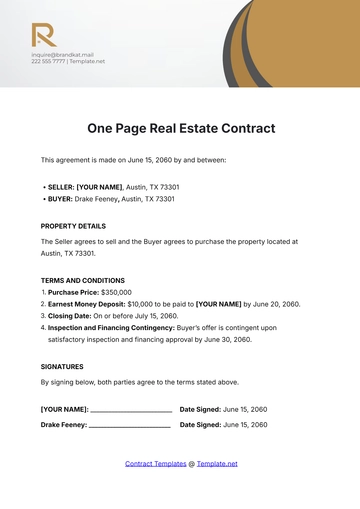

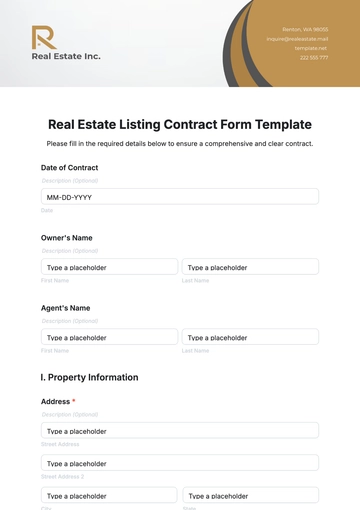

Free Real Estate Sales Contract

THIS CONTRACT, made and entered into this [Month Day, Year], hereinafter referred to as "The Effective Date", by and between [Property Owner Name], hereafter the "Seller", with a mailing address of [Seller's Address], and [Buyer Name], hereafter the "Buyer", with a mailing address of [Buyer's Address].

1. PURPOSE

In the heart of every real estate transaction lies the fundamental agreement that outlines the framework of the sale, defining both the seller's and buyer's commitments and understanding. This Real Estate Sales Contract stands as the cornerstone of such transactions, meticulously crafted to ensure clarity, legality, and fairness in the transfer of property ownership. It encapsulates the essential elements of the sale, from the agreement's purpose to the detailed conditions under which the property will change hands, providing a solid foundation upon which both parties can rely.

1.1. Comprehensive Purpose

The Comprehensive Purpose of this Real Estate Sales Contract extends beyond the mere agreement between the Seller, [Your Company Name], and the Buyer, [Your Client Name]. It meticulously outlines the sale's terms, providing a robust, enforceable framework to oversee the property's transfer in a manner that is both legal and orderly. By establishing clear parameters and expectations, this contract ensures that the property's transition from [Your Company Name] to [Your Client Name] respects all agreed-upon conditions, thereby safeguarding the interests of both parties involved. This purposeful design is intended not only to delineate responsibilities and rights but also to facilitate a smooth and transparent transition of ownership, underscoring the contract’s role as the backbone of the transaction.

1.2. Binding Agreement

This Real Estate Sales Contract represents a legally binding agreement that mandates adherence to its terms from both the Seller, [Your Company Name], and the Buyer, [Your Client Name]. It solidifies the intent of both parties to proceed with the property transfer under the specified conditions outlined within the document. Once executed, this contract unequivocally binds [Your Company Name] and [Your Client Name] to fulfill their obligations as stipulated, underpinning the transaction with a legal foundation that guarantees progression towards completion.

1.3. Facilitation of Transfer

The essence of this Real Estate Sales Contract lies in its capacity to facilitate a lawful and orderly transfer of property ownership from [Your Company Name] to [Your Client Name]. Acting as a comprehensive blueprint, it details every necessary legal provision and procedural step, from initial agreement to final handover. The contract’s meticulous preparation and explicit documentation aim to eliminate ambiguity, minimize conflict potential, and ensure a seamless transition. It plays an instrumental role in navigating both parties through the complex landscape of real estate transfer, emphasizing the importance of adhering to legal standards and procedures throughout the transaction.

2. PROPERTY

In every real estate transaction, the accurate identification and comprehensive description of the property in question are paramount. This section of this Real Estate Sales Contract serves this crucial function, meticulously cataloging the property's complete address, legal description, and any additional attributes critical to the sale. By providing a detailed record as recognized by local authorities, this segment ensures transparency, reduces ambiguity, and lays the groundwork for a clear, undisputed transfer of ownership.

2.1. Legal Description and Location

The legal description and location form the backbone of the property's identification, ensuring an unequivocal understanding of the land in question. This section includes:

Complete Address: The full street address provides an initial, easily understandable location of the property.

Lot Number and Subdivision: These details offer a more specific identification within the broader context of its neighborhood or development area.

Boundary Descriptions: Utilizing metes and bounds, or lot and block descriptions, these legal boundaries delineate the property's precise perimeters.

Land Measurements: Detailed measurements of the property's area, often in acres or square feet, based on official surveys or public records.

This comprehensive detailing eliminates any potential for ambiguity concerning the property's extent or location, ensuring that the boundaries, size, and specific location are clear to all parties and for any future reference or disputes.

2.2. Improvements and Fixtures

This section comprehensively addresses:

Improvements: These are enhancements made to the property, such as buildings, landscaping, fences, and other structures that add value and utility. The inclusion of improvements in the sale is explicitly detailed to avoid misunderstandings.

Fixtures: Items that might initially have been personal property but are now permanently attached to the property, such as lighting fixtures, built-in appliances, and HVAC systems, are specified. The contract delineates which fixtures are to remain with the property post-sale, ensuring clarity on what is included in the transaction.

The explicit listing of improvements and fixtures clarifies the physical state and components of the property being transferred, facilitating a mutual understanding of the sale's scope between the buyer and seller.

2.3. Authority and Verification

The integrity of the property description and the inclusivity of the sale are validated through:

Official Records: Documentation held by local government entities or other authoritative bodies, such as deeds, previous sale records, and zoning documents, confirm the accuracy of the property description.

Verification Processes: Procedures such as title searches and property surveys are conducted to ensure the property's legal description matches official records and that there are no discrepancies in boundaries or entitlements.

This reliance on authoritative sources and thorough verification processes underscores the commitment to due diligence and legal precision, providing a solid foundation for the legal transfer of property ownership and ensuring compliance with all relevant laws and regulations.

3. SALES PRICE

This section of this Real Estate Sales Contract is a critical component, capturing the essence of the transaction's financial exchange. It clearly outlines the agreed-upon purchase price for the property, stated both numerically and in words, to avoid any ambiguity. This figure represents the core of the financial agreement between buyer and seller, laying out the sum total to be transferred for ownership of the property, while also setting the stage for the detailed discussions of closing costs and potential financial adjustments.

3.1. Purchase Price Definition

The "Purchase Price Definition" is the cornerstone of the financial transaction in a real estate sale, providing a clear and unambiguous statement of the amount to be paid by the buyer to the seller. This segment includes:

Total Amount: The exact figure that the buyer agrees to pay, presented in both numerical form and spelled out in words to ensure absolute clarity and prevent any numerical discrepancies.

Documentation: A requirement for this sum to be documented meticulously, capturing the essence of the agreement and serving as a key reference point in the contract.

Purpose: The rationale behind this precise articulation is to solidify the understanding of financial commitment, forming the basis for a transparent and dispute-free transaction.

The meticulous detailing of the purchase price is intended to eliminate confusion and lay a clear financial foundation for the transaction, ensuring both parties are aligned on the terms of the property transfer.

3.2. Exclusions and Adjustments

This section outlines the financial components that are not covered by the base purchase price and highlights potential areas for adjustments, including:

Closing Costs Exclusions: It explicitly states that the agreed-upon purchase price does not include various closing costs—like title search fees, attorney fees, and applicable state taxes—which are to be calculated and settled separately.

Potential Adjustments: The contract acknowledges the possibility of adjustments to the final purchase price based on outcomes from property inspections, appraisals, and other pre-closing evaluations. This ensures any issues identified can be fairly addressed, potentially affecting the total cost.

Transparency and Fairness: By detailing these exclusions and potential adjustments, the section aims to promote transparency in the transaction process, setting the stage for a fair and equitable agreement between the buyer and the seller.

This careful delineation of exclusions and adjustments is crucial for managing expectations and facilitating a smooth path to closing, ensuring all financial aspects of the transaction are understood and agreed upon.

3.3. Binding Financial Agreement

The sales price's declaration within the contract establishes a legally binding financial agreement, which includes:

Buyer's Obligation: A commitment by the buyer to deliver the agreed-upon amount, emphasizing the seriousness and enforceability of this financial responsibility.

Seller's Commitment: The seller's obligation to proceed with the transfer of property ownership upon receipt of the specified purchase price, underlining their role and responsibility in the transaction.

Legal Basis and Enforceability: This agreement acts as a fundamental legal basis for the transaction, providing both a framework for enforcement and a mechanism for dispute resolution, should it be necessary.

By formalizing the financial expectations and obligations of both parties, this agreement serves as a pivotal component of the contractual relationship, ensuring that the transaction proceeds on a firm, agreed-upon financial foundation.

4. DEPOSIT

This section outlines the requirement for the buyer to provide an earnest money deposit, a financial pledge demonstrating their serious intent to purchase. Held in escrow by a designated agent, this deposit acts as a guarantee of the buyer’s fulfillment of contractual obligations, ensuring a layer of security for both parties involved. Whether applied towards the final purchase price at closing or returned under specific conditions, the handling of this deposit is clearly delineated to prevent misunderstandings and facilitate a smooth path to sale completion.

4.1. Earnest Money Deposit

Security Measure: The earnest money deposit serves as a tangible commitment from the buyer, securing their intent and involvement in the transaction.

Deposit Amount: The specified amount to be deposited is clearly stated, providing clarity on the financial commitment required from the buyer upon contract execution.

Escrow Handling: Managed by [Escrow Agent Name], the deposit remains in escrow, ensuring it is safeguarded and neutrally held until the sale reaches completion or a stipulated contract condition necessitates its release.

4.2. Application and Disbursement

Towards Purchase Price: Typically, the deposit is credited towards the purchase price at closing, directly contributing to the transaction's financial settlement.

Contract Termination Conditions: In cases where the contract is terminated under terms agreed upon within the document, the deposit’s disbursement is handled according to predefined conditions, ensuring fairness and transparency.

4.3. Importance of Escrow

Neutral Third Party: The escrow agent’s role as a neutral third party is crucial for maintaining trust in the deposit's handling, providing assurance that the funds are managed impartially.

Security and Compliance: Holding the deposit in escrow ensures that the funds are secure and that their eventual disbursement complies with the contract terms, reflecting the agreed-upon conditions between buyer and seller.

The deposit section, with its focus on earnest money, escrow management, and clear terms for application and disbursement, embodies the transaction's security and commitment, laying a foundation of trust and assurance for both parties as they proceed towards closing.

5. CLOSING DATE

The parties agree to close the sale of the Property on or before [Closing Date]. The closing shall occur at a place and time agreed upon by both parties, where all documents will be signed, and the balance of the purchase price paid. Should a delay arise that is not caused by the Buyer’s failure to comply with the terms, both parties may mutually agree in writing to extend this date.

6. CONTINGENCIES

This section is a pivotal part of this Real Estate Sales Contract, designed to protect both the buyer and seller by outlining conditions that must be met for the transaction to proceed. These contingencies ensure that critical aspects of the property and financing are satisfactory before the sale is finalized. Including conditions related to inspection, financing, title, and appraisal, this section provides a clear roadmap for navigating potential obstacles, thereby safeguarding the interests of both parties involved. By setting forth these conditions, the contract ensures that the transaction moves forward on solid ground, with each contingency serving as a checkpoint that validates the deal's terms.

6.1. Inspection Contingency

This clause grants the buyer the right to conduct a thorough inspection of the property. It allows for a comprehensive evaluation of the property's condition, including its structural integrity, systems (electrical, plumbing, HVAC), and any other criteria deemed important by the buyer. The purpose is to ensure the property meets the buyer's expectations and standards before proceeding with the purchase. Should any issues arise during the inspection, the buyer has the option to request repairs, renegotiate the purchase price, or, in some cases, withdraw from the contract without penalty.

6.2. Financing Contingency

The financing contingency is crucial for buyers who require a mortgage to purchase the property. It conditions the sale on the buyer securing a loan from a recognized lending institution under terms that are acceptable to them. This contingency protects the buyer, allowing them to exit the contract if they are unable to obtain financing without facing legal or financial penalties. It highlights the importance of timely loan approval and the potential impact of financing on the transaction's progression.

6.3. Title Contingency

Under the title contingency, the sale is contingent upon the seller providing a clear and marketable title to the property. This means the title must be free from any liens, encumbrances, or legal claims that could affect the buyer's ownership rights. A clear title is fundamental for ensuring that the buyer receives full legal ownership of the property without any disputes or claims from third parties. This clause often involves a thorough title search by a title company or attorney to identify any issues that must be resolved before the sale can proceed.

6.4. Appraisal Contingency

This contingency ties the completion of the sale to the property being appraised at or above the agreed-upon purchase price. It protects the buyer (and the lender) by ensuring that they are not overpaying for the property based on its current market value. If the appraisal comes in lower than the purchase price, the buyer has the leverage to renegotiate the price, seek additional financing, or withdraw from the contract with their earnest money deposit intact.

By incorporating these contingencies into the contract, both the buyer and seller are afforded a level of protection and clarity, ensuring that the sale proceeds only if these critical conditions are satisfactorily met or waived.

7. GOVERNING LAW

This Contract, and any dispute arising out of the terms herein, shall be construed and governed in accordance with the laws of the State of [State].

Any legal action or proceeding concerning the validity, interpretation, and enforcement of this contract, matters arising out of or related to this contract or its making, performance, or breach, shall be brought in a court of competent jurisdiction in [State].

8. ENTIRE CONTRACT

This Contract constitutes the entire agreement between the parties concerning the subject matter hereof and supersedes all previous communications, representations, understandings, and agreements, either oral or written, between the parties with respect to said subject matter.

This Contract may not be amended, nor any obligation waived, except by a writing signed by both parties hereto.

IN WITNESS WHEREOF, the parties have executed this Contract as of the date first above written.

SELLER:

[Property Owner Name]

[Your Job Title]

BUYER:

[Buyer Name]

[Job Title] (if applicable)

- 100% Customizable, free editor

- Access 1 Million+ Templates, photo’s & graphics

- Download or share as a template

- Click and replace photos, graphics, text, backgrounds

- Resize, crop, AI write & more

- Access advanced editor

Navigate your real estate deals with Template.net’s Real Estate Sales Contract Template. It's fully customizable and editable in our Ai Editor Tool, enabling you to tailor it to your unique business needs. This key tool empowers you to craft professional, effective contracts with minimal effort. Streamline your sales process, maximize efficiency, and close deals faster with our user-friendly template today.

You may also like

- Rental Contract

- Contractor Contract

- Contract Agreement

- One Page Contract

- School Contract

- Social Media Contract

- Service Contract

- Business Contract

- Restaurant Contract

- Marketing Contract

- Real Estate Contract

- IT Contract

- Cleaning Contract

- Property Contract

- Supplier Contract

- Partnership Contract

- Food Business Contract

- Construction Contract

- Employment Contract

- Investment Contract

- Project Contract

- Payment Contract

- Student Contract

- Travel Agency Contract

- Startup Contract

- Annual Maintenance Contract

- Employee Contract

- Gym Contract

- Event Planning Contract

- Personal Contract

- Nursing Home Contract

- Law Firm Contract

- Work from Home Contract

- Software Development Contract

- Maintenance Contract

- Music Contract

- Amendment Contract

- Band Contract

- DJ Contract

- University Contract

- Salon Contract

- Renovation Contract

- Photography Contract

- Lawn Care Contract