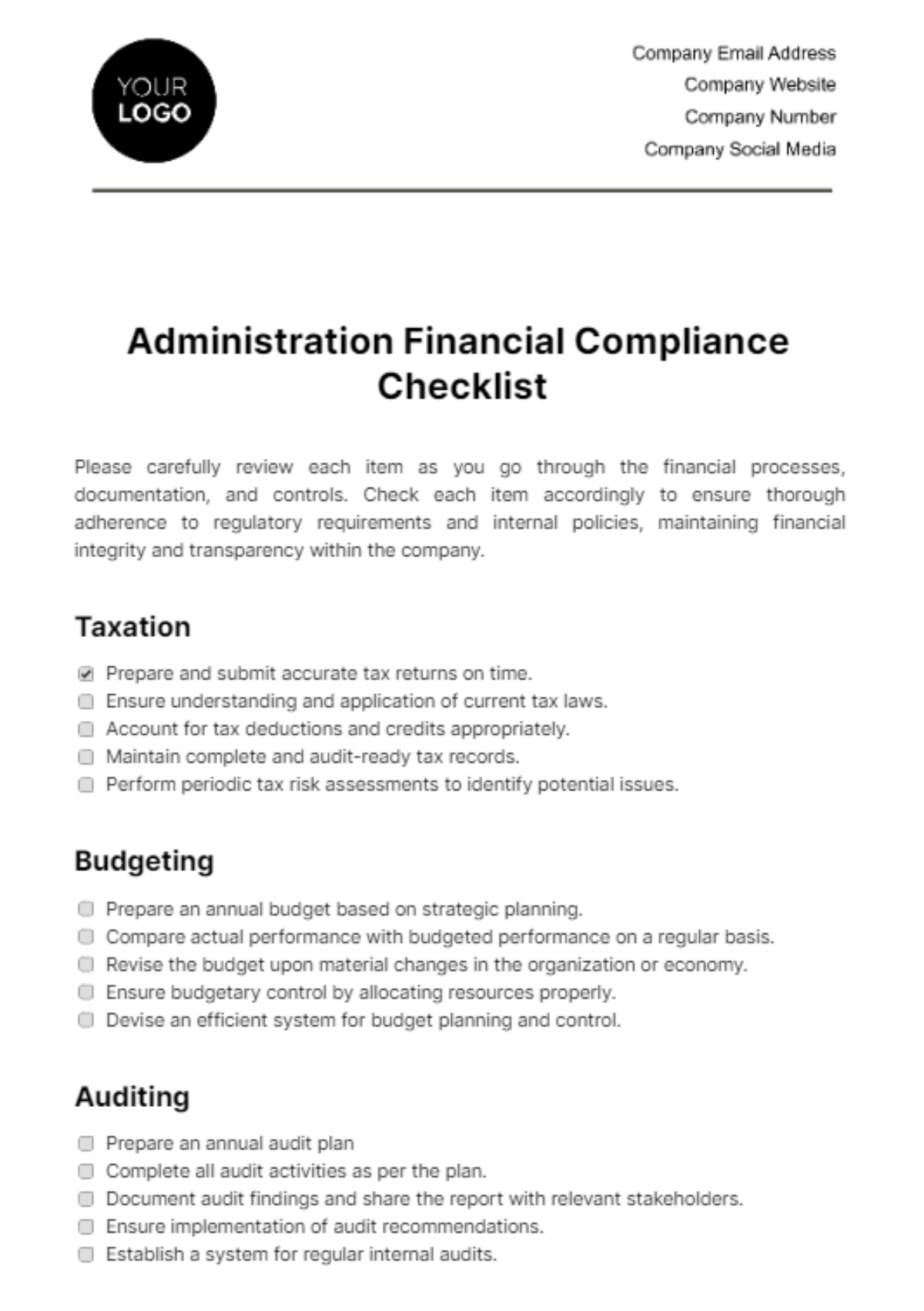

Free Administration Financial Compliance Checklist

Please carefully review each item as you go through the financial processes, documentation, and controls. Check each item accordingly to ensure thorough adherence to regulatory requirements and internal policies, maintaining financial integrity and transparency within the company.

Taxation

Prepare and submit accurate tax returns on time.

Ensure understanding and application of current tax laws.

Account for tax deductions and credits appropriately.

Maintain complete and audit-ready tax records.

Perform periodic tax risk assessments to identify potential issues.

Budgeting

Prepare an annual budget based on strategic planning.

Compare actual performance with budgeted performance on a regular basis.

Revise the budget upon material changes in the organization or economy.

Ensure budgetary control by allocating resources properly.

Devise an efficient system for budget planning and control.

Auditing

Prepare an annual audit plan

Complete all audit activities as per the plan.

Document audit findings and share the report with relevant stakeholders.

Ensure implementation of audit recommendations.

Establish a system for regular internal audits.

Reporting and Financial Analysis

Generate regular financial reports and statements.

Conduct performance analysis against the set budget.

Ensure accurate and timely reporting to stakeholders (Board, management, etc.).

Analyze financial trends and predict future positions.

Review and update financial forecast models regularly.

Internal Control

Implement a well-documented financial policies and procedures.

Ensure segregation of duties among staff.

Perform timely reconciliation of accounts.

Establish appropriate approval authorities.

Identify and classify risks associated with access controls.

Risk Management

Identify financial risks and establish a risk register.

Develop risk mitigation strategies.

Install a regular risk reporting and monitoring system.

Provide periodic risk management training to staff.

Ensure continuous improvements in risk management.

- 100% Customizable, free editor

- Access 1 Million+ Templates, photo’s & graphics

- Download or share as a template

- Click and replace photos, graphics, text, backgrounds

- Resize, crop, AI write & more

- Access advanced editor

Template.net offers the Administration Financial Compliance Checklist Template, an essential tool for businesses! This editable template provides a comprehensive framework for managing financial compliance, ensuring a smooth audit process. With our AI Editor Tool, it is conveniently customizable to fit your specific needs, making the compliance process seamless and efficient!

You may also like

- Cleaning Checklist

- Daily Checklist

- Travel Checklist

- Self Care Checklist

- Risk Assessment Checklist

- Onboarding Checklist

- Quality Checklist

- Compliance Checklist

- Audit Checklist

- Registry Checklist

- HR Checklist

- Restaurant Checklist

- Checklist Layout

- Creative Checklist

- Sales Checklist

- Construction Checklist

- Task Checklist

- Professional Checklist

- Hotel Checklist

- Employee Checklist

- Moving Checklist

- Marketing Checklist

- Accounting Checklist

- Camping Checklist

- Packing Checklist

- Real Estate Checklist

- Cleaning Checklist Service

- New Employee Checklist

- Food Checklist

- Home Inspection Checklist

- Advertising Checklist

- Event Checklist

- SEO Checklist

- Assessment Checklist

- Inspection Checklist

- Baby Registry Checklist

- Induction Checklist

- Employee Training Checklist

- Medical Checklist

- Safety Checklist

- Site Checklist

- Job Checklist

- Service Checklist

- Nanny Checklist

- Building Checklist

- Work Checklist

- Office Checklist

- Training Checklist

- Website Checklist

- IT and Software Checklist

- Performance Checklist

- Project Checklist

- Startup Checklist

- Education Checklist

- Home Checklist

- School Checklist

- Maintenance Checklist

- Planning Checklist

- Manager Checklist

- Wedding Checklist

- Vehicle Checklist

- Travel Agency Checklist

- Vehicle Inspection Checklist

- Interior Design Checklist

- Backpacking Checklist

- Business Checklist

- Legal Checklist

- Nursing Home Checklist

- Weekly Checklist

- Recruitment Checklist

- Salon Checklist

- Baby Checklist

- Equipment Checklist

- Trade Show Checklist

- Party Checklist

- Hospital Bag Checklist

- Evaluation Checklist

- Agency Checklist

- First Apartment Checklist

- Hiring Checklist

- Opening Checklist

- Small Business Checklist

- Rental Checklist

- College Dorm Checklist

- New Puppy Checklist

- University Checklist

- Building Maintenance Checklist

- Work From Home Checklist

- Student Checklist

- Application Checklist