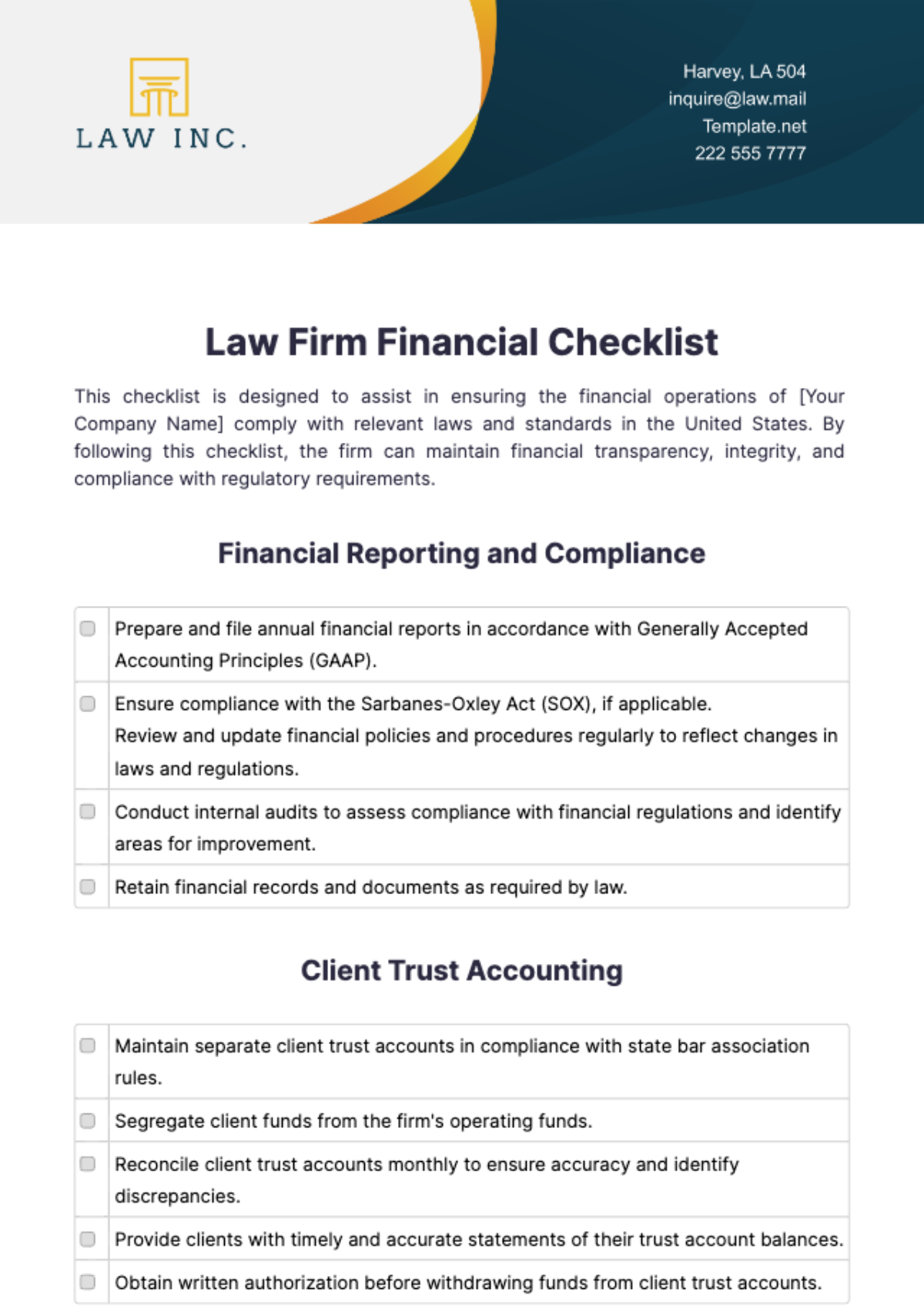

Free Law Firm Financial Checklist

This checklist is designed to assist in ensuring the financial operations of [Your Company Name] comply with relevant laws and standards in the United States. By following this checklist, the firm can maintain financial transparency, integrity, and compliance with regulatory requirements.

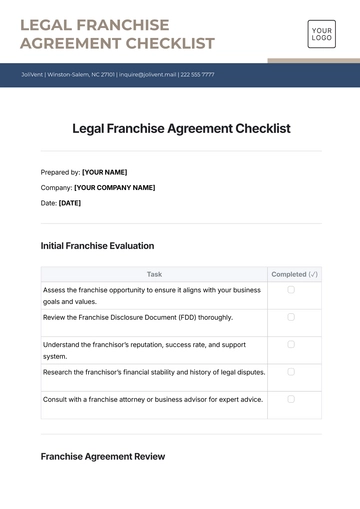

Financial Reporting and Compliance

Prepare and file annual financial reports in accordance with Generally Accepted Accounting Principles (GAAP). | |

Ensure compliance with the Sarbanes-Oxley Act (SOX), if applicable. Review and update financial policies and procedures regularly to reflect changes in laws and regulations. | |

Conduct internal audits to assess compliance with financial regulations and identify areas for improvement. | |

Retain financial records and documents as required by law. |

Client Trust Accounting

Maintain separate client trust accounts in compliance with state bar association rules. | |

Segregate client funds from the firm's operating funds. | |

Reconcile client trust accounts monthly to ensure accuracy and identify discrepancies. | |

Provide clients with timely and accurate statements of their trust account balances. | |

Obtain written authorization before withdrawing funds from client trust accounts. |

Billing and Fee Arrangements

Establish clear fee agreements with clients, detailing rates, billing methods, and payment terms. | |

Invoice clients promptly and accurately for legal services rendered. | |

Document all billable hours and expenses incurred on client matters. | |

Review and approve billing entries for accuracy and compliance with fee agreements. | |

Monitor accounts receivable and follow up on overdue payments. |

Expense Management

Implement policies and procedures for expense reimbursement, including allowable expenses and documentation requirements. | |

Monitor and control non-billable expenses to ensure they are reasonable and necessary for business operations. | |

Review and approve all firm expenditures to prevent unauthorized or excessive spending. | |

Negotiate favorable terms with vendors and service providers to minimize costs. |

Tax Compliance

File federal, state, and local tax returns accurately and on time. | |

Maintain records of income, expenses, and deductions to support tax filings. | |

Comply with tax laws related to employee payroll, benefits, and withholding. | |

Stay informed about changes to tax laws and regulations that may affect the firm's tax obligations. | |

Consult with tax professionals to ensure compliance and minimize tax liabilities. |

- 100% Customizable, free editor

- Access 1 Million+ Templates, photo’s & graphics

- Download or share as a template

- Click and replace photos, graphics, text, backgrounds

- Resize, crop, AI write & more

- Access advanced editor

Ensure thorough financial management with the Law Firm Financial Checklist Template from Template.net. This editable and customizable template provides a comprehensive list of financial tasks and considerations essential for running a law firm efficiently. Editable in our Ai Editor Tool, it covers areas such as budgeting, billing practices, client trust account management, tax compliance, and financial reporting.

You may also like

- Cleaning Checklist

- Daily Checklist

- Travel Checklist

- Self Care Checklist

- Risk Assessment Checklist

- Onboarding Checklist

- Quality Checklist

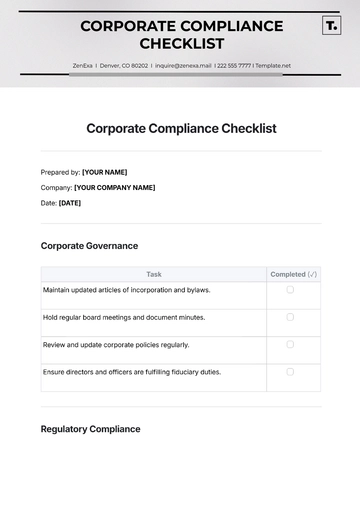

- Compliance Checklist

- Audit Checklist

- Registry Checklist

- HR Checklist

- Restaurant Checklist

- Checklist Layout

- Creative Checklist

- Sales Checklist

- Construction Checklist

- Task Checklist

- Professional Checklist

- Hotel Checklist

- Employee Checklist

- Moving Checklist

- Marketing Checklist

- Accounting Checklist

- Camping Checklist

- Packing Checklist

- Real Estate Checklist

- Cleaning Checklist Service

- New Employee Checklist

- Food Checklist

- Home Inspection Checklist

- Advertising Checklist

- Event Checklist

- SEO Checklist

- Assessment Checklist

- Inspection Checklist

- Baby Registry Checklist

- Induction Checklist

- Employee Training Checklist

- Medical Checklist

- Safety Checklist

- Site Checklist

- Job Checklist

- Service Checklist

- Nanny Checklist

- Building Checklist

- Work Checklist

- Office Checklist

- Training Checklist

- Website Checklist

- IT and Software Checklist

- Performance Checklist

- Project Checklist

- Startup Checklist

- Education Checklist

- Home Checklist

- School Checklist

- Maintenance Checklist

- Planning Checklist

- Manager Checklist

- Wedding Checklist

- Vehicle Checklist

- Travel Agency Checklist

- Vehicle Inspection Checklist

- Interior Design Checklist

- Backpacking Checklist

- Business Checklist

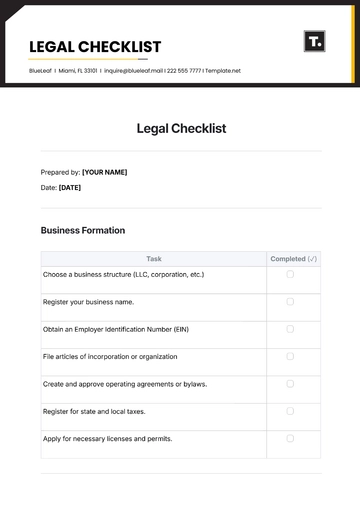

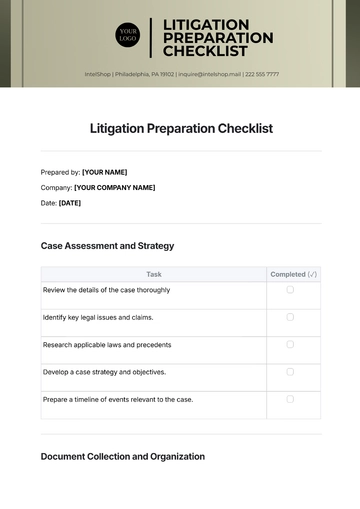

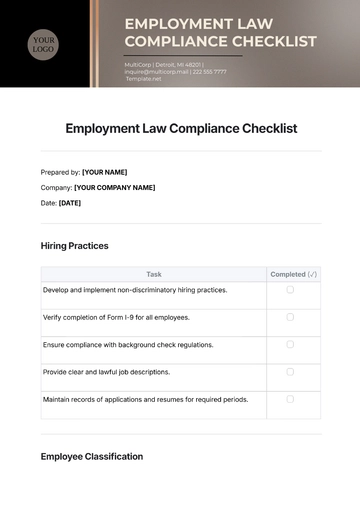

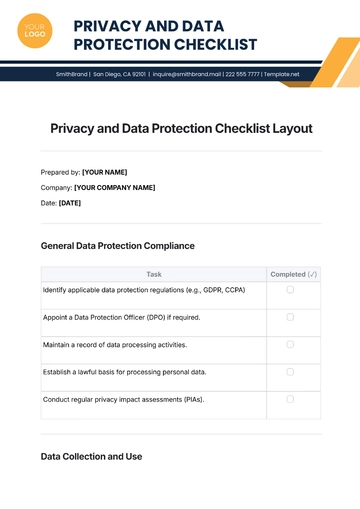

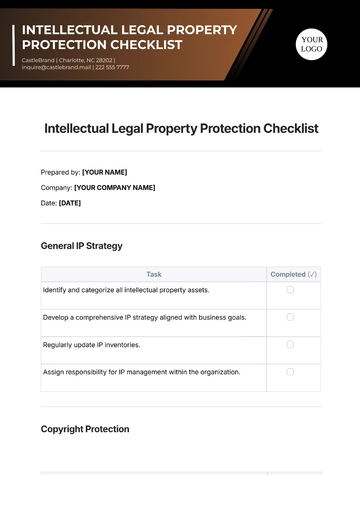

- Legal Checklist

- Nursing Home Checklist

- Weekly Checklist

- Recruitment Checklist

- Salon Checklist

- Baby Checklist

- Equipment Checklist

- Trade Show Checklist

- Party Checklist

- Hospital Bag Checklist

- Evaluation Checklist

- Agency Checklist

- First Apartment Checklist

- Hiring Checklist

- Opening Checklist

- Small Business Checklist

- Rental Checklist

- College Dorm Checklist

- New Puppy Checklist

- University Checklist

- Building Maintenance Checklist

- Work From Home Checklist

- Student Checklist

- Application Checklist