Table of Contents

- Statement Template Bundle

- 7+ Monthly Income and Expense Statement Templates in PDF | DOC

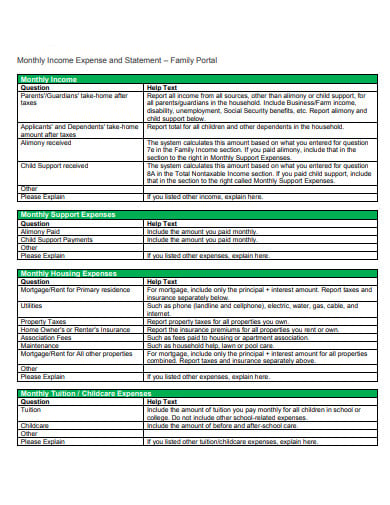

- 1. Family Monthly Income and Expense Statement

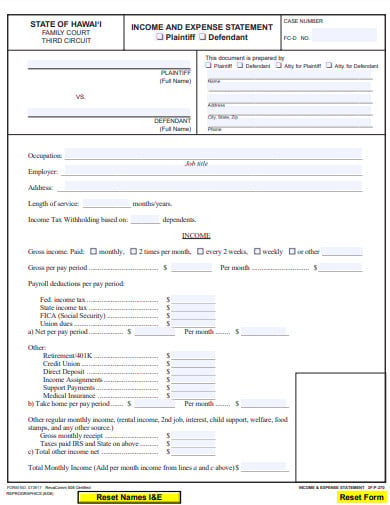

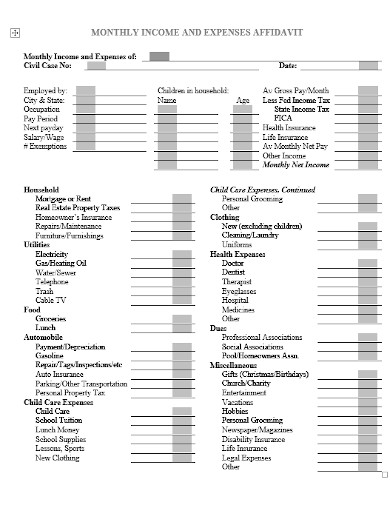

- 2. State Monthly Income and Expense Statement

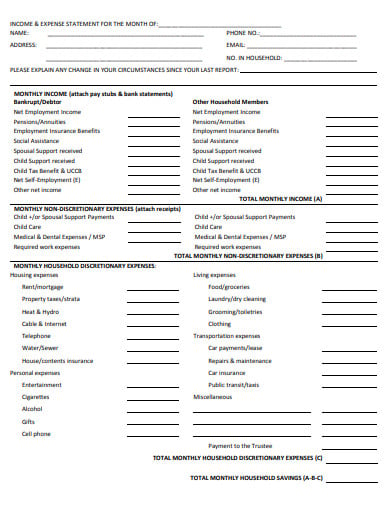

- 3. Monthly Income and Expense Statement Template

- 4. Monthly Income and Expense Statement Example

- 5. Business Monthly Income and Expense Statement

- 6. Parent Monthly Income and Expense Statement

- 7. Monthly Income and Expense Statement in PDF

- 8. Monthly Income and Expense Statement in DOC

- Why Keep a Monthly Income-Expense Statement?

- What is an Expense Analysis?

- How to Create an Expense Analysis in MS Word?

- What to Write in a Company’s Expense Report?

7+ Monthly Income and Expense Statement Templates in PDF | DOC

Office trips sound fun, right? Well, as long as you get to visit places between client meetings and the company takes full responsibility for your payments, what else could you ask for. However, this process of reimbursement needs to go through a full-term formal process called expense report drafting and approval. To make things easier you can take the help of our templates that have pre-formatted forms for office reimbursements and expense reports.

Statement Template Bundle

7+ Monthly Income and Expense Statement Templates in PDF | DOC

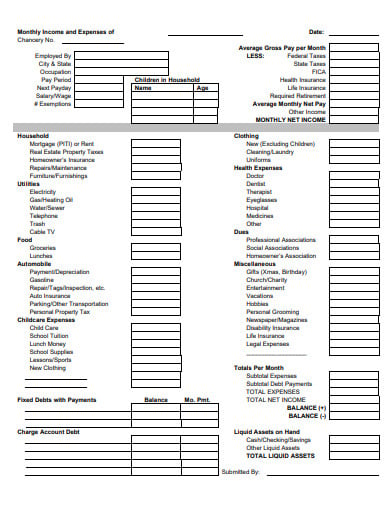

1. Family Monthly Income and Expense Statement

cathedralcrusaders.org

cathedralcrusaders.org2. State Monthly Income and Expense Statement

state.hi.us

state.hi.us3. Monthly Income and Expense Statement Template

chilliwack.com

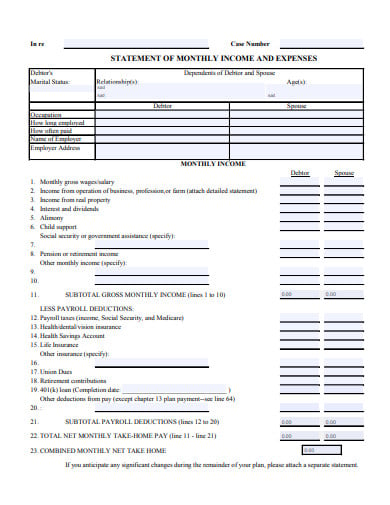

chilliwack.com4. Monthly Income and Expense Statement Example

divorcelawinfo.com

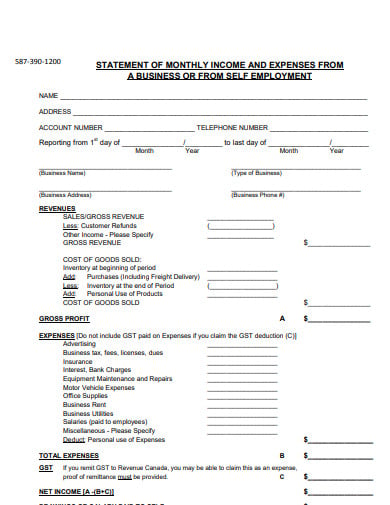

divorcelawinfo.com5. Business Monthly Income and Expense Statement

calgaryhousingcompany.org

calgaryhousingcompany.org6. Parent Monthly Income and Expense Statement

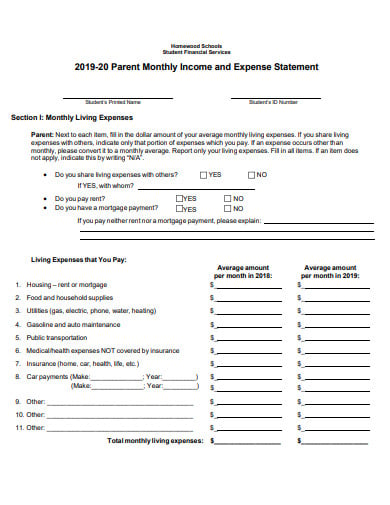

jhu.edu

jhu.edu7. Monthly Income and Expense Statement in PDF

nsh.com

nsh.com8. Monthly Income and Expense Statement in DOC

winfredclerk.com

winfredclerk.comWhy Keep a Monthly Income-Expense Statement?

A monthly income-expense statement will help you to analyze where your money is heading and the sheet will represent your inculcate income. This is how you can help to save your money and make future investments by saving some.

What is an Expense Analysis?

Expense analysis in a business is a very technical work and is beyond the scope of most bookkeepers. Usually, the task is given to the CFO of a company. If he is a good one, then he should probably be doing it without being explicitly told to do so. More time spent on the analysis does not equate to better results. What matters are the answers?

How to Create an Expense Analysis in MS Word?

Step 1: Create a New Document

Open MS Office and create a new document. You might use any other spreadsheet software that you feel comfortable with. If you have some other software you can use that as well. Write ‘Expense Analysis’ as the title of the document. Change the font size to around 20pts make it look like a title.

Step 2: Income Section

One of the benefits of using a spreadsheet is that you won’t be having to create tables separately. Write the headings as ‘income source,’ ‘estimated,’ ‘actual’ and ‘difference’ for the four columns that we are going to be using.

Step 3: Expenditure Section

In the expenditure section, we are going to use create columns as well. The first one would be the ‘expenditure sources’ column and the second one would contain the amount you had specifically allocated for that purpose. The third one would be containing the actual amount that was getting used. The last table should contain the difference between the previous two.

Step 4: Balance

In this section, the balance needs to be calculated. This is the difference between the amount of money that you have earned and that you have spent. If you use the functional programming feature in Google Sheets, you can check the change in realtime. You don’t have to calculate everything yourself. This way you can adjust your expenses when you have over-spent on something.

Step 5: Graph

It’s harder to get something sensible from just a bunch of numbers. That is why it is suggested that you make use of graphs. When the data gets visually represented it makes easier to figure out where you need to cut corners. Use the type of chart that is best suited for the data that is being recorded here. We would recommend that you use a bar graph.

What to Write in a Company’s Expense Report?

Expense reports for employees need to be carefully drafted. This allows the employee to fairly receive his money back and does not let the company spend more than required. The steps to drafting an expense report are:

Cover All Prospects

Whenever the company chooses to reimburse an employee the number of aspects is usually more than one. It is usually food, transport, accommodation, etc. Do not miss out on any.

All Reports Are Not the Same

An accident reimbursement report is not the same as travel expenses reimbursements. Keep that in mind what drafting the report.

Be Fair and Keep Proofs

Since the company is reimbursing, do not take undue advantage of it. Every expense claim should be backed up by enough proof.

List the Details

List all the details- the name of the employee, the reason for reimbursement, date of the expense, type of expense, etc all should be noted down in detail.

Authorization of the Employee

The employee must conform to the fact that all the details provided by him are true and error-free.