Bring Your Business Communications to Life with Collection Letter Templates from Template.net

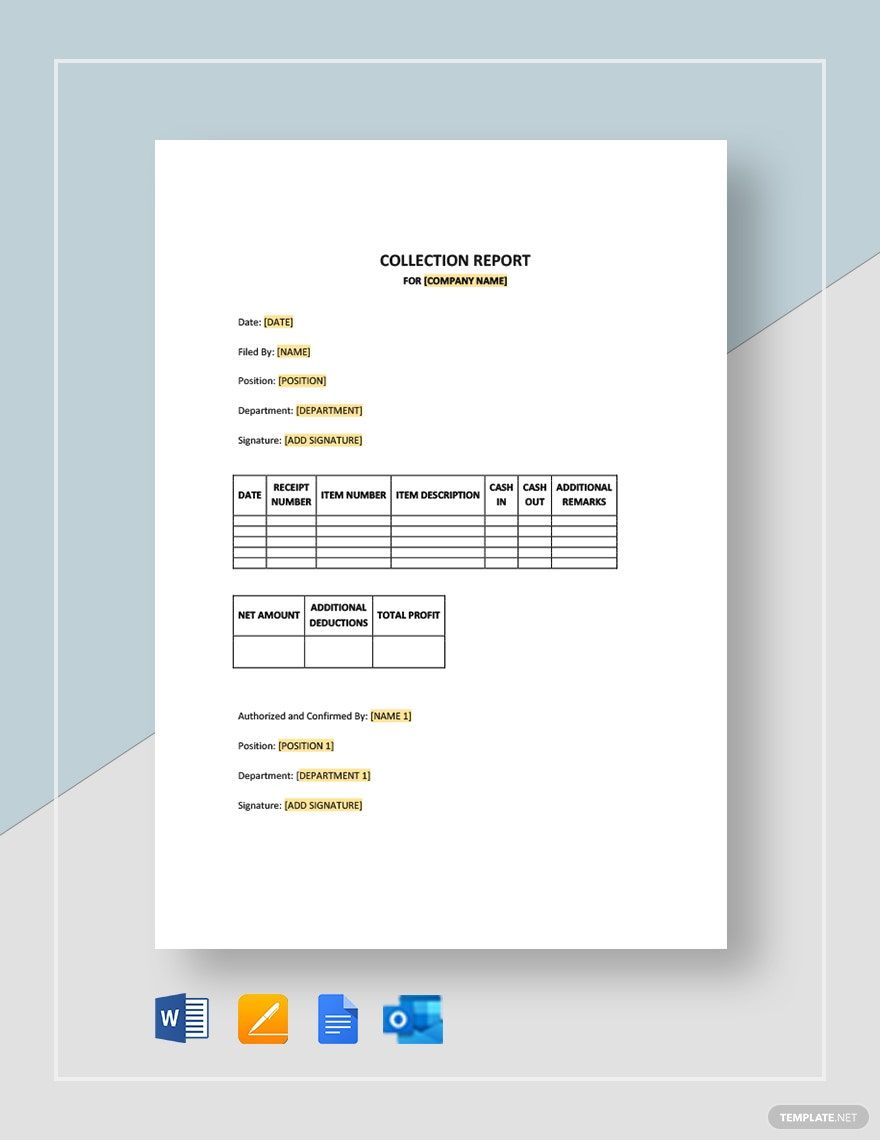

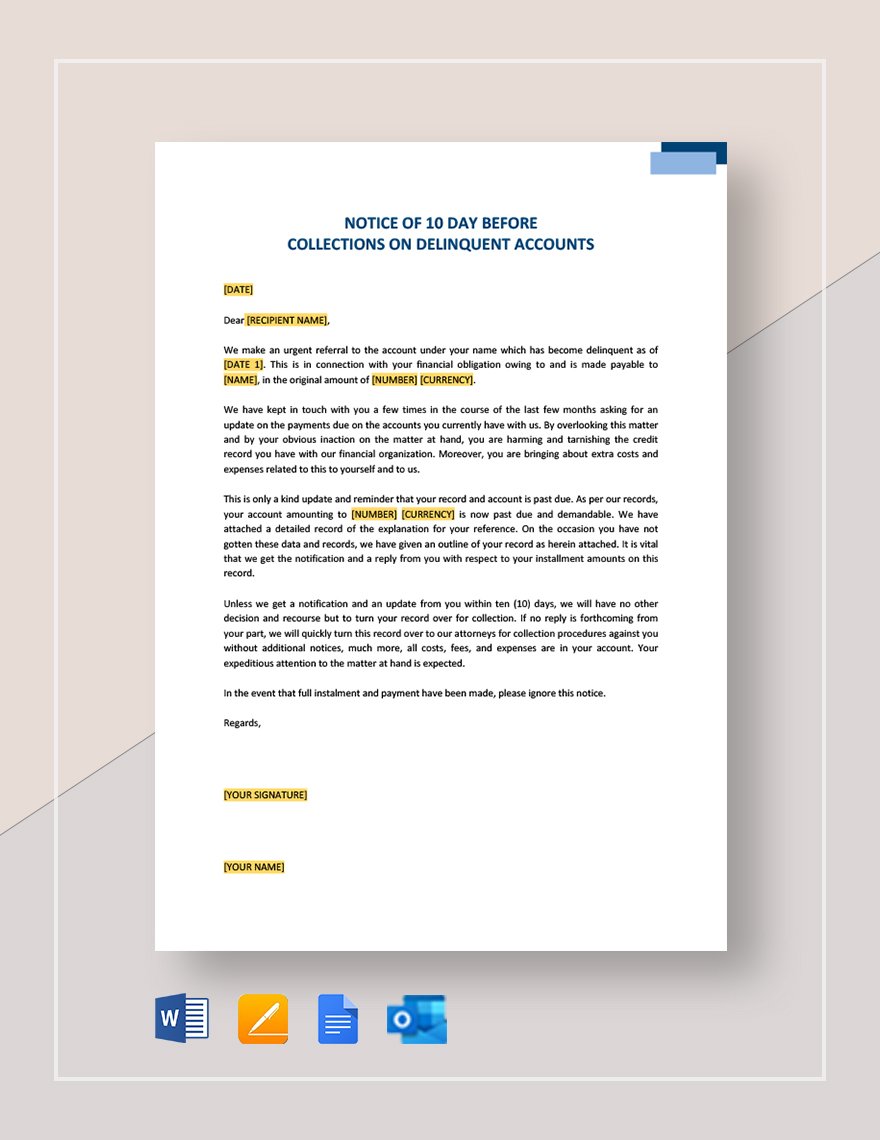

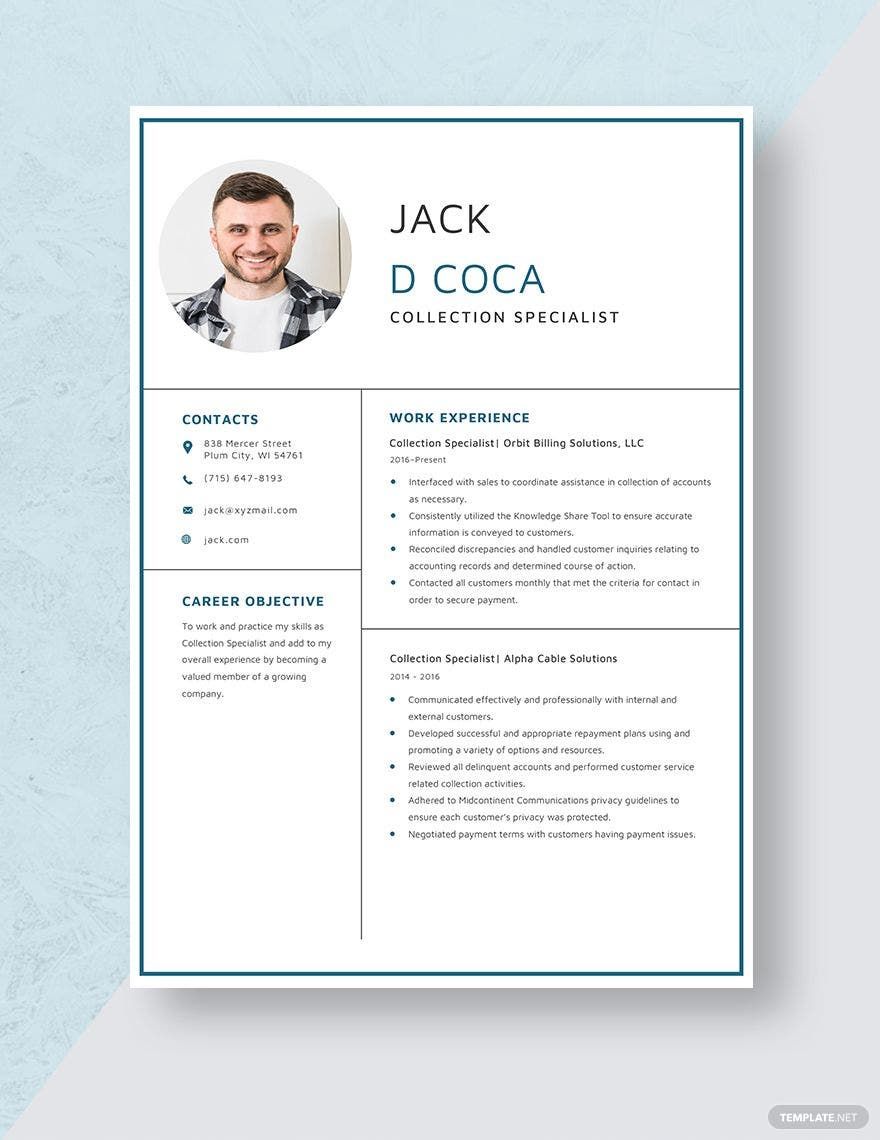

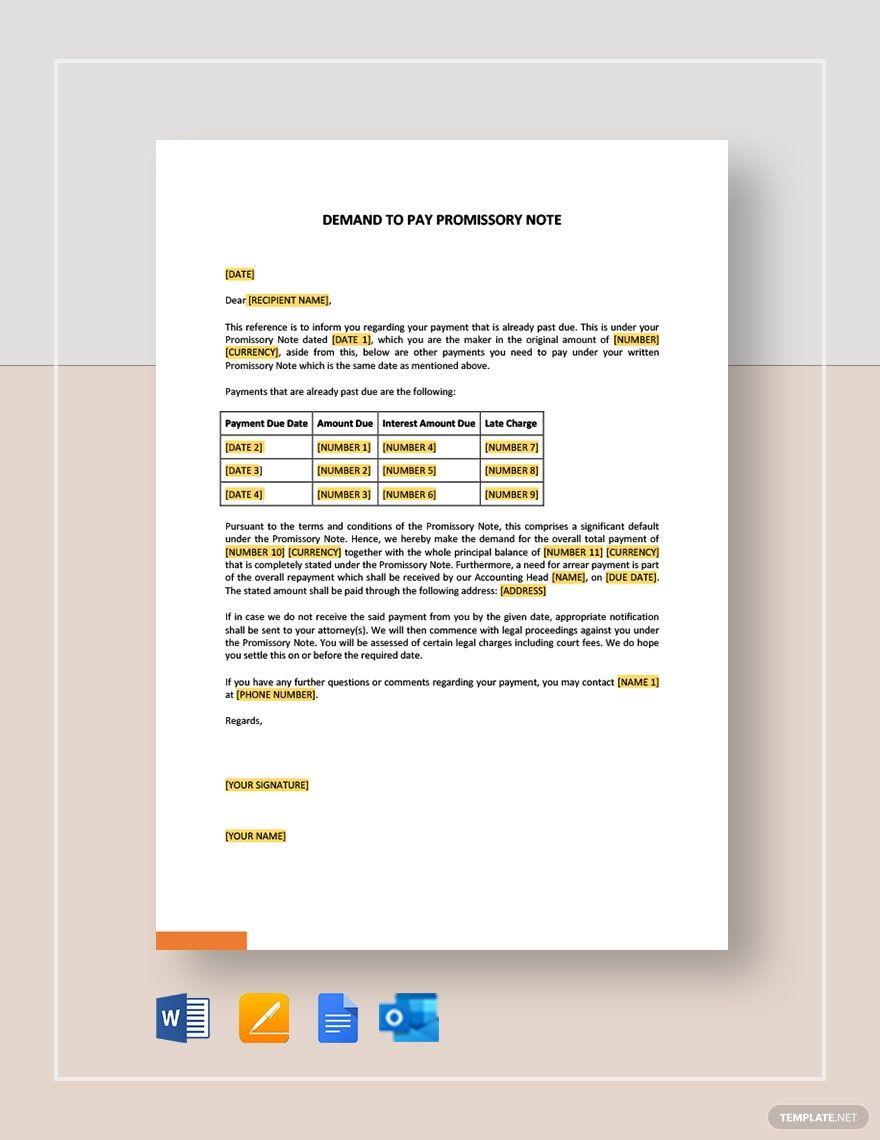

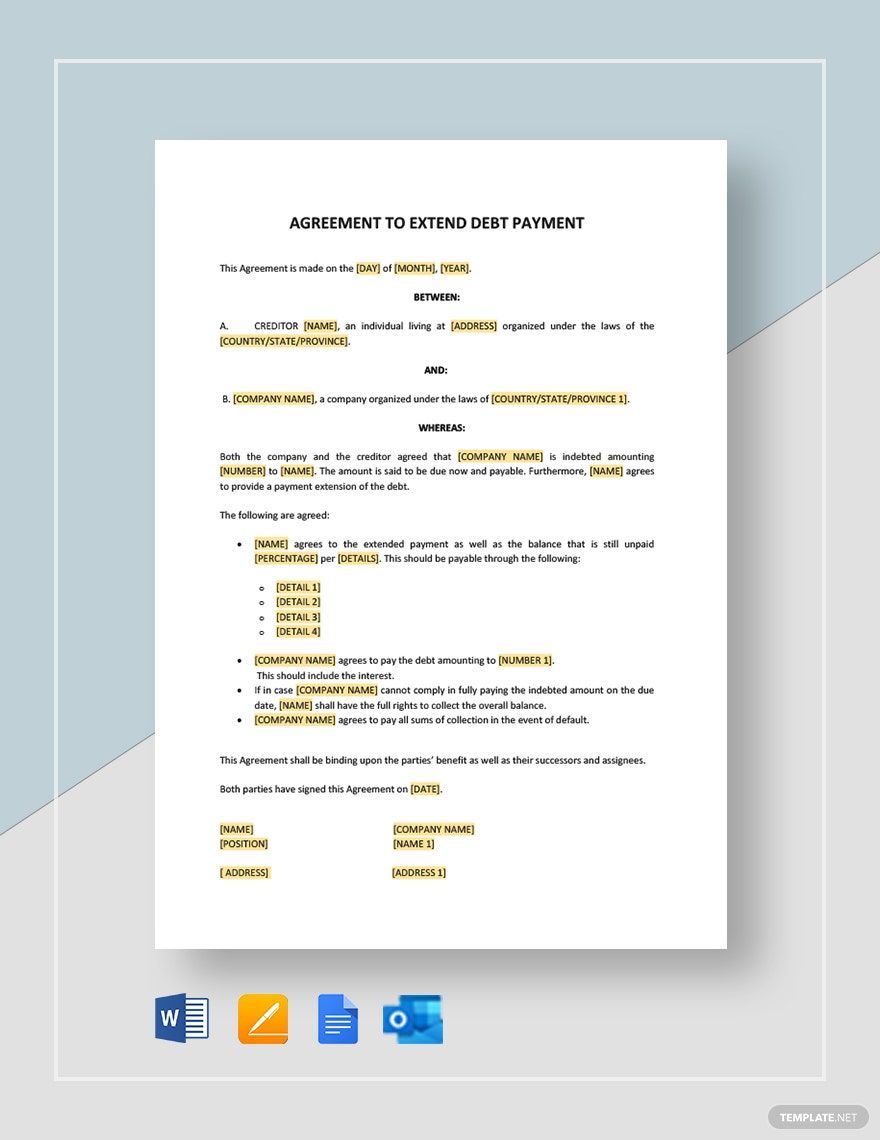

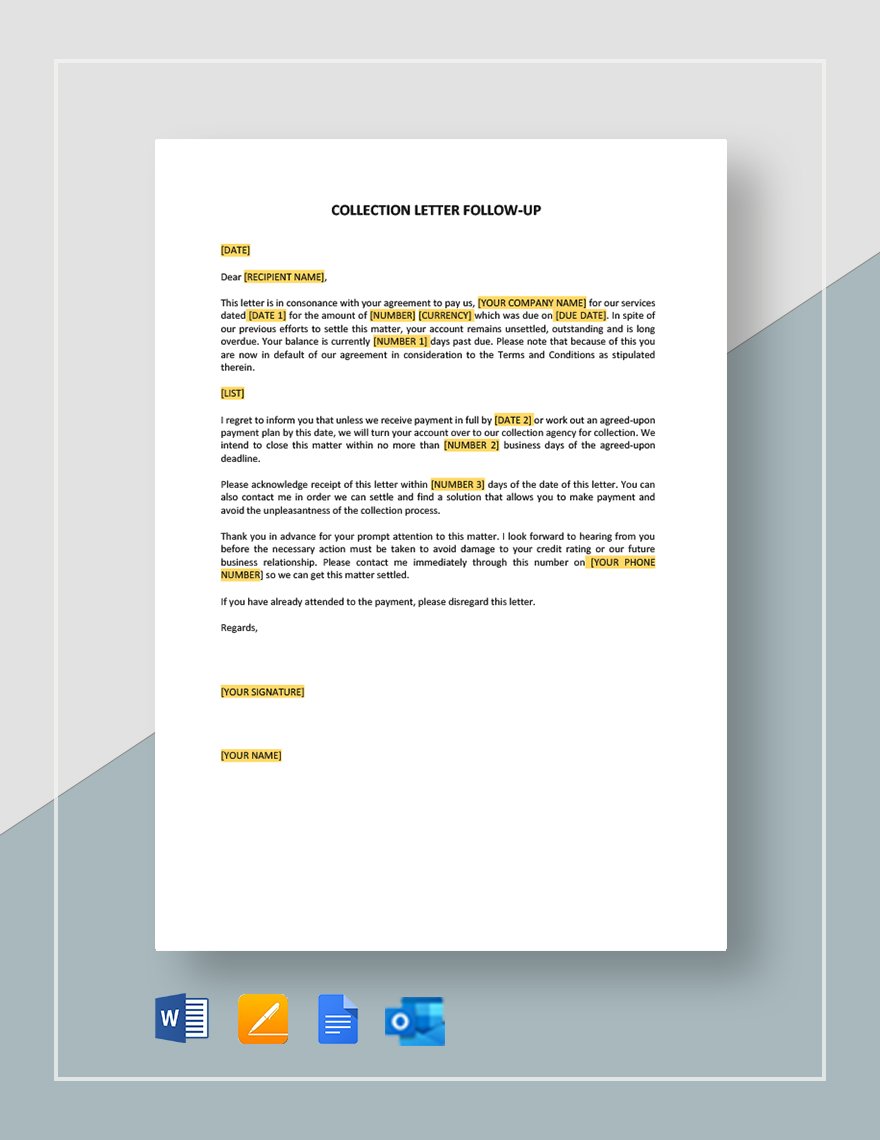

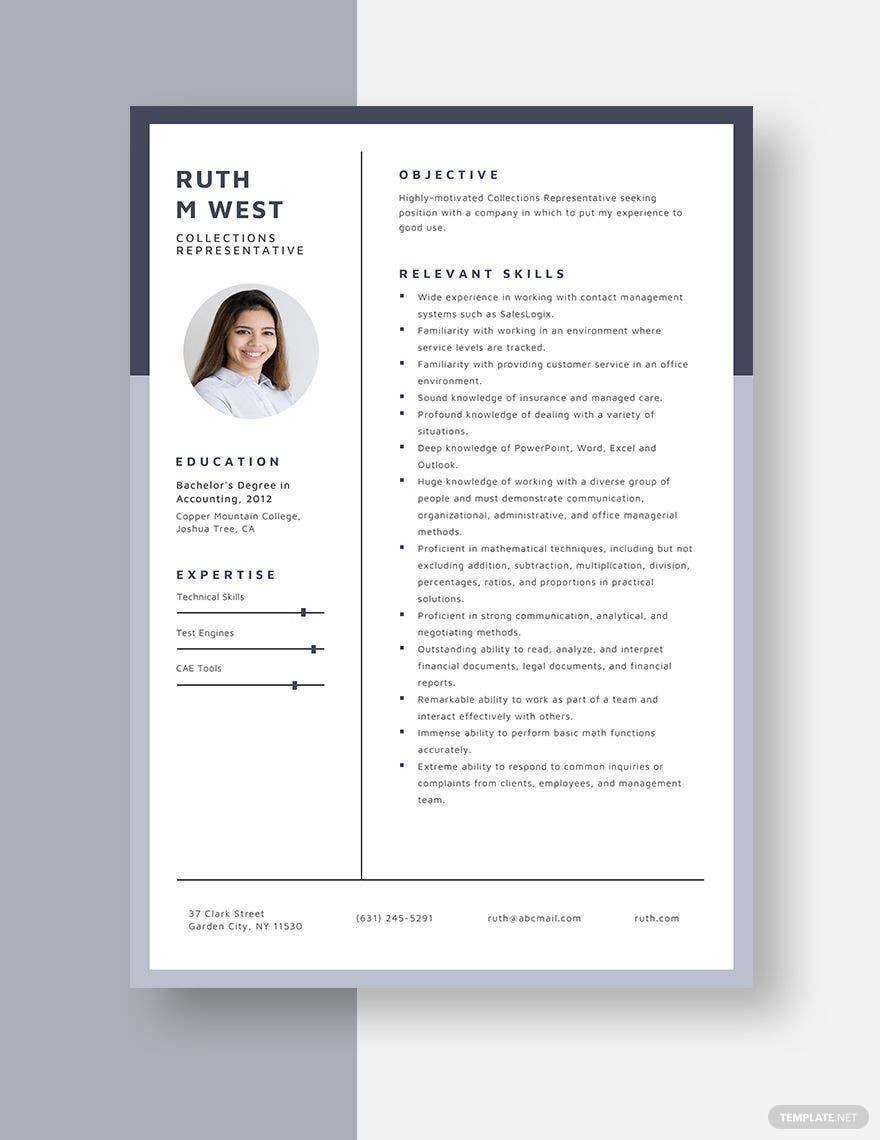

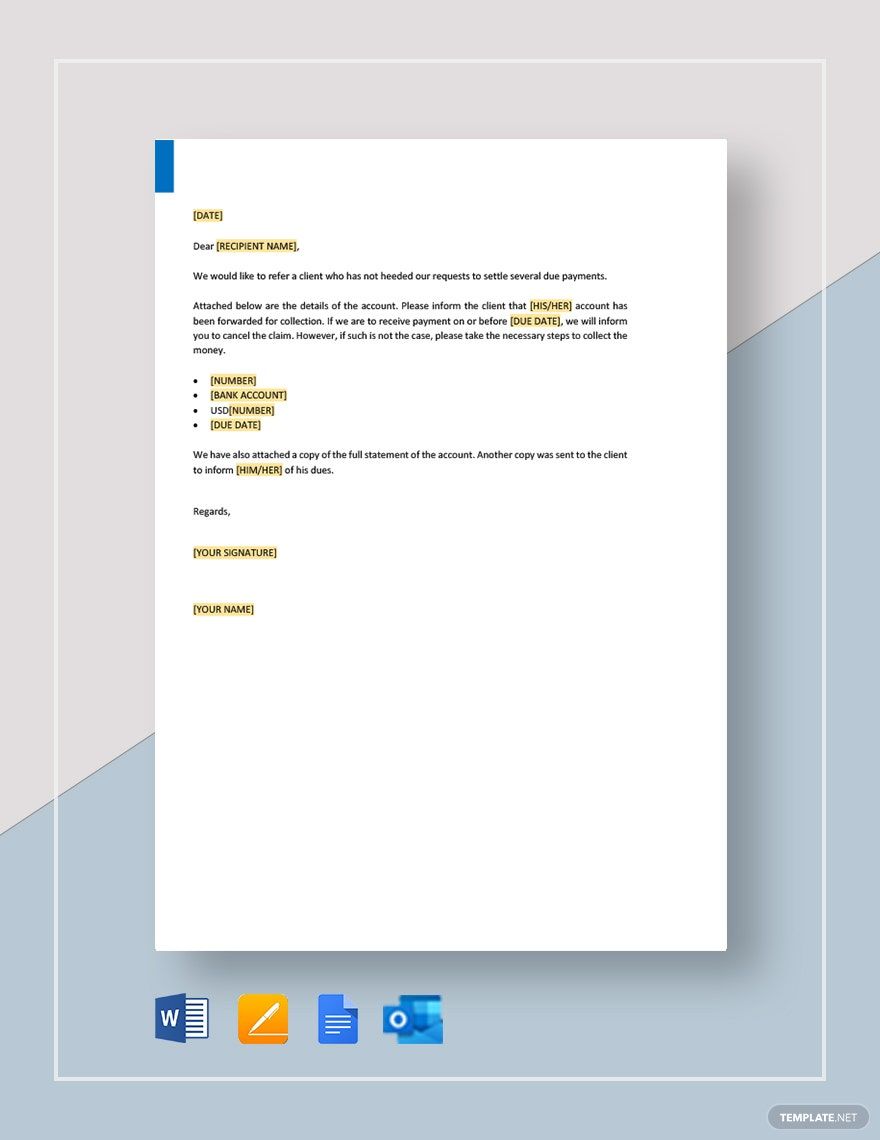

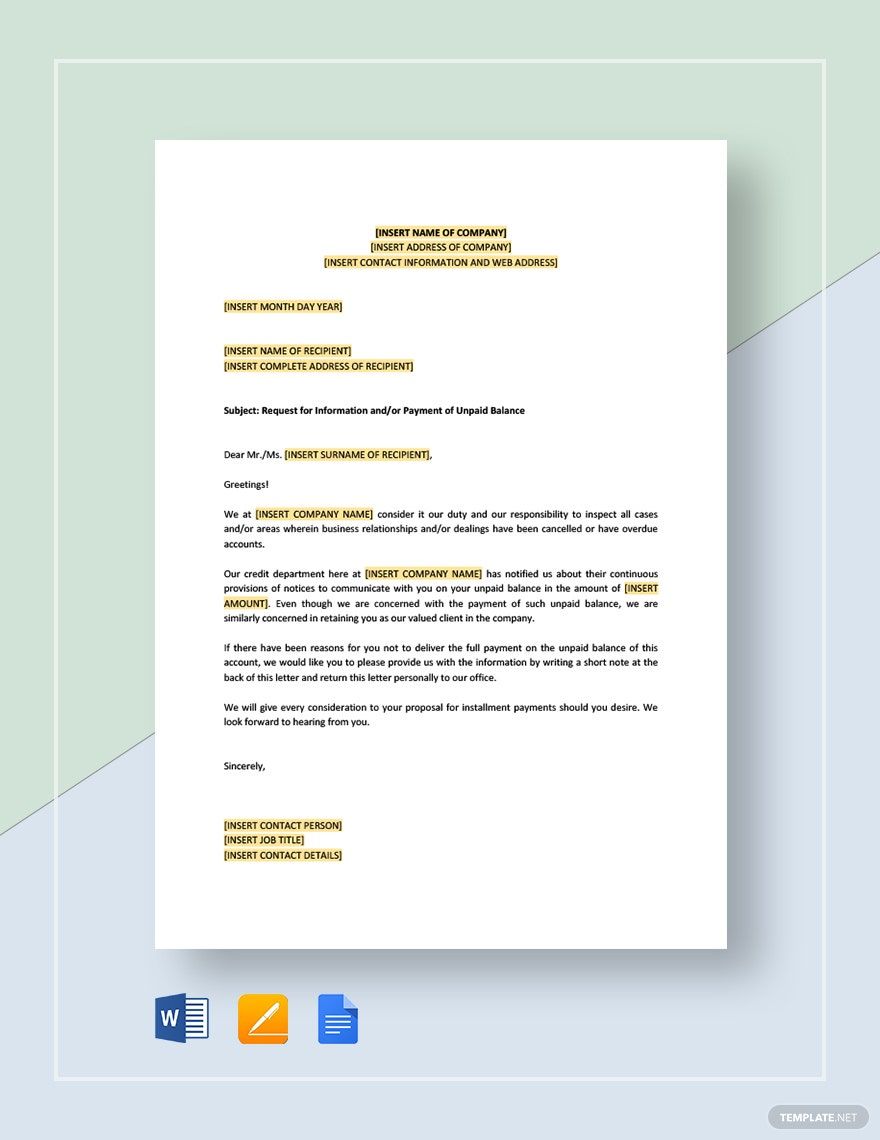

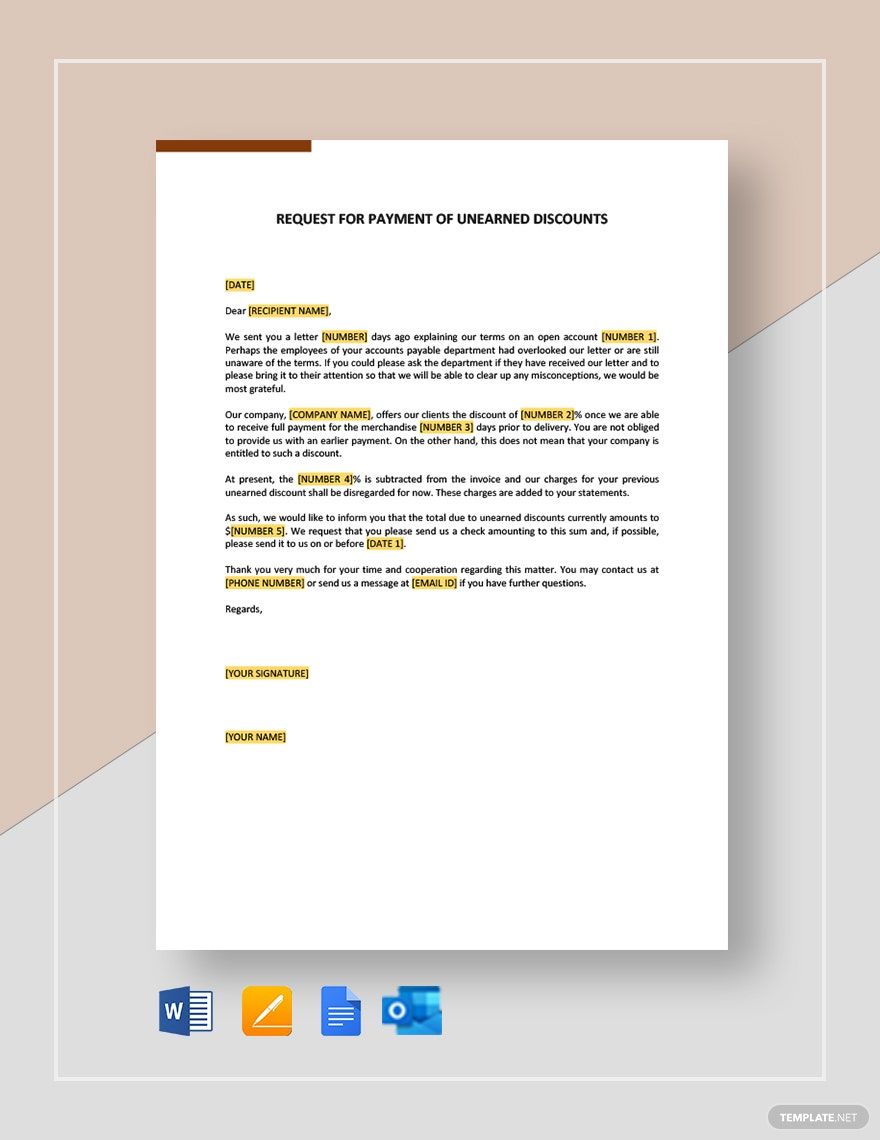

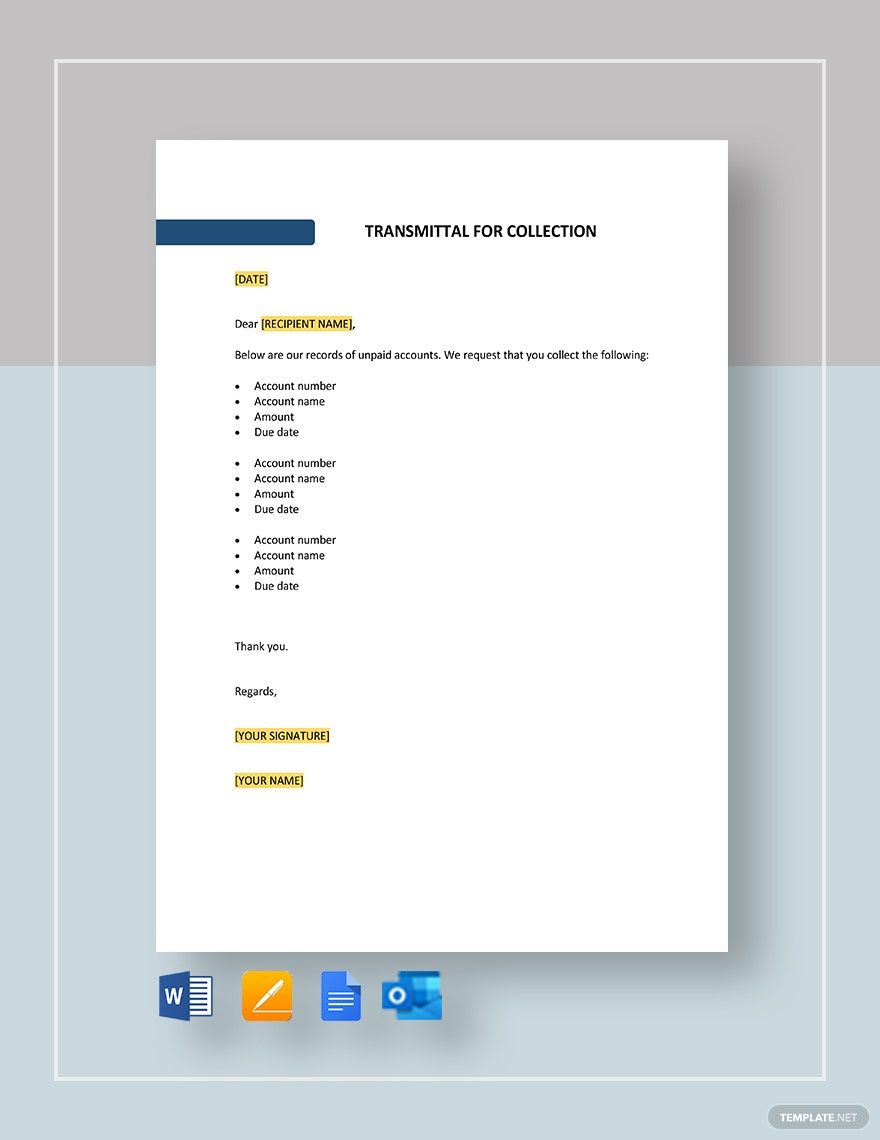

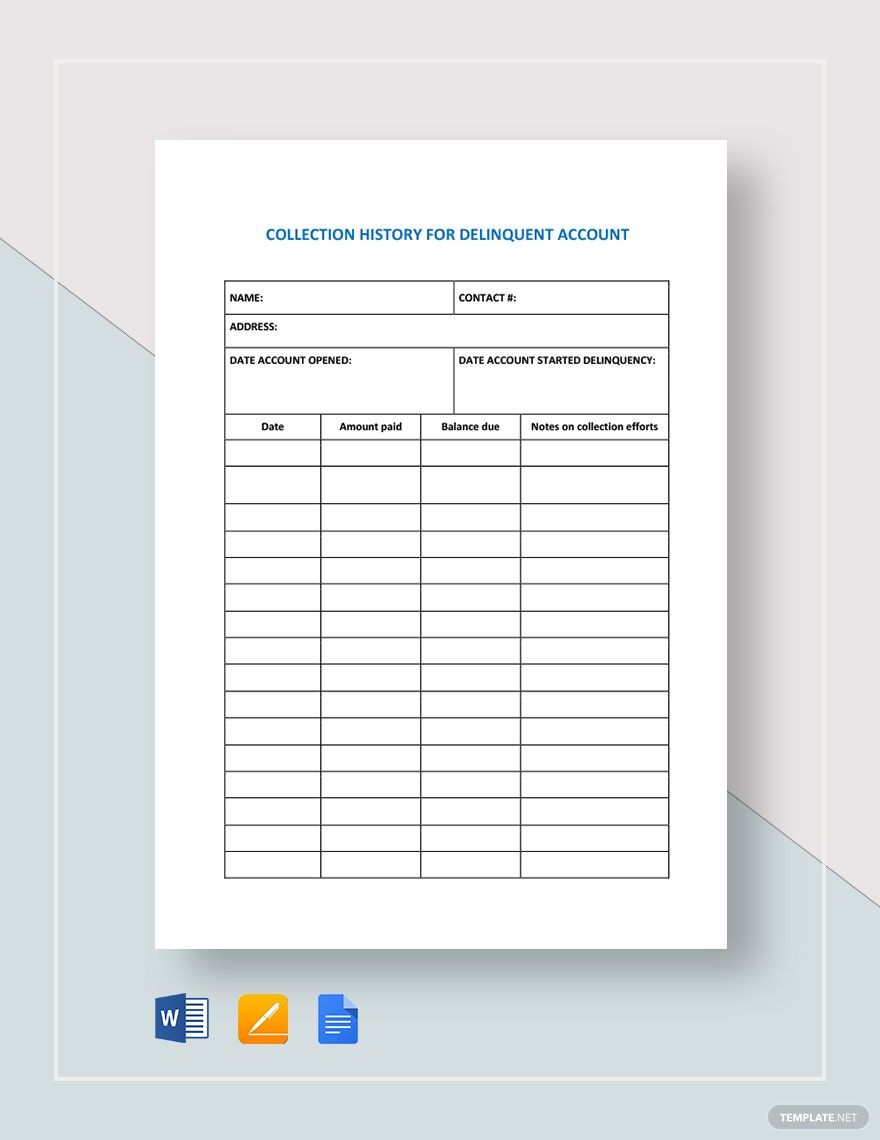

Keep your business communications professional, efficient, and impactful with Collection Letter Templates from Template.net. Designed for business owners, accountants, and administrative professionals, these templates enable you to keep your audience engaged, enhance your brand's credibility, and streamline your communication process. Utilize them to remind clients of overdue payments, or notify customers about upcoming changes in payment terms. These templates come complete with customizable fields for time, date, and contact information, ensuring personalized and effective correspondence. Enjoy the convenience of no design skills required, and benefit from professional-grade templates that are ready for both print and digital distribution, making it easier than ever to uphold your company's communication standards.

Discover the many Collection Letter Templates we have on hand, offering you a plethora of designs and formats suitable for every business need. Start by selecting a template that fits your purpose, then simply swap in your business’s assets, like logos or custom headers, and tweak colors and fonts to match your brand's aesthetic. Take your letters to the next level by dragging-and-dropping icons or graphics, and leverage AI-powered text tools to craft compelling and precise messages. The possibilities are endless and skill-free, ensuring that anyone on your team can produce top-tier documents effortlessly. Our library is regularly updated with new designs each week, providing fresh options to keep your communications current. When you're finished, download your document or share it via email, export it to various formats, or print it for distribution, making it ideal for reaching multiple channels and collaborating in real time.