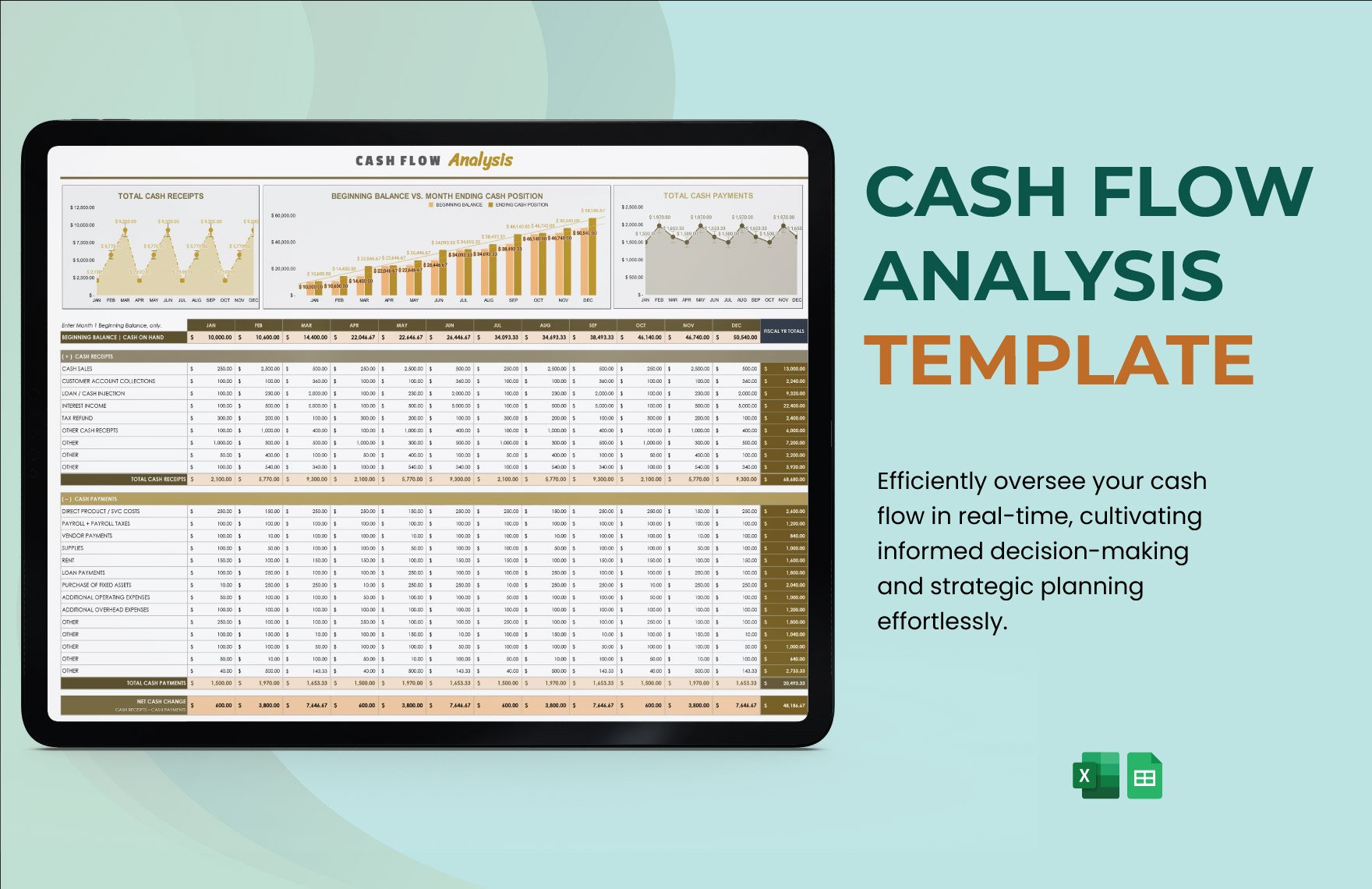

Have more awareness of your financial statements in running your business. Ensure yourself financially with these premium templates on cash analysis. Cash flow statement templates, balance sheet templates, income statement templates, analysis report templates, capital analysis templates, cash receipts templates, analysis format templates, and cash inflows templates are all ready-made for you to use. Download now and let your company capture every nook and cranny of your financial statements.

What Is a Cash Analysis?

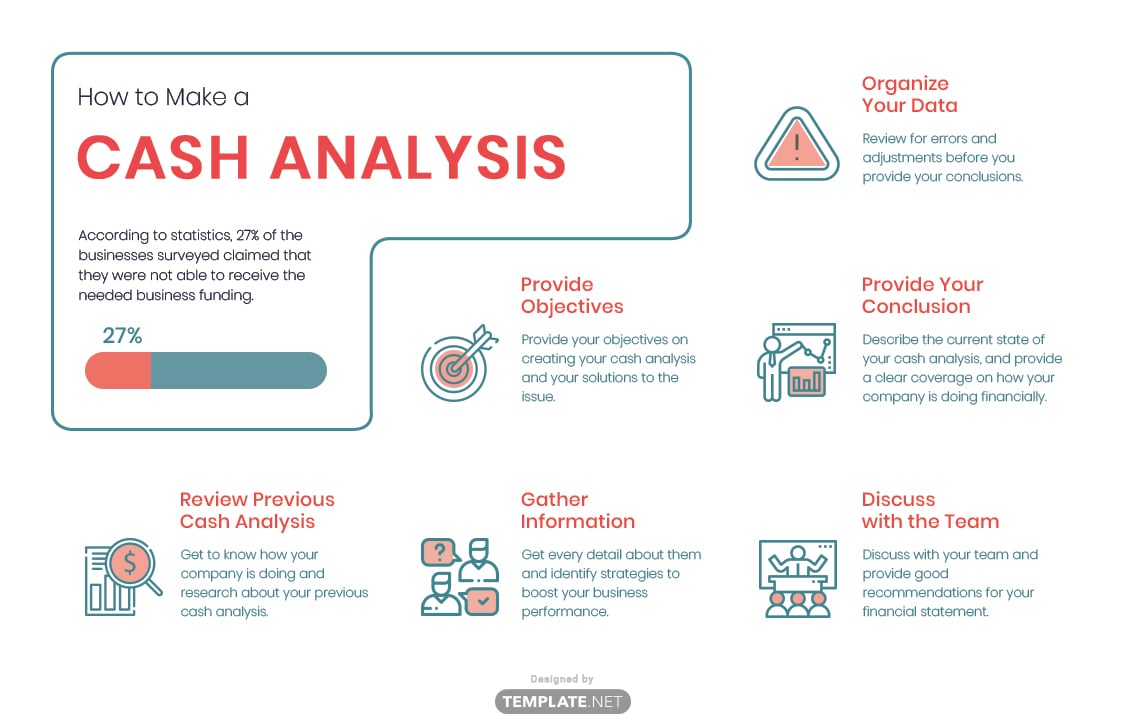

How to Make a Cash Analysis

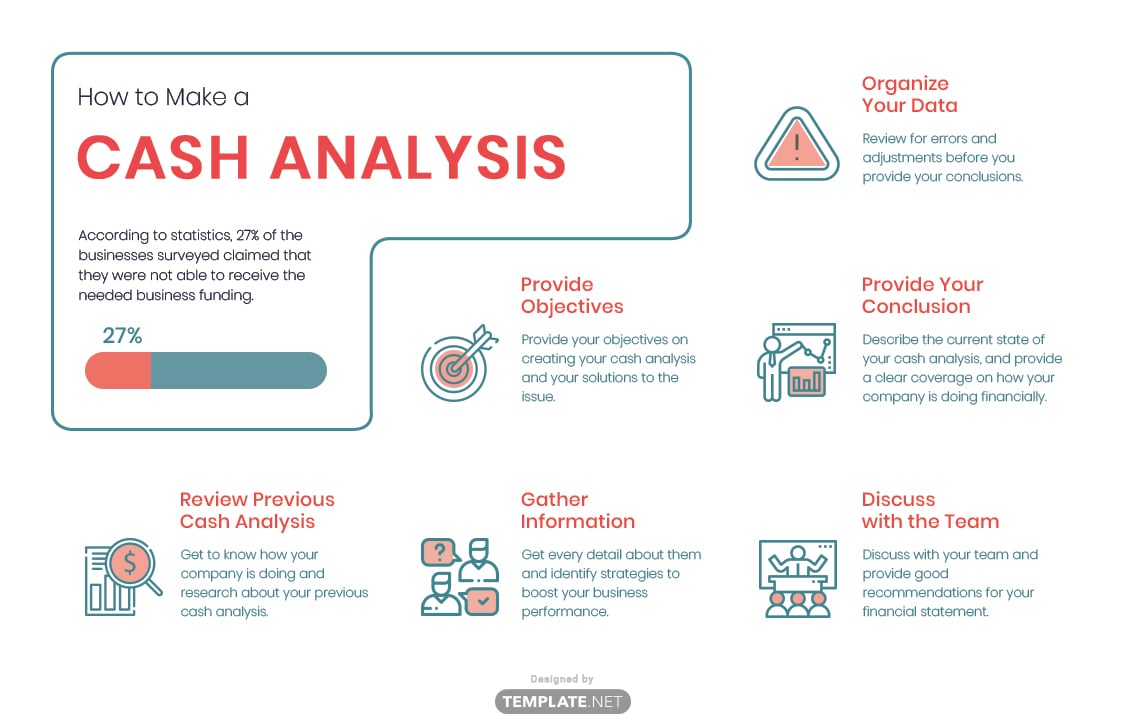

A cash analysis is a process of examining the company's cash flow during a specific period. This states how much income and expenses the company has, and where the company is receiving and using its budget. This enables the company to track down unwanted scenarios with its financial statements and project a better cash flow forecast. Small businesses like yourself handle a lot of financial statements. Every day you monitor your cash usage for capital expenditures. According to statistics, 27% of the businesses surveyed claimed that they were not able to receive the needed business funding. Why is that? Obviously, it is because of poor financial management. Performing a cash analysis will help you get an accurate understanding of your company's cash flow and performance.

1. Review Previous Cash Analysis

Get to know how your company is doing and research about your previous cash analysis. Check and review your previous cash flow statements, quarterly payment schedules, accounts receivable, operating activities, indirect statements, investing activities, and income statements to get a full and clear understanding of your company's financial statements. Then, compare it with the current ones.

2. Provide Objectives

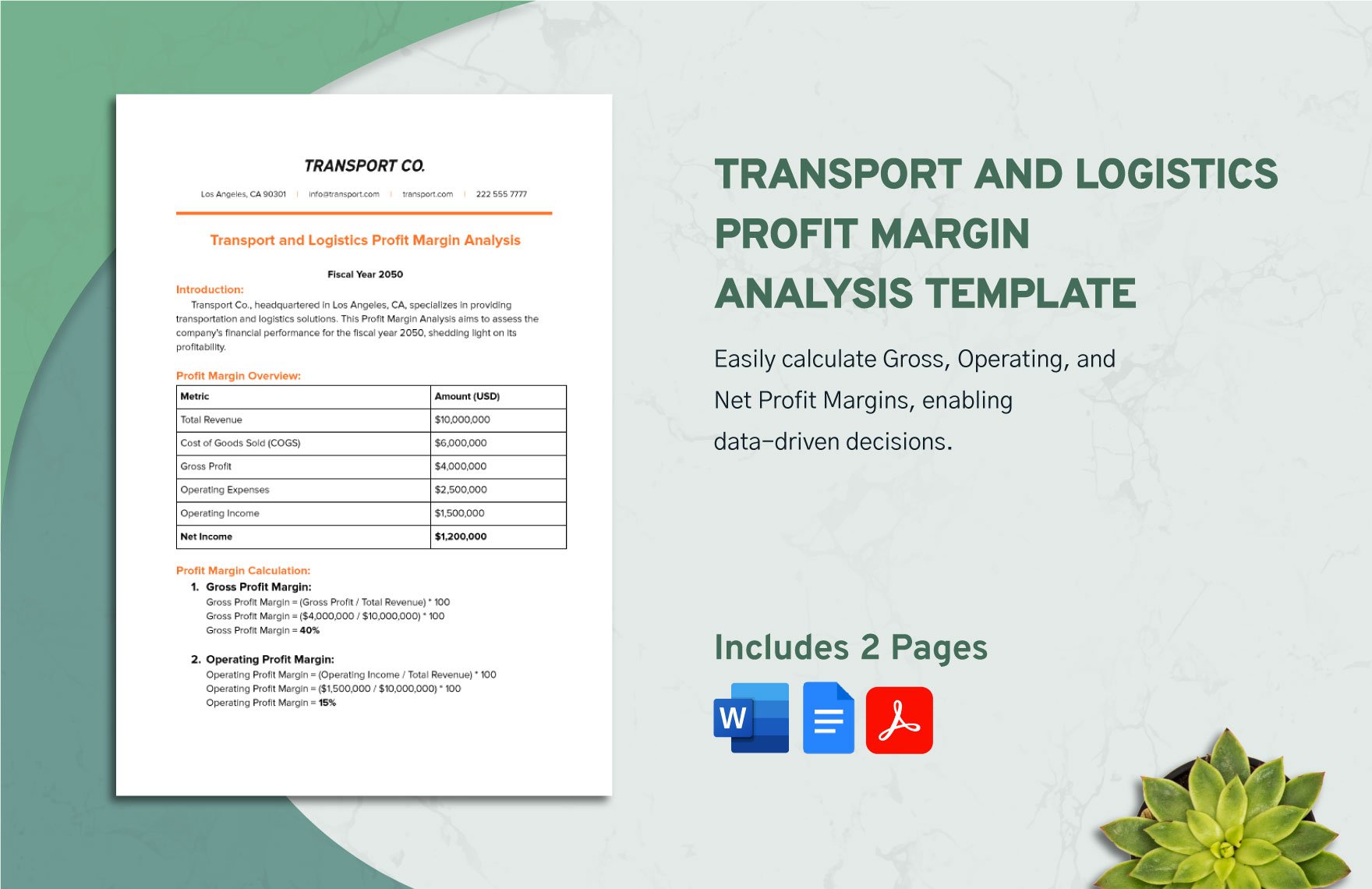

Base on your previous cash flow analysis, identify some issues and flaws occurring with it. Provide your objectives on creating your cash analysis and your solutions to the issue. Determine whether your business is earning more than it is spending, know when to make the right investments, and check if your business has the financial capacity to purchase more capital and assets. Then, you determine a comprehensive data to give your management sound and well-informed financial decisions.

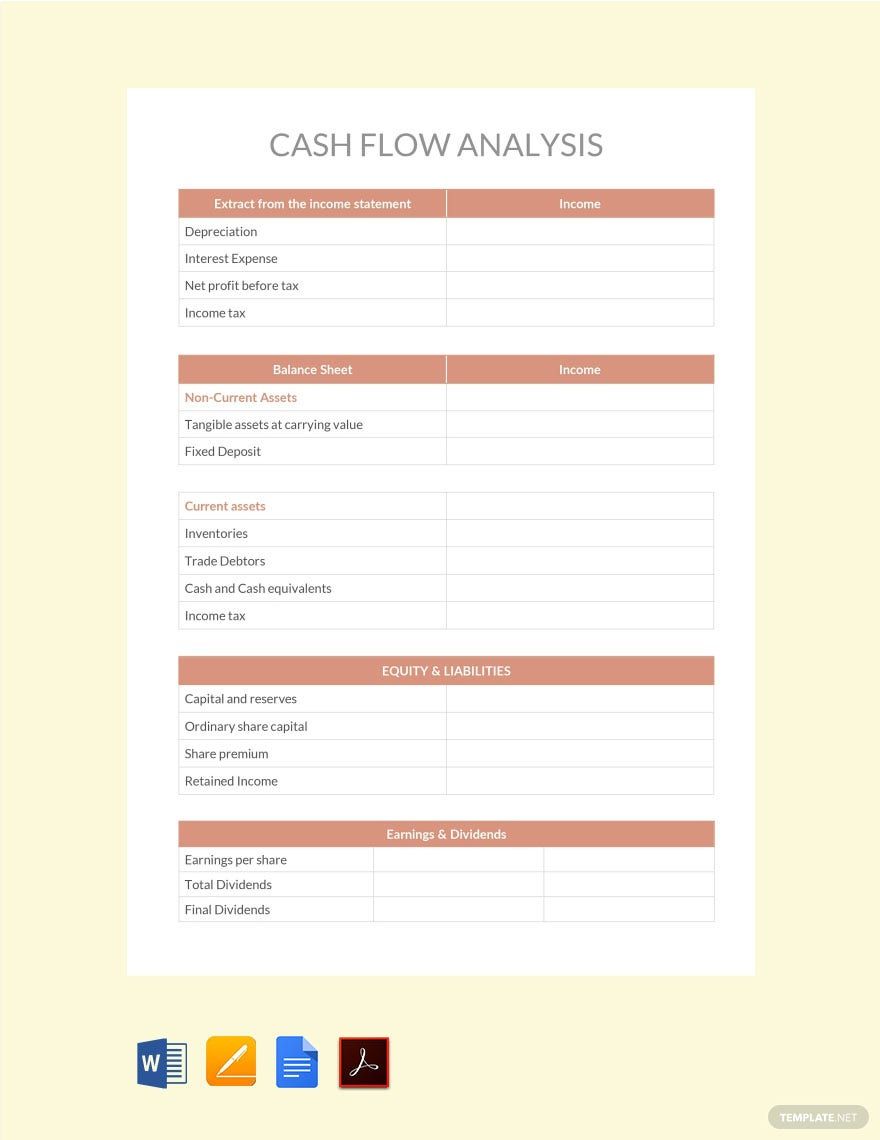

3. Gather Information

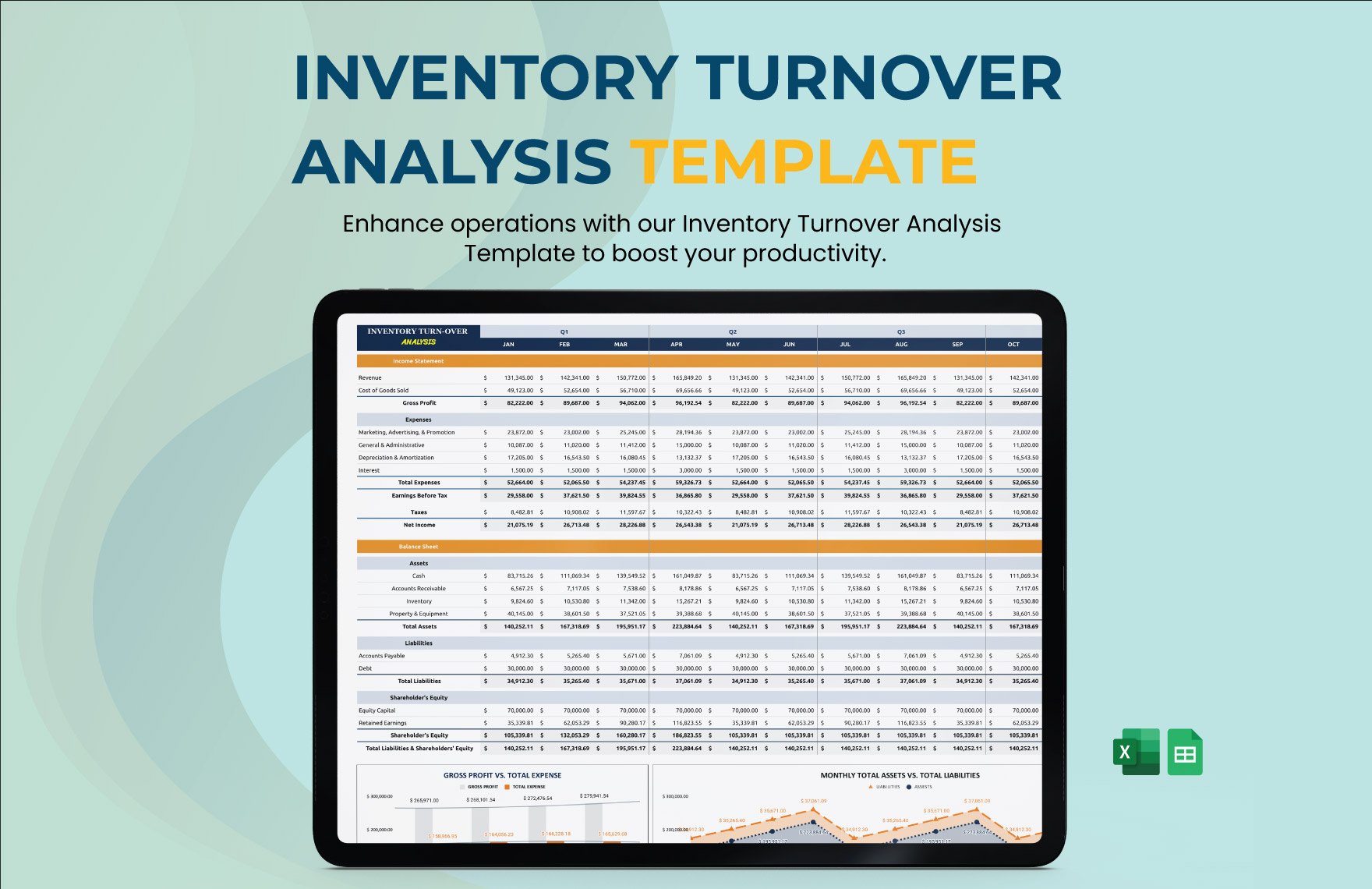

Your company has a lot of operations every day; each department has different functions in business—check their activities. Gather data on your operating expenses, financing expenses, and investing expenses. Your operation activities consist of your accounts payable, accounts receivable, inventory, and tax payment. Your financing activities deal with the money loaned or withdrawn to raise your capital, while your investing activities focus on real estate expansion. Get every detail about them and identify strategies to boost your business performance.

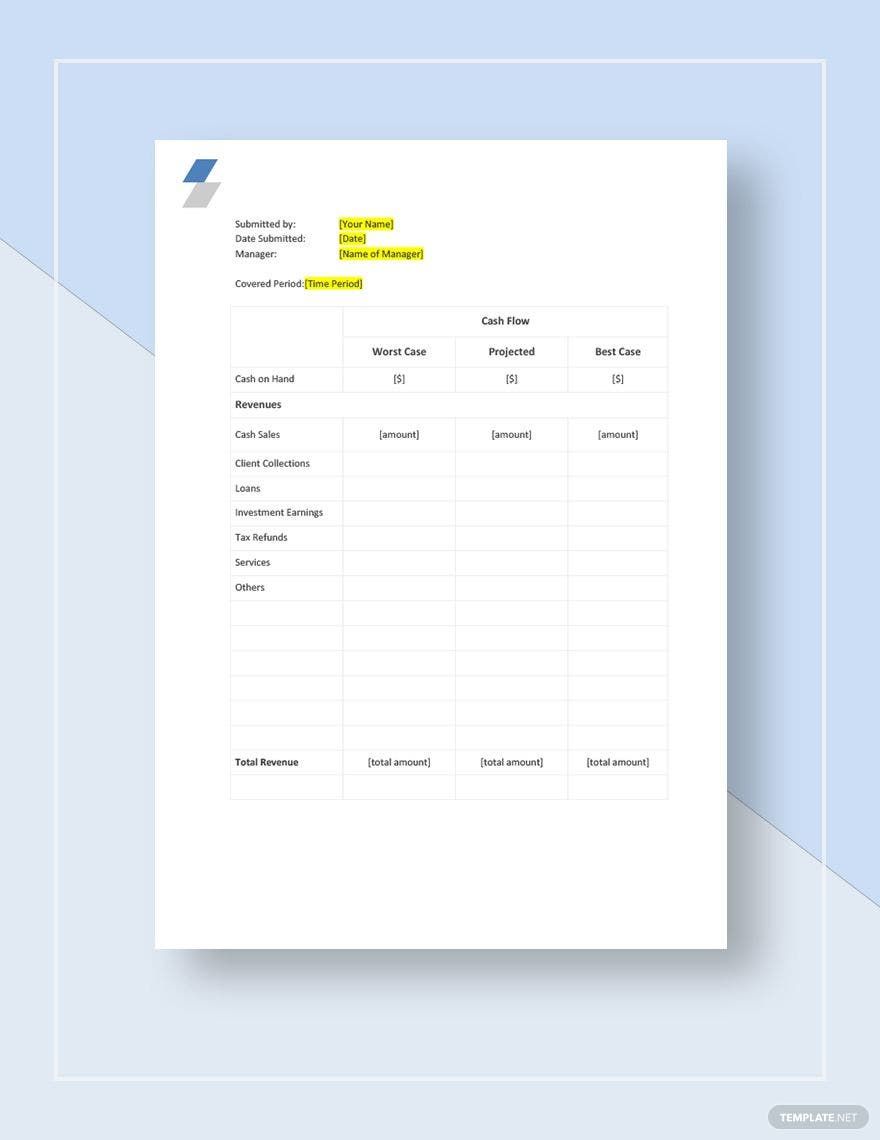

4. Organize Your Data

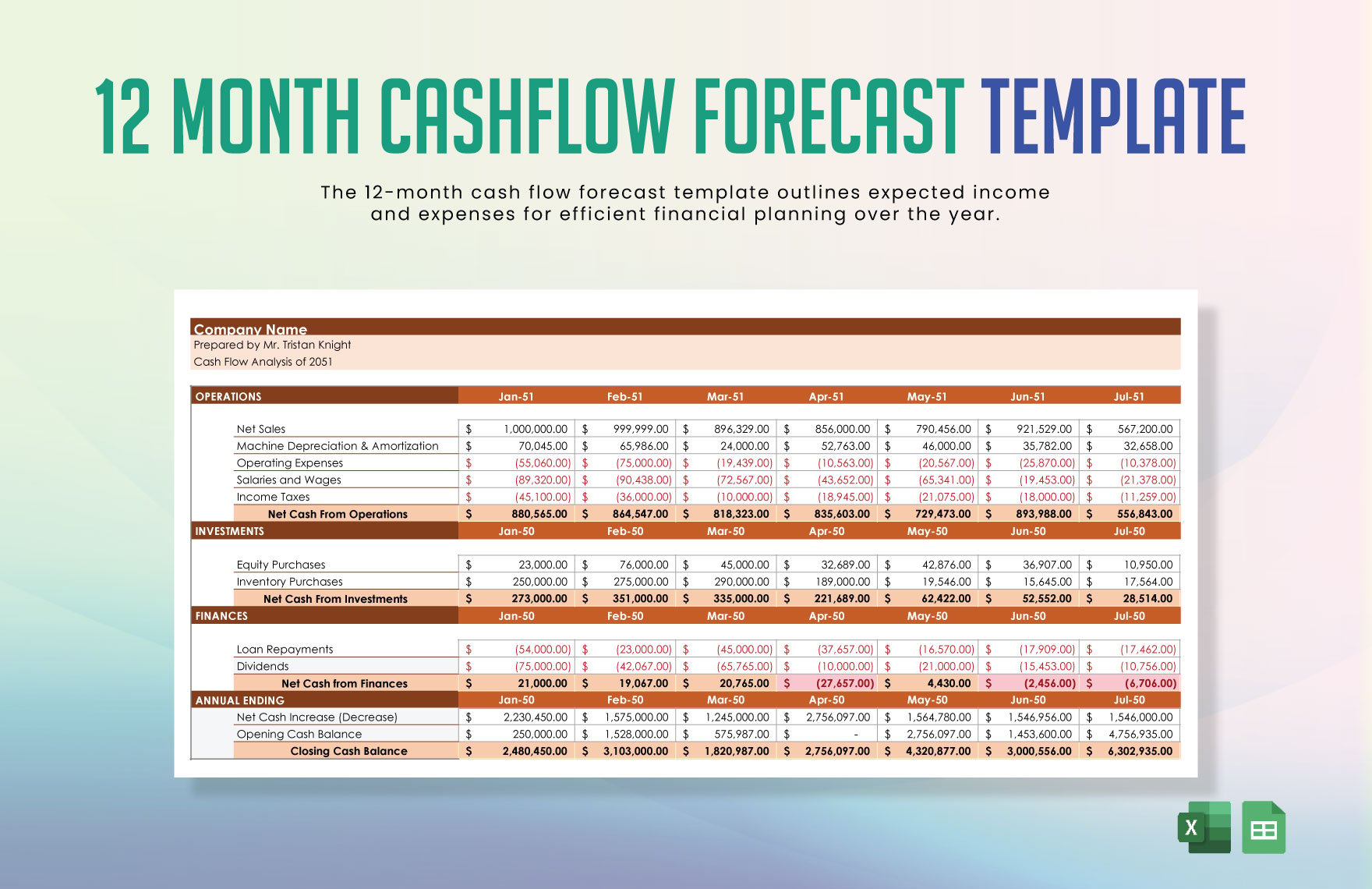

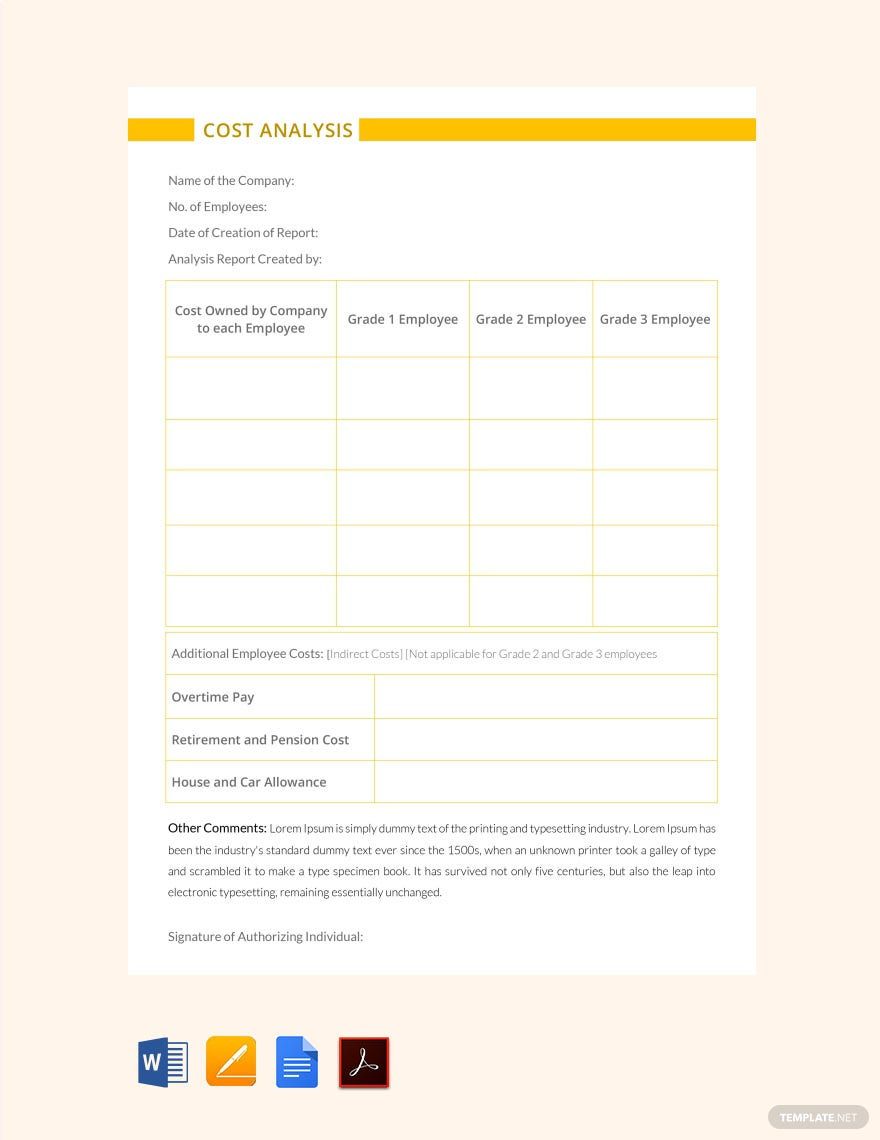

Organize your data by creating a table to summarize your analysis statement. Create areas for each type of expense and detail every amount covered by each activity. Be legible with how you present your data; use proper font styles and font sizes. Then calculate everything on your cash analysis. Review for errors and adjustments before you provide your conclusions.

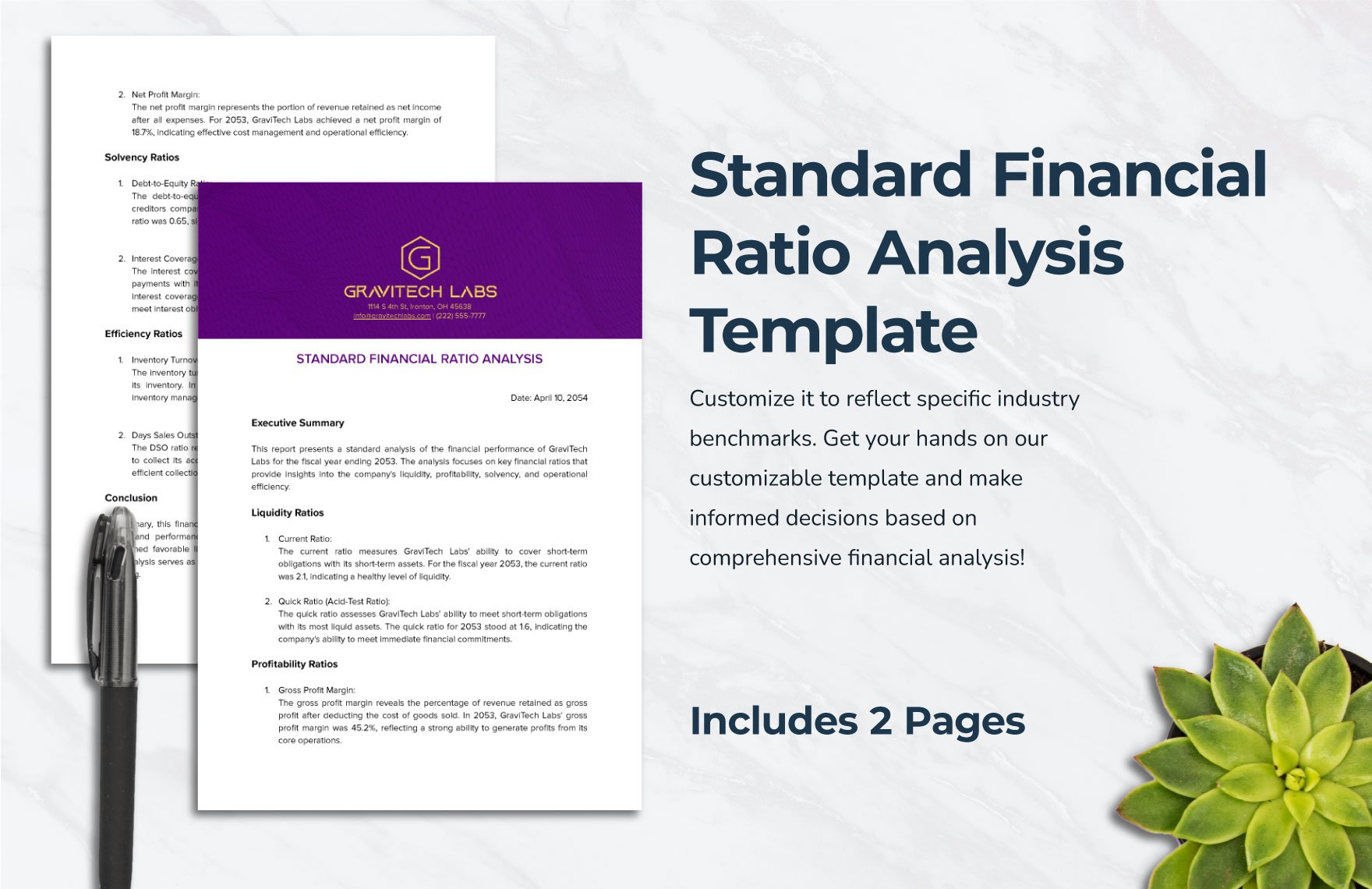

5. Provide Your Conclusion

Provide further discussion with your findings and analysis. Describe the current state of the cash analysis, and provide a clear coverage on how your company is doing financially. Capture the positive qualities of both your internal and external finances and produce the best strategy to perform better in business. Then, proceed with your conclusions.

6. Discuss with the Team

Lastly, discuss with your team and provide good recommendations for your financial statement. The bottom line is, you try your best to avoid incurring excessive expenses in your company and invite more revenues to your business. After you complete your cash analysis, you may use this as a further reference for your future business.