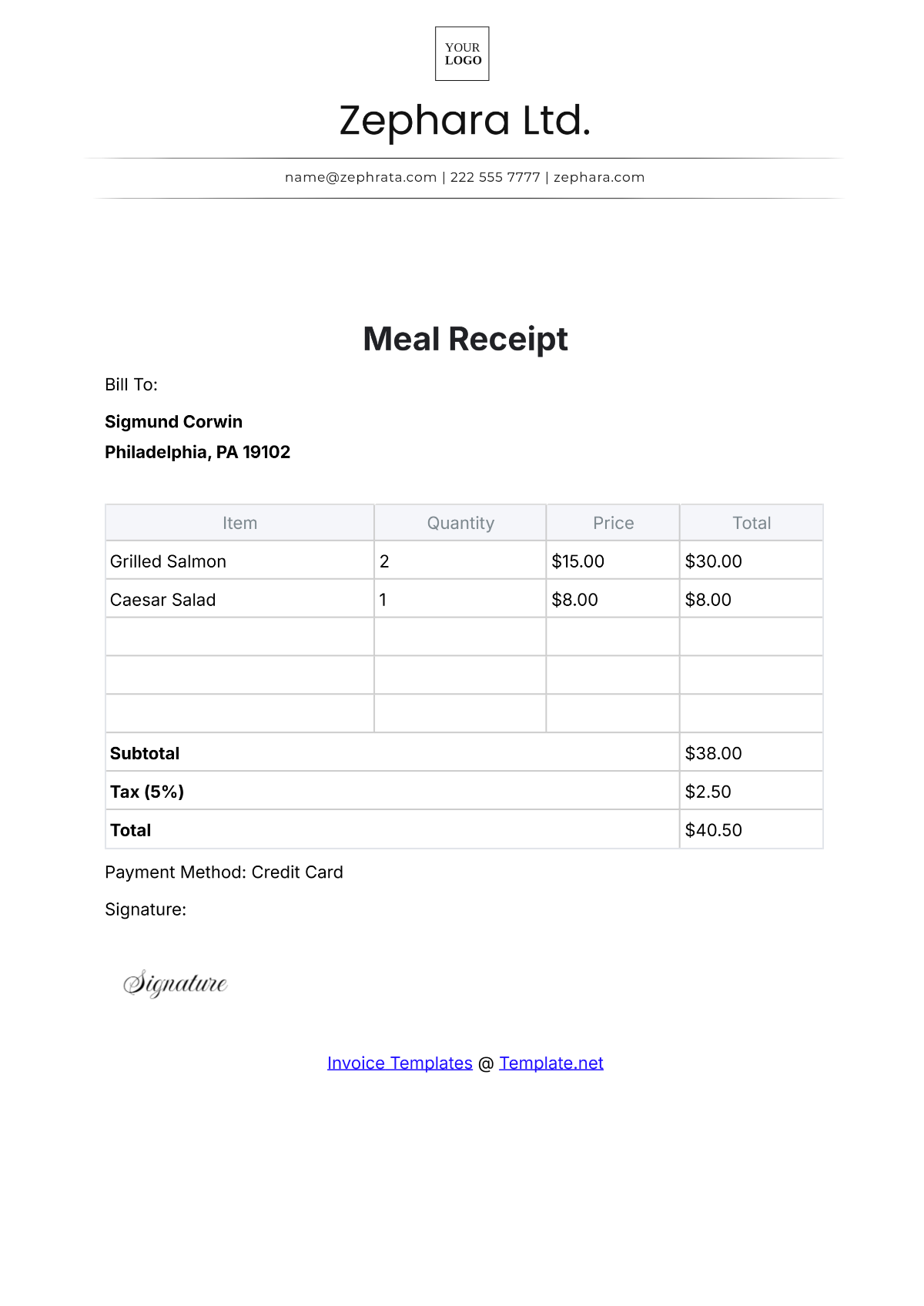

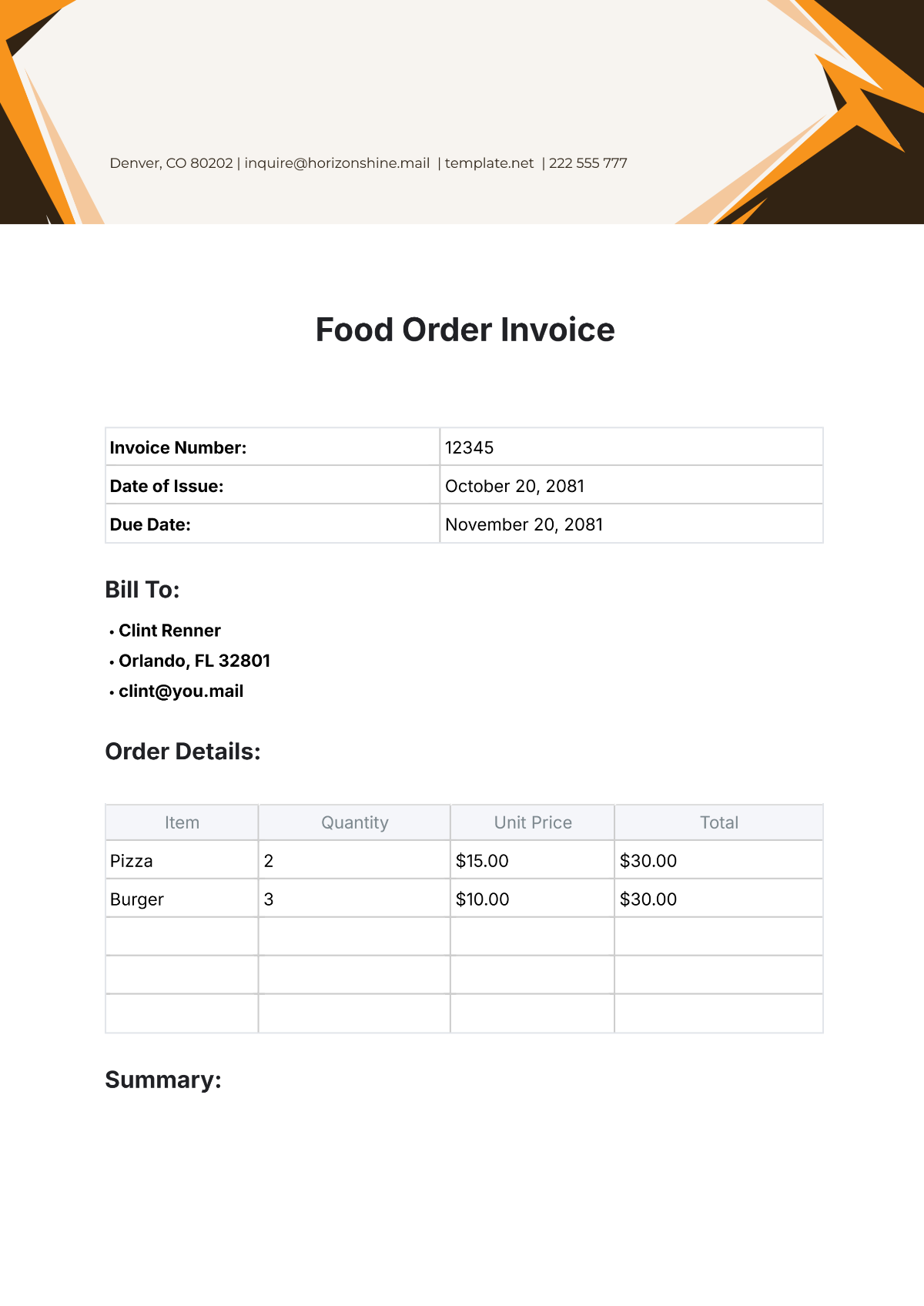

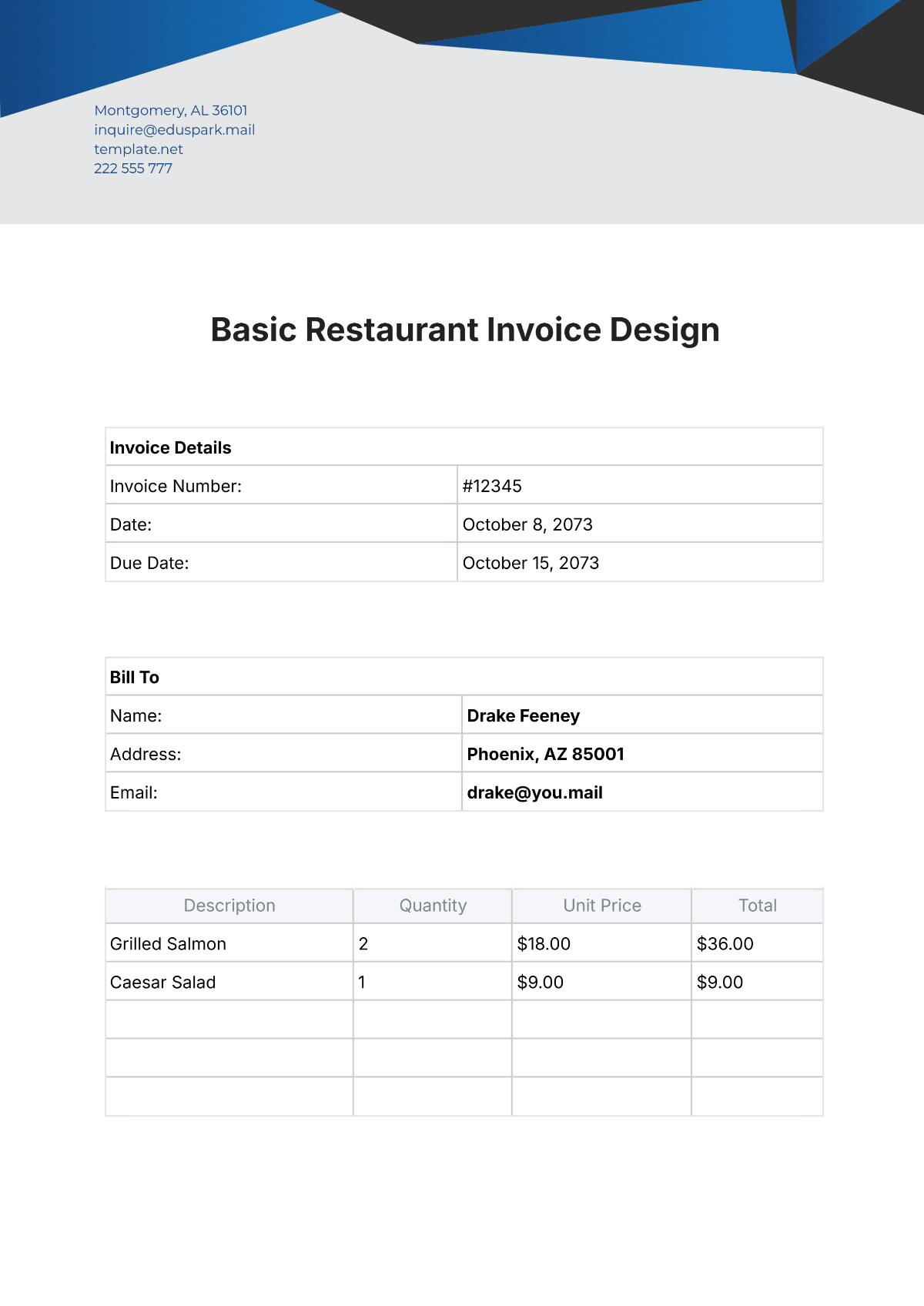

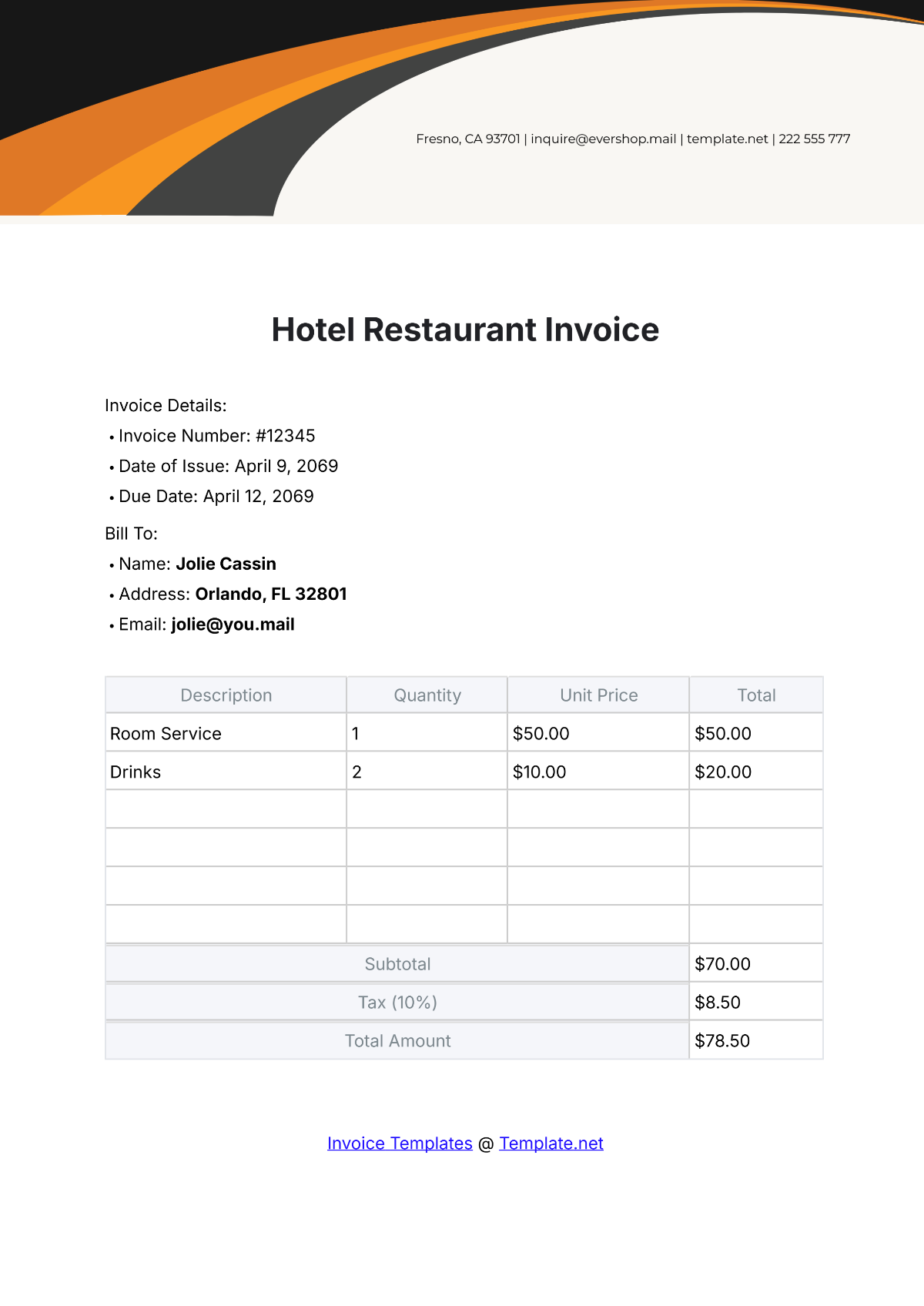

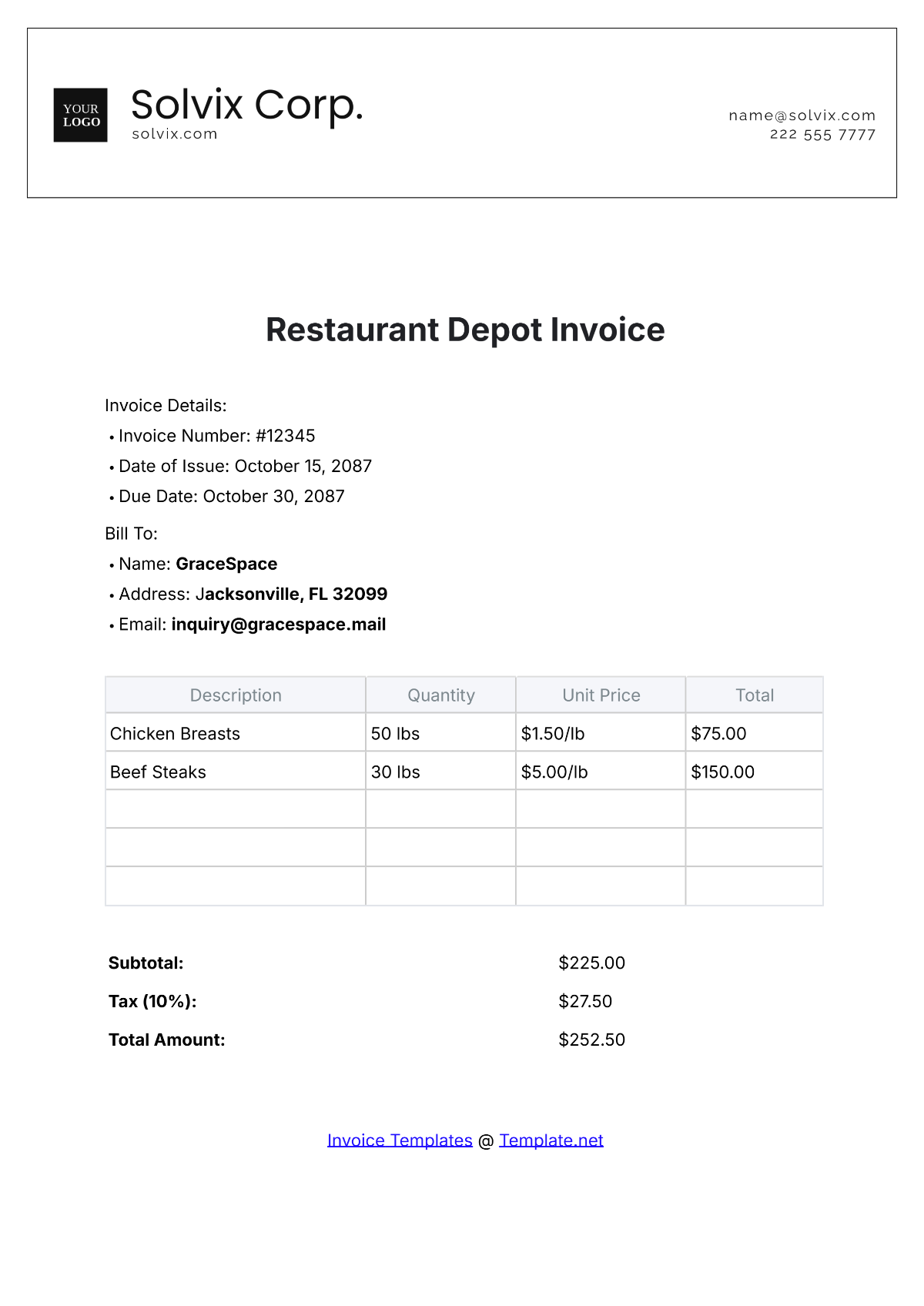

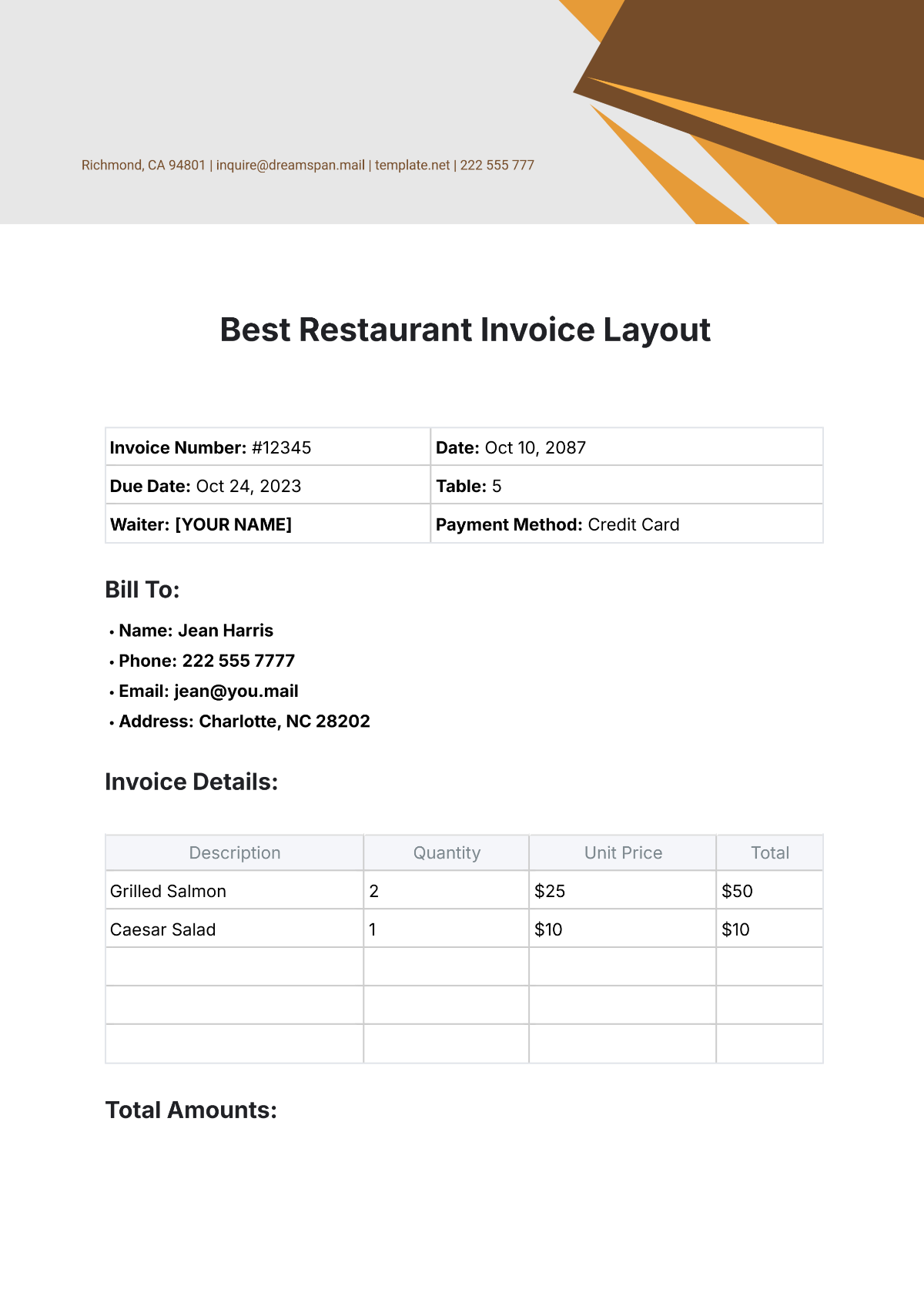

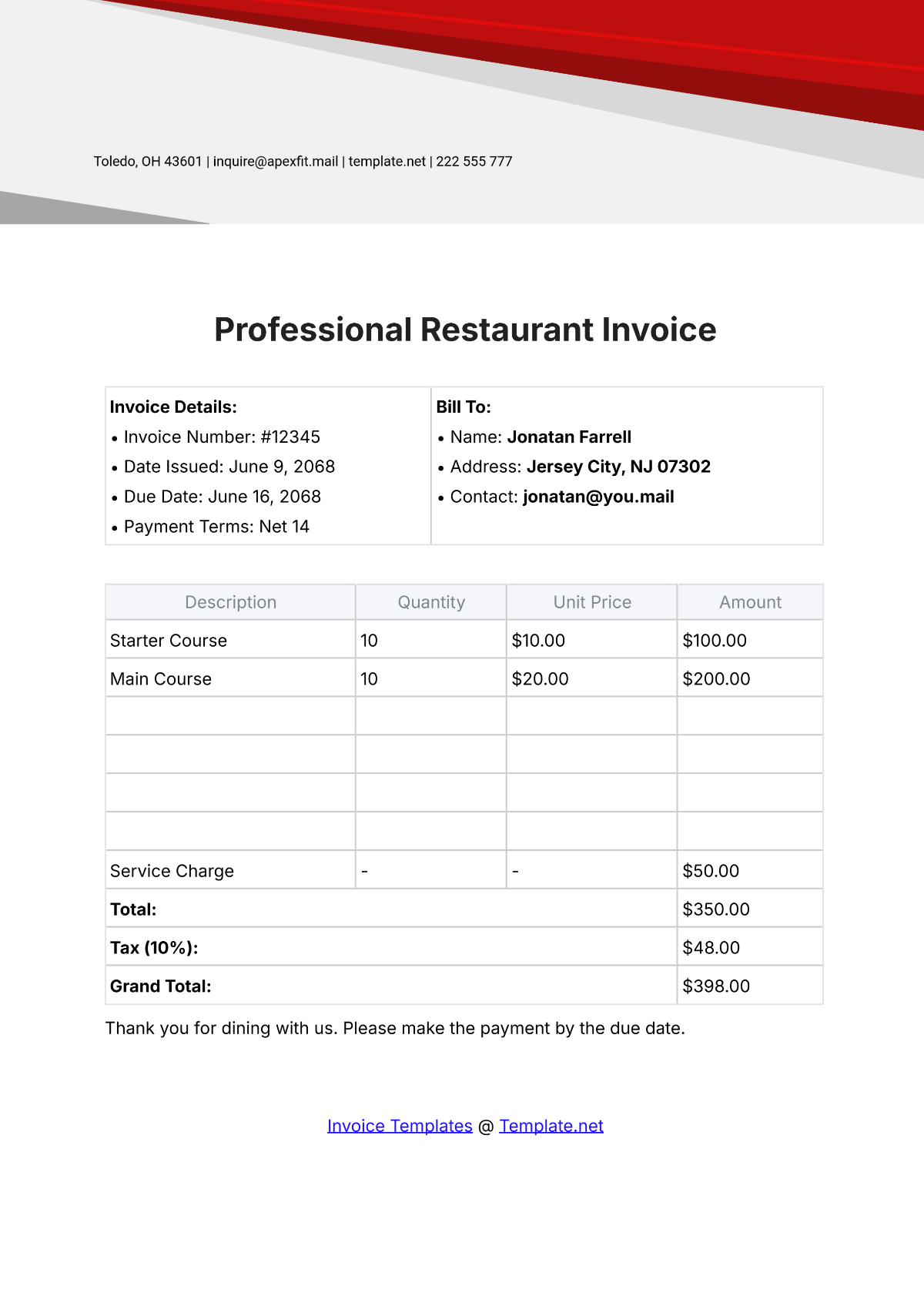

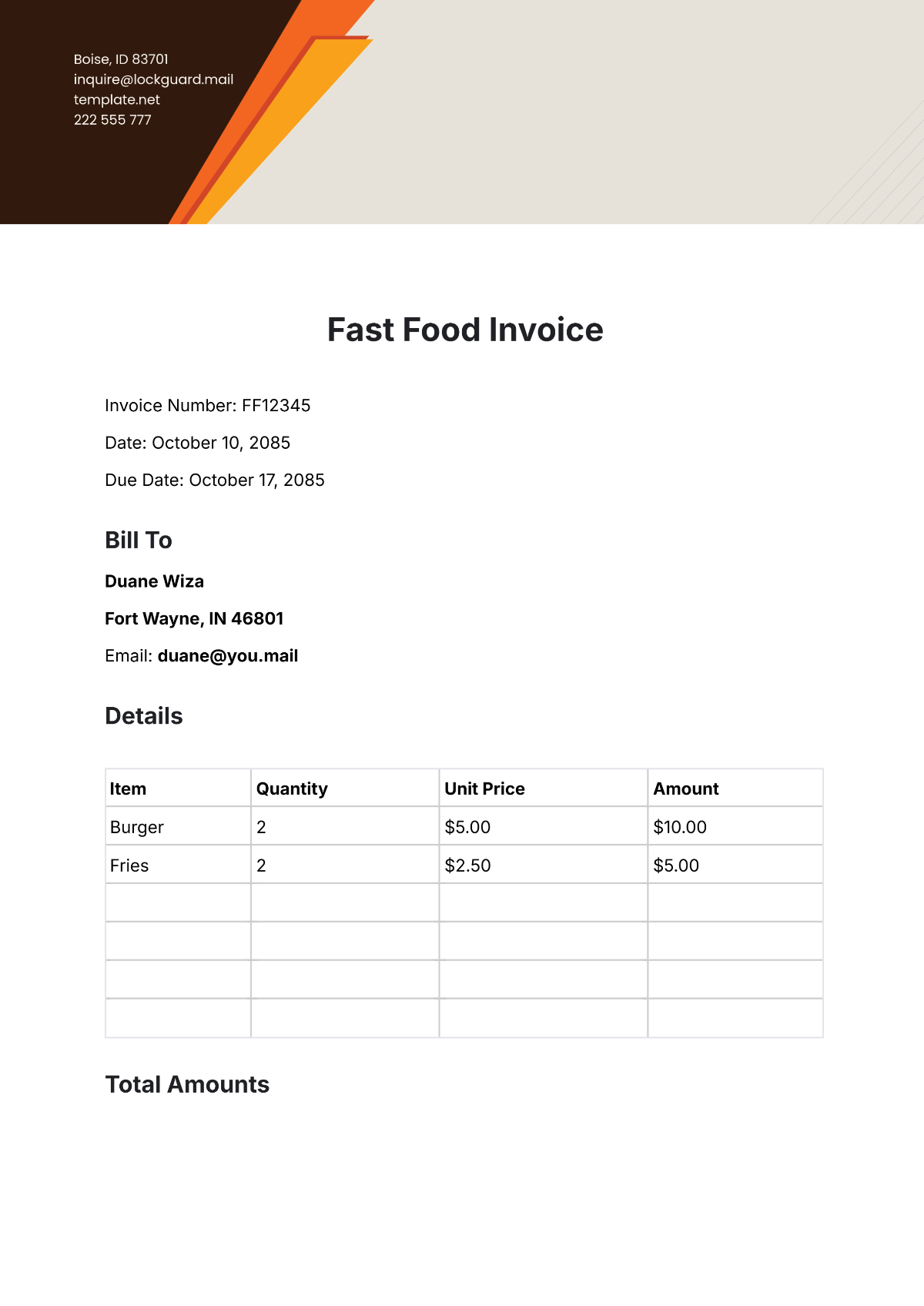

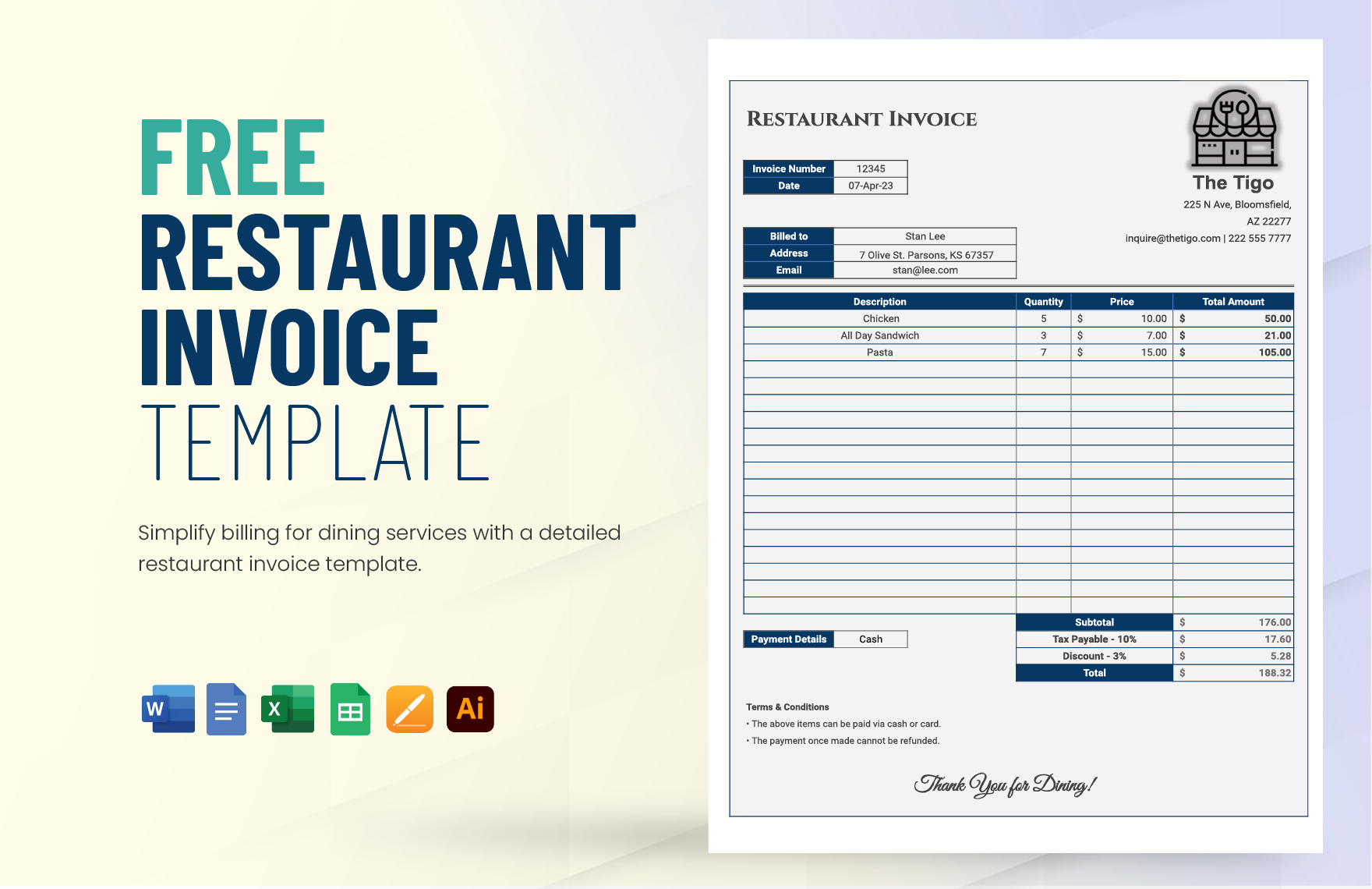

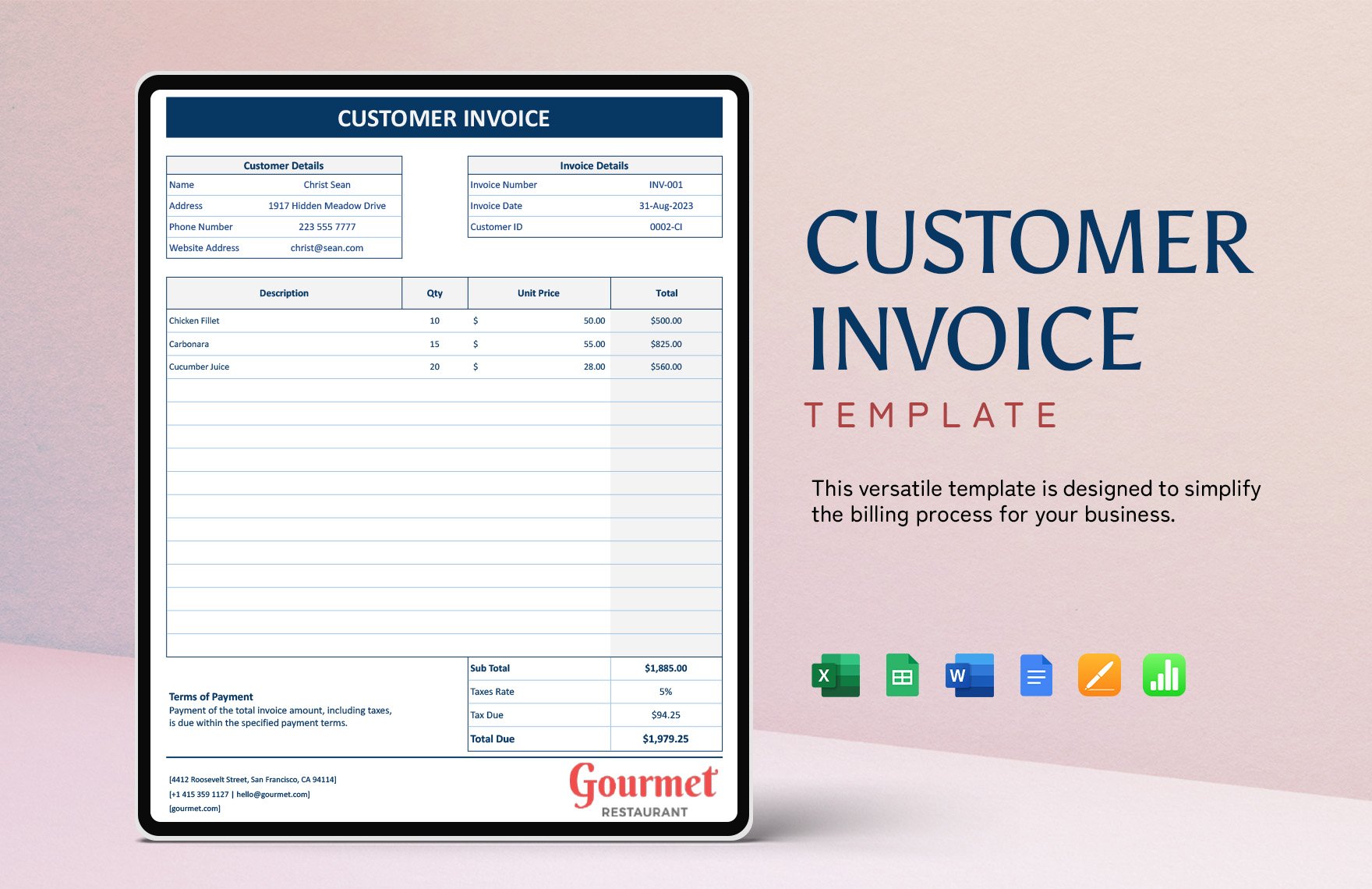

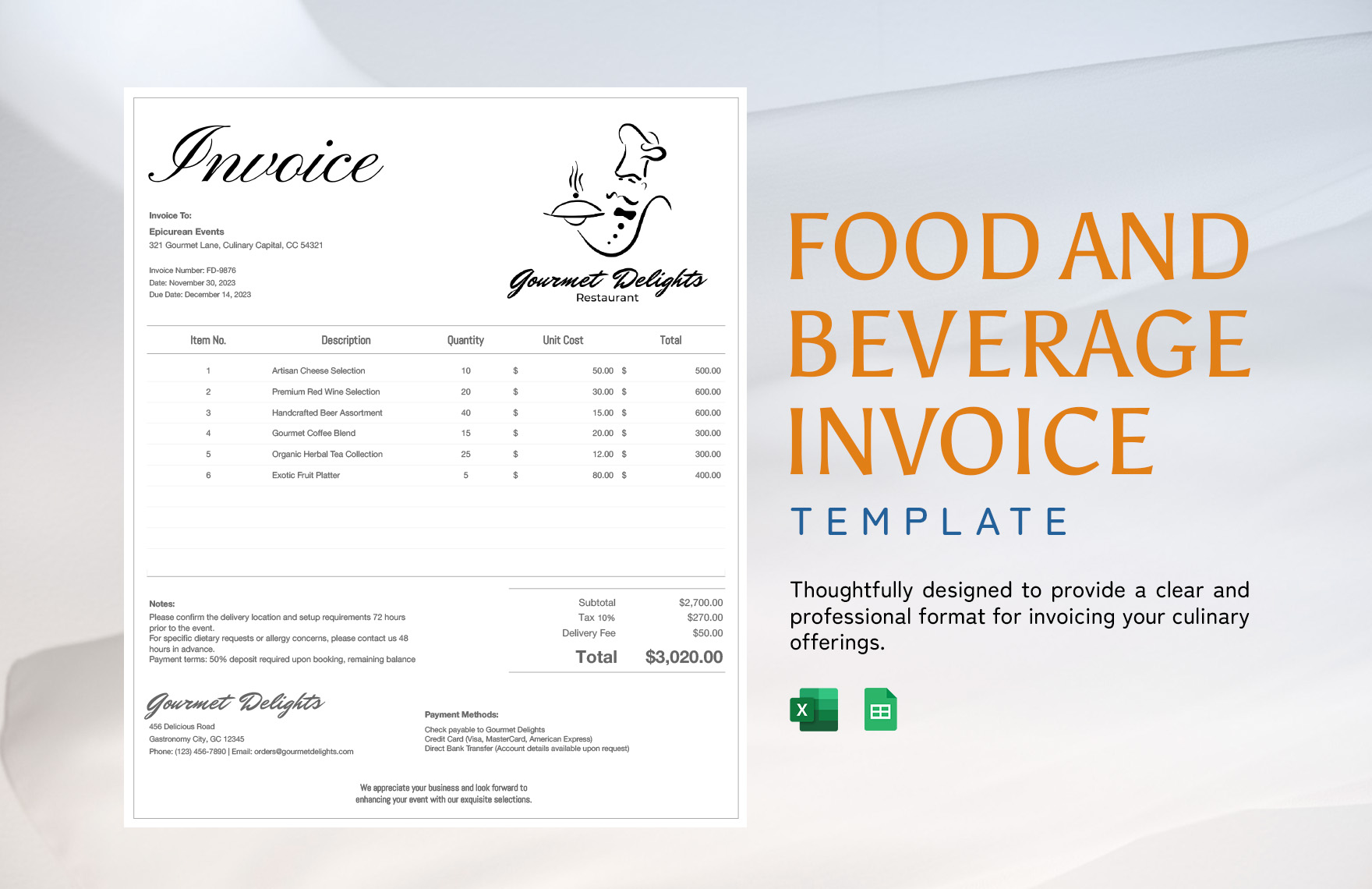

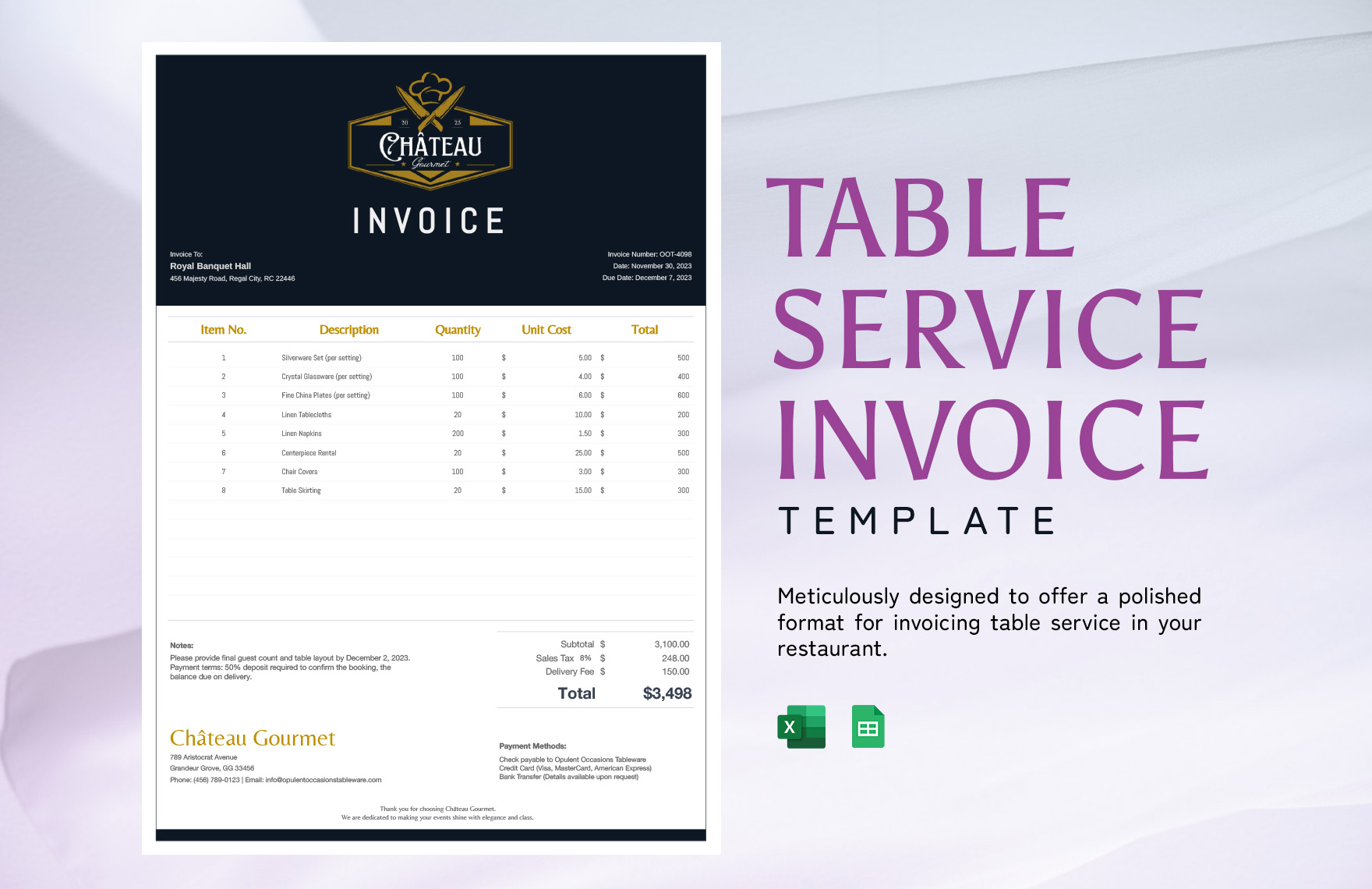

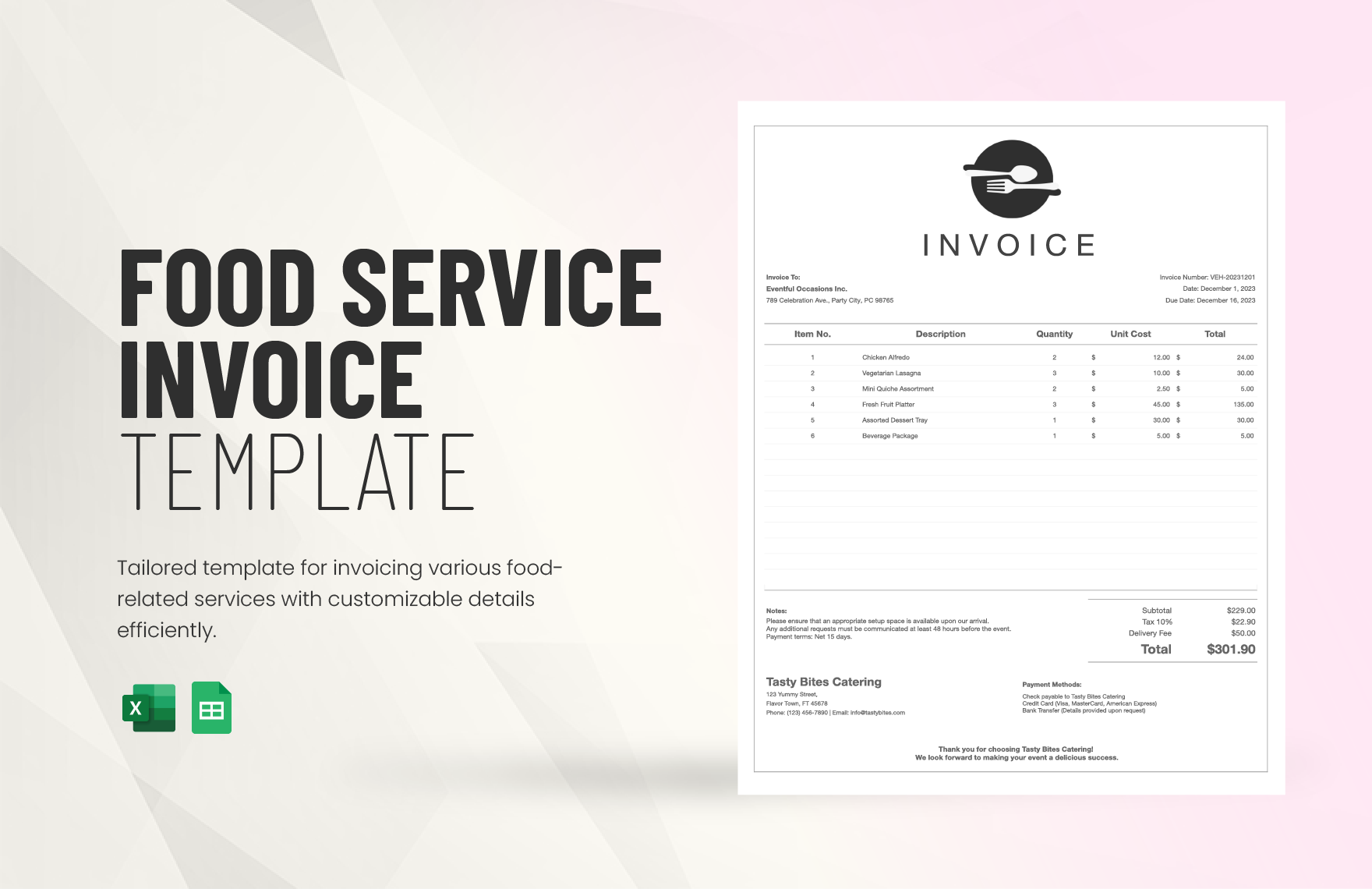

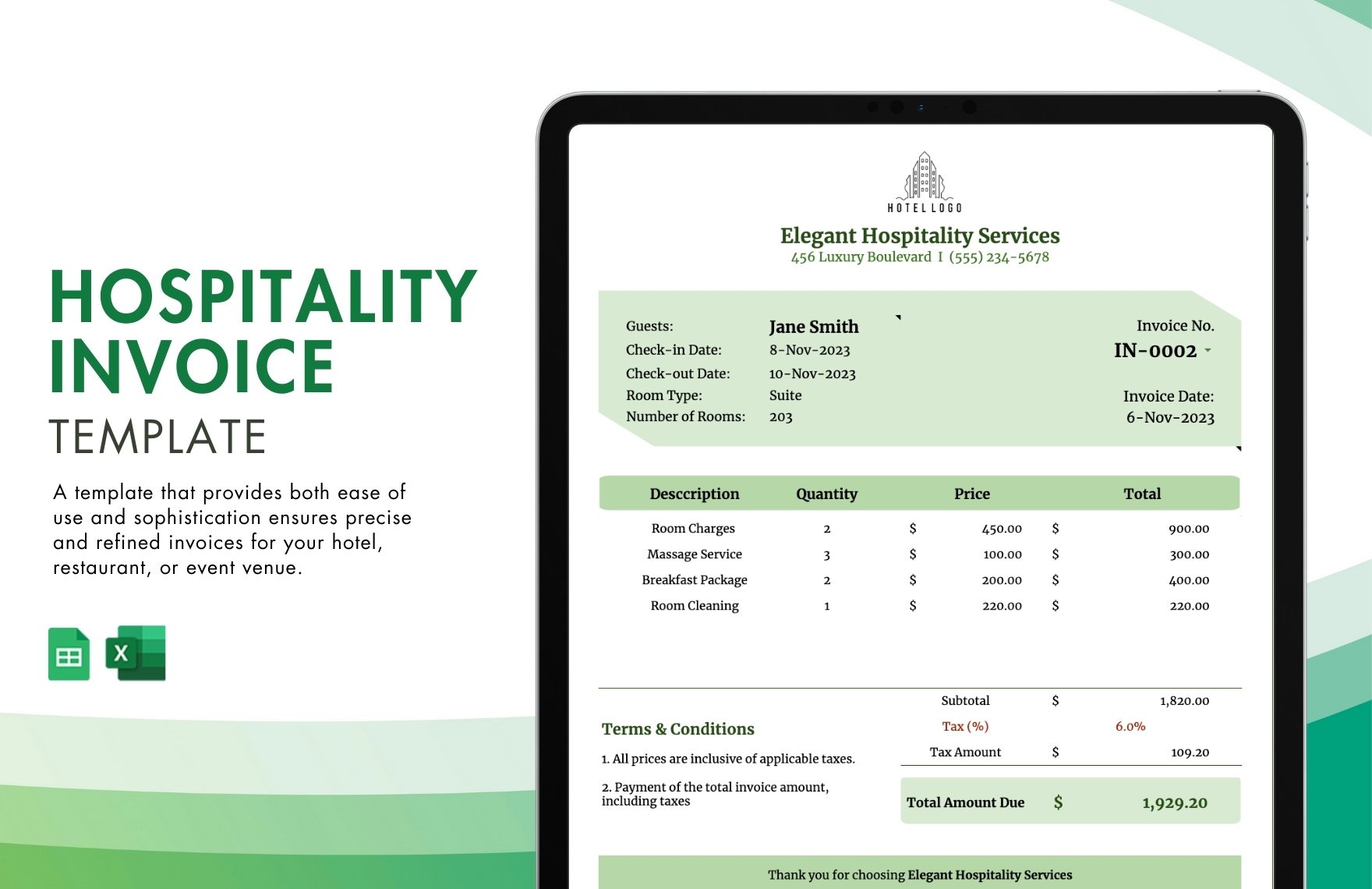

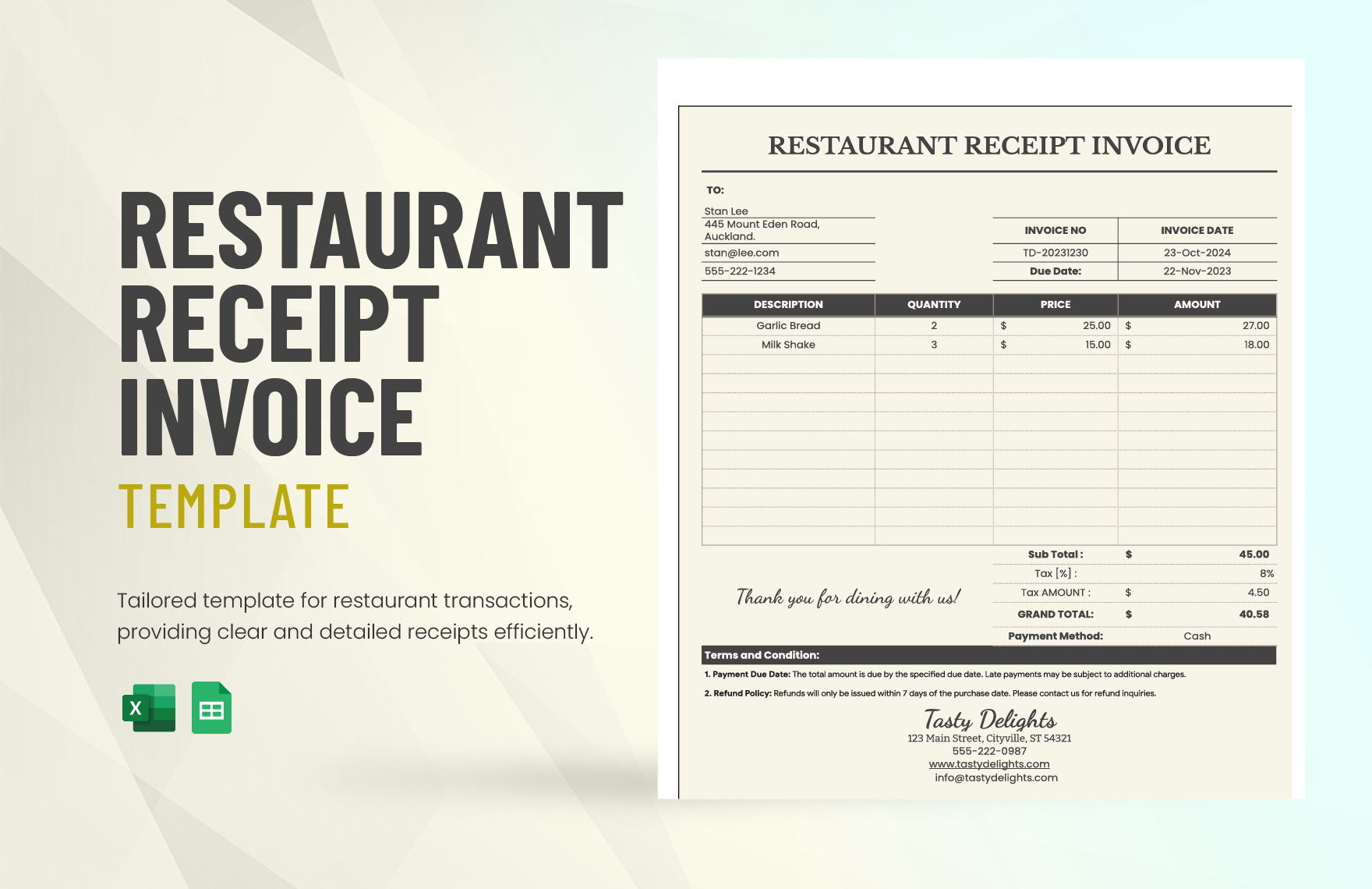

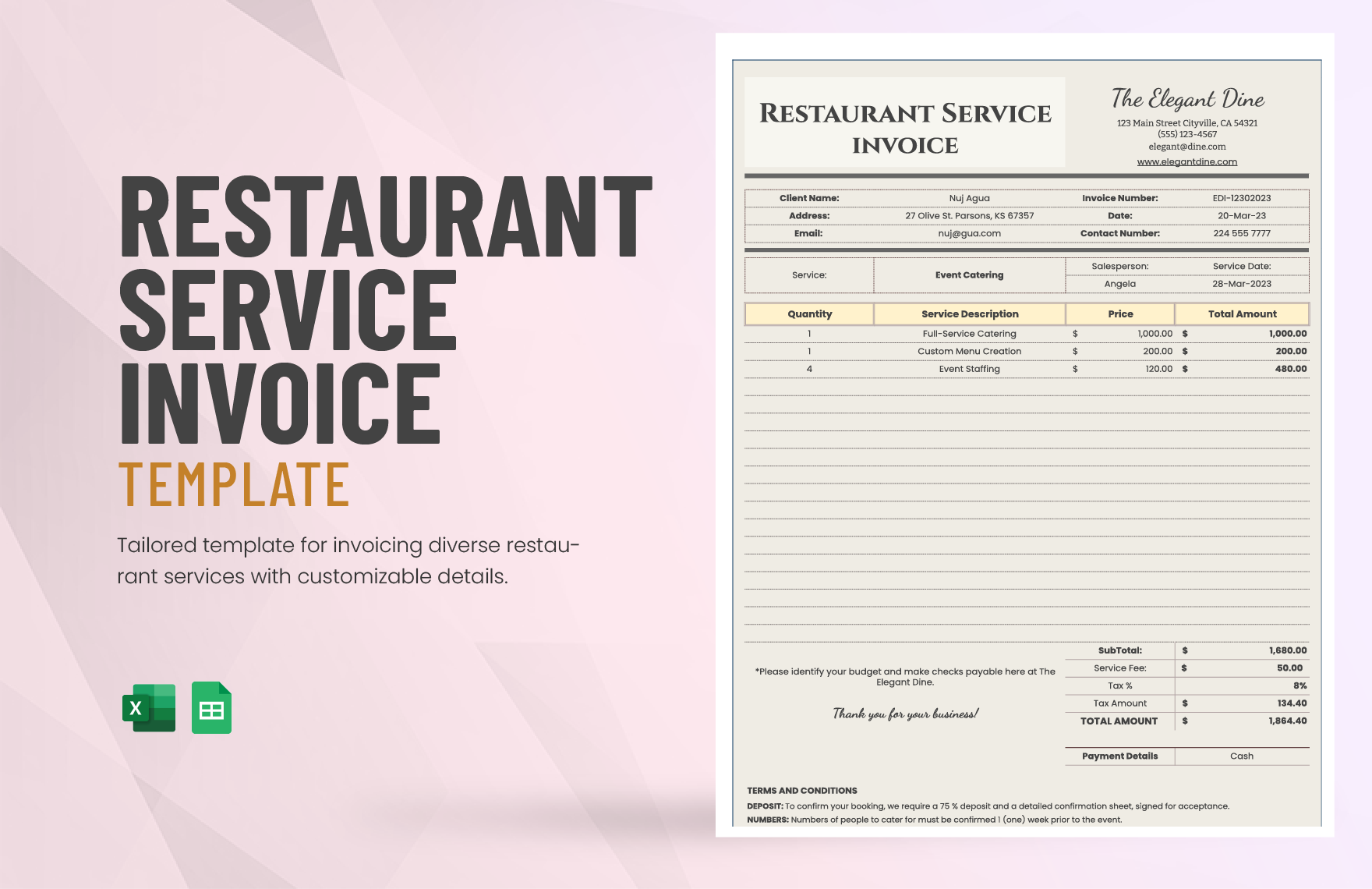

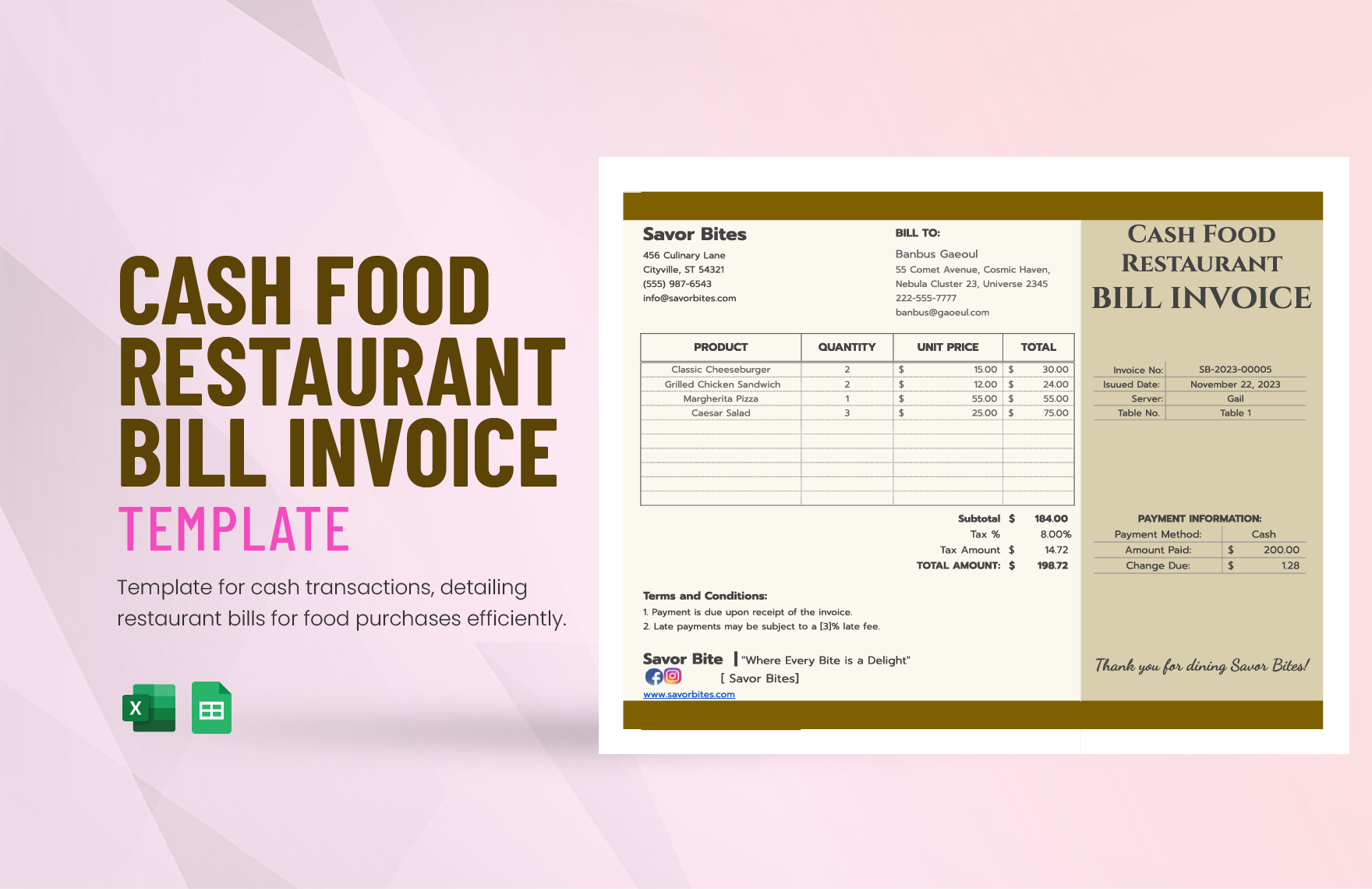

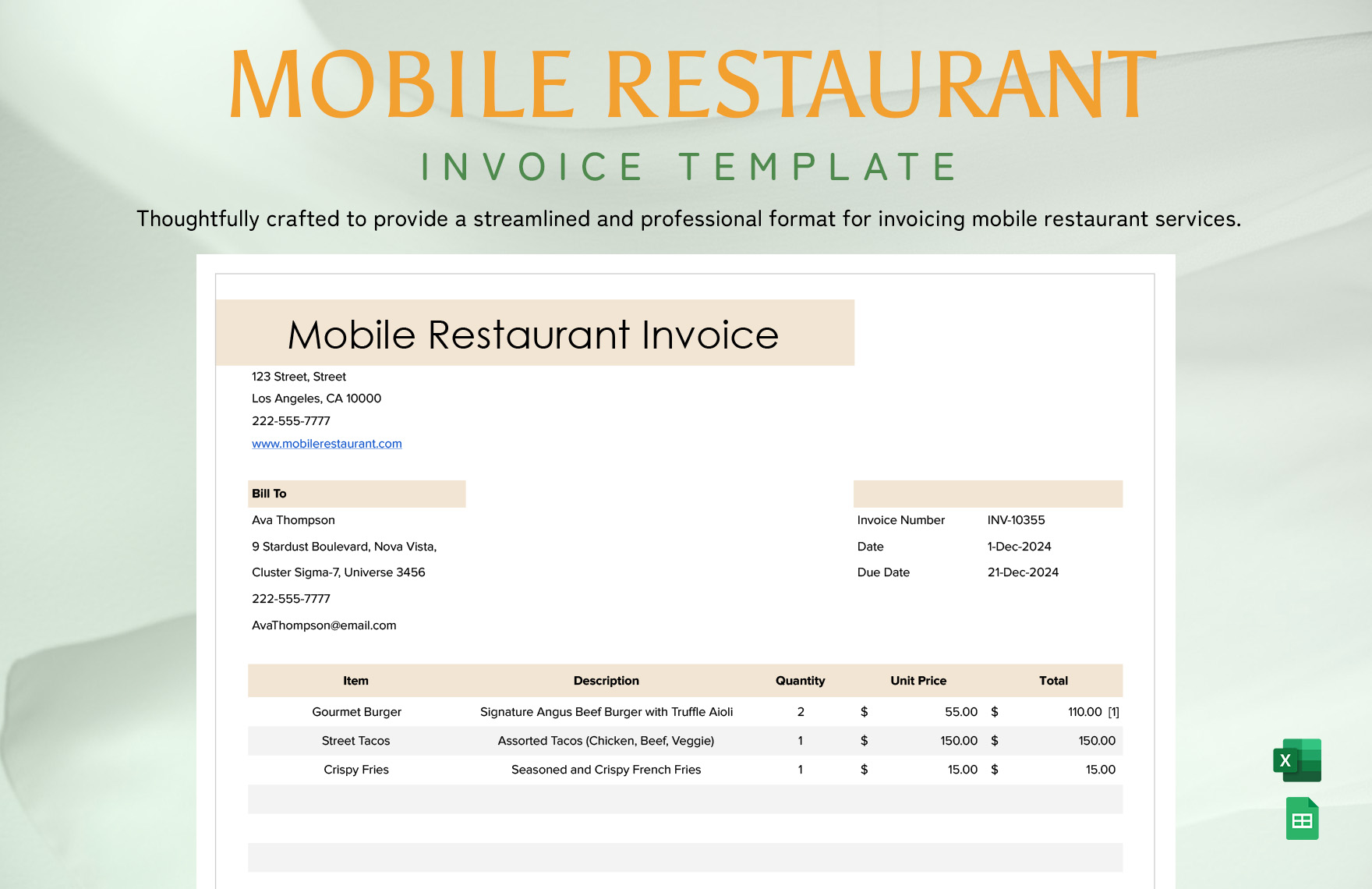

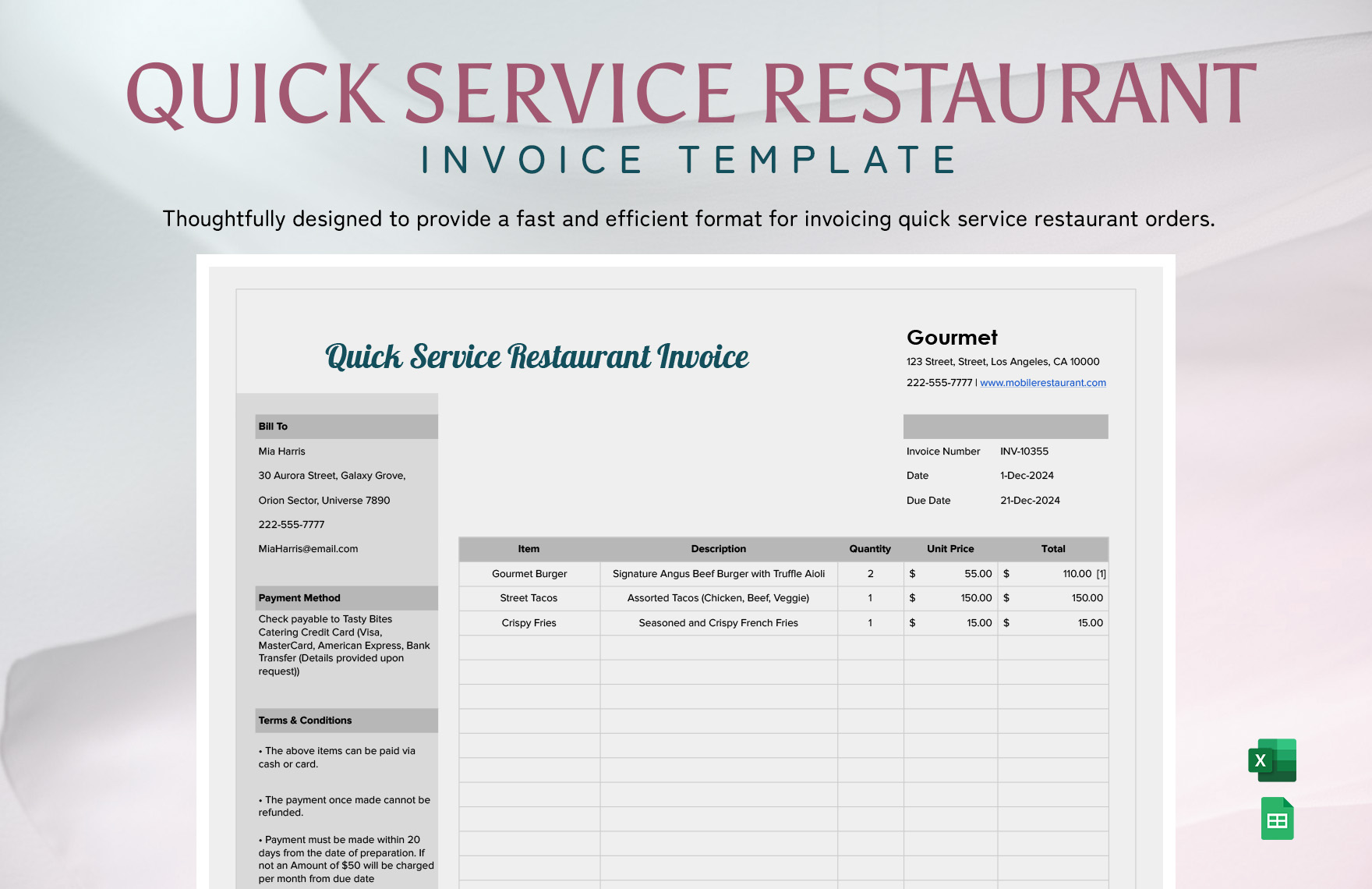

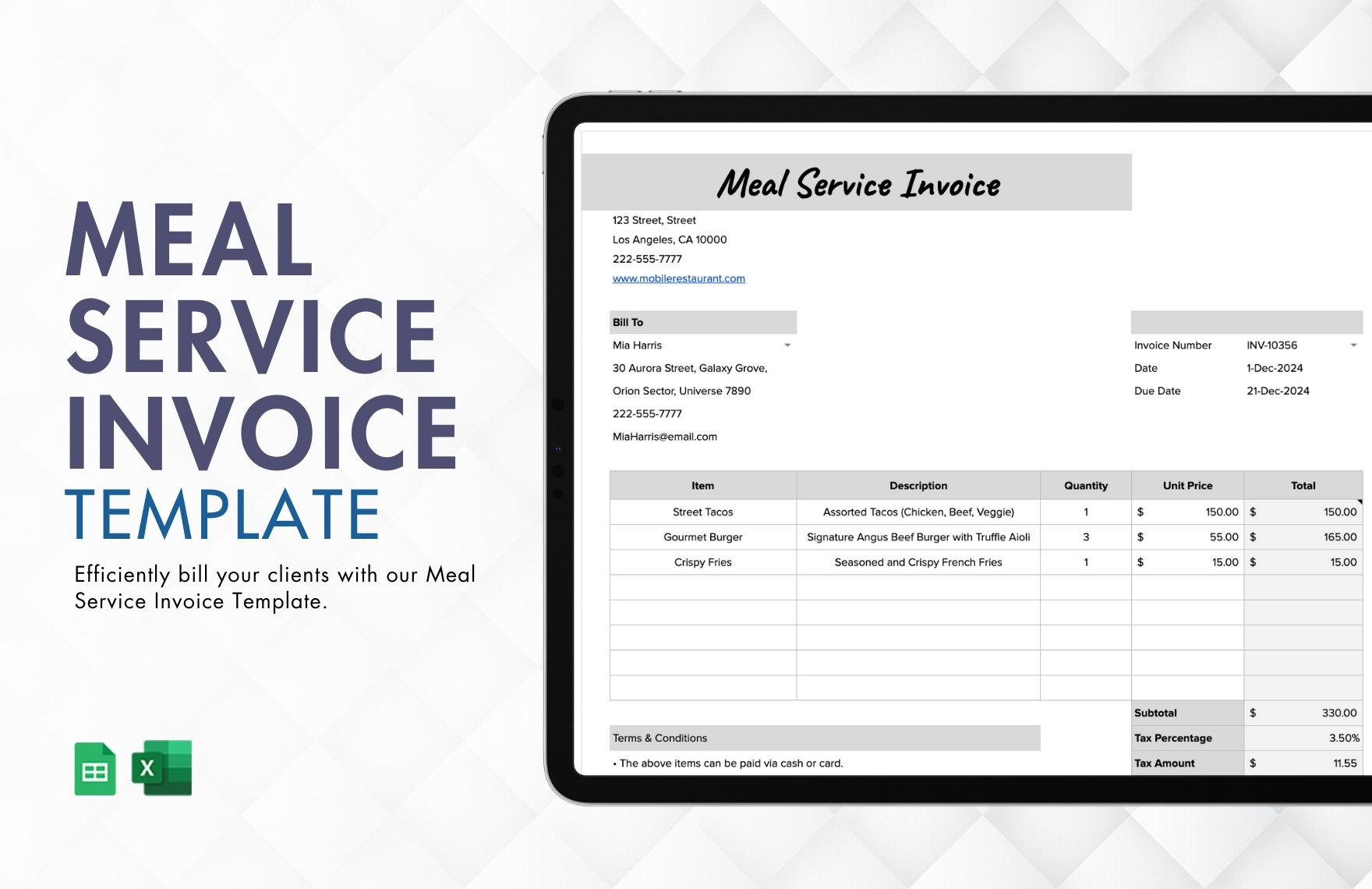

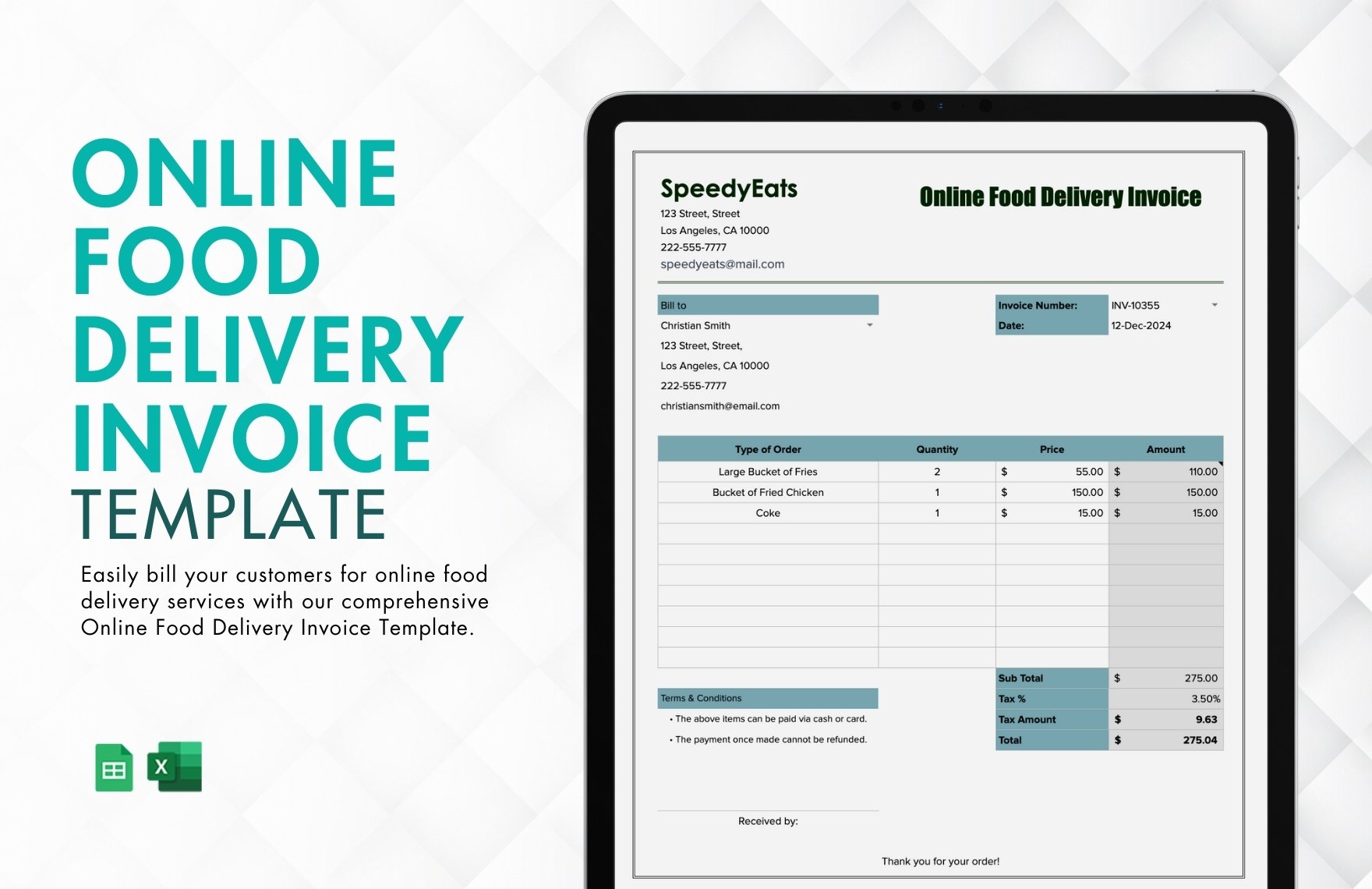

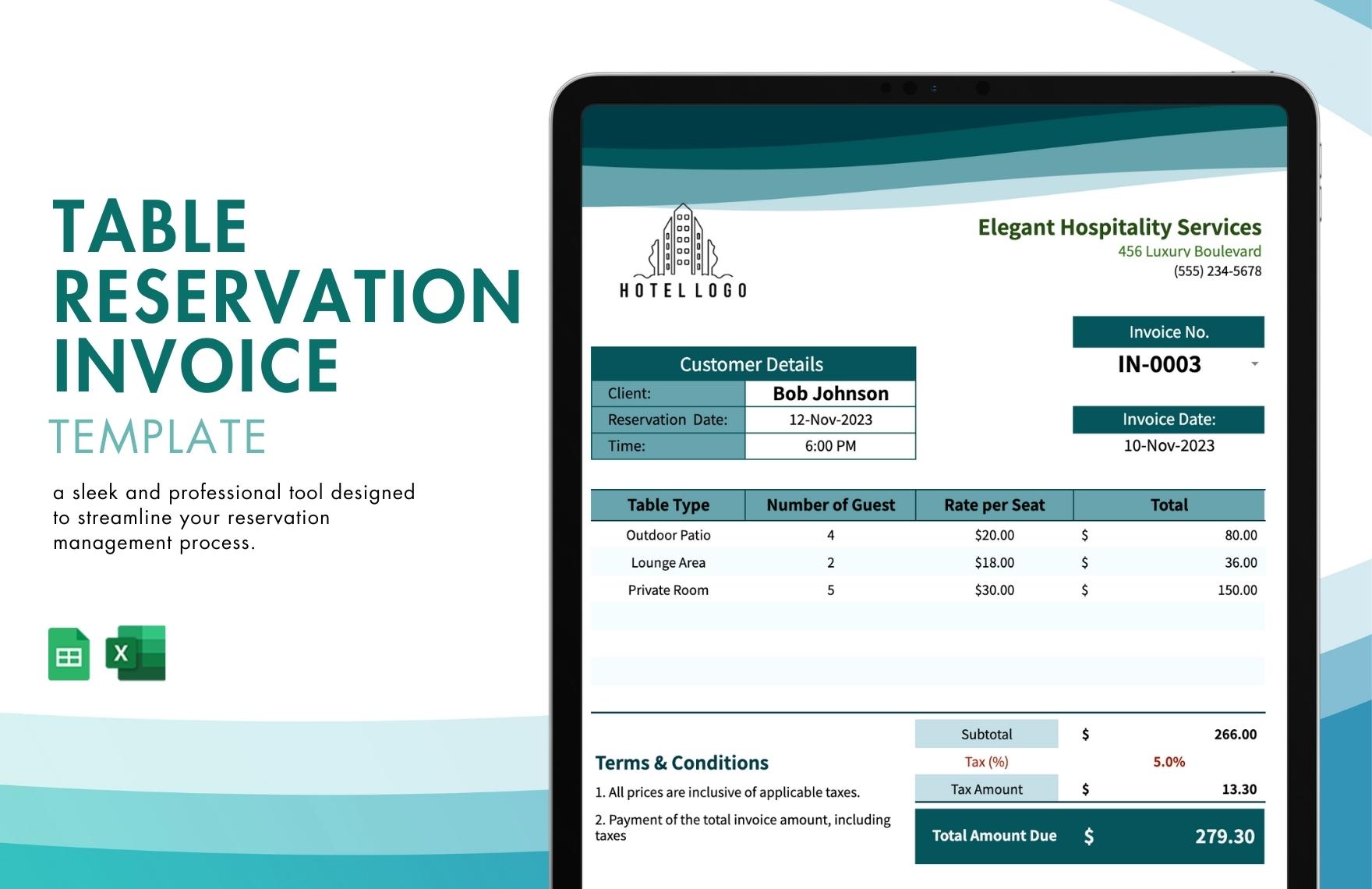

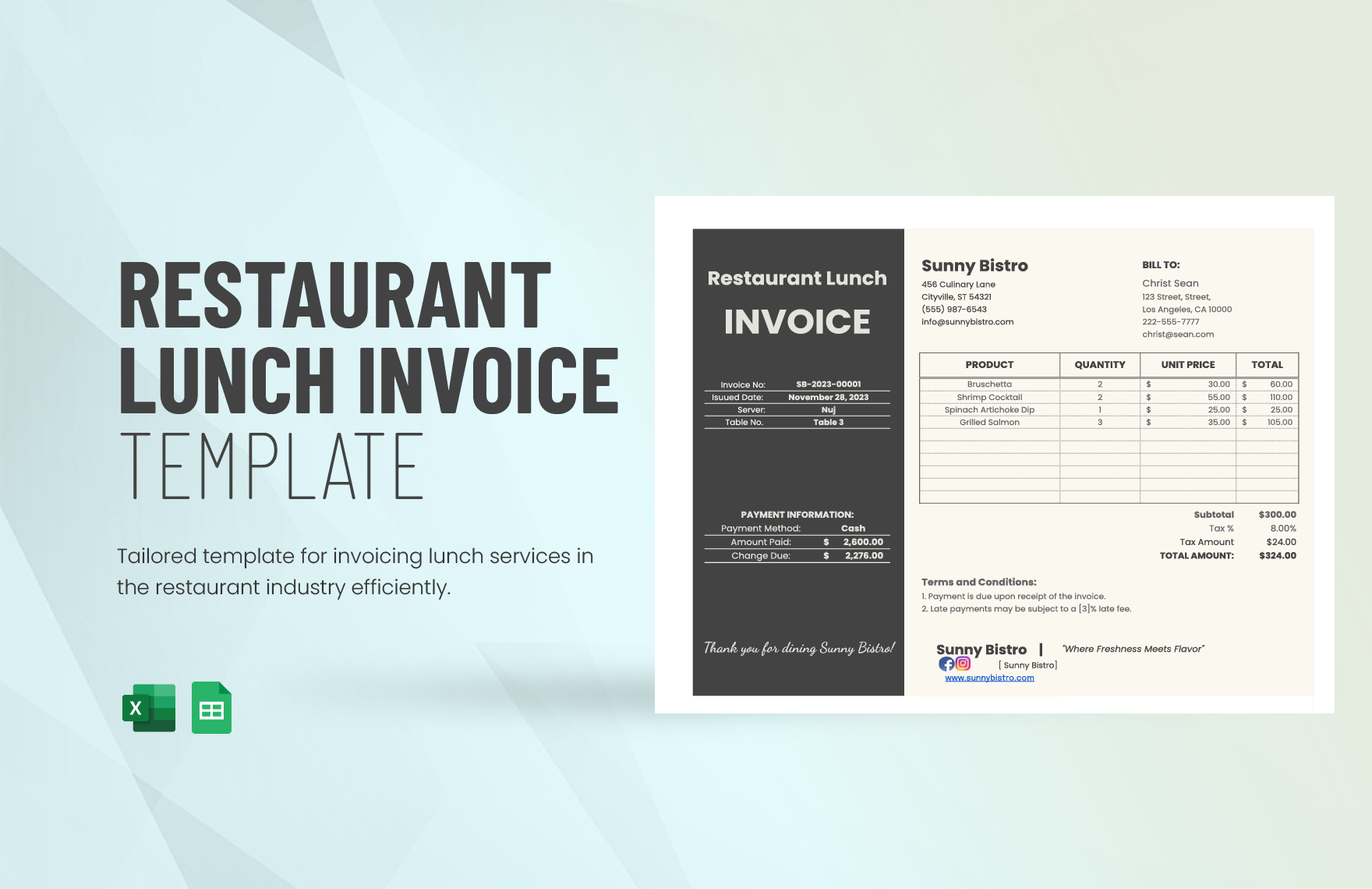

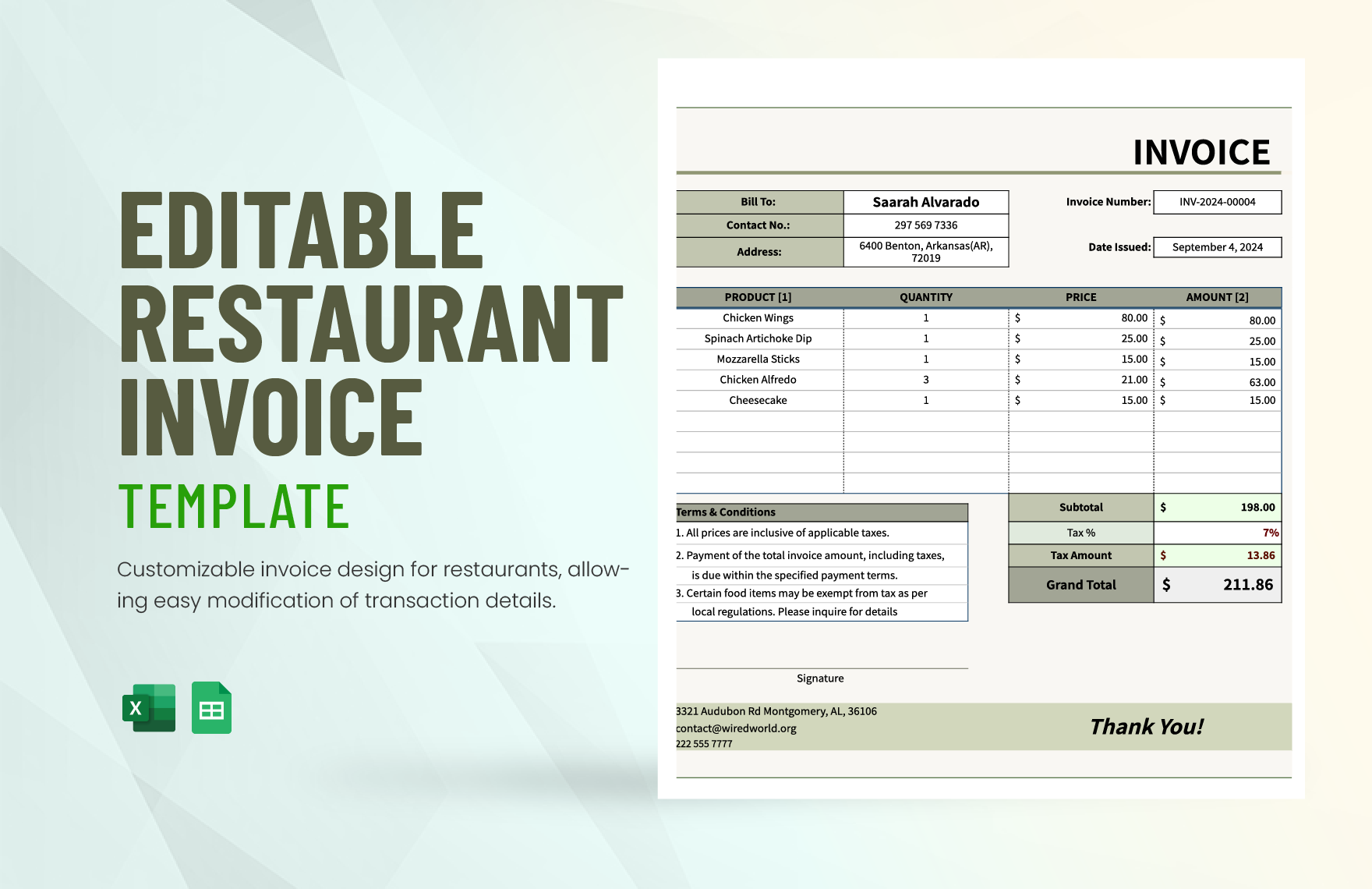

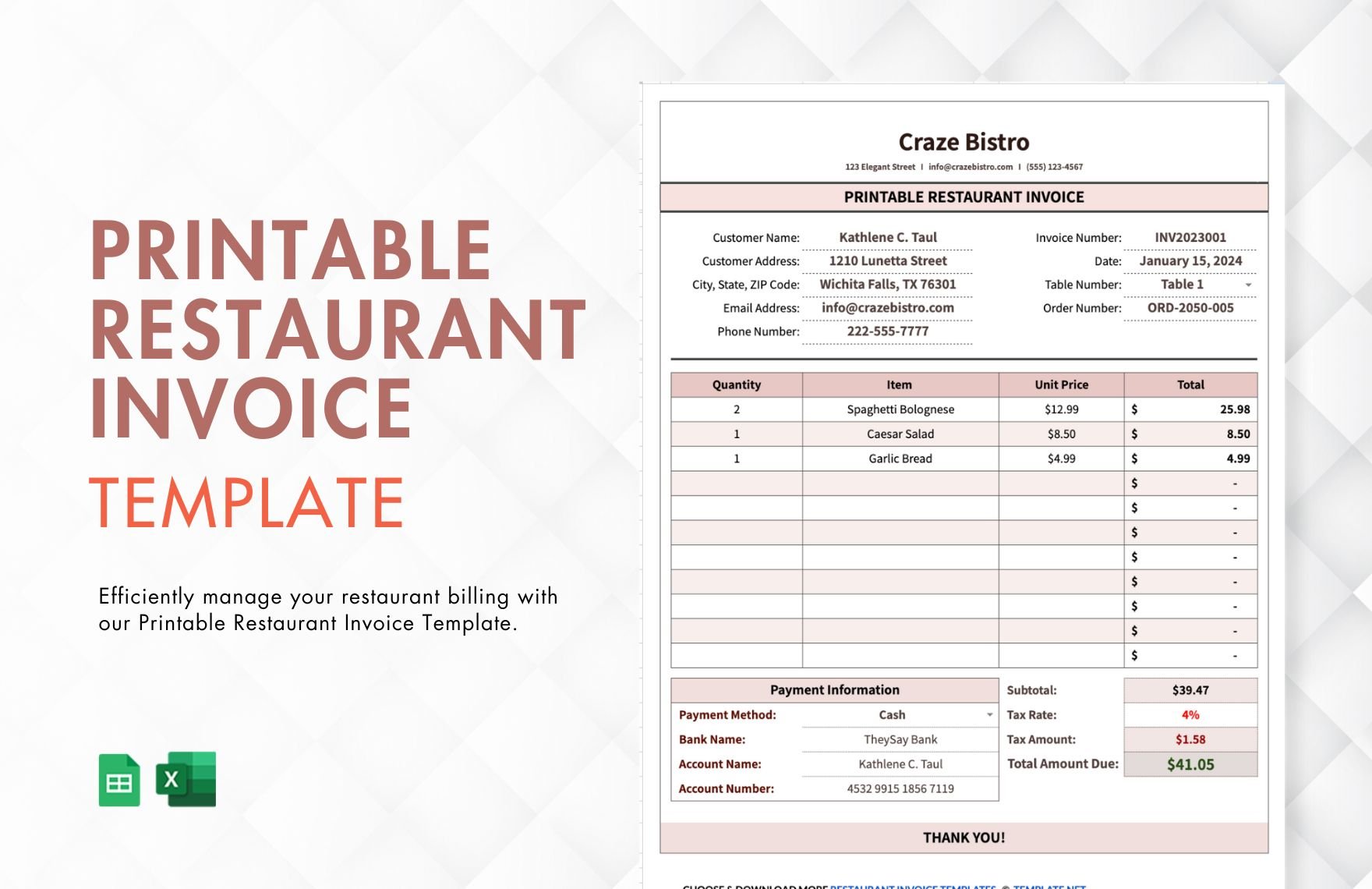

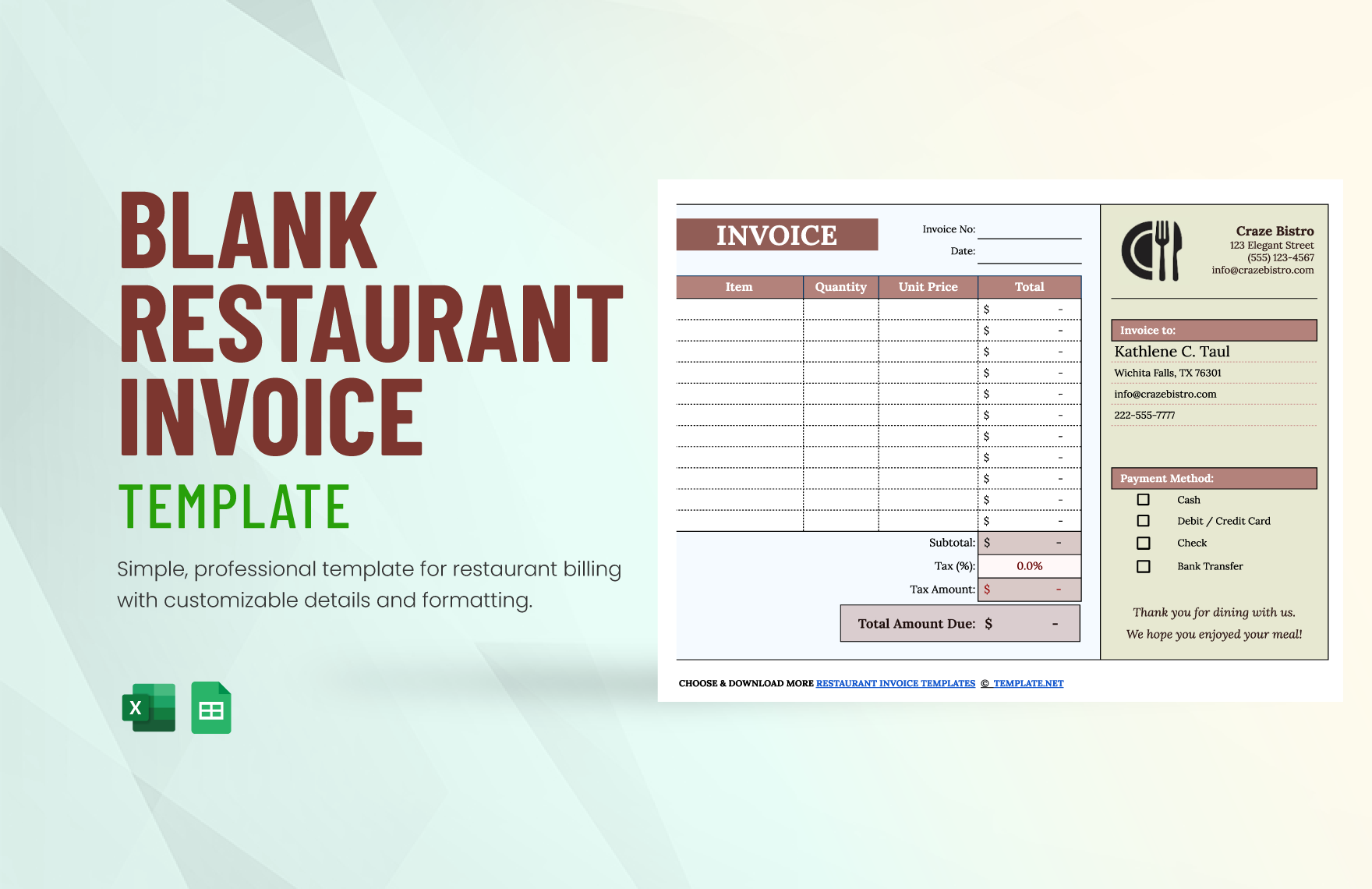

Keep your restaurant's operations smooth and efficient with Restaurant Invoice Templates from Template.net. Designed specifically for restaurant owners, managers, and accountants, these templates help streamline your billing process, reduce errors, and maintain professionalism in every transaction. For instance, quickly promote a special dining event by including necessary costs within your invoices or mention discount offers to boost customer retention. Each template includes key details such as itemized charges, tax calculations, and company contact info, ensuring clarity for your customers. With user-friendly designs, professional-grade layouts, and no complex formatting skills required, these templates provide a hassle-free experience that saves you both time and money. Plus, take advantage of customizable elements for both digital and print distribution, making it easy to fit your establishment's unique branding needs.

Discover the many Restaurant Invoice Templates we have on hand, providing you with endless choices to suit your specific needs. Simply select a template, effortlessly swap in your restaurant's assets, and tweak colors or fonts to align with your brand style. Add advanced touches by dragging and dropping icons or graphics, incorporating animated effects, or utilizing AI-powered text tools to enhance communication. Enjoy the fun of creating invoices that are not only functional but also visually appealing, all without any technical expertise required. New designs are added regularly, ensuring you always have fresh options at your fingertips. When you're finished, download or share your professional invoice via link, email, or export for print, making it ideal for use across multiple channels. Collaborate in real time with your team and ensure consistent branding with every invoice sent.