14+ Operating Budget Templates

An organization’s financial plans should include budgets samples for operation as well as capital. The operating budget is a combination of notable expenses, expected future cost, and forecasted income over the course of a year. They provide an overview of the costs of running the business in other words, the company’s day-to-day expenses and income which gives you the chance to calculate the estimate profit. You can also see more on Operating Budget in Google Docs.

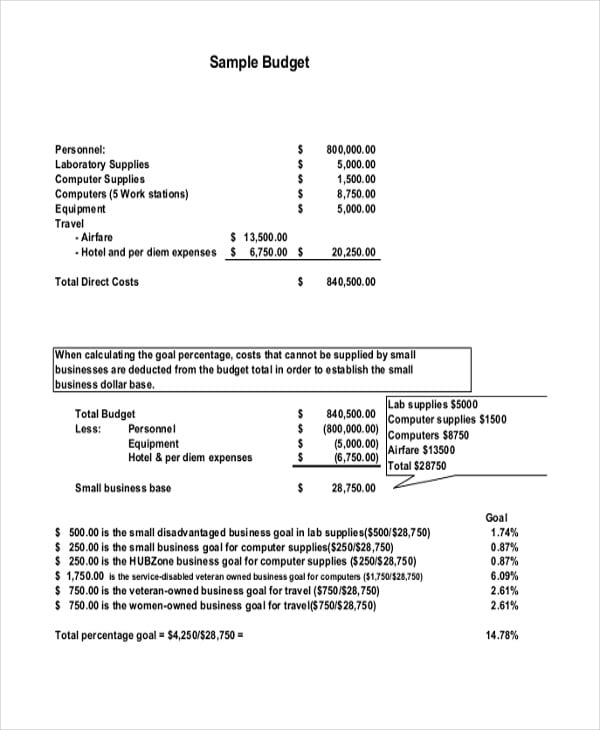

Sample Operating Budget Template

Simple Annual Operating Budget Template

School Accounting Operating Budget Template

Operating budgets are prepared in advance of the accounting period, which requires the estimated expenses and revenues beforehand. People in charge of preparing it invest a lot time to make sure that the financial information provided us accurate and consistent. Below is a compilation of operating simple budget templates that any business owner or accountant can download and use.

Simple Operating Budget Design Template

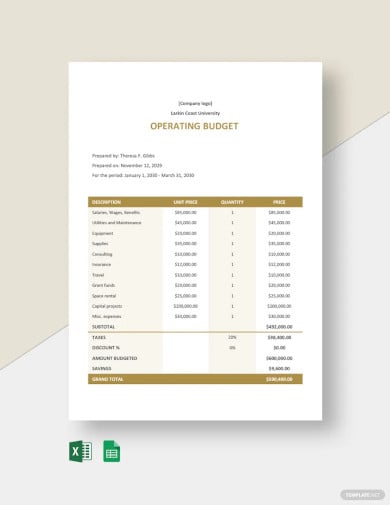

University Operating Budget Creative Template

Free Annual Healthcare Operating Budget Template

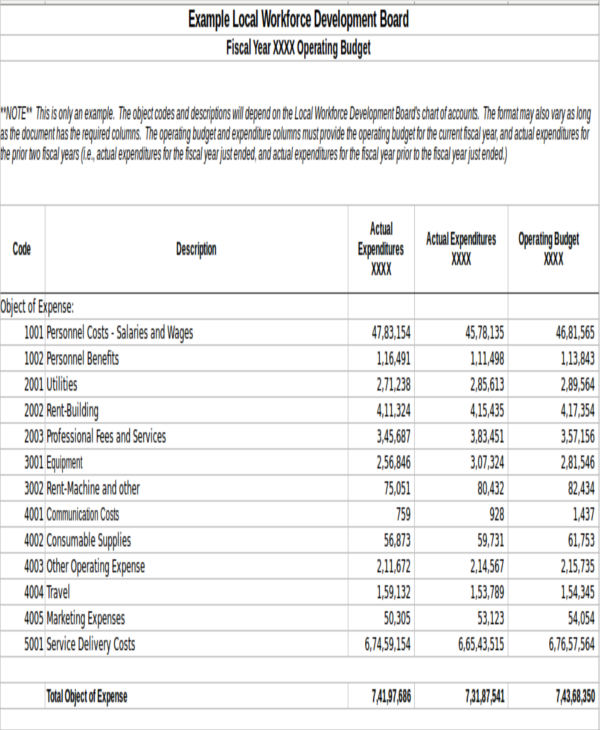

twc.state.tx.us

twc.state.tx.usFree Yearly Non Profit Operating Budget Template

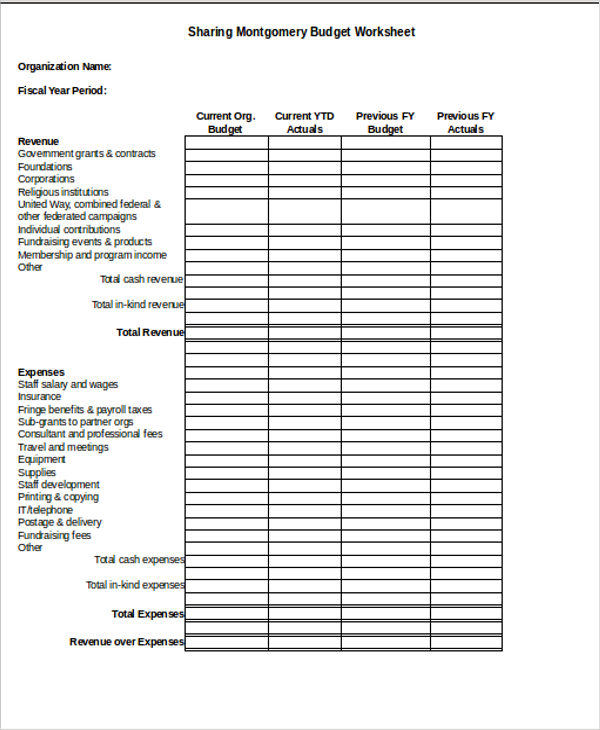

whatcomcf.org

whatcomcf.orgFree Monthly Operating Financial Budget Template

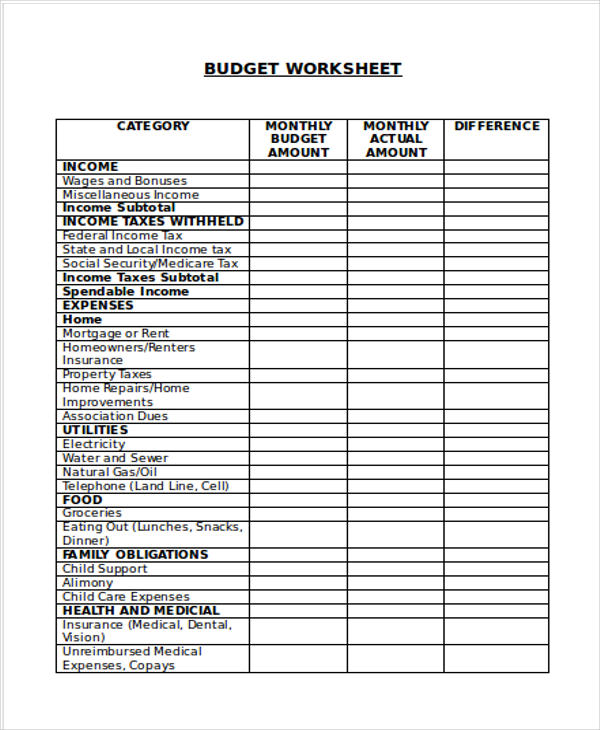

uminfopoint.umsystem.edu

uminfopoint.umsystem.eduFree Small Business Operating Budget Template

ospa.umn.edu

ospa.umn.eduStructure of an Operating Budget

- Sale or Turnover. First of all, you must sample estimate the cost of your products by finding out how much the customer is willing to pay for it. Sale or turnover refers to the money you receive from customers when the make a purchase of a product or service from you. You can also see more on simple estimates.

- Variable Cost or Used Goods. In the next line, the expenses directly connected with the sale is deducted. It refers to the cost that varies depending on production output and the more you sell the higher it gets. You can also see more on Operating Budget in Google Sheets.

- Gross Profit. This is the difference between the sale and the variable cost and shows how much is money left. Focusing on this figure is essential as an insufficiently high gross profit means bad business.

- Fixed Cost. Fixed costs refer to expenses that do not depend on the sales volume. If you sell more, it will not usually be bigger; if you sell less, it will not become smaller. You can also see more on Operating Budget in Word.

- Write-Off or Depreciation. Investments in a new building or modern technology can depreciate over time, so these expenses should be spread out over several years and not in the first year. You can also see more on Operating Budget in PDF.

- Interest. It is inevitable to require outside funding especially if you’re are just starting up as a business. Interest acquired by the money you borrowed from the bank can be taken from the operating basic budget.

Operating budgets may differ depending on the size of your business. Once you are able to identify the type of business you have and are familiar with the basic outline of an operating budget, it will be easier for you to choose from our array of Business Budget templates presented on this page. Don’t forget to check out our Excel Budget templates, too!

Free Restaurant Operating Capital Budget Template

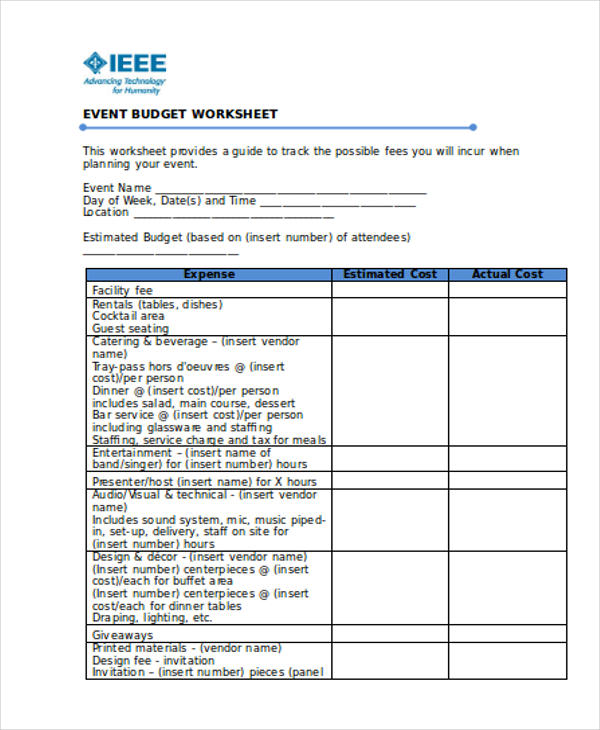

www.ieee.org

www.ieee.orgDaycare Operating Expense Budget Form Template

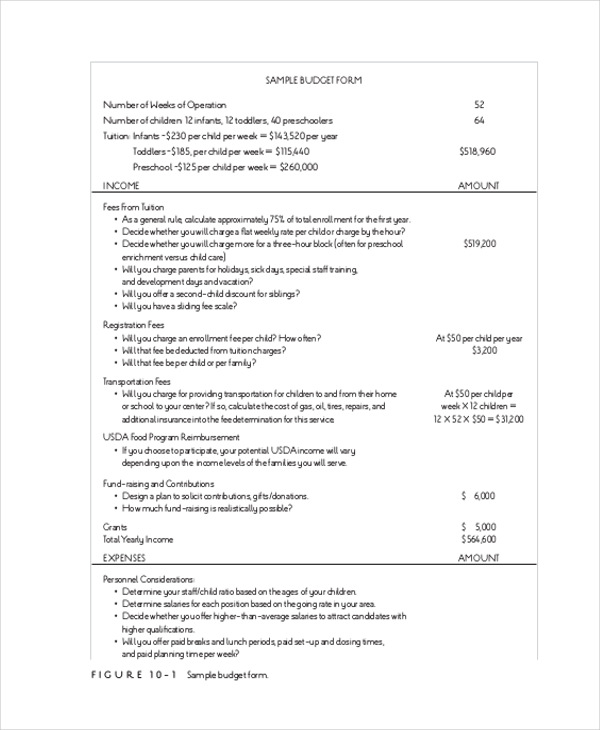

cengage.com

cengage.comFree Church School Operating Budget Template

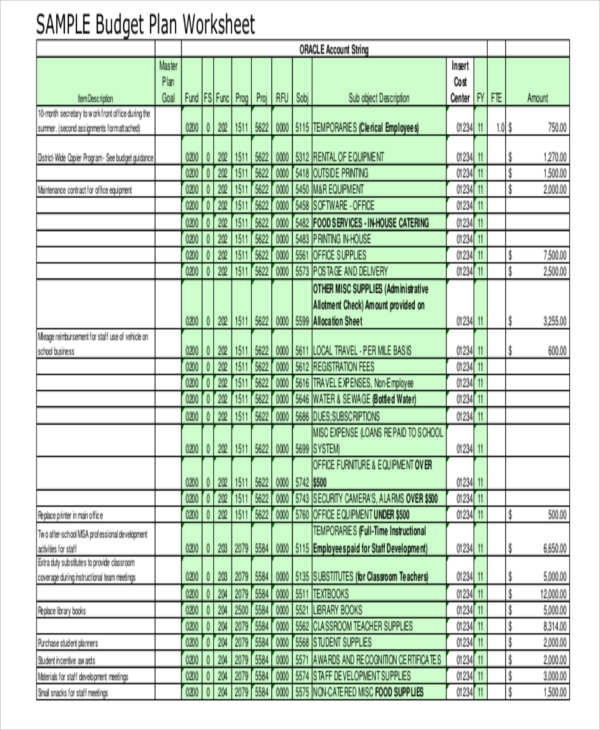

pgcps.org

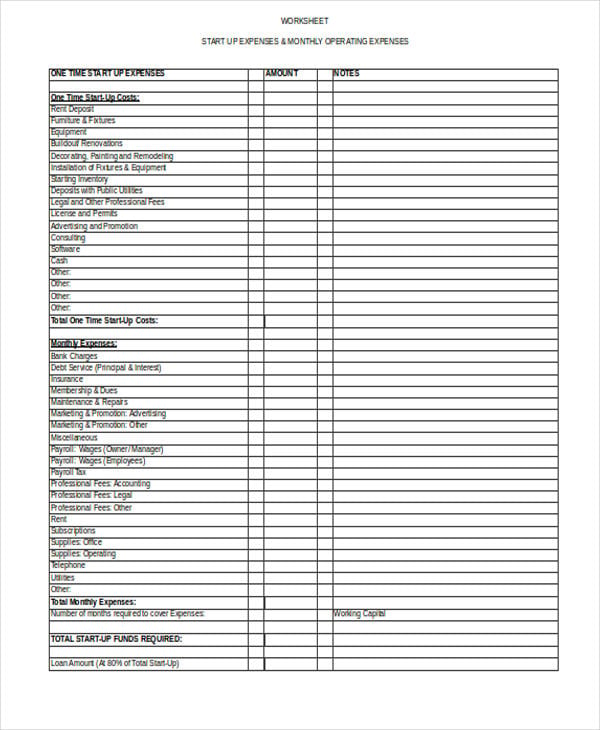

pgcps.orgFree Department Startup Operating Budget Template

sbdc.umb.edu

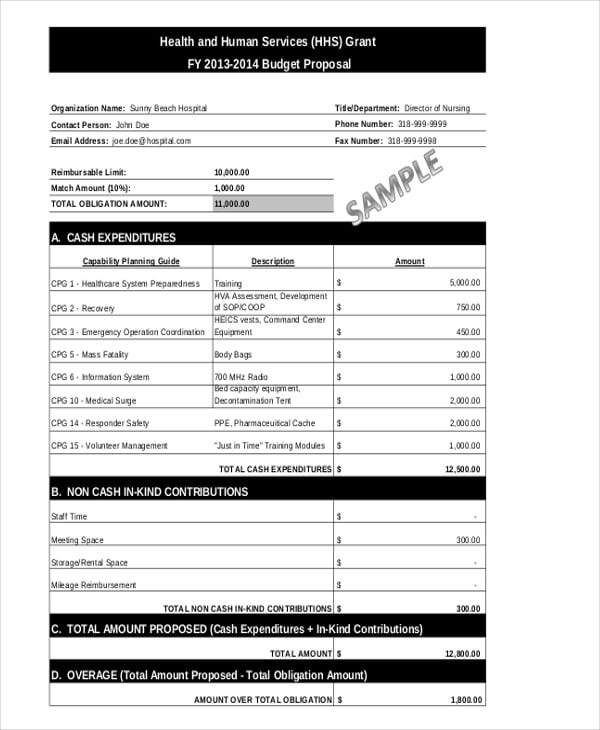

sbdc.umb.eduFree Nursing Hospital Operating Budget Template

c.ymcdn.com

c.ymcdn.comHow to Stay on the Budget

Creating an operating printable budget is essential not only for your company’s financial well-being but also for setting up your short- and long-term goals. Taking control of your finances means taking control of the future of your business.

To establish your finances and stay on the budget outline, you should:

- Set your goals.

- Track your spending.

- Personalize your budget format.

For your other business budgeting needs, check out our Manufacturing Budget template.