Free Top 20 U.S. States by Total Household Debt (2020-2025)

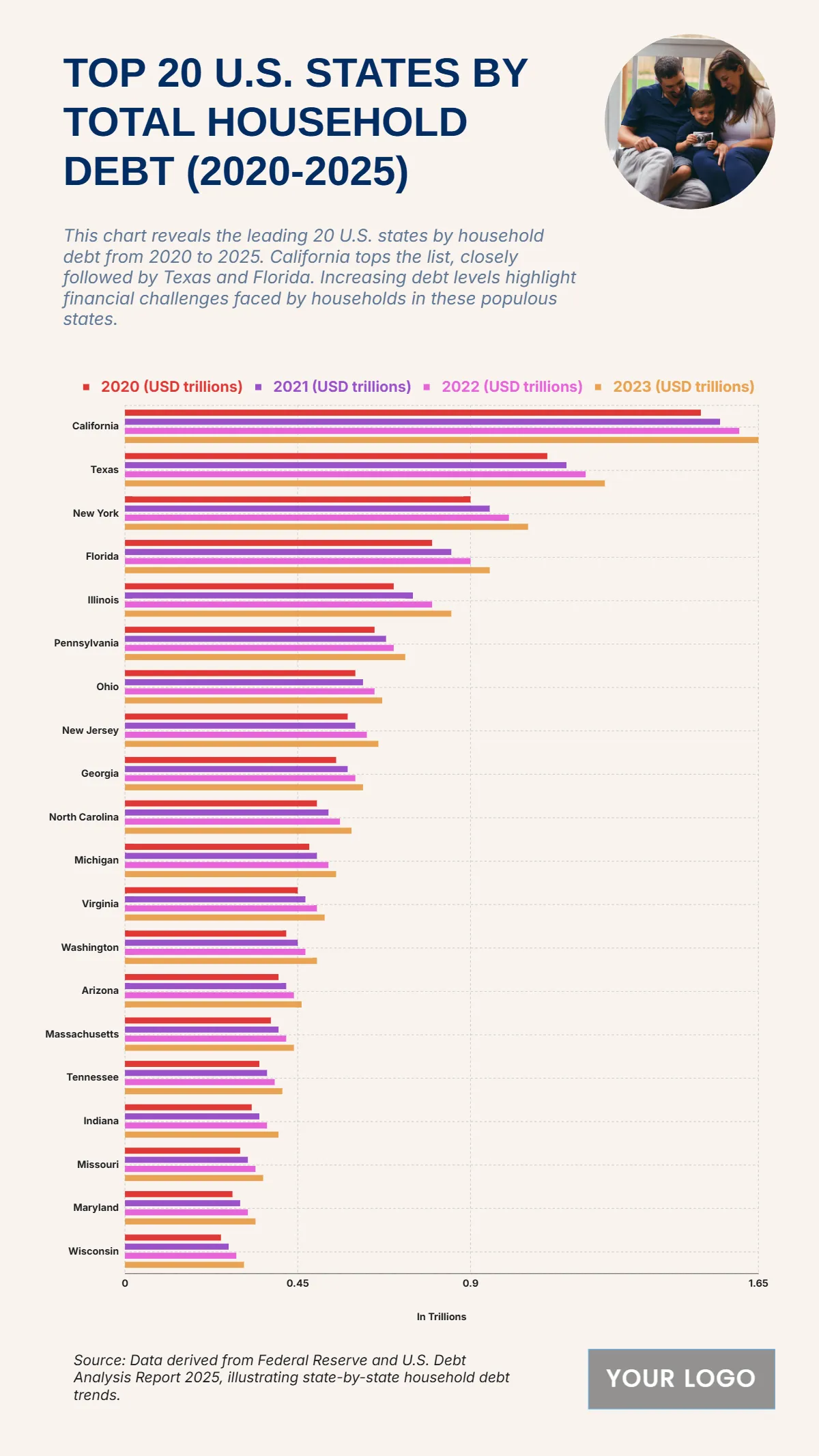

The chart reveals a notable increase in household debt across all major states, with California leading at USD 1.65 trillion in 2023, up from USD 1.5 trillion in 2020, underscoring its high housing costs and consumer spending trends. Texas follows at USD 1.25 trillion, reflecting population growth and strong real estate activity. New York rises to USD 1.05 trillion, while Florida climbs to USD 0.95 trillion, maintaining their positions in the top tier of indebted states. States like Illinois (USD 0.85 trillion) and Pennsylvania (USD 0.73 trillion) also display consistent upward trends. At the lower end, Wisconsin holds USD 0.31 trillion, followed by Maryland at USD 0.34 trillion. Overall, the data highlights a steady debt accumulation nationwide from 2020 to 2025, closely tied to housing markets, inflationary pressures, and increasing consumer borrowing.

| Labels | 2020 (USD trillions) | 2021 (USD trillions) | 2022 (USD trillions) | 2023 (USD trillions) |

|---|---|---|---|---|

| California | 1.5 | 1.55 | 1.6 | 1.65 |

| Texas | 1.1 | 1.15 | 1.2 | 1.25 |

| New York | 0.9 | 0.95 | 1.0 | 1.05 |

| Florida | 0.8 | 0.85 | 0.9 | 0.95 |

| Illinois | 0.7 | 0.75 | 0.8 | 0.85 |

| Pennsylvania | 0.65 | 0.68 | 0.7 | 0.73 |

| Ohio | 0.6 | 0.62 | 0.65 | 0.7 |

| New Jersey | 0.58 | 0.6 | 0.63 | 0.66 |

| Georgia | 0.55 | 0.58 | 0.6 | 0.63 |

| North Carolina | 0.5 | 0.53 | 0.56 | 0.59 |

| Michigan | 0.48 | 0.5 | 0.53 | 0.55 |

| Virginia | 0.45 | 0.47 | 0.5 | 0.52 |

| Washington | 0.42 | 0.45 | 0.47 | 0.5 |

| Arizona | 0.4 | 0.42 | 0.44 | 0.47 |

| Massachusetts | 0.38 | 0.4 | 0.42 | 0.44 |

| Tennessee | 0.35 | 0.37 | 0.39 | 0.41 |

| Indiana | 0.33 | 0.35 | 0.37 | 0.4 |

| Missouri | 0.3 | 0.32 | 0.34 | 0.37 |

| Maryland | 0.28 | 0.3 | 0.32 | 0.34 |

| Wisconsin | 0.25 | 0.27 | 0.29 | 0.31 |