Table of Contents

- 5+ Correspondence Audit Templates PDF

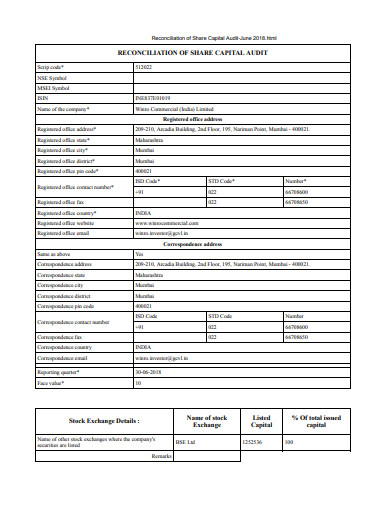

- 1. Correspondence Reconciliation Audit Template

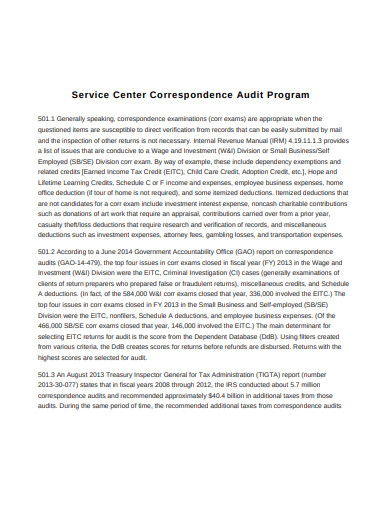

- 2. Correspondence Audit Program Format

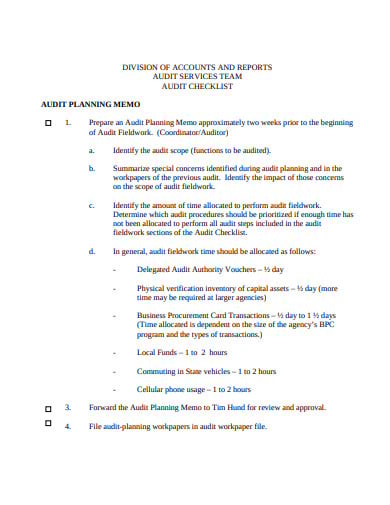

- 3. Basic Correspondence Audit Checklist

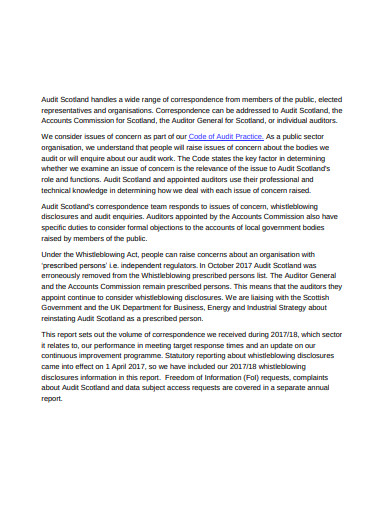

- 4. Correspondence Audit Simple

- 5. Internal Correspondence Audit Office Template

- 6. Correspondence Audit Documentation Example

- What Do You Understand By Correspondance Audit?

- How Will You Deal With the Correspondance Audit?

- How Long Does It Take for a Correspondence Audit?

- What are the Other Types of Audit Conducted by Internal Revenue Service?

- How to Prepare For an IRS Audit?

5+ Correspondence Audit Templates PDF

To maintain a proper taxation process in an organization it is necessary that an audit is conducted. This will help to resolve any issue that can give rise to any complications in the tax paid or the records of the tax that is paid the organization or an entity. Correspondace Audit is a kind of tax audit that is performed by the body named Internal Revenue Service via email.

5+ Correspondence Audit Templates PDF

1. Correspondence Reconciliation Audit Template

winrocommercial.com

winrocommercial.com2. Correspondence Audit Program Format

tax.thomsonreuters.com

tax.thomsonreuters.com3. Basic Correspondence Audit Checklist

da.ks.gov

da.ks.gov4. Correspondence Audit Simple

audit-scotland.gov.uk

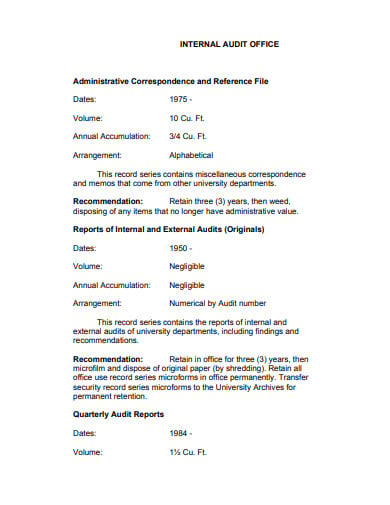

audit-scotland.gov.uk5. Internal Correspondence Audit Office Template

recordsmgmt.siu.edu

recordsmgmt.siu.edu6. Correspondence Audit Documentation Example

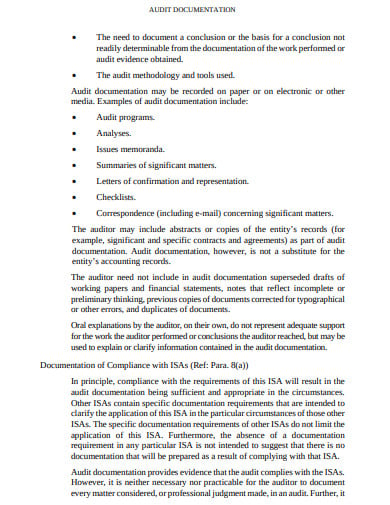

ifac.org

ifac.orgWhat Do You Understand By Correspondance Audit?

Under the various tax, audits performed by the Internal Revenue Service the correspondence audit is the lowest form of the audit. In this audit system, the auditor mails a request to the taxpayer to provide additional information about an issue or a specific item on their tax return.

The scope is very limited for the correspondence audit. The method is usually used for small matters or which involves a small amount of money. In the correspondace audit as long as the taxpayer is able to provide sufficient evidence to resolve the issue, the audit process is closed. In case any error or fraudulent activity is discovered while auditing the penalties involved are payment of additional tax, fines, a criminal investigation, etc.

How Will You Deal With the Correspondance Audit?

Step 1: Do Not Worry

When an IRS office mails most of the cases it is for the matters that are not complex. These may include income that you did not report to the IRS, filling details, dependants, itemized deduction, eligibility for credits.

Step 2: Respond Immediately

When you receive an mail from the IRS do not get intimidated. Respond immediately, answer all the questions, produce all the records and within the deadline.

Step 3: The Mail Audit is Not Assigned in Person

In case you do not respond to IRS mail immediately or fail to produce sufficient evidence, the IRS won’t’ assign an officer to handle your case, or send you follow-ups. The office will send you a tax bill with penalties and interests.

Step 4: Send Everything in Single Response

There are many taxpayers from whom the IRS will receive emails. If you send multiple responses it may confuse the IRS and they might lose your email of evidence. Therefore send everything in one single response.

How Long Does It Take for a Correspondence Audit?

If you respond on time with all the valid documentation and the records then the process can be quickly wrapped up. But in case you do not respond on time it can stretch to one year or even more. In case you are found guilty and you owe more taxes and penalties you can request the IRS Appeal Office to look at your case. If you have new information the IRS Appeal Office gives you an independent analysis.

What are the Other Types of Audit Conducted by Internal Revenue Service?

-

Office Audit

This is a kind of an in-person audit where a representative of the Internal Audit Service interviews the taxpayer and investigates the documents and the records in the IRS office. The purpose of an office audit is to make sure that the taxpayer is producing the document and the records that are needed. The officer wants to know that the taxpayer shows the actual income, deduction, and payment records. A tax return can be asked by the IRS randomly or incase the taxpayer is suspected of any fraud. This type of audit covers only those issues that the IRS reports to the taxpayer in the written notice.

-

Field Audit

This is a type of office audit but the audit is conducted at taxpayer’s home, taxpayer’s place of business, or accountant offices, but not in the IRS office. This type of audit is done for more complicated issues and can be expensive. The audit process can last for a longer period of time depending on the taxpayer’s office.

How to Prepare For an IRS Audit?

Step 1: Retaining the Service of a Professional

If you are getting yourself or your business audited you need to take the help from the professional who is aware of the tax laws. This person can be enrolled agents, tax attorneys, CPA agents who can represent you or your business in an audit.

Step 2: Keeping Good Records

This is not something that you should do once in a year. You should get into a habit of keeping records which includes primary and secondary tax payment records and using the personal filling system to keep them with the approximate tax return data. The primary records are the bills and receipts. Secondary records are the spreadsheets, mileage logs and other informations that are recorded.

Step 3: Gathering Information

In case you haven’t kept the records, you need to go back to the year and try to create the approximate record but as accurately as possible. Wherever you have invested to need to check those records and the tax you have paid. Gather all the information and arrange them in an organized pattern.

Step 4: Be Prepared

This means you have to be well aware of what is going to happen, what are the processes you have to go through, etc. You can ask if you have contacts in the same industry and get informed about the process and the procedure they have gone through. If you are aware of some of the questions that the IRS person will ask, it will be easier for you to handle when you face the situation in practice. You can go and check the IRS website to gather further information about the process.

Step 5: Being Professional

If possible you have to comply with the date, time venue the auditor sets for you. In case there is an issue try to negotiate. Be well dressed and organized. The taxpayer’s presentation is a critical issue, therefore you have to be polite, prompt, and professional.

Step 6: Avoid Too Much of Friendly Attitude

You have to be sure of the fact that you have done something wrong or there is an error in the records you have produced otherwise you would not have been in this situation in the first place. You have to be forthcoming but only answer to the questions that are directed towards you. Your overfriendly approach may convert the suspicion of the IRS auditor into clarity. You have to be confident without being impatient and fearful. Avoid becoming a volunteer for the information.

There are situations when you do not owe the IRS any tax amount but it is the other way round. To fall in the latter category you can hire professionals to do calculations for the complex taxes you are paying.