Free Financial Cost Review Process Outline

A. Initiation

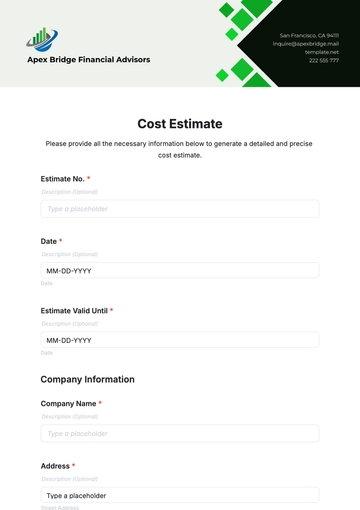

Purpose Identification: Clearly define the objective of the cost review process.

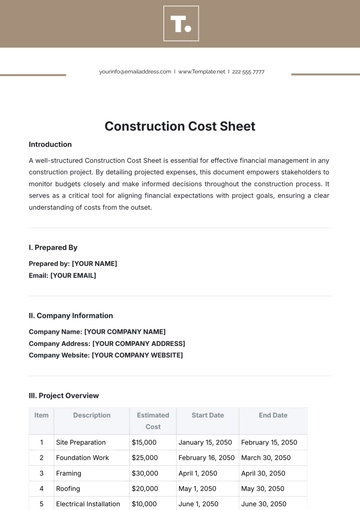

Scope Determination: Specify the financial elements (projects, departments, etc.) to be reviewed.

Stakeholder Identification: List all parties involved in the process (e.g., finance team, department heads).

B. Data Collection

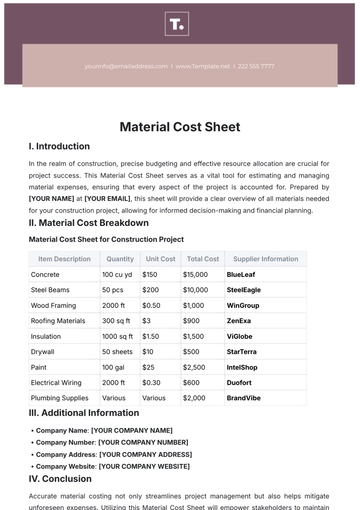

Financial Data Gathering: Collect relevant financial data such as budgets, expense reports, income statements.

Historical Data Review: Analyze past financial records for trends and benchmarks.

Source Verification: Ensure data accuracy by verifying sources and methods of data collection.

C. Data Analysis

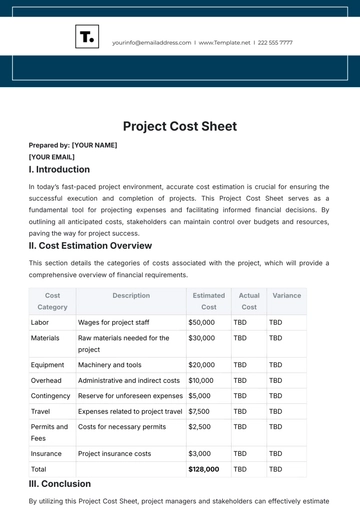

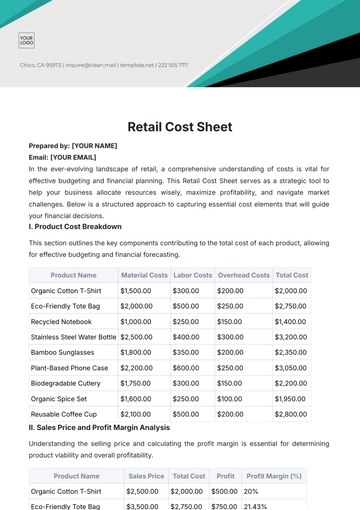

Trend Analysis: Examine financial trends over time.

Variance Analysis: Compare actual results to budgeted figures to identify variances.

Ratio Analysis: Use financial ratios to assess financial health and efficiency.

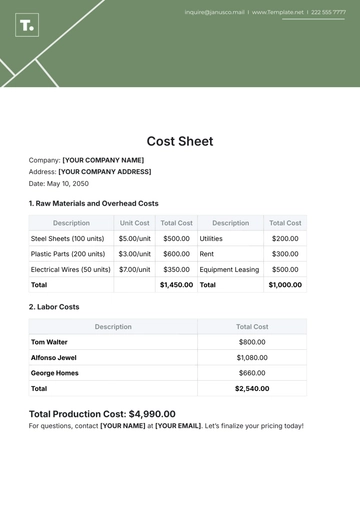

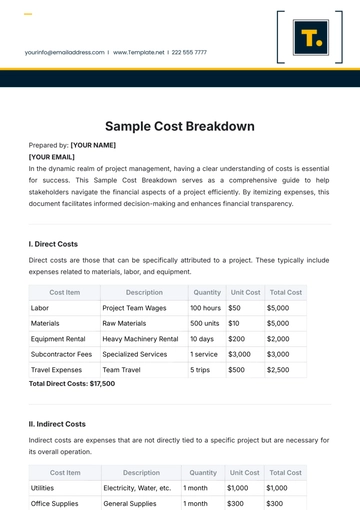

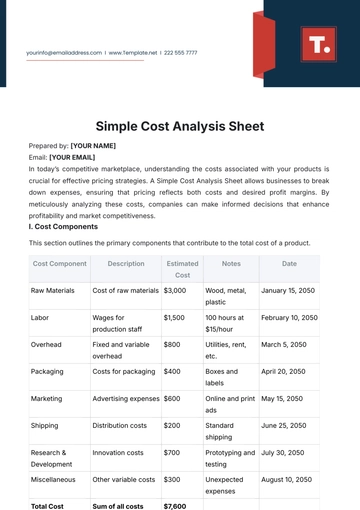

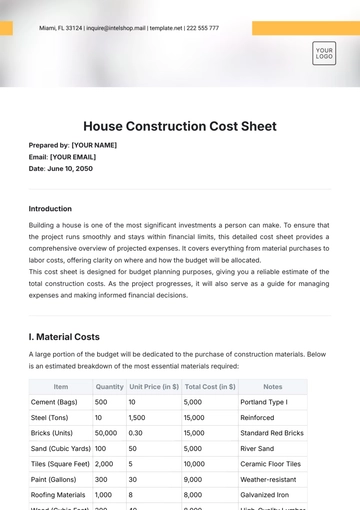

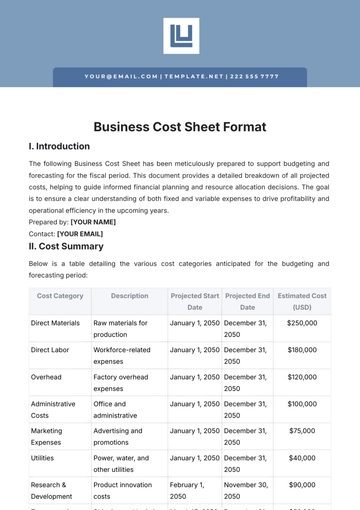

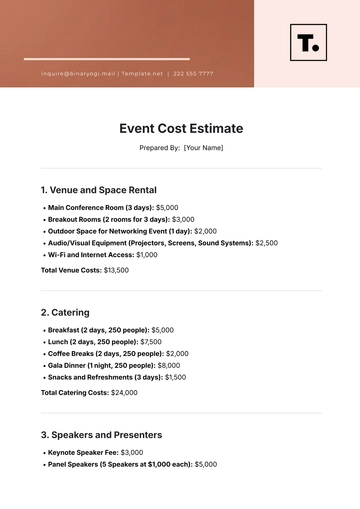

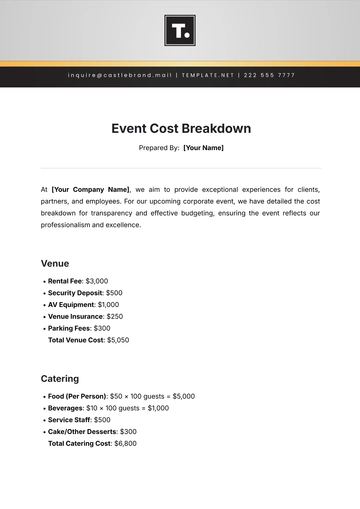

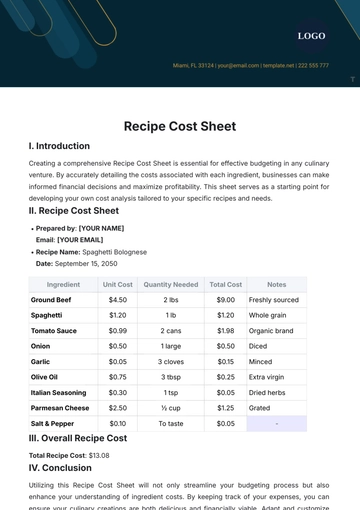

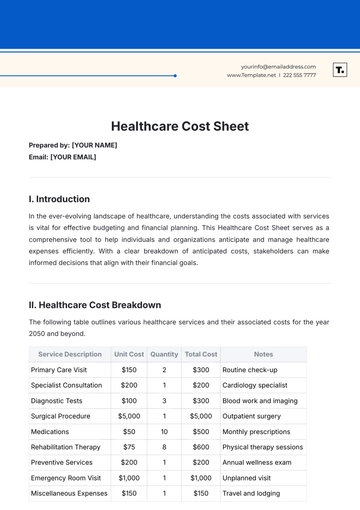

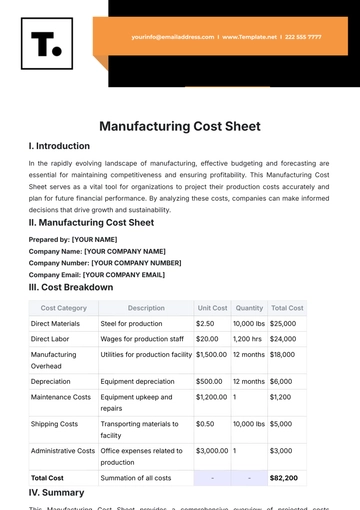

D. Cost Identification

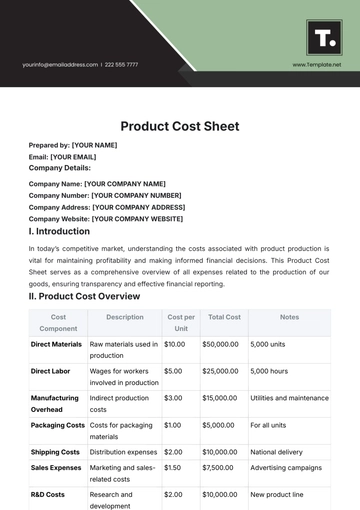

Direct Costs: Identify costs directly tied to specific projects or departments (e.g., salaries, materials).

Indirect Costs: Account for overheads and shared expenses (e.g., utilities, administrative costs).

Opportunity Costs: Consider potential revenue lost by choosing one option over another.

E. Cost Evaluation

Cost-Benefit Analysis: Evaluate the financial benefits of an expense relative to its cost.

Return on Investment (ROI): Calculate ROI for significant expenditures.

Risk Assessment: Identify and evaluate financial risks associated with expenditures.

F. Benchmarking

Industry Benchmarking: Compare costs with industry averages or standards.

Internal Benchmarking: Compare costs across different departments or projects within the organization.

G. Reporting

Report Preparation: Compile findings in a comprehensive report.

Key Performance Indicators (KPIs): Highlight important metrics and indicators.

Recommendations: Provide actionable recommendations based on the analysis.

H. Review and Approval

Internal Review: Conduct reviews by finance teams and department heads.

Stakeholder Approval: Present findings to stakeholders for feedback and approval.

I. Implementation

Action Plan: Develop a plan to implement recommended changes.

Budget Adjustments: Make necessary adjustments to budgets based on findings.

Monitoring: Establish a system for monitoring the impact of changes.

J. Follow-up and Continuous Improvement

Periodic Review: Schedule regular reviews to assess the impact of implemented changes.

Feedback Loop: Create a mechanism for ongoing feedback and suggestions.

Adjustment and Optimization: Continuously adjust strategies based on feedback and new data.

- 100% Customizable, free editor

- Access 1 Million+ Templates, photo’s & graphics

- Download or share as a template

- Click and replace photos, graphics, text, backgrounds

- Resize, crop, AI write & more

- Access advanced editor

The Financial Cost Review Process Outline Template from Template.net is a meticulously crafted tool for streamlining financial evaluations. This template simplifies the review of costs in any business setting. Fully editable and customizable in our AI Editor tool, it adapts effortlessly to different financial scenarios, ensuring a thorough and organized cost review process. An essential asset for effective financial management.