Free Tax Payment Plan

I. Introduction

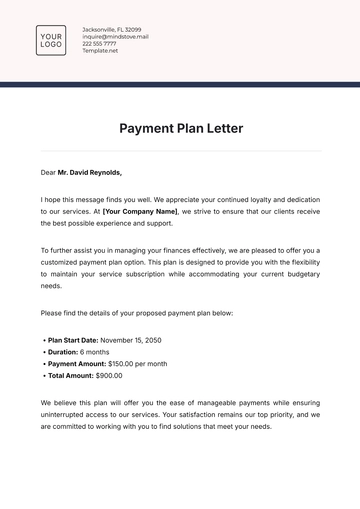

Welcome to the Tax Payment Plan designed to assist taxpayers in managing and settling their tax liabilities effectively. This plan provides a structured approach to fulfill tax obligations while minimizing financial strain.

II. Taxpayer Information

A. Personal Information

Taxpayer ID: [Your Taxpayer ID]

Contact Information:

Email: [Your Email]

Phone: [Your Phone Number]

B. Tax Authority

Authority Name: [Tax Authority Name]

Contact Information:

Phone: [Tax Authority Phone Number]

Email: [Tax Authority Email]

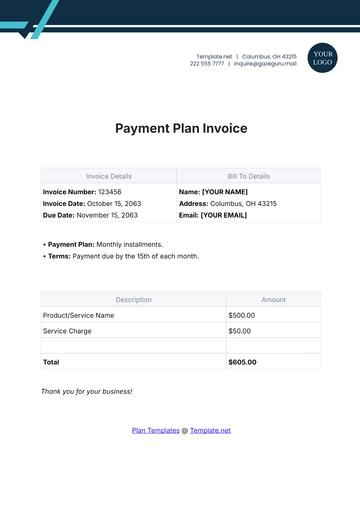

III. Tax Liability

A. Summary of Tax Owed

Total Tax Owed: $10,000

Breakdown:

Income Tax: $7,000

Property Tax: $2,000

Sales Tax: $1,000

B. Penalties and Interest

Total Penalties: $500

Total Interest: $200

IV. Payment Terms

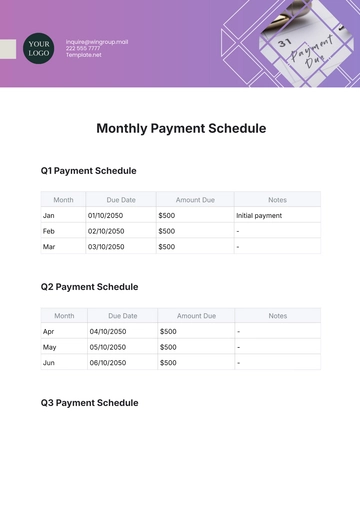

A. Proposed Payment Schedule

Total Duration: 12 months

Installment Frequency: Monthly

Installment Amount: $875

B. Method of Payment

Preferred Payment Method: Electronic Transfer

V. Financial Information

A. Income Statement

Total Income: $60,000

Total Expenses: $45,000

Net Income: $15,000

B. Assets and Liabilities

Assets: $100,000

Liabilities: $50,000

Net Worth: $50,000

VI. Terms and Conditions

A. Responsibilities

Taxpayer Responsibilities: Timely payment of installments, providing accurate financial information.

Tax Authority Responsibilities: Processing payments promptly, and assisting when needed.

B. Consequences of Default

Penalties for Default: Additional penalties may be applied, and legal action may be taken.

Legal Actions: Tax liens, asset seizure, or legal proceedings may occur in case of default.

VII. Signatures

We, the undersigned, agree to the terms and conditions outlined in this Tax Payment Plan.

[Your Name]

[Date Signed]

[Tax Authority Name]

[Date Signed]

- 100% Customizable, free editor

- Access 1 Million+ Templates, photo’s & graphics

- Download or share as a template

- Click and replace photos, graphics, text, backgrounds

- Resize, crop, AI write & more

- Access advanced editor

Introducing the Tax Payment Plan Template, meticulously designed by Template.net for structured tax management and compliance. This customizable document empowers individuals and businesses to organize and plan their tax payments effectively. With editable features and a user-friendly layout, it facilitates tailored tax planning to meet specific financial circumstances and obligations. Streamline your tax management process and gain valuable insights into budgeting and scheduling tax payments. Elevate your financial planning with this versatile template, your essential tool for ensuring timely and accurate tax payments while maintaining financial stability.

You may also like

- Finance Plan

- Construction Plan

- Sales Plan

- Development Plan

- Career Plan

- Budget Plan

- HR Plan

- Education Plan

- Transition Plan

- Work Plan

- Training Plan

- Communication Plan

- Operation Plan

- Health And Safety Plan

- Strategy Plan

- Professional Development Plan

- Advertising Plan

- Risk Management Plan

- Restaurant Plan

- School Plan

- Nursing Home Patient Care Plan

- Nursing Care Plan

- Plan Event

- Startup Plan

- Social Media Plan

- Staffing Plan

- Annual Plan

- Content Plan

- Payment Plan

- Implementation Plan

- Hotel Plan

- Workout Plan

- Accounting Plan

- Campaign Plan

- Essay Plan

- 30 60 90 Day Plan

- Research Plan

- Recruitment Plan

- 90 Day Plan

- Quarterly Plan

- Emergency Plan

- 5 Year Plan

- Gym Plan

- Personal Plan

- IT and Software Plan

- Treatment Plan

- Real Estate Plan

- Law Firm Plan

- Healthcare Plan

- Improvement Plan

- Media Plan

- 5 Year Business Plan

- Learning Plan

- Marketing Campaign Plan

- Travel Agency Plan

- Cleaning Services Plan

- Interior Design Plan

- Performance Plan

- PR Plan

- Birth Plan

- Life Plan

- SEO Plan

- Disaster Recovery Plan

- Continuity Plan

- Launch Plan

- Legal Plan

- Behavior Plan

- Performance Improvement Plan

- Salon Plan

- Security Plan

- Security Management Plan

- Employee Development Plan

- Quality Plan

- Service Improvement Plan

- Growth Plan

- Incident Response Plan

- Basketball Plan

- Emergency Action Plan

- Product Launch Plan

- Spa Plan

- Employee Training Plan

- Data Analysis Plan

- Employee Action Plan

- Territory Plan

- Audit Plan

- Classroom Plan

- Activity Plan

- Parenting Plan

- Care Plan

- Project Execution Plan

- Exercise Plan

- Internship Plan

- Software Development Plan

- Continuous Improvement Plan

- Leave Plan

- 90 Day Sales Plan

- Advertising Agency Plan

- Employee Transition Plan

- Smart Action Plan

- Workplace Safety Plan

- Behavior Change Plan

- Contingency Plan

- Continuity of Operations Plan

- Health Plan

- Quality Control Plan

- Self Plan

- Sports Development Plan

- Change Management Plan

- Ecommerce Plan

- Personal Financial Plan

- Process Improvement Plan

- 30-60-90 Day Sales Plan

- Crisis Management Plan

- Engagement Plan

- Execution Plan

- Pandemic Plan

- Quality Assurance Plan

- Service Continuity Plan

- Agile Project Plan

- Fundraising Plan

- Job Transition Plan

- Asset Maintenance Plan

- Maintenance Plan

- Software Test Plan

- Staff Training and Development Plan

- 3 Year Plan

- Brand Activation Plan

- Release Plan

- Resource Plan

- Risk Mitigation Plan

- Teacher Plan

- 30 60 90 Day Plan for New Manager

- Food Safety Plan

- Food Truck Plan

- Hiring Plan

- Quality Management Plan

- Wellness Plan

- Behavior Intervention Plan

- Bonus Plan

- Investment Plan

- Maternity Leave Plan

- Pandemic Response Plan

- Succession Planning

- Coaching Plan

- Configuration Management Plan

- Remote Work Plan

- Self Care Plan

- Teaching Plan

- 100-Day Plan

- HACCP Plan

- Student Plan

- Sustainability Plan

- 30 60 90 Day Plan for Interview

- Access Plan

- Site Specific Safety Plan