Table of Contents

12+ Monthly Balance Sheet Templates

As a business owner, you are entitled to checking on the financial status of your company, aside from overseeing its day-to-day operations. Various tools enable you to conduct such financial checkups, however, nothing is simpler and more effective than a handy monthly balance sheet.

A monthly balance sheet is a business document that shows the company’s assets, liabilities, and equity up to the current month following a standardized format. It helps business owners check on their spending, especially in the aspect of gaining profit and getting in debts as investments. Although a monthly balance sheet has indeed a form to follow, there exists a lot of customization options. Browse through this article to see the widest variety of these monthly balance sheet templates and format.

12+ Monthly Balance Sheet Templates

Sample Monthly Balance Sheet Template

Monthly Balance Sheet Template

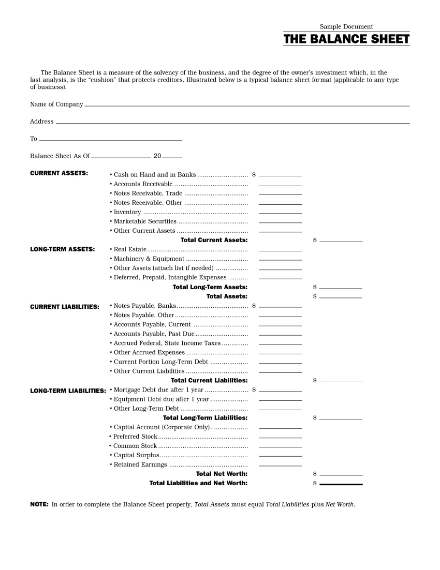

Balance Sheet Template

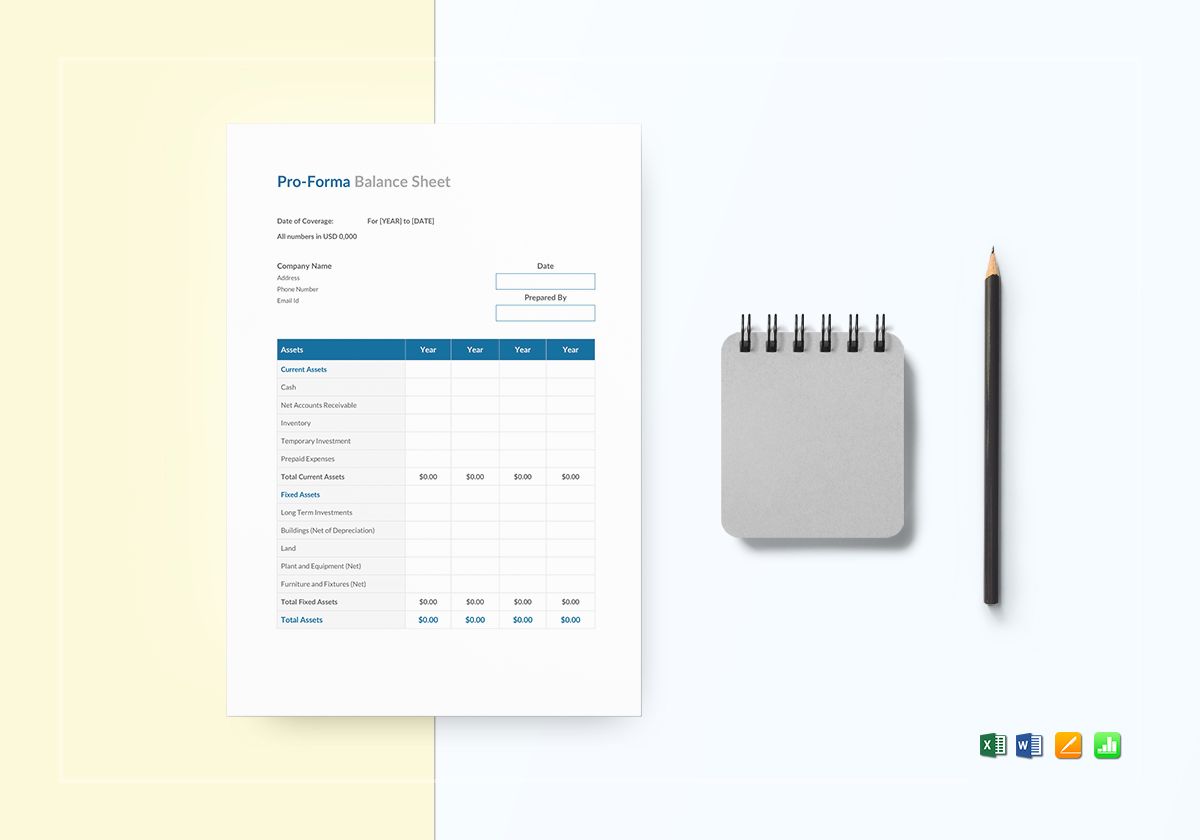

Proforma Balance Sheet Template

Elements of a Good Monthly Balance Sheet

1. Company Name: Your company name is important to be indicated in your balance sheet to give a sense of identification for your document. Auditors who will pore over your financial statements will also be able to verify that the monthly balance sheet they are checking is indeed from your company organization.

2. Time Period: A balance sheet is made to show a company’s assets, liabilities, and equity on a certain point over a period of time. In the case of a monthly balance sheet, you will be displaying your company’s financial position covered over a month.

3. Assets: The assets in your monthly balance sheet represent all of the goods and resources that your company owns. Common forms of assets are cash, stocks, bonds, supplies, inventory, and prepaid expenses. The sum of your company’s assets should be equal with your company’s liabilities and owner’s equity.

4. Liabilities: The liabilities in your monthly balance sheet accounts for all of the debts incurred up until the current month. They can be short-term debts and long-term debts as long as they are due for pay from your company. Liabilities can be accounts payable, mortgages, and pension plan obligations.

5. Equity: The owner’s equity in your balance sheet represents the money invested to the company, from the owner’s money put in to the investors funding support. The sum of the equity and liabilities should be equal with the company’s assets.

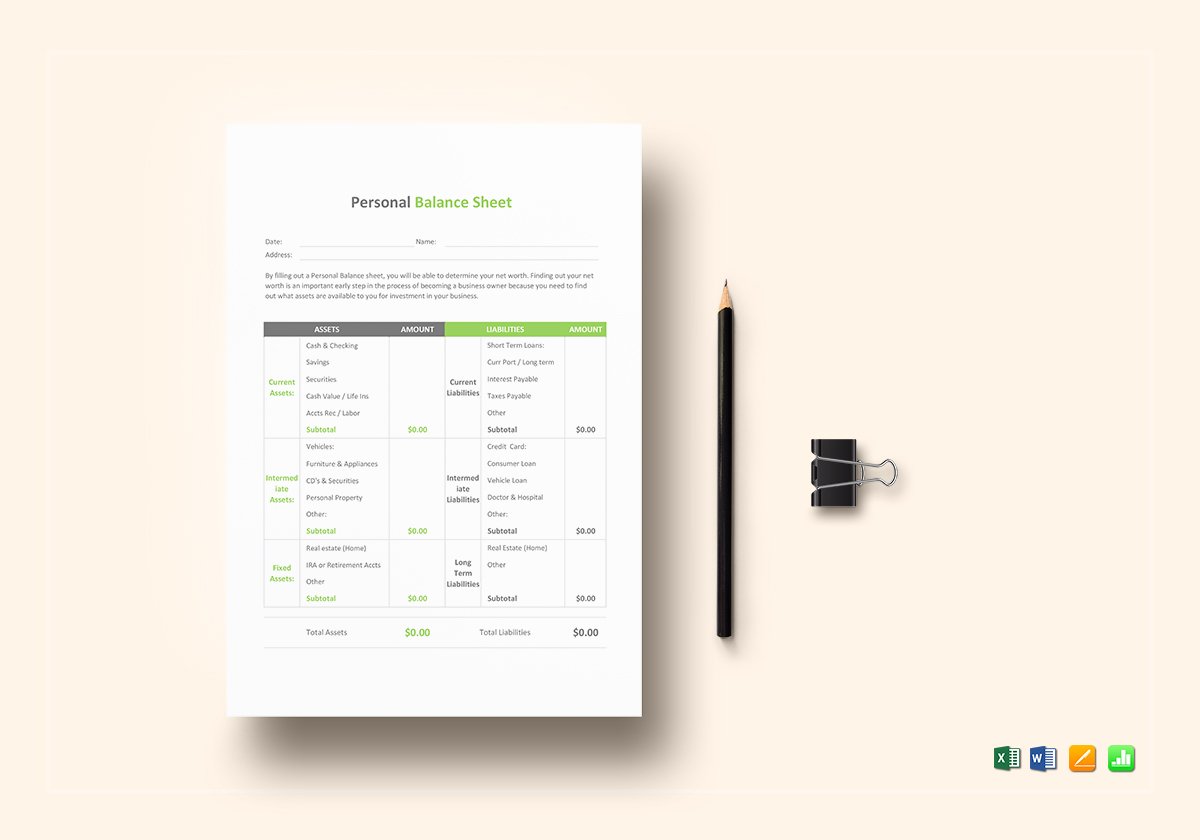

Personal Balance Sheet Template

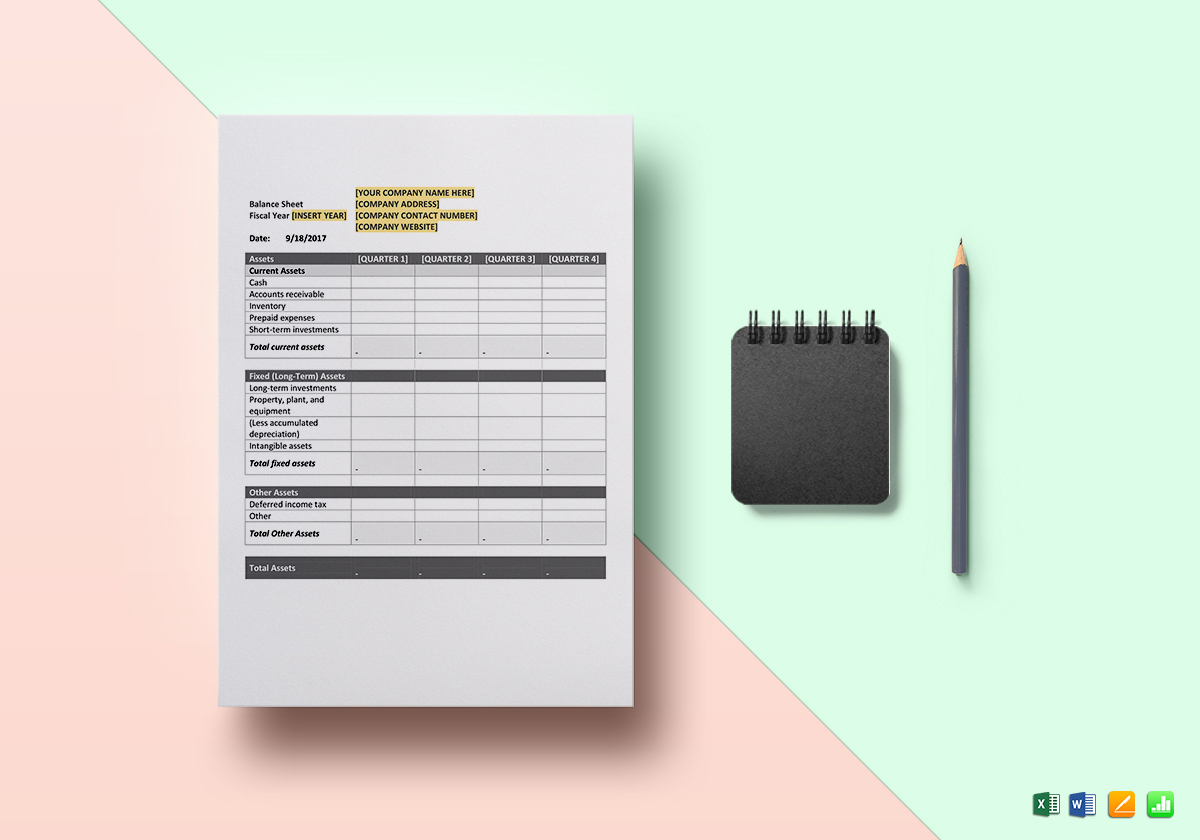

Quarterly Balance Sheet Template

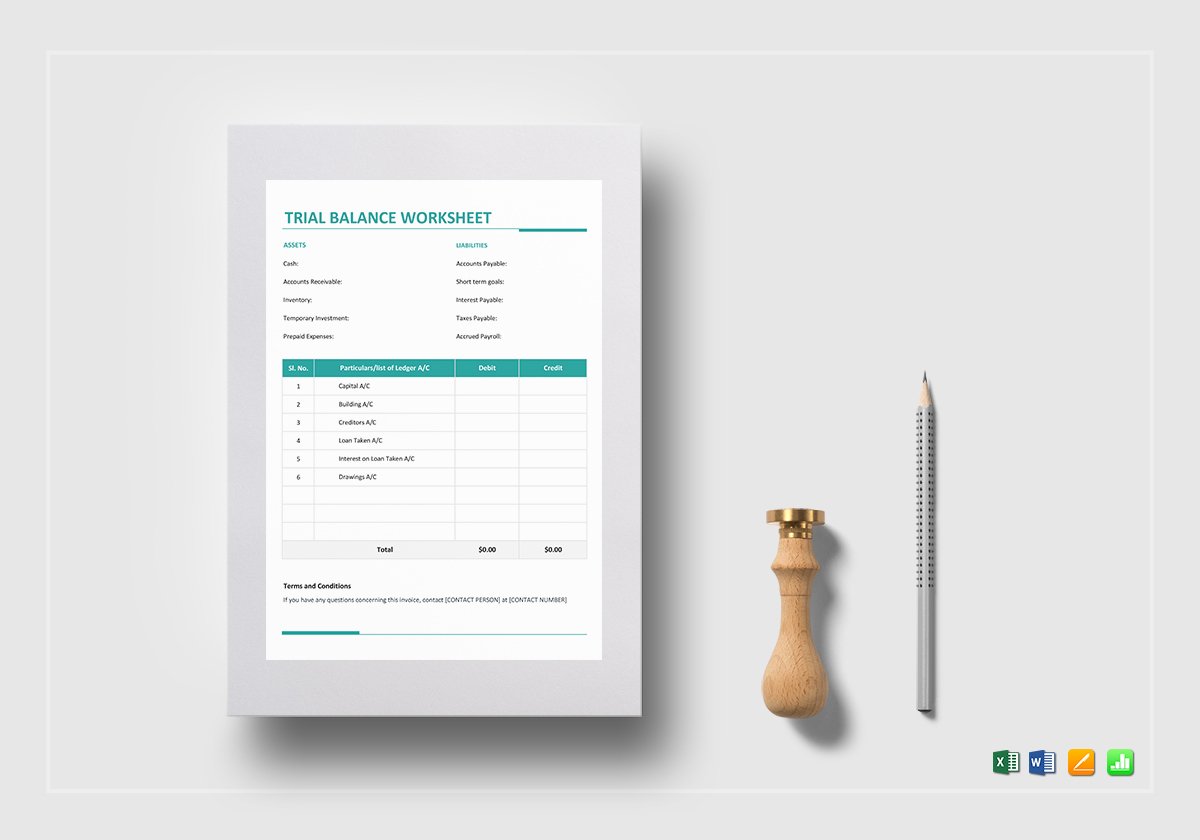

Trial Balance Worksheet Template

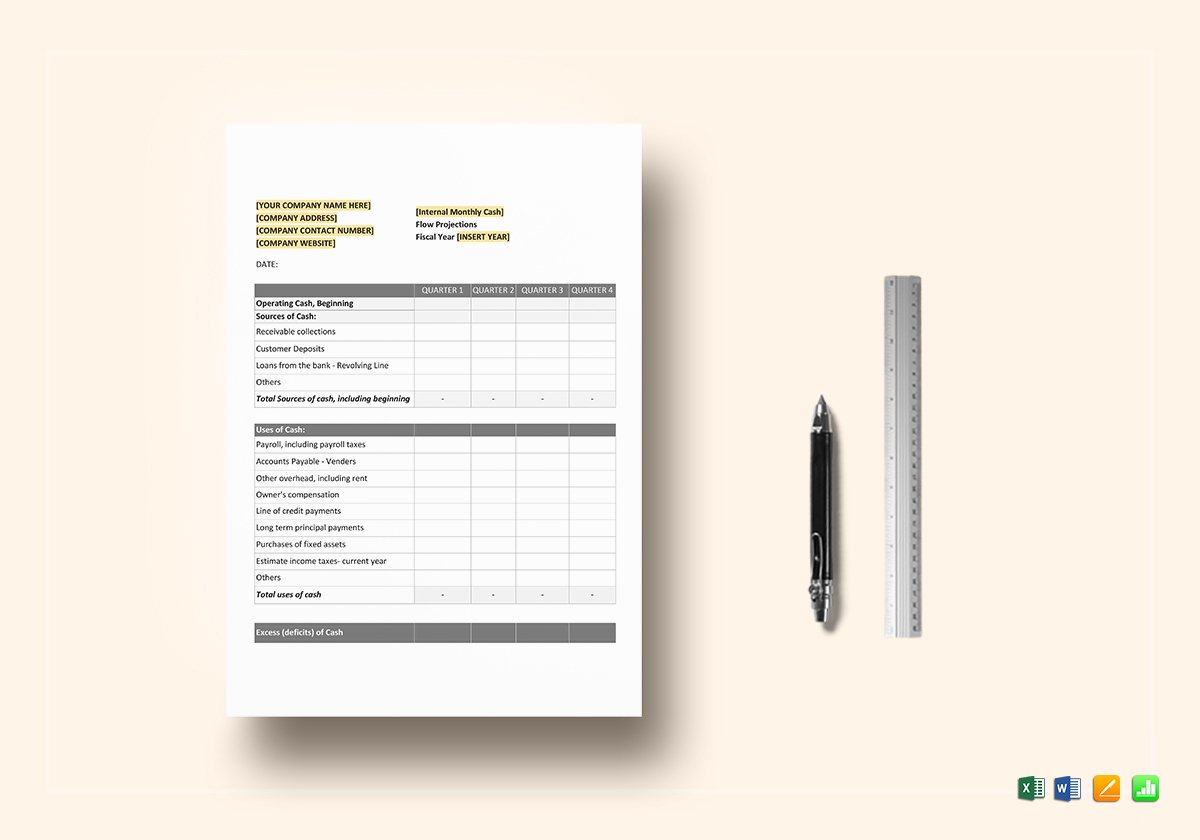

Monthly Cash Flow Forecast Template

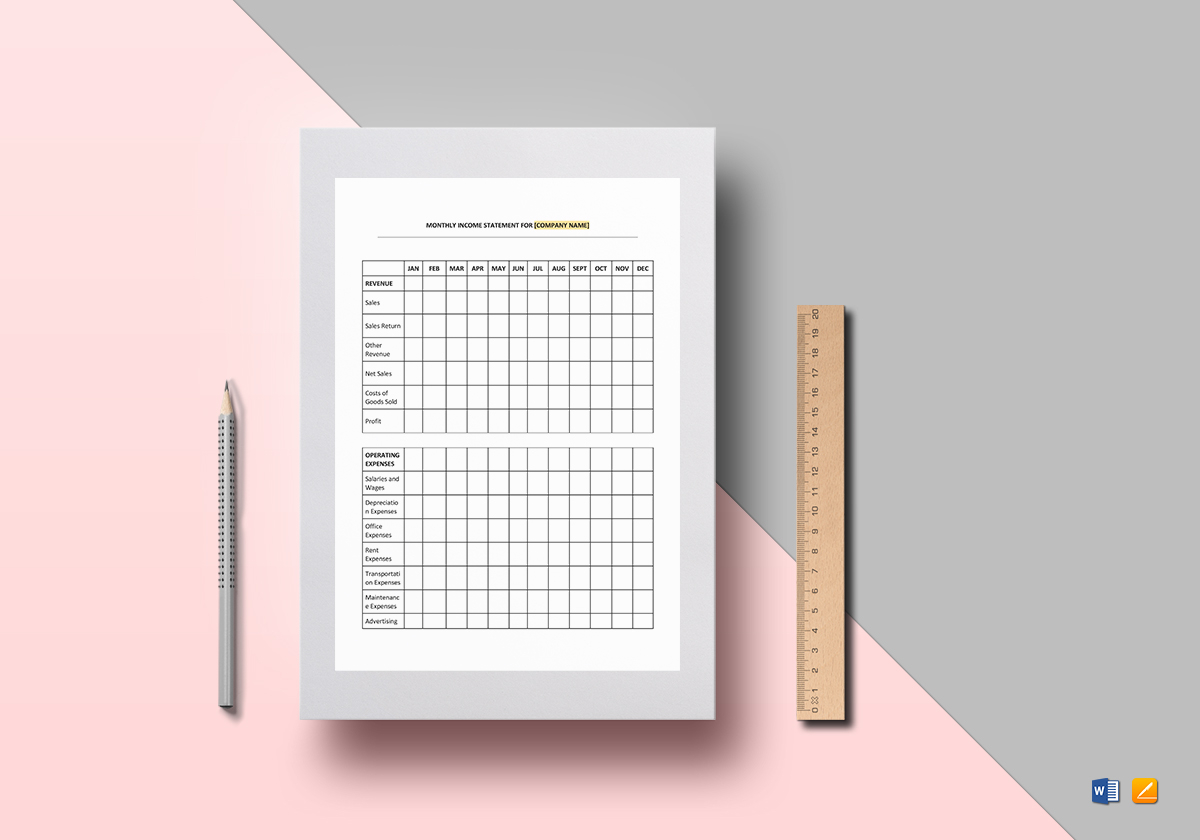

Income Statement Monthly Template

Business Balance Sheet

famemaine.com

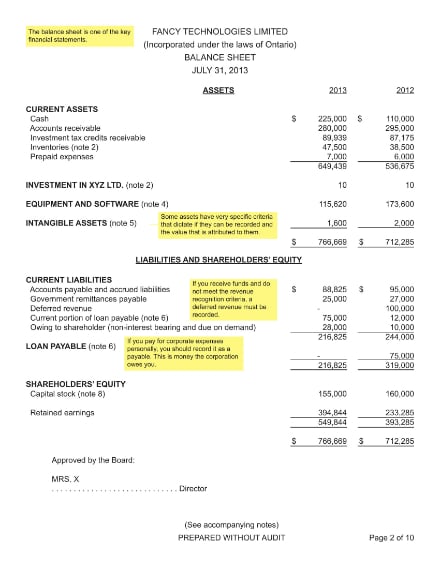

famemaine.comFinancial Balance Sheet Example

marsdd.com

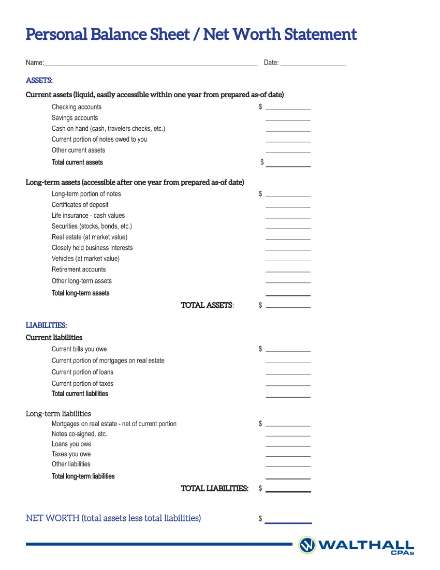

marsdd.comNet Worth Balance Sheet

walthall.com

walthall.comPersonal Balance Sheet Example

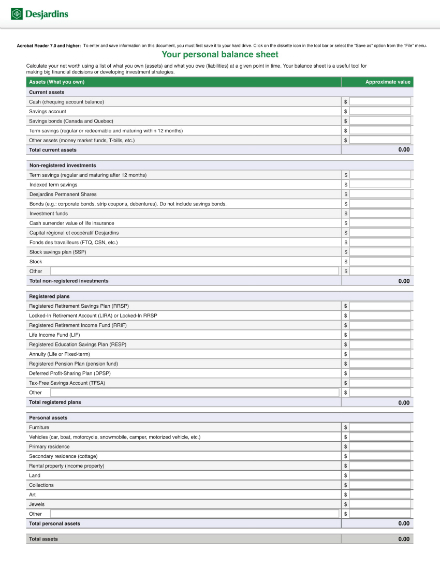

desjardins.com

desjardins.comSample Balance Sheet for Psychological Services

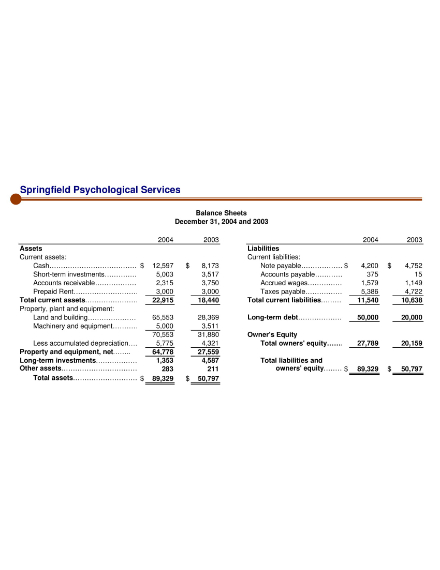

apapracticecentral.org

apapracticecentral.orgSteps to Make a Great Monthly Balance Sheet

1. Header: Using your favorite spreadsheet program, create a new file for your monthly balance sheet. Before delving into the numbers of your company, set up the header first at the topmost section of your document. Your header is composed of a label “Balance Sheet”, the name of your company or organization, and the effective month of the balance sheet.

2. Assets: There are two kinds of assets that you will be listing down in this part: current assets and non-current assets. Your current assets refer to the assets that can be converted to cash within a year. List them down according to how easily they can be converted into cash and determine their subtotal. Your non-current assets are long-term assets that can be used for more than a year. It can be a company’s property, equipment, or intangible goods. Also, list these things down and find out their subtotal. Add up the total amount of your assets and label this sum with “Total Assets.”

3. Liabilities: Just like assets, your liabilities also come in two kinds: current liabilities and fixed liabilities. Your current liabilities are those debts that are due within one year while your fixed liabilities are those debts that take more than a year to be settled. List down all your liabilities for each type, and come up with their sub-totals. Add these sub-totals together and you will have you “Total Liabilities.”

4. Equity: This section is shorter compared to the preceding two. The equity of your monthly balance sheet is the total capital expenditure of the company. This means that you have to add up the money the owner put in plus the total funding that the investors pooled in. Add this amount to your total liabilities and label their sum as “Total Liabilities and Equity.” This sum should be equal to your total assets. Should the otherwise happens, then go over your books and check if you have something missed out.

Tips for a Great Monthly Balance Sheet

- Double check your monthly balance sheet: It is imperative to go over your financial audit reports again and check if you have missed out on something in your financial statements. However, even if you have balanced your assets and liabilities on the first try, you still need to verify your numbers to see if you have done everything right.

- Have a clear understanding of your resources and obligations: It can sometimes be tempting to just read the operating statement and the bank balance to know the numbers you need to input in your monthly balance sheet. However, this might not be as effective as going over all your previous balance sheet accounts. Doing so will let you take into account ongoing transactions and other financial items that you need to include in your balance sheet.

Types of Monthly Balance Sheets

Monthly balance sheets can come in various formats, and different factors affect to how things are being listed down, such as the size of the business, the type of industry that the company belongs, and the number of items that need to be accounted for. However, there exist four common formats that accountants often use when creating a monthly balance sheet, and these are the following:

- Classified Monthly Balance Sheet: The most common type of monthly balance sheet format, classified balance sheet aggregates a corporate entity’s assets, liabilities, and equity into categories of accounts. This type of balance sheet is effective in presenting a huge amount of financial data into something that is easily discernible.

- Comparative Monthly Balance Sheet: From the name itself, this type of monthly balance sheet compares a company’s assets, liabilities, and equity for the current month to another month in the same or previous year through a side-by-side presentation. It is best when a company needs to gauge the progress it has made after a certain period of time.

- Common-sized Monthly Balance Sheet: This type of monthly balance sheet is the same as the classified monthly balance sheet but with an extra column that indicates the percentage of an item to the total share of asset or liability in the company. These percentages can be used in business presentations where trend lines are made to examine the sizes of accounts in the company.

- Vertical Balance Sheet: This monthly balance sheet lists down its assets, liabilities, and equity in a single column. Starting from the assets, then liabilities, and lastly the equity, the items listed in each category are arranged in decreasing order of liquidity, which refers to a certain characteristic of items that pertain to how easily they can be converted into cash.

Monthly Balance Sheet FAQs

What are some examples of intangible goods I can list down as assets?

Intangible goods are non-monetary assets with no physical substance but can still yield the company income. Some examples of these intangible goods are patents, copyrights, and trademarks.

How do I find out the profits of my company?

Your profit is the amount you gained after investing some money. To get this amount, get the sum of all of your costs, then subtract the total money you have.

What is deferred revenue?

Deferred revenue refers to money allocated for the next month or next fiscal year’s spending. It is common for non-profit budgets to have deferred revenues in the forms of grants and sponsorship that are received early, unspent portion of a multi-year grant, or subscription sales of the next charity season.

A lot of startup businesses lose control over their spending because they have lost their grip on their financial position. However, if you develop the habit of reading over your monthly balance sheet, you will have one less thing to worry about and keep your two feet standing on the ground, despite the potential shakeups that you might encounter in your business venture.