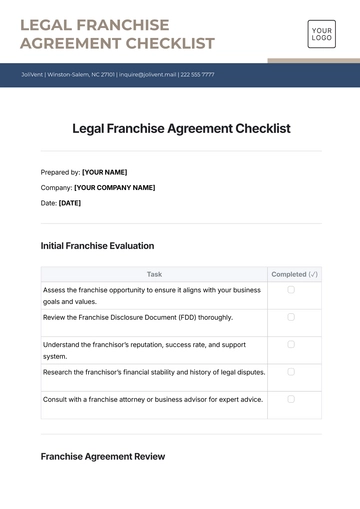

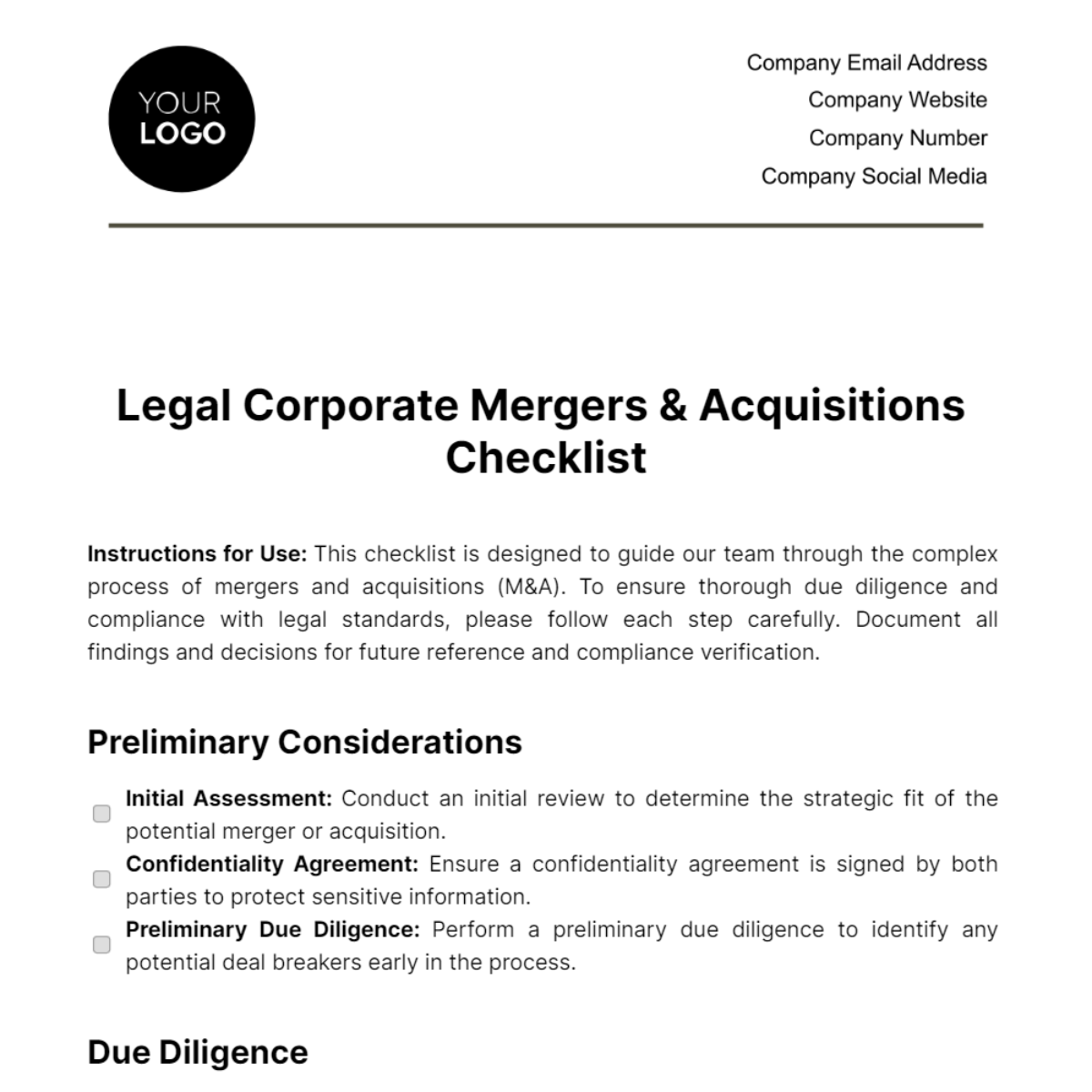

Free Legal Corporate Mergers & Acquisitions Checklist

Instructions for Use: This checklist is designed to guide our team through the complex process of mergers and acquisitions (M&A). To ensure thorough due diligence and compliance with legal standards, please follow each step carefully. Document all findings and decisions for future reference and compliance verification.

Preliminary Considerations

Initial Assessment: Conduct an initial review to determine the strategic fit of the potential merger or acquisition.

Confidentiality Agreement: Ensure a confidentiality agreement is signed by both parties to protect sensitive information.

Preliminary Due Diligence: Perform a preliminary due diligence to identify any potential deal breakers early in the process.

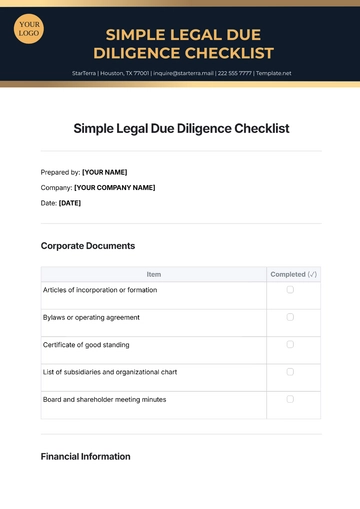

Due Diligence

Financial Analysis: Review the target’s financial statements, tax returns, and other financial metrics.

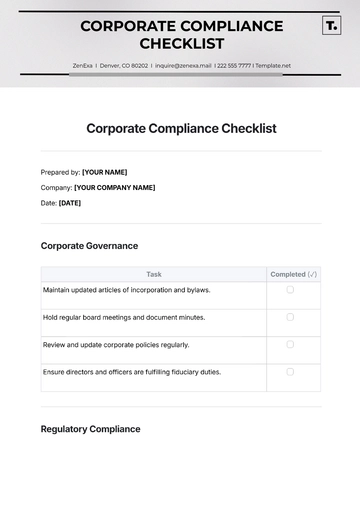

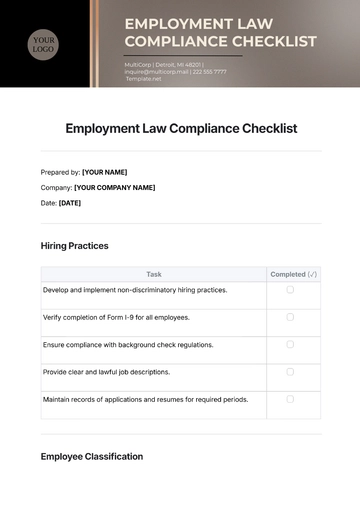

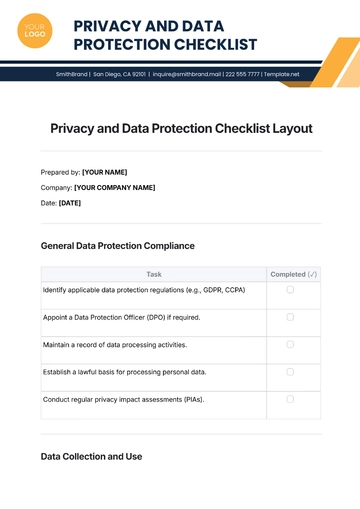

Legal Compliance: Verify the target company's compliance with laws and regulations.

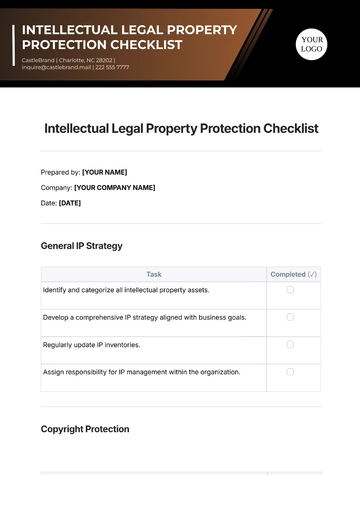

Intellectual Property: Assess the integrity and ownership of intellectual property.

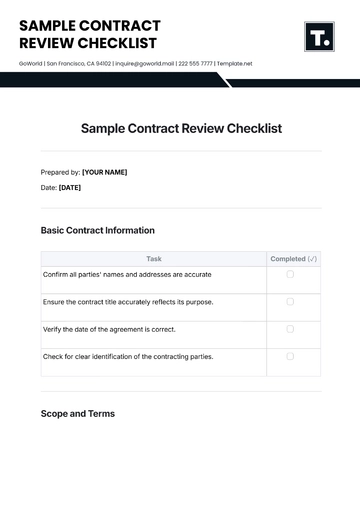

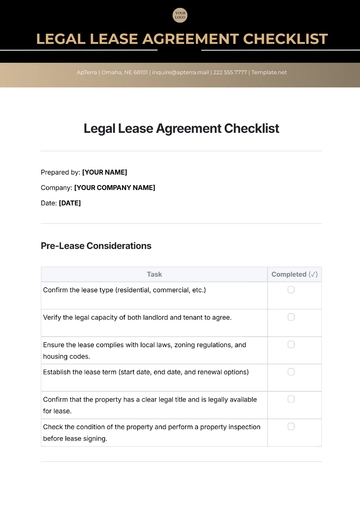

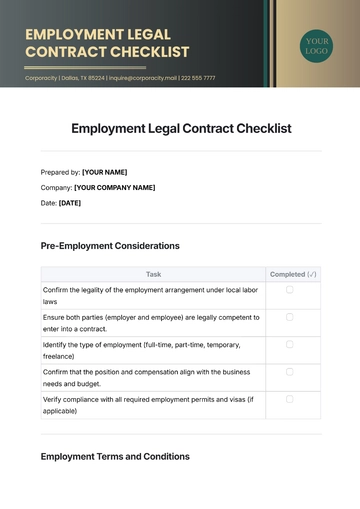

Contracts Review: Examine existing contracts with customers, suppliers, and employees.

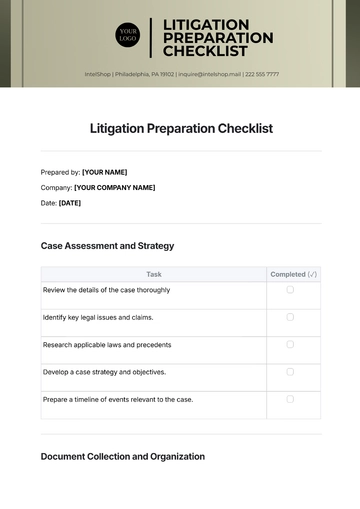

Litigation Risks: Identify any current or potential litigation risks.

Valuation and Negotiation

Valuation: Determine the value of the target company using various valuation methods.

Offer Preparation: Prepare a preliminary offer based on the valuation and strategic considerations.

Negotiation: Engage in negotiations with the target company, aiming to reach a preliminary agreement.

Structuring the Deal

Deal Structure: Decide on the structure of the deal (e.g., asset purchase, stock purchase).

Financing Arrangements: Outline the financing arrangements, including loans, equity financing, or a combination of both.

Regulatory Approvals: Identify and apply for any necessary regulatory approvals.

Final Due Diligence

Comprehensive Legal Due Diligence: Conduct a thorough legal review covering all aspects of the target company.

Final Financial Review: Perform a final review of the target’s financial health and projections.

Operational Review: Evaluate the target company's operations, including IT systems, human resources, and operational capabilities.

Closing Preparation

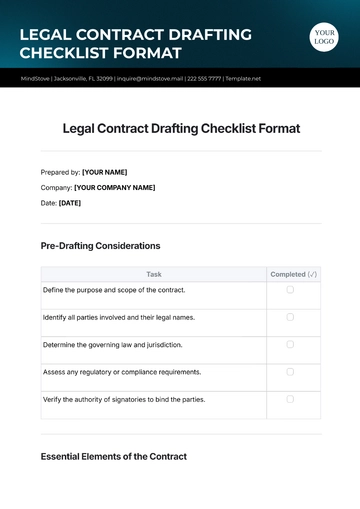

Drafting Agreements: Draft the necessary legal documents, including the purchase agreement, with detailed terms and conditions.

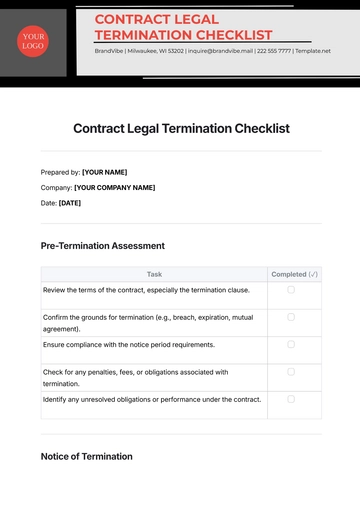

Closing Checklist: Prepare a closing checklist to ensure all conditions are met before finalizing the deal.

Board Approvals: Obtain approval from our board of directors and the target company's board, if applicable.

Post-Merger Integration

Integration Planning: Develop a detailed plan for integrating the target company into our operations.

Employee Communication: Communicate the merger or acquisition to employees of both companies in a timely and clear manner.

Systems Integration: Begin the process of integrating systems, processes, and cultures.

Regulatory Compliance: Ensure ongoing compliance with all regulatory requirements post-merger or acquisition.

Review and Analysis

Performance Review: Assess the performance of the acquisition against initial objectives and projections.

Lessons Learned: Document lessons learned and best practices for future M&A activities.

- 100% Customizable, free editor

- Access 1 Million+ Templates, photo’s & graphics

- Download or share as a template

- Click and replace photos, graphics, text, backgrounds

- Resize, crop, AI write & more

- Access advanced editor

Facilitate seamless mergers and acquisitions with the Legal Corporate Mergers & Acquisitions Checklist Template from Template.net. This template is editable and customizable, offering a comprehensive guide to ensure every critical step is covered efficiently. Perfectly editable in our AI Editor tool, it adapts to your specific needs, making the complex M&A process straightforward. Trust Template.net for your corporate strategy essentials.

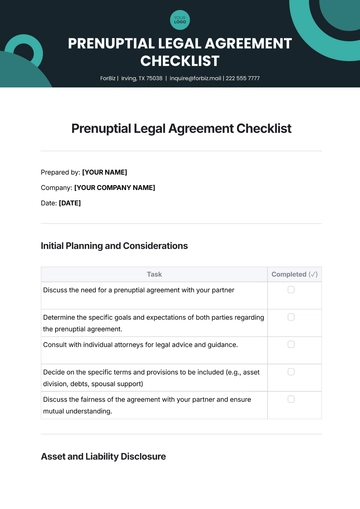

You may also like

- Cleaning Checklist

- Daily Checklist

- Travel Checklist

- Self Care Checklist

- Risk Assessment Checklist

- Onboarding Checklist

- Quality Checklist

- Compliance Checklist

- Audit Checklist

- Registry Checklist

- HR Checklist

- Restaurant Checklist

- Checklist Layout

- Creative Checklist

- Sales Checklist

- Construction Checklist

- Task Checklist

- Professional Checklist

- Hotel Checklist

- Employee Checklist

- Moving Checklist

- Marketing Checklist

- Accounting Checklist

- Camping Checklist

- Packing Checklist

- Real Estate Checklist

- Cleaning Checklist Service

- New Employee Checklist

- Food Checklist

- Home Inspection Checklist

- Advertising Checklist

- Event Checklist

- SEO Checklist

- Assessment Checklist

- Inspection Checklist

- Baby Registry Checklist

- Induction Checklist

- Employee Training Checklist

- Medical Checklist

- Safety Checklist

- Site Checklist

- Job Checklist

- Service Checklist

- Nanny Checklist

- Building Checklist

- Work Checklist

- Office Checklist

- Training Checklist

- Website Checklist

- IT and Software Checklist

- Performance Checklist

- Project Checklist

- Startup Checklist

- Education Checklist

- Home Checklist

- School Checklist

- Maintenance Checklist

- Planning Checklist

- Manager Checklist

- Wedding Checklist

- Vehicle Checklist

- Travel Agency Checklist

- Vehicle Inspection Checklist

- Interior Design Checklist

- Backpacking Checklist

- Business Checklist

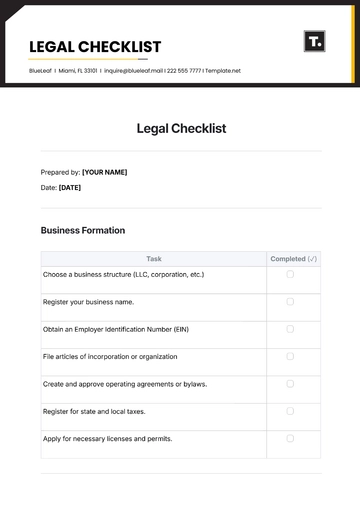

- Legal Checklist

- Nursing Home Checklist

- Weekly Checklist

- Recruitment Checklist

- Salon Checklist

- Baby Checklist

- Equipment Checklist

- Trade Show Checklist

- Party Checklist

- Hospital Bag Checklist

- Evaluation Checklist

- Agency Checklist

- First Apartment Checklist

- Hiring Checklist

- Opening Checklist

- Small Business Checklist

- Rental Checklist

- College Dorm Checklist

- New Puppy Checklist

- University Checklist

- Building Maintenance Checklist

- Work From Home Checklist

- Student Checklist

- Application Checklist