Bring your Professional Agreements to life with Loan Agreement Templates from Template.net

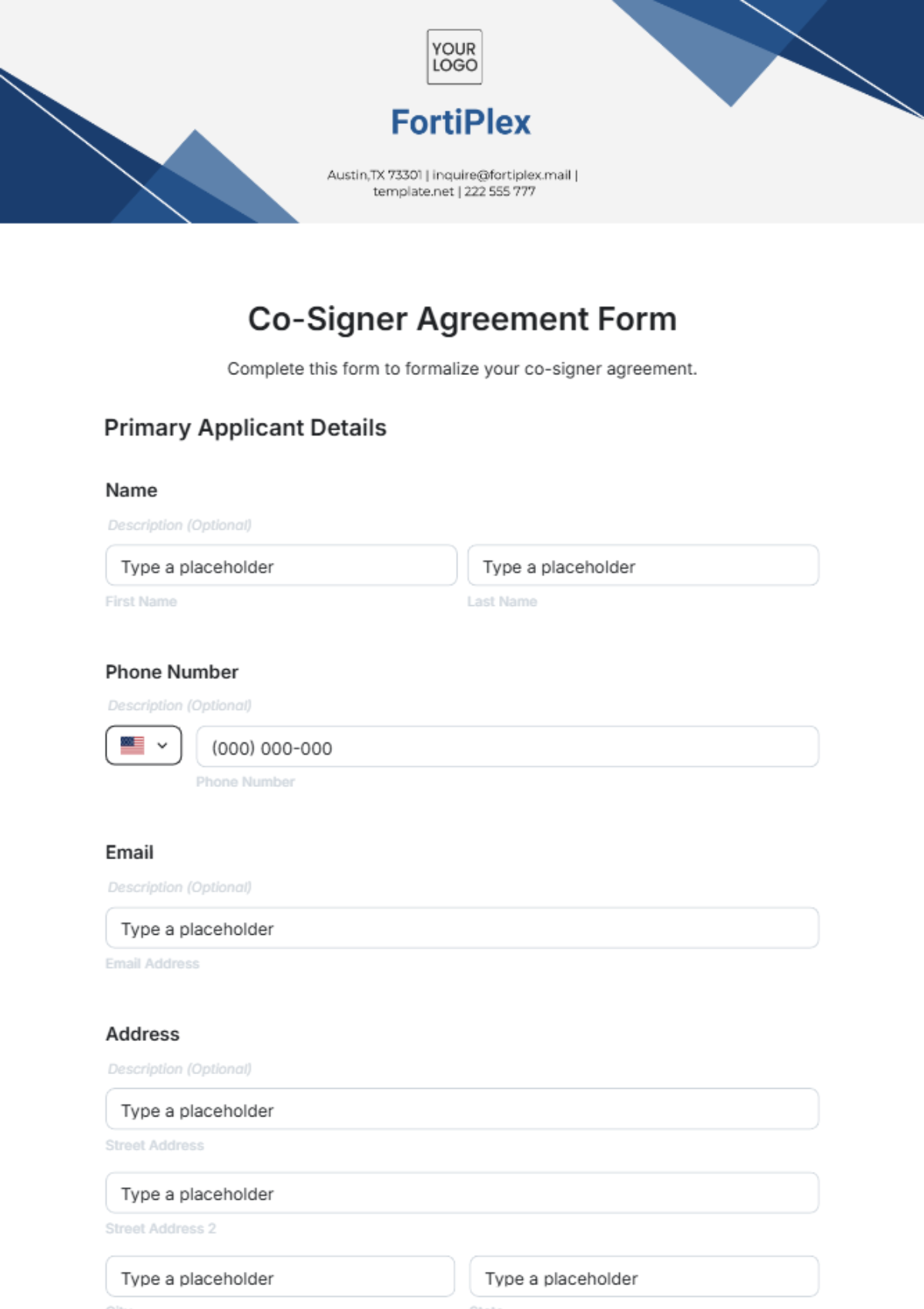

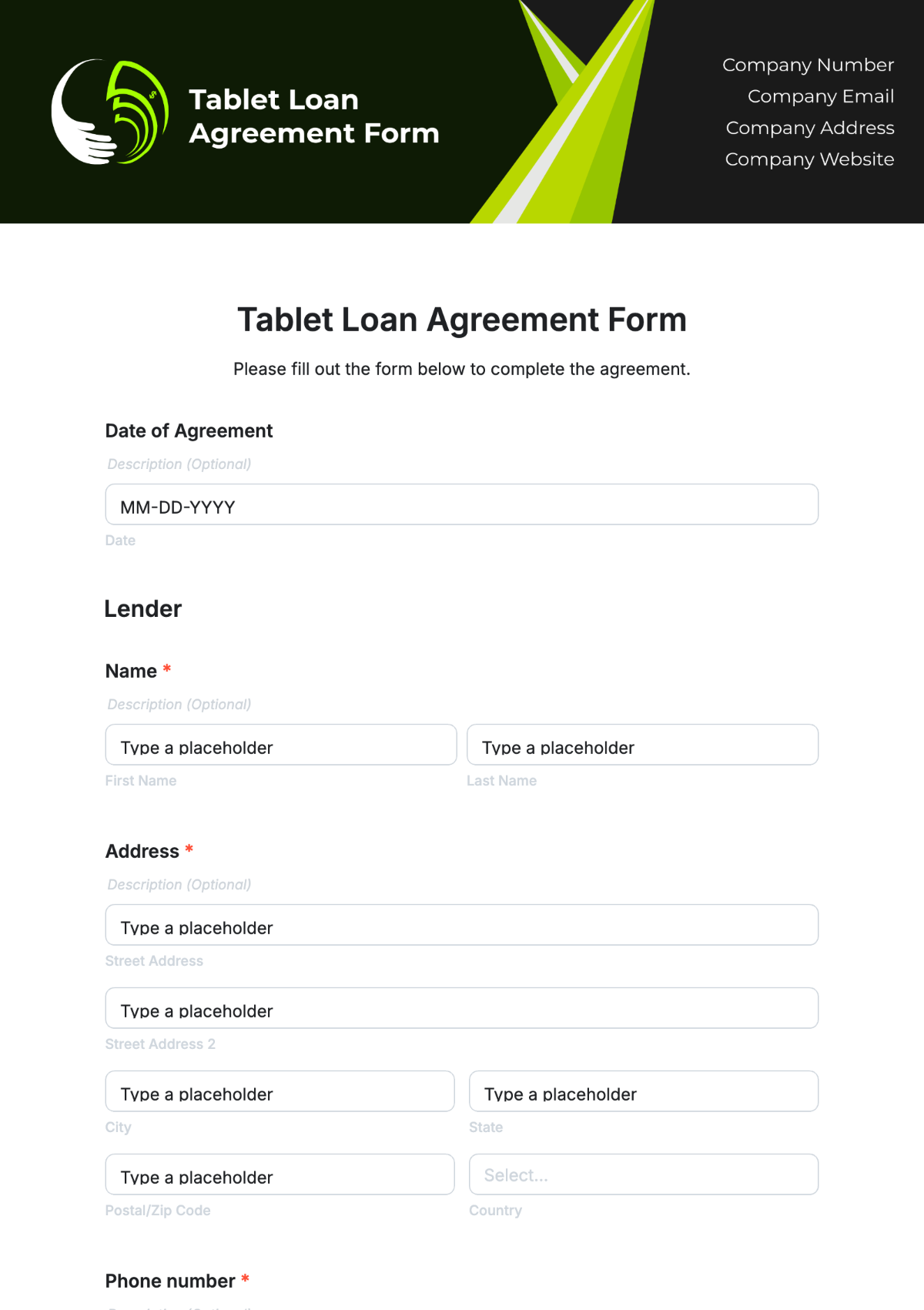

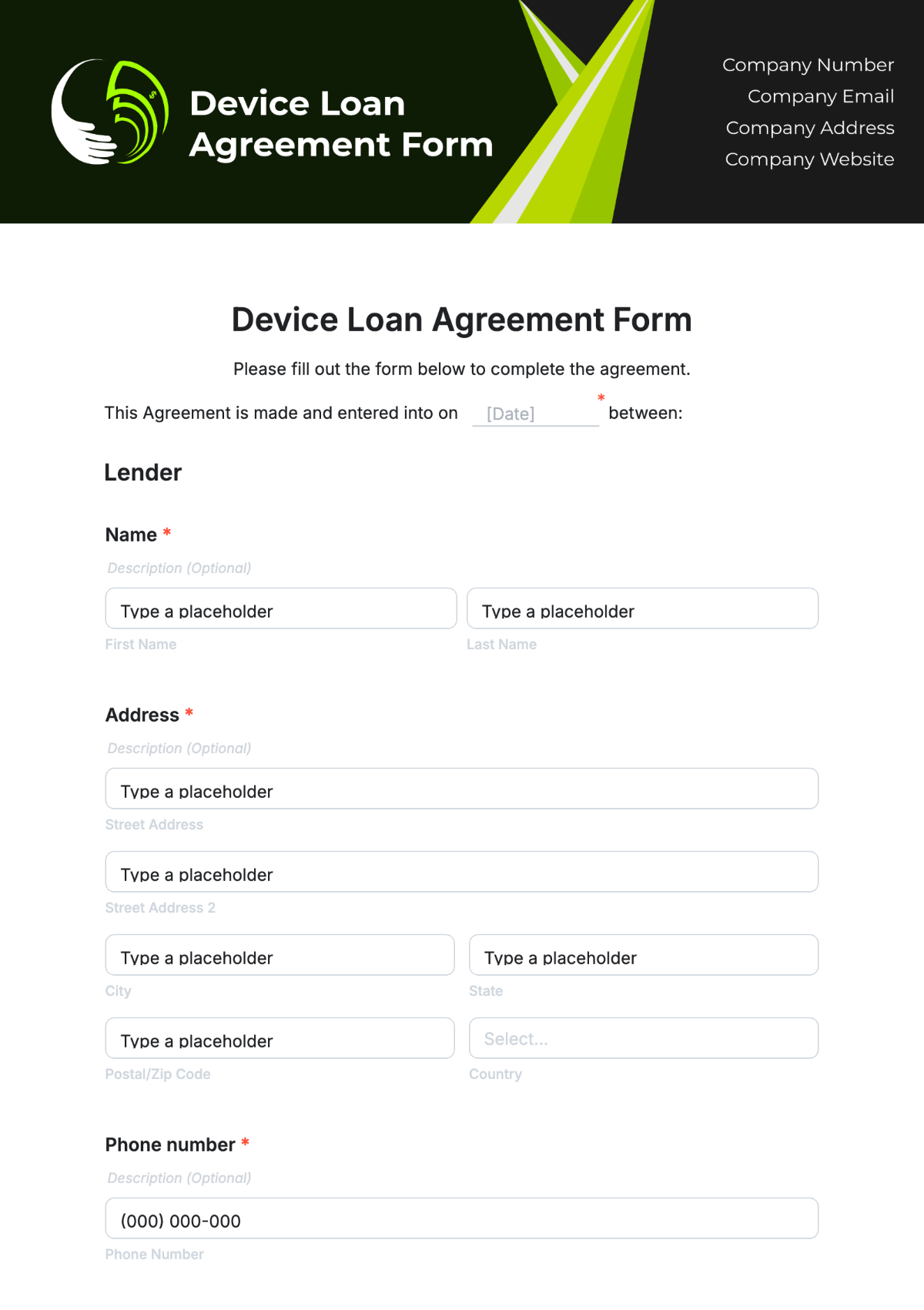

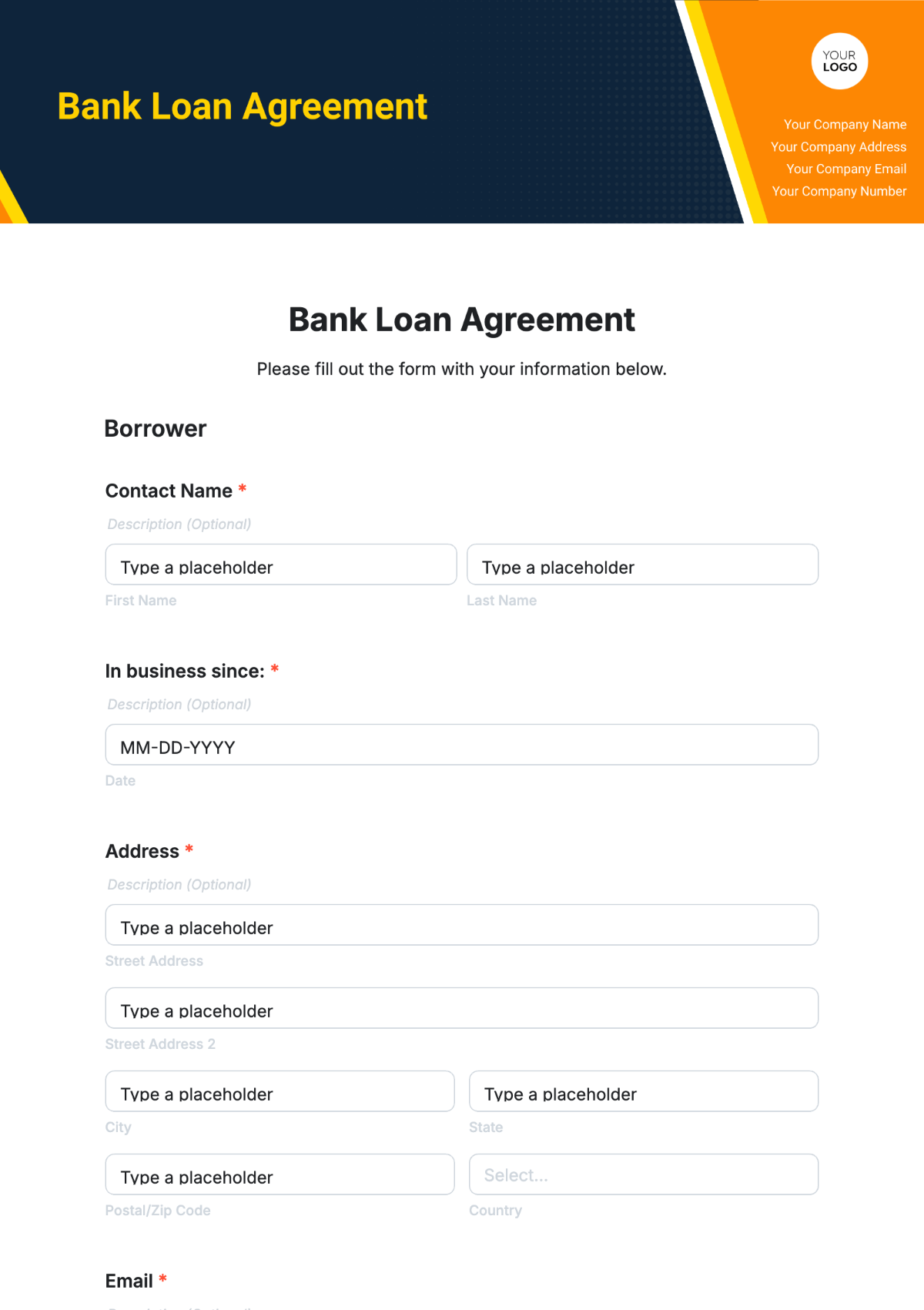

Keep your business secure and professional with meticulously crafted Loan Agreement Templates from Template.net. Designed for entrepreneurs, legal professionals, and small business owners, these templates help maintain a robust and clear agreement in place, minimizing future disputes and misunderstandings. Whether you need to formalize a personal loan or set up a business funding agreement, our templates offer tailored solutions to fit various scenarios. Include significant details such as interest rates, repayment schedules, and borrower information effortlessly with our customizable templates. No legal expertise required; step into creating professional-grade agreements easily and efficiently. Start now and Loan Agreement Maker to meet your exact needs, be it print or digital distribution.

Discover the many Loan Agreement Templates we have on hand, each designed to cater to your specific requirements. Simply select from a range of templates, swap in your preferred details, and customize colors and fonts to reflect your brand or personal style. Enhance your document with intuitive drag-and-drop features for icons and graphics, or use our AI-powered text tools to refine the content with ease. The process is simple and enjoyable, making the possibilities truly endless without requiring any specialized skills. Enjoy regularly updated templates, ensuring you always have fresh, professional designs to choose from. When you’re finished, download or share via print or email, or publish directly to your preferred digital platforms. It’s ideal for multiple channels, allowing seamless collaboration in real time.