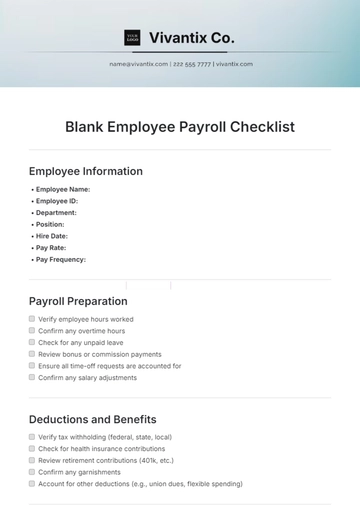

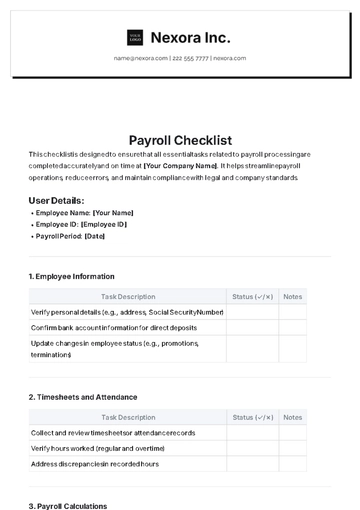

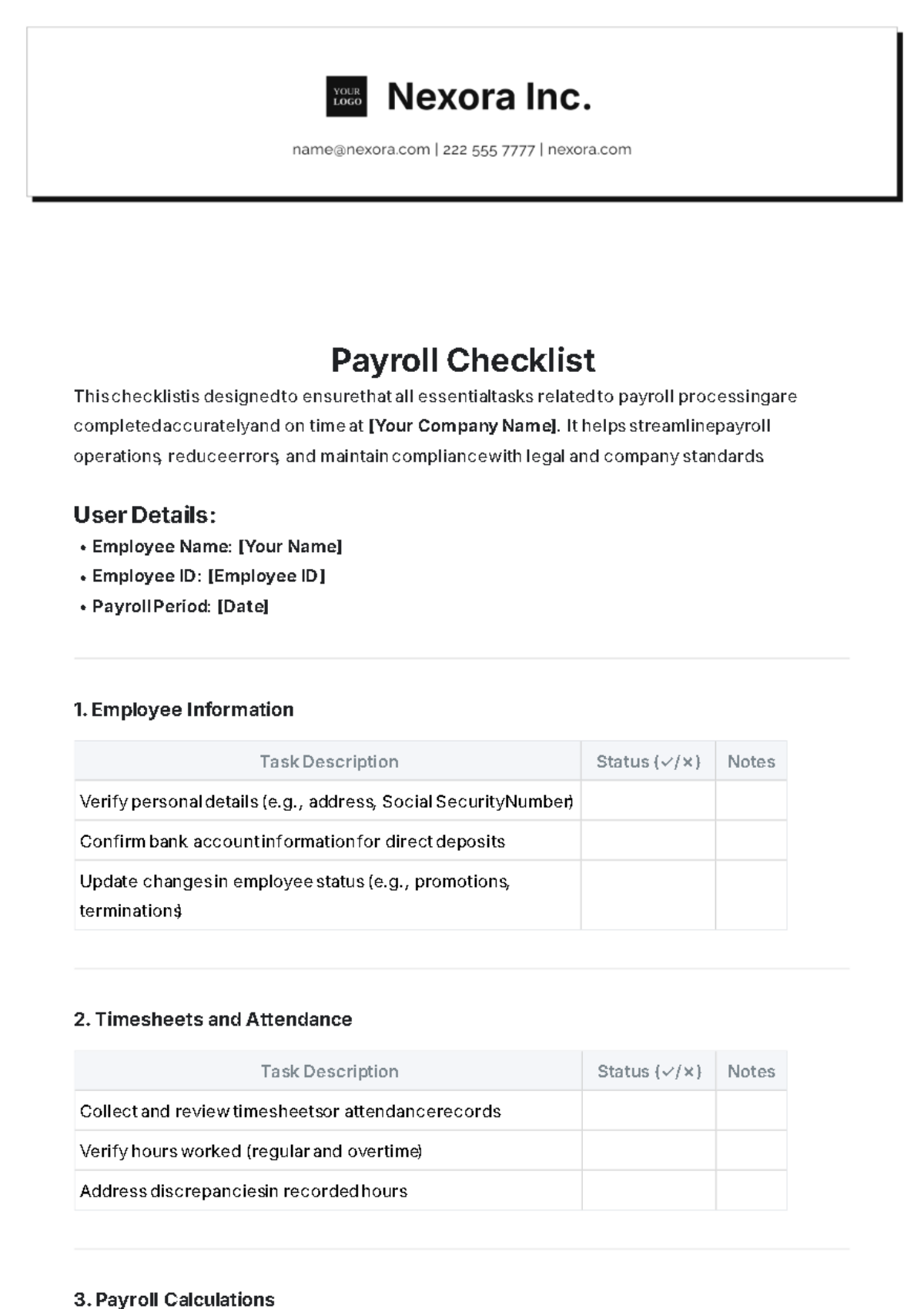

Free Payroll Checklist

This checklist is designed to ensure that all essential tasks related to payroll processing are completed accurately and on time at [Your Company Name]. It helps streamline payroll operations, reduce errors, and maintain compliance with legal and company standards.

User Details:

Employee Name: [Your Name]

Employee ID: [Employee ID]

Payroll Period: [Date]

1. Employee Information

Task Description | Status (✓/✗) | Notes |

|---|---|---|

Verify personal details (e.g., address, Social Security Number) | ||

Confirm bank account information for direct deposits | ||

Update changes in employee status (e.g., promotions, terminations) |

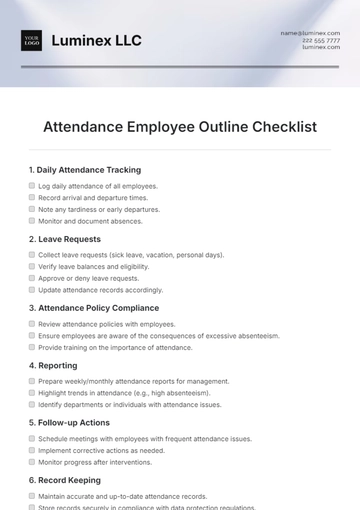

2. Timesheets and Attendance

Task Description | Status (✓/✗) | Notes |

|---|---|---|

Collect and review timesheets or attendance records | ||

Verify hours worked (regular and overtime) | ||

Address discrepancies in recorded hours |

3. Payroll Calculations

Task Description | Status (✓/✗) | Notes |

|---|---|---|

Calculate gross pay (regular hours, overtime, bonuses) | ||

Deduct federal taxes | ||

Deduct state and local taxes | ||

Deduct other withholdings (e.g., health insurance premiums, retirement contributions) |

4. Benefits and Deductions

Task Description | Status (✓/✗) | Notes |

|---|---|---|

Review and apply employee benefits (e.g., health insurance, retirement plans) | ||

Process voluntary deductions (e.g., charitable contributions) | ||

Update changes in benefits or deductions |

5. Payroll Processing

Task Description | Status (✓/✗) | Notes |

|---|---|---|

Input payroll data into the payroll system | ||

Review payroll calculations for accuracy | ||

Approve payroll for processing |

6. Compliance and Reporting

Task Description | Status (✓/✗) | Notes |

|---|---|---|

Ensure compliance with federal and state labor laws | ||

Prepare and submit required payroll reports (e.g., W-2s, 1099s) | ||

File tax forms with appropriate agencies |

7. Payments

Task Description | Status (✓/✗) | Notes |

|---|---|---|

Distribute paychecks or initiate direct deposits | ||

Confirm all payments are processed correctly | ||

Address issues with payments |

8. Post-Payroll Tasks

Task Description | Status (✓/✗) | Notes |

|---|---|---|

Archive payroll records securely | ||

Review and address any payroll issues or discrepancies | ||

Prepare for the next payroll cycle |

9. Audits and Reconciliation

Task Description | Status (✓/✗) | Notes |

|---|---|---|

Perform payroll reconciliation to ensure accuracy | ||

Conduct periodic audits to verify compliance and correctness | ||

Document and resolve any audit findings |

- 100% Customizable, free editor

- Access 1 Million+ Templates, photo’s & graphics

- Download or share as a template

- Click and replace photos, graphics, text, backgrounds

- Resize, crop, AI write & more

- Access advanced editor

Streamline your payroll process with the Payroll Checklist Template from Template.net. This editable and customizable template provides a comprehensive format for tracking payroll tasks, deadlines, and compliance requirements. Use our AI Editor Tool to tailor your checklist, ensuring a detailed, organized, and efficient payroll management system. Get a copy now!

You may also like

- Cleaning Checklist

- Daily Checklist

- Travel Checklist

- Self Care Checklist

- Risk Assessment Checklist

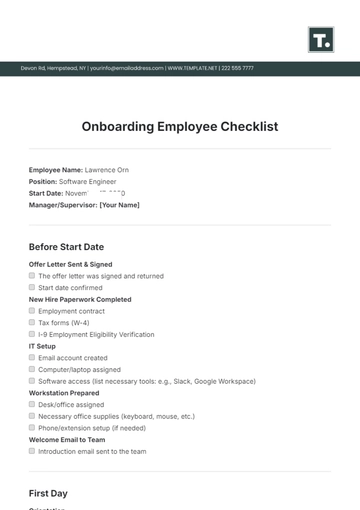

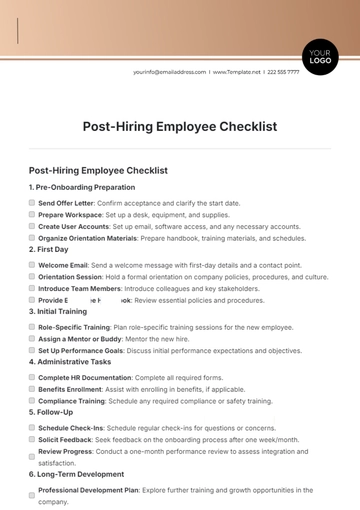

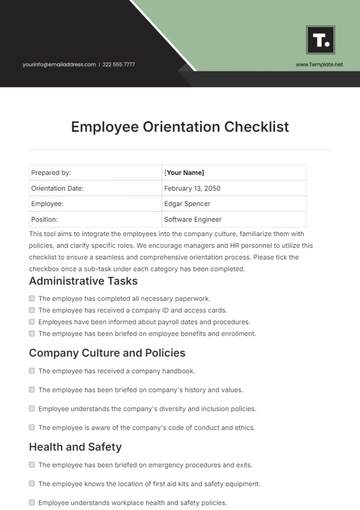

- Onboarding Checklist

- Quality Checklist

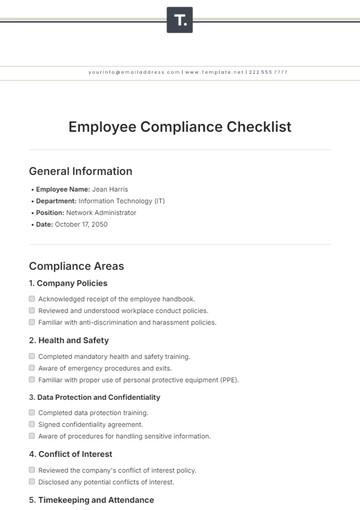

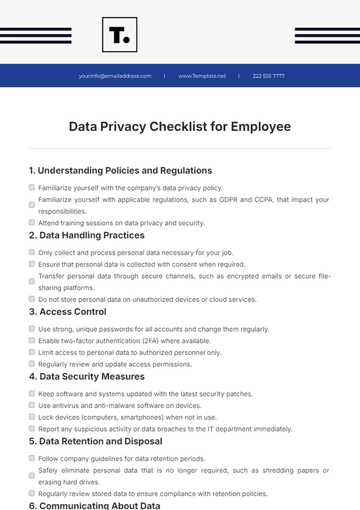

- Compliance Checklist

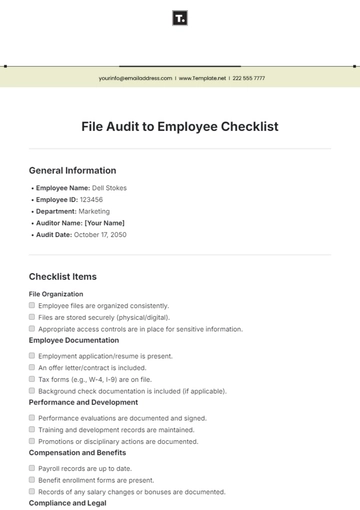

- Audit Checklist

- Registry Checklist

- HR Checklist

- Restaurant Checklist

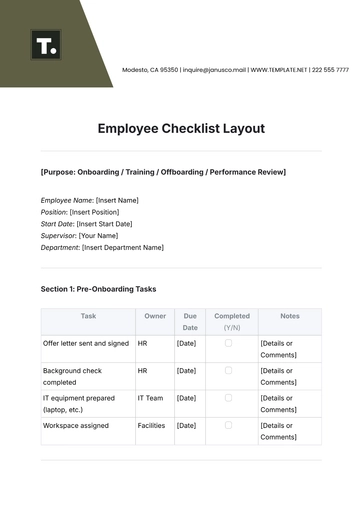

- Checklist Layout

- Creative Checklist

- Sales Checklist

- Construction Checklist

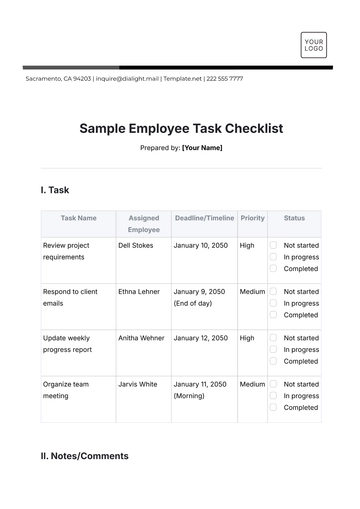

- Task Checklist

- Professional Checklist

- Hotel Checklist

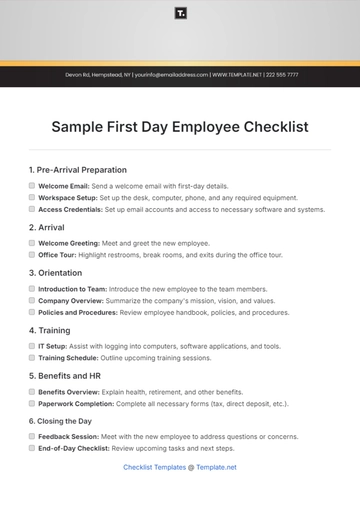

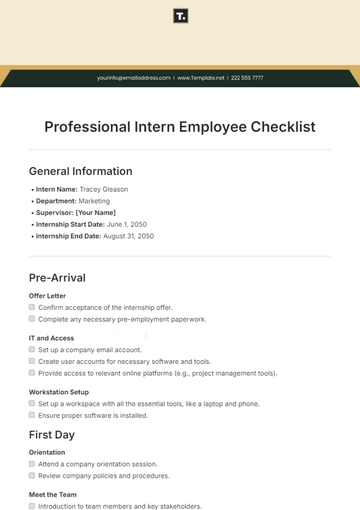

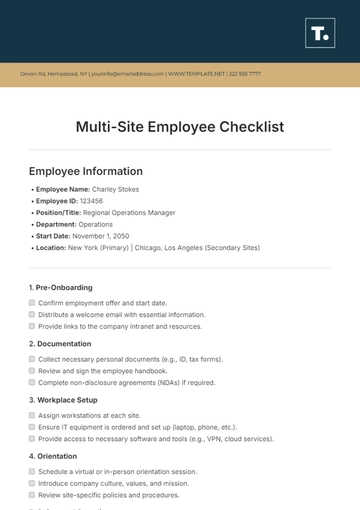

- Employee Checklist

- Moving Checklist

- Marketing Checklist

- Accounting Checklist

- Camping Checklist

- Packing Checklist

- Real Estate Checklist

- Cleaning Checklist Service

- New Employee Checklist

- Food Checklist

- Home Inspection Checklist

- Advertising Checklist

- Event Checklist

- SEO Checklist

- Assessment Checklist

- Inspection Checklist

- Baby Registry Checklist

- Induction Checklist

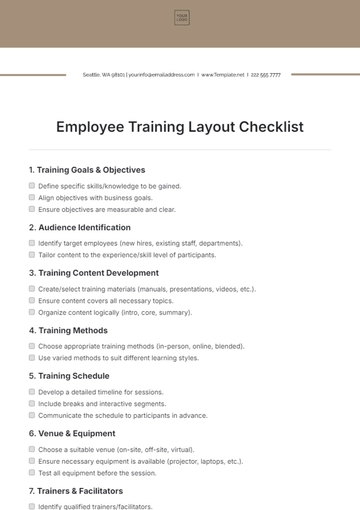

- Employee Training Checklist

- Medical Checklist

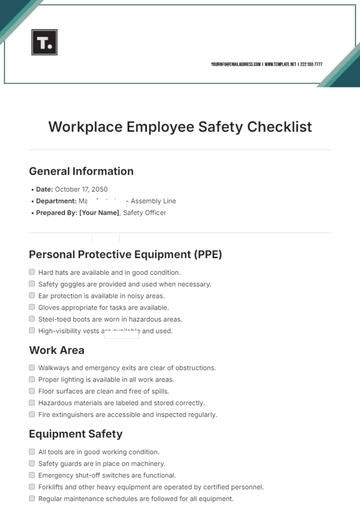

- Safety Checklist

- Site Checklist

- Job Checklist

- Service Checklist

- Nanny Checklist

- Building Checklist

- Work Checklist

- Office Checklist

- Training Checklist

- Website Checklist

- IT and Software Checklist

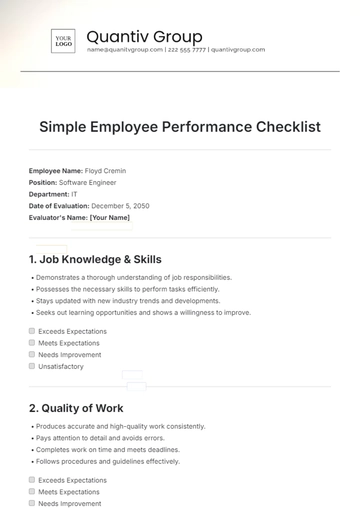

- Performance Checklist

- Project Checklist

- Startup Checklist

- Education Checklist

- Home Checklist

- School Checklist

- Maintenance Checklist

- Planning Checklist

- Manager Checklist

- Wedding Checklist

- Vehicle Checklist

- Travel Agency Checklist

- Vehicle Inspection Checklist

- Interior Design Checklist

- Backpacking Checklist

- Business Checklist

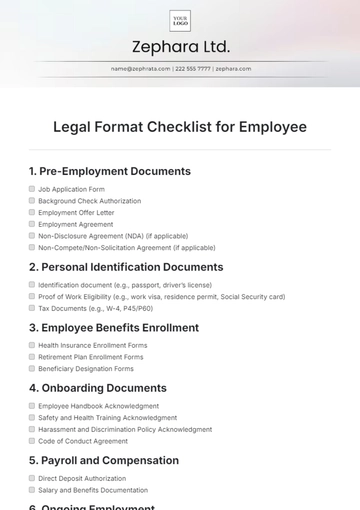

- Legal Checklist

- Nursing Home Checklist

- Weekly Checklist

- Recruitment Checklist

- Salon Checklist

- Baby Checklist

- Equipment Checklist

- Trade Show Checklist

- Party Checklist

- Hospital Bag Checklist

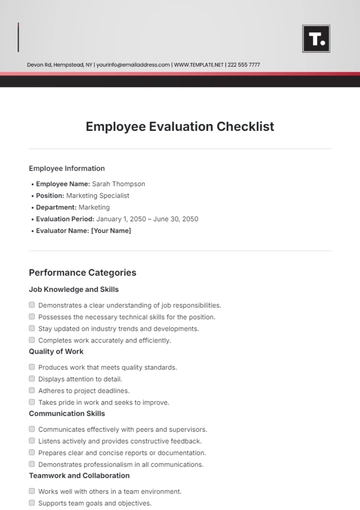

- Evaluation Checklist

- Agency Checklist

- First Apartment Checklist

- Hiring Checklist

- Opening Checklist

- Small Business Checklist

- Rental Checklist

- College Dorm Checklist

- New Puppy Checklist

- University Checklist

- Building Maintenance Checklist

- Work From Home Checklist

- Student Checklist

- Application Checklist