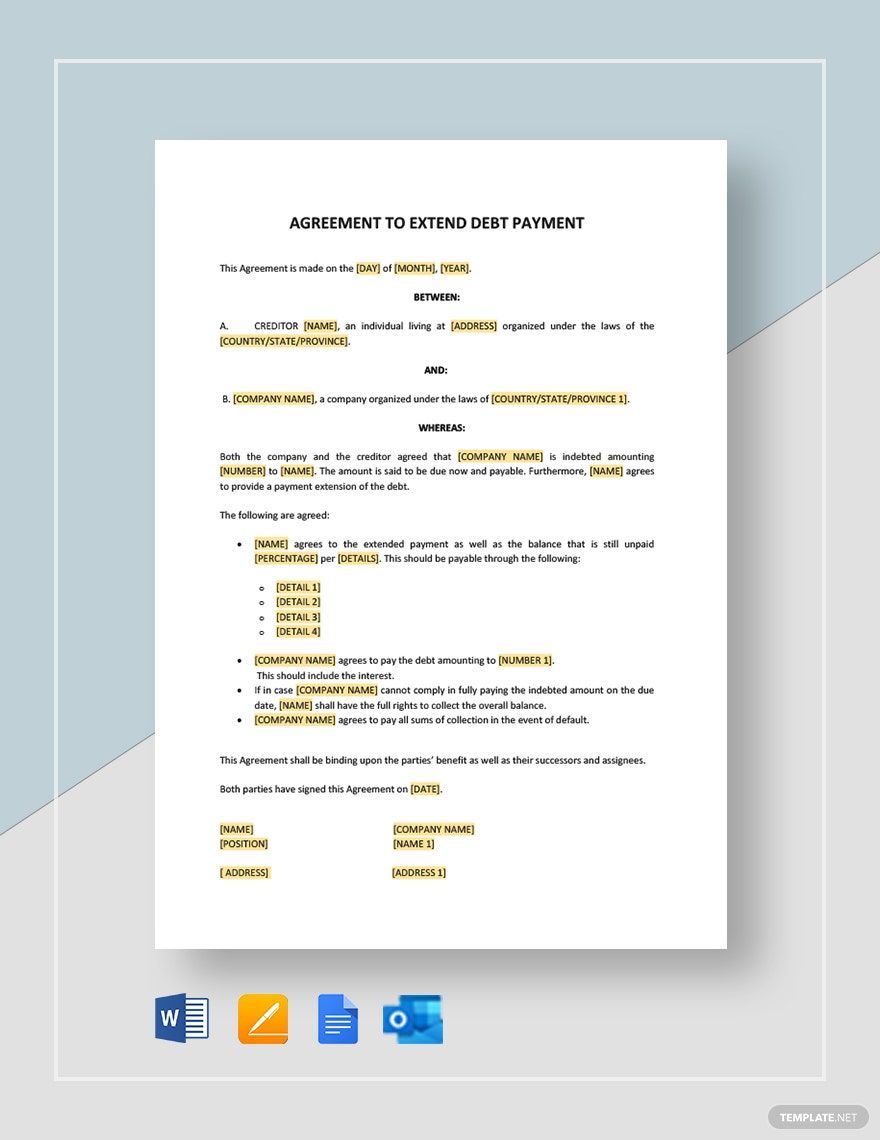

Discover the Ultimate Debt Management Solutions with Debt Agreement Templates from Template.net

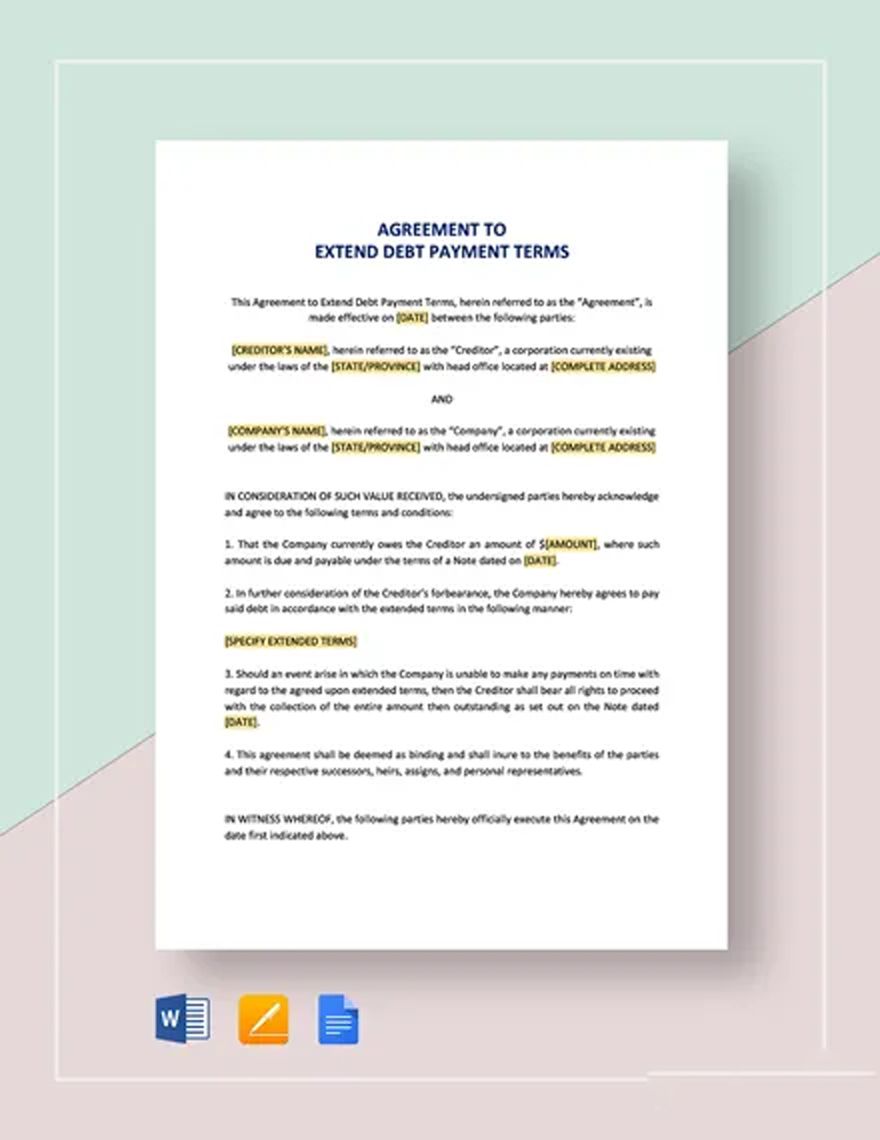

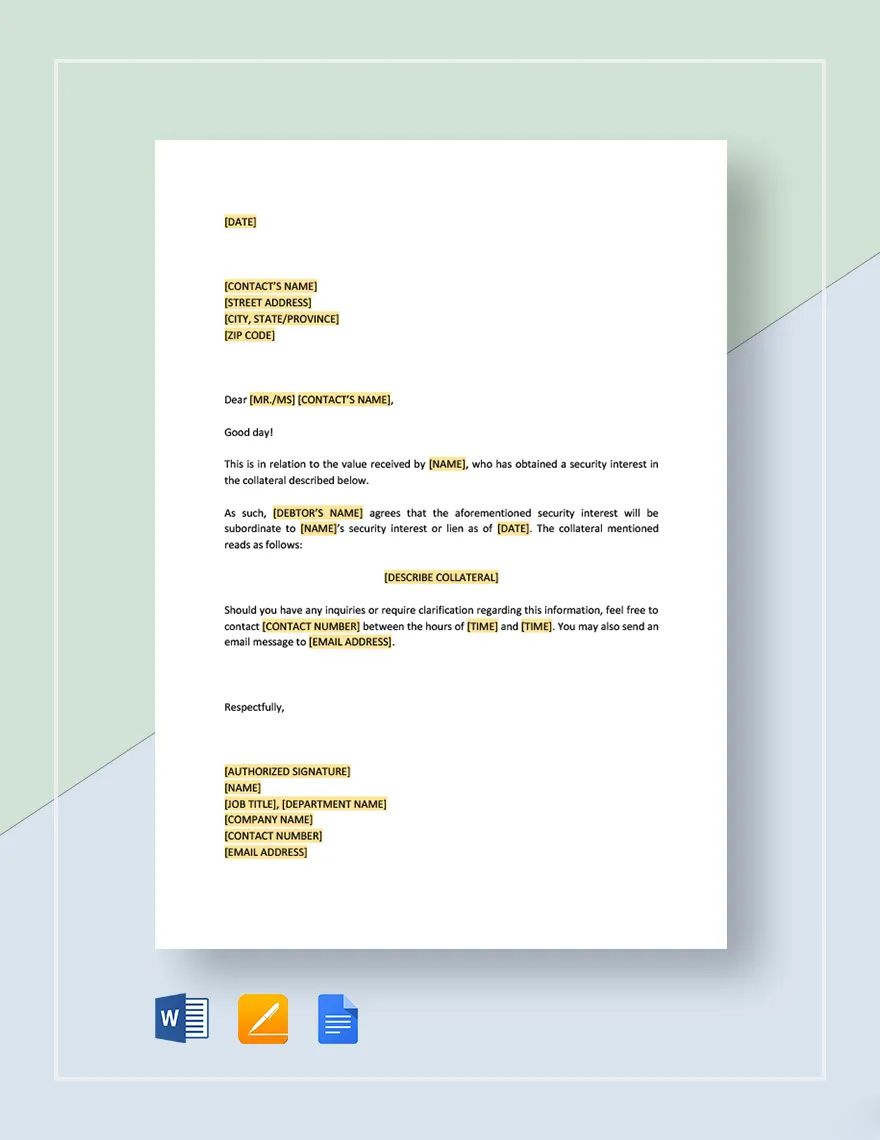

Bring your financial peace of mind to life with Debt Agreement Templates from Template.net. Designed for individuals, businesses, and financial advisors, these templates empower you to handle financial negotiations and agreements effectively, protect your interests, and streamline your documentation process. Utilize them to create comprehensive debt settlement plans or develop detailed payment agreements that offer transparency to all parties involved. Each template includes vital contact information fields and customizable sections for specific financial terms. With no extensive legal knowledge required, these professionally designed tools are perfect for anyone looking for easy, cost-effective solutions for managing debt-related documents. The templates are suitable for both print and digital distribution, providing customizable layouts that seamlessly fit into your workflow.

Discover the many Debt Agreement Templates we have on hand, each crafted to meet various financial needs. Select a template that suits your scenario, easily swap in your financial data, and modify colors and fonts to match your branding. Enhance your documents with advanced touches, such as dragging and dropping icons or graphics, or adding animated effects to emphasize crucial points. With our intuitive interface, the possibilities for customization are endless and require no specialized skills. Explore our regularly updated library of templates to find fresh, relevant designs that keep pace with evolving financial landscapes. When you’re finished, download your completed agreement or share it via email, print, or export, ensuring you can use it across multiple channels and collaborate in real time.