Table of Contents

- Statement Template Bundle

- 8+ Monthly Cash Flow Statement Templates in PDF | DOC

- 1. Parent’s Monthly Cash Flow Statement Template

- 2. Monthly Cash Flow Statement Template

- 3. Personal Monthly Cash Flow Statement Template

- 4. Monthly Cash Flow Statement Sheet Template

- 5. Monthly Cash Flow Statement Example

- 6. Simplified Monthly Cash Flow Statement Template

- 7. Monthly Cash Flow Budget Statement Template

- 8. Monthly Cash Flow Project Statement Template

- 9. Monthly Cash Flow Statement Template in DOC

- What is a Cash Balance Plan?

- How to Create the Cash Flow Statement Analysis?

- How Does a Cash Flow Statement Analyze the Outflow?

- Ways to Analyze a Cash Flow Statement under the Indirect Method:

8+ Monthly Cash Flow Statement Templates in PDF | DOC

Cash flow statements are required in every company as it summarizes the financial health of the company. It becomes mandatory to keep track of how the company generates money to maintain operational costs. With the help of statement templates, it’s easier to draft a balance statement and income statement, included in the company’s financial reports at the end of the fiscal year.

Statement Template Bundle

8+ Monthly Cash Flow Statement Templates in PDF | DOC

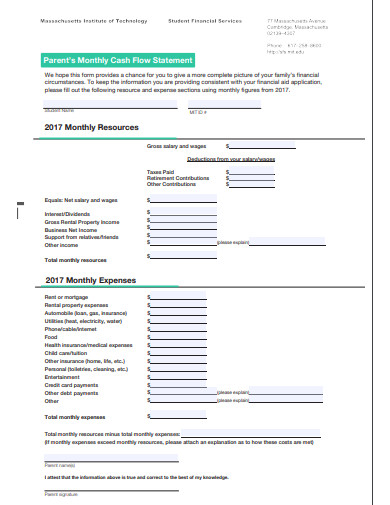

1. Parent’s Monthly Cash Flow Statement Template

mit.edu

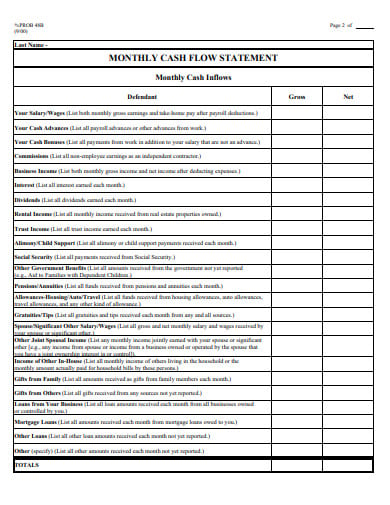

mit.edu2. Monthly Cash Flow Statement Template

uscourts.gov

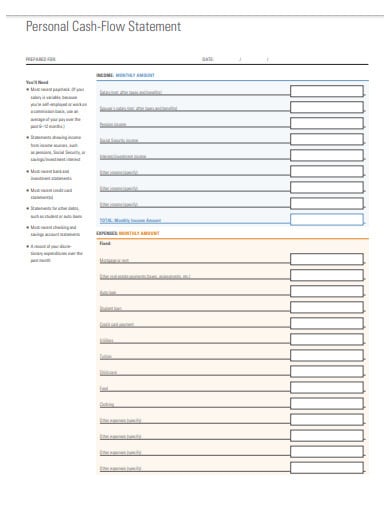

uscourts.gov3. Personal Monthly Cash Flow Statement Template

morningstar.com

morningstar.com4. Monthly Cash Flow Statement Sheet Template

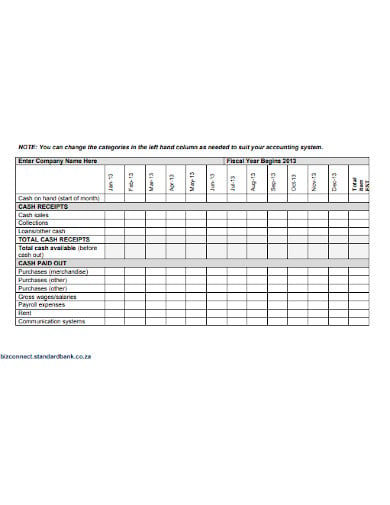

standardbank.co.za

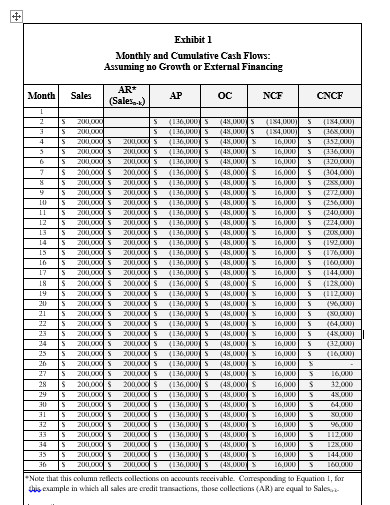

standardbank.co.za5. Monthly Cash Flow Statement Example

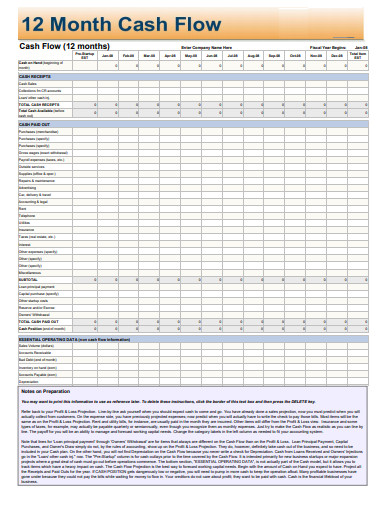

fitsmallbusiness.com

fitsmallbusiness.com6. Simplified Monthly Cash Flow Statement Template

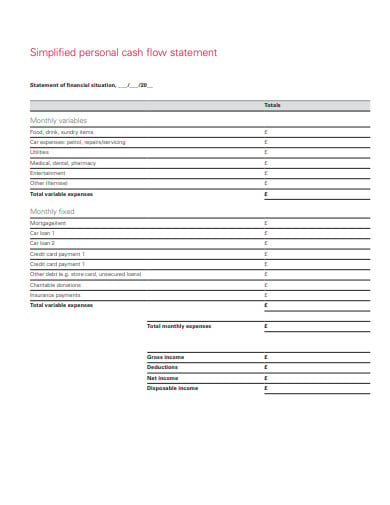

co.uk

co.uk7. Monthly Cash Flow Budget Statement Template

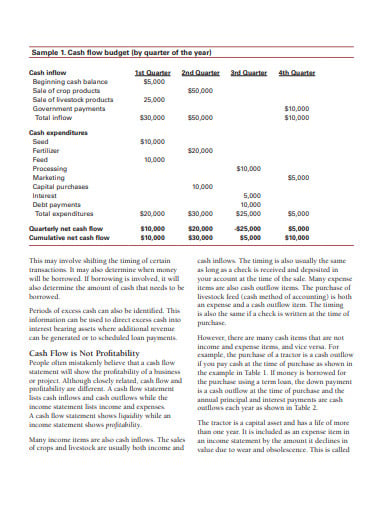

iastate.edu

iastate.edu8. Monthly Cash Flow Project Statement Template

purdue.edu

purdue.edu9. Monthly Cash Flow Statement Template in DOC

facweb.furman.edu

facweb.furman.eduWhat is a Cash Balance Plan?

The cash balance plan is the twist in the proverbial pension plan. This plan provides the employee with the continuance annuity. Except for the pension of the employee, the cash balance plan is to formulate all the necessities in the account capped for each employee. It is the amount that the participating employees can use in form of the cash balance before retirement. The cash balance plan carries a specific approach that is fixed or approved for the account of the employee. The cash balance plan is the account molded by the employer for the improvement of the employee and this can be used by them before retirement. The cash balance is different from that of the pension account.

How to Create the Cash Flow Statement Analysis?

Step 1: Gather the Basic Document and Data

You should gather all the document such as to know the position of the financial statement. The difference in the cash flow from the previous period. I need to gather the document of the equity and the comprehensive income such as the profit or loss income.

Step 2: Calculate the Basic Changes in the Balance Sheet

The basic changes made in the balance sheet must be calculated otherwise there will huge mistake in the calculation of the cash flow.

Step 3: Put the Changes in the Statement of the Cashflow

If any changes made in the account such as the balance sheet or the income sheet then you can make those changes in the cash flow otherwise the statement will contain mistakes in the account.

Step 4: Adjust the Non-cash Item from Total Comprehensive Income

The adjustment of the non-cash items such as capital depreciation, investment gain or losses, and all the items that do not involve any cash payments.

Step 5: Adjust the Noncash Item for Other Information

You have to adjust the non-cash items and the other information in the statement or the analysis of the cash flow either cash inflow or the outflow.

Step 6: Add up and Perform the Final Check

Then when you’re done with the adding up of the statement details proofread the statement and perform the final checking once again to avoid silly errors.

How Does a Cash Flow Statement Analyze the Outflow?

The cash flow statement analyzes the cash inflow and where the cash is spent. It measures the liquidity state of the company and thinks of the long term solvency. The cash is considered to be the liquid asset. The statement analysis templates are to attain the cash inflow and the outflow. It is the prime motive of the statement analysis and other two analysis statement is the balance sheet and the income sheet.

Ways to Analyze a Cash Flow Statement under the Indirect Method:

Step 1: Determine the Effect of Operating Profit

The first stage in creating a cash flow statement is that you need to first calculate the operating costs before the working capital changes and determine the effect. You have to check the increase or decrease in the current assets and liabilities to find out the total operating costs.

Step 2: Add up all the Cash Flows

The next step is to calculate the cash flows from investing activities by counting up the cash flows that are either matured or sold while deducting the cash flows which have been purchased as part of new investments. Record the various changes in the business with accurate numbers.

Step 3: Calculate the Cash Flows from Liabilities

Cash flow from non-current or long-term liabilities and the working capital of the shareholder determines the cash flows from financing activities. This also includes debentures, bonds, long-term notes for cash, redemption or repayment of loans and so on.

Step 4: Include Account Change Information

Another essential information that the balance sheet should include is about the change of accounts form one period to another. Al the functions that were operational during one accounting period should reflect in the balance sheet and analyzed during the fiscal year.

Step 5: Check and Review the Cash Statement

This is an important step in formatting a final cash flow statement. Before finalizing the balance statement, you need to review the profits and loss, income and cash outflow statements as well. They need to be thoroughly analyzed in comparison with the past transactions and the future goals of the business.