Free Quarterly Payroll Accounting Report

Date: [Month Day, Year]

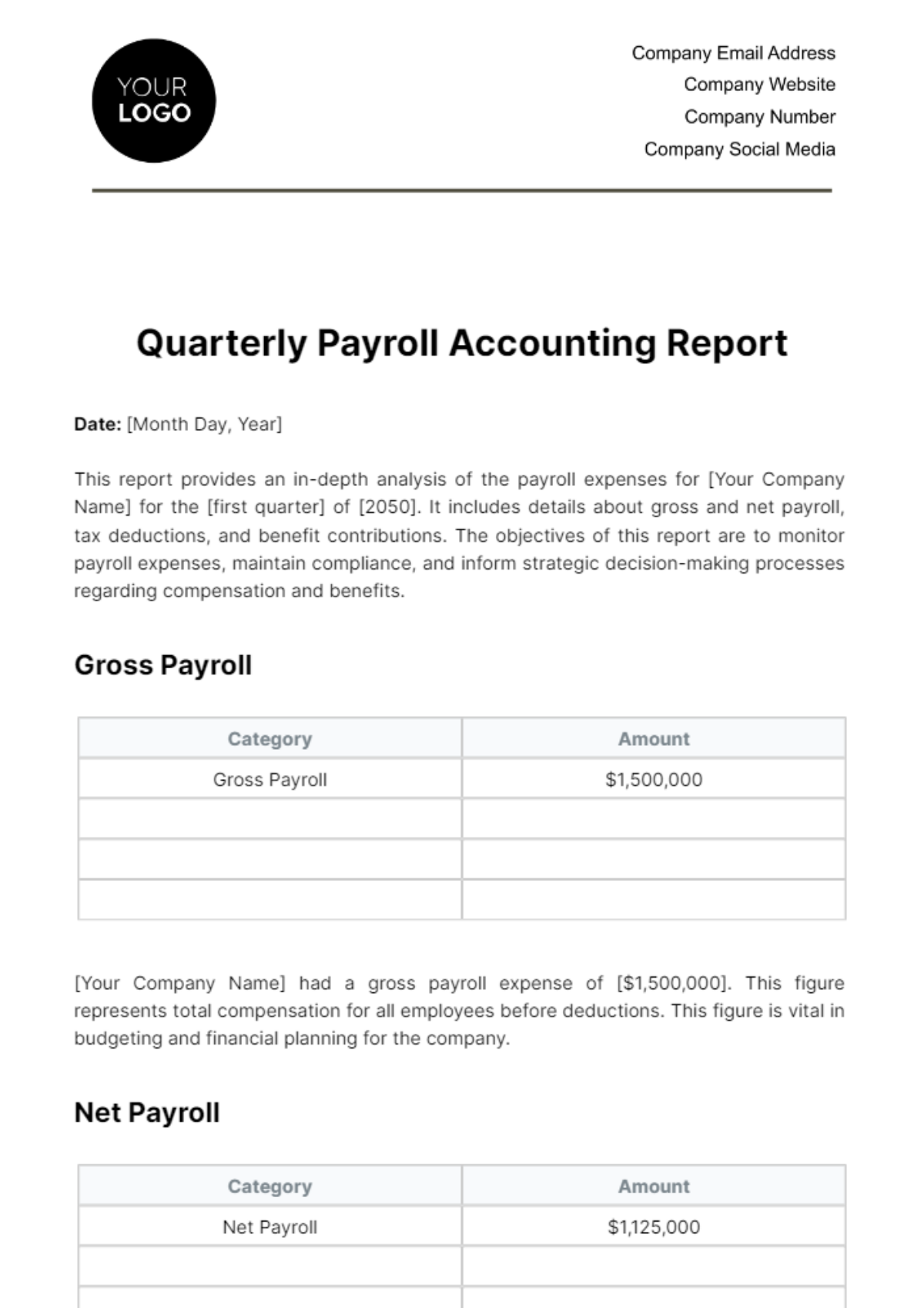

This report provides an in-depth analysis of the payroll expenses for [Your Company Name] for the [first quarter] of [2050]. It includes details about gross and net payroll, tax deductions, and benefit contributions. The objectives of this report are to monitor payroll expenses, maintain compliance, and inform strategic decision-making processes regarding compensation and benefits.

Gross Payroll

Category | Amount |

|---|---|

Gross Payroll | $1,500,000 |

[Your Company Name] had a gross payroll expense of [$1,500,000]. This figure represents total compensation for all employees before deductions. This figure is vital in budgeting and financial planning for the company.

Net Payroll

Category | Amount |

|---|---|

Net Payroll | $1,125,000 |

The company's net payroll expense was [$1,125,000]. This figure represents the total amount disbursed to employees after deductions such as taxes and benefit contributions. This number allows the company to identify the actual cost to the company of employee compensation.

Tax Deductions

Category | Amount |

|---|---|

Tax Deductions | $300,000 |

The total amount of tax deductions amounted to [$300,000]. These deductions are integral components for compliance with local and federal tax codes. Staying abreast of tax expenses helps ensure financial and legal compliance.

Benefits Contributions

Category | Amount |

|---|---|

Benefits Contributions | $75,000 |

[Your Company Name] contributed a total amount of [$75,000] to employee benefits. Benefits contributions include payments towards health insurance, retirement funds, and other employee benefits.

The payroll expenses for [Q1 2050] were managed effectively and remained within the budgetary limits. We intend to continue monitoring payroll data closely to maintain compliance and inform business decisions. The payroll accounting process will also focus on optimizing operating costs and boosting employee satisfaction through sustainable compensation and benefits policies.

- 100% Customizable, free editor

- Access 1 Million+ Templates, photo’s & graphics

- Download or share as a template

- Click and replace photos, graphics, text, backgrounds

- Resize, crop, AI write & more

- Access advanced editor

Effortlessly manage all your quarterly payroll-related tasks with Template.net’s Quarterly Payroll Accounting Report Template. All details are editable using our Ai Editor Tool, giving you a completely customizable experience. Simplify complex calculations, enhance productivity, and get reliable results every time. This editable, user-friendly tool ensures accurate payroll management.

You may also like

- Sales Report

- Daily Report

- Project Report

- Business Report

- Weekly Report

- Incident Report

- Annual Report

- Report Layout

- Report Design

- Progress Report

- Marketing Report

- Company Report

- Monthly Report

- Audit Report

- Status Report

- School Report

- Reports Hr

- Management Report

- Project Status Report

- Handover Report

- Health And Safety Report

- Restaurant Report

- Construction Report

- Research Report

- Evaluation Report

- Investigation Report

- Employee Report

- Advertising Report

- Weekly Status Report

- Project Management Report

- Finance Report

- Service Report

- Technical Report

- Meeting Report

- Quarterly Report

- Inspection Report

- Medical Report

- Test Report

- Summary Report

- Inventory Report

- Valuation Report

- Operations Report

- Payroll Report

- Training Report

- Job Report

- Case Report

- Performance Report

- Board Report

- Internal Audit Report

- Student Report

- Monthly Management Report

- Small Business Report

- Accident Report

- Call Center Report

- Activity Report

- IT and Software Report

- Internship Report

- Visit Report

- Product Report

- Book Report

- Property Report

- Recruitment Report

- University Report

- Event Report

- SEO Report

- Conference Report

- Narrative Report

- Nursing Home Report

- Preschool Report

- Call Report

- Customer Report

- Employee Incident Report

- Accomplishment Report

- Social Media Report

- Work From Home Report

- Security Report

- Damage Report

- Quality Report

- Internal Report

- Nurse Report

- Real Estate Report

- Hotel Report

- Equipment Report

- Credit Report

- Field Report

- Non Profit Report

- Maintenance Report

- News Report

- Survey Report

- Executive Report

- Law Firm Report

- Advertising Agency Report

- Interior Design Report

- Travel Agency Report

- Stock Report

- Salon Report

- Bug Report

- Workplace Report

- Action Report

- Investor Report

- Cleaning Services Report

- Consulting Report

- Freelancer Report

- Site Visit Report

- Trip Report

- Classroom Observation Report

- Vehicle Report

- Final Report

- Software Report