17+ Sample Valuation Reports

A valuation report is a type of report writing detailing the inspection and the market value of the asset surveyed. This can be made for physical property, for marketable securities, and for liabilities. This report template is needed for business activities like capital budgeting and financial reporting.

Report Template Bundle

Valuation Report Template

Property Valuation Report Template

Training Evaluation Report Template

Building Evaluation Report Template

Free Property Valuation Report Template

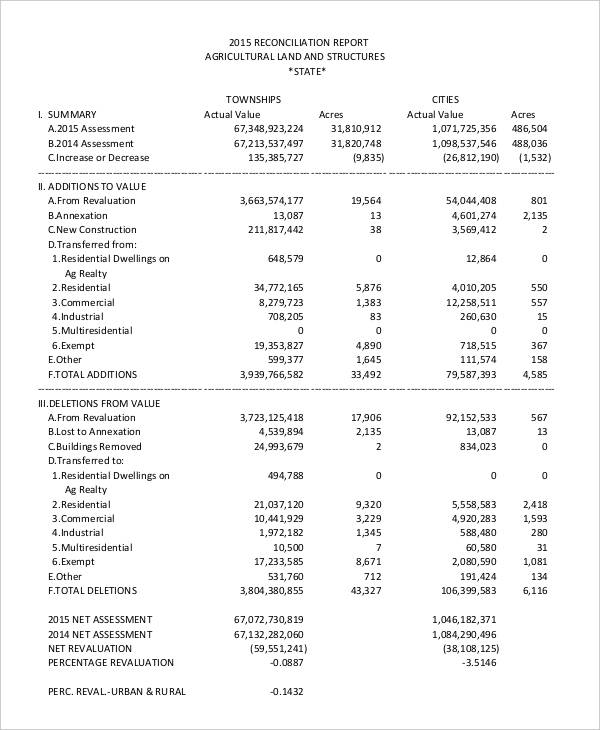

tax.iowa.gov

tax.iowa.govIn making a valuation sample report, you discuss about the purpose of the valuation, indicate the dates of inspection and valuation, and present a detailed information about the asset valued. Aside from that, you also have to identify the market conditions and the valuation methods. Lastly, you are to present a valuation certificate. The following sample valuation report templates will give you a run through on how to generate a valuation report for different purposes.

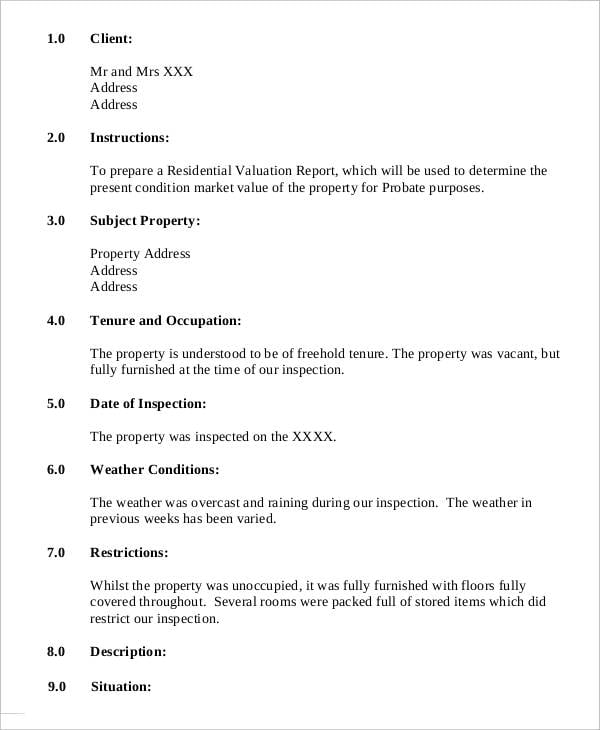

Free Residential Valuation Report Template

wilkins-vardy.co.uk

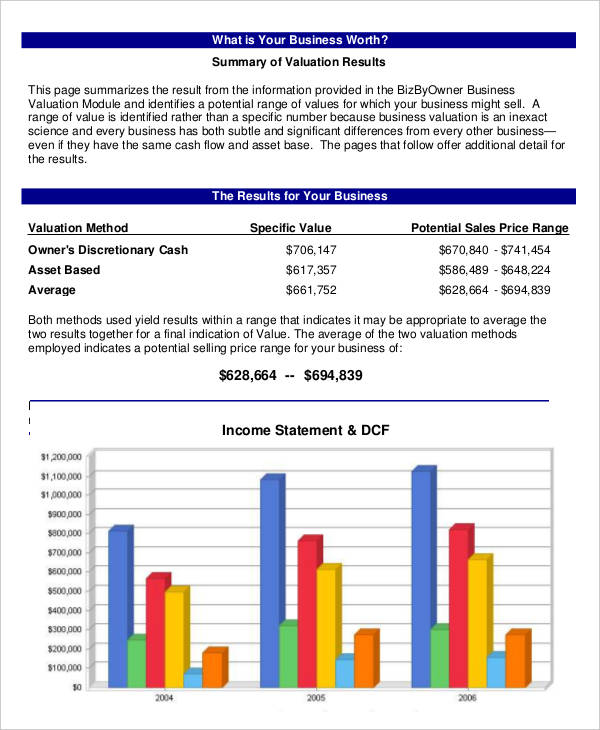

wilkins-vardy.co.ukFree Business Summary of Valuation Report Template

bizbyowner.com

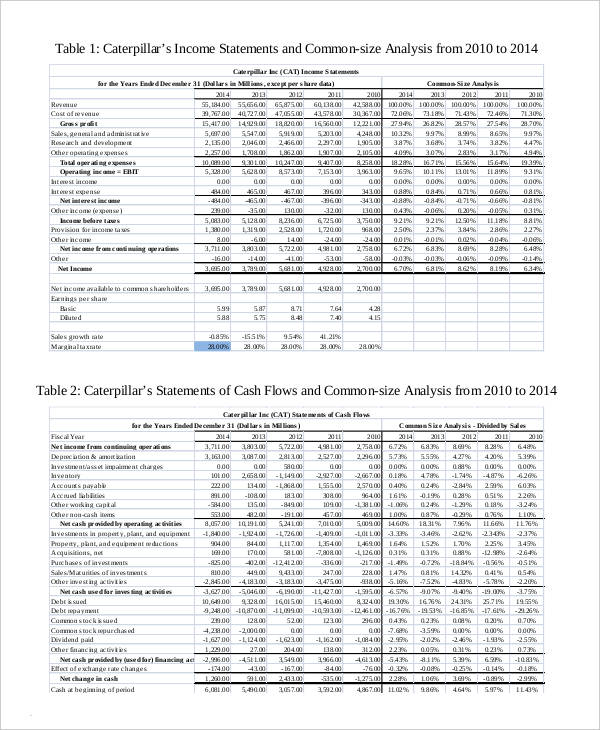

bizbyowner.comFree Teacher Stock Valuation Report Template

craig.csufresno.edu

craig.csufresno.eduFree Business Valuation Report Form Template

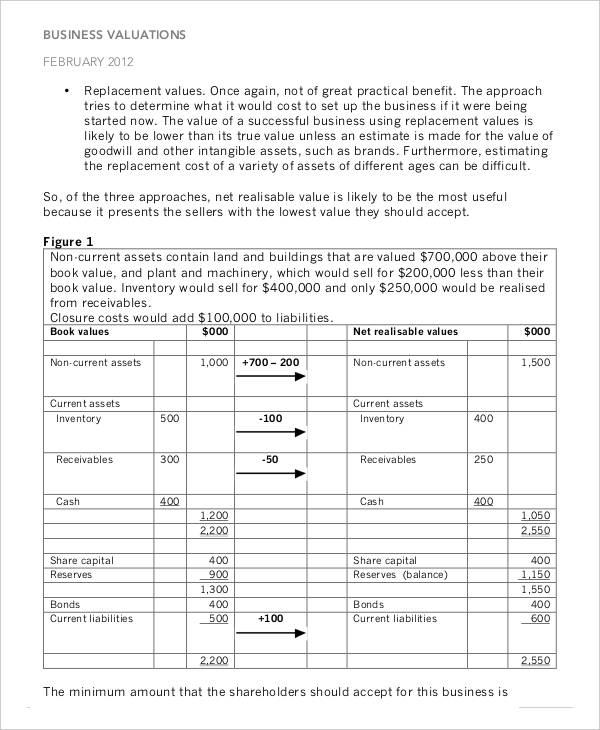

accaglobal.com

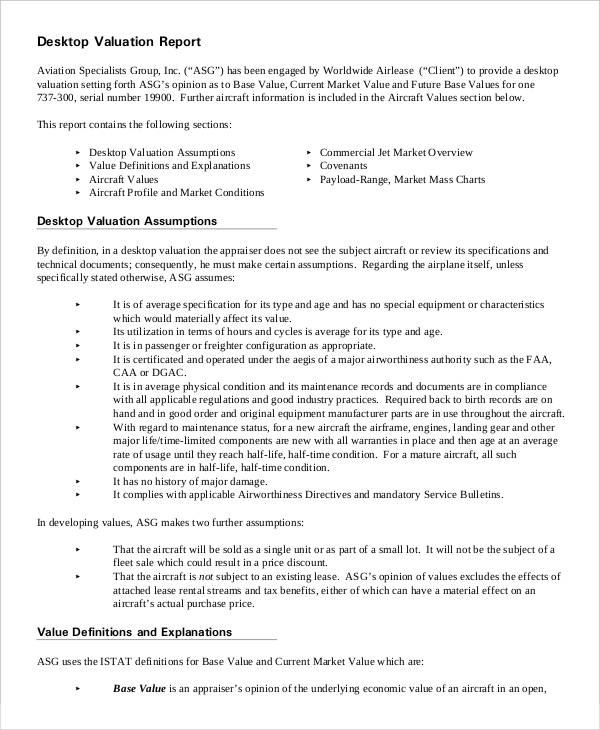

accaglobal.comFree Desktop Valuation Written Report Template

barangaroo.nsw.gov.au

barangaroo.nsw.gov.auFree Performance Assets Valuation Report Template

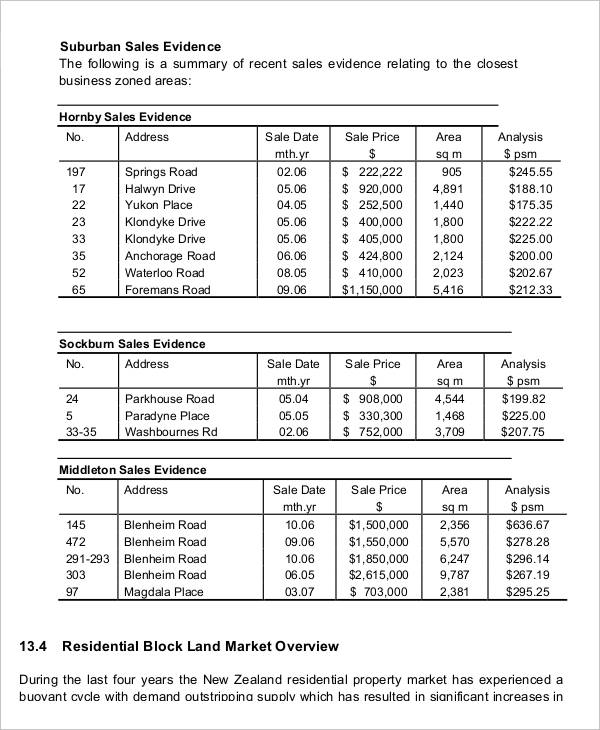

christchurchairport.co.nz

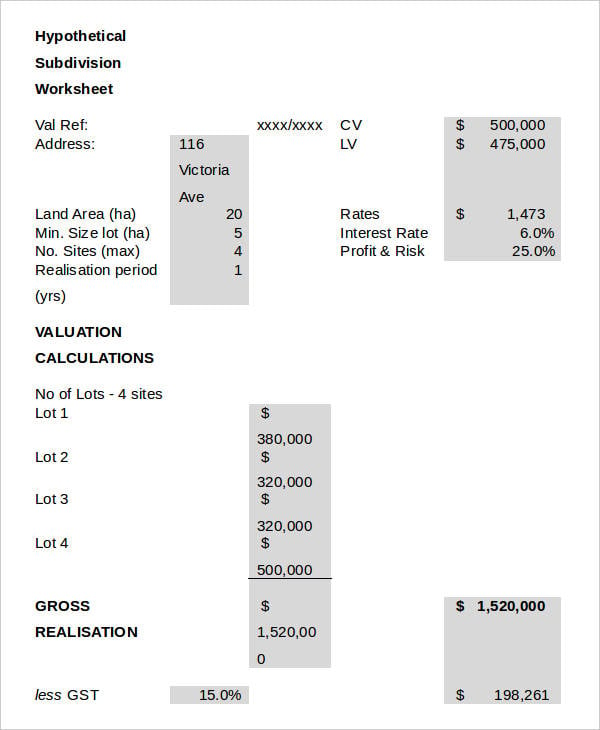

christchurchairport.co.nzFree Land Valuation Report Template Example

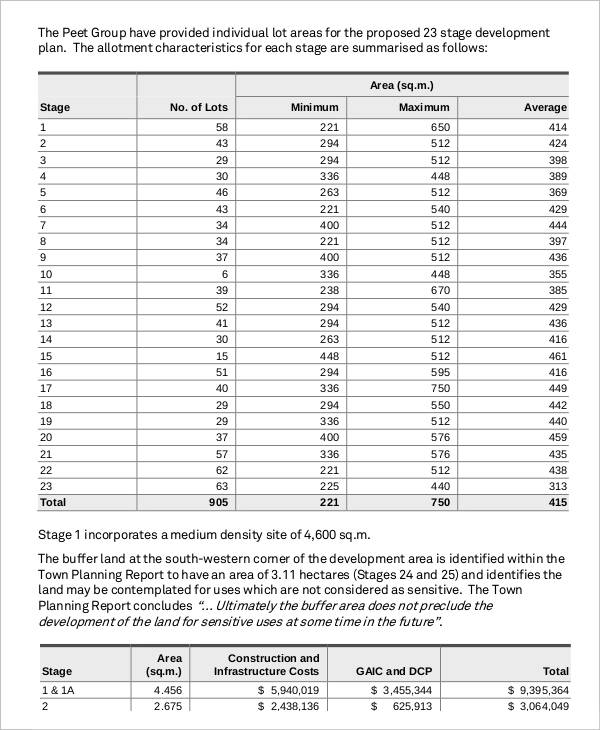

100percentinvesting.com.au

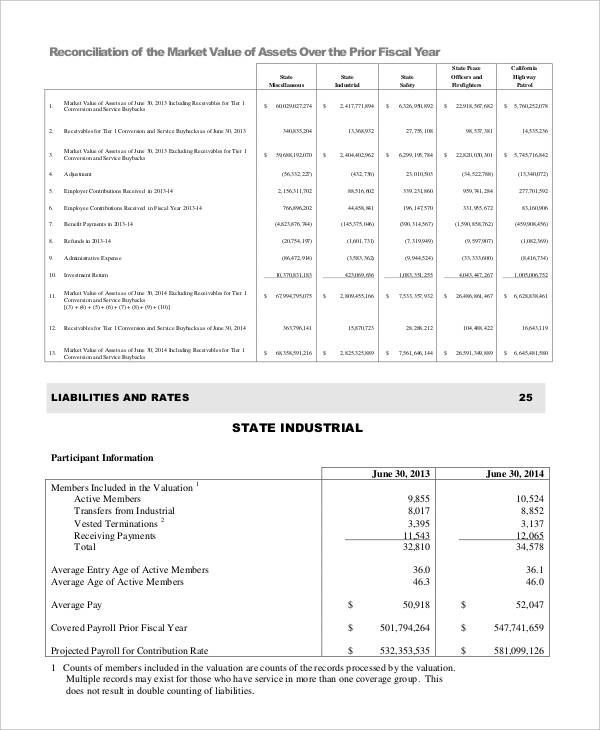

100percentinvesting.com.auFree State Actuarial Valuation Report Template

calpers.ca.gov

calpers.ca.govFree Basic Employee Valuation Report Template

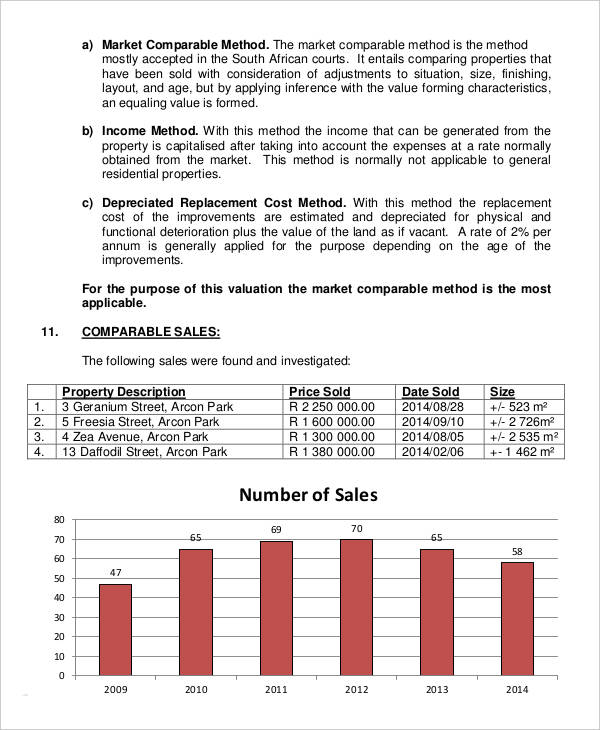

vaalvaluations.co.za

vaalvaluations.co.zaBusiness Valuation Report

Made by any type of business, a business valuation report is a simple report discussing the estimation process of the economic value of an owner’s business interest. The following information is generally included when writing a valuation basic report:

- Purpose of Valuation. This part of the report layout states the reason why the valuation report is being made.

- Definition of Standard Value. This states the conditions the business is valued.

- Effective Valuation Date of Appraisal. This serves as the basis of the time period for valuation.

- Date of Report Issuance. This is the date to issue the valuation report.

- Identification of the asset being valued. This part discusses what the asset being valued is in detail.

- List of Data considered part of the Analysis. In the design report, there are various analyses that show how a business is faring. It could come from the Financial Reports and Book Reports generated by the business.

- Appraisal Procedures. This discusses different valuation methods and approaches being used on the report format.

- Methodologies considered. All the important or key terms are defined.

- Opinion of Value. With careful assessment, this states the best guess for the value of the asset.

- List of Assumptions. A discussion of the limiting conditions affecting analysis and conclusions.

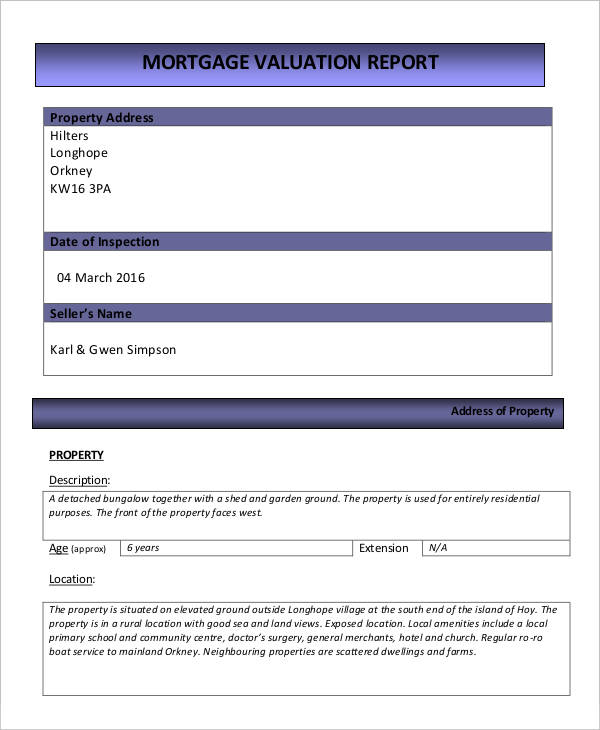

Free Mortgage Valuation Report Template

orkneypropertycentre.co.uk

orkneypropertycentre.co.ukFree Commercial Property Valuation Report Template

nzta.govt.nz

nzta.govt.nzFree Real Estate Valuation Report Template

safgyo.com

safgyo.comWhy Do You Need a Valuation Report?

When it comes to valuation reports, the importance and the role it signifies depends the area or designation of the asset. The following areas are:

- In portfolio management. For investors, when they are involved in trading or purchasing of assets, valuation gives the information they need. Aside from that, analyses generated from company reports like Sales Reports and Marketing Reports that are being presented on valuation reports are being used as basis for their trade.

- In acquisition analysis. Valuation is an important factor when it comes to acquisition of firms. For both parties, the bidding firm and the target firm, each of their values and the combined value are to be considered with the use of the valuation report. You can also see more on Valuation Reports in PDF.

- In corporate finance. For a firm’s life cycle, a valuation is needed in every stage it undertakes. Every expansion is made with the knowledge of the business’s estimated values and assumptions that comprise the valuation report.

- In legal and tax purposes. Most valuations are done because of the legal and tax reasons private companies face. For example, a new partner is to be added on the partnership. The partnership conducts a valuation helping them in deciding the approval or the decline of the partner entry. You can also see more on Valuation Report in Word Templates.

Valuation report is essential in every business move. That is why it is important to generate a report that will effectively aid the stakeholders involved. You can also see more on Template.Net site!