How a Credit Report is Different from a Credit Score

Your credit report and credit score are two of the most crucial elements needed for a credit application. Unfortunately, there are still a lot of people who have a hard time distinguishing the definition and role of each credit terms. Although credit report and credit score may sound alike, they have entirely different definitions and functions. In this article, we will get to know the difference between a credit report and credit score and why it is crucial to keep the tabs on the two terms.

What’s a Credit Report

According to an article that is published in Wikipedia, “A credit report is a record of the borrower’s credit history from a number of sources, including banks, credit card companies, collection agencies, and governments”. Hence, you can say that a credit report shows a compilation of essential data on how a person deals with his or her debt. It basically contains information about the amount of debt that has been accumulated, the amount that has been paid, the home and work address, Social Security number of the debtor, as well as any information on mortgages, bankruptcy, and foreclosed and repossessed properties, such as home and vehicles. Oftentimes, lenders and investors determine the credit worthiness of person or entrepreneur by the information found in his or her credit report.

Basic Elements of a Credit Report

Total Number of Accounts

The credit report often shows both the person’s current and delinquent accounts, including the active and closed accounts. The report also shows the following information:

- Type of accounts

- The date the accounts were opened

- Monthly payments made

- Outstanding balances

Account History

The account history that is shown in your credit report includes essential information on the person’s payment status, credit limit, high balances, and annual payment history.

Public Records

Public records such as bankruptcy, the amount of assets and exempts, liabilities, reference number, and closing dates, are also found in your credit report. It also shows personal records such as overdue child support, tax liens, and country and state court records. This information will stay on the person’s record for up to seven years, depending on the type of account the borrower owns. However, credit reports do not include any conviction and arrest record of the borrower.

Payment History

A credit report is a great tool used by lenders to determine how well the borrower is able to manage all his or her obligations or debts. The information includes the amount that had been borrowed, business loans, car repayments, and other types of financing types. All this information are crucial in determining the borrower’s credit score.

Who Manages the Information on Your Credit Report

If you are living in the United States, there are three major credit bureaus or credit reporting agencies that manage your credit report information: Equifax, Experian, and TransUnion. Oftentimes, when you do business financial transactions, companies submit your debt information to one or three of the credit bureaus who will then update your credit report with the information that they received from the company. Credit card transactions and loan payments are updated monthly on your credit report.

While there are a few business establishments that do not regularly make updates on your credit report for your monthly payments, these establishments will send a notification to the credit bureaus if you fail to settle your monthly payment for a few times. Let us take for example; even if your telephone bill is not automatically listed on your credit report, the credit bureau will list it as a debt collection if you fail to settle your account for more than six months.

Obtaining Your Credit Report

Under the Fair Credit Reporting Act or FCRA, every borrower is entitled to a free credit report each of the three major credit bureaus per year. Once you have received your credit report, take some time to review the information that is recorded on the document and make sure that all the information that is listed on your credit report are accurate. If there is any inaccuracy on your credit report information, make sure to let the credit bureau know about it so that it will be addressed as soon as possible. Monitoring the information on your credit report regularly can help prevent potential credit report scam. In case you become a victim of identity theft, make sure to report it to the right authorities.

What’s a Credit Score

According to an article that is published in Forbes.com, “your credit score is a three-digit numerical grade that provides a snapshot of your credit-worthiness to credit card companies, mortgage lenders, auto lenders, etc. – pretty much anyone who wants to loan you money or extend you a line of credit”. Basically, your credit score is used to assess your credit risk as it provides the lender an overview of how well you are likely to repay your loan and make payments on time. There are various of ways in which credit bureaus calculate your credit score. Nonetheless, all three credit bureaus use a complex mathematical model that takes the borrower’s payment history, the amount of money loaned, types of credit, the period of credit history, and new credits into account. However, your present financial behavior may have a positive or negative effect on your credit score.

Basic Elements of a Credit Score

Since we already mentioned that a credit score plays an integral part in your ability to secure a loan, it is now time to know its basic elements and importance:

Payment History

A borrower’s credit score makes up 35 percent of your credit score. However, your payment history can be affected by certain factors, such as on-time or late payment and missed balances. While we all know that making on-time payments can yield positive scores, late or missed payments, foreclosure, tax liens, bankruptcy, and repossession can have a huge negative effect on your credit score.

Credit Utilization Ratio

Your credit utilization ratio makes up 30 percent of your credit score. Your revolving credit balances and the available credit in your name determine your credit utilization ratio. Although most financial institutions would like their clients to max out the use of their credit cards, high balance can have a negative effect on your credit score, even if you are able to make a full payment at the end of the month. Financial experts recommend credit card users to keep their credit utilization ratio just below 30 percent.

Credit History Period

The length of your credit history is the period of time in which your oldest account is kept open, and it makes up 15 percent of your credit score. If you keep your account open for a long period of time, your credit score will become higher.

New Credit and Credit Mix

If you are a new borrower, it is not recommended to open a number of credit lines all at the same time as it suggests the lender that you are having a financial trouble. Credit mix, on the other hand, can be considered to be a vague category. However, financial experts believed that when a borrower is able to repay different debts on time, it signifies that he or she is able to deal with all credits.

How to Check Your Credit Score

There are four essential factors to keep in mind if you are looking to access your credit score.

- You can access your credit score directly at the Fair Isaac Corporation or FICO website.

- You can contact the credit bureau and purchase a credit report from them.

- You can get your annual free credit report at AnnualCreditReport.com. All you have to do is choose your state and answer some questions.

Sample Credit Report Templates that You Can Download and Use

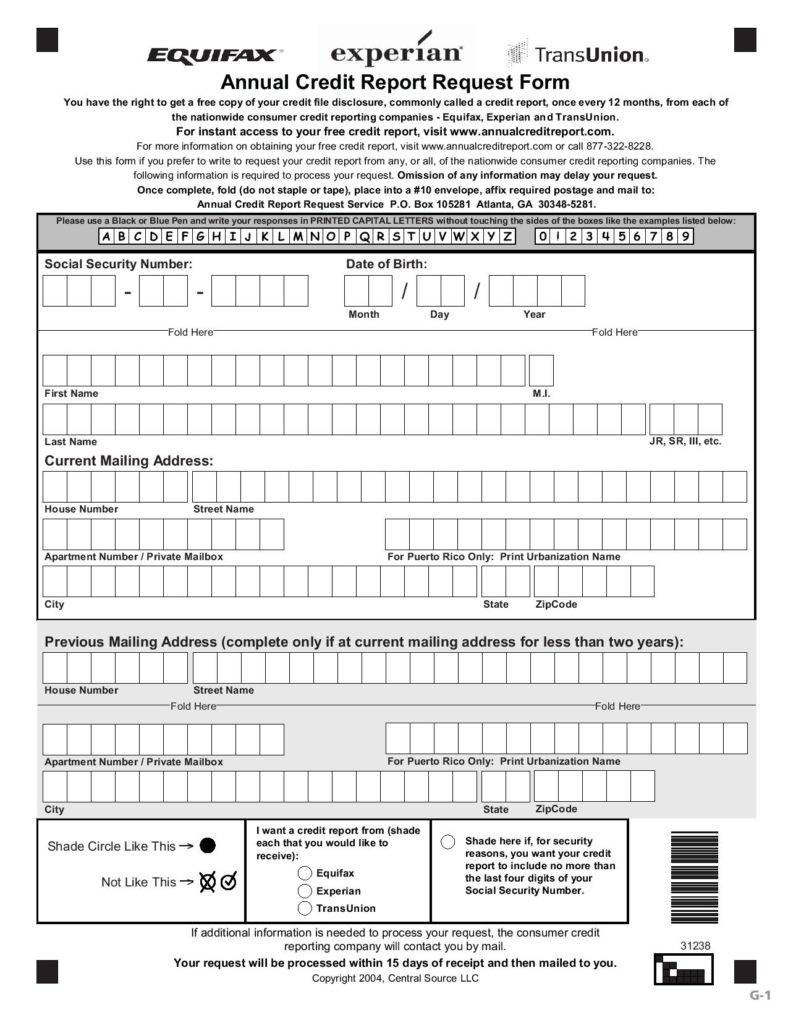

Best Annual Free Credit Report Request Form

consumer.ftc.gov

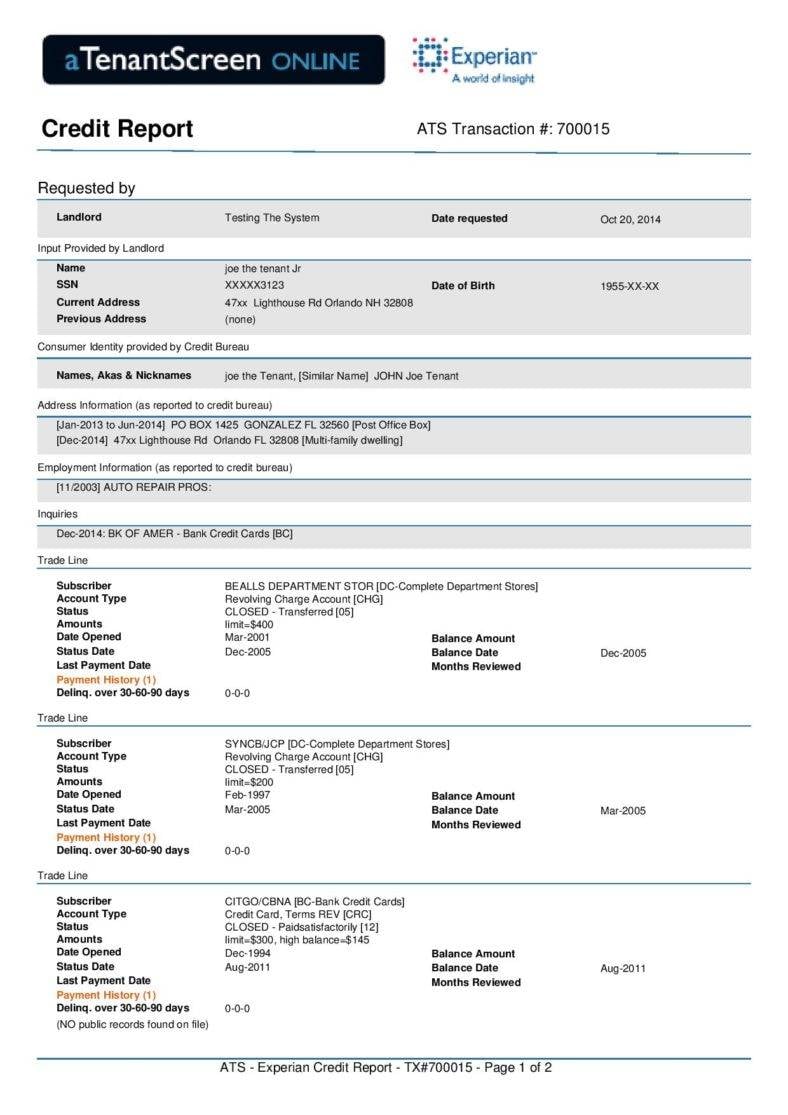

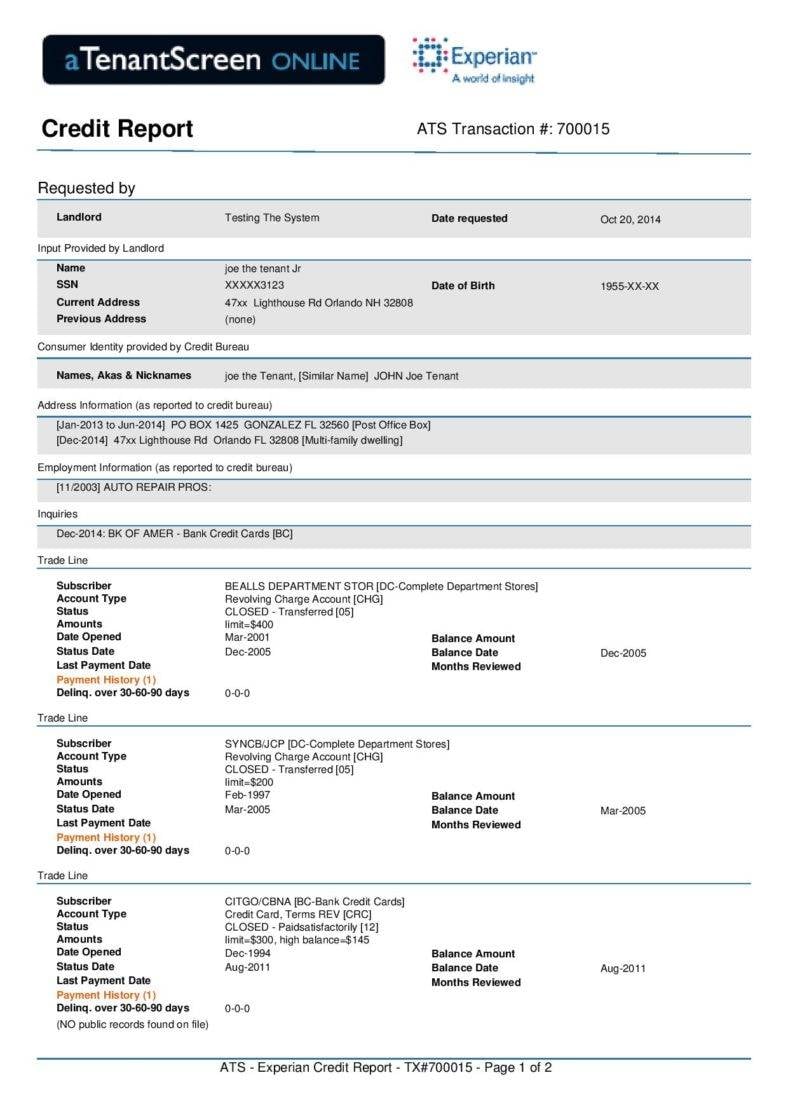

Free Experian Credit Report

atenantscreen.com

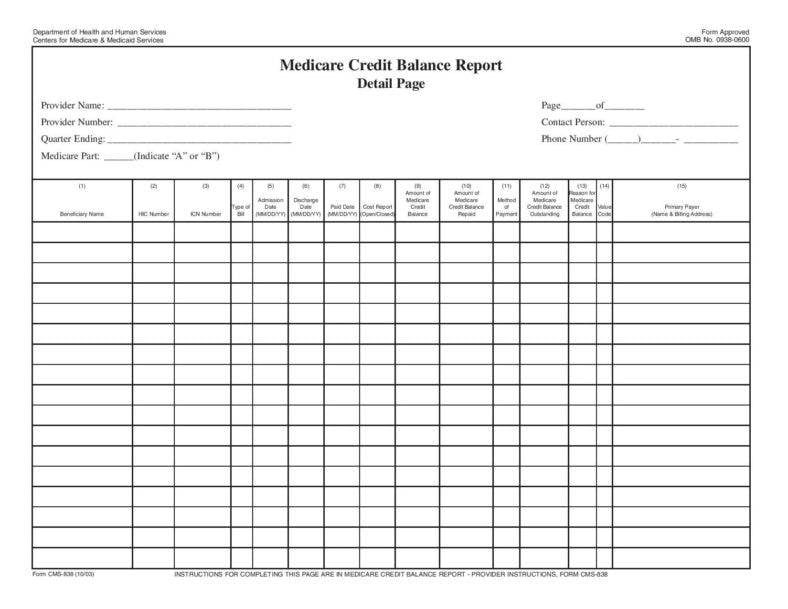

Credit Balance Report Template

cms.gov

Simple Credit Report

housing-rights.org

Free Credit Report

equifax.com

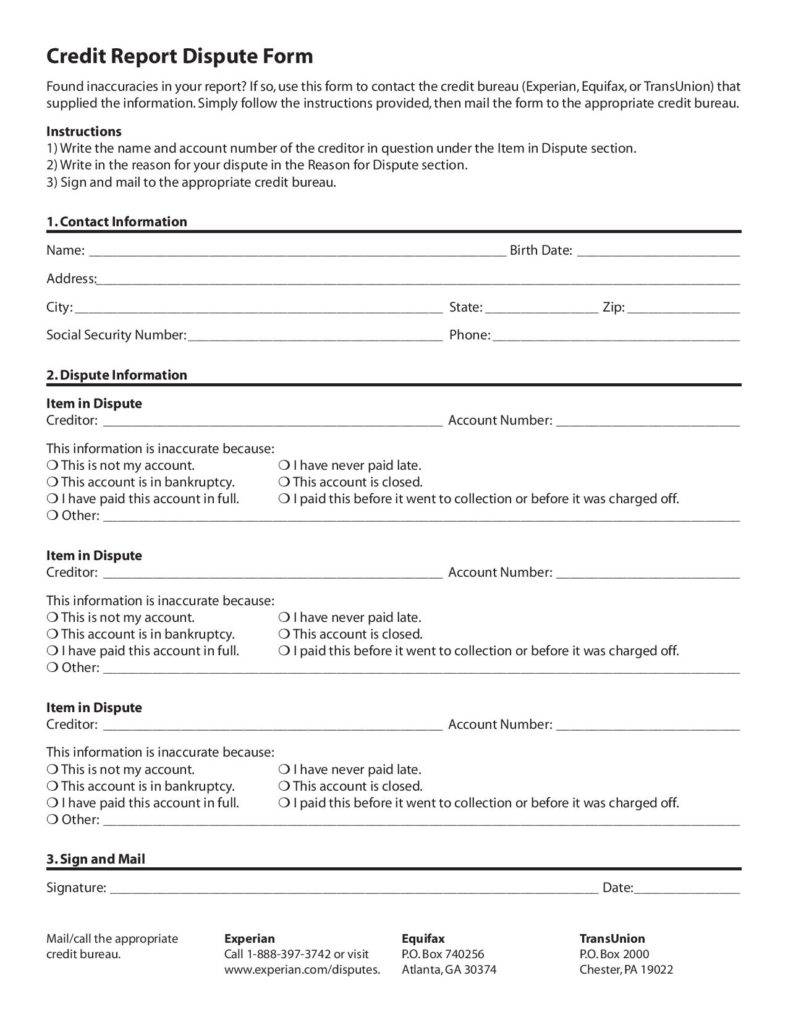

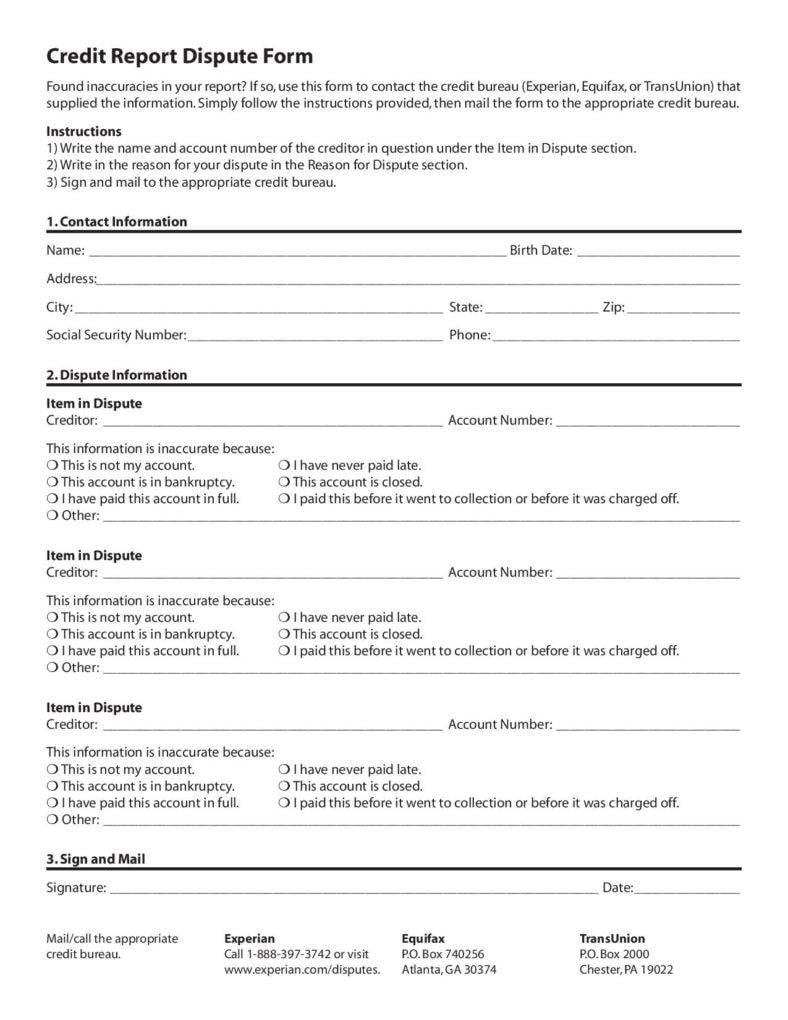

Free Credit Report Dispute Form

housing-rights.org

Sample Corporate Credit

businesscreditreports.com

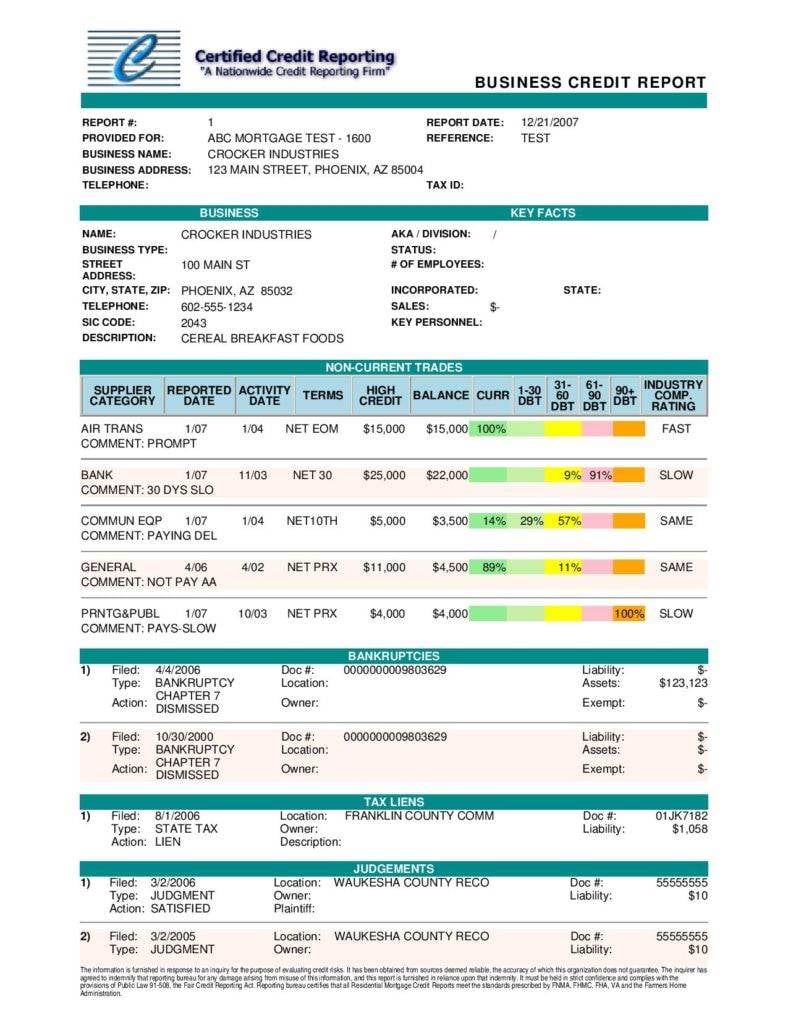

Free Business Credit Report

certifiedcredit.com

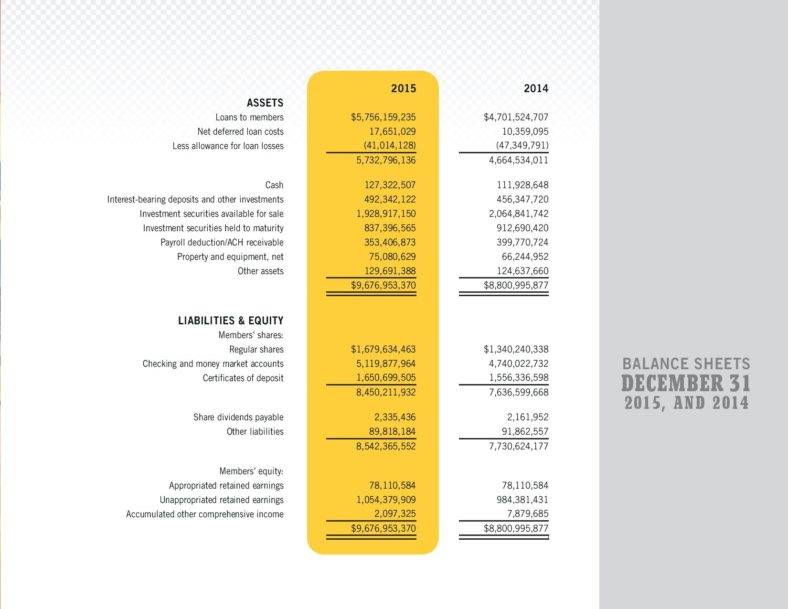

Credit Union Annual Report Template

golden1.com

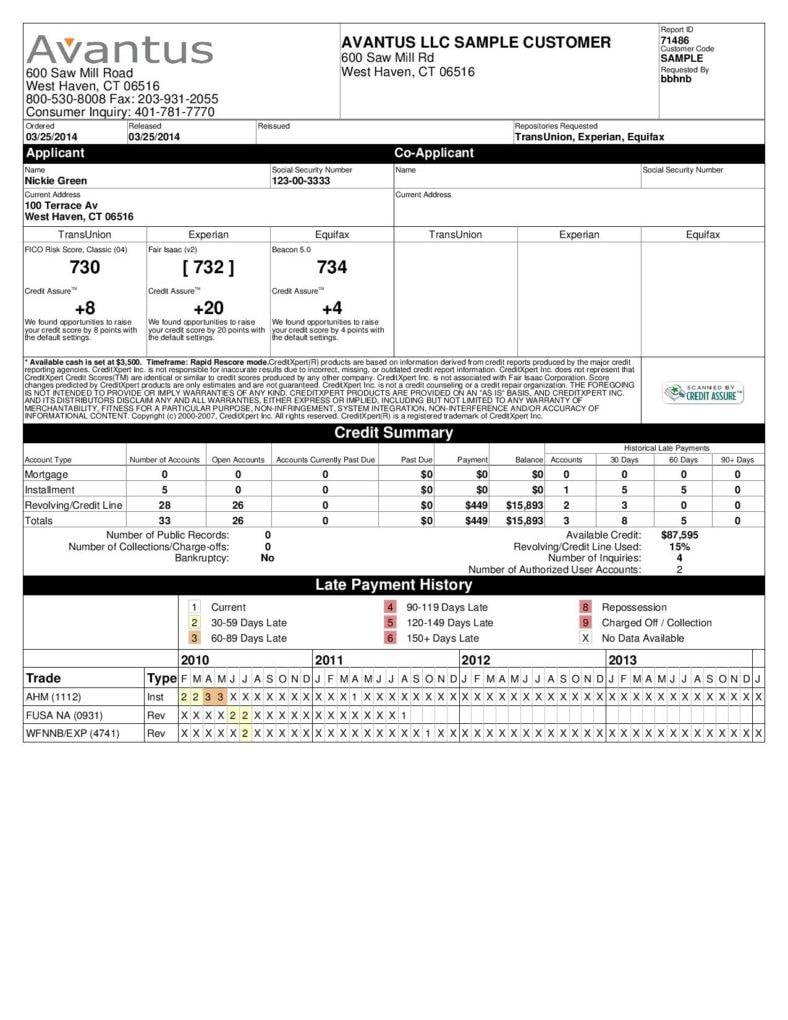

Merged Credit Report Template

avantus.com

Final Thoughts

Although a credit report and a credit score are two different entities with unique functions, they are extremely useful in securing loans for your business. And now that you are able to effectively distinguish the difference between the two credit terms, all you have left to do is to take some steps on how to improve them. As an entrepreneur, it is extremely important to understand that having a positive credit report and credit score is essential in growing and flourishing your business. That is why if you find yourself suffering from negative credit report and credit score, you should make a move to repair them, otherwise, it would be difficult for financial institutions to trust you.

Now that we have reached the end of this article, we would recommend you to browse through our collections of business templates. Make sure that you check out our article on 4 Reasons to Monitor Your Company Credit Report. You can also download our collection on credit note templates because they are available for free. So what are you waiting for? Download them now and use them as your reference.