Table of Contents

Due Diligences

Due diligences are analytical tools used by investors and companies to evaluate or investigate the odds of acquiring a business entity. Creating a systematic due diligence report for your due diligence process and M&A plans is integral to guiding you in formulating logical decisions while finalizing business contracts and deals.

Download the Free Due Diligences Article in PDF

File Format:

Due Diligence Definition & Meaning

A due diligence is a clear and well-documented report that provides a comprehensive summary of the due diligence process and procedures.

Due diligences are vital for businesses to let the buyers and sellers gain an all-encompassing perspective of their potential investment of product purchase.

What Is a Due Diligence?

Due diligence is a summarized report of all the fundamental information collected from in-depth research and investigations into the target company for M&A plans. It is used by many investors and buyers to evaluate the pros and cons before concluding the deal. Also, it is a strategic document that addresses all potential risks and concerns.

10 Types of Due Diligence

Business Due Diligence

Investors use business due diligence to conduct an extensive investigation of their target company ahead of an audit, capital raise, initial public offerings (IPOs), or M&A. It validates the market environment of the target company by having an in-depth analysis of its financial records, legal issues, and market positioning. Also, it helps the buyers to arrive at a reasonable offer price and construct a favorable transaction.

Technical Due Diligence

Technical due diligence refers to a document used during the process of evaluating the technology and related components of a business or organization in conjunction with main corporate events such as acquisitions, mergers, and IPOs. It assists the potential buyer to get an accurate look at the true value and potential growth and risks of the target company. This tool analyzes their software, products, systems, and technological practices.

Investment Due Diligence

Determine if the venture capital fund or other investors will invest in your business using investment due diligence. It gathers crucial information about potential investees to make a well-informed decision before the execution of the contracts and transactions. Plus, this process can lead to less risk during the investment and establish a sustainable relationship between the investor and entrepreneur.

Product Due Diligence

Dealers perform product due diligence to assess all the relevant aspects of the products and securities available to the customers. They examine the features, structure, risks, initial and ongoing costs, and impact of those prices. A customizable due diligence report template is a beneficial tool to help you outline the assessment of how current customers are using the product and their satisfaction level with the existing product.

Company Due Diligence

Acquiring firms undertake due diligence to examine the assets, business, and financial performance of the target company thoroughly. For instance, they assess the company’s financial statements, financial projections, capital expenditure plans, inventory schedules, and other aspects. Construct a compelling company due diligence document to demonstrate the due diligence analysis process of your target company.

Employee Due Diligence

Create a simple employee due diligence when you collect information about a prospective employee. As an employer, it is very important to evaluate the information and background of your applicants so that you can thoroughly check if they are what they claim to be. However, you need to have discretion and a sense of fair play when conducting background checks.

Due Diligence Policy

Make a basic due diligence policy checklist to guide the compliance manager while administering the due diligence process. Following this checklist is useful for analysts and managers to become knowledgeable about the assets, benefits, contracts, liabilities, and potential issues of a company. Additionally, it is used for a public or private financing transaction, a joint venture, the preparation of an audited financial statement, general risk management, and IPO.

Operational Due Diligence

Often requested by the bank or other financier who supports the acquisition, operational due diligence is an iterative process of formulating and testing the business model and operations of the target company. Write an operational due diligence document to help you in reviewing a target company’s operational aspects during M&A. Identify risks that might appear and seek to mitigate them.

Customer Due Diligence

Financial institutions use customer due diligence when collecting and examining relevant information about an existing customer or potential customer. The information analyzed during this process is sourced from the customers, published sanctions lists, public data sources, and private data sources. It uncovers any possible risk to the financial institution performing business with other parties and verifies the identity of the customer.

Intuitive Due Diligence

Prepare an intuitive due diligence document when you conduct due diligence on your target company. Indicate the basic information of your business and the target firm. Mention the corporate documents required such as the records of stocks, options, warrant issuances, and documentation of past and present agreements and rights of shareholders.

Due Diligence Uses, Purpose, Importance

A due diligence is an important document that captures the extensive findings of the diligence process. Prospective buyers use this tool to cross-examine their potential investments. What are the common uses, purposes, and importance of due diligence?

Provides Business Financial and Operational Details

Due diligence documents provide crucial information regarding the finances and operations of the business. It gives accurate and genuine details of the target company’s financials. Also, it clarifies the day-to-day operations of the business to prospective investors.

Educates Companies Undertaking Merger or Acquisition

An all-inclusive due diligence report allows companies to be educated and informed about a business arrangement, transaction, or any other contract and plan. Prospective buyers need to know all sides of the story or the core aspects of their target company for successful M&A. With appropriate due diligence, the investors are provided with a guarantee of what they are getting.

Guides Buyers and Sellers to Make Informed Decisions

It is used to guide buyers and sellers in making informed and worthwhile decisions. They can identify and evaluate the assets, liabilities, and possible risks in the target company. This document enables the buyers to check the accuracy and validity of the financial, commercial, and legal aspects of the company.

Increases the Success Rate of the Business Deal

Due diligence is an integral part of the M&A planning process as it unravels major issues or assets that need to be resolved. It helps the buyers to mitigate risks and address the pitfalls of the transaction properly before the business deal closes. Thus, it is beneficial to clearly understand all the details about the company.

Detects Strengths and Weaknesses

Many companies have flaws that need to be detected early on before the agreement. Due diligence is an essential process to determine which areas of the target company have high and low performances. Before you acquire a company or make a deal with the other party, detect their strengths and weaknesses.

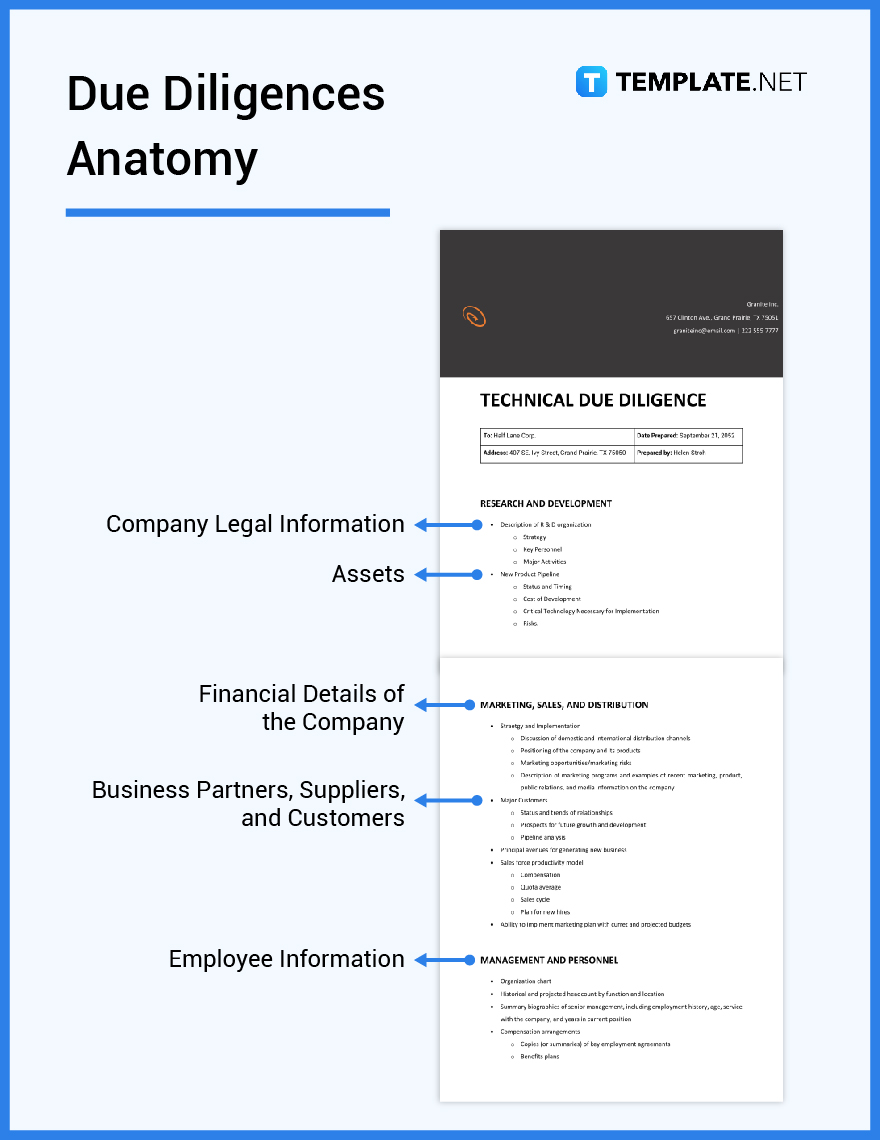

What’s in a Due Diligence? Parts?

Financial Details of the Company

Create a simple list or table of the core financial details of the company or organization. Include information from the balance sheets, income statements, annual reports, profit/loss records, loans and debts, tax returns, future forecasts and projections, stock history, and other financial documents.

Employee Information

Indicate the information of the key people involved in the company and their work experiences such as HR and employees. Add some information about retired employees who made significant contributions to the company.

Assets

Define anything that has current or future economic value to the company. Some examples of assets are inventory, investments, intellectual property (IP), patents, and PPE (Property, Plant, and Equipment).

Business Partners, Suppliers, and Customers

Describe the different parties of the business firm’s supply chain. Explain their relationships with their business partners, suppliers, and customers.

Company Legal Information

Inspect the legal aspects of the target company for M&A. Detail the crucial legal information of the company which includes existing contracts, partnership agreements, tax compliance, any past or outstanding lawsuits, licensing, and permits.

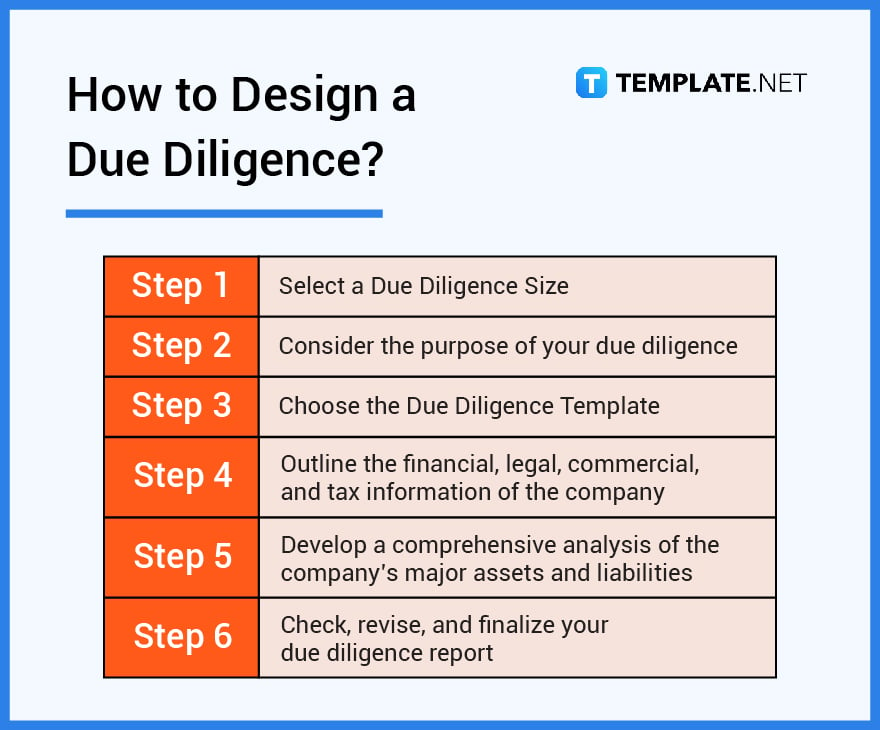

How to Design a Due Diligence

1. Select a Due Diligence Size

2. Consider the purpose of your due diligence

3. Choose the Due Diligence Template

4. Outline the financial, legal, commercial, and tax information of the company

5. Develop a comprehensive analysis of the company’s major assets and liabilities

6. Check, revise, and finalize your due diligence report

Due Diligence vs. Assessment

Due diligence is an investigative process undertaken by an individual investor or a prospective buyer to review or audit the assets and liabilities of a target business or organization and to confirm facts or information before entering into an M&A agreement and contract signing.

An assessment is a systematic evaluation or comprehensive appraisal of a person, business, group, product, or service, allowing decision-makers to have logical judgment concerning the performance or quality of someone or something.

What’s The Difference Between Due Diligence, Notes, and Statement?

Due diligence is an analytical tool used by individual investors or prospective buyers to conduct risk and compliance checks on their target companies or organizations and to make sure that the details of a transaction are legal.

Notes are legal documents used to represent loans an issuer made to a creditor or a business investor and some of them are used for investment purposes like mortgage-backed notes.

A statement is a financial report that demonstrates the financial activities, performance, and plans of a business, allowing lenders and investors to examine a business’ financial condition and earnings potential.

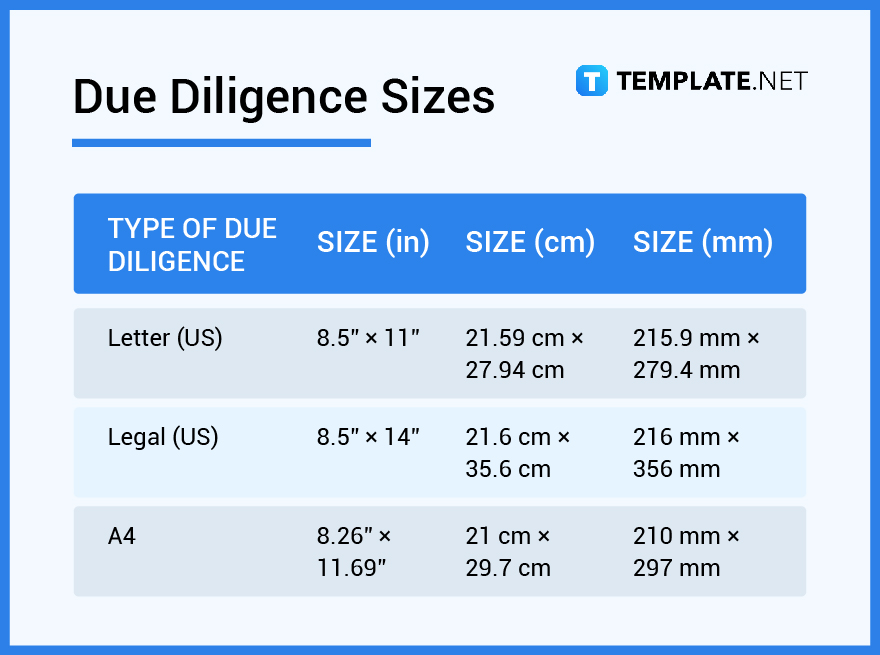

Due Diligence Sizes

Due diligence documents have different standard sizes and formats. The due diligence size and format are based on the use and purpose of the business, company, or organization.

Due Diligence Ideas & Examples

There is a variety of unique ways that you can do in creating due diligence. You can find various due diligence ideas and design inspiration that you can use for preparing this document.

- Outsourcing Due Diligence Ideas and Examples

- Commercial Due Diligence Ideas and Examples

- Kitchen Due Diligence Ideas and Examples

- M&A Due Diligence Report Ideas and Examples

- Project Due Diligence Ideas and Examples

- Contract Due Diligence Ideas and Examples

- Legal Due Diligence List Ideas and Examples

- Financial Due Diligence Ideas and Examples

- Real Estate Due Diligence Ideas and Examples

- Technology Due Diligence Ideas and Examples

FAQs

What does due diligence include?

A due diligence document includes in-depth analyses and reviews of financial statements, sales figures, shareholder structure, and other economic, legal, and fiscal conditions of a business or an individual.

When should due diligence be carried out?

Due diligence should be carried out after the buyer and seller agreed, but before the official merger or acquisition contract is signed.

Why do we have due diligence?

We have due diligence because it is used to conduct a systematic audit, investigation, and risk and compliance review to companies of their financial records before the proposed acquisition or merger with another company.

Who can conduct due diligence?

Broker-dealers, fund managers, equity research firms, individual investors, risk and compliance analysts, and companies that consider possible acquisitions or buyers are the ones who can conduct due diligence.

What are due diligence documents?

Due diligence documents are crucial tools for the comprehensive research and detailed analysis of various aspects of a company or an organization such as legal, financial, sales, and marketing before a potential corporate merger, acquisition, or purchase of securities takes place.

What is a due diligence checklist?

A due diligence checklist is a type of checklist that investigates a target company to buy through sale, merger, or acquisition.

How do you conduct due diligence in a company?

To conduct due diligence in a company, it is important that you evaluate the project goals carefully, examine business financial records, inspect the documents thoroughly, develop a well-structured business plan and model analysis, set a final offering, and perform risk management.

What are the key roles in due diligence?

The key roles are to help buyers and sellers make smart decisions in M&A by validating the accuracy of the presented information, ensuring that the transaction complies with the established criteria, and increasing the chances of a successful deal by revealing major issues.

Which framework is used for due diligence?

The FITME framework is used for due diligence to guide companies when they analyze options and develop the M&A strategy suitable for them.

What are the due diligence requirements?

The due diligence requirements are completing and submitting Form 8867, ensuring that any claimed advantage is based on facts, asking the taxpayer the appropriate questions, and keeping financial records for three years.