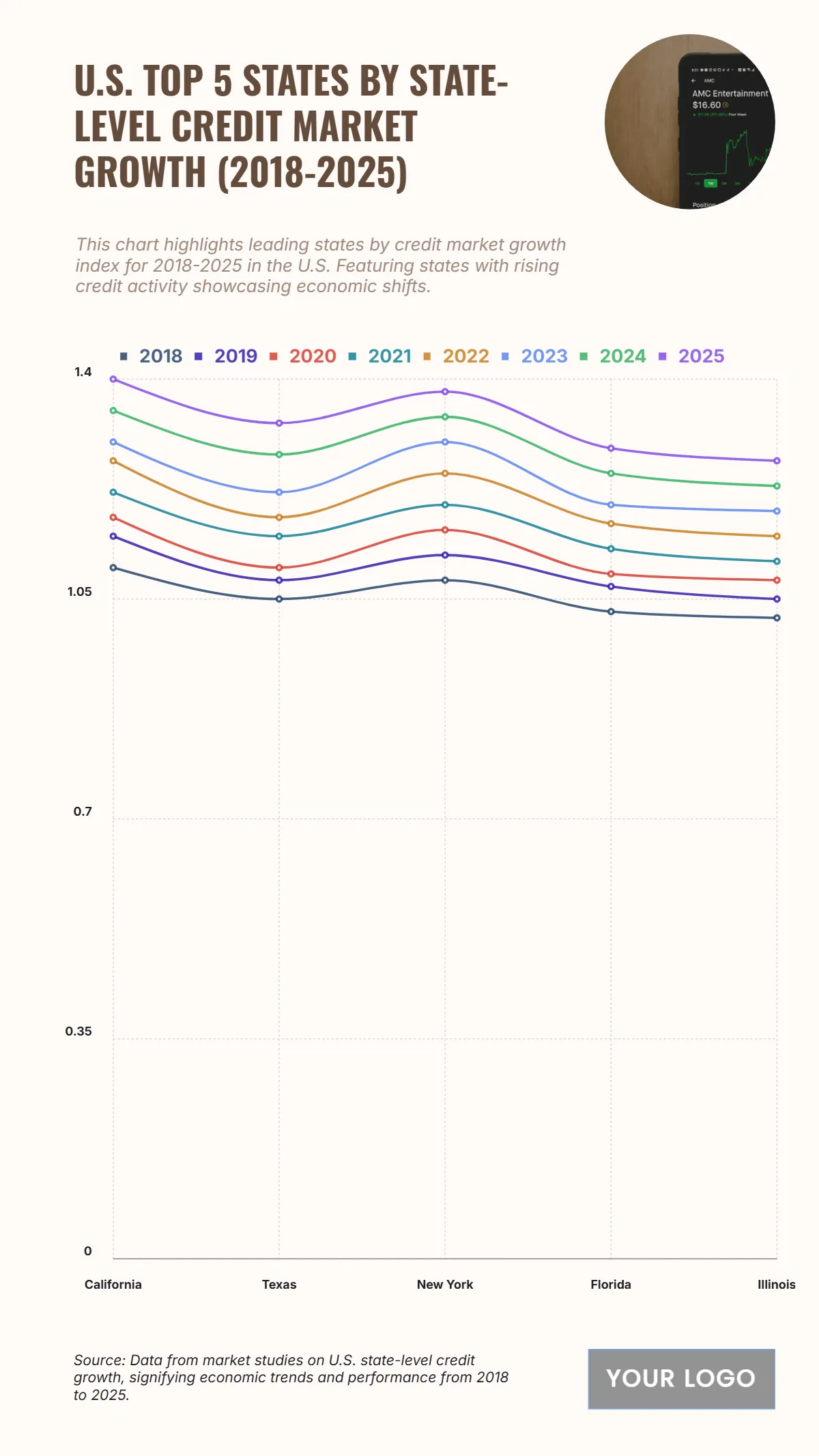

Free U.S. Top 5 States by State-Level Credit Market Growth (2018-2025)

The chart depicts a steady and robust credit market growth across leading U.S. states from 2018 to 2025. California leads the index, increasing from 1.10 in 2018 to 1.40 by 2025, indicating strong economic activity and financial expansion. New York closely follows, growing from 1.08 to 1.38, reflecting its status as a major financial hub. Texas climbs from 1.05 to 1.33, showing accelerated growth in credit activity, while Florida rises from 1.03 to 1.29, driven by expanding consumer and business credit use. Illinois also sees a steady increase to 1.27. The consistent upward trend across all states suggests a strengthening credit environment, supported by economic expansion, rising consumer confidence, and increased access to financing mechanisms over time.

| State | 2018 | 2019 | 2020 | 2021 | 2022 | 2023 | 2024 | 2025 |

|---|---|---|---|---|---|---|---|---|

| California | 1.10 | 1.15 | 1.18 | 1.22 | 1.27 | 1.30 | 1.35 | 1.40 |

| Texas | 1.05 | 1.08 | 1.10 | 1.15 | 1.18 | 1.22 | 1.28 | 1.33 |

| New York | 1.08 | 1.12 | 1.16 | 1.20 | 1.25 | 1.30 | 1.34 | 1.38 |

| Florida | 1.03 | 1.07 | 1.09 | 1.13 | 1.17 | 1.20 | 1.25 | 1.29 |

| Illinois | 1.02 | 1.05 | 1.08 | 1.11 | 1.15 | 1.19 | 1.23 | 1.27 |