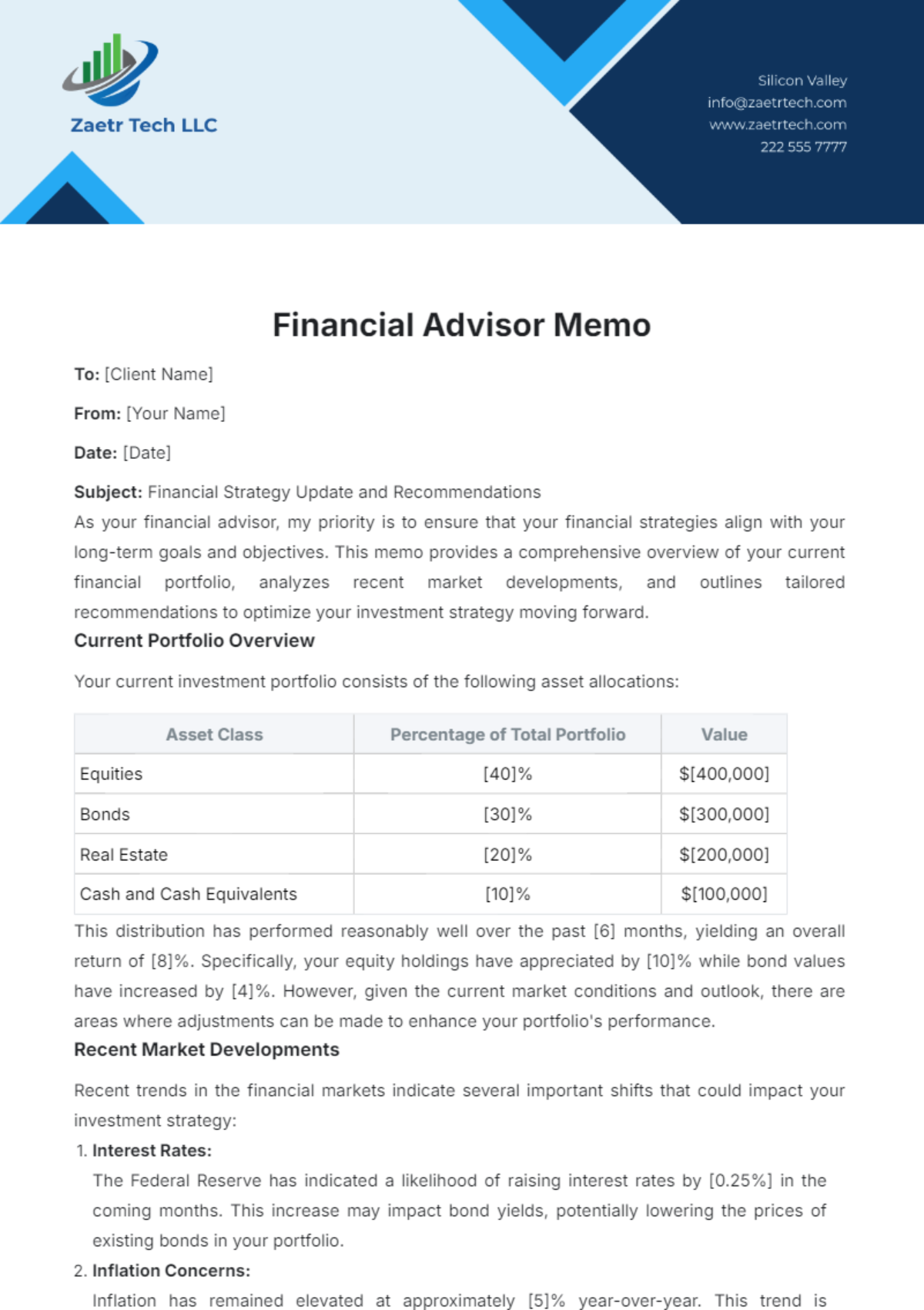

Bring Your Investment Insights to Life with Investment Memo Templates from Template.net

Keep your investment team engaged, streamline decision-making, and communicate strategies with clarity using Investment Memo Templates from Template.net. Designed for finance professionals and corporate strategists, these templates enable you to articulate your investment proposals with precision and professionalism. Whether you're pitching a new investment opportunity or summarizing portfolio performance, our templates offer the perfect format to enhance your presentation. Include critical information like metrics, projections, or company overviews effortlessly. With no design skills needed, you can enjoy the ease of professional-grade layouts that cater to both print and digital distribution.

Discover the many investment memo templates we have on hand, ready to be customized to fit your unique needs. Select from a variety of templates, seamlessly swapping in financial data and insights, tweaking colors and fonts to match your brand’s identity. Use advanced features like drag-and-drop icons or graphics, and integrate animated effects for impactful presentations. The possibilities are endless and skill-free, with regularly updated templates ensuring your memos remain fresh and relevant. When you're finished, easily download or share your memos via print, email, or export options, making these templates ideal for multiple channels and collaborative efforts.