Table of Contents

- Cash Flow Definition & Meaning

- What Is a Cash Flow?

- 10 Types of Cash Flow

- Cash Flow Uses, Purpose, Importance

- What’s in a Cash Flow? Parts?

- How to Design a Cash Flow

- Cash Flow vs. Income Statement

- What’s the Difference Between Cash Flow, Revenue, and Budget?

- Cash Flow Sizes

- Cash Flow Ideas & Examples

- FAQs

Cash Flow

Cash Flow is the change in the amount of money that a company, institution, or person has. The terminology is used in finance to refer to the volume of money (currency) produced or spent over a specific period of time.

Cash Flow Definition & Meaning

Cash flow is the entire amount of money coming into and going out of a business, particularly as it relates to liquidity.

The net quantity of money and money equivalents entering and leaving a business is known as cash flow.

What Is a Cash Flow?

The flow of money is known as cash flow (in the form of inflow or outflow). A cash flow statement is a type of financial statement that details the sources and expenditures of a company’s cash over time. Cash flows from operating, cash flows from investing, and cash flows from financing are the three main categories of cash flows for businesses. A few methods for examining a company’s cash flow are the debt service coverage ratio, and unlevered free cash flow.

10 Types of Cash Flow

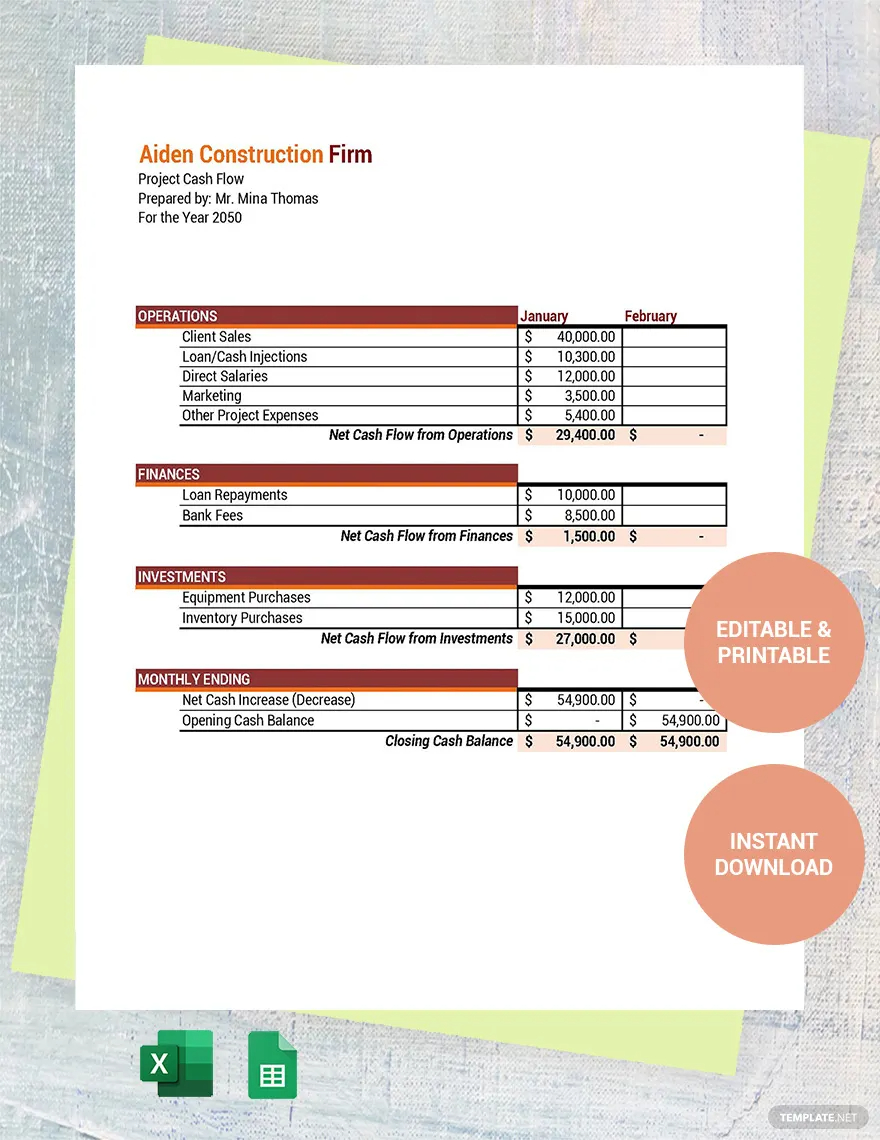

Project Cash Flow

The term “project cash flow” describes the inflow and outflow of funds inside an organization for a particular ongoing or planned project. For a project like this, revenue and expenses are included in the cash flow. It is a critical component of budget planning for business projects that don’t call for the use of a vendor or supplier. A project cash flow forecast should show project-related costs and revenues as well as when you will realize those costs and revenues in at least monthly increments.

Cash Flow Tracker

A cash flow tracker can be utilized to organize your financial inflows and outflows and improve your cash management procedures. Excel offers a thorough cash flow tracker spreadsheet template that serves as a guideline for managing cash in enterprises. The steps included in this cash flow tracker include starting point setting, future cash flow forecasting, incoming cash recording, outgoing cash recording, and result tracking.

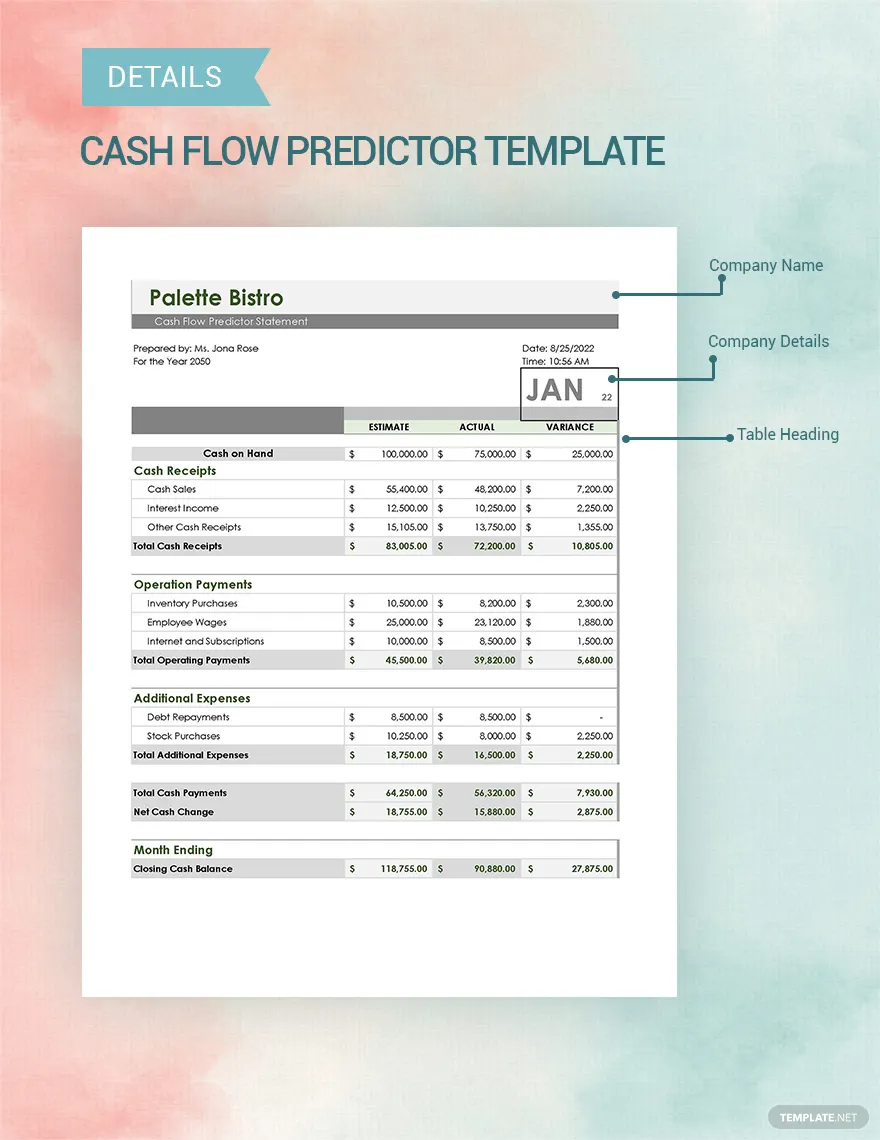

Cash Flow Predictor

The practice of anticipating your company’s future financial state is known as cash flow forecasting, or sometimes cash flow predictor. Calculating your cash position and creating cash flow predictions depends on adding up all of your anticipated revenue and outgoings. Businesses may manage their liquidity and determine if they will have enough cash on hand to pay their financial obligations with the use of cash flow forecasting.

Cash Flow Management

The method through which a company keeps tabs on the inflow and outflow of money is known as cash flow management. The main objective of cash flow management is to make sure that the amount of money coming in always exceeds the amount going out, leaving the company with a surplus. Additionally, cash flow management makes sure that surplus funds are invested or kept to generate the highest returns on capital blocked.

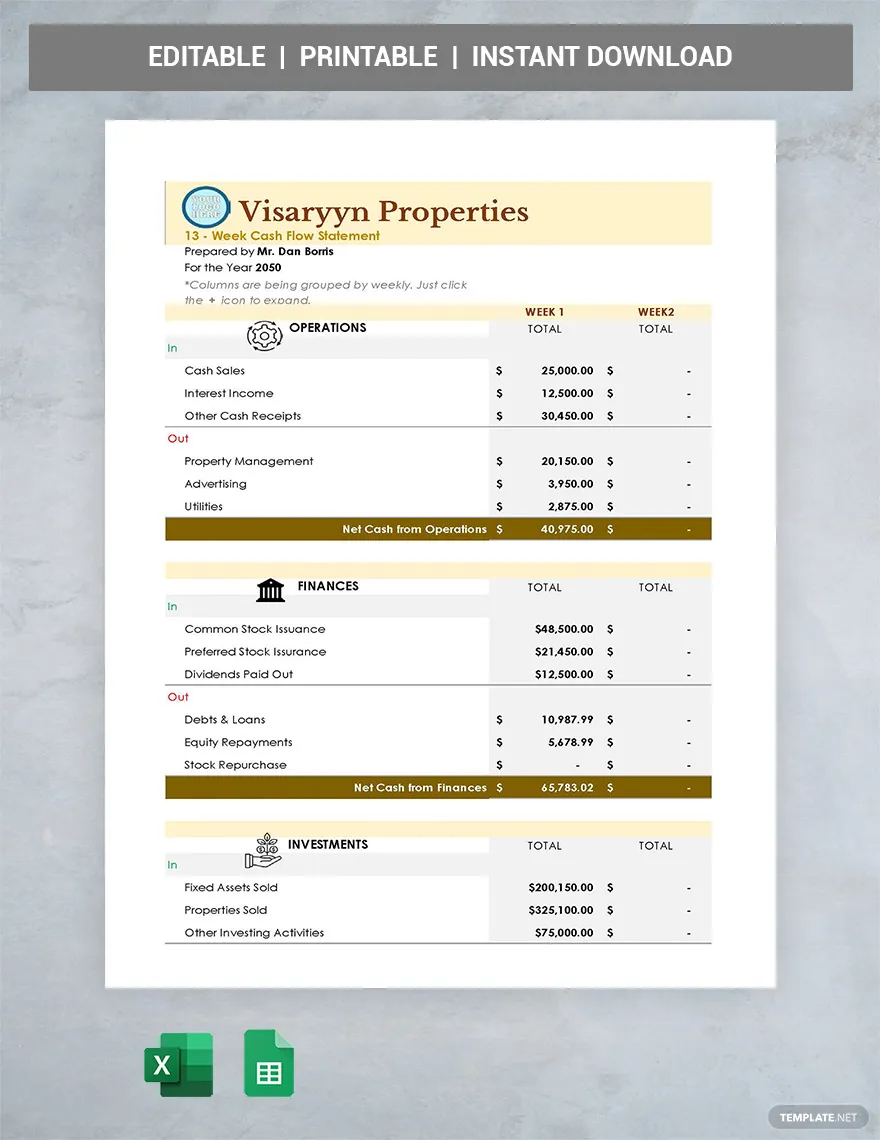

13-Week Cash Flow

A forecast of the weekly cash flow is known as the 13-week cash flow model. The 13-week cash flow forecasts weekly cash receipts less cash outlays using the direct formula. When a firm experiences financial trouble, the forecast is typically employed in turnaround circumstances to give clarity into the company’s short-term possibilities.

Cashflow Planning

Cashflow planning entails all significant cash inflows that are forecasted and presented in a table form related to sales, new loans, interest received, etc. Then, it involves carefully analyzing the timing of anticipated outflows related to suppliers, wages, other expenses, capital expenditures, loan repayments, dividends, tax, interest payments, etc. The net cash flow is the difference between the cash inflows and outflows over a specific period. Any potential short-term bank funding requirements can be determined by adding or subtracting this net cash flow from open bank balances.

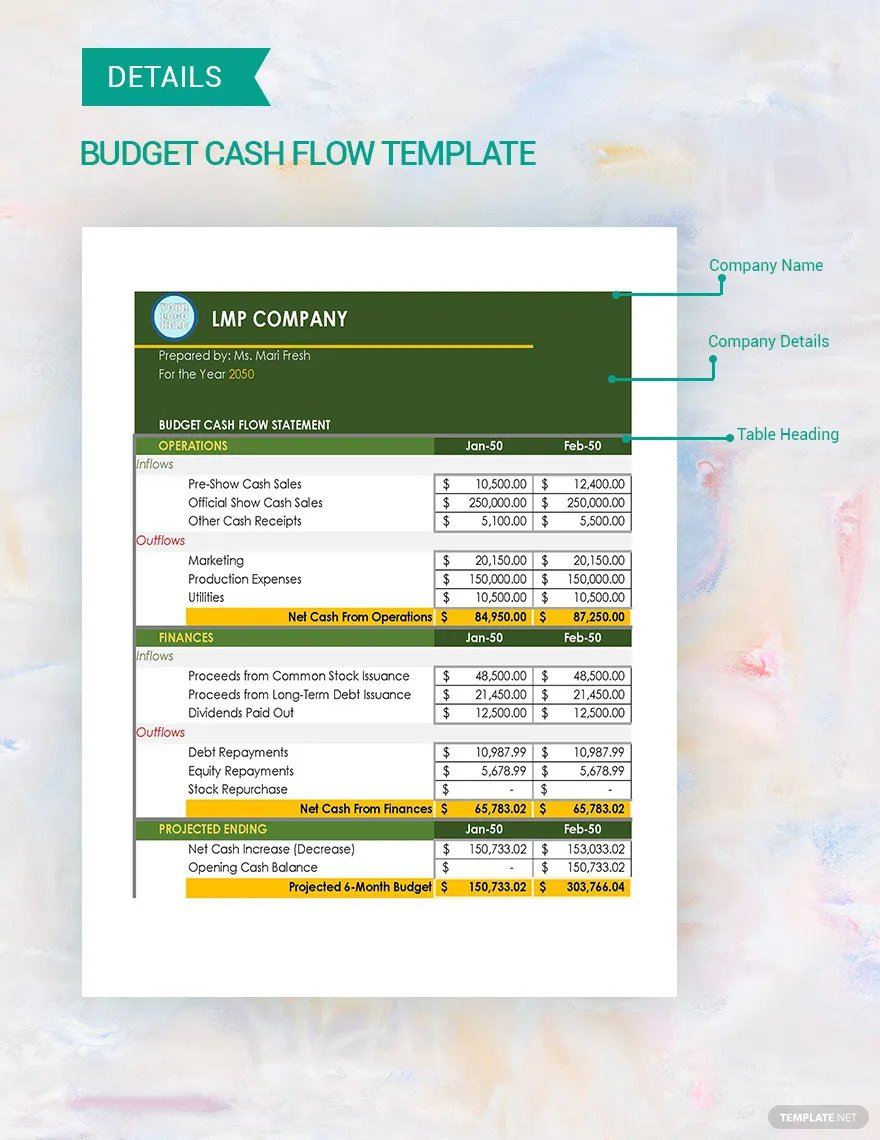

Budget Cash Flow

A budget cash flow provides an overview of the inflows and outflows of cash over a given time. This is frequently referred to as the cash budget or simply cash flow. Just as cash flow is one of the most important aspects of a business, the cash flow projection or table is one of the most important parts of a business plan.

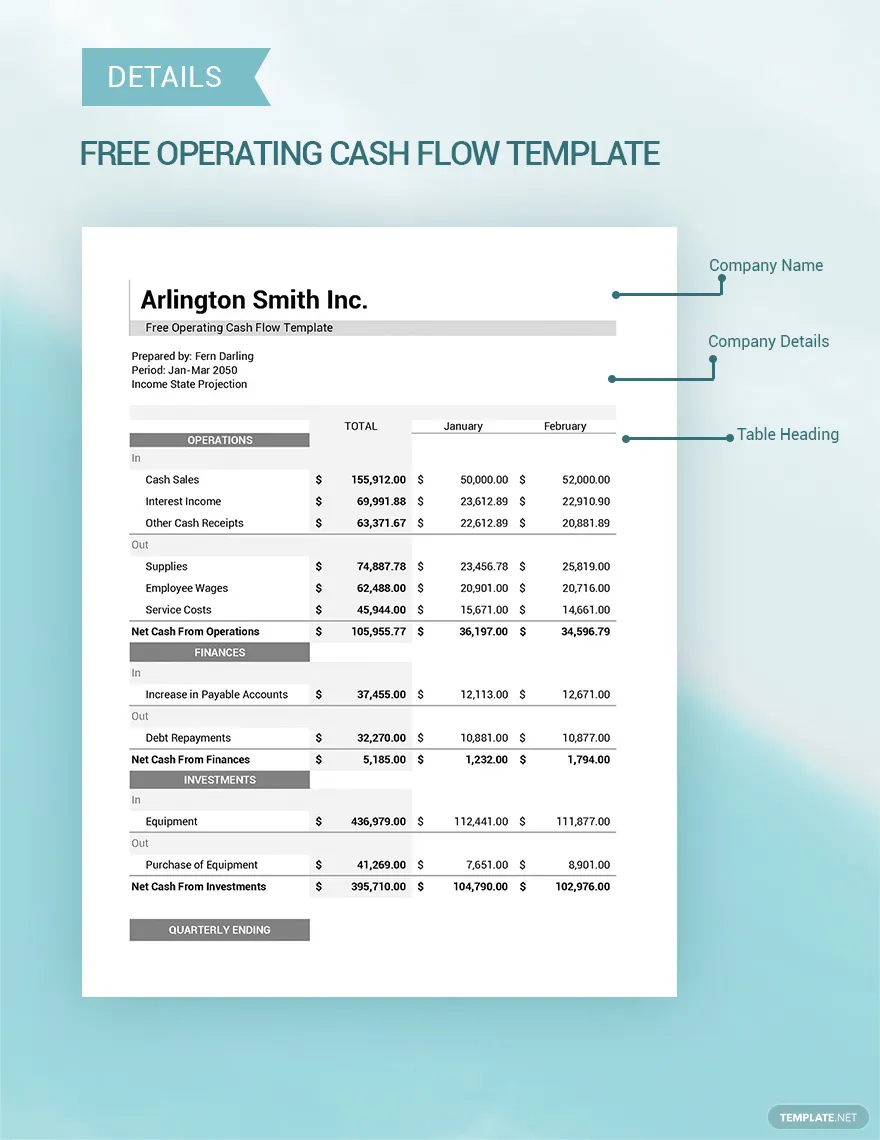

Operating Cash Flow

Operating cash flow is an indicator of how much money a corporation makes from regular business operations. It shows if a business can produce sufficient positive cash flow to support and expand its operations, or else it might need outside finance for capital growth. It can be displayed on a cash flow statement in two ways: the direct and the indirect methods.

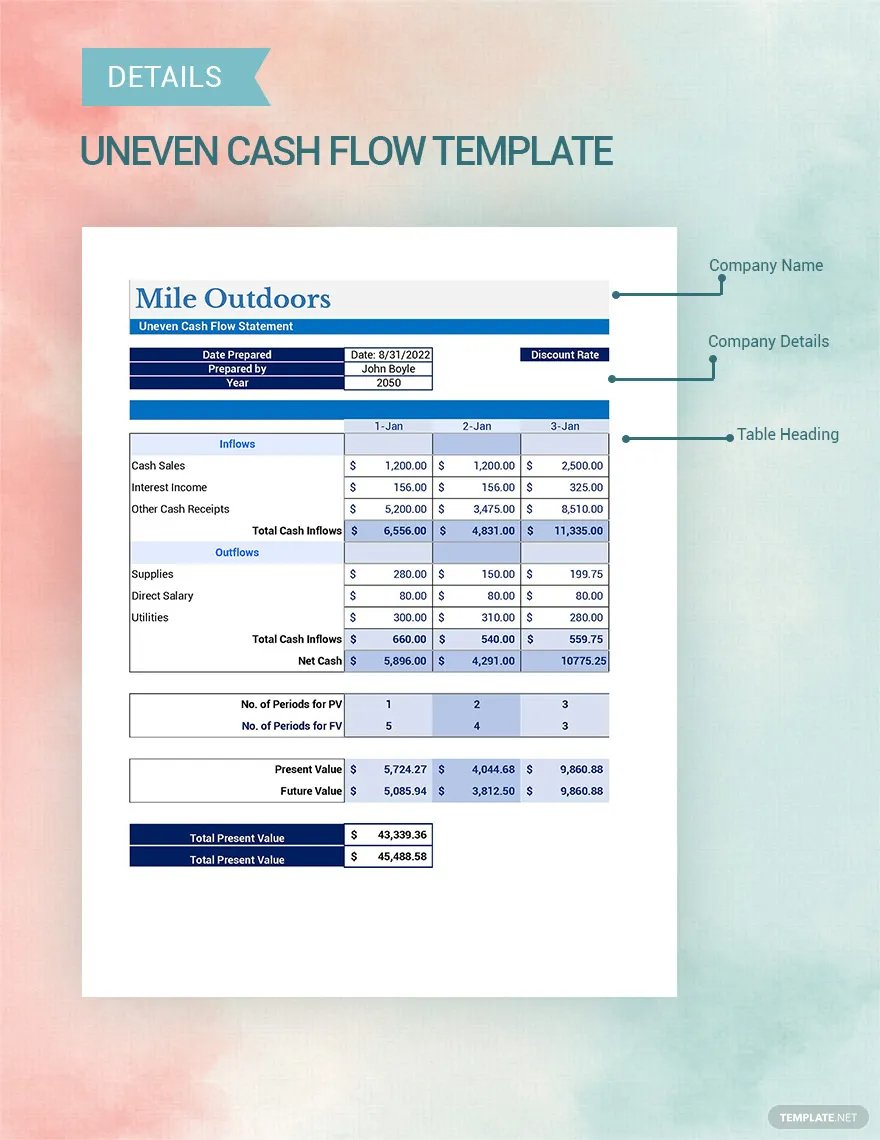

Uneven Cash Flow

A sequence of unequal payments made over a specific time frame is referred to as uneven cash flow. It could be related to any number of financial circumstances, including capital budgeting. Important components of appraising all types of investments include both fixed and uneven cash flows. A financial equation is used to calculate the present value of several potential future cash flows.

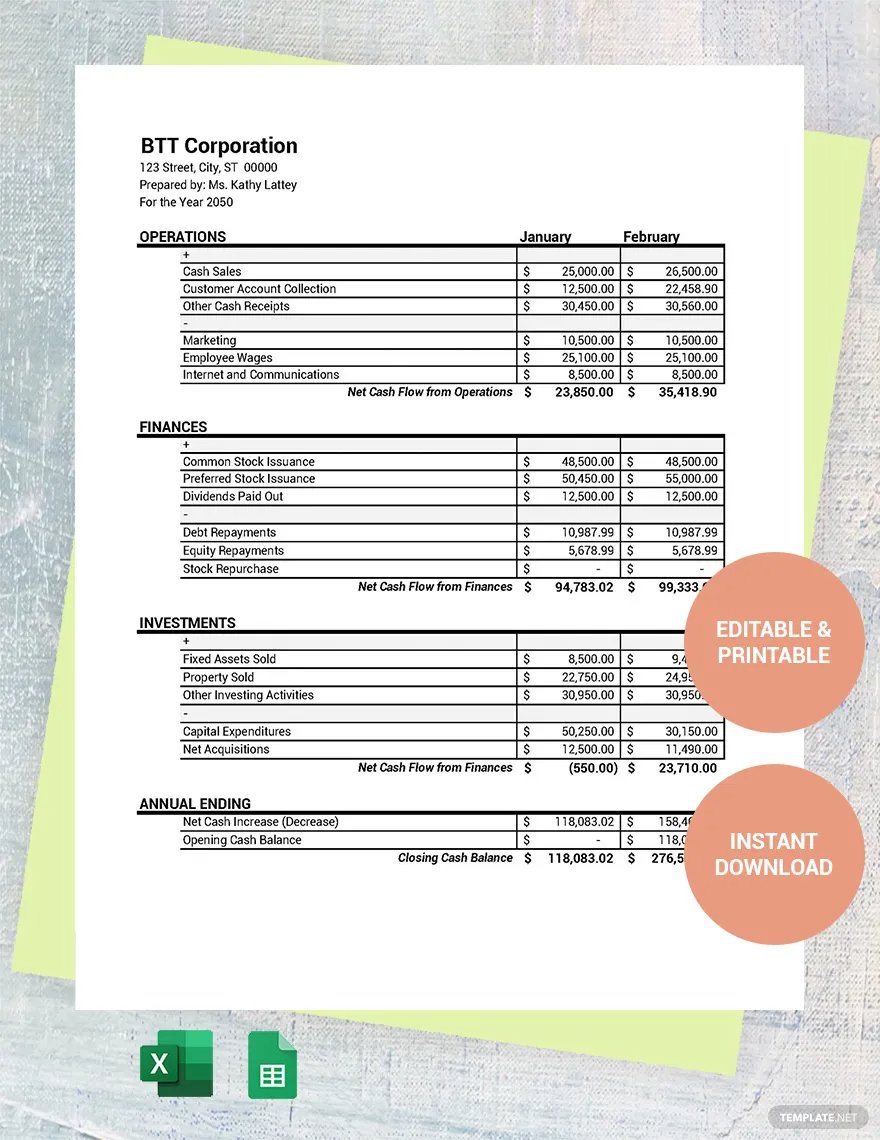

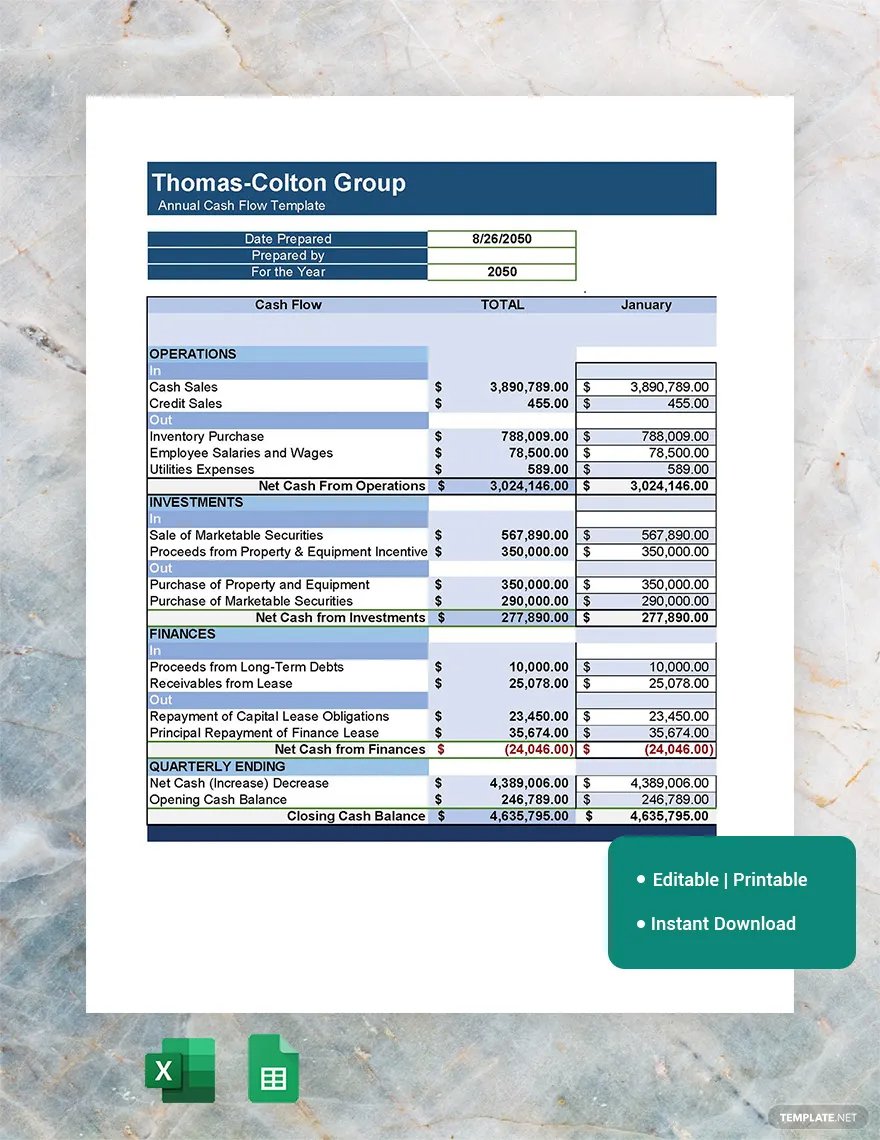

Annual Cash Flow

Annual cash flow is the firm’s net income from operations before interest, taxes, debts, depreciation, and amortization. Every quarter, it is calculated on a trailing 12-month basis. Additionally, it refers to a sum that is equal to the consolidated cash flow for the relevant calendar year and any amounts that need to be appropriately adjusted by the administrator in its reasonable discretion to account for any mergers and acquisitions that take place after the effective date.

Cash Flow Uses, Purpose, Importance

You must give great importance to your cash flow statement if you want your company to be strong and successful. Making better business decisions over time may be aided by knowing where your company is in terms of cash flow. Cash flow, like accounts payable, business expenses, and accounts receivable, is essential to any company’s performance, regardless of the industry.

Comprehend How Money is Being Spent

You’ll have a better idea of where you’re currently spending money if you manage cash flow effectively. The knowledge you obtain can be used to aid in making wiser business decisions. It can involve lowering certain operating costs, researching loan payments, or working on a cash flow study.

Improve Decision-Making and Planning Skills

Knowing exactly where your money is and how much is available at any given time allows you to manage your cash flow effectively. Learning this will be important when making plans and decisions. It can assist in avoiding costly errors that could endanger your company.

Safeguard Your Business Connections

If you are not aware of where your firm stands or if you are having cash flow problems, your relationship with your business partners may suffer. You don’t want poor cash flow activity to damage your reputation as a small business owner. Making sure you have the resources required to pay suppliers on time may be made easier by having payment schedules in place.

Assessment of the Entity’s Cash Balance

The assessment of the entity’s cash balance at a particular point in time is the cash flow statement’s primary goal. The cash balance refers to the specifics of the organization’s financial movements solely. Every organization’s accounting function uses different techniques to record revenues and expenses, such as accruals and prepayments.

Crucial for Accrual-Basis Accounting

Cash flow statements, together with income statements and balance sheets, are the most important financial documents for small business owners. If your organization uses accrual-basis accounting instead of cash-basis accounting, you must regularly compare the earnings on your income statement to the actual cash inflow and outflow on your statement of cash flows. You run the danger of inadvertently spending money if you list a payment even though you won’t be reimbursed immediately after finishing a project.

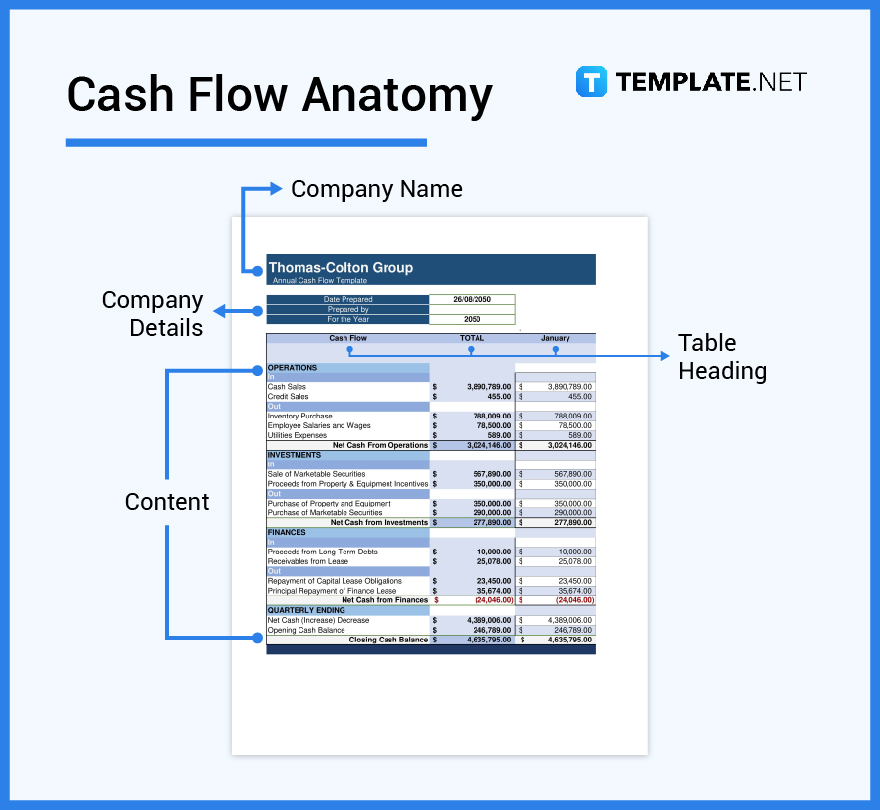

What’s in a Cash Flow? Parts?

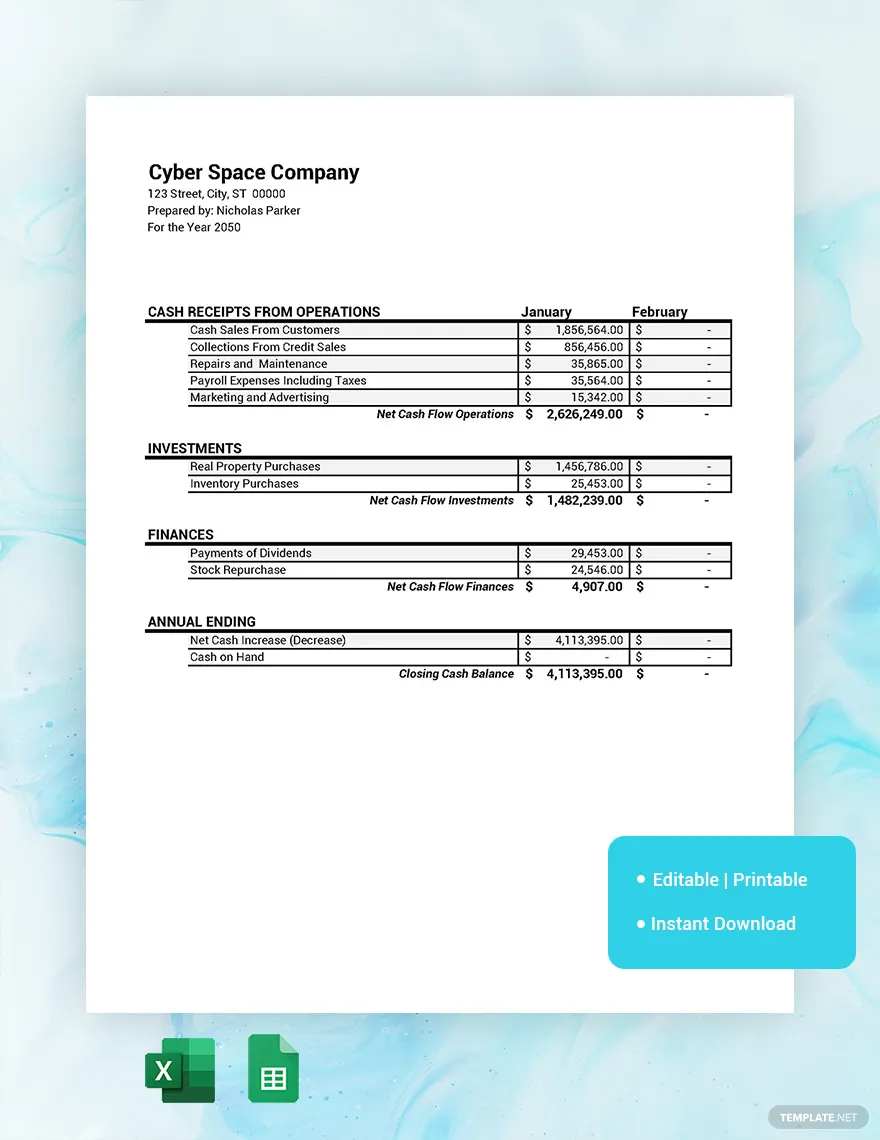

Company Name

The first and most important part of the cash flow document is your company name. This information is the first thing to be written in the statement.

Company Details

The next part of the cash flow document is the company details. This is the area where you can include the name of the person who prepared the cash flow statement, the period of the cash flow, as well as the preparation time and date.

Table Heading

The table heading acts as the division of the listed amounts entered into the cash flow document. There are usually three sections categorized under this part.

Content

The content is where you input all of the information about the cash flows of your company. These include the opening balance, cash inflows, cash outflows, net cash flow, and closing balance.

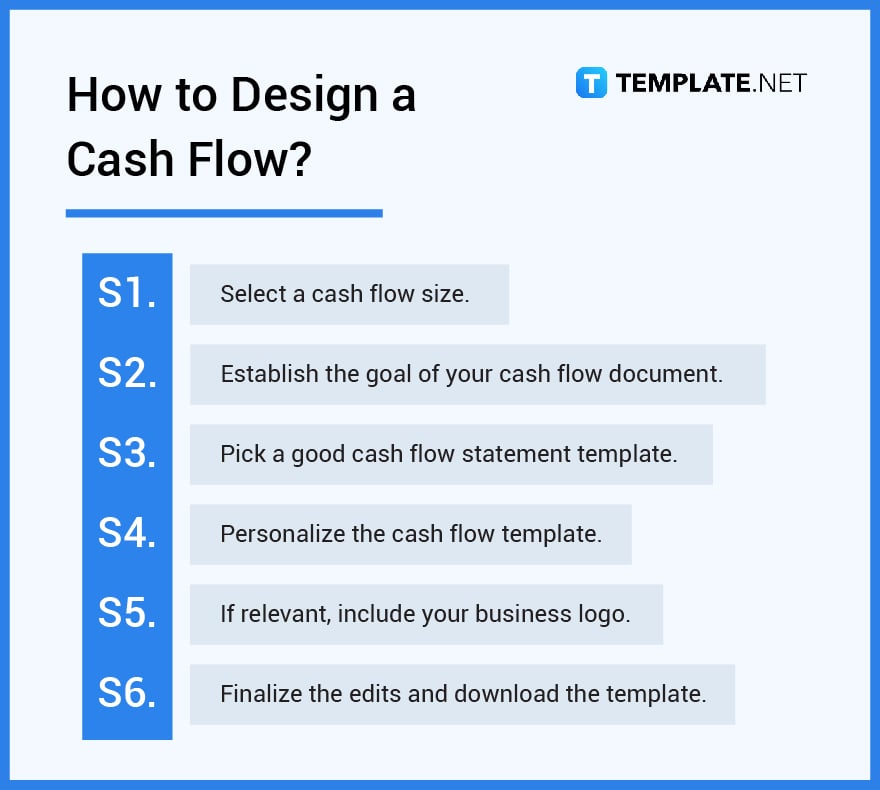

How to Design a Cash Flow

1. Select a Cash Flow Size.

2. Establish the goal of your cash flow document.

3. Pick a good Cash Flow Statement Template.

4. Personalize the cash flow template.

5. If relevant, include your business logo.

6. Finalize the edits and download the template.

Cash Flow vs. Income Statement

The cash flow statement, which is divided into operating, investing, and financing categories, helps determine the business’s liquidity and solvency, which in turn affects the present and future cash flows.

The income statement, which is divided into operational and non-operating operations, is useful for determining the company’s profitability.

What’s the Difference Between Cash Flow, Revenue, and Budget?

Cash flow is the total of a corporation’s net cash inflow and outflow during a specific timeframe.

Revenue is the sum of money a business generates over a certain period that also contains the total amount (discounts and deductions)of product returns.

A budget is a representation of earnings and expenses for a given future time.

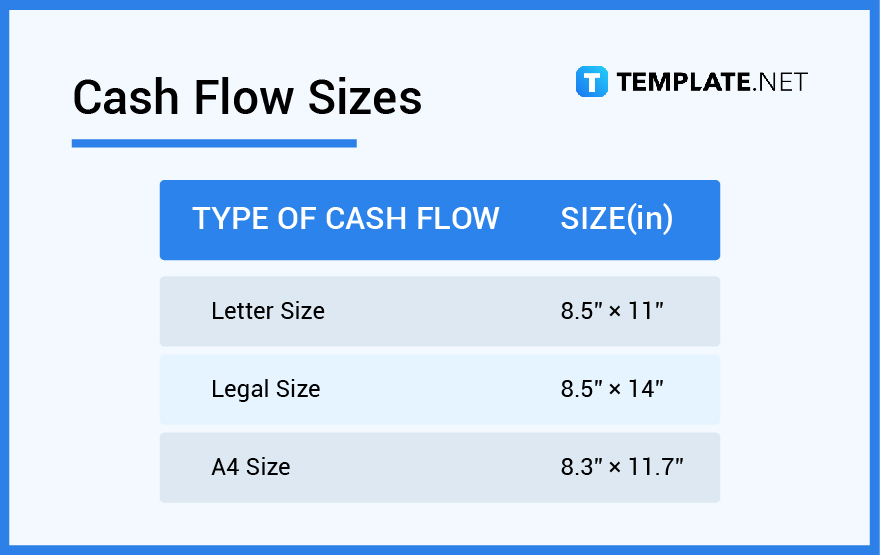

Cash Flow Sizes

You can find various cash flow sizes that you can work with if you need to generate a cash flow document using Microsoft Excel or print one for your company. Make sure to pick the right one for a more presentable document.

Cash Flow Ideas & Examples

There are many different styles and features available for cash flow statements, all of which are intended to be practical and helpful to businesses. Having said that, there are numerous cash flow ideas and examples that can assist you in understanding the various components of this document and serve as motivation for making one.

- Cash Flow Ideas and Examples

- Cash Flow Analysis Ideas and Examples

- Monthly Cash Flow Management Ideas and Examples

- Discounted Cash Flow Ideas and Examples

- Personal Cash Flow Ideas and Examples

- Cash Flow Statement Ideas and Examples

- Daily Cash Flow Ideas and Examples

- SaaS Cash Flow Forecast Ideas and Examples

- Cash Flow Forecasting Ideas and Examples

- Simple Cash Flow Ideas and Examples

- Freelance Cash Flow Sheet Ideas and Examples

FAQs

What should a cash flow statement contain?

A cash flow statement should contain your company name, company details, table heading, and cash flow content (including the opening balance, cash inflows, cash outflows, net cash flow, and closing balance).

What is the impact of cash flow on business?

A positive cash flow allows you more money to invest in your business development plan’s expenses, like new equipment or a new facility, giving you greater freedom to reinvest.

What are considered cash flows?

All of the cash or currency involved in your business, specifically those generated by your business operations, investments, and financing.

What happens when cash flow is negative?

When you spend more money than you bring into your business, you have negative cash flow, which results in your bank accounts gradually being emptied, leaving you with less and less cash over time.

What is the cash flow from investing activities?

The portion of a company’s cash flow statement under cash flow from investing activities shows how much money was spent on (or profit was made from) making investments during a specific period.

What does cash flow tell you?

The cash flow statement (CFS), also known as the statement of cash flows, is a financial statement that lists the total amount of cash and cash equivalents coming into and going out of a business.

What is a good cash flow to sales?

A good cash flow to sales ratio ranges between 10% and 55%.

What makes an effective cash flow?

Effective cash flow results in positive cash flow and shows that a company’s liquid assets are growing, allowing it to meet commitments, reinvest in its operations, return capital to shareholders, pay expenses, and act as a safety net against upcoming financial difficulties.

What are the factors that influence cash flow?

Overhead expenditures and indirect costs are the two most common factors that could have an impact on your company’s cash flow.

What factors affect the level and riskiness of cash flows?

The factors affecting the level and riskiness of cash flows include manager decisions, external environments, and long-term and short-term debt.