Table of Contents

- Checkbook Register Definition & Meaning

- What Is a Checkbook Register?

- 10 Types of Checkbook Register

- Checkbook Register Uses, Purpose, and Importance

- What’s in a Checkbook Register? Parts?

- How to Design A Study Guide

- Checkbook Register vs. Bank Statement

- What’s the Difference Between a Checkbook Register, Balance Sheet, and Accounting?

- Checkbook Register Sizes

- Checkbook Register Ideas and Examples

- FAQs

Checkbook Register

Checkbook registers are one of the many basic yet practical tools a person can use to manage their finances. If you own a bank account, keeping a checkbook register can help you track and monitor your bank transactions.

Checkbook Register Definition & Meaning

A checkbook register is a document or statement that is used to record check payments and other financial transactions.

A checkbook register is an important tool designed to help individuals and businesses keep better track of their different financial transactions.

What Is a Checkbook Register?

A checkbook register typically contains several columns that are arranged in a particular order. Any financial or bank transaction including deposits, withdrawals, and interest fees are chronologically recorded in a checkbook register. A checkbook register can either be a physical document or an electronic one.

10 Types of Checkbook Register

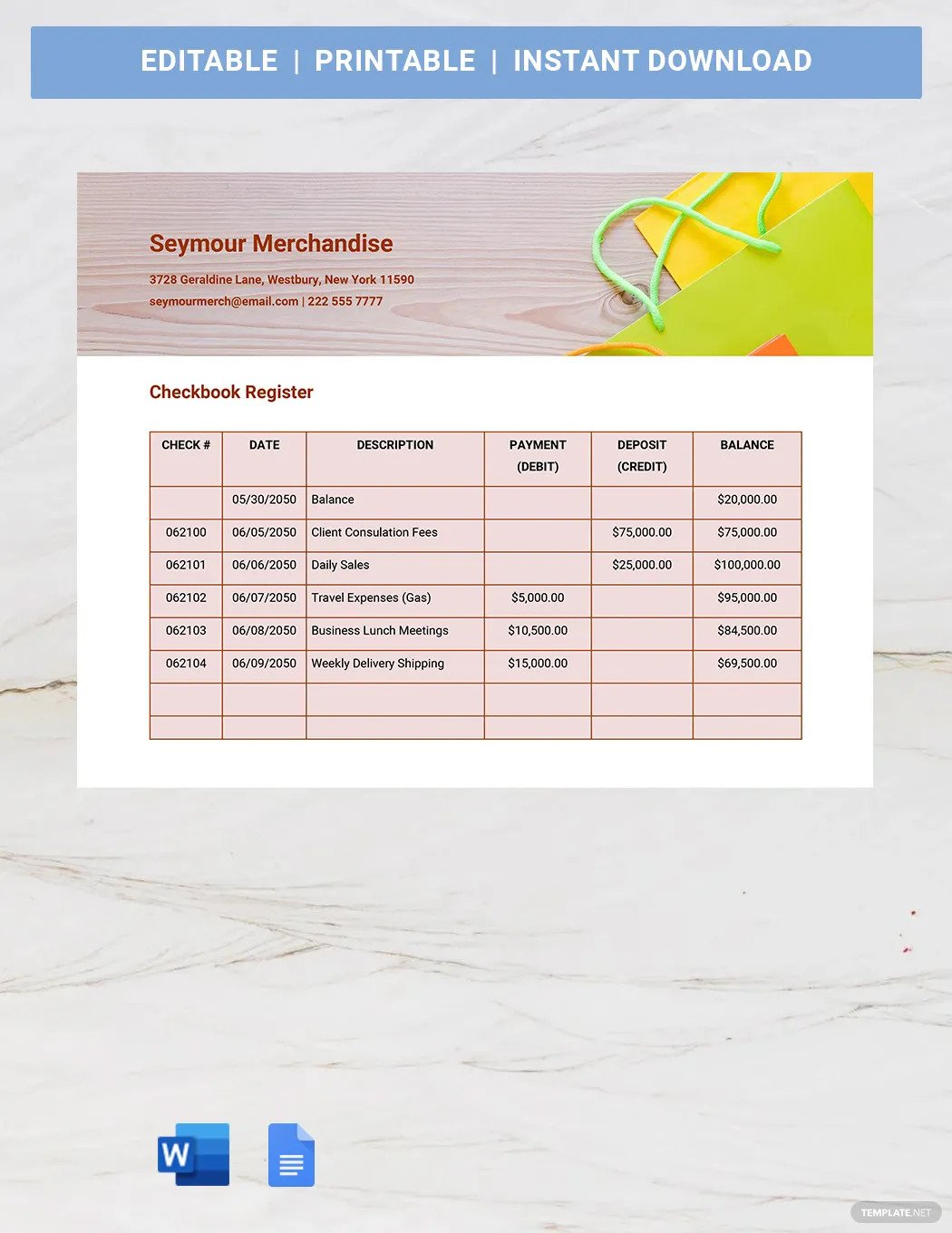

Daily Checkbook Register

Maintaining a daily checkbook register helps you keep track of your financial transactions. Although you don’t necessarily need to use it every day, it is still an important document for any checking bank account. It is where you keep a record of your checks payments- both debit and credit transactions.

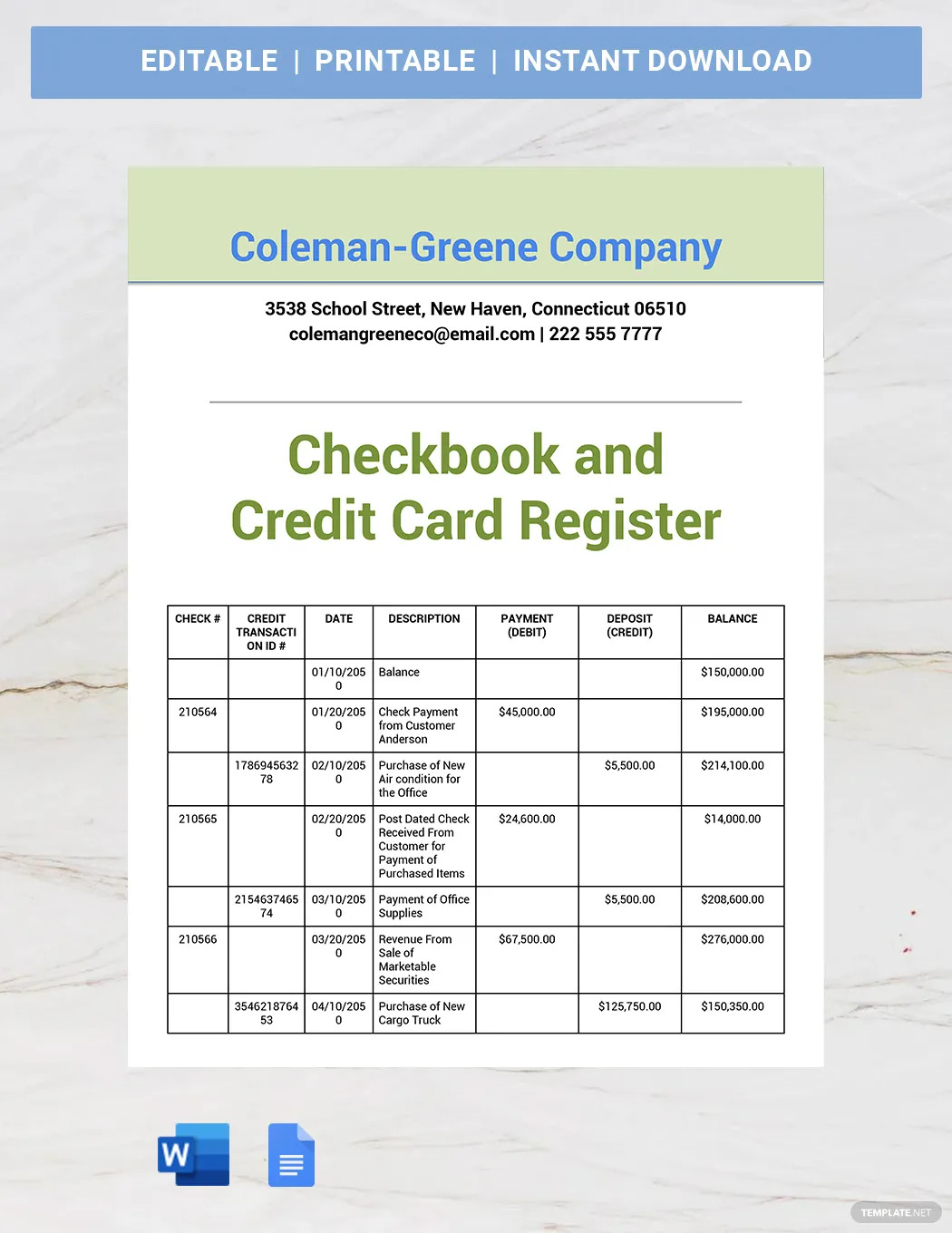

Credit Card Checkbook Register

Credit cards have definitely made people’s lives more convenient; however, ease and convenience do not come without a cost. It is easy to fall into debt if you don’t use your credit card responsibly and prudently. But a credit card checkbook register may be able to help you avoid overspending or going over your budget.

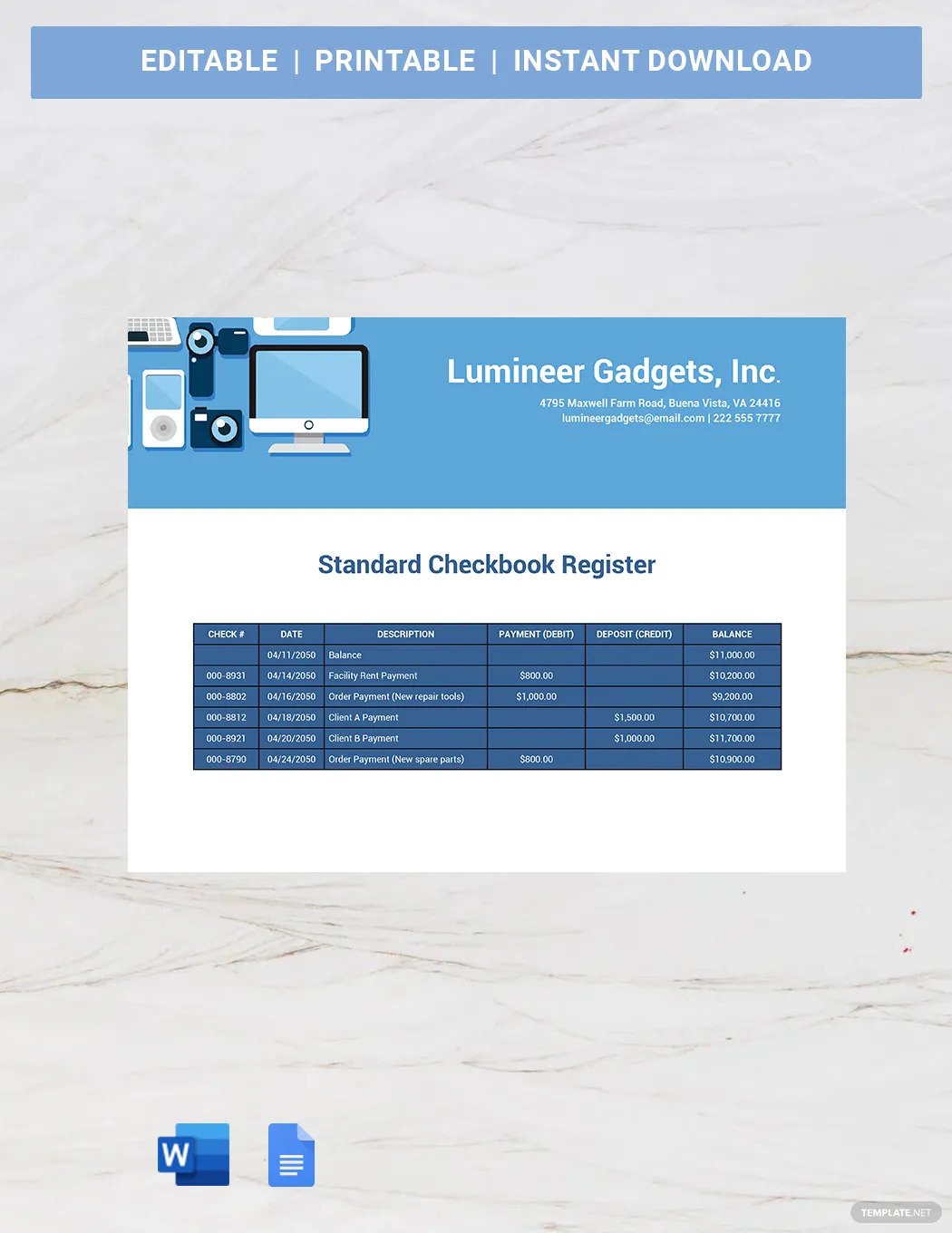

Standard Checkbook Register

If you want to monitor your bank account’s activities, consider keeping a checkbook register. It is a basic document that is used to record and document all your financial activities and transactions. A basic or standard checkbook register must contain several columns to input the balance, transaction date, check number, description, etc.

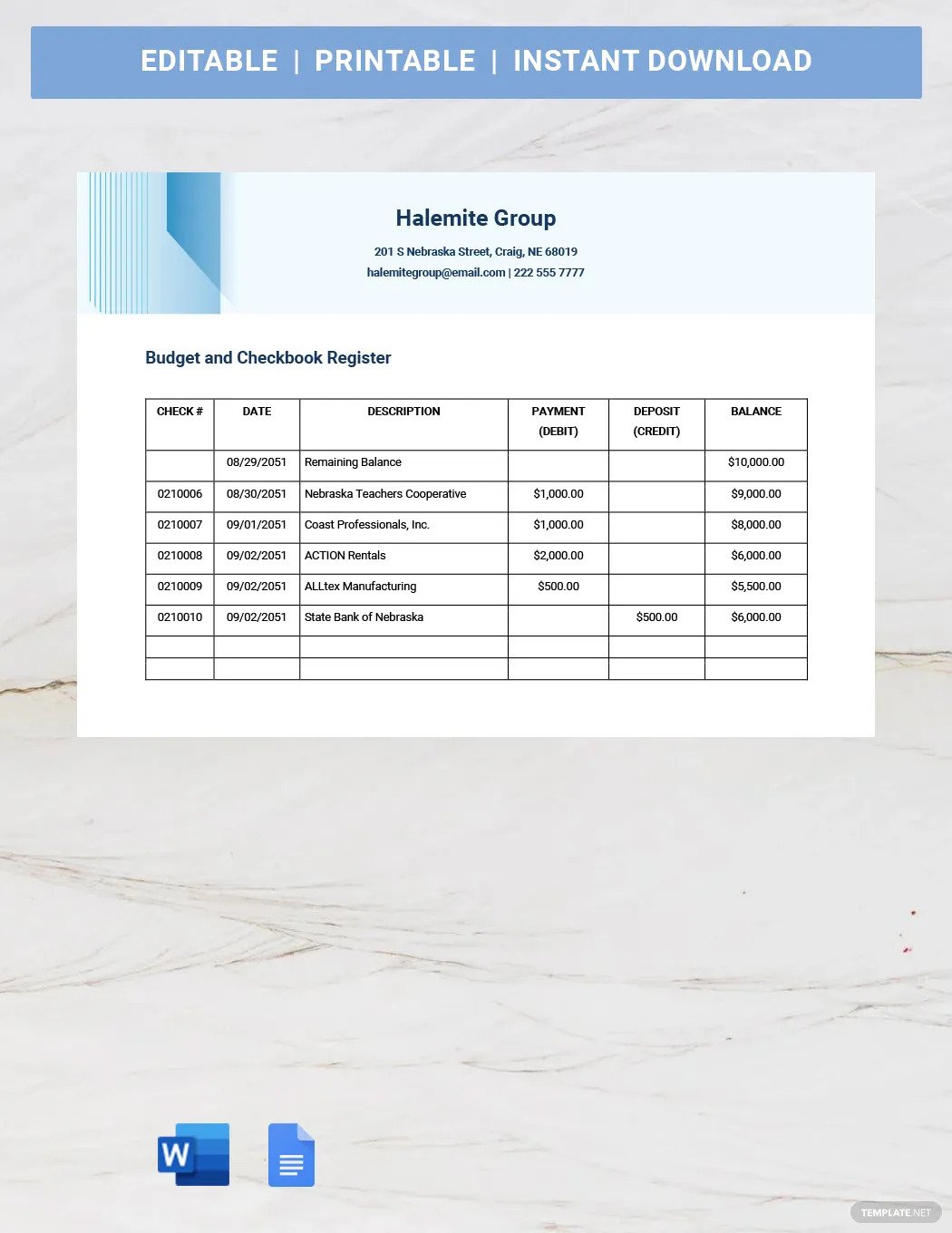

Budget Checkbook Register

Keeping a personal checkbook register can definitely help you budget better. The two financial concepts are fundamentally intertwined. If you want to start budgeting, saving up, or just monitoring your spending habits, then having a budget checkbook register is a good way to start.

Planner Checkbook Register

The best way to avoid going over your budget and falling into debt is to be mindful and responsible when it comes to your finances. A checkbook register, for instance, can give you an accurate idea of where your money is going. Everything from your mortgage payment to your credit card transactions can be listed in your checkbook register planner.

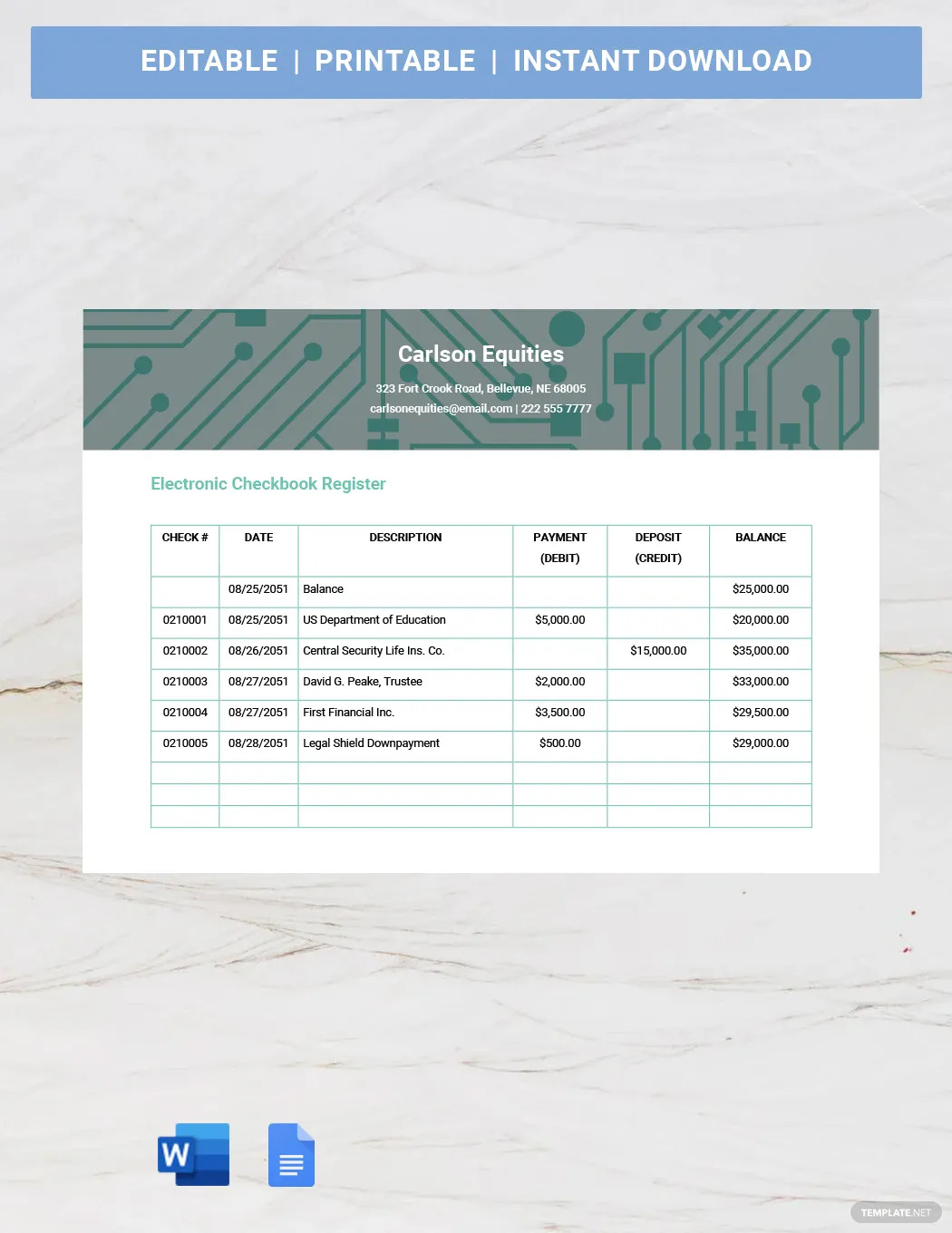

Electronic Checkbook Register

In the past, checkbook registers were handwritten and kept in manual logbooks such as general ledgers. Today, probably the only people who still use handwritten check registers are the older generation. In the Digital Age, electronic checkbook registers are a more convenient alternative for keeping a record of your bank transactions.

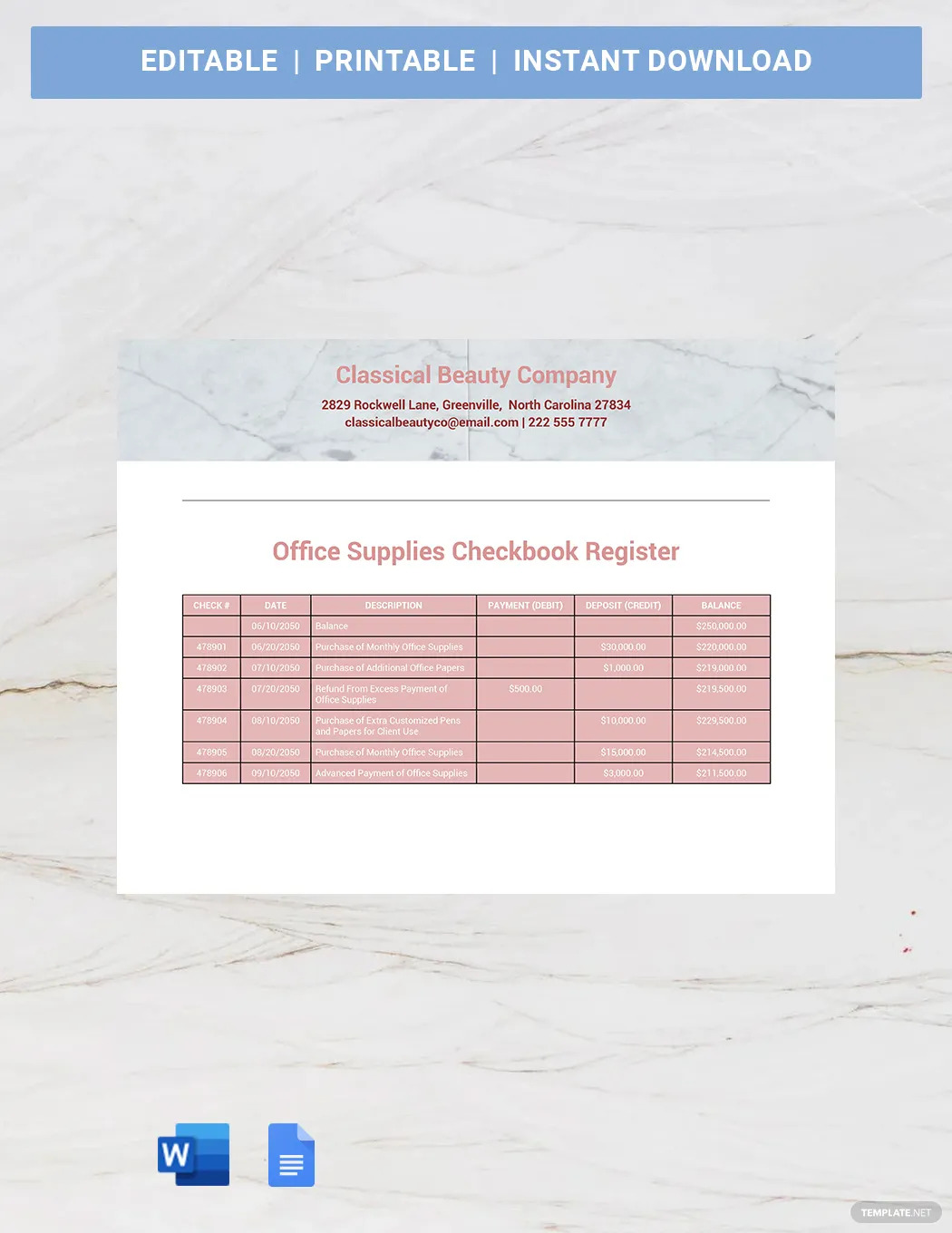

Office Supplies Checkbook Register

It is a common practice for big companies to buy office supplies in bulk. These wholesale purchases of basic office supplies do not come with a small price tag either. Documenting all your transactions in an office supplies checkbook register will help you monitor the procurement of office supplies and other needs.

Traditional Checkbook Register

A traditional checkbook register must contain several basic components. These components include the date of the transaction, check number, payment amount, deposit amount, current balance, and a brief description. Further, a table or spreadsheet format is often used when making checkbook registers because it makes it look more organized and systematic.

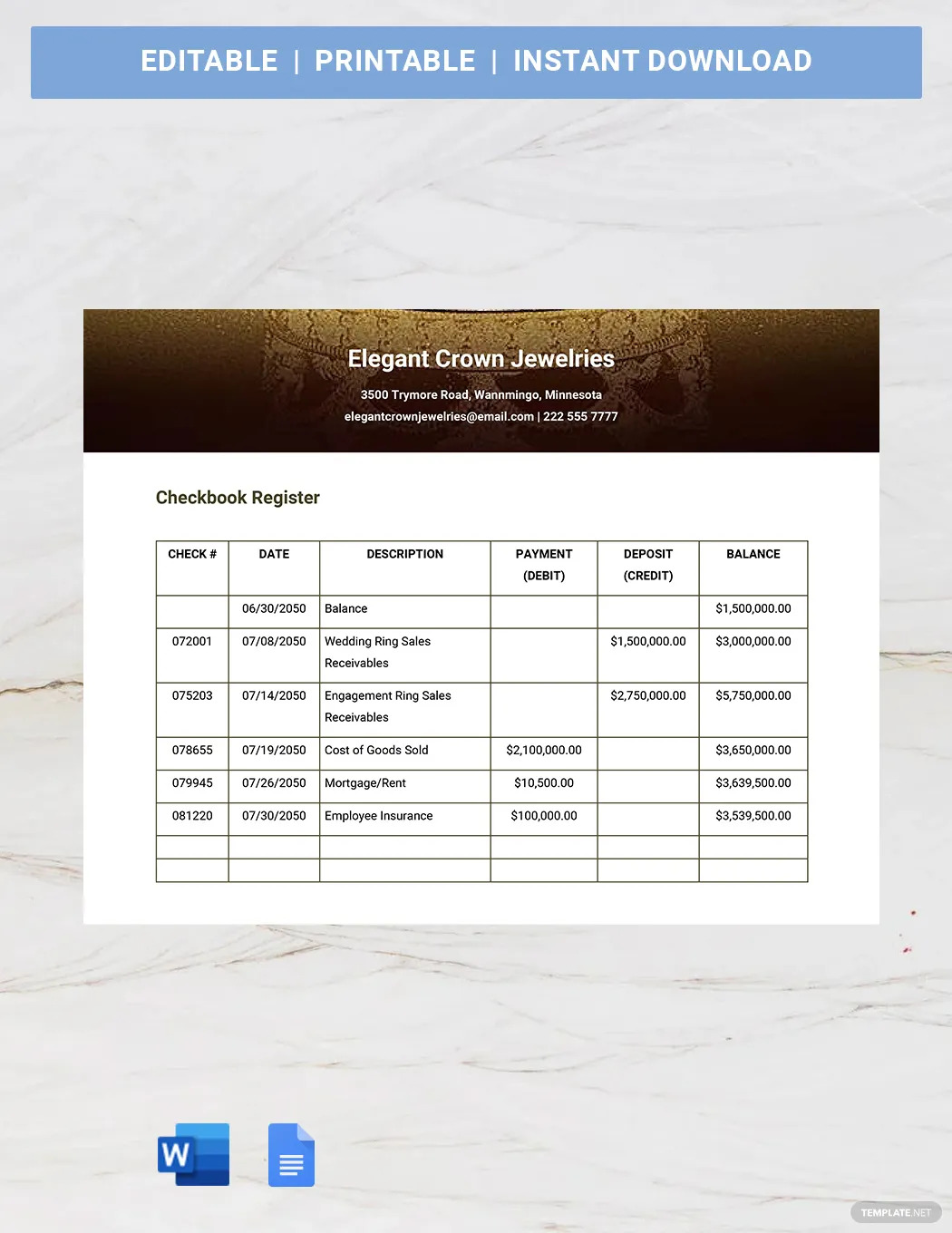

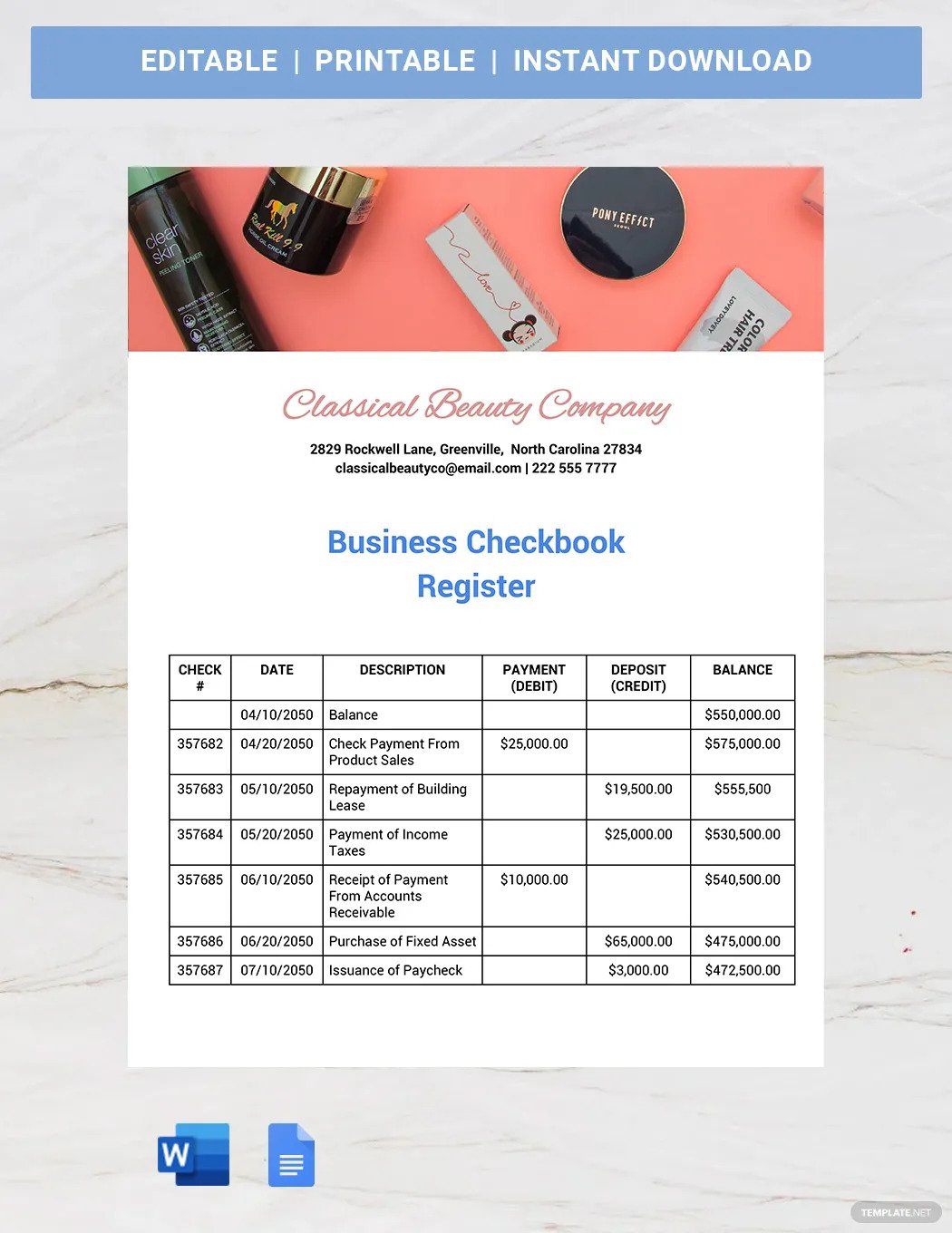

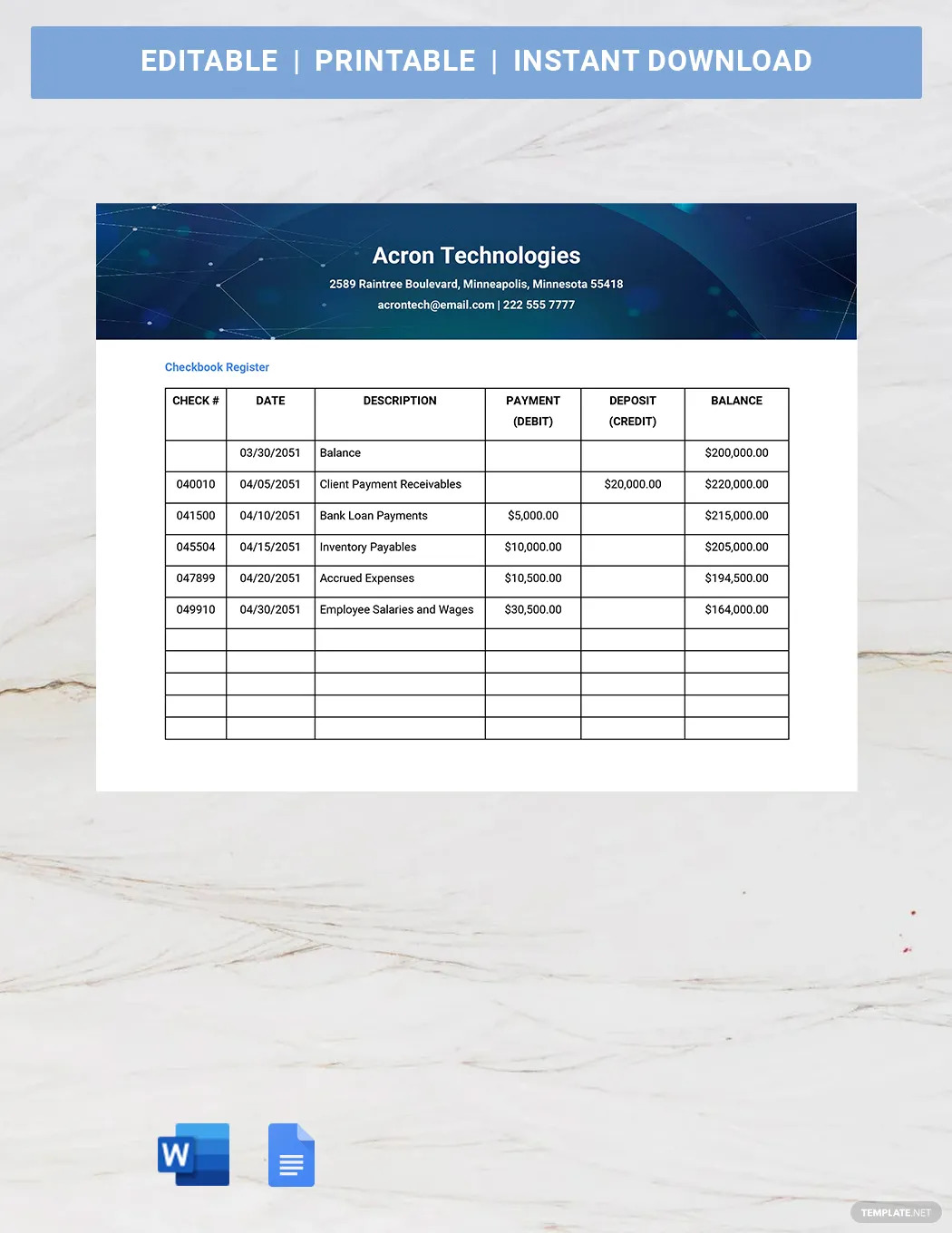

Business Checkbook Register

Operating your own business is both a challenging and fulfilling venture. The financial and accounting aspect of the business is one of the basic responsibilities that you, as a business owner, have to constantly oversee. With a business checkbook register, you can have a bird’s-eye view of all your company’s financial transactions and activities.

Digital Checkbook Register

A digital checkbook register makes it easier for you to monitor your bank transactions. You can easily update your financial records on your computer, phone, or any device. Bank account holders can even access their transaction information remotely or on the go.

Checkbook Register Uses, Purpose, and Importance

A checkbook register is a basic accounting tool that is pretty simple and straightforward to use. There are several benefits of owning and keeping a checkbook register—whether it is for personal use or for business reasons.

Keep an Organized Record

First and foremost, a checkbook register is used to record or monitor financial transactions. Whether you make a monthly deposit or cash in a check payment, all these activities should be reflected in your checkbook register. It is also highly important to keep your checkbook register records up-to-date.

Effective Budgeting Tool

A checkbook register can also be considered an effective tool for budgeting. Keeping a record of your bank transactions can help you determine how much money you have left or is available to spend. This crucial information can be quite useful in mapping out your budget plan or savings plan.

Determine the Running Balance

If you religiously and constantly update your checkbook register, you will always know what your running balance is. The running balance is your current balance or the amount of money you have in your bank account. This is important information to consider when you need to make financial decisions.

Real-time and Accurate Information

There are times when bank statements are not immediately updated due to various reasons like delayed systems and processes. This is not necessarily a bad thing as the transactions will eventually be reflected sooner or later. But the benefit of using a checkbook register is that you get real-time information and the exact amounts are instantly reflected in the record.

Bank Statement Reconciliation

Sometimes you can’t always depend on your bank. After all, the banking and finance systems are not immune to mistakes and errors can definitely happen. But keeping a personal record of your bank transactions can help you spot errors, compare, and reconcile your bank’s records with your own bookkeeping.

What’s in a Checkbook Register? Parts?

Check Number

A check number is a unique number for each check issued and should be specifically indicated in the checkbook register. The check number is needed for precise and accurate bookkeeping.

Date of Transaction

Under the date of transaction column, specify the specific date the deposit, withdrawal, or any financial transaction was made. Make sure to input the complete date—the day, month, and year in the checkbook register.

Description

Always include a brief description of each and every transaction- whether it is an electric bill or a cash deposit. This will be useful when reviewing your bank activities and previous financial transactions.

Amount

It is important to specify the exact amount of each transaction; this refers to both the money deposited into the account and the money withdrawn from the account. This section may be divided into two separate columns- debit and credit.

Balance

The last column is reserved for the balance which is essentially the amount of money remaining after the latest transaction. The amount may increase or decrease depending on the type of transaction made.

How to Design A Study Guide

1. Choose a Checkbook Register Size.

2. Determine the objective of the checkbook register.

3. Select a Checkbook Register Template.

4. Edit the company name and company details.

5. Input the check number and date of the transaction.

6. Add a short description and the amount, then calculate the balance for each entry.

Checkbook Register vs. Bank Statement

A checkbook register is a record of bank transactions in real-time and it can be prepared by the bank account holder themselves.

A bank statement is a statement that reflects all the financial transactions of a bank account holder; however, the statement is issued by the bank—sometimes upon request of the client or account holder.

What’s the Difference Between a Checkbook Register, Balance Sheet, and Accounting?

A checkbook register is a financial document used in recording various transactions such as account withdrawals and bank deposits.

A balance sheet is a financial document that details a company or establishment’s assets, liabilities, capital, and other relevant financial data.

Accounting involves the documentation, tabulation, analysis, and summarization of a person or company’s financial and monetary transactions.

Checkbook Register Sizes

A checkbook register contains several crucial data that allow businesses and individuals to keep track of their financial and bank transactions. There are different checkbook register sizes and formats that may be used to prepare an effective and practical checkbook register document.

- Letter Size (8.5 inches × 11 inches)

- Legal Size (8.5 inches × 14 inches)

- A4 Size (8.3 inches × 11.7 inches)

Checkbook Register Ideas and Examples

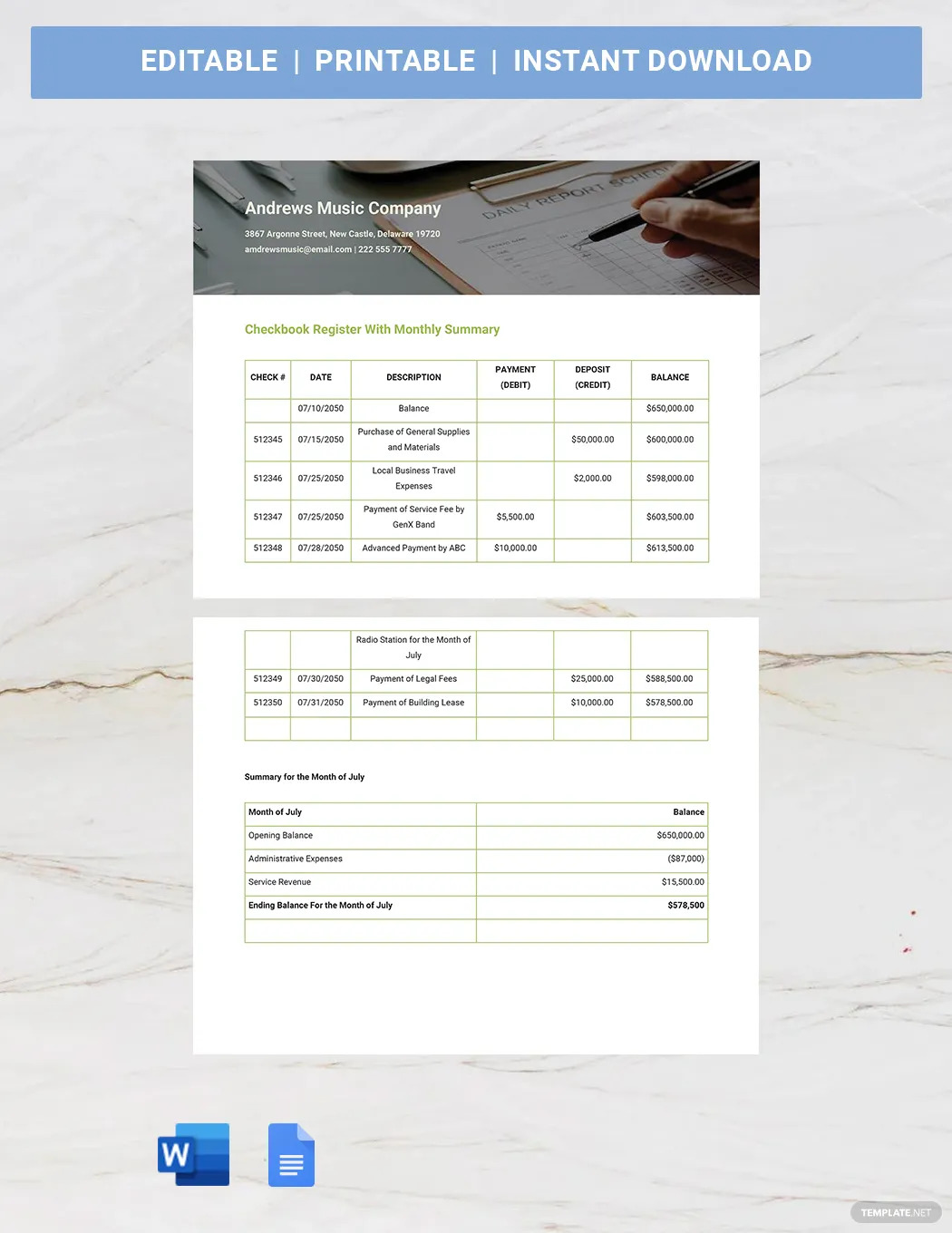

Checkbook registers can be used for both personal finance and business accounting records. There are also various types of checkbook register ideas and examples that are specifically designed to cater to different needs and objectives.

- Checkbook Register Income and Expenses Ideas and Examples

- Personal Checkbook Register Ideas and Examples

- Checkbook Transaction Register Ideas and Examples

- Checkbook Register Monthly Summary Ideas and Examples

- Simple Checkbook Register Ideas and Examples

- Budget Checkbook Register Ideas and Examples

- Business Checkbook Register Ideas and Examples

- Credit Card Checkbook Register Ideas and Examples

- Electronic Checkbook Register Ideas and Examples

- Checkbook Register Planner Ideas and Examples

FAQs

What should be included in a checkbook register?

A checkbook register should contain all the various transactions of a bank account such as account balance, withdrawals, deposits, interest fees, etc.

Where do you get a checkbook register?

You can get a checkbook register at your local bank, purchase checkbook registers at retail stores (e.g., office supply stores), and you can also create your own checkbook register using a ready-made template.

How do you do a checkbook register?

Record each financial transaction in your checkbook register by listing the date, check number, the amount or balance, and a brief description of the transaction.

What do you write in a checkbook register?

Input all check, debit, deposit, and credit transactions into a checkbook register.

What is a register for a checkbook?

A checkbook register is a document where all your check payments and business or financial transactions are detailed and recorded.

What types of data should be in a checkbook register?

Data such as the check number, account balance, date of transaction, and relevant notes or descriptions should be noted in a checkbook register.

Why is it important to maintain an accurate checkbook register?

It is important to maintain an accurate checkbook register in order to get a clear picture of how much you are spending and also to keep your financial records more organized.

How often should you update your checkbook register?

You should update your checkbook register after every financial transaction made-whether it is a deposit, debit, or credit transaction.

Do checks come with a checkbook register?

Most banks provide a free checkbook register when you open a checking account or when you place an order for checks.

Which transaction should you record in your checkbook register?

Financial transactions such as deposits, withdrawals, debit card payments, and check payments must be recorded in a checkbook register.

Do banks give free check registers?

Yes, a lot of banks still issue free checkbook registers when an individual or business client opens a checking account.

Do people still balance their checkbooks?

Even though the manual practice of balancing checkbook registers has become a little outdated, there are still people (especially the older generation) that still fill out their checkbook registers manually or by hand.

Why would you want a check register?

There are many benefits to keeping a checkbook register such as having an effective way of monitoring one’s bank transactions and activities.

How long should you keep checkbook registers?

Ideally, you should not keep your checkbook registers for longer than 10 years.

Should you shred checkbook registers?

For security reasons, you should shred old or unused checkbook registers yourself or you can request your bank to do it for you.

Are check registers really necessary?

Yes, checkbook registers are important documents that can help you keep track of your bank account transactions.

What is another name for a checkbook register?

Another name for a checkbook register is a cash disbursement journal.