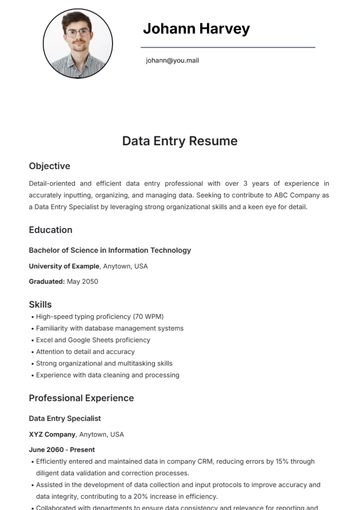

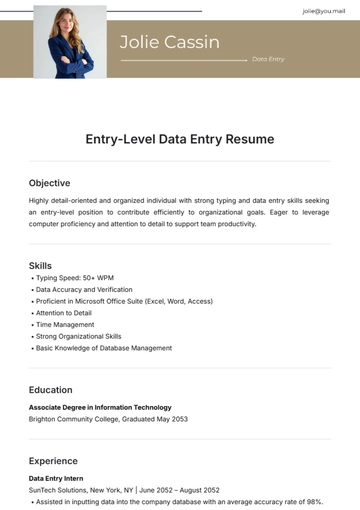

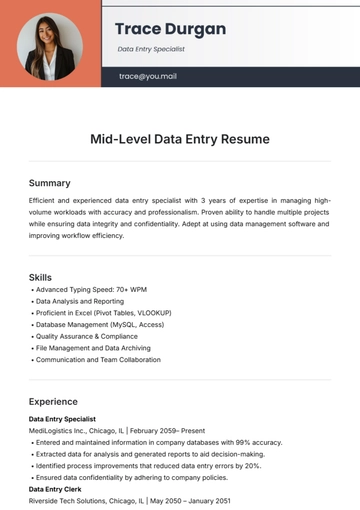

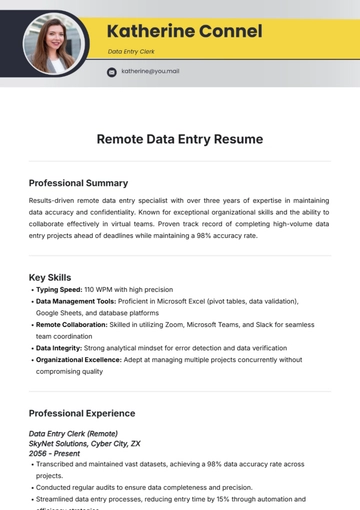

Free Tax Exempt Data Entry Clerk Resume

Objective

Detail-oriented and efficient Data Entry Clerk with 5 years of work experience, proficient in tax-exempt regulations and data management. Fluent in English and Spanish, I am strongly committed to accuracy and efficiency in data entry tasks. With a 28-year-old female, born on June 15th, I aim to leverage my skills and experience to contribute effectively to the operations of a tax-exempt organization, ensuring compliance and supporting financial transparency.

Education

Bachelor of Science in Accounting

[University Name], [City, State] [Year of Graduation]

Skills

Proficient in data entry with a typing speed of 70 words per minute

Strong attention to detail and accuracy in data input

Familiarity with tax-exempt regulations and terminology

Excellent knowledge of Microsoft Office Suite, particularly Excel and Access

Experience with database management software such as Salesforce and

QuickBooks

Ability to prioritize tasks and meet deadlines in a fast-paced environment

Experience

Data Entry Clerk

[Tax-Exempt Organization Name], [City, State], [Year] - Present

Perform accurate and efficient data entry of financial transactions into the organization's database

Ensure compliance with tax-exempt regulations and maintain confidentiality of sensitive information

Collaborate with the finance team to reconcile discrepancies and resolve data entry errors

Generate reports and assist in financial analysis as needed

Provide administrative support to the finance department, including filing and organizing documents

Data Entry Intern

[Non-Profit Organization Name], [City, State], [Year] - [Year]

Assisted in the data entry of donor information and contribution records

Conducted research to verify donor eligibility for tax-exempt status

Provided administrative support to the fundraising team, including preparing mailings and organizing fundraising events

Participated in team meetings and contributed ideas for improving data entry processes

Volunteer Experience

Tax Assistance Volunteer

[Local Tax Assistance Program], [City, State], [Year] - [Year]

Assisted low-income individuals and families in preparing and filing their tax returns

Provided information on tax credits and deductions available to eligible taxpayers

Completed IRS training and passed certification exam to become a certified tax preparer

Ensured accuracy and compliance with tax laws and regulations while maintaining client confidentiality

References

Available upon request

- 100% Customizable, free editor

- Access 1 Million+ Templates, photo’s & graphics

- Download or share as a template

- Click and replace photos, graphics, text, backgrounds

- Resize, crop, AI write & more

- Access advanced editor

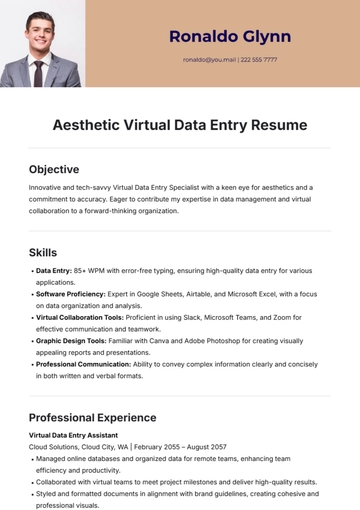

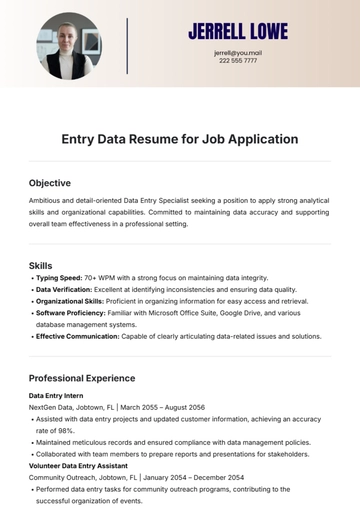

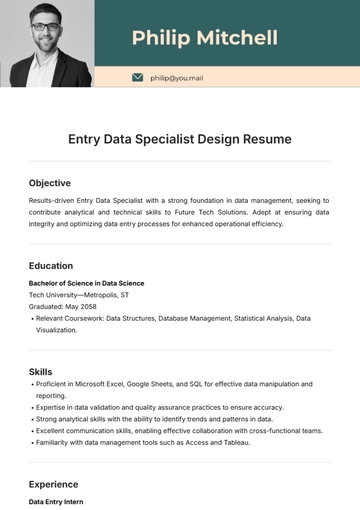

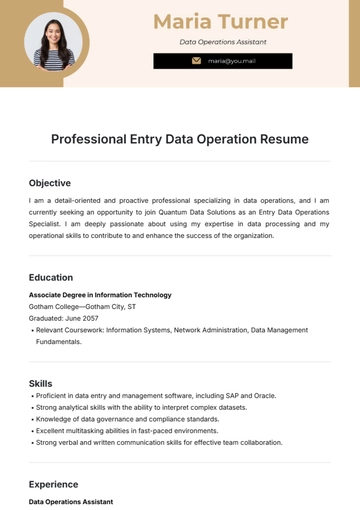

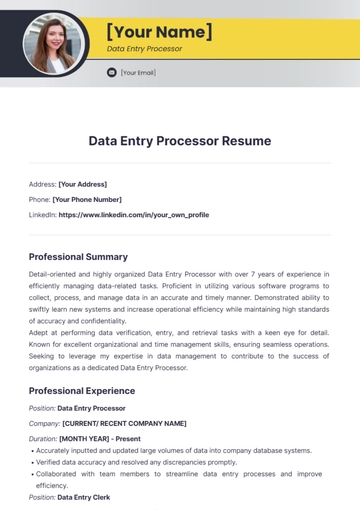

Elevate your career with the Tax Exempt Data Entry Clerk Resume offered by Template.net. This highly customizable template is designed for precision and professionalism. Easily downloadable and printable, it ensures your credentials stand out. Benefit from the convenience of editing in our AI Editor Tool, making your resume perfect for any job application.

You may also like

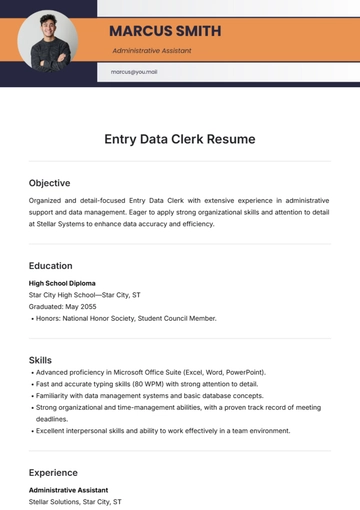

- Simple Resume

- High School Resume

- Actor Resume

- Accountant Resume

- Academic Resume

- Corporate Resume

- Infographic Resume

- Sale Resume

- Business Analyst Resume

- Skills Based Resume

- Professional Resume

- ATS Resume

- Summary Resume

- Customer Service Resume

- Software Engineer Resume

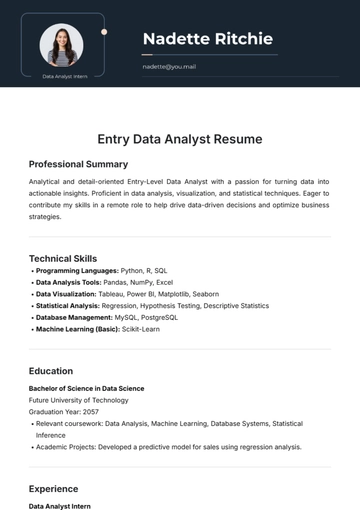

- Data Analyst Resume

- Functional Resume

- Project Manager Resume

- Nurse Resume

- Federal Resume

- Server Resume

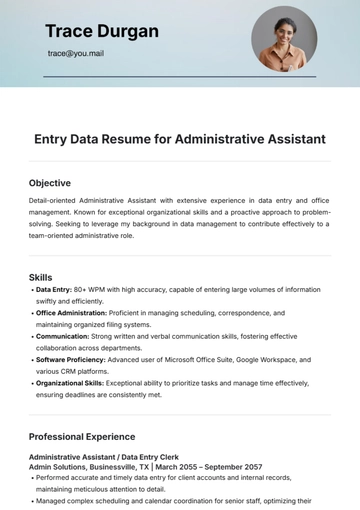

- Administrative Assistant Resume

- Sales Associate Resume

- CNA Resume

- Bartender Resume

- Graduate Resume

- Engineer Resume

- Data Science Resume

- Warehouse Resume

- Volunteer Resume

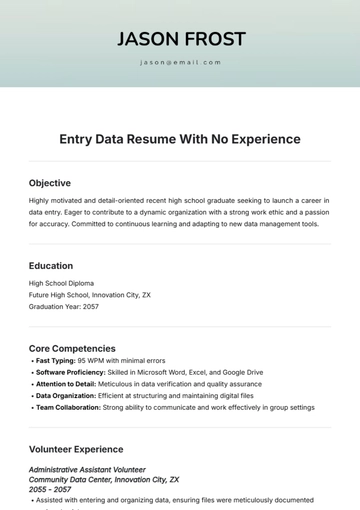

- No Experience Resume

- Chronological Resume

- Marketing Resume

- Executive Resume

- Truck Driver Resume

- Cashier Resume

- Resume Format

- Two Page Resume

- Basic Resume

- Manager Resume

- Supervisor Resume

- Director Resume

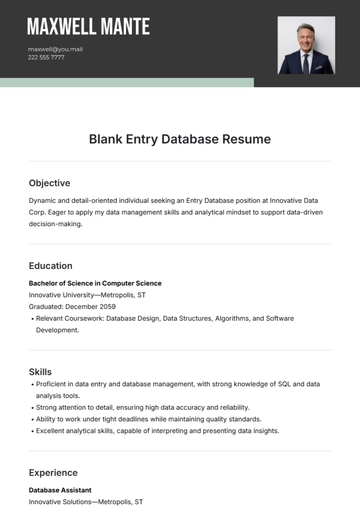

- Blank Resume

- One Page Resume

- Developer Resume

- Caregiver Resume

- Personal Resume

- Consultant Resume

- Administrator Resume

- Officer Resume

- Medical Resume

- Job Resume

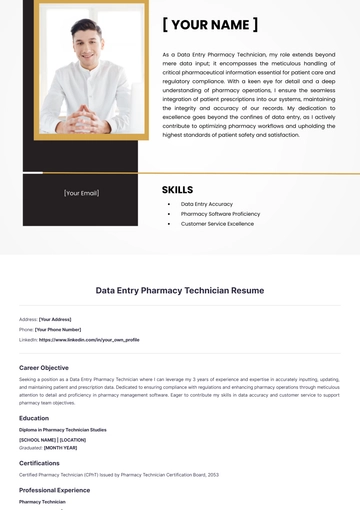

- Technician Resume

- Clerk Resume

- Driver Resume

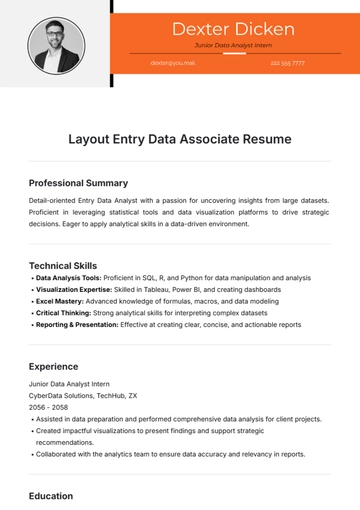

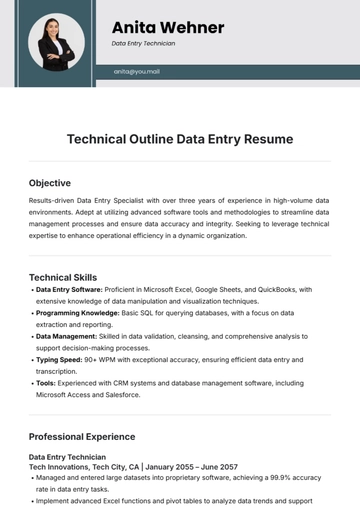

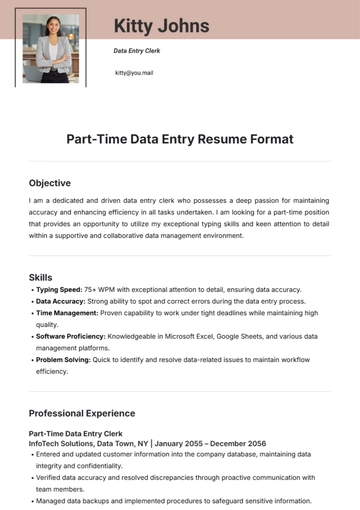

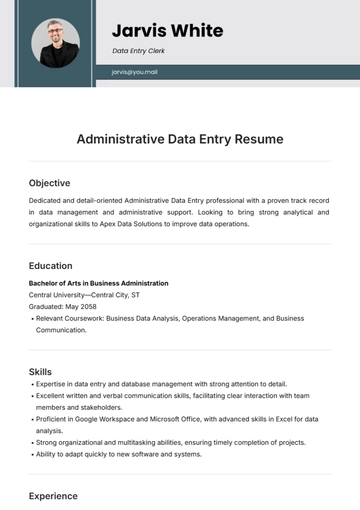

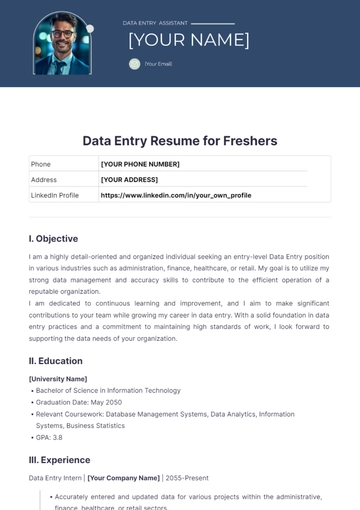

- Data Entry Resume

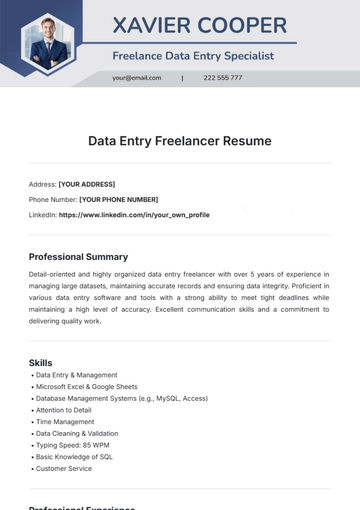

- Freelancer Resume

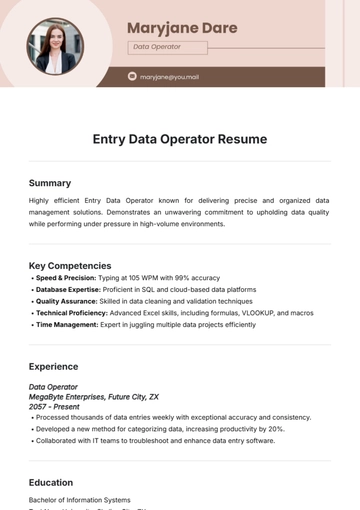

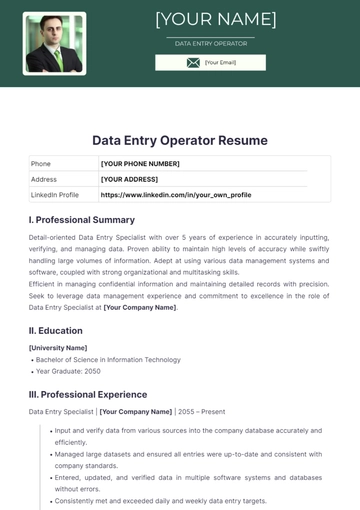

- Operator Resume

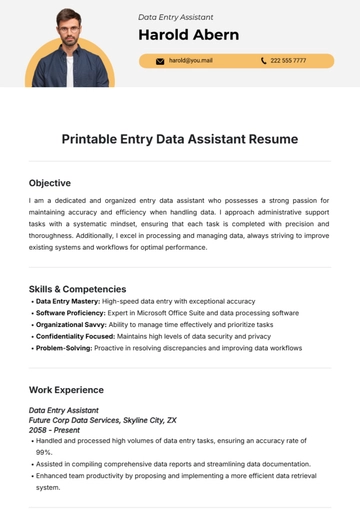

- Printable Resume

- Worker Resume

- Student Resume

- Doctor Resume

- Merchandiser Resume

- Architecture Resume

- Photographer Resume

- Chef Resume

- Lawyer Resume

- Secretary Resume

- Customer Support Resume

- Computer Operator Resume

- Programmer Resume

- Pharmacist Resume

- Electrician Resume

- Librarian Resume

- Computer Resume

- IT Resume

- Experience Resume

- Instructor Resume

- Fashion Designer Resume

- Mechanic Resume

- Attendant Resume

- Principal Resume

- Professor Resume

- Safety Resume

- Waitress Resume

- MBA Resume

- Security Guard Resume

- Editor Resume

- Tester Resume

- Auditor Resume

- Writer Resume

- Trainer Resume

- Advertising Resume

- Harvard Resume

- Receptionist Resume

- Buyer Resume

- Physician Resume

- Scientist Resume

- 2 Page Resume

- Therapist Resume

- CEO resume

- General Manager Resume

- Attorney Resume

- Project Coordinator Resume

- Bus Driver Resume

- Cook Resume

- Artist Resume

- Pastor Resume

- Recruiter Resume

- Team Leader Resume

- Apprentice Resume

- Police Resume

- Military Resume

- Personal Trainer Resume

- Contractor Resume

- Dietician Resume

- First Job Resume

- HVAC Resume

- Psychologist Resume

- Public Relations Resume

- Support Specialist Resume

- Computer Technician Resume

- Drafter Resume

- Foreman Resume

- Underwriter Resume

- Photo Resume

- Teacher Resume

- Modern Resume

- Fresher Resume

- Creative Resume

- Internship Resume

- Graphic Designer Resume

- College Resume