Table of Contents

- Statement Template Bundle

- 10+ Expenditure Statement Templates in Google Docs | Word | Pages | PDF | DOC

- 1. Expense Statement Template

- 2. Restaurant Expense Statement Template

- 3. Expenditure Statement Template

- 4. Expenditure Statement Format

- 5. Tax Expenditure Statement Template

- 6. Final Statement of Expenditure in DOC

- 7. Monthly Expenditure Statement Template

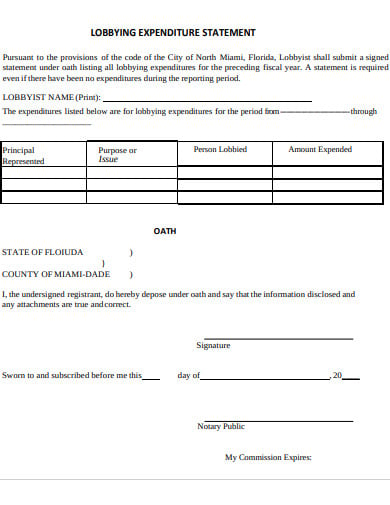

- 8. Lobbying Expenditure Statement in PDF

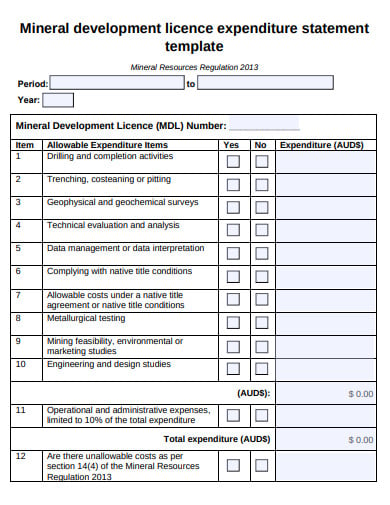

- 9. Licence Expenditure Statement Template

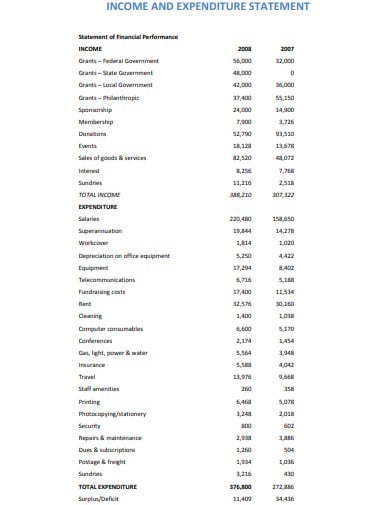

- 10. Income and Expenditure Statement in PDF

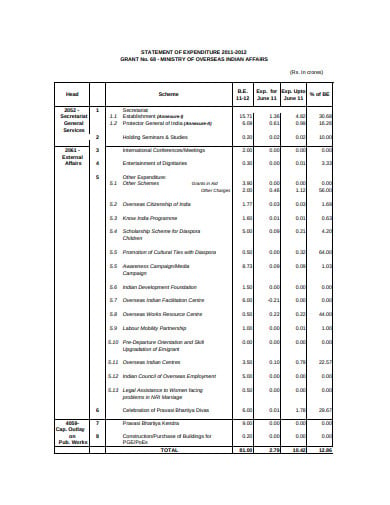

- 11. Standard Expenditure Statement

- What are the steps to create an expenditure statement?

- What is the importance of the expenditure statement?

- What’s the difference between income and expenditure?

10+ Expenditure Statement Templates in Google Docs | Word | Pages | PDF | DOC

Statement of Expenditure is a multi-column self-balancing monthly statement of expenditures of an operative level workplace. It is created to the concerned central level office at the end of every month as a monthly report. Hence, it is also called a monthly expenditure report. Have a look at the various expenditure statement templates provided down below and choose the ones that best fit your purpose.

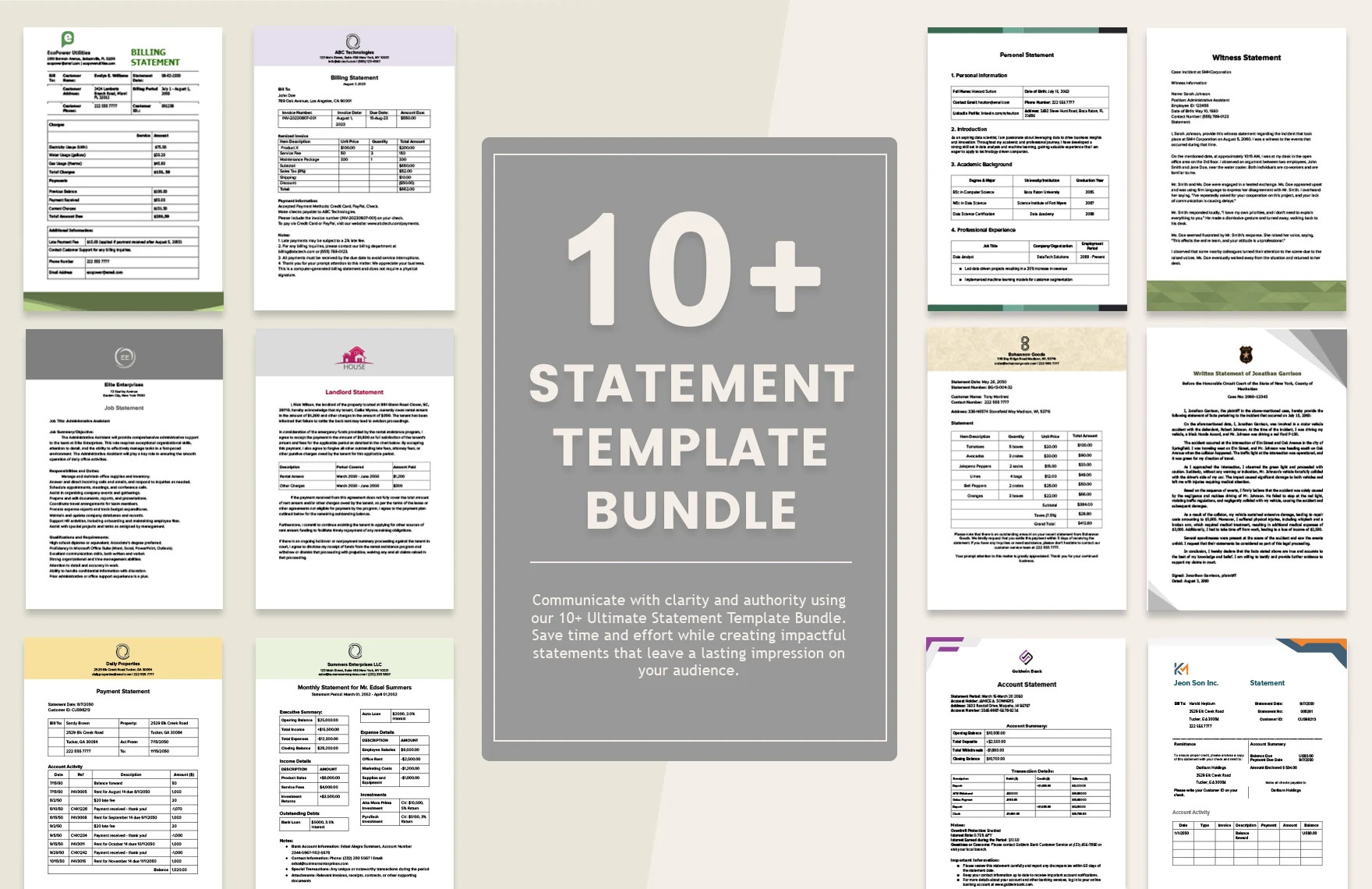

Statement Template Bundle

10+ Expenditure Statement Templates in Google Docs | Word | Pages | PDF | DOC

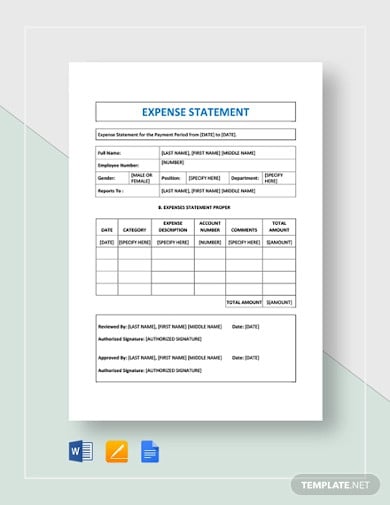

1. Expense Statement Template

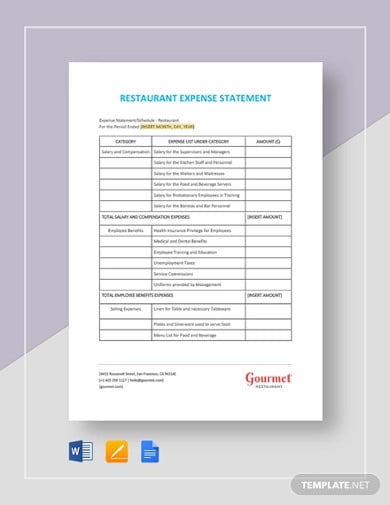

2. Restaurant Expense Statement Template

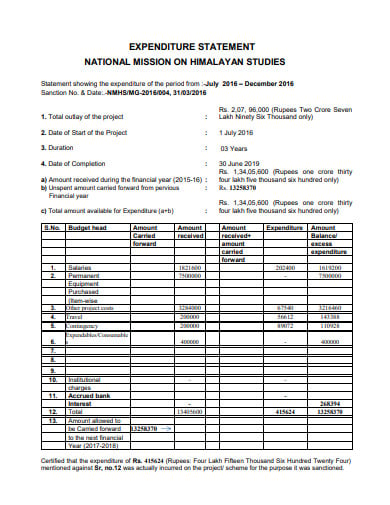

3. Expenditure Statement Template

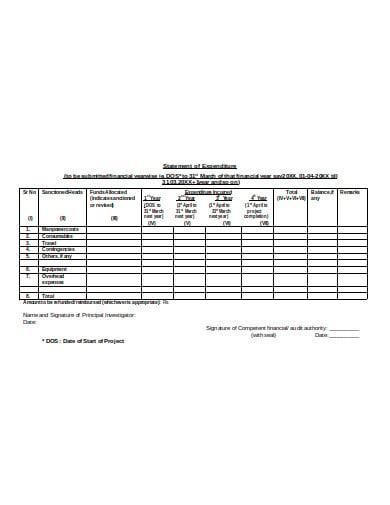

nmhs.org.in

nmhs.org.in4. Expenditure Statement Format

dst.gov.in

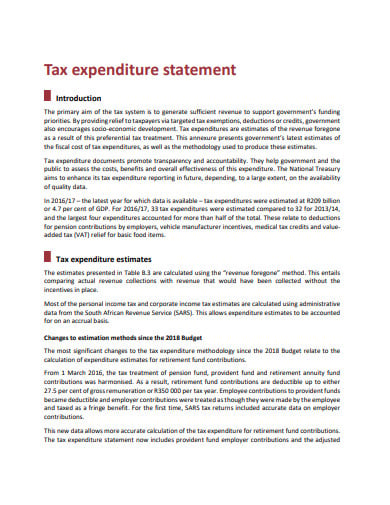

dst.gov.in5. Tax Expenditure Statement Template

treasury.gov.za

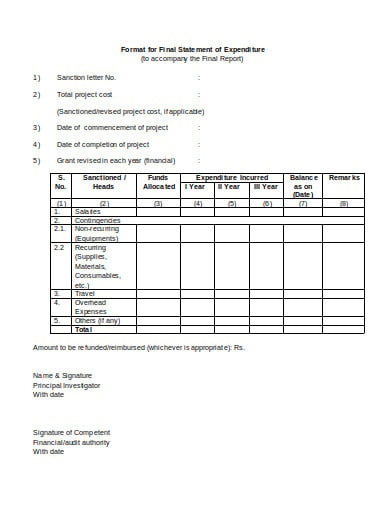

treasury.gov.za6. Final Statement of Expenditure in DOC

icmr.nic.in

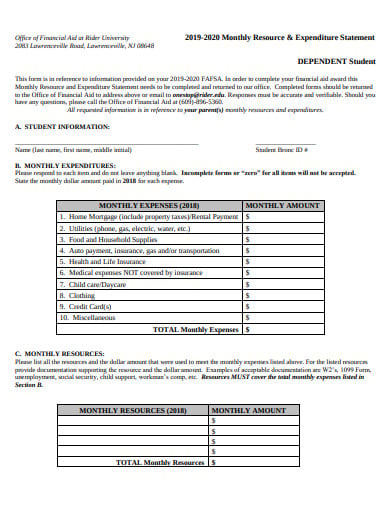

icmr.nic.in7. Monthly Expenditure Statement Template

rider.edu

rider.edu8. Lobbying Expenditure Statement in PDF

northmiamifl.gov

northmiamifl.gov9. Licence Expenditure Statement Template

dnrme.qld.gov.au

dnrme.qld.gov.au10. Income and Expenditure Statement in PDF

ourcommunity.com.au

ourcommunity.com.au11. Standard Expenditure Statement

mea.gov.in

mea.gov.in

What are the steps to create an expenditure statement?

1. Work Out the Details

You need to know the amounts coming in, and to whom any payments will be made. To do this, track everything you pay over the course of many months. This means collecting together your bank and credit card statements, and keeping track of any additional payments in cash as they’re made.

2. Determine Your Net Income

It’s necessary to know what you’re really making as profit (your net income), preferably than just the headline figure (your gross income) coming in. To do this, you’ll need to work out your income as acquired from the above exercise, then subtract your total expenditure. Don’t forget to add expenses such as health insurance, any repayments on loans, rent or mortgage, etc.

Once you’ve examined your revenues to the expenses you’ve acquired, you’ll have an income statement.

What it will do, most importantly, is tell you whether your business is making a profit or loss – if the end, you’ll have to return your expenses and work out which ones to decrease to get back on an even base. To do this, count out what your non-essential costs are, then see where you can clip back to get yourself back in the black.

3. Account for Future Income and Expenses

Next, you need to project your gross income and expenditure figures forward to get an idea of future income. You will have to base the guidelines on your present data, factoring it up by using tools such as the annual current and divined expansion and interest rates as guides.

Set enough yet realistic targets based on your capacity, costs of supplies, and expansion plans. You’ll have to enter any predicted investments such as marketing budgets and investments in assets.

Remember you have two types of costs – fixed and variable. The former including rent, insurance, and utilities are easy to foretell because they remain somewhat even on an annual basis.

Variable costs are more complicated to determine – these are the irregular expenses, such as payments for materials, and even vehicles – which are necessary, but not common, expense. It’s beneficial to take past variable costs and do some trend examination to see how they have improved year on year.

4. Account for Change

While it’s good to try and foretell the future, it’s critical to realize that predictions become less accurate the further forward in time you move, so you’ll have to return your budget regularly to keep it right.

Experts say that while the interval between budgets really depends on the size and nature of your business, it’s essential to check regularly to decide if it needs to be arranged. You’ll need to go through the above steps each time to make sure all of your figures are still correct, making adjustments as needed. For a small business, a budget every three to six months is recommended as moderate.

5. Be Disciplined

This leads to a critical point – you have to be trained, and learn to get your spending under control, to make sure your finances are in good shape. This means exploitation of the budget as the way to rein in your expenditure, and as a commitment to paying your bills.

This indicates the end of pressure purchases, however attractive they may seem. If disbursement wasn’t planned into the budget and isn’t rigidly important, it should be suspended until the next budget review.

Set yourself rewards to form this discipline a lot of acceptable, like a visit or a modest add to pay on yourself if you hit your targets – likewise, introduce a penalty if your discipline ends up lacking.

What is the importance of the expenditure statement?

Importance of the expenditure statement are as follows:

1. It assists to estimate the development of operating level offices.

2. It presents essential data to the central level offices for controlling budget expenditure.

3. It presents data to the office of the treasury and controller for making a decision on budget release and revolving funds.

4. It gives data for making a future budget of operating level offices.