Table of Contents

- What are Retirement Plans for Individuals?

- Steps to make a Retirement Plan

- 10+ Retirement Plans for Individuals Templates in PDF | DOC

- 1. Employee Retirement Plans for Individuals

- 2. Funds Before Retirement for Individual Accounts in DOC

- 3. Retirement Saving Plans for Individuals Template

- 4. Retirement Plans for Individuals Format

- 5. Retirement Saving Multiplier Plans for Individuals

- 6. Retirement Pension Plans for Individuals Sample

- 7. Individual Retirement Accounts Plan Template

- 8. Retirement Plans for Individuals Example

- 9. Retirement Planning for Individuals

- 10. Basic Retirement Plans for Individuals

- 11. Employee Retirement Saving Plans in PDF

- Why Need Retirement Planning?

- Conclusion

10+ Retirement Plans for Individuals Templates in PDF | DOC

It is evident that young people pay more attention to their new careers, run the family or settling in new locations, therefore, they are reluctant to discuss their retirement planning so early. However, you never know when you will start getting old and regret that you did not think about planning your retirement. Hence, think about your future and start planning for your golden ages in advance by making a proper retirement planning with the help of our plan templates.

What are Retirement Plans for Individuals?

The process of determining the retirement income goals and the actions and decisions that are required to achieve those goals is known as retirement planning. In this planning, an individual identifies his/her sources of income, estimate expenses, implement a savings program and also manage assets and risks. It helps in estimating the future cash flows as well as determine whether the retirement income goal will be achieved or not.

Steps to make a Retirement Plan

Some key components are included in the process of planning a retirement. The following are some of the common components.

Step 1: Set Your Retirement Goals

The first thing before you make your retirement plan in Google Sheets is to set some achievable retirement goals. Make sure that you arrange these financial goals into short, medium and long-term. These goals will be needing some financial resources as well and this is where a retirement plan or any kind of pension plan comes in.

Step 2: Evaluate Your Current Financial Position

Your financial situation can be very different during your old age and when you have just started your career. Therefore, you will have to take stock of your current situation to achieve your retirement goal and the good thing is that you will start saving.

Step 3: Calculate Your Expenses

You will have to calculate the amount of money that you will be needing for your retirement goals and assess what help you will be getting from your current wealth. Determine the types of expenses that you are going to spend after retirement and how will you manage these expenses.

Step 4: Recognize the Retirement Corpus Builders

One of the best ways through which you can get a recurring income after your retirement is by using a retirement plan, apart from other provident funds and savings. These are specially designed to meet your needs after retirement and usually, fall under the category of life insurance plans.

Step 5: Generate Monthly Income from Retirement Plans

You will have to set up a proper system if you want to generate monthly income from the retirement corpus. You can take an immediate pension plan or other investments that will ensure that every month, you get a fixed sum of money. Do not forget to confidently take care of your daily expenses and choose from benefits like a guaranteed income for life or pension with an annual increase, etc

10+ Retirement Plans for Individuals Templates in PDF | DOC

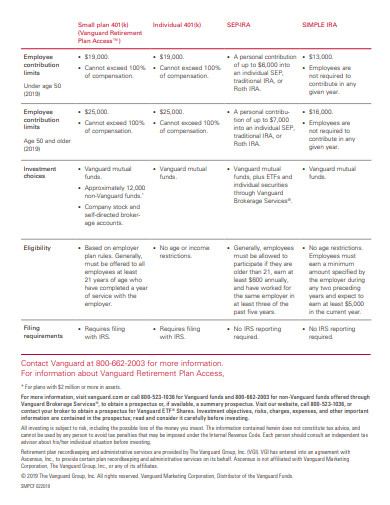

1. Employee Retirement Plans for Individuals

institutional.vanguard.com

institutional.vanguard.comThis is a retirement plan for individuals template that includes a quick and easy guide to help you in deciding which is the best fit for your business as well as employees. It consists of the basic facts about the different types of plans along with its features and benefits. A table is provided to make it easier for you to understand the benefits of the various plans and who can participate in these plans. It also talks about the employer contribution limits and about the eligibility to participate. You can also go through our plan templates in Word format for more varieties.

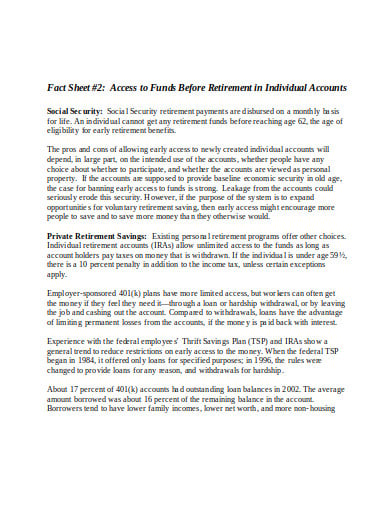

2. Funds Before Retirement for Individual Accounts in DOC

nasi.org

nasi.orgIt is compulsory to have access to funds before retirement in individual accounts if you want to spend your golden ages with ease. This template in Google Docs will provide some guidance regarding social insurance and paying benefits from individual accounts in federal retirement. It mentions some information about social security and that these payments are disbursed on a monthly basis for life. It also states that an individual cannot get any retirement funds before reaching old age around 60 i.e the age of eligibility for getting early retirement benefits.

3. Retirement Saving Plans for Individuals Template

upenn.edu

upenn.eduIf you want to boost your retirement plan coverage then you can download this useful template that lays out some new approaches to boost retirement plan coverage. This retirement savings plan in PDF describes and evaluates the models and features that are used in the emerging state-sponsored retirement savings plans such as Multiple Employer Plans and Marketplaces, etc. Using these plans will have an enormous potential to raise payroll-deduction retirement savings plans.

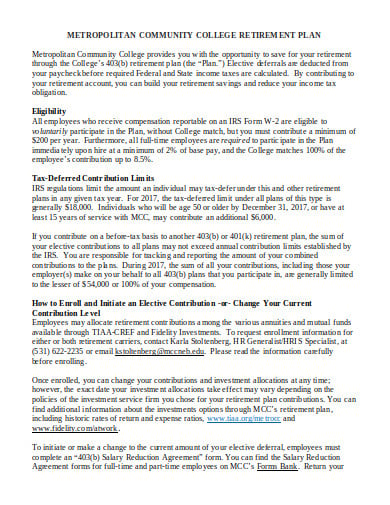

4. Retirement Plans for Individuals Format

mccneb.edu

mccneb.eduIf you want to know how to enroll and initiate an elective contribution or change your current contribution level, then this template may help you out with it. It consists of a universal availability notice that is prepared by Metropolitan Community College Retirement Plan. It mentions that elective deferrals are deducted from your paycheck before the Federal and State income taxes are calculated. Download now while it is still available and you can check our plan templates in Pages format as well if you are looking for this particular format.

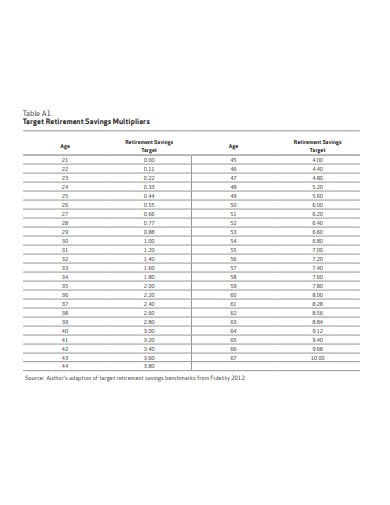

5. Retirement Saving Multiplier Plans for Individuals

nirsonline.org

nirsonline.orgYou can learn a lot more about retirement planning and all about its benefits as well as its disadvantages. And we have just the perfect template to enlighten you about the various elements of retirement. Professional authors have prepared this report to understand the challenges that the working-class individuals face in retirement. The study provided in this report analyzes workplace retirement plan coverage, retirement account ownership, and retirement savings. Go through our plan templates in Pages if you are an Apple user.

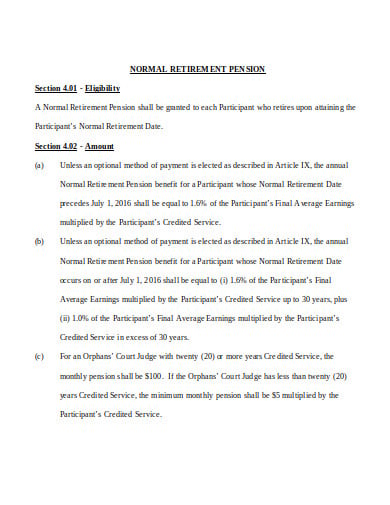

6. Retirement Pension Plans for Individuals Sample

carolinemd.org

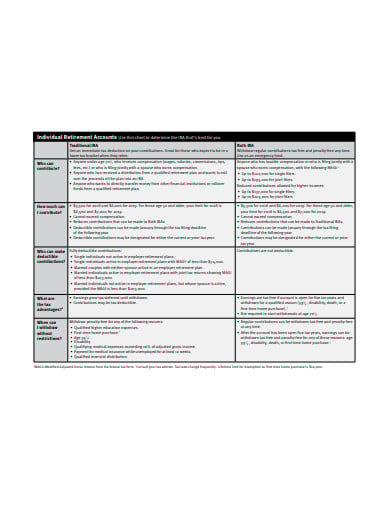

carolinemd.org7. Individual Retirement Accounts Plan Template

stcu.org

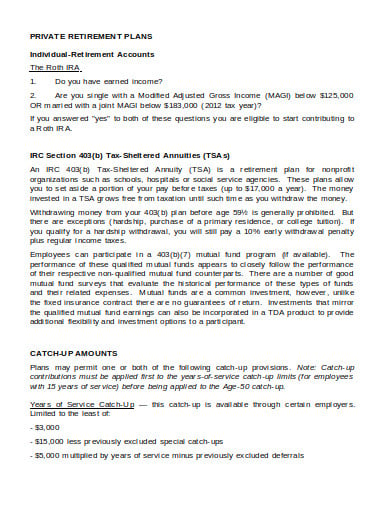

stcu.org8. Retirement Plans for Individuals Example

nea.org/assets

nea.org/assets9. Retirement Planning for Individuals

schwab.com

schwab.com10. Basic Retirement Plans for Individuals

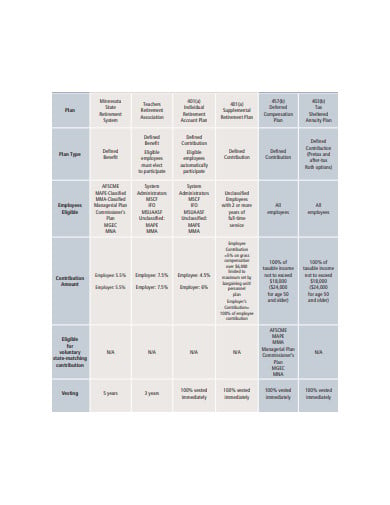

minnstate.edu

minnstate.edu11. Employee Retirement Saving Plans in PDF

blackrock.com

blackrock.comWhy Need Retirement Planning?

-

For Medical Emergencies

Health problems are always uninvited and medical expenses make a huge impact on your financial status after retirement. By taking a proper retirement plan, this medical inflation can be avoided.

-

To Reduce Inflation

Some costs or expenses may remail the same after retirement even if you try hard to retire so a good pension plan will help you in accounting for the anticipated inflation.

-

No Pensions Plans Funded by the State

When there are no state-sponsored pension or retirement plans provided to an individual, your pension strategies will give you the flexibility to buy a retirement plan as well as remain in control. Getting engaged in retirement planning is a wise thing to do and once you get to know the goals, then invest in a pension plan and get a self-sponsored retirement income.

Conclusion

No one wants to spend their golden age in tension or stress instead of relaxing and enjoy. If you think positively, it is nothing but a process that will make things easier for you after you have given up your work life. Since retirement planning is about having savings and estimate future expenses, it will help you in doing everything that you wished to do post-retirement. The templates provided here will guide you through and help you in preparing a trustworthy retirement plan so make sure you do not miss out on planning your retirement right away.