Table of Contents

- Notice Template Bundle

- 10+ Audit Notice Templates in PDF | DOC

- 1. Municipal Income Tax Audit Notice

- 2. Residence Exemption Audit Notice

- 3. Notice of Intent to Audit

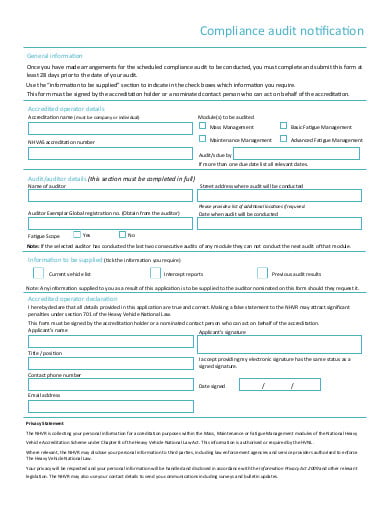

- 4. Compliance Audit Notification

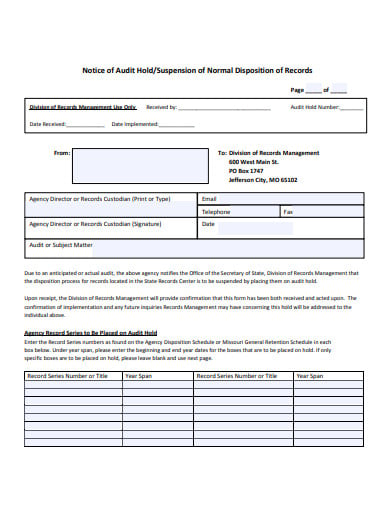

- 5. Notice of Audit Hold

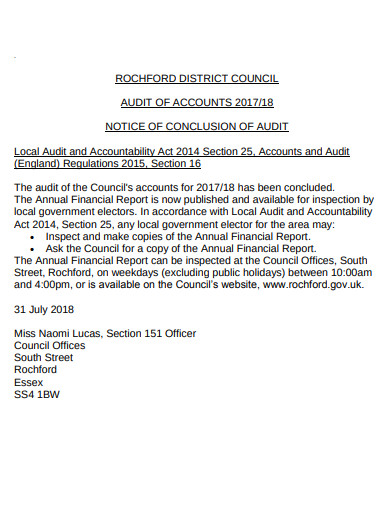

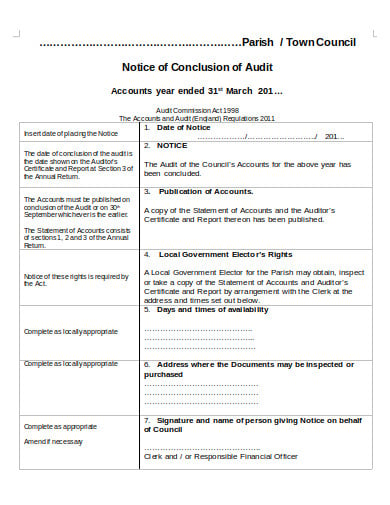

- 6. Notice of Conclusion of Audit

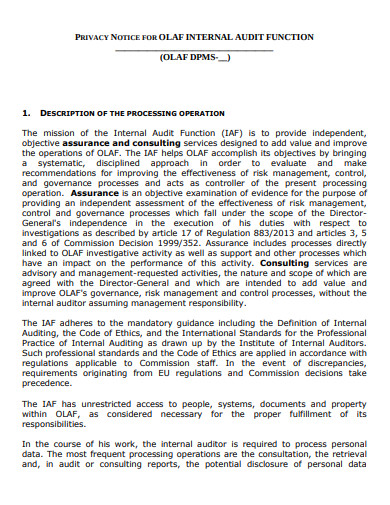

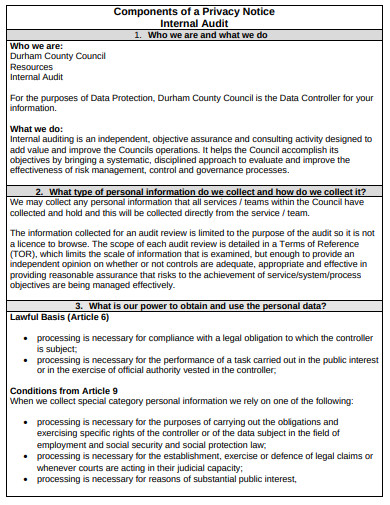

- 7. Privacy Notice for Internal Audit

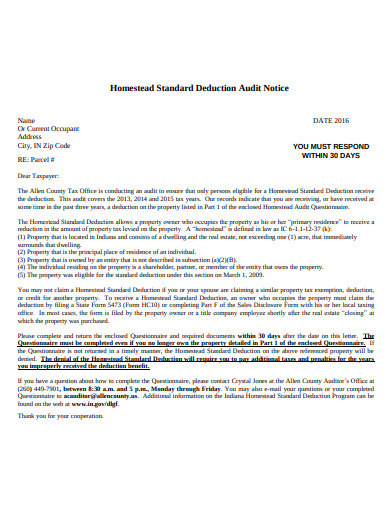

- 8. Standard Deduction Audit Notice

- 9. Privacy Notice of Internal Audit

- 10. Sample Notice of Conclusion of Audit

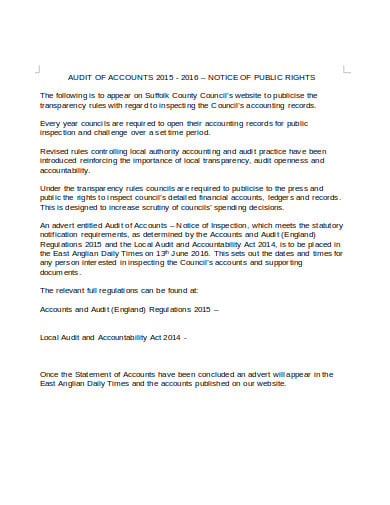

- 11. Audit Notice Template in DOC

- Checking Out the Reasons For the Issue of an Audit Notice:

- What are the Several Types of Audit?

- What is the Most Important Thing to Be Done While Making an Audit Notice?

10+ Audit Notice Templates in PDF | DOC

An audit notice initiates a duty review that follows a bookkeeping methodology where the IRS inspects your individual or business monetary records to guarantee you documented your government form precisely. On the off chance that you demonstrate that your underlying return was finished and right, you won’t be asked anything further, yet if the IRS discovers blunders or deliberate is-reportings, you’ll need to pay the recalculated return sum and any intrigue punishments. On the off chance that you get a review notice, here are the means you can take to rapidly resolve the circumstance.

Notice Template Bundle

10+ Audit Notice Templates in PDF | DOC

1. Municipal Income Tax Audit Notice

troyohio.gov

troyohio.gov2. Residence Exemption Audit Notice

michigan.gov

michigan.gov3. Notice of Intent to Audit

azdor.gov

azdor.gov4. Compliance Audit Notification

nhvr.gov.au

nhvr.gov.au5. Notice of Audit Hold

sos.mo.gov

sos.mo.gov6. Notice of Conclusion of Audit

rochford.gov.uk

rochford.gov.uk7. Privacy Notice for Internal Audit

ec.europa.eu

ec.europa.eu8. Standard Deduction Audit Notice

allencounty.us

allencounty.us9. Privacy Notice of Internal Audit

durham.gov.uk

durham.gov.uk10. Sample Notice of Conclusion of Audit

leicestershireandrutlandalc.gov.uk

leicestershireandrutlandalc.gov.uk11. Audit Notice Template in DOC

suffolk.gov.uk

suffolk.gov.ukChecking Out the Reasons For the Issue of an Audit Notice:

Inquire As to Why Your Return Was Selected For An Audit?

While the IRS should disclose to you why your arrival was chosen, it’s dependent upon you to inquire. Your duties can be examined for an assortment of reasons, including:

- Explicit action on your arrival, for example, monetary compensation, 1099 and W-2 structures that don’t coordinate your detailing, high conclusions comparative with your pay, reports conflicting with earlier years, and so on.

- Related assessments, where your report includes exchanges with another person being examined.

- Programmed banners, where PC programs find distant “scores” on returns (ex: better than expected retention).

Arbitrary Determination

All IRS Notices or Letters contain a notification number in the upper right-hand corner. These numbers will additionally advise you about the particular issue(s) with your expense form. When you realize what you are being evaluated for, you can limit your concentration and start gathering pertinent records.

Decide How You Are Being Audited:

There are various kinds of assessment reviews, each with their own necessities. Knowing how you are being examined will enable you to figure out what archives you need, where to send them, and whether you need an expense legal advisor.

What are the Several Types of Audit?

Correspondence Audit

The IRS administration focus approaches you for more data concerning a piece of your government form. The IRS is for the most part looking for receipts, checks and comparative data.

Office Audit

The IRS Service Center requests that you get certain records from your neighborhood IRS office. The review is directed there.

Field Audit

An IRS operator goes to your place of business to lead the review face to face.

Citizen Compliance Measurement Program Audit

This is the broadest kind of review, where all aspects of your assessment form must be proved by reports, including birth and marriage endorsements. The main role of this review is to refresh the information used to compose the PC scoring program.

For both field reviews and TCMP reviews, it’s enthusiastically prescribed that you have a legal advisor present while the review is led.

What is the Most Important Thing to Be Done While Making an Audit Notice?

When you comprehend what is anticipated from you, you can begin experiencing your records to locate the applicable receipts and archives. Never send in your unique reports or your lone duplicate, and never send in more than is mentioned. In the event that you can’t discover significant documentation, quickly demand copies, since the inspectors won’t acknowledge the reason that records are absent or lost.

When you have every one of your duplicates and firsts, get them composed, particularly on the off chance that you are confronting an in-person review—great association shows the specialist that you are a mindful citizen, and may bring about the operator constraining the extent of their examination.

Get A Tax Lawyer

When you get warning of an IRS charge review, contact the duty consultant who arranged your arrival. The person in question can clarify the review procedure and help you get ready. On the off chance that you are as yet anxious about the review, or have a field reviewer going to your work environment, it’s a smart thought to enlist an expert assessment legal counselor.