Table of Contents

- Satisfaction of Mortgage Definition & Meaning

- What Is a Satisfaction of Mortgage?

- 10 Types of Satisfaction of Mortgage

- Satisfaction of Mortgage Uses, Purpose, Importance

- What’s in a Satisfaction of Mortgage? Parts?

- How to Design Satisfaction of Mortgage

- Satisfaction of Mortgage vs. Deed

- What’s the Difference Between Satisfaction of Mortgage, Statement, and Form?

- Satisfaction of Mortgage Sizes

- Satisfaction of Mortgage Ideas & Examples

- FAQs

Satisfaction of Mortgage

Satisfaction of mortgages are documents that verify that a person’s mortgage has already been fulfilled. Its definition, types, and ways to create one will be explained in this article.

Satisfaction of Mortgage Definition & Meaning

Satisfaction of mortgage, according to an article by Julia Kagan, is a document confirming that a mortgage has been paid and presenting the provisions of transferred collateral title rights.

Also, a satisfaction of mortgage, signed by all parties involved in the mortgage loan and collateral title, is required to be prepared by mortgage lenders.

What Is a Satisfaction of Mortgage?

According to an article by Julia Kagan, the satisfaction of mortgage documents envelope details of the mortgage loan, provisions that release the ender from a lien against a property, and the steps to transfer property titles. These documents should be prepared and filled with the appropriate county recorder, land registry office, and city registrar by lending institutions. Satisfaction of mortgage is a useful document when an owner wants to make their property as collateral for a business or personal loan.

10 Types of Satisfaction of Mortgage

Arizona Satisfaction of Mortgage

An Arizona satisfaction of mortgage, based on the state’s law, must be signed by the mortgagee. Moreover, the satisfaction must be written in a proper format and must be recorded to provide a notice of the satisfaction. Also, an attorney may execute the release of the mortgage.

California Satisfaction of Mortgage

A California satisfaction of mortgage must be “discharged by a certificate signed by the mortgagee,” according to California Statutes Civil Code, or their personal representatives. Failing to record a satisfaction of mortgage requires the violator to pay a total amount of three hundred dollars ($300). And just like in most states, a satisfaction of mortgage must also be recorded in the County Recorder’s office.

Georgia Satisfaction of Mortgage

Georgia satisfaction of mortgage should be demanded from the lender if a borrower needs to obtain the said document. According to the Department of Banking and Finance, the borrower can directly reach out to the holder of the security of deed if the lender failed to release the lien after sixty days since the day the mortgage has been fully paid. The state of Georgia recommends visiting the website of the Georgia General Assembly to access any part of the Georgia Code.

Florida Satisfaction of Mortgage

A Florida satisfaction of mortgage contains the same details required to be presented in other states. A lender in Florida is required to follow the steps cited in Florida Statute 701.04 in removing or canceling a lien on a mortgagee’s property. As for the mortgagee, the Florida Statute also cites that the state’s homeowners must be aware of the legal requirements to satisfy their mortgages because if it’s not done correctly their lien will stay in the public records.

Connecticut Satisfaction of Mortgage

A Connecticut satisfaction of mortgage must state the names of the lenders and the borrowers plus the date of the mortgage, and the volume and page of land records according to the General Statute of Connecticut. On the other hand, homeowners need to pay a sixty-dollar fee to record a document on the land records for the first page and five dollars for each additional page. Unfortunately, if a mortgagee fails to record a satisfaction of mortgage within sixty days, they will need to pay $200 for each week beyond the 60 days.

Hawaii Satisfaction of Mortgage

A Hawaii satisfaction of mortgage must be provided by the mortgagee of a real estate once the mortgagor paid the bill in full. There should also be an acknowledgment statement provided that will describe the satisfied mortgage as sufficiently as possible. Furthermore, the document must be recorded in the bureau of conveyances or assistant registrar of the land court’s office.

Kansas Satisfaction of Mortgage

The 2019 Kansas statute states that the mortgagee must enter a Kansas satisfaction of mortgage within twenty days after the full payment, instead of sixty like in other states, otherwise they will be liable for the damages. A fine amounting to $500 plus additional attorney fees will be charged against the mortgagee. On the other hand, a satisfaction of mortgage must contain an acknowledgment approved by the Kansas statute.

Indiana Satisfaction of Mortgage

In Indiana, a mortgagor has the right to demand a release of a mortgage from a lender once the payment has been fully paid but has not been recorded yet. A lender only has fifteen days to execute an Indiana satisfaction of mortgage to avoid a penalty with a total sum not exceeding $500. If there is a failure to record the satisfaction of mortgage, the court may appoint a commissioner to release or satisfy the mortgage.

Minnesota Satisfaction of Mortgage

Minnesota homeowners, through written request, can demand the delivery of a Minnesota satisfaction of mortgage within ten days however they would need to pre-pay the mortgagee’s reasonable expenses. But if mortgagors demand the delivery of the recordable certificate of satisfaction within forty days, then they will not be required to pay for the mortgagee’s expenses. Similar to other states, a lender in Minnesota who failed to record the satisfaction of mortgage within sixty days will have to pay $500.

North Dakota Satisfaction of Mortgage

The North Dakota satisfaction of mortgage should be signed by the owner of the mortgage and must be acknowledged by the mortgagee or lending institution. In North Dakota, a mortgagee must deliver the satisfaction of mortgage within thirty to sixty days after the property owner fulfills the mortgage. If the former fails to record the satisfaction within the said days, they will be charged a hundred dollars plus the amount of all sustained damages.

Satisfaction of Mortgage Uses, Purpose, Importance

Satisfaction of mortgage is a critical document that all homeowners must have. Besides the document being proof of property ownership, a satisfaction of mortgage holds other purposes or uses. The following are a few examples:

Confirms Full Payment of Mortgage

Financial matters are never to be taken lightly, especially if you invest time and energy into them. As a homeowner, securing the satisfaction of mortgage after paying the mortgage in full is important. It serves as a confirmation that the payment has been fulfilled and avoids any kind of liability.

Proves Property Ownership

Satisfaction of mortgage releases the lien on a property, transferring the title to the borrower. This document will, in return, prove that a mortgagor is the rightful owner of a particular property. However, the satisfaction of mortgage must be recorded in the appropriate agency otherwise the lien will still show on the property.

Updates Credit History

The satisfaction of mortgage includes information such as the names of the borrower and the lender, the full amount of the mortgage, and the total amount of the satisfied mortgage. Because the document contains financial details, it can be utilized to update a borrower’s credit history. This is why homeowners should closely follow the process of entering or executing a satisfaction of mortgage despite it being the responsibility of the lender.

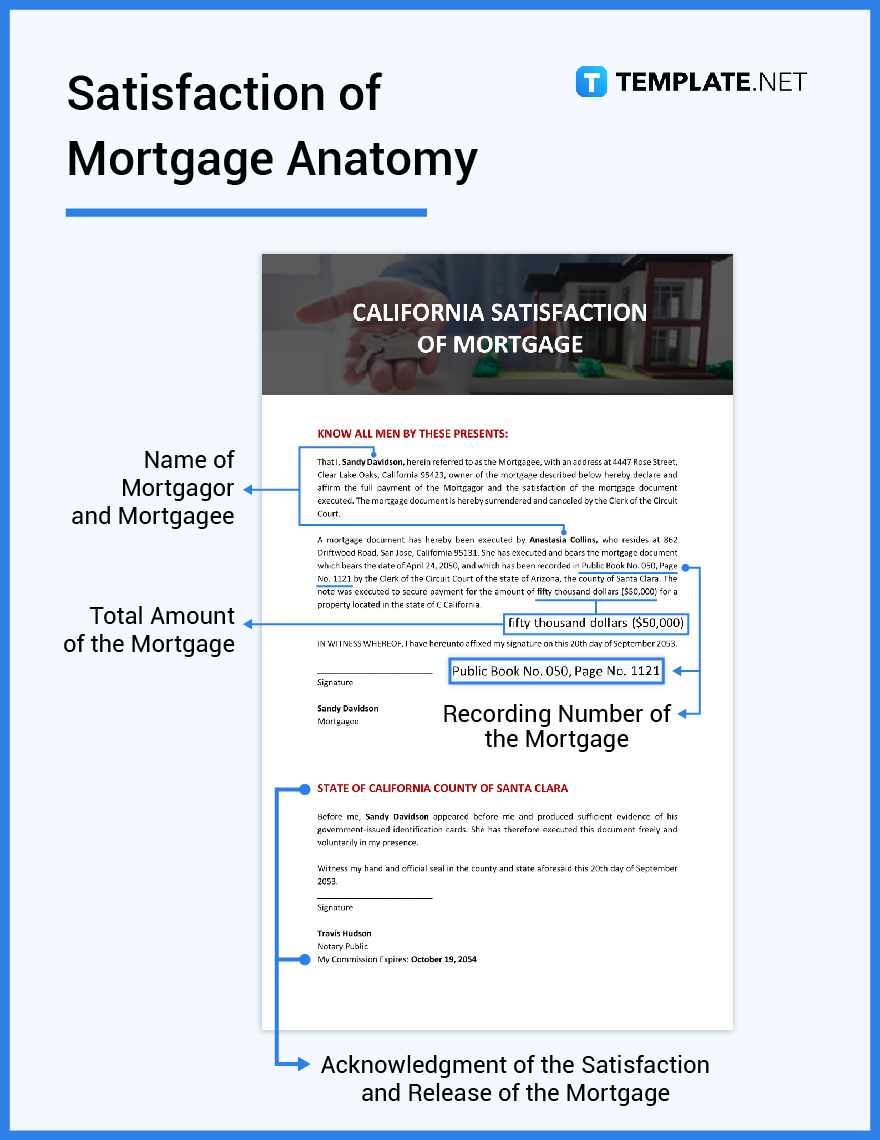

What’s in a Satisfaction of Mortgage? Parts?

Name of Mortgagor and Mortgagee

The first part of the satisfaction of mortgage document is the full name of both the mortgagor and the mortgagee.

Recording Number of the Mortgage

A recording number of the mortgage is the unique number that is given by the office of the county recorder which makes the satisfaction of mortgage a public record.

Total Amount of the Mortgage

This states the exact amount of mortgage the mortgagee needs to accomplish.

Acknowledgment of the Satisfaction and Release of the Mortgage

A paragraph or statement acknowledging the payment or application of a mortgage.

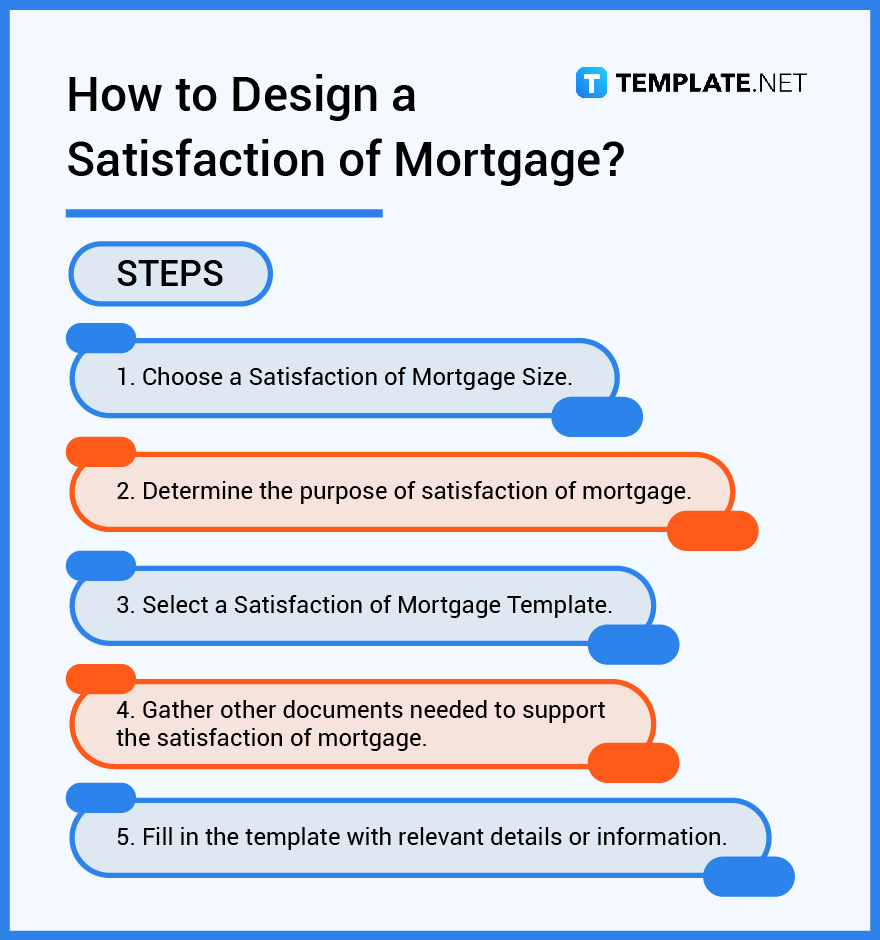

How to Design Satisfaction of Mortgage

1. Choose a Satisfaction of Mortgage Size.

2. Determine the purpose of satisfaction of mortgage.

3. Select a Satisfaction of Mortgage Template.

4. Gather other documents needed to support the satisfaction of mortgage.

5. Fill in the template with relevant details or information.

Satisfaction of Mortgage vs. Deed

Satisfaction of mortgage, based on the Legal Information Institute’s definition, is a document proving that a borrower has fully paid off the mortgage.

A deed is, as defined in the Oxford dictionary, a document, specifically one regarding the ownership of property or legal rights, that is signed and delivered.

What’s the Difference Between Satisfaction of Mortgage, Statement, and Form?

Satisfaction of Mortgage is a document that confirms a mortgage is not a lien on the property anymore.

A Statement is a document, given by a lender, that provides loan details.

A Form, according to Merriam-Webster, is a printed document with blank spaces for the insertion of the required information.

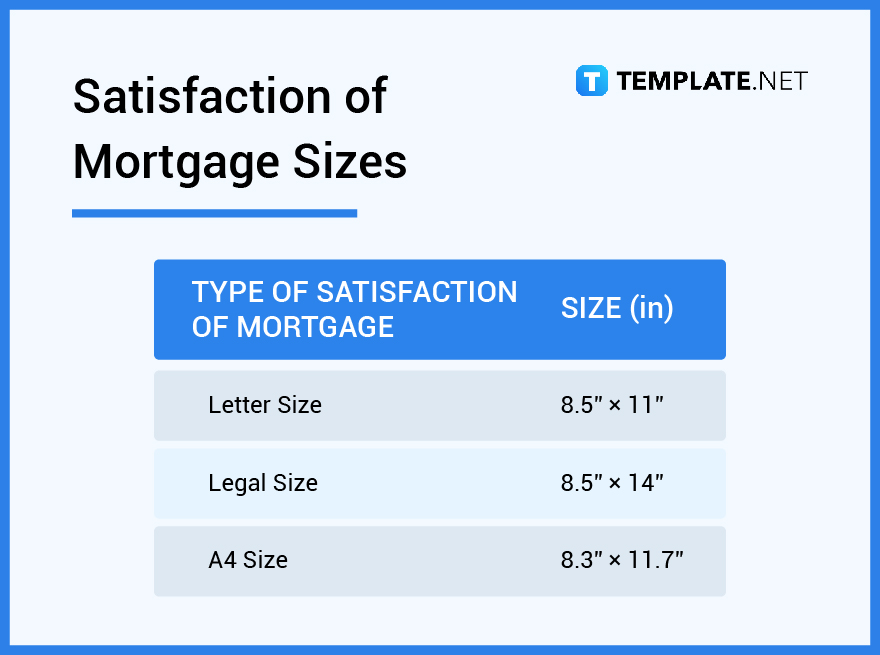

Satisfaction of Mortgage Sizes

For printing, a few satisfaction of mortgage size options can be considered. The paper sizes below are standard sizes used for the satisfaction of mortgage:

Satisfaction of Mortgage Ideas & Examples

If you are looking for other examples besides the ones in this article, we have another list for you. The following satisfaction of mortgage ideas and examples might be the ones you are looking for:

- New York Satisfaction of Mortgage Ideas and Examples

- Ohio Satisfaction of Mortgage Ideas and Examples

- Virginia Satisfaction of Mortgage Ideas and Examples

- Rhode Satisfaction of Mortgage Ideas and Examples

- Michigan Satisfaction of Mortgage Ideas and Examples

- Texas Satisfaction of Mortgage Ideas and Examples

- Oregon Satisfaction of Mortgage Ideas and Examples

- Utah Satisfaction of Mortgage Ideas and Examples

- Wisconsin Satisfaction of Mortgage Ideas and Examples

- Pennsylvania Satisfaction of Mortgage Ideas and Examples

FAQs

What should be included in the Satisfaction of Document?

Satisfaction of mortgage should include the names of the mortgagor and mortgagee, the amount of mortgage, the receiving number of the mortgage, and the release of the mortgage.

How do you find out if a mortgage has been satisfied?

According to Consumer Financial Protection Bureau, state property records will show if a lien is released.

Is a satisfaction of mortgage the same as a title?

Satisfaction of mortgage is not the same as a title however it does contain the details of a property title especially one that was used as collateral.

Who prepares satisfaction of mortgage?

The lending company is the one responsible for the preparation of satisfaction of mortgage.

What to do after mortgage is paid off?

Some of the things you can do after paying off your mortgage, as advised by Forbes, include canceling automatic payments, getting an escrow refund, and contacting a tax collector.

What effect does a satisfaction of mortgage have on a property?

Because of satisfaction of mortgage, a property becomes officially and legally owned by a person or a mortgagee since the document proves property ownership.

What does lost mortgage satisfaction mean?

A lost mortgage satisfaction may mean that a lender failed to record a satisfaction of mortgage within a scheduled time which could cause legal fines.

What does a satisfaction of mortgage charge?

A satisfaction of mortgage charge is a fee charged by the office of the County Recorder of Deeds to record the release of a lien on a property.

Who are the parties in a satisfaction of mortgage?

The parties in a Satisfaction of Mortgage are the mortgagor and the mortgagee.

How long does a bank have to satisfy a mortgage?

Generally, it takes thirty days to receive a satisfaction of mortgage, according to Bankrate’s Dhara Singh, but some states like Florida take sixty days from the time the borrower paid the mortgage to prepare the document.

What is the difference between satisfaction of mortgage and release of mortgage?

The satisfaction of mortgage and release of mortgage are the same document that confirms a mortgage has been fully paid.

How much does a lender pays if they fail to record a satisfaction of mortgage?

The charge fee for the failure of recording satisfaction of mortgage depends on which state you are but the common charge fee amounts to $500.

Do satisfaction of mortgage documents require witnesses?

Unlike affidavits, satisfaction of mortgage documents do not require witnesses but must be acknowledged by the mortgagee to be recorded in the right agency.