Free Budget Plan For Biweekly Pay

Prepared by [Your Name]

1. Executive Summary

This Family Budget Plan aims to effectively manage biweekly pay, ensuring all necessary expenses are covered while promoting savings and debt reduction. The plan provides a detailed financial framework for the prudent allocation of family resources.

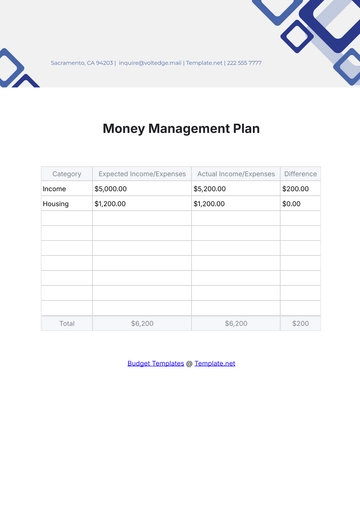

2. Financial Overview

Income Source | Amount | Frequency |

|---|---|---|

Salary | $2,500 | Every two weeks |

Freelance Jobs | $500 | Occasionally |

Interest Income | $50 | Monthly |

Other | $100 | Occasionally |

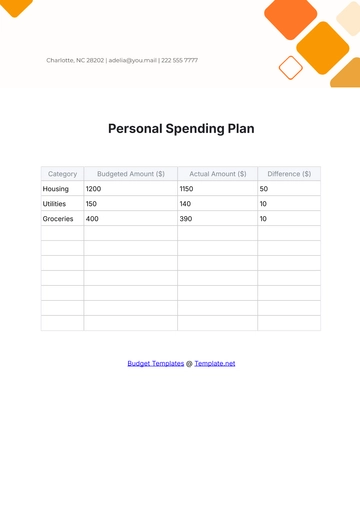

3. Expense Breakdown

Expense | Amount |

|---|---|

Mortgage/Rent | $1,200 |

Utilities | $300 |

Internet/Cable | $100 |

Insurance | $250 |

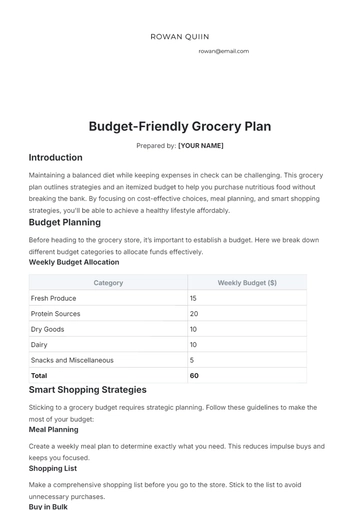

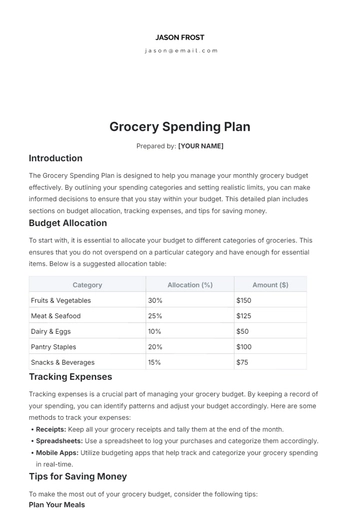

Groceries | $400 |

Dining Out | $150 |

Entertainment | $100 |

Gas/Transportation | $120 |

Miscellaneous | $80 |

4. Savings Plan

Savings Type | Amount | Frequency |

|---|---|---|

Emergency Fund | $200 | Biweekly |

Retirement Fund | $300 | Biweekly |

College Savings | $100 | Biweekly |

5. Debt Payment Schedule

Debt Type | Outstanding Balance | Minimum Payment | Biweekly Payment |

|---|---|---|---|

Credit Card | $5,000 | $150 | $200 |

Auto Loan | $10,000 | $350 | $175 |

Student Loan | $15,000 | $200 | $100 |

6. Budget Summary

Category | Amount |

|---|---|

Total Income | $3,150 |

Total Fixed Expenses | $1,850 |

Total Variable Expenses | $850 |

Total Savings | $600 |

Total Debt Payments | $475 |

Net Surplus/Deficit | -$125 |

7. Recommendations

Expense Reduction: Monitor and reduce variable expenses such as dining out and entertainment.

Increase Savings: Aim to increase contributions to both short-term and long-term savings.

Debt Management: Focus on paying off high-interest debts first to reduce overall financial burden.

- 100% Customizable, free editor

- Access 1 Million+ Templates, photo’s & graphics

- Download or share as a template

- Click and replace photos, graphics, text, backgrounds

- Resize, crop, AI write & more

- Access advanced editor

Optimize your finances with our Biweekly Pay Budget Plan Template, offered by Template.net. This customizable tool syncs perfectly with your biweekly pay schedule. Download and print for easy reference. Editable in our AI Editor Tool, it adapts to your financial goals effortlessly. Take control of your budget with simplicity and precision.

You may also like

- Finance Plan

- Construction Plan

- Sales Plan

- Development Plan

- Career Plan

- Budget Plan

- HR Plan

- Education Plan

- Transition Plan

- Work Plan

- Training Plan

- Communication Plan

- Operation Plan

- Health And Safety Plan

- Strategy Plan

- Professional Development Plan

- Advertising Plan

- Risk Management Plan

- Restaurant Plan

- School Plan

- Nursing Home Patient Care Plan

- Nursing Care Plan

- Plan Event

- Startup Plan

- Social Media Plan

- Staffing Plan

- Annual Plan

- Content Plan

- Payment Plan

- Implementation Plan

- Hotel Plan

- Workout Plan

- Accounting Plan

- Campaign Plan

- Essay Plan

- 30 60 90 Day Plan

- Research Plan

- Recruitment Plan

- 90 Day Plan

- Quarterly Plan

- Emergency Plan

- 5 Year Plan

- Gym Plan

- Personal Plan

- IT and Software Plan

- Treatment Plan

- Real Estate Plan

- Law Firm Plan

- Healthcare Plan

- Improvement Plan

- Media Plan

- 5 Year Business Plan

- Learning Plan

- Marketing Campaign Plan

- Travel Agency Plan

- Cleaning Services Plan

- Interior Design Plan

- Performance Plan

- PR Plan

- Birth Plan

- Life Plan

- SEO Plan

- Disaster Recovery Plan

- Continuity Plan

- Launch Plan

- Legal Plan

- Behavior Plan

- Performance Improvement Plan

- Salon Plan

- Security Plan

- Security Management Plan

- Employee Development Plan

- Quality Plan

- Service Improvement Plan

- Growth Plan

- Incident Response Plan

- Basketball Plan

- Emergency Action Plan

- Product Launch Plan

- Spa Plan

- Employee Training Plan

- Data Analysis Plan

- Employee Action Plan

- Territory Plan

- Audit Plan

- Classroom Plan

- Activity Plan

- Parenting Plan

- Care Plan

- Project Execution Plan

- Exercise Plan

- Internship Plan

- Software Development Plan

- Continuous Improvement Plan

- Leave Plan

- 90 Day Sales Plan

- Advertising Agency Plan

- Employee Transition Plan

- Smart Action Plan

- Workplace Safety Plan

- Behavior Change Plan

- Contingency Plan

- Continuity of Operations Plan

- Health Plan

- Quality Control Plan

- Self Plan

- Sports Development Plan

- Change Management Plan

- Ecommerce Plan

- Personal Financial Plan

- Process Improvement Plan

- 30-60-90 Day Sales Plan

- Crisis Management Plan

- Engagement Plan

- Execution Plan

- Pandemic Plan

- Quality Assurance Plan

- Service Continuity Plan

- Agile Project Plan

- Fundraising Plan

- Job Transition Plan

- Asset Maintenance Plan

- Maintenance Plan

- Software Test Plan

- Staff Training and Development Plan

- 3 Year Plan

- Brand Activation Plan

- Release Plan

- Resource Plan

- Risk Mitigation Plan

- Teacher Plan

- 30 60 90 Day Plan for New Manager

- Food Safety Plan

- Food Truck Plan

- Hiring Plan

- Quality Management Plan

- Wellness Plan

- Behavior Intervention Plan

- Bonus Plan

- Investment Plan

- Maternity Leave Plan

- Pandemic Response Plan

- Succession Planning

- Coaching Plan

- Configuration Management Plan

- Remote Work Plan

- Self Care Plan

- Teaching Plan

- 100-Day Plan

- HACCP Plan

- Student Plan

- Sustainability Plan

- 30 60 90 Day Plan for Interview

- Access Plan

- Site Specific Safety Plan