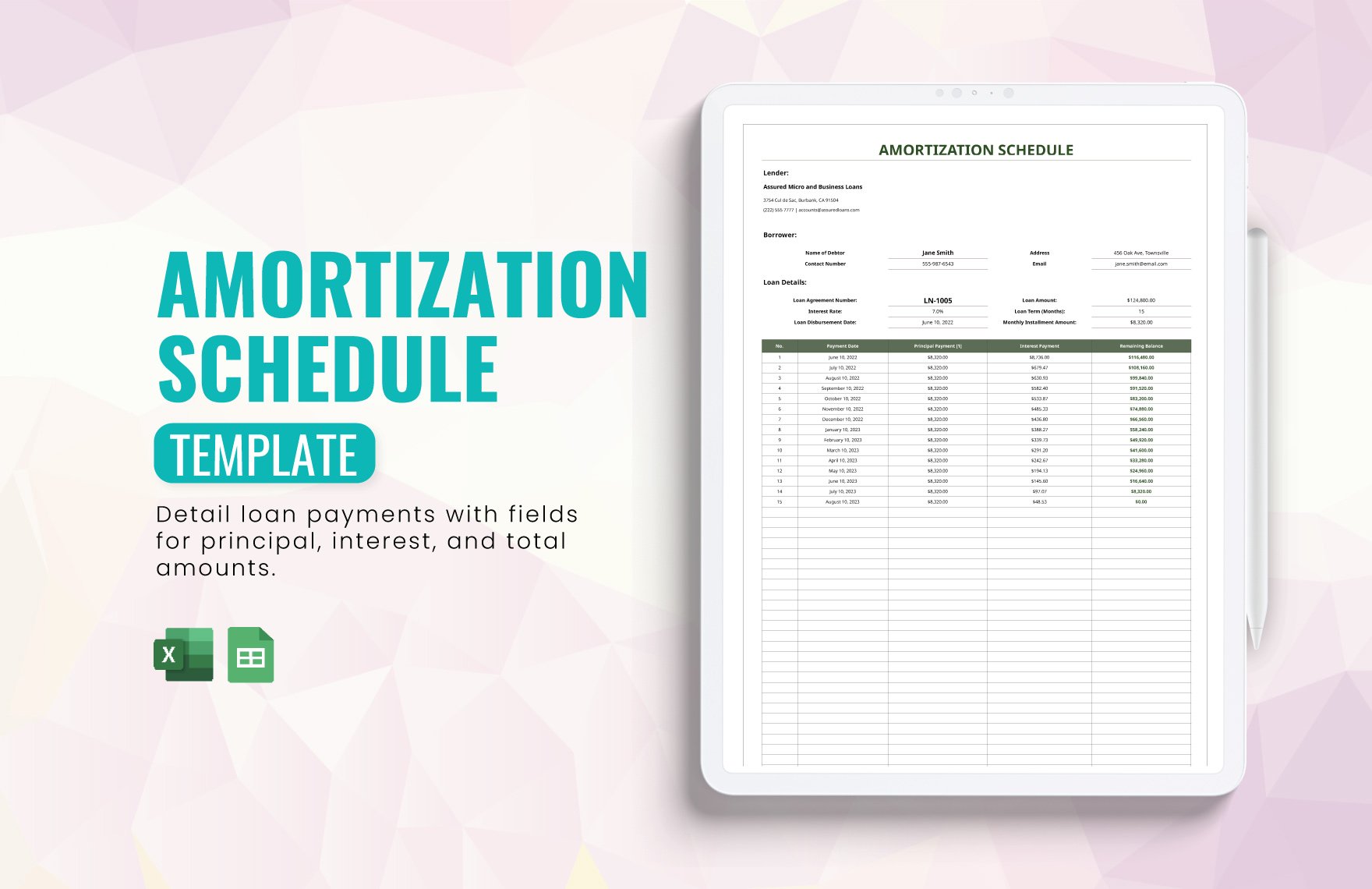

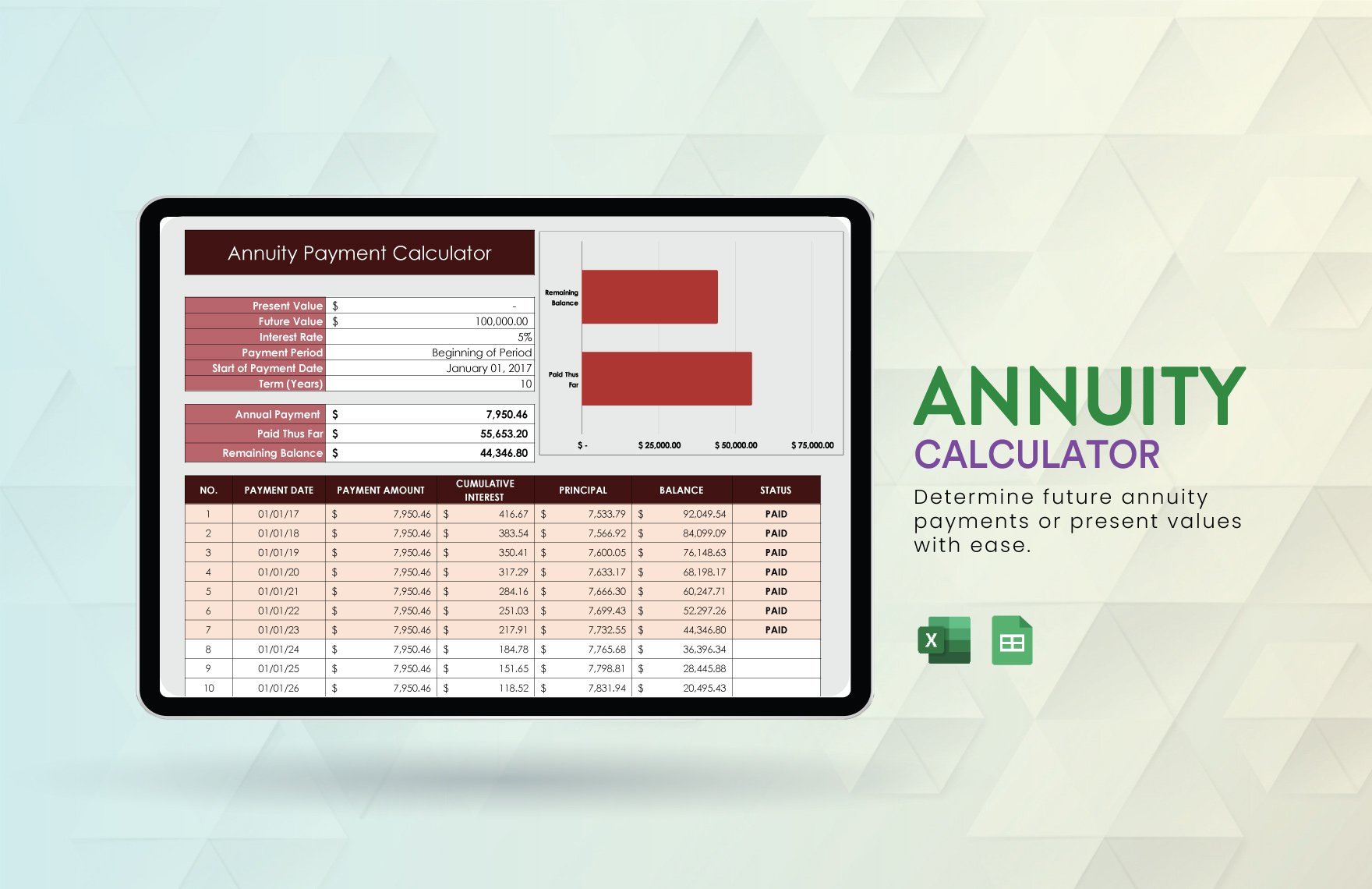

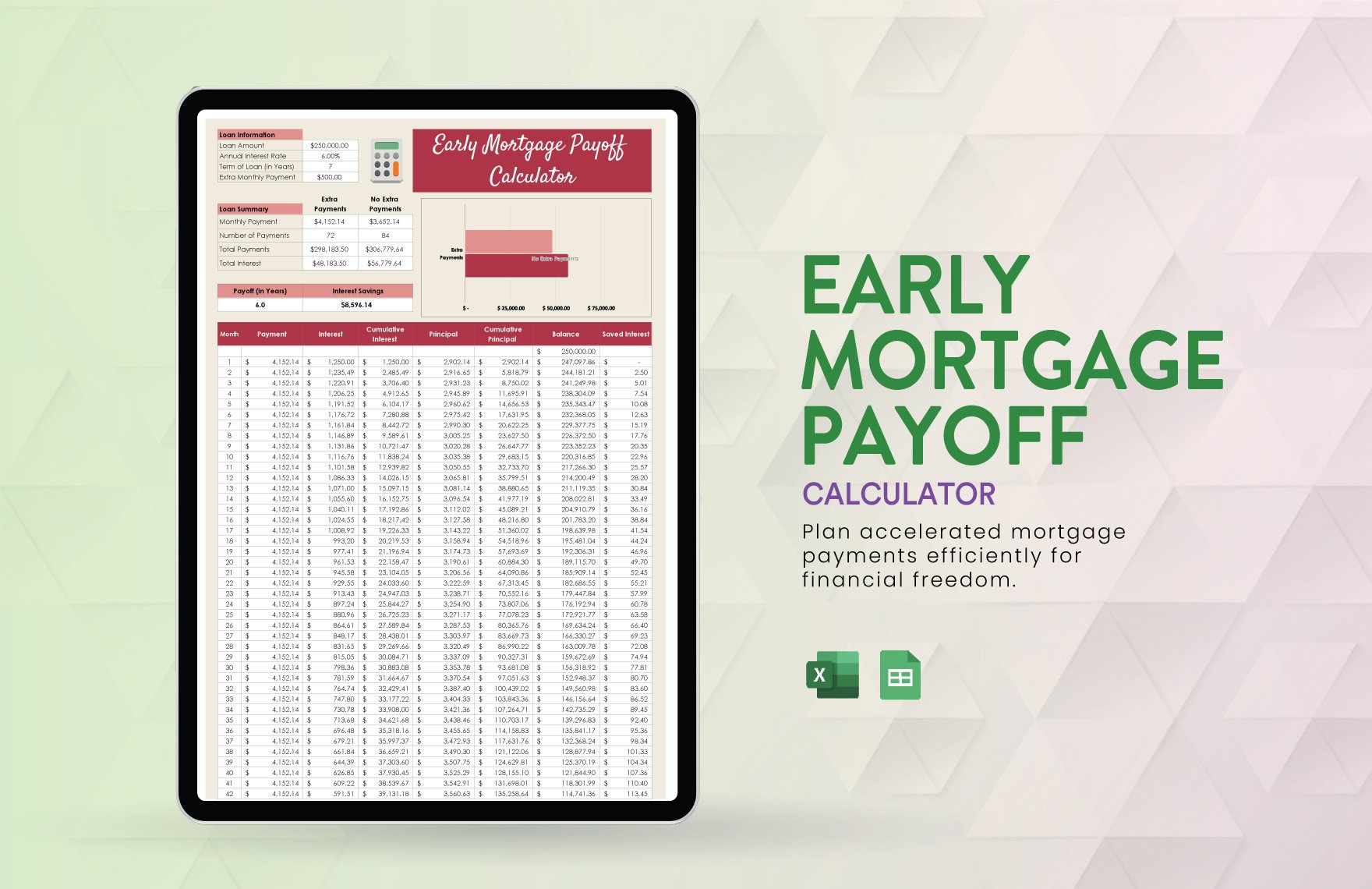

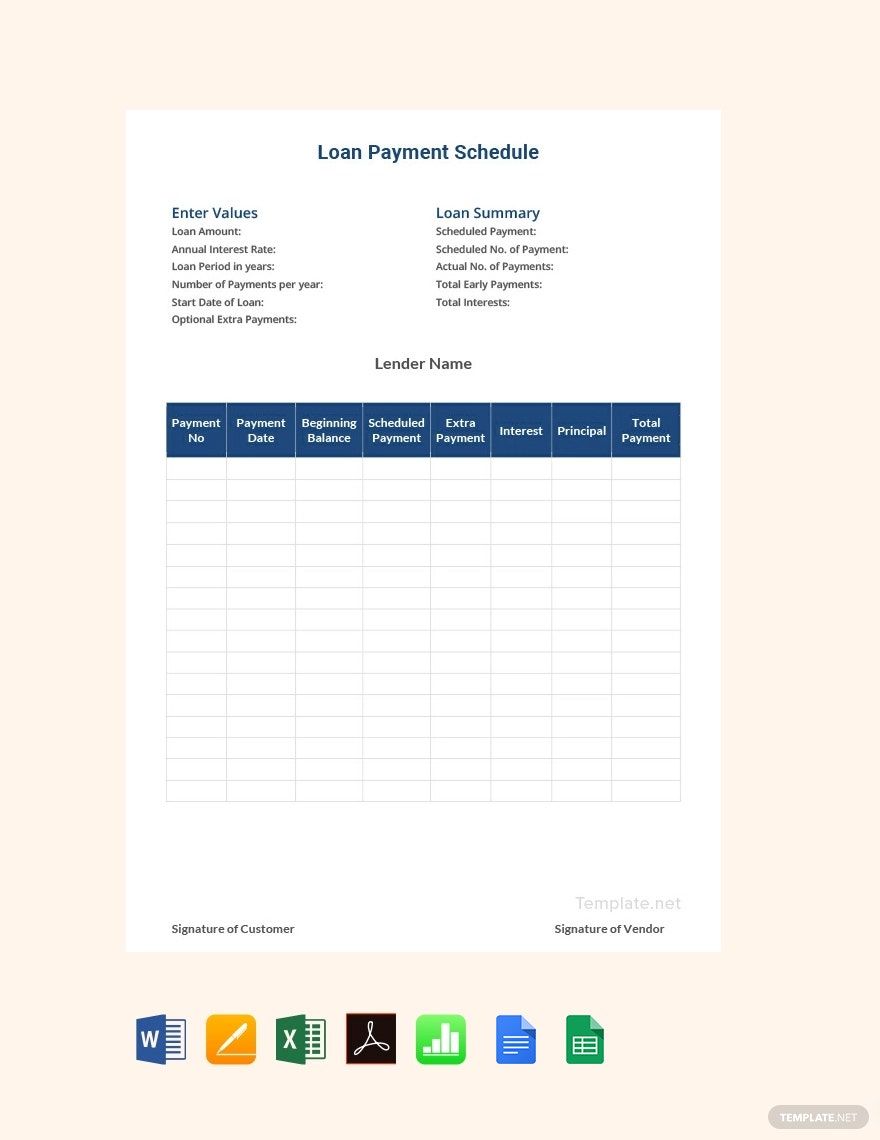

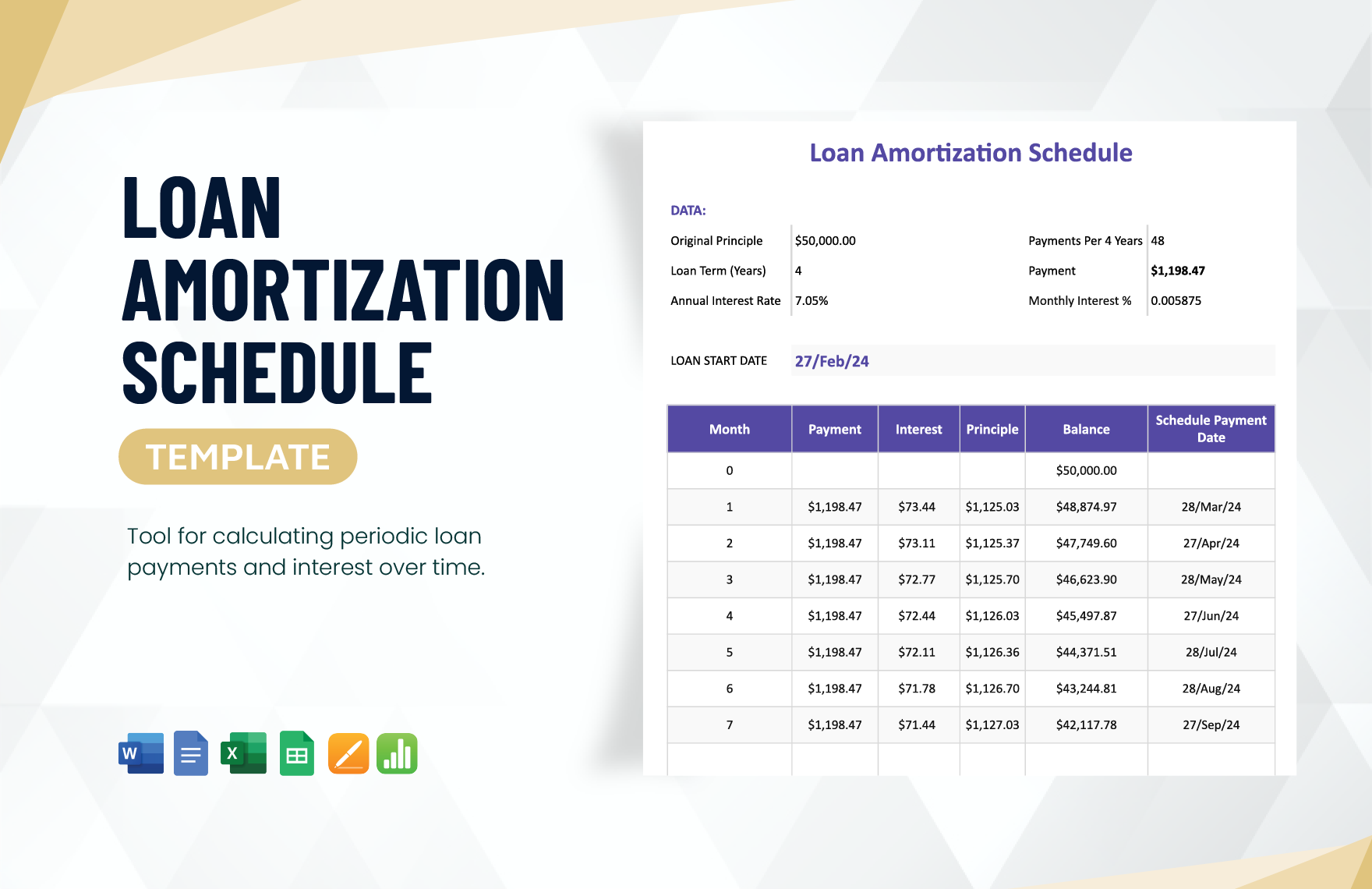

Studies show that people tend to forget loans that do not have written evidence. There are different types of loans, an amortized loan is one of them. When you have this loan, you will have a scheduled periodic payment on both your principal loan and its interest. This continues until you are able to finish paying for your loan. To keep track with your progress, you will need an amortization schedule.

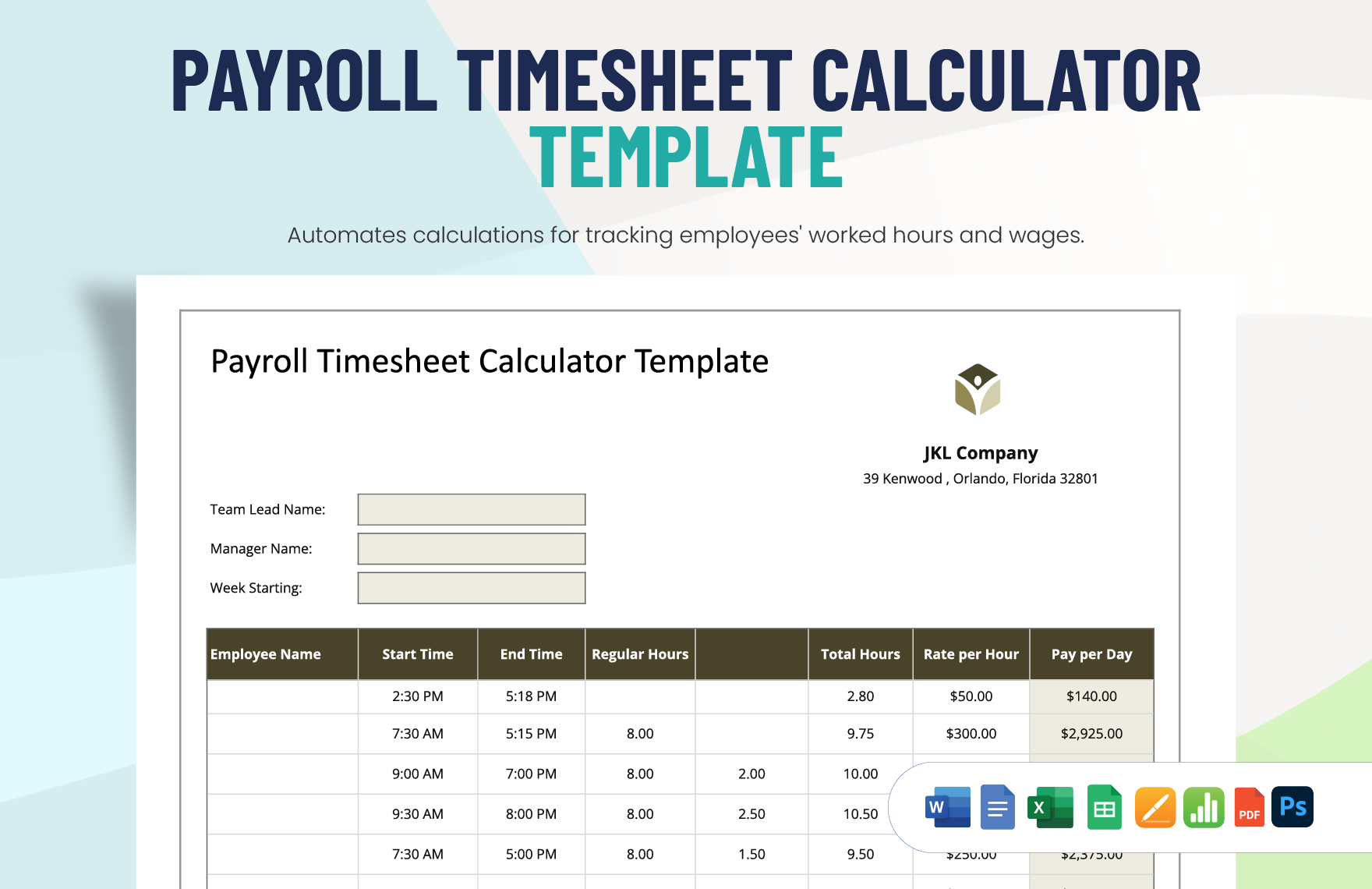

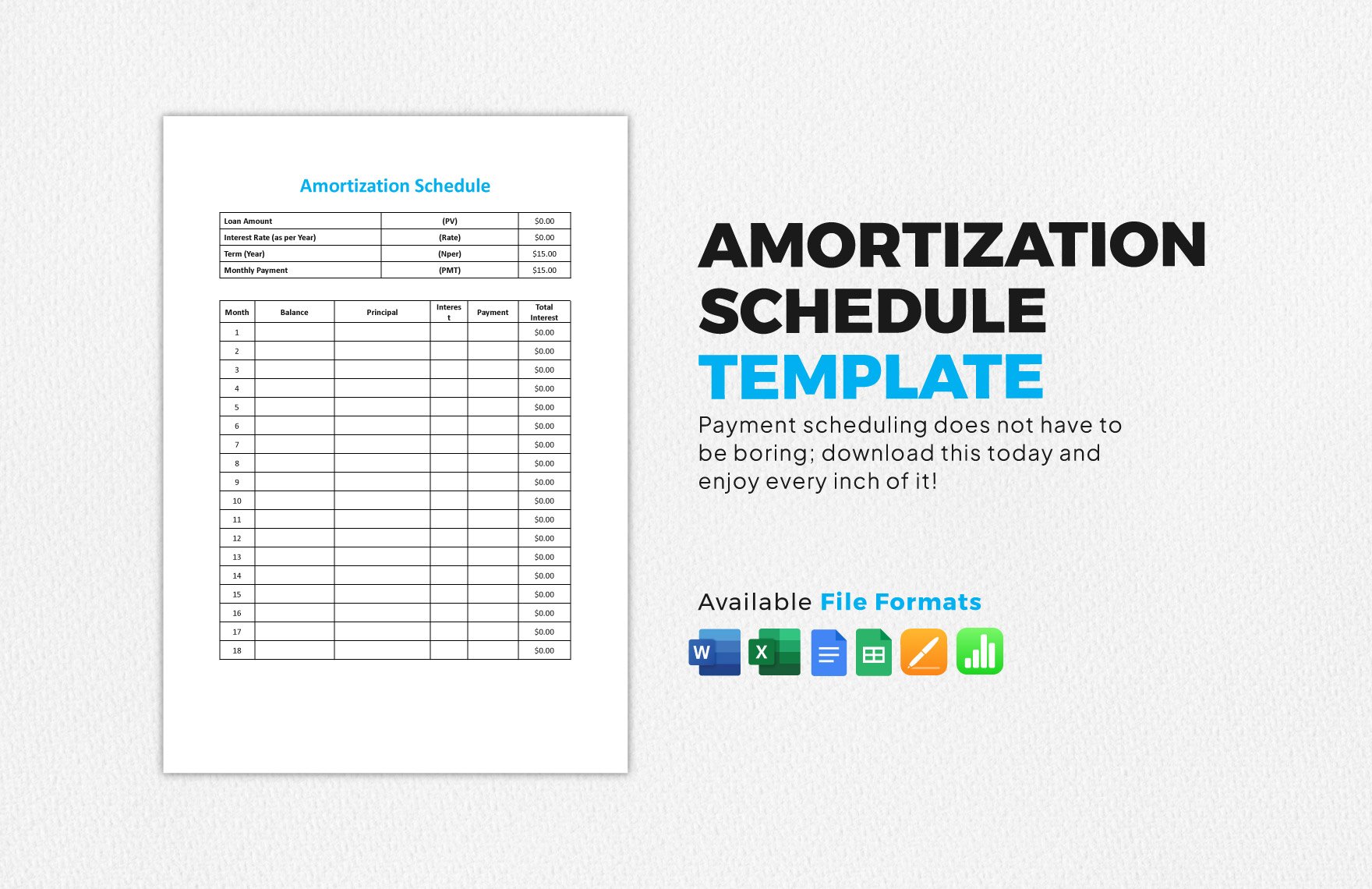

1. Input Basic Information

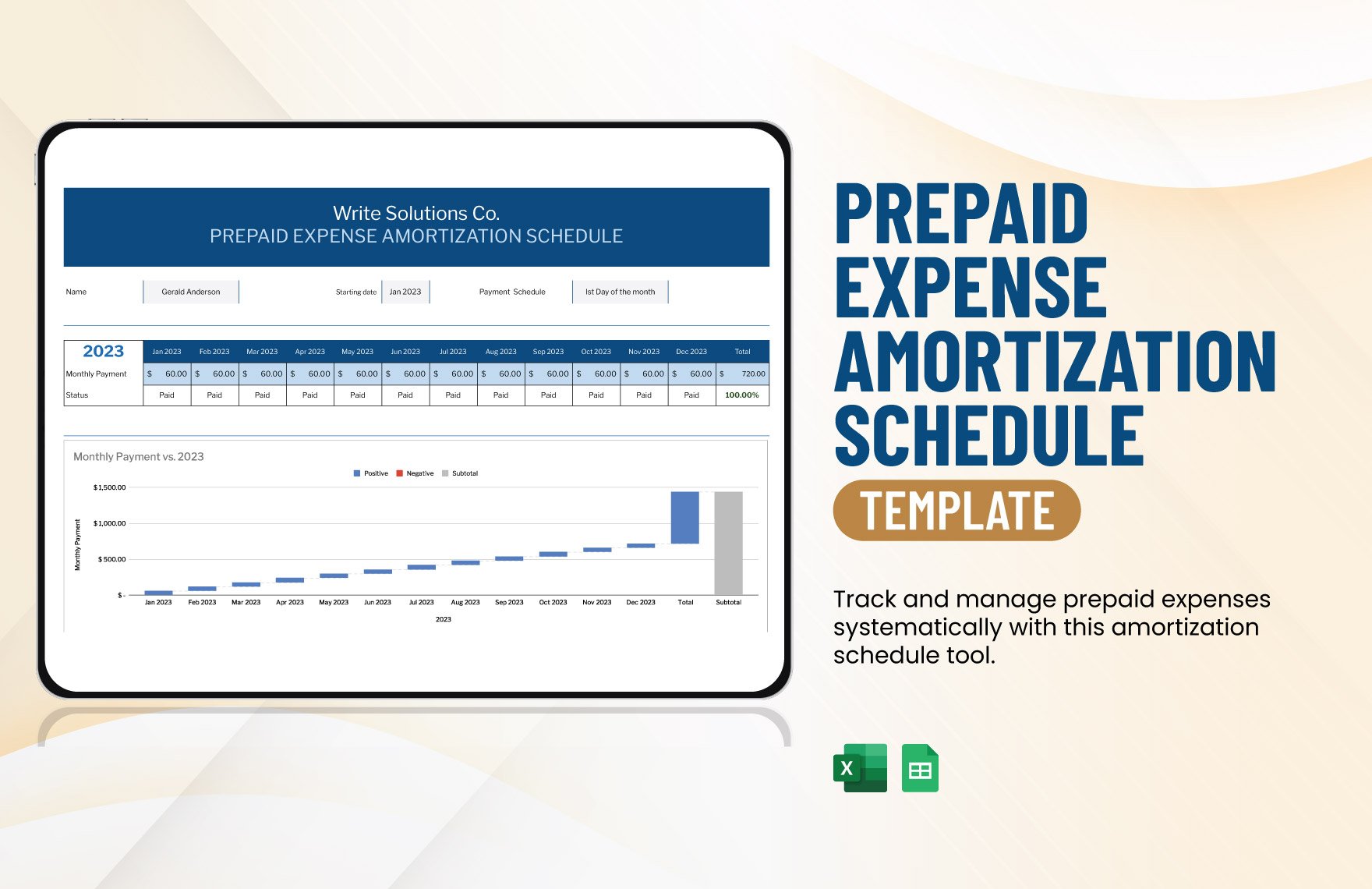

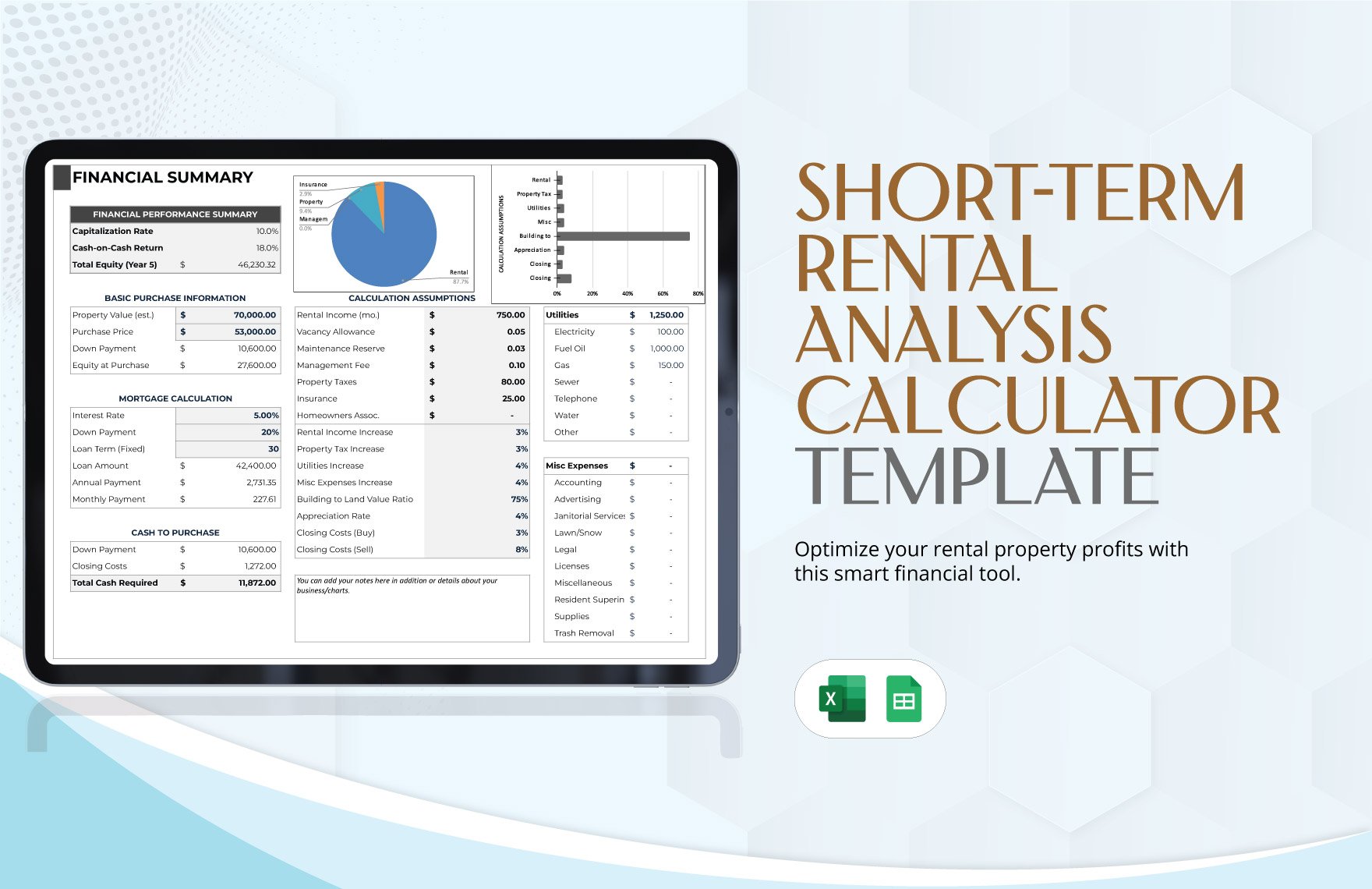

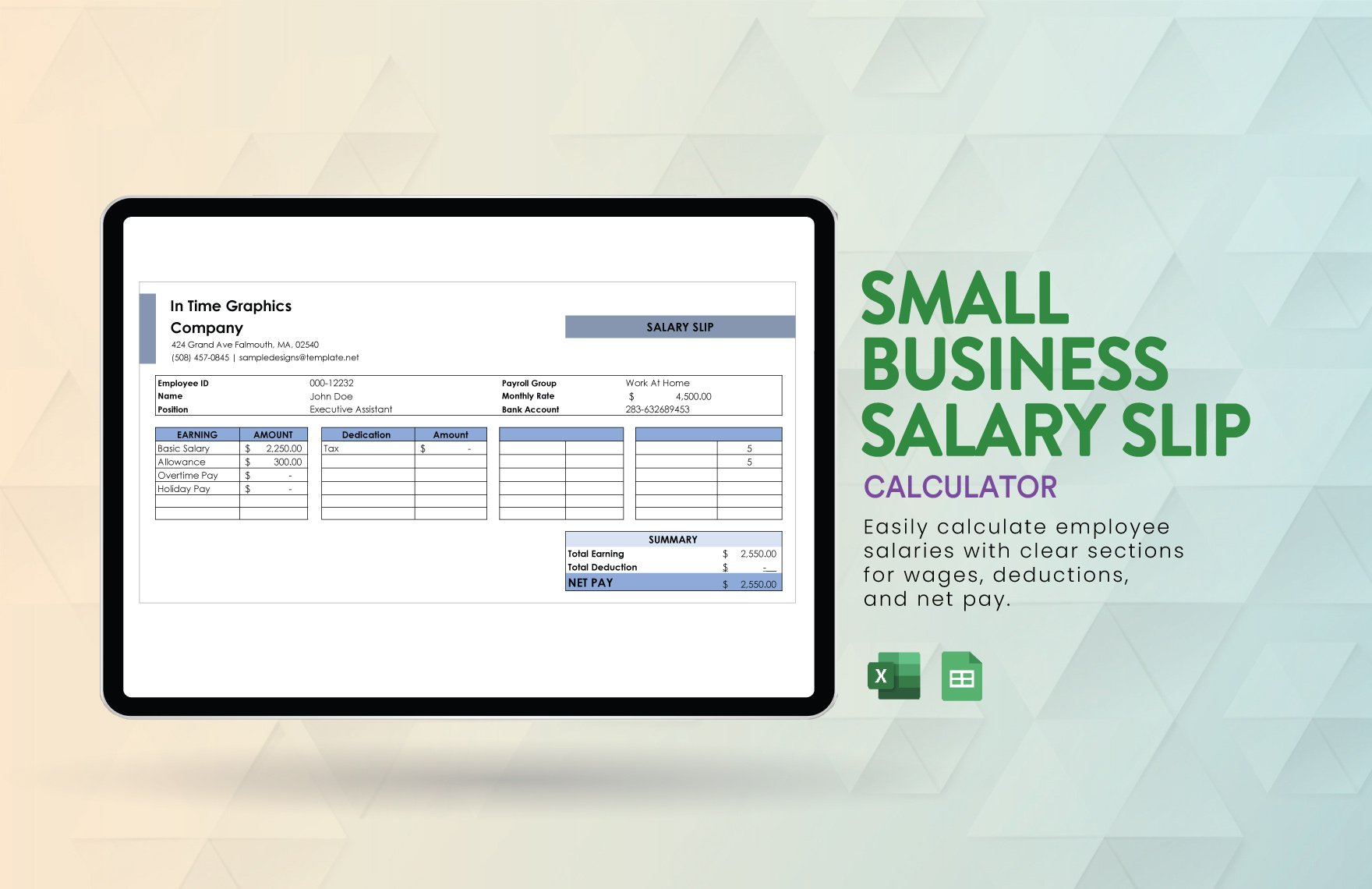

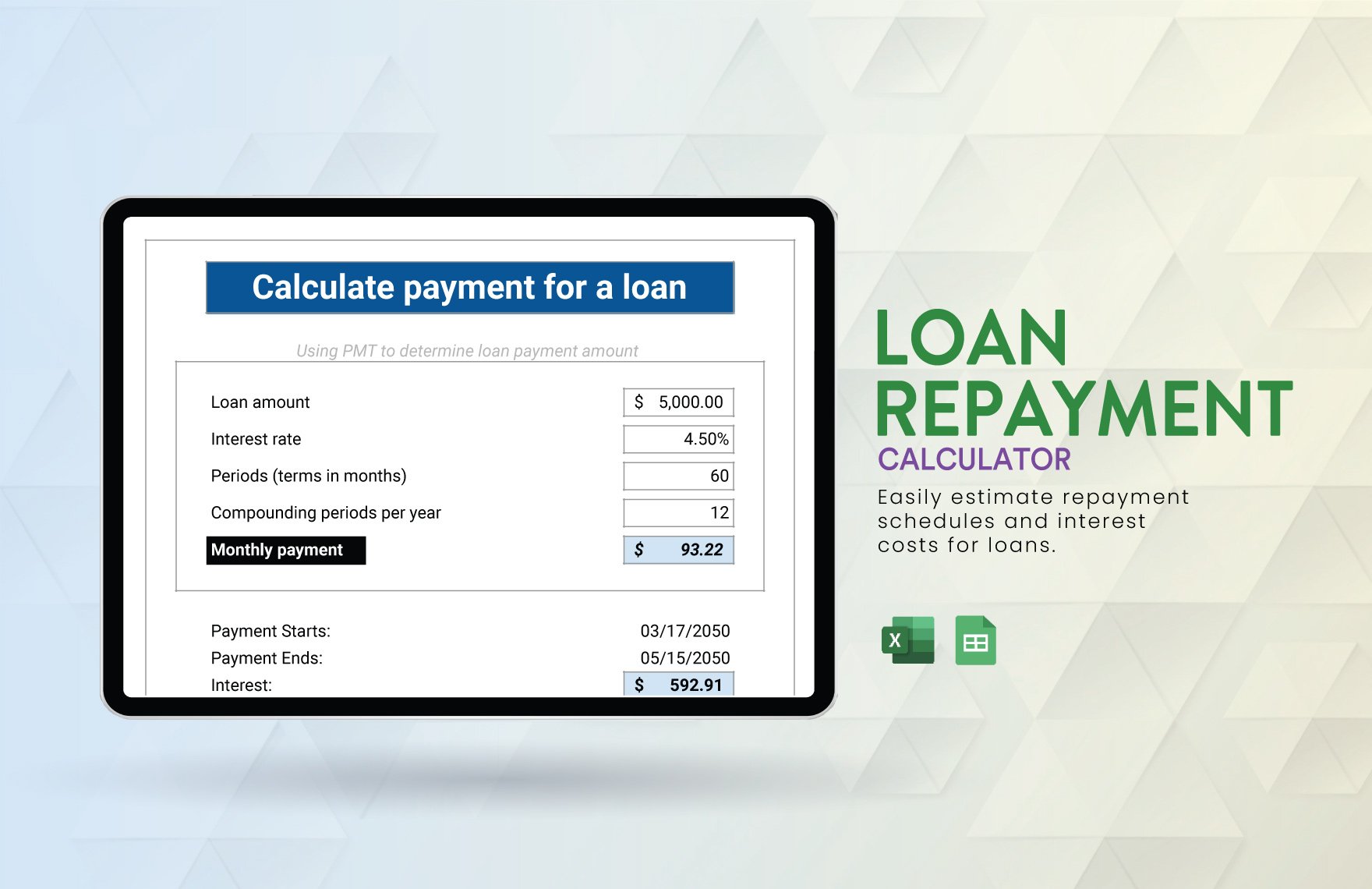

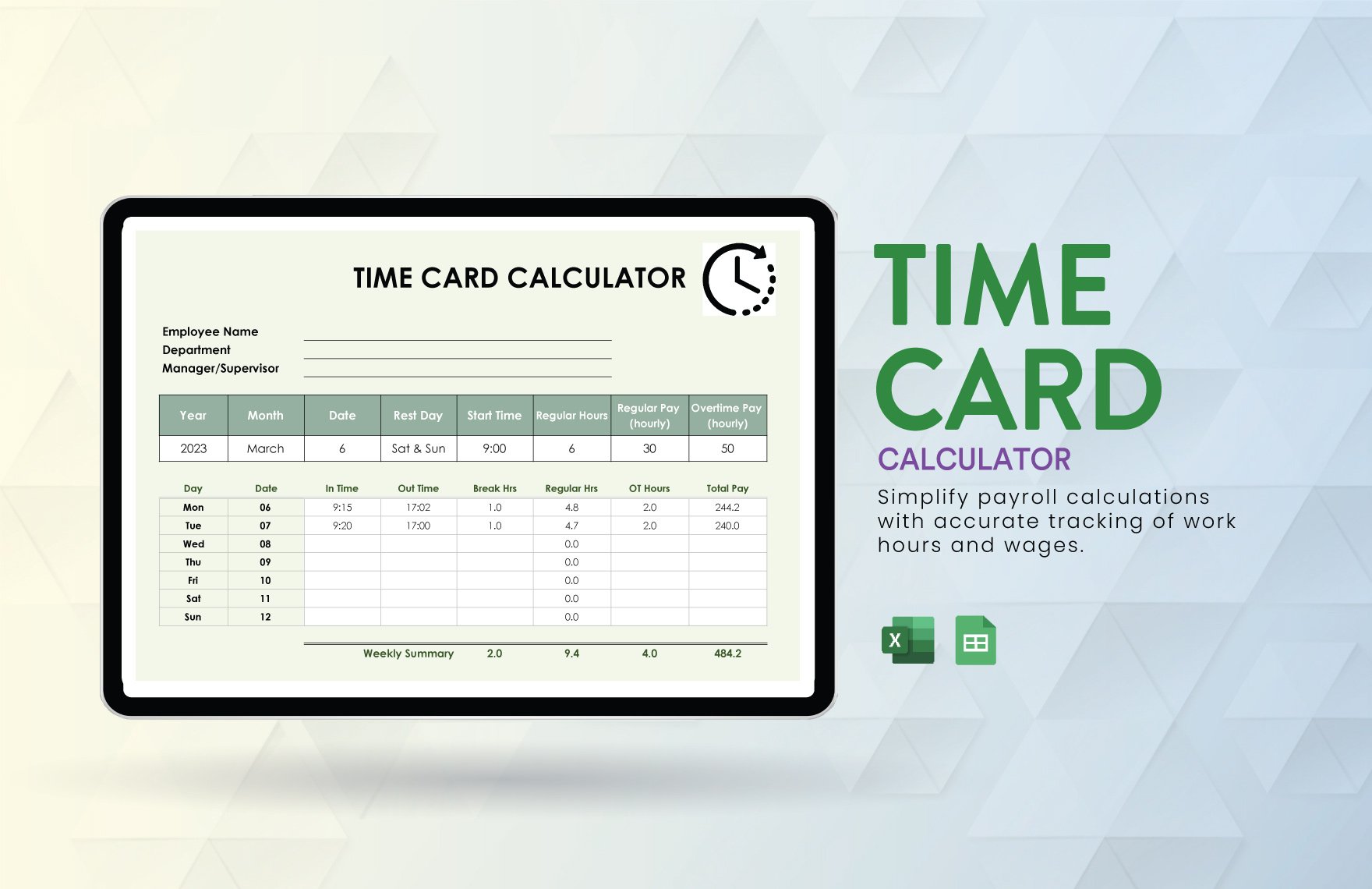

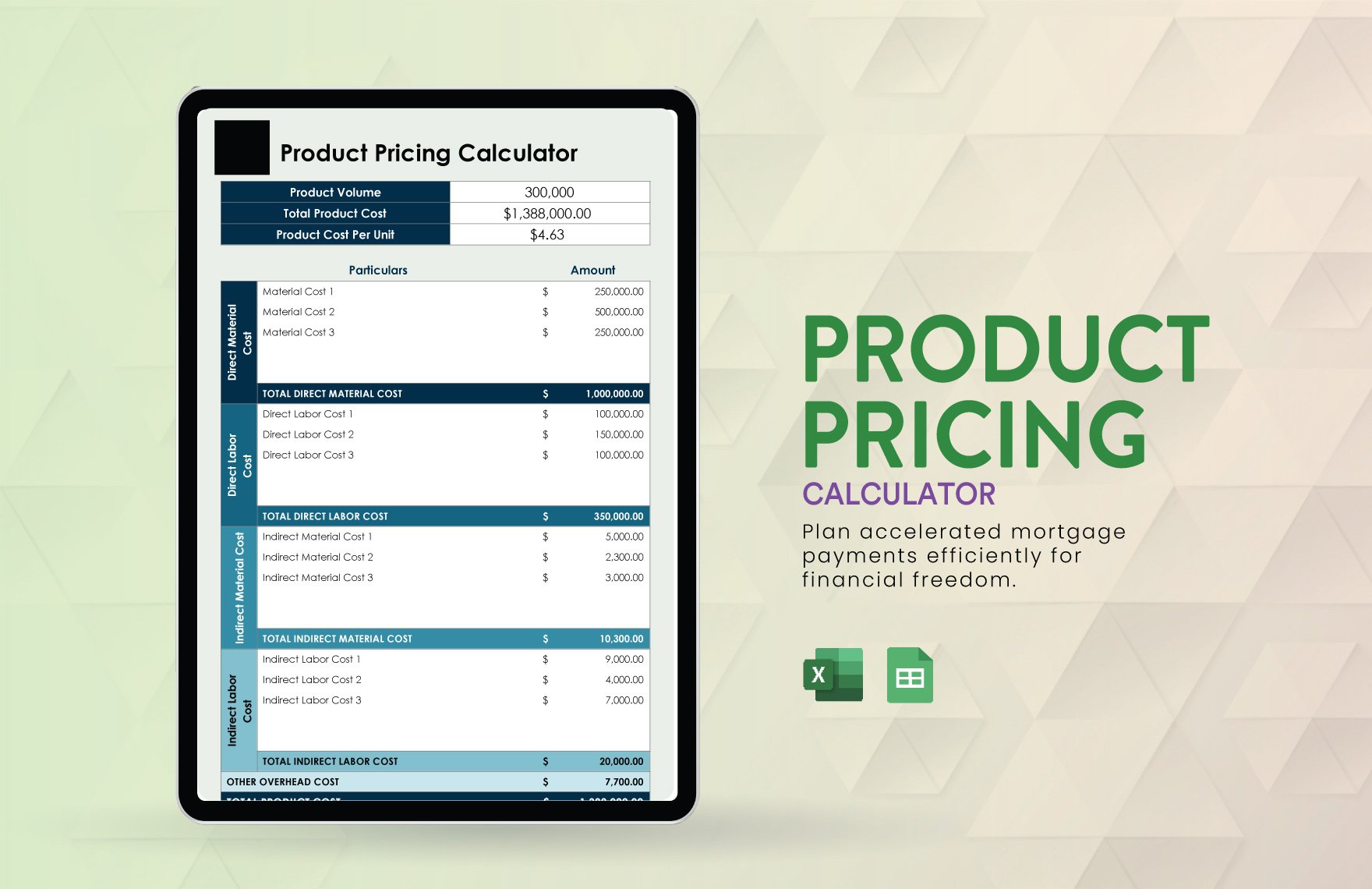

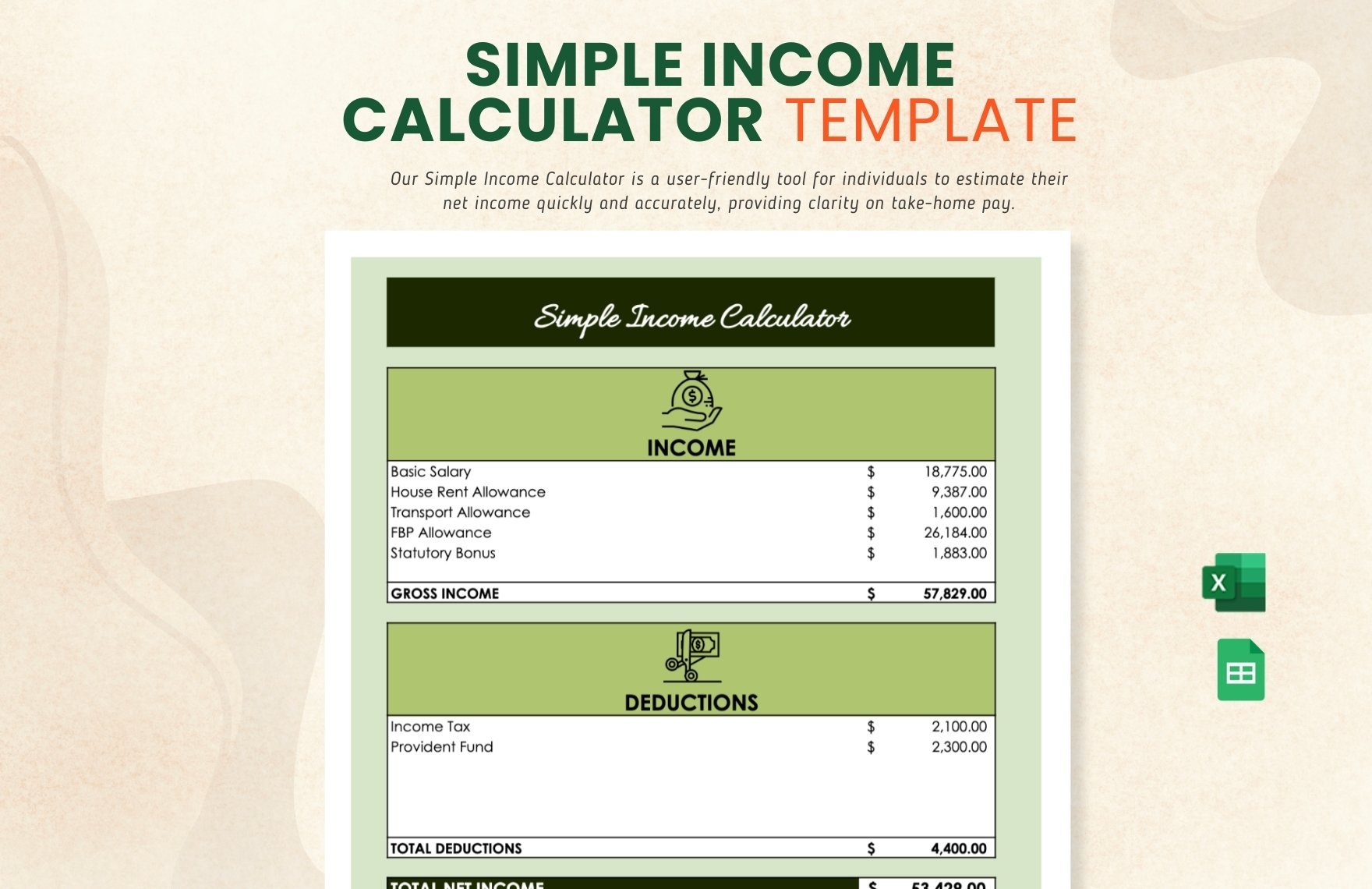

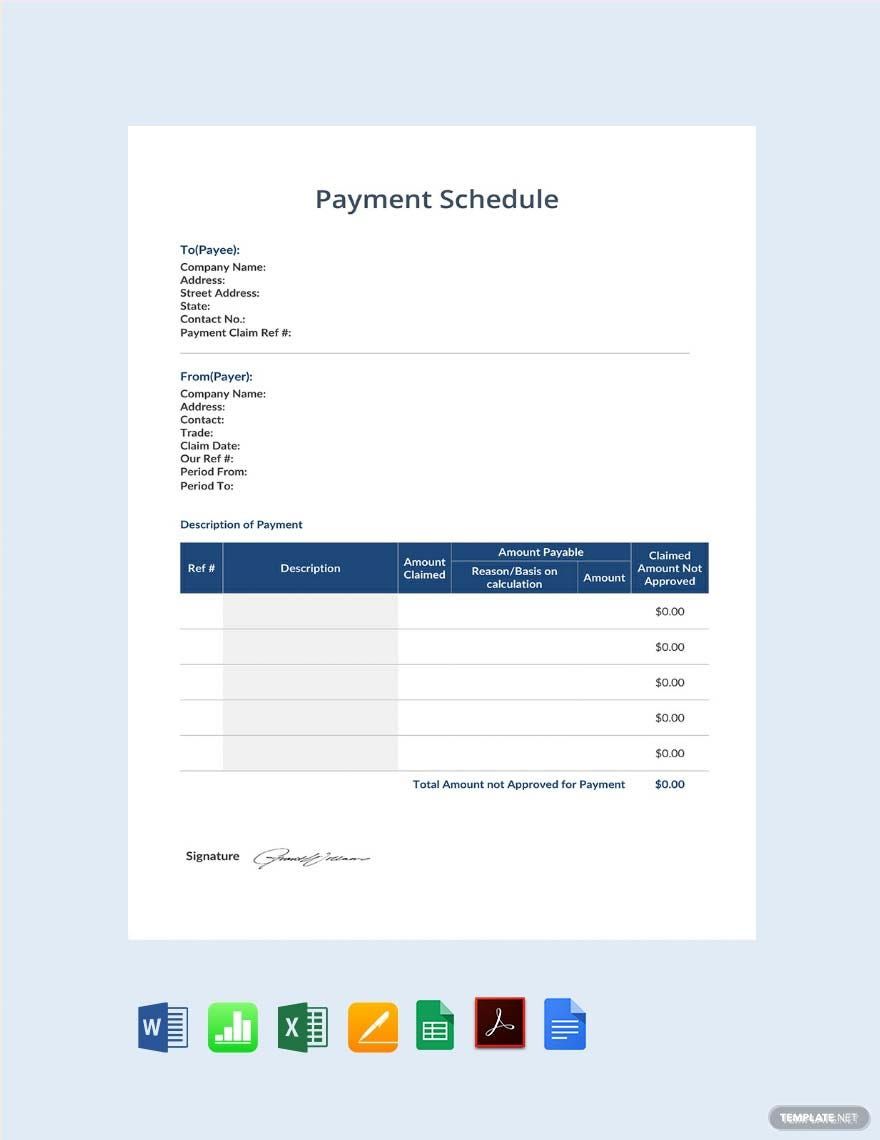

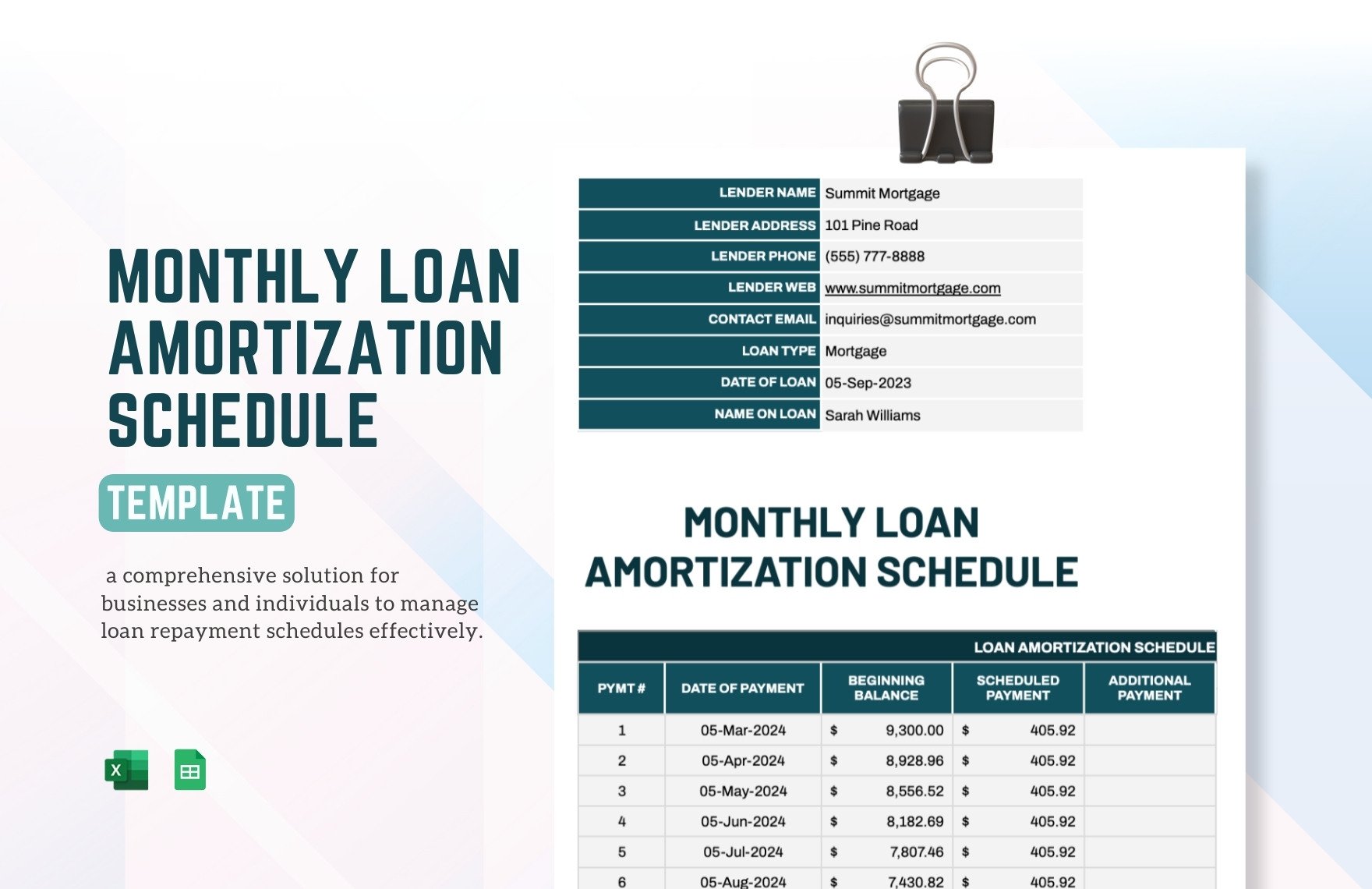

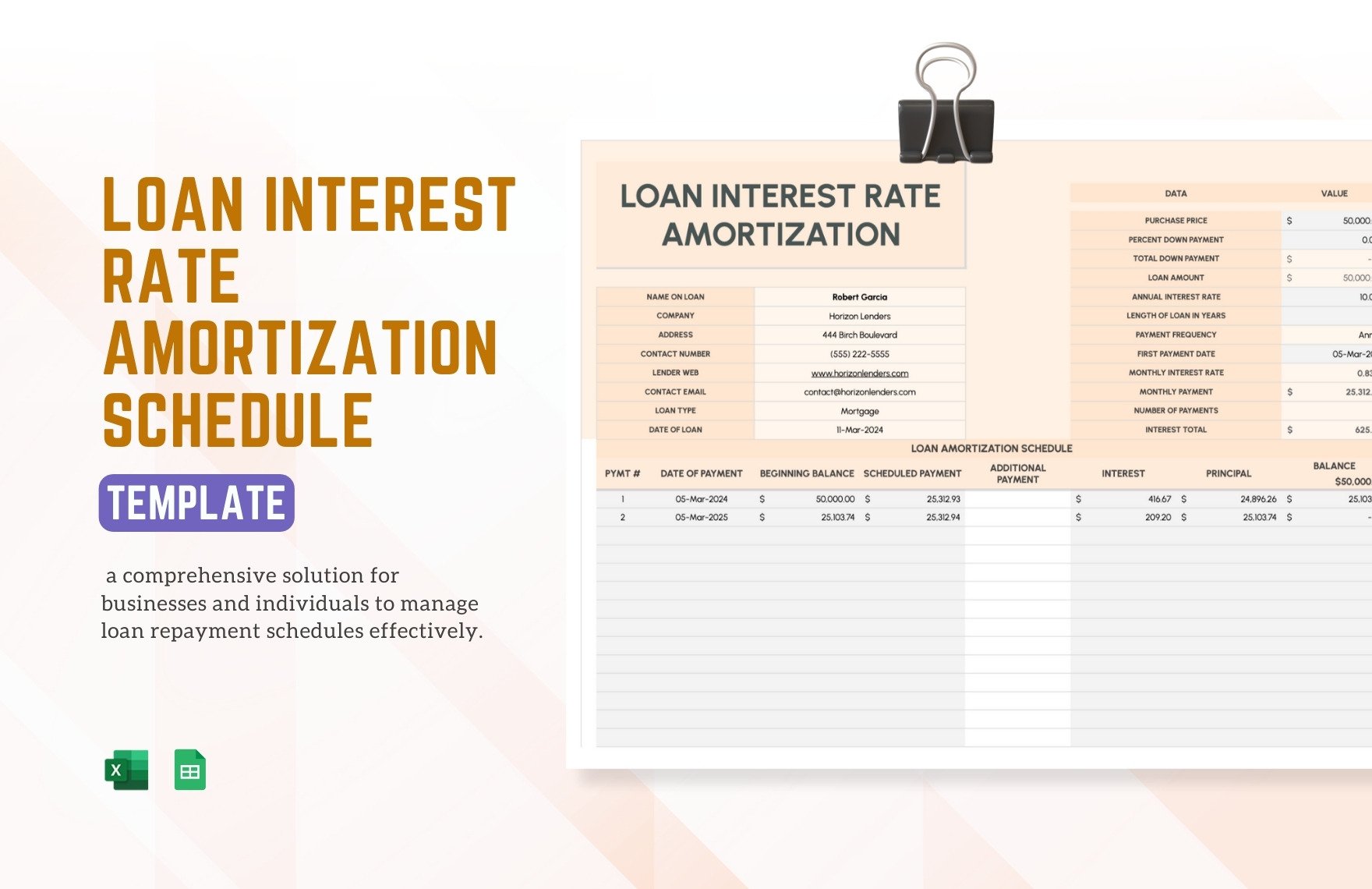

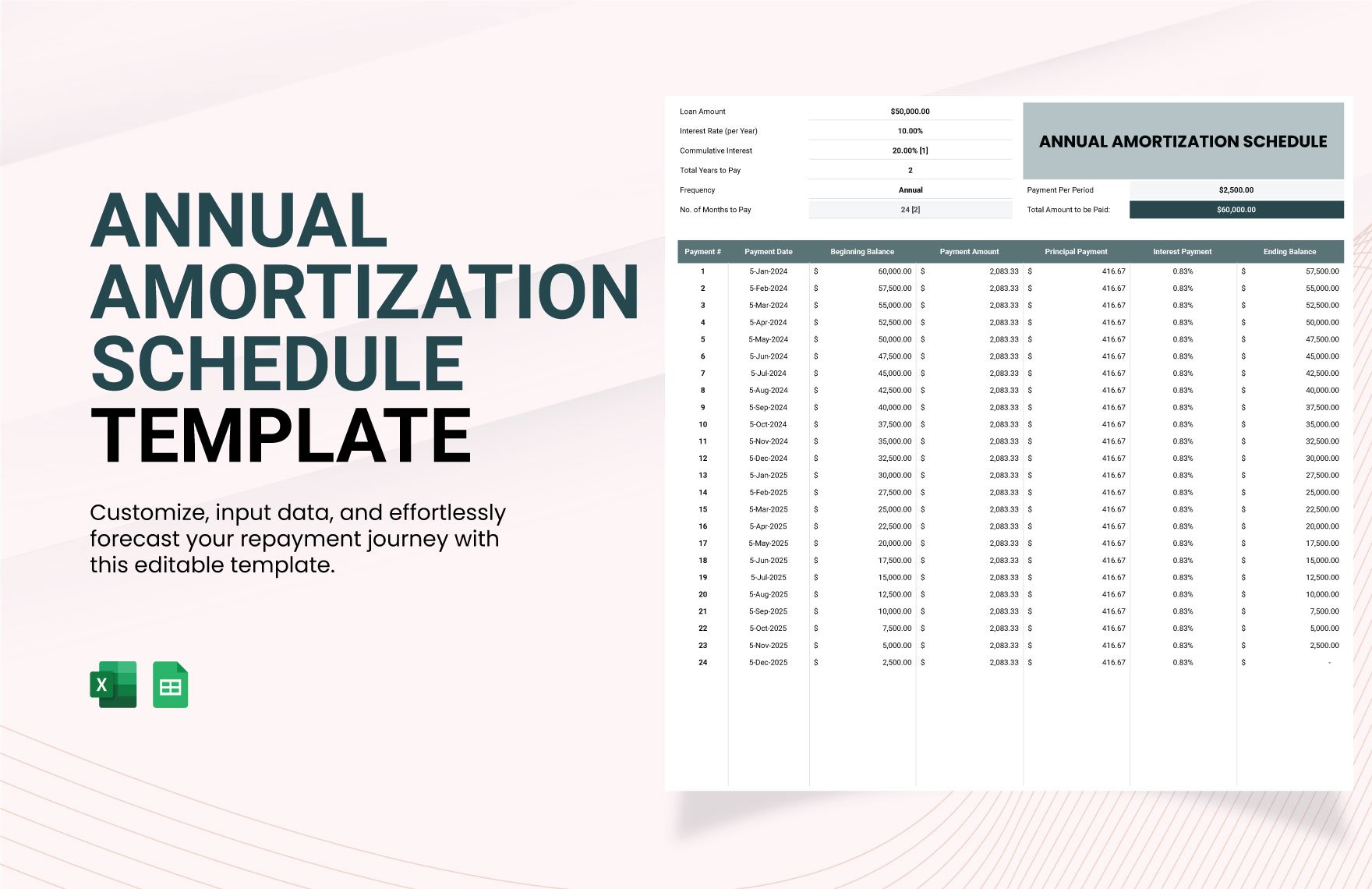

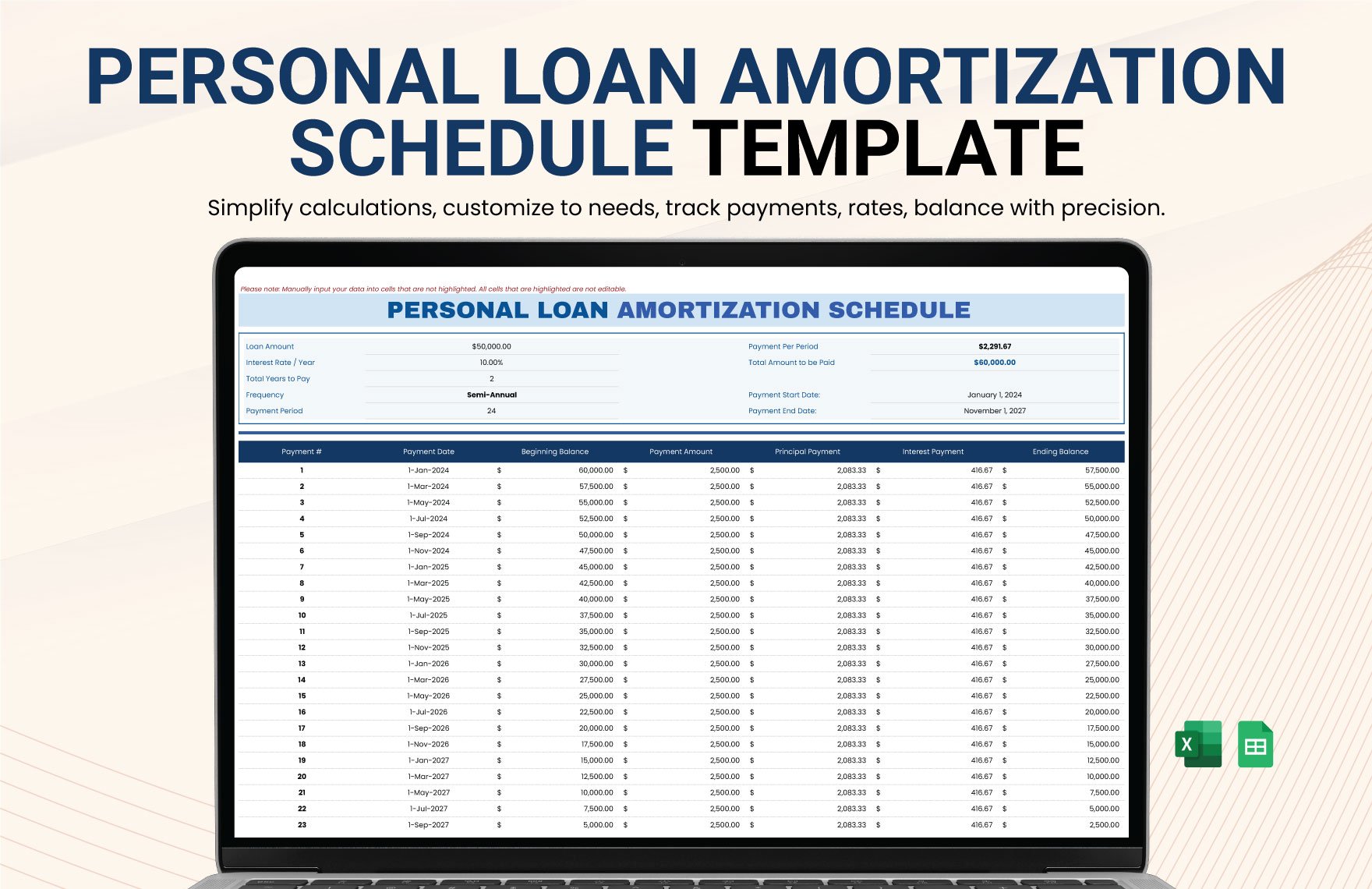

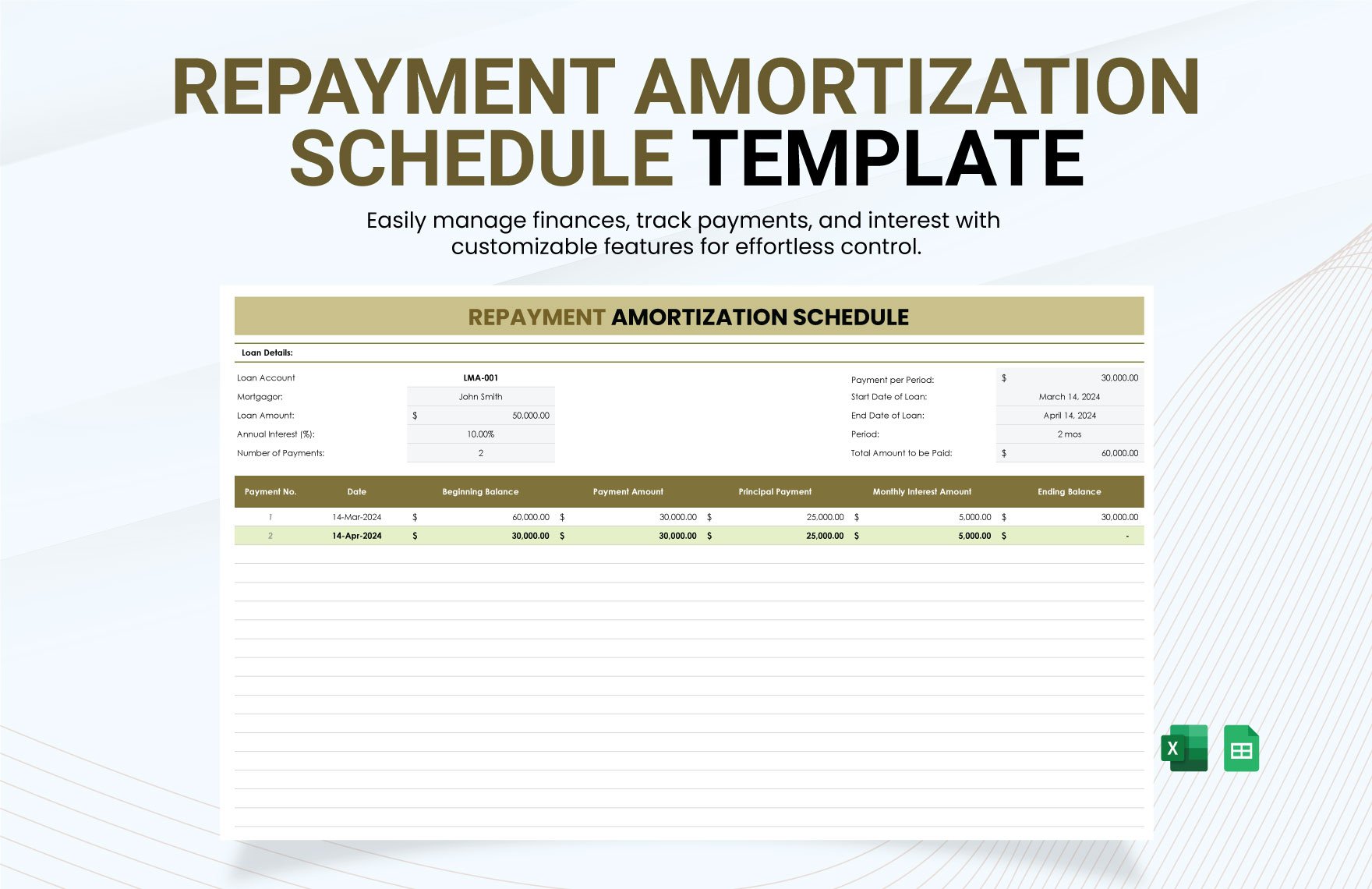

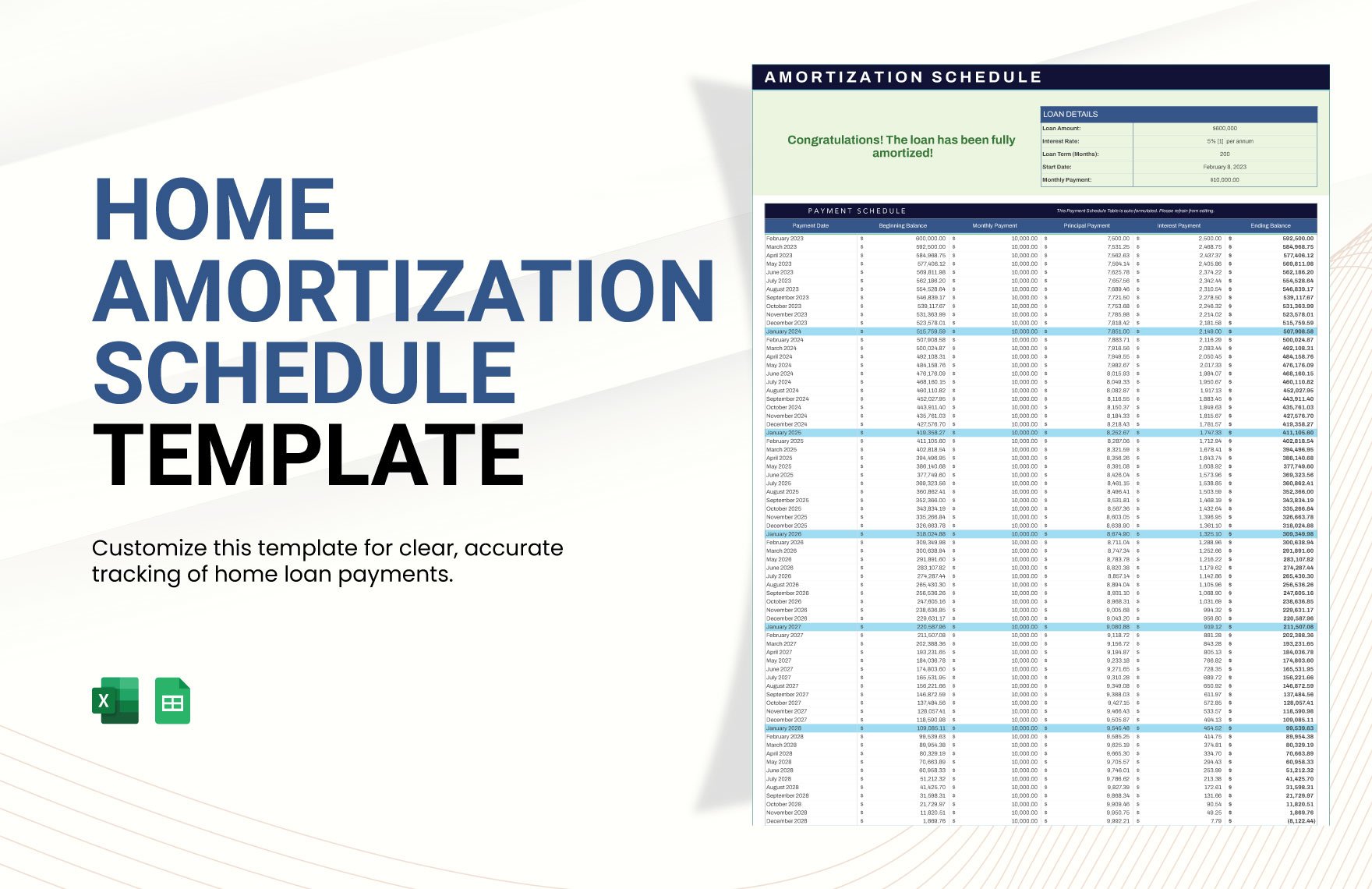

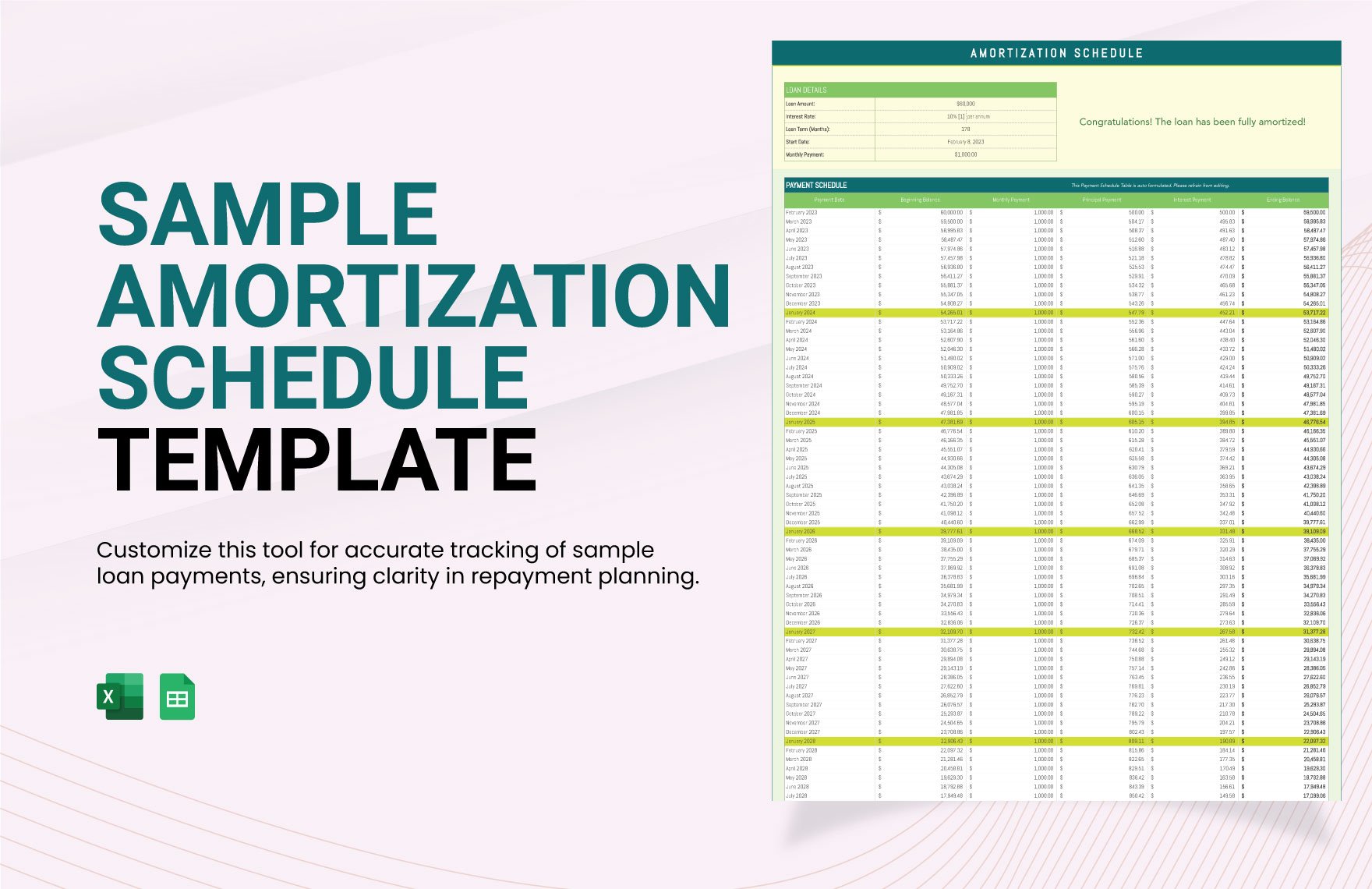

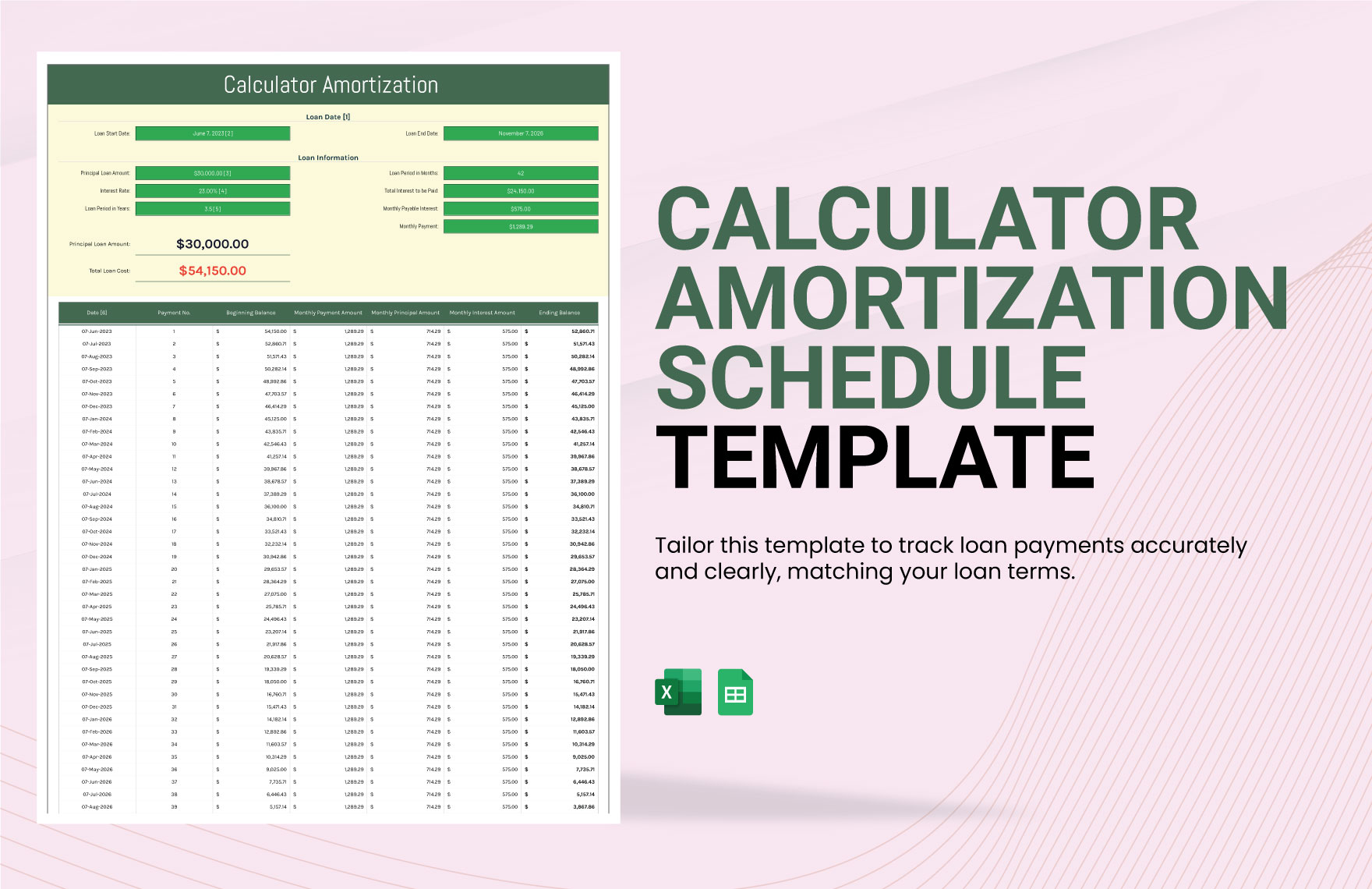

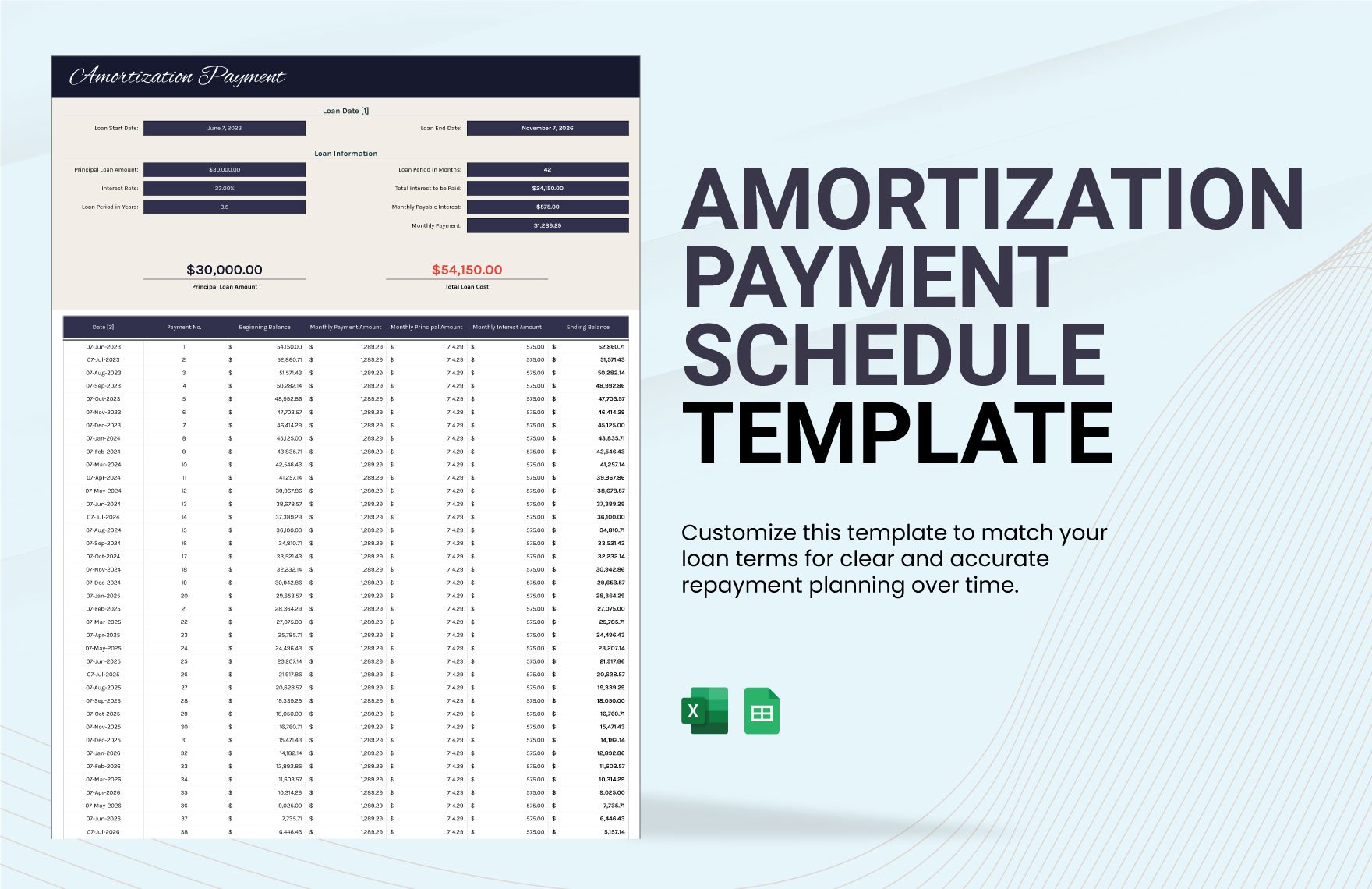

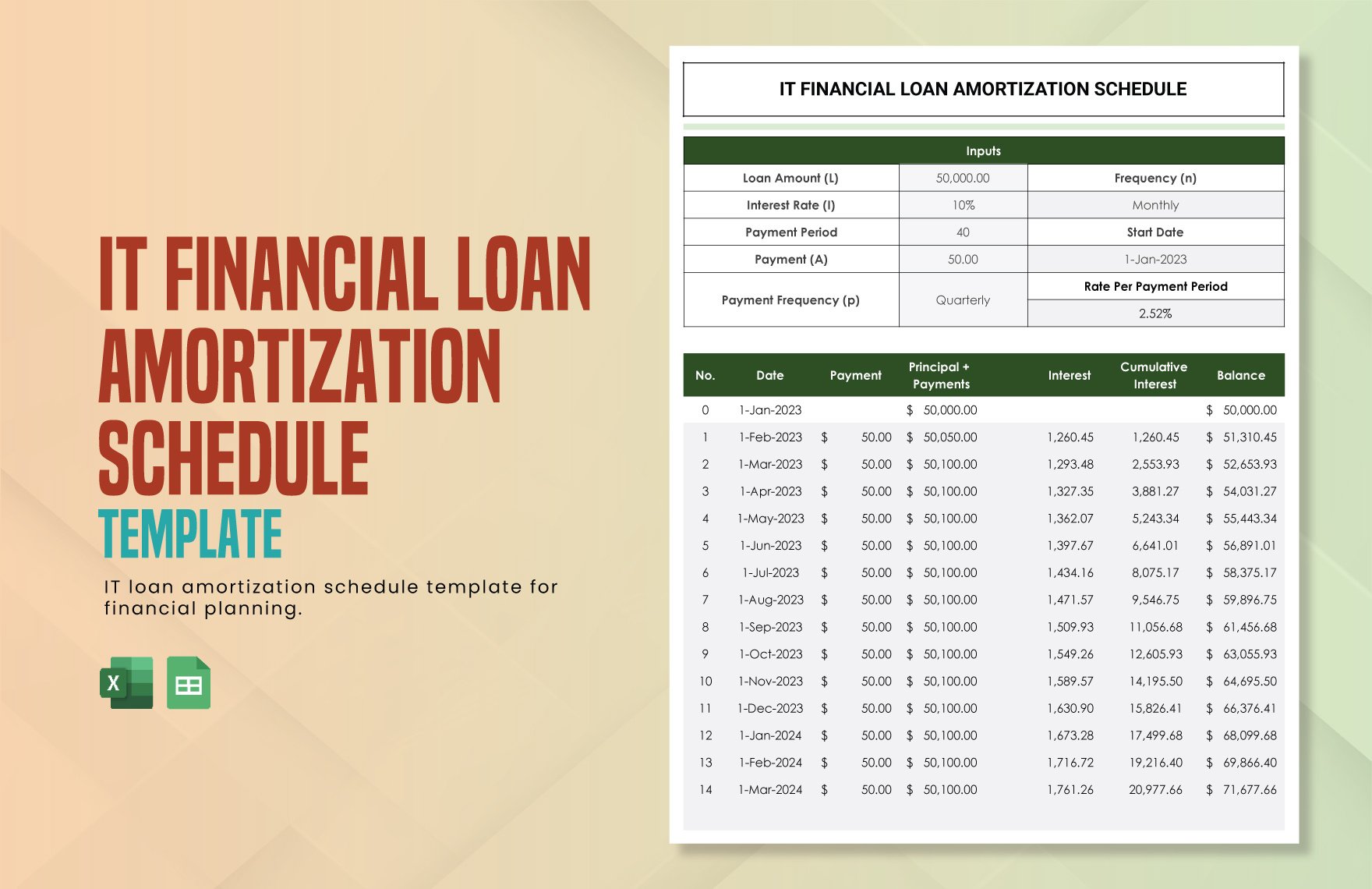

Before everything else, input basic information of your borrowers in your sample schedule. Write their name and other necessary contact details. Specify the amount they wish to loan, include the yearly loan interest rate and the period on how long they need to pay their debt. You may also input the required amount to be paid per month.

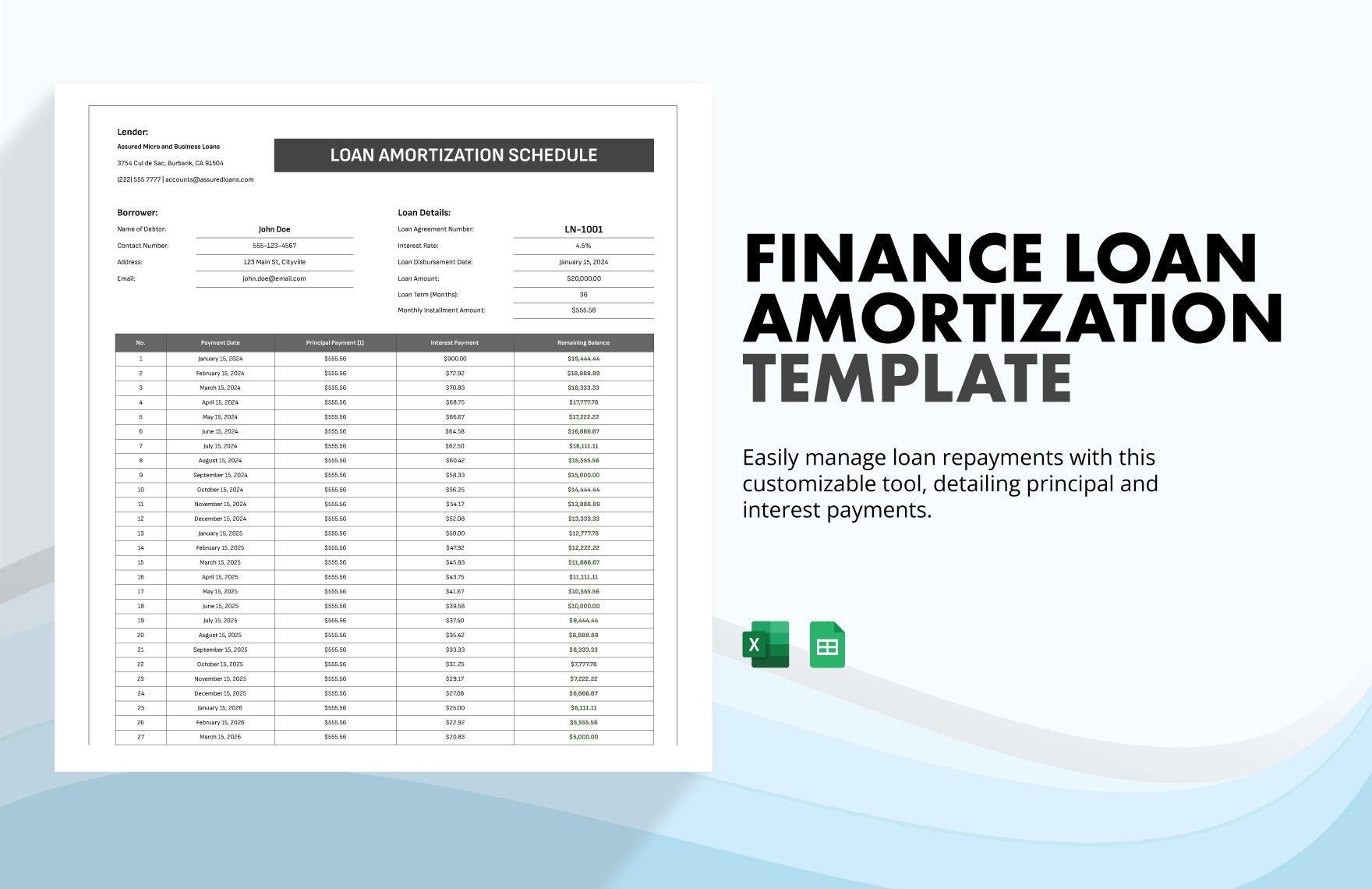

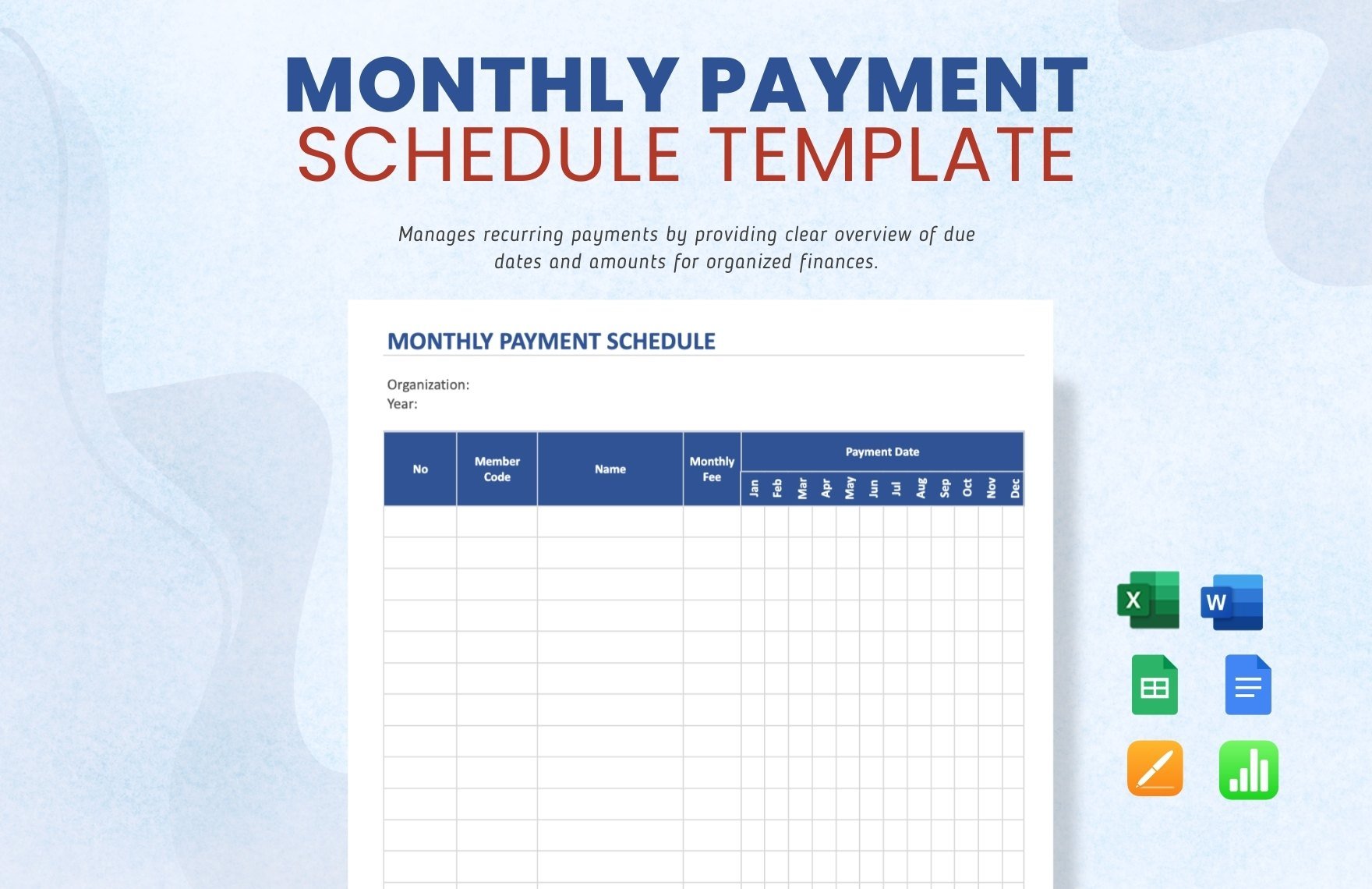

2. Create a Table

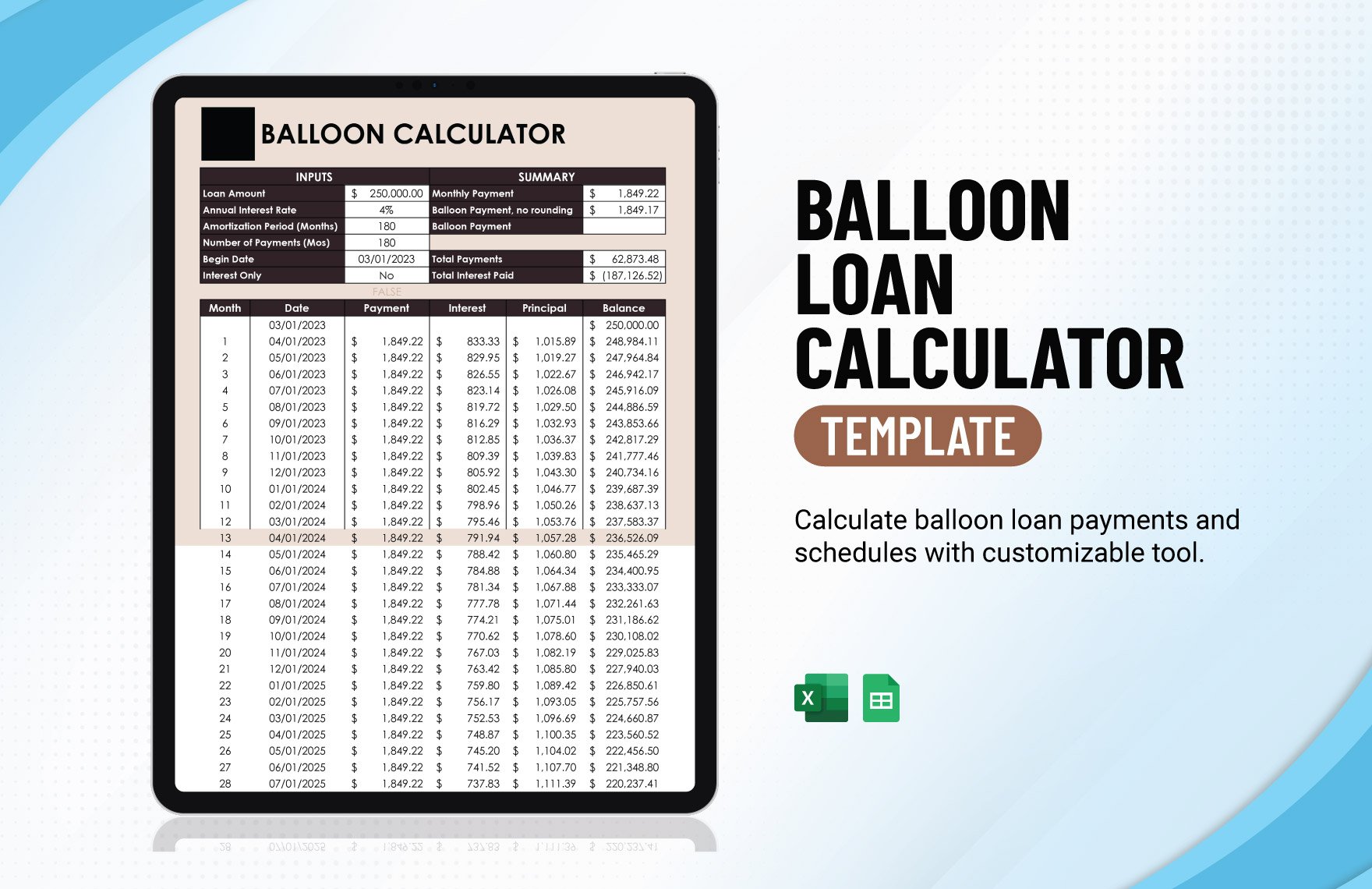

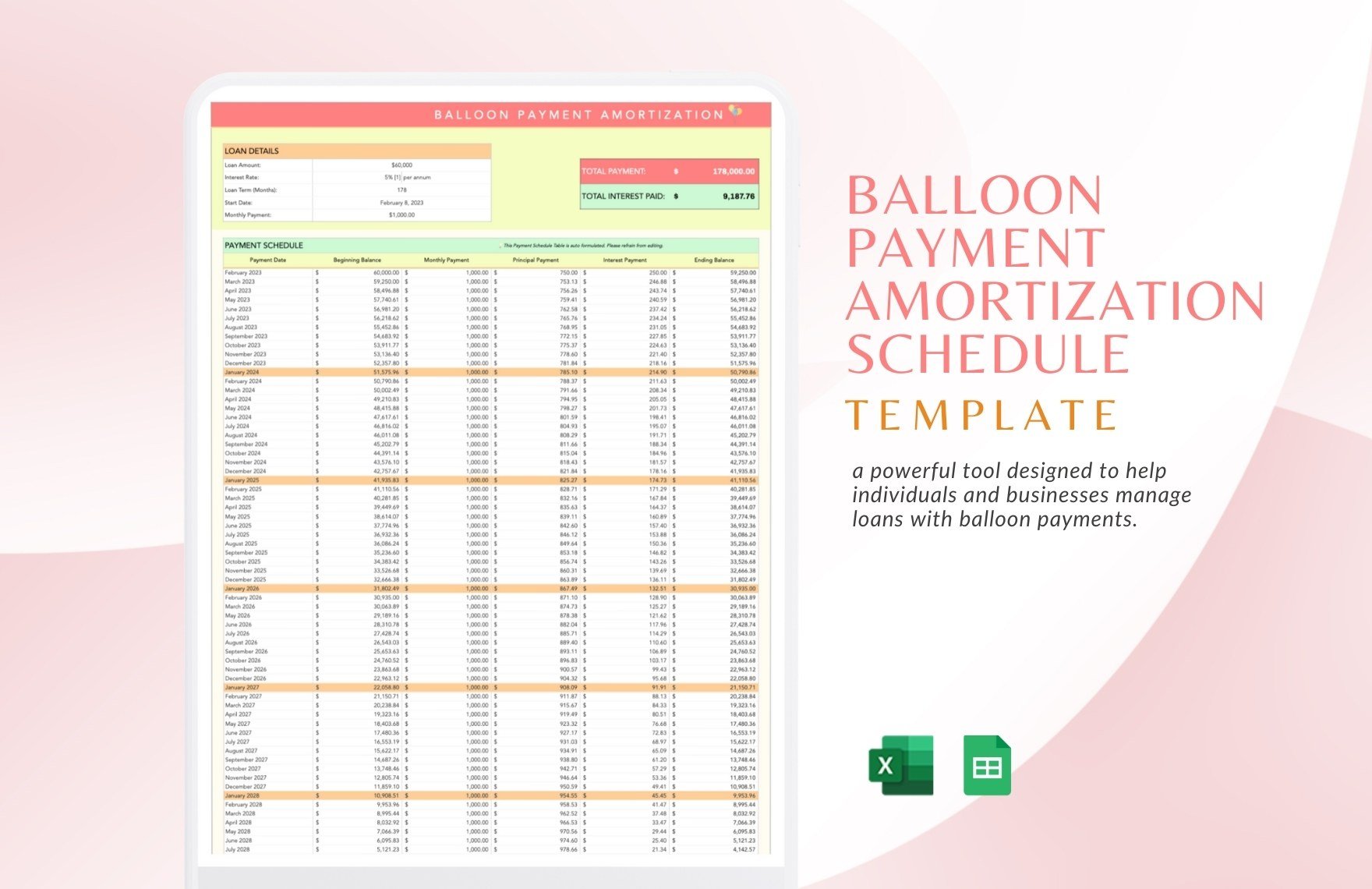

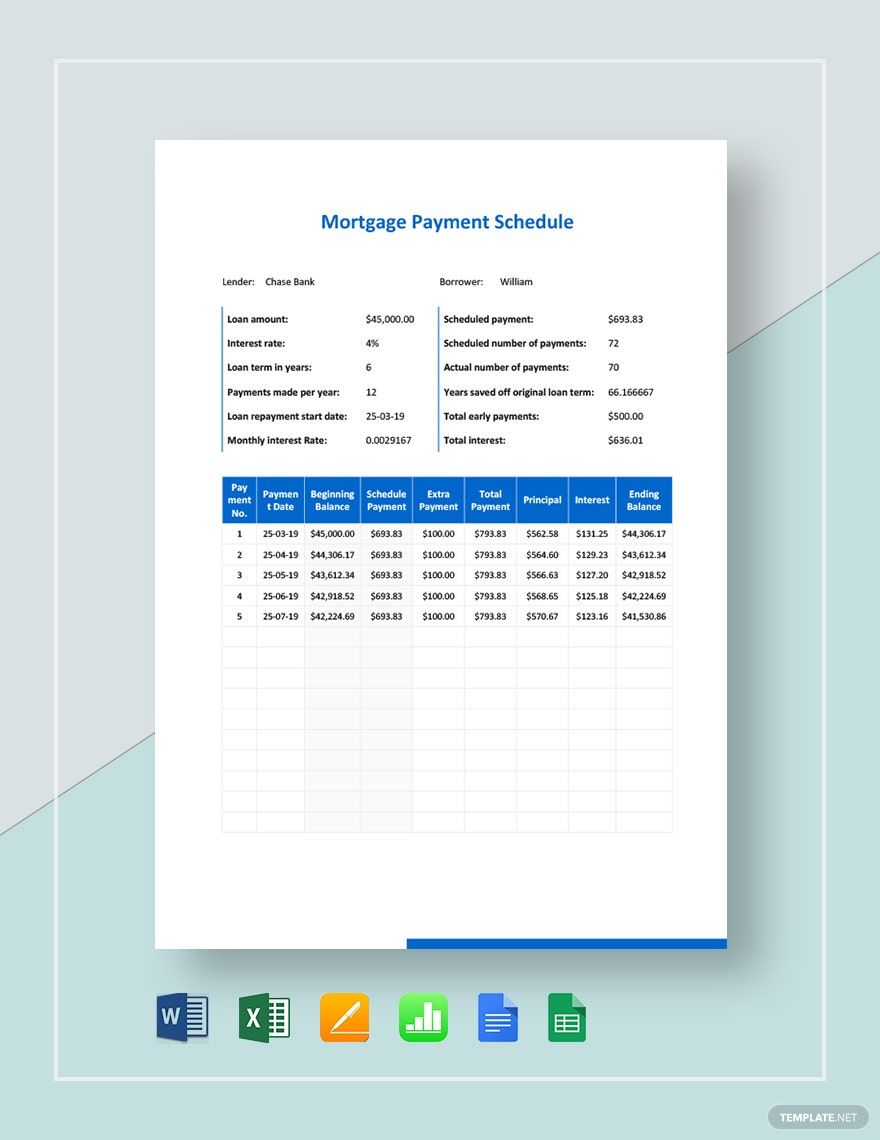

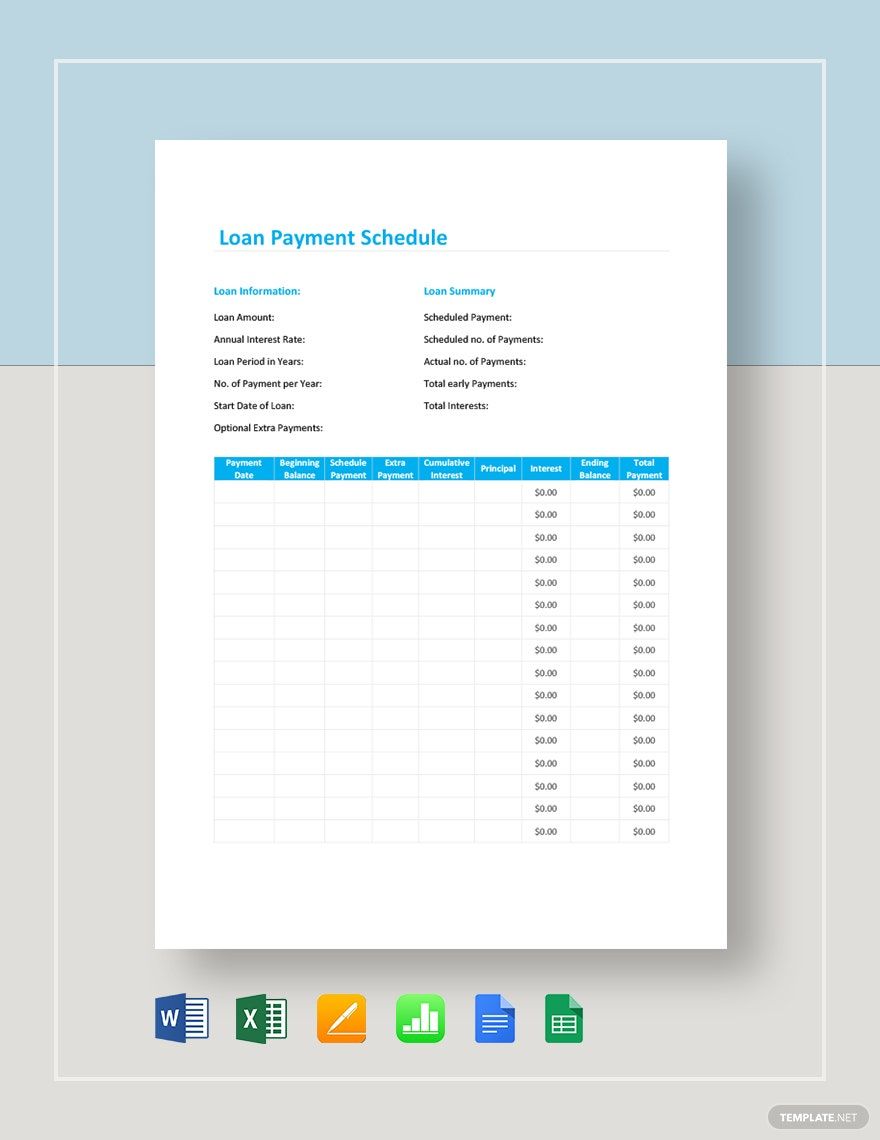

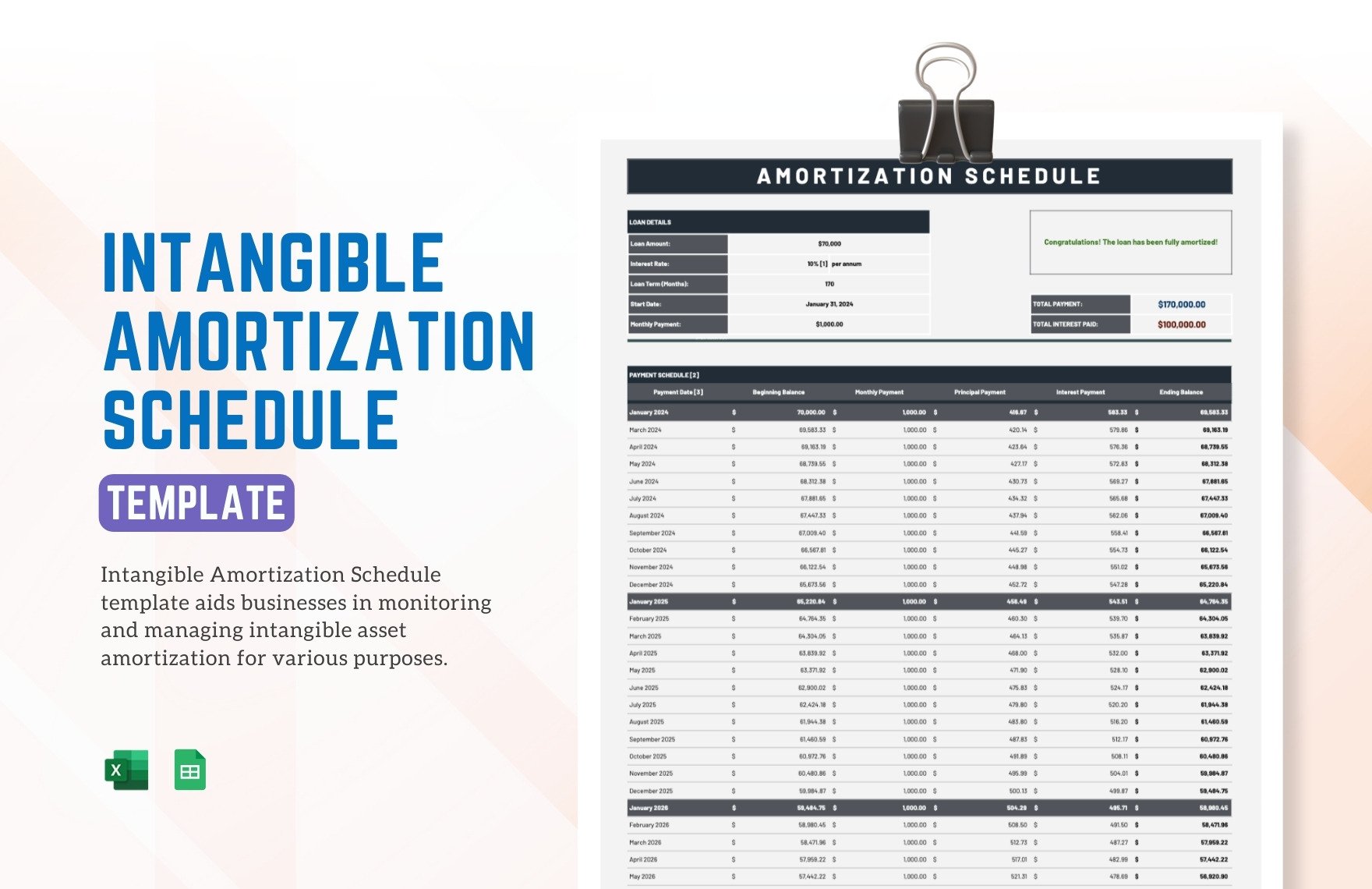

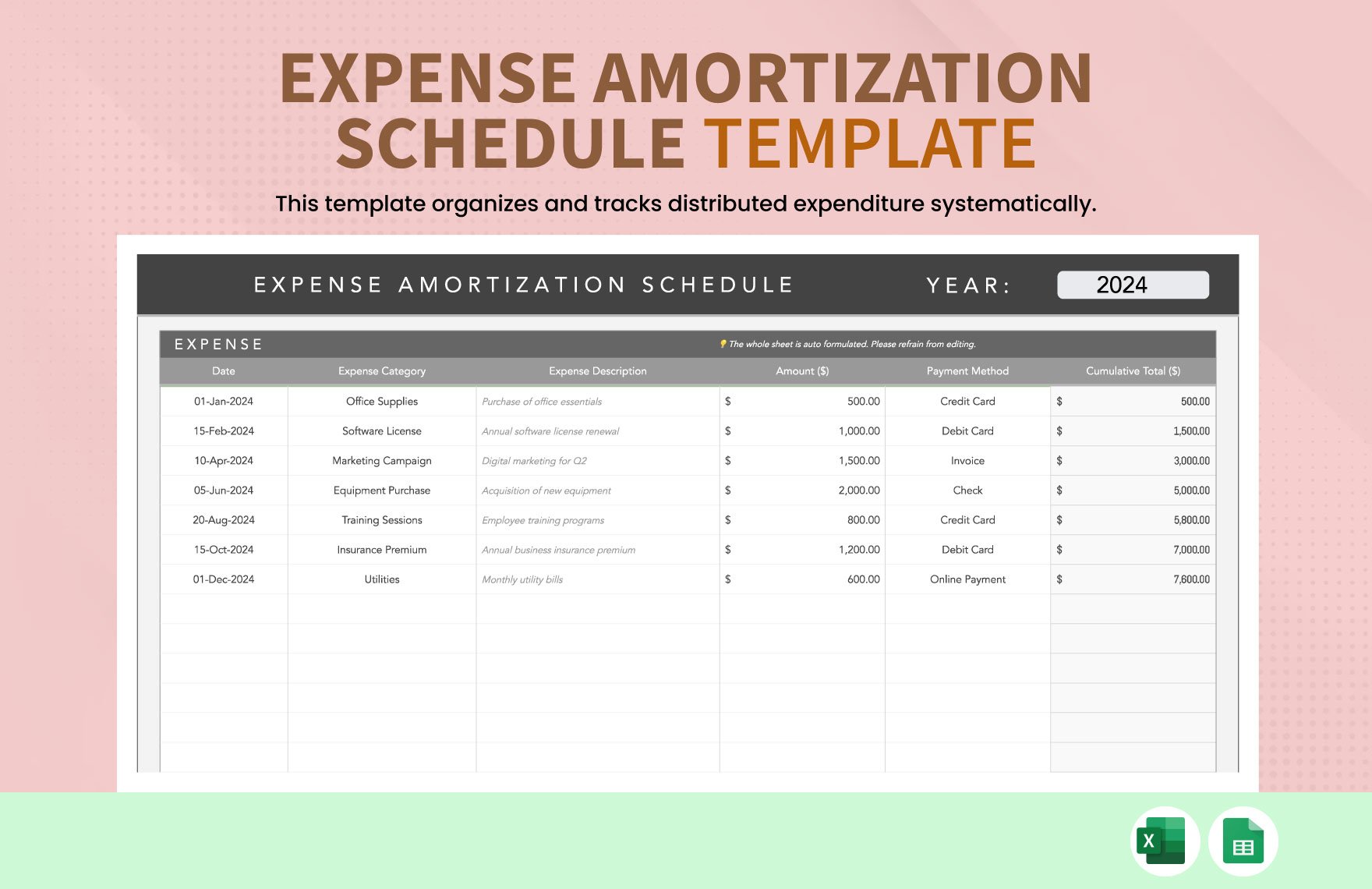

Create a table for your payment schedule and reflect their scheduled payments, interest expenses, principal repayment, and the cumulative interest. To do this, place a column for the month of their payment, loan balance, principal amount, and interest rate. Include their payment as well as the total interest every time they fail to pay for the specified month.

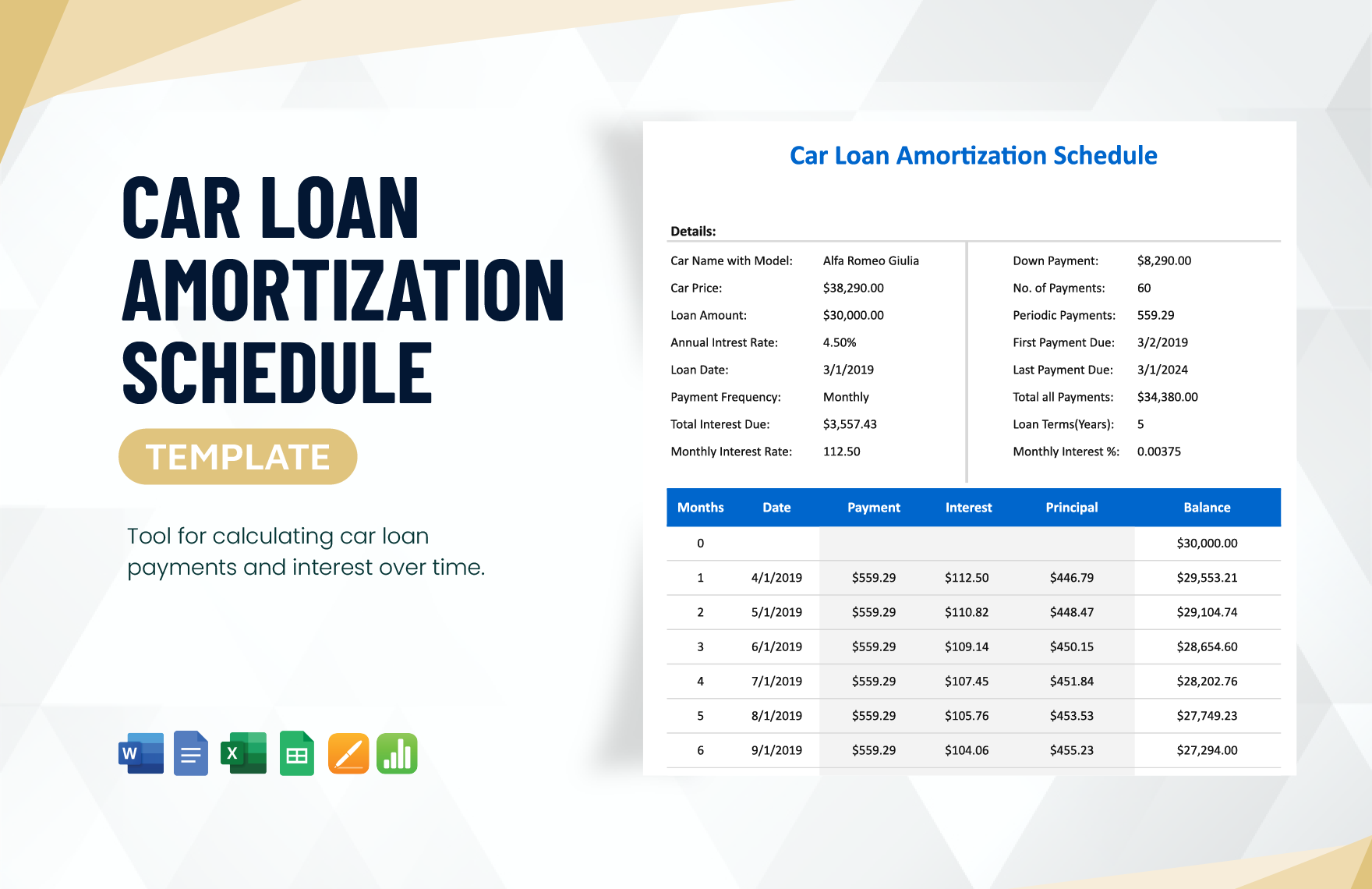

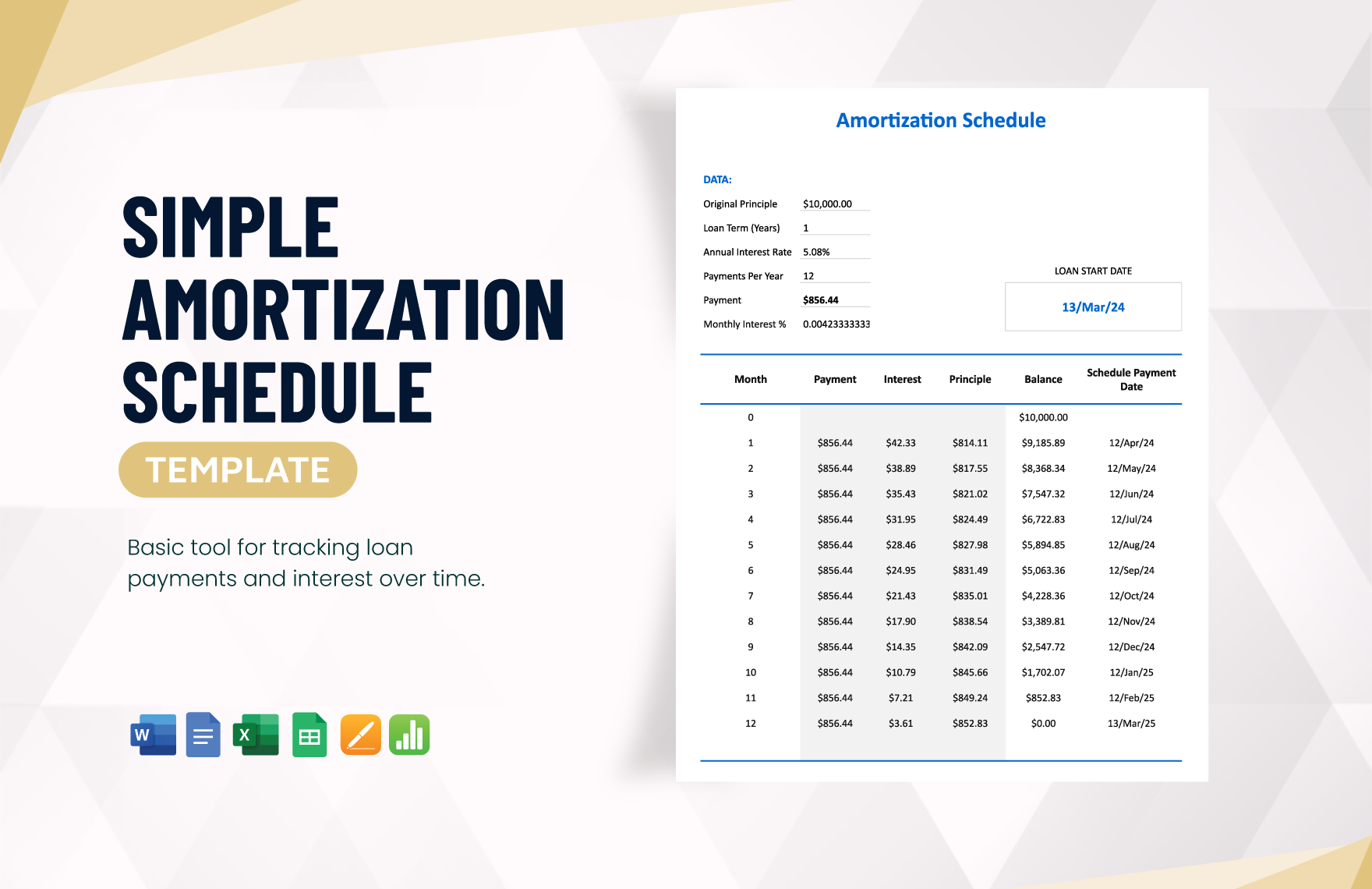

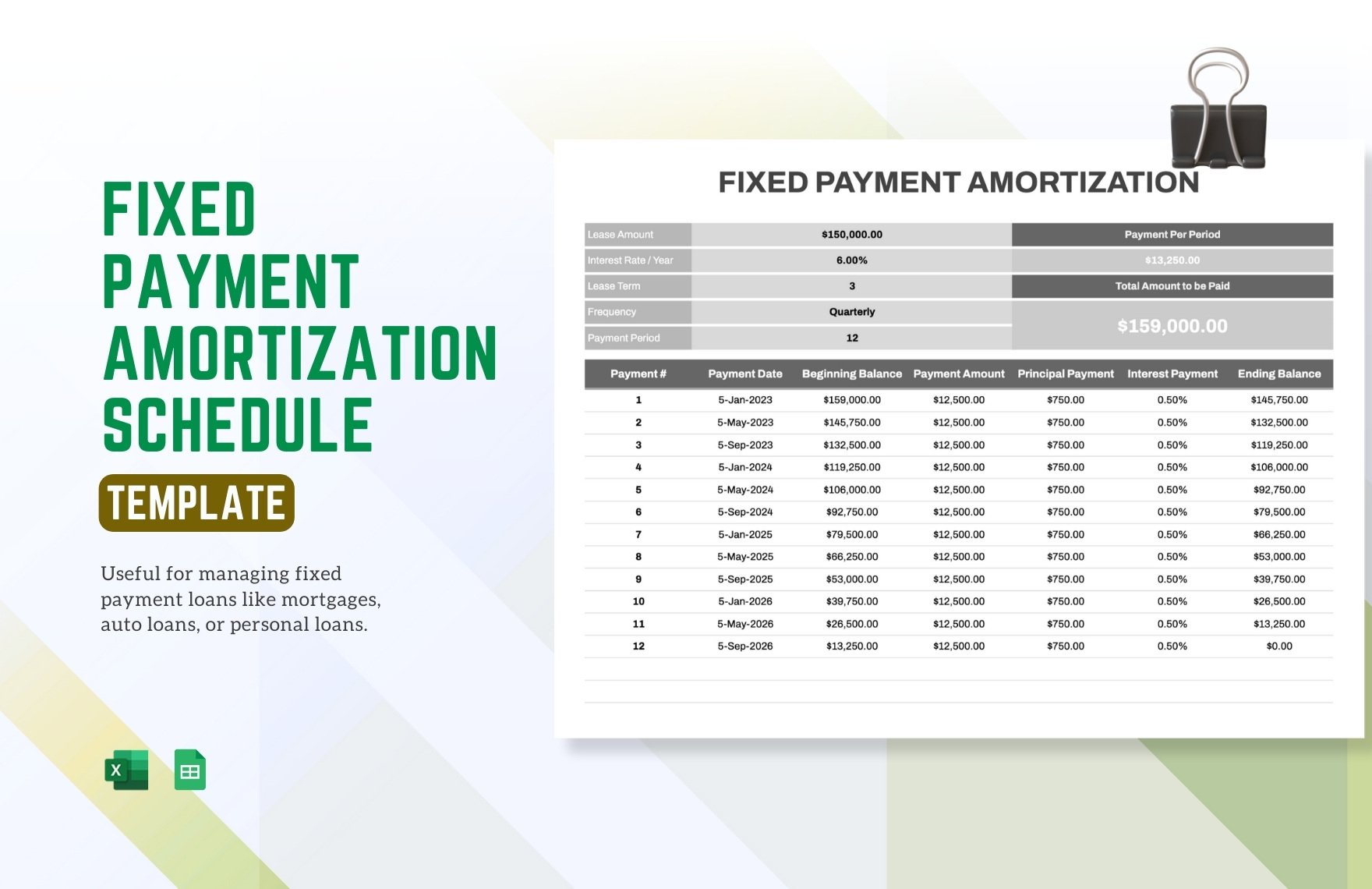

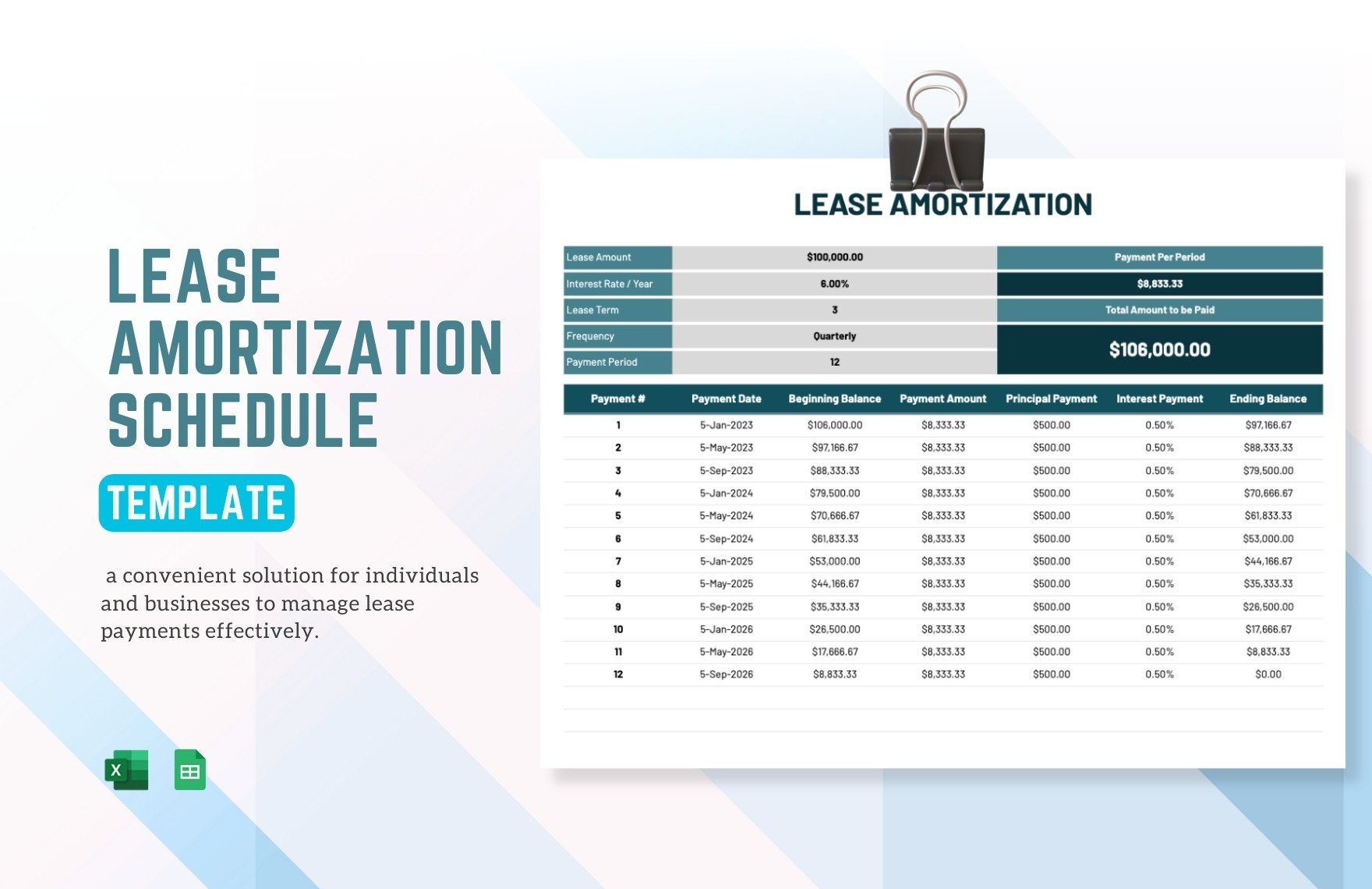

3. Add Balance

At the beginning of the loan, the interest cost is at its highest amount and so does the balance amount. Your borrower will be paying constantly on the principal amount along with the interest rates until their loan reaches to zero. Their loan balance is commonly set at the left side of the table, written in a decreasing amount.

4. Specify Principal and Interest

Like the balance amount, your interest rate starts high and will gradually decrease as payments are given monthly. Every month, your borrower pays in different amount but their total payment remains equal each period. This commonly happens with a monthly loan payment, but amortization is an accounting term that may be applied to other types of balances as well.

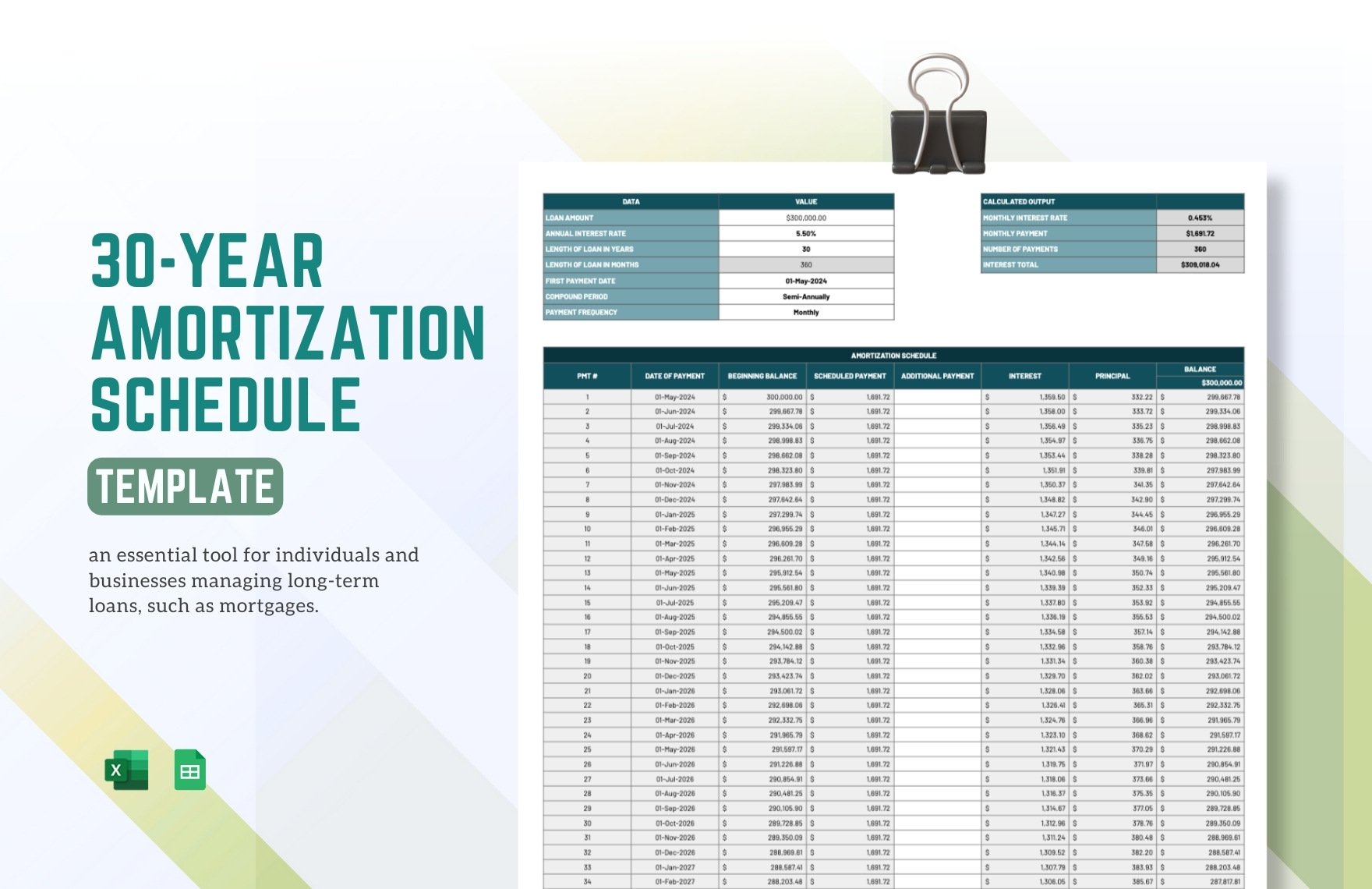

5. Include Payment

Specify the loan payments of your borrowers in your table. You may require them to have a monthly payment or a yearly payment, it's up to you. if they have extra payments and additional fees besides the interest, you may include them as well. Soon they can finally pay a 30-year mortgage from you.

6. Total Everything

Now that everything is set, you may begin to total the entire amount. There is a specific formula to calculate the entire thing, you may use a mortgage calculator to help you with it. When you calculate, their total monthly loan payments don't really change but may differ on the ratio of payments until the total debt is eliminated.